Introduction

The value of currencies is determined by the market fundamentals of demand and supply (Mahr, 2008). Otherwise, the value of the dollar will drop. This paper assesses the exchange rate trends between the British Pound, the U.S. dollar and the Euro. The analysis will examine the factors behind the relational trend of the Pound vs. the U.S dollar, and the Pound vs. the Euro. The report discusses possible causes of the changes in foreign exchange rates mentioned. Further, the paper investigates the existence of correlation between the selected currencies.

Causes of changes in foreign exchange rate

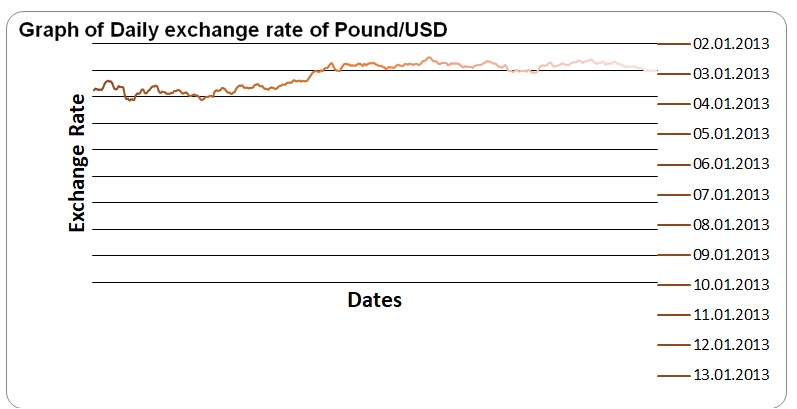

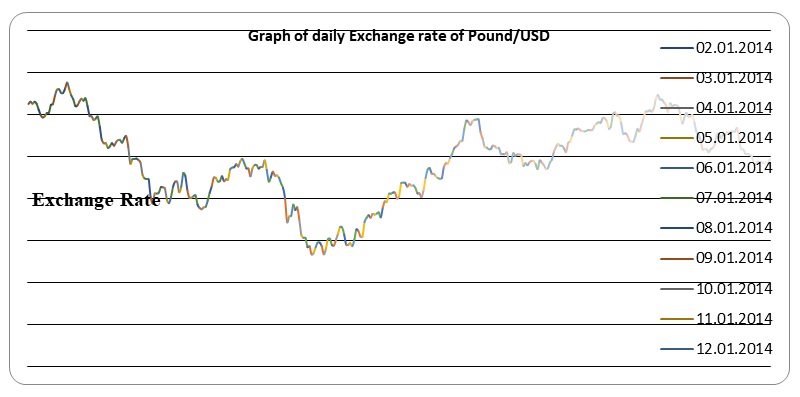

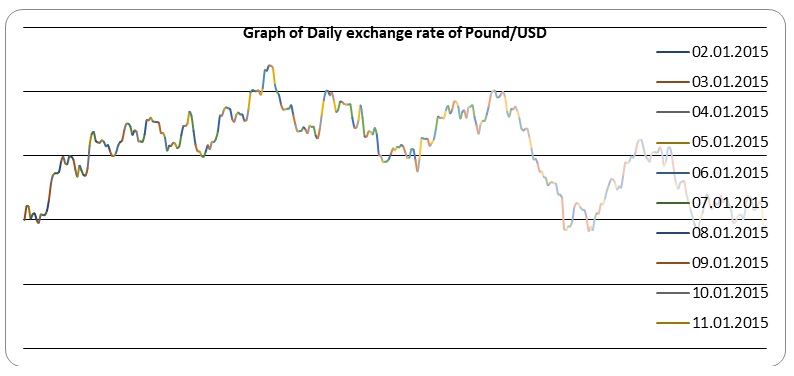

The changing trend in the exchange rate between the Pound and the U.S. dollar may be explained by numerous possible causes. In assessing the trend in 2009, the U.S dollar performed well during the first quarter of the year. This may be explained by the passionate economic recovery plans and government interventions that were undertaken by the Federal government to control exchange rates. The fact that the Federal Reserve was regulated, influenced the interest rate and strengthening of the local currency against the foreign currency. The rising value of the Pound meant that the UK goods were more competitive compared to the U.S dollar given the low inflation rates relative to inflation rates of the U.S. The U.S. goods possibly become less competitive leading to a low demand for the U.S dollar.

The observable gain in value of the U.S. dollar against the sterling Pound during the mid 2009 could be explained by the market speculation of the rise in value of the dollar in the foreseeable future.

The reduction in the value of the British Pound relative to the U.S dollar from the beginning of 2010 up to September could be explained by the setting in of the Euro crisis that had more negative effect on the British market. This meant that the UK’s inflation rates rose relative to the U.S. dollar. The low inflation rates of the U.S dollar led to the shift in demand for the Pound causing.

Although other causes may be worth considering, considerable evidence suggests that the Euro financial crisis had far-reaching negative effect on the value of the Pound. The U.S. goods became more attractive compared to products from the UK. During this period, the reduction in the competitiveness of the Pound had long run effect on the relative value of the Pound against the dollar.

Although the Pound strived to regain its glory, the long run effects caused by the extreme loss in competitiveness of the UK products in the U.S and global market (Denzel, 2010). During the year, the Pound fell considerably by over 20% against the dollar (Arestis and Sawyer, 2012). Some studies have cited the increasing deficit of the UK current account due to the increased importation of products from the U.S (Emerging Markets Monitor, 2009). On the other hand, intervention of the Bank of England to cut down interest rate beginning from 2008 toward the end of 2009 explains the trendy reduction in the value of the Pound compared to the U.S dollar (World Bank, 2010; Peters, 2010).

The recent recession that hit the UK economy has continued to affect the value of the dollar. The expectation of the market of the future low value of the UK Pound caused a further influence on the value of the Pound to develop a downward trend (Laurance, 2008). The Bank of England’s action to pursue quantitative easing by increasing the supply of money in the economy has been cited as a reason behind the downward relationship of the Pound relative to the U.S dollar and the Euro (Osterholt, 2012). The increased prospect of high inflation of the UK economy has caused less attractive UK bonds.

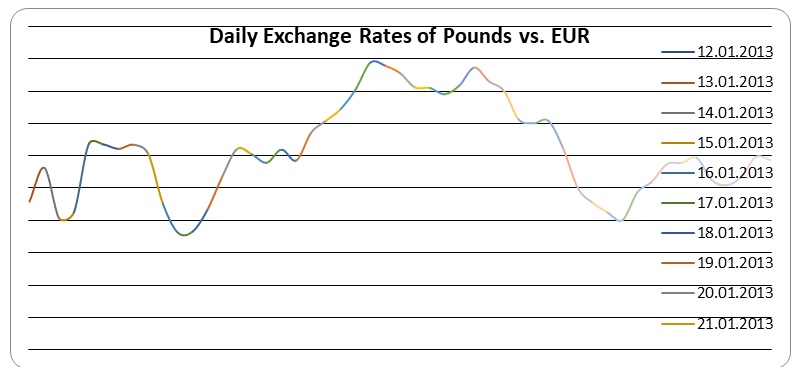

Analysis of the exchange Rate between the Pound and the Euro

2009 exchange rate of the Pound/Euro

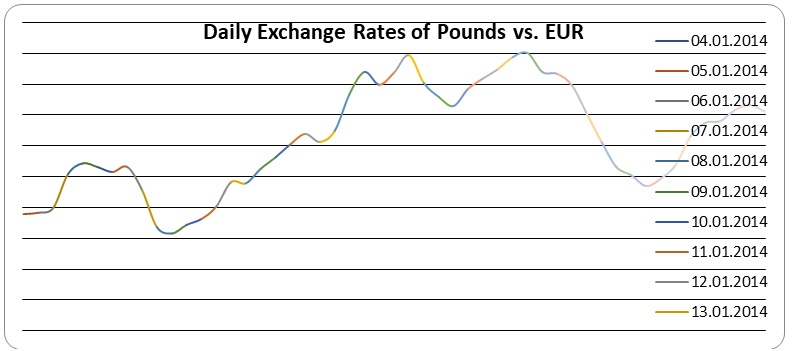

The Pound had an upward swing against the Euro during the first quarter of 2009. This shows that possibly the UK economy experienced a positive growth contrary to the downturns in the European Union. The graphical analysis indicates that the Euro gained value against the Pound during the early part of the second quarter. However, this trend was interfered by a stronger Pound value due to the contraction in the Euro GDP. This could be explained by the overall contraction in the Euro zone industries critical to the growth of the economy. In addition, the deepening recession in the Spanish and Italian market economies could explain this trend.

During the third quarter of 2009, the Euro experienced a similar downswing, especially in the month of June where the Pound struck the highest mark of 1.18 against the Euro. However, the overall trend changed dramatically with a drop in value of the Pound during the last quarter of 2009. For instance, the Pound performed badly against the Euro, especially between October and November 2009 where it hit the lowest 1.08, which represented a drop.

2010 exchange rate of the Pound/Euro

The rate of inflation may not come down soon to leverage the Euro against the Pound as indicated by the current and historical analysis. The high global oil prices that continue to rock the entire Euro zone have been cited as the fundamental factor causing a declining value of the Euro relative to the UK Pound. The continuous positive relationship that underpins the downward shift throughout the first and second quarters of 2010 indicates the spill-over effect of economic downturns from periphery countries. For example, the Spanish and the Italian sovereign bond yields are increasing over time as the Euro depreciates in value fueled by low market demand.

2011 exchange rate of the Pound/Euro

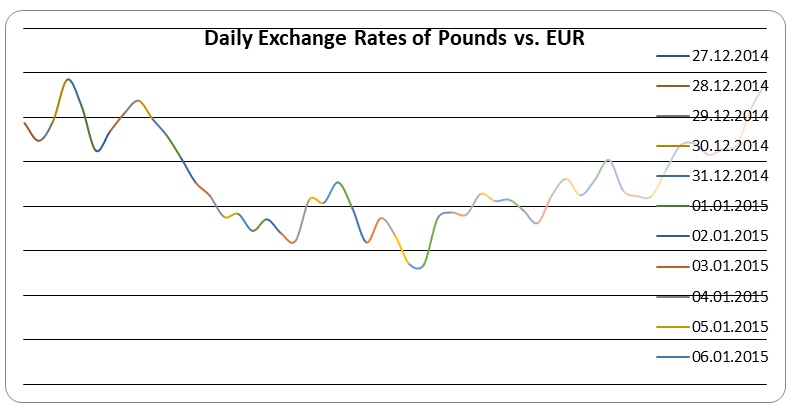

The beginning of 2010 saw again in the value of the Euro as the Pound was stripped off its value. The slow depreciation in the value of the Pound was possibly not because of the strengthening of the Euro, but rather a shift in the monetary policy that sought to hold back the value of the Euro currency. Because of the raging recession, and austerity, the European Central Bank chose to loosen its monetary policies even further to avoid the effects of declining economies of periphery countries. The cutting down of the interest rates by the Central Bank of Europe caused a shift in investment interests from the Pound toward the Euro. Although the British Pound was headed to a better level, the market anticipation of its continued drop on value served to contribute toward further downward trend against the Euro. This situation is evident from the graphical representation in the figure below.

Analysis of the correlation between changes in exchange rates

The analysis of the graphs of exchange rates between the U.S dollar and the British Pound reveals a unique relationship (Michalowski, 2011; Beblavý, Cobham, and Ódor, 2011). In this case, the analysis shows that the sterling Pound stretches further compared to the dollar in whichever direction (Backe and Scardax, 2009). This means that when the Pound increases in value relative to the U.S dollar, it does that further. Similarly, when the value of the Pound drops relative to the value of the U.S dollar, it drops further. This relationship indicates that when the value of the U.S dollar rises, the value of the Pound increases considerably (Lorca-Susino, 2010). The EUR/GBP cross currency pair showed a positive relationship between the Pound and the dollar. While the economic crisis performed poorly, the U.S dollar weakened against other currencies (OANDA, 2012). However, the Pound did not respond in the same direction.

This relationship is the result of the poor state of the British economy, and not because of the strength and value of the Euro (Orabi and Saymeh, 2012). The rising value of the Euro against the Euro was due to increased invest heavily in the British government bonds amidst the soaring effects of the Eurozone debt crisis (Eiteman, Stonehill and Michael, 2012). In the later part of 2010 and 2011, the Pound managed to appreciate relative to the Euro (Shapiro, 2010). Inflation concerns in the UK led the Bank of England to raise interest rates in late 2006 and 2007 (Doran et al., 2009; Bahmani-Oskooee and Tanku, 2007).

The rising value of the Pound relative to the Euro has shown a positive correlation between the two currencies (GBP/USD). It is interesting to note that the Pound has maintained upward momentum (Archer, 2010). The strong relationship between the Pound and the Euro is as a result of the strong linkage between these two countries (Arestis and Sawyer, 2012).

MY opinion on the future of exchange rate between the Pound, USD, and Euro

The future of the relative exchange rate between the Pound and the USD could be a recap of the 2009 financial market indicators. As the Euro zone crisis continues to surge, the Pound shall continue to be under immense pressure as the U.S dollar gains value. However, it should be noted that although the U.S has its share of the ongoing Euro zone financial crisis, negative effects are less compared to the Pound. The relationship between the Euro and the Pound will be a negative correlation in which an increase in the value of the dollar will cause a similar reduction in the value of the Pound, causing a downward trend.

On the other hand, the Pound will continue to post a positive relationship with the U.S dollar. Here, increased rise in the value of the dollar will cause a relative rise in the value of the Pound bearing on the pressure emanating from the Euro zone. Reduced competitiveness of the British products in the Euro zone and the U.S will cause a constant reduction in demand for the Pound making the USD grow stronger (Arestis and Sawyer, 2012).

References

Archer, H. 2010. ‘United Kingdom’, United Kingdom Country Monitor.

Arestis, P & Sawyer, M. 2012. ‘The Euro Crisis, Palgrave Macmillan, London.

Backe, P & Scardax, F. 2009. European and Non-European Emerging Market Currencies: Forward Premium Puzzle and Fundamentals. Focus on European Economic Integration Journal, vol. 2, pp. 56-66.

Bahmani-Oskooee, M & Tanku A. 2007. ‘Black Market Exchange Rate vs. Official Rate in Testing the PPP: Which Rate Fosters the Adjustment Process,’ Economics Letters.

Bahmani-Oskooee, M & Gelan A. 2006. ‘Black Market Exchange Rate and Productivity Bias Hypothesis,’ Economics Letters, vol. 91, pp. 243-249.

Bahmani-Oskooee M & Kovyryalova, M. 2008. ‘The J-Curve: Evidence from Industry Trade Data between US and UK,’ Economic Issues, vol.13, no. 1.

Beblavý M, Cobham D, Ódor L. 2011. The Euro Area and the Financial Crisis, Cambridge University Press, Cambridge University.

Denzel, MA., 2010. Handbook of World Exchange Rates, 1590-1914, Ashgate Publishing, New York, NY.

Doran et al 2009. Seasonal Patterns in the Information Content of Implied Volatility, Research Paper, College of Business.

Eiteman, DK, Stonehill, AL & Michael, H. 2012. Multinational business Finance, Pearson-Addison Wesley, New York, NY.

Emerging Markets Monitor 2009. Analysis and market intelligence on fixed income, forex and equities in Asia, EMEA and Latin America, vol.14. no. 38.

Floyd, JE 2009. Interest Rates, Exchange Rates and World Monetary Policy, Springer, New York, NY.

Laurance, B 2008. Pound Hits All-time low Against Euro, Daily Mail.

Lorca-Susino, M 2010. The Euro in the 21st Century: Economic Crisis and Financial Uproar, Ashgate Publishing, London.

Mahr, J 2008. Five Years of the Euro: “Teuro” Or Strong Currency? GRIN Verlag, New York

Michalowski, G 2011, Attacking Currency Trends: How to Anticipate and Trade Big Moves in the Forex Market, John Wiley & Sons, New York, NY.

Miner, RC 2012. Practical Pattern Recognition for Trends and Corrections, John Wiley & Sons, New York, NY.

OANDA 2012. Historical Exchange Rates. Web.

Orabi, MA, & Saymeh, AA. 2012. ‘Effect of Interest, Moving Average, and Historical Volatility in Forecasting Exchange Prices of Major International Currencies’, International Journal of Economics and Finance, vol. 4. no. 5.

Osterholt, K 2012 Is the EU Fiscal Compact enough to avoid another Euro Crisis? GRIN Verlag, New York, NY.

Peters, M 2010, What the 2008/2009 World Economic Crisis Means for Global Agricultural Trade, DIANE Publishing, New York.

Shapiro, AC 2010. Multinational Financial Management, John Willey & Sons, New York, NY.

World Bank 2010. World Development Indicators 2010. World Bank Publications, London.