Green Leaf Problem

Green Leaf Grocery started in 1956 in Virginia, after which it expanded in the mid-1970s to concentrate on healthy foods and focus on the sale of organic foods. Under the management of Fredrick, the grocery opened up to 62 stores in the Mid Atlantic area. The company later selected Jack Lawrence as the new Chief Executive Officer to take responsibility for leadership after the death of Fred in 2004. Jack later closed down several weak branches to concentrate on the productive stores that could emphasize quality operations. The CEO later expanded and opened more outlets in the adjacent markets to reach a ne number of 118 stores by 2014 (Cox & Crocker, 2018). The acquisition of other stores such as Sunbeam in the North East was also an effective strategy during the expansion.

The company experience impressive expansion in different aspects such as profitability and the number of stores implying a larger market share. The company, however, started to face several forms of cultural conflict as the core problem. The firm’s employees developed a negative attitude towards the new CEO’s salary compared to what Fredrick used to earn as the lowest salary in line with other workers in the business. The company had increased Jack’s salary with a higher value than other employees.

The other workers referred to the action as “Corporate greed,” which contradicted the organizational culture under Fredrick’s management. Despite Jacks’s tremendous performance, the human resource department viewed the likelihood of raising further Jack’s salary would make other employees develop a feeling of discrimination. There is a likelihood that the failure for the company to offer the CEO a more competitive compensation compared to other market players might tempt Jack to move to a relatively higher-paying organization.

The Compensation Situation

Green Leaf Grocery offered Jack an initial contract as a CEO with $175,000 when they first hired him. The company offered performance bonuses of up to $120,000 besides the salary. Jack later started to earn an increase in salary due to his merit in performance that made his salary reach $230,000 (Cox & Crocker, 2018). The company faced cultural strains due to Jack’s salary and has to review its tactical objective towards the compensation plan. There is a need for Green Leaf Grocery to create a compensation committee to help solve all the challenges of total compensation and ensure its competitiveness in the market to prevent other rivals from attracting executive managers.

The compensation committee will be responsible for formulating an appropriate compensation plan by making recommendations for the CEO and other executive board members. The compensation packages then move to the independent directors of the full board for approval. The shareholders also approve the equity-based compensation for the company executive officers.

After approval of equity-based compensation, Green Leaf Grocery needs to use benchmark programs to establish the CEO pay against other firms of the same size. The comparison should also focus on businesses in the same industry and geographical location as a strategy of determining the compensation levels. The most common useful benchmark practices target money compensation at the 50th percentile and the 75th percentile over lasting pay (Price, 2018). Green Leaf Grocery has to approach a third-party consultant Company to give direction on the program proposal and compensation levels.

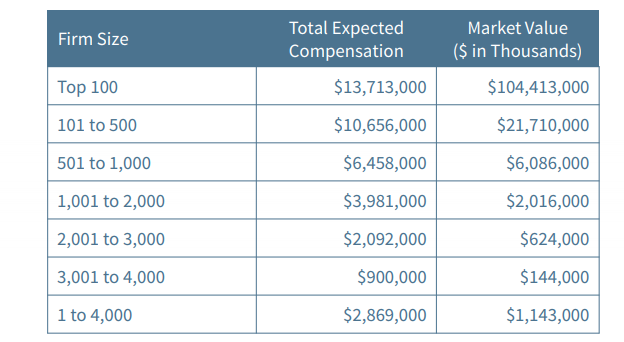

On the other hand, the company needs to handle the situation with care since compensation consultants are in some instances vulnerable to conflict of interest if they also offer other services to the same organization. The United States’ CEOs, based on the Equilar compensation data earn a total compensation as shown in figure 1 (Price, 2018). According to the balance sheet, the overall owners’ equity of Green Leaf Grocery was $386.8 million in 2015, implying that the firm belongs to organizations with a size of 2001 to 4000 that gives their CEOs a pay of $2,092,000 (Price, 2018). This data provides useful benchmarking insights that can help the company design and implement a fair and competitive package for its top management.

The changes in the company’s size determine the long-term changes in the CEOs pay. Besides the company’s size, the superior compensation level will be subject to the CEO’s performance as indicated in the compensation agreement. The estimation of the executive compensation is based on various measures such as expected pay, realizable pay, and realized pay of the CEO. Jack’s CEO earns an average of 1.8 times the second-highest-paid officer when determining the ratio of CEO pay to other executive officers (Hopkins, 2017). The ultimate compensation combination needs to be appealing to maintain and persuade the CEO to stick with the firm in the short-term and the long run.

Alignment of the CEO and Stockholder Interests

Firms demonstrate financial alignment in terms of a positive relationship between the CEO return and shareholder return. Firms that effectively align the interests of the company stockholders gain a competitive advantage in the market and obtain alignment payments on a sustainable foundation which exists as improvements in the company performance. Financial alignment of the Green Leaf Grocery will ensure managerial targets and operations are aligned to reduce the agency expenses hence limiting challenges that can result when evaluating the CEOs’ impractical actions (Karim, Lee, & Suh, 2018). The CEOs’ efforts will be towards stockholder beneficial programs and decisions, and thus such activities will generate a positive lasting effect on the company’s performance.

Shifting more risk to the CEO’s compensation may offset the agency cost savings. Green Leaf Grocery may change the risk to the CEO, creating a result-oriented contract that implies a higher total payment to the CEO to pay him for the additional risk created (Karim et al., 2018). The company, therefore, needs to ensure the CEO’s financial alignment that would continuously align the executive’s preferences and pro-shareholder activities that in turn assure future long-term performance.

The CEO’s participation in the company’s return may be a significant factor that may determine the association between financial orientation and the future performance of Green Leaf Grocery. If Green Leaf decides to offer the CEO equity-based compensation and acquire equity stakes, the shares of revenue will be proportional to the CEO’s equity in the organization. Although outcome-based agreements may shift risk to Green Leaf Grocery, risk premier would be appropriate if the firm view the CEO as a shareholder (Sanchez-Marin et al., 2017). Therefore, the company should maintain a higher compensation and consider the CEO a significant factor in financial alignment since he has promoted and supported a considerable stockholder return.

Green Leaf Grocery IPO

Discount has become one of the critical consumer trends in recent years, and hence consumers tend to patronize outlets that give good value. The discount chain such as TJ Max has generated a robust financial outcome and stock price performance due to the discount retail model approach. Green Grocery needs to capitalize on the trends that support the discount retail model and offer discounts since it will provide opportunities for purchasing inventories in bulk.

IPO attracts people who intend to invest in growing companies. Like most grocery companies, Green Leaf Grocery has shown robust growth under the new CEO need to establish a list of an IPO (O’Regan, 2018). The company has also continued to realize sales growth and revenue with the generation of positively performing sales stores. The level of revenue growth has been higher than the store count due to an increase in the income for each store. There is robust investor demand for the IPO offering. Hence, Green Leaf Grocery’s IPO is poised to succeed due to the forward business model of the organization, a clear growth plan, and attractive financial characteristics.

Recommendations

An appropriately formulated CEO compensation plan is always significant in promoting the attraction and retaining of top talent and skills essential for a business. From the case study, firms such as Green Leaf Groceries must require effective management to grow and obtain more profits. Therefore, organizations that value executive comprehensive compensation has superior performance than those that avoid such executive aspects (McClure, 2017).

Apart from the preference for compensation for the executive, a well-structured compensation schedule does not allow for disproportionate payment criticism, such as the one that other employees have demonstrated in the case study. Therefore, Green Leaf Grocery should use measures as the foundation of CEOs’ compensation, enhance effective communication, and scale compensation standards from similar companies. The company should also frequently value the firm’s equity and incorporate short-term and long-term motivations in the compensation plan.

References

Cox, M. Z., & Crocker, R. M. (2018). Green Leaf Grocery – Executive compensation case study. Journal of Business Case Studies, 14(1), 11-16. Web.

Hopkins, C. (2017). How to create a compensation plan in 6 steps. Web.

Karim, K., Lee, E., & Suh, S. (2018). Corporate social responsibility and CEO compensation structure. Advances in Accounting, 40, 27-41. Web.

Kolb, R. W. (2012). Too much is not enough: Incentives in executive compensation. New York, NY: Oxford University Press.

Larcker, D., F. & Tayan, B. (2017). CEO compensation: Data spotlight. Web.

McClure, B. (2017). A guide to CEO compensation. Web.

O’Regan, G. (2018). The innovation in computing companion. Cham, Switzerland: Springer.

Price, N. J. (2018). How to create a CEO compensation package. Web.

Sanchez-Marin, G., Lozano-Reina, G., Baixauli-Soler, J. S., & Lucas-Perez, M. E. (2017). Say on pay effectiveness, corporate governance mechanisms, and CEO compensation alignment. BRQ Business Research Quarterly, 20(4), 226-239. Web.