The Saudi Arabian Agency (SAMA) which was established in 1952 was assigned a duty, responsibility, or obligation to chiefly follow written contract or certificate of insurance which would reasonably fluctuate the value of the Riyal.

Over the past three decades, the duties and powers of SAMA have gradually increased. In the present day, it acts to fulfill a purpose, role, or function of most of the duties in a traditional manner affiliated with a central bank. These duties lie between the four main groups: The question of coins and notes, performing as a banker to the government, having a firm understanding or knowledge of financial institutions, and setting up monetary policies (Mixon, Johnny, and Michel 158).

In Saudi Arabia, government financial/monetary sources of aid or support that may be drawn upon when needed are reused into the inland economy through five government-possessed, became more focused on lending institutions capable of rendering enduring credit to precedence spheres at highly conceding or yielding rates; the amount of this credit is, in fact, about double the total of commercial bank funds made available to the private sector.

The Saudi Arabian Monetary Agency (SAMA) gets government down payment intended for investment abroad (Collyns 20).

Definition of investment bank

An investment bank can be referred to as an organization or institution founded and united for purposes that specifically involve fiscal matters. They also act as an assistant in a subordinate or supportive function for large company or group of businesses, recognized in law and acting as a single entity, and the organization that is the governing authority of a political unit in increasing in quantity or value of their assets through the guarantee of financial support and serving as brokers in the issuing of bonds.

In line with this, an investment bank can be categorized as a financial institution that carries out the role of investment banking, thus having or performing the activities of other finance-related operations, as well as asset management, equity research, and many others.

Additionally, the set of a financial institution maybe just be one of the portions of a more extensive financial institution like a commercial bank.

Consequently, an investment bank does not undertake the normal banking operations of depositing money in contrast to their counterpart banks in the category of retail banks and commercial banks. However, they help in the amalgamation, contracting, assuming, or acquiring possession of companies. Furthermore, the investment banks offer supportive services in the likes of market order, and the trading of a financial instrument whose value is based on another security, fixed income security, traded goods, foreign exchange, and equity securities.

What is made up of bank loans and bank deposits?

Saudi banks have enjoyed a flourishing economy flush with oil money souring the stock market in recent years. Following the stock market correction in 2006, growth in newly licensed, brokerage, asset management, and investment advisory companies, as well as foreign bans keen to enter the market is creating a competitive sector in the development of the Saudi Arabia monetary system between the years 2004 to 2008.

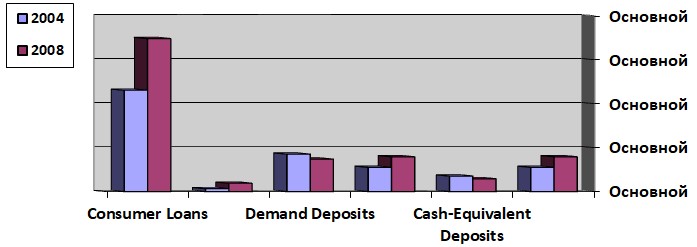

The graph below illustrates Saudi Arabia’s monetary development plan.

Functions of the security firms and investment banks in Saudi Arabia

Iqbal and Greening in their book noted that the world financial sector is rapidly growing with the inclusion of Islamic finance (Iqbal & Greening xiii).

In Saudi Arabia, the investment bank is known as the Saudi Arabian Monetary Agency (SAMA) which is also called the Central bank of Saudi Arabia and was established in the year 1952.

Although at the time this organization was established, there was no form of the monetary system being practiced in the country, hence, the medium of exchange was basically by using foreign currencies in addition to the national silver coins called the Saudi Arabia silver coin.

In line with this, the countries banknotes were not in circulation, and the banking operations of the country were managed and controlled by the branches of foreign banks.

On the creation of the Saudi Arabian Monetary Agency (SAMA) in 1952, they performed an extremely important role in the amalgamation and growth of Saudi Arabia’s financial system. In connection to this, their first task was to contribute to the progress and the development of the banking system in Saudi Arabia thereby, formulating the country’s first currency which was later changed from the old currency to the Saudi Arabian Riyal in the year march 1961 in agreement with the Article VIII of the Articles of Agreements of the IMF.

In addition to this, The Article of Agreement includes some exemptions to the IMF rule, which states that “The prohibition in Article VIII (2) (a) is limited to payments and transfers for current international transactions” (Lowenfeld 665).

Lending

In the 1980s the banking sector functioned quite unofficially with easy access to money available for clients to borrow that follow as a consequence of considerable loan loss resulting from the failure of a debt to be paid between 1985 and1989.

In the past few years, the sector has become more proficient and expanded as increased liquidity from the oil boom has reached the banking system.

Total commercial bank assets have risen from SR508bn ($137bn) in 2002 to SR1.1trn ($291.6bn) at the end of 2007. Deposits have matured at the same rapidity, to SR718bn ($194bn) by the end of 2007.

As oil money poured in, bank lending rates to the private sector also began to increase speed. Private facilities increased by 36% in 2004 and by 42% in 2005 to SR410bn ($111bn). A high proportion of this debt was customers disposing of money or property with the expectation that the same will be returned and invested in shares.

The Arab Monetary Fund which was established in the year 1976 was enforced a year later. Its first loan agreement was signed in August 1978 and it amounted to 25 million. AMF was seen as a regional financial institution to help and encourage Arab economic integration. AMF’s contemporary automatic loan of three years maturity is maintained at a level of 75 percent of a member’s quota in convertible currency and is given without conditionality to finance a balance of payment deficit. Consequently, compensatory loans are repayable within three years in four installments after a grace period of 18 months.

The exchange where security trading is conducted by professional stockbroker’s index became immoderate with borrowed money and oil-price-driven confidence, reaching a peak of 20,635 in February 2006, a multiple increments by the end of 2002.

The modification came in the form of a decline markedly in the stock market in 2006 and the first half of 2007, penetrating out at 6862 in June 2007.

Banks refrained from a severe process of changing to an inferior state in the assessment of their laying out money or capital in an enterprise with the expectation of profit in their portfolios but lost profits from brokerage services as trading rates dash violently or with great speed. In 2005 and 2006 the total worth of stock market investors was SR9.4trn ($2.5trn).

In 2007 the value went down by 51% to SR2.6trn ($702bn), a 70% decrease in brokerage fee for services rendered based on a percentage of an amount received, collected, or agreed to be paid. Having improved progressively since 2001, Commercial banking gains dropped from 13% to SR30.3bn ($8.2bn) in 2007.

To take charge of the impingement of growing consumers contributing to the stock market, the SAUDI Arabian Monetary Authority (SAMA) enforced a lending restraint in 2006. Debt was limited to a third of an individual’s salary and a maturity of five years. The rate of growth in private sector debt facilities slowed to 10% (Ṣabrī & Sabri 90).

The restraints lessened consumers’ continuous and profound contemplation on the stock market. BANK lending income and reversed the previous trend of increasing long-term lending. The number of loans for longer than one year fell to 42% in 2007.

Despite the stock market correction, the rest of the economy remained strong in 2006 and 2007. Growth in bank deposits reached 21% and bank reserves expanded by 47% in 2006. This led to criticism that banks were sitting on too much cash, but the sector responded in 2007 by increasing total claims on the private sector loans to total deposits remaining stable at 80.5%. This is low for the region and characteristics of Saudis risk-averse banking system.

In 2007 total banking assets expanded by 25%,customer deposits by 21% and bank reserves by 41% to SR256bn($69bn).Deposits on demand made up 43.4% of total deposits and 14% were foreign currency deposits.

My recommendation if I were working for one of the big banks as an adviser

Wealth and management of assets form protection over a variety of assets commodities offered for sale and strategies. The commitment to elasticity and originality helps in making certain that we are in a position to make the certain new and planned favorable combination of circumstances for improved proceeds within our investment strategy. In line with this, the investment banks are sometimes referred to as “corporate finance” or “advisory services” (Madura 19).

Wealth management has no definite definition both as far as products and services provided are concerned, but as per my understanding, I would say that it is a financial service provided to clients and should be followed closely to avoid any loss or harm of any kind to the lending institution.

As an adviser, I will focus on both sides of the client’s balance sheet to avoid any losses that might be incurred by the bank. Wealth management has a greater emphasis on financial advice and is concerned with gatherings, maintaining, preserving, enhancing, and transferring wealth.

Successful action of solving an investment problem grounded on the collateral of individuals and a complex entity or a move towards money furnished for an aggregate asset can be created by us. Without interruption, we are working out new methods, producing and investing elaborate and systematic plan of action to look after assets and deal with definite risks and human subjection to an influencing experience.

In conclusion, we can benefit from proactive tailored services, regular valuations and performance updates, control over our investment as much as we wish to, unending contact with our investment team. All these will help in improving and enlarging our profits and closeness with our investors.

Works Cited

Collyns, Charles. Alternatives to the central bank in the developing world. Washington, DC: International Monetary Fund, 1983. Print.

Iqbal, Zamir. and Greuning, V. Hennie. Risk analysis for Islamic banks: Stand Alones Series World Bank e-Library. Washington D.C: World Bank Publications, 2008. Print.

Lowenfeld, F. Andreas. International economic law series International economic law. New York, NY: Oxford University Press, 2003. Print.

Madura, Jeff. Financial Markets and Institutions. Mason OH: Cengage Learning, 2008. Print.

Mixon, Wilson, Johany, Ali, and Michel Berne. The Saudi Arabian economy. Surrey Hill, Australia: Taylor & Francis, 1986. Print.

Ṣabrī, N. Rashīd and Sabri, N. Rashid. International financial systems and stock volatility: issues and…, Volume 13. U.K: Emerald Group Publishing, 2002. Print.