Introduction

Regional economic blocs are common and exist in all parts of the globe. Such blocs provide the member countries with great economic, social as well as political advantages that cannot be achieved without them. The Gulf Cooperation Council is one such regional economic bloc. The GCC was formed by six Arab states which are located in the Arabian Peninsula. What are the goals of the formation of the GCC? What are the major economic profiles of the GCC member states?

How successful has been the GCC integration into the global economy? What are some of the advantages and disadvantages of a common market for the GCC member states? These are some of the questions that will be addressed in this report. The aim of the report is to provide detailed information about the economic structure of the Gulf Cooperation Council.

Establishment and Structure of the Gulf Cooperation Council

The Gulf Cooperation Council is a regional organization that was formed to enhance the members’ political, economic and social institutions. The members of the GCC are Arab countries located along the Gulf and whose desire was to address the challenges they faced from their neighboring environment. The extent of the GCC work consists of “economy, politics, security, culture, health, information, education, legal affairs, administration, energy, industry, mining, agriculture, fishery and livestock,” (Hashem 5). The physical characteristic of the GCC members and the resemblance of their laws, economic and societal factors, and the characteristic of modern problems are the aspects that facilitated the formation of the GCC.

Communal physical features, the presence of comparable systems and social ties, as well as the comparable feature of problems the member states were facing were the fundamental factors that contributed to the inception of the GCC. Based on these similar features, the Foreign Ministers of the six member states held a meeting in Riyadh, Saudi Arabia, on 4th February, 1981. At the close of the convention, it was stated that, ” … the Ministers agreed to establish a council for cooperation between the States of the Arabian Gulf, and to form a Secretariat-General to achieve this goal, and to convene regular summit meetings at the Ministerial level so as to realize the desired goals of these countries and their people,” (qtd. in Hashem 6).

The success of this meeting formed the backbone upon which the GCC was created. About one and a half months later, the initial GCC summit meeting was convened at Abu Dhabi, United Arab Emirates. From that day, GCC conventions have been frequently held on a yearly basis (Hashem).

The inauguration of the GCC in May 1981 served as the peak of the grave attempts instilled with faith in the GCC’s goals and conscientious of its desire for rational and political endeavors beginning from the second half of the 1970s. Therefore, the formation of the Council was seen as the realization of the grand dream of the citizens of GCC member states. This was mirrored in the combined attempts towards economic, social and political assimilation otherwise known as the Gulf Unity.

The Gulf Unity encompasses the essential historical, cultural, human and physical elements and aspects thus rendering it proficient in addressing all the problems that intimidate its cultural advancement.The Gulf Unity is able to prevent the different challenges that arise and oppose its presence or that threaten one or more of its members at the domestic, regional and global levels. Once the procedure of the communal action undertaken by the GCC member states had been reviewed and evaluated, it was apparent that it was capable of suppressing the threats the purpose for which the Council had been created. Those problems were encompassed in a cluster of threats.

The mutual action was capable of situating itself against the problems and risks by making sure that the historical and societal existence of its members was effective in the global platform all through the era of its survival.

Structure of the Gulf Cooperation Council

The GCC is structured as follows:

Supreme Council

The Supreme Council is the head of the GCC. It consists of the heads of the GCC member countries. The executive position of the Supreme Council revolves around the member states’ heads according to the alphabetical sequence of their names. Two regular and consultative assemblies are held by the Supreme Council each year. Extraordinary assemblies may be held if a member requests for one and if the member is supported by any other member. The assemblies held by the Supreme Council usually take place within the confines of the member states. The validity of the Supreme Council’s assemblies is effective only if at least sixty percent of the member states are present. The commission of the GCC is referred to as “The Commission for the Settlement of Dispute,” (Hashem 8).

The Supreme Council is in charge of this commission. The make-up of the commission is created by the Supreme Council for each situation on an impromptu basis and depending on the unique characteristic of the disagreement. If the dispute originates from the understanding or execution of the Charter, the Council may pass on the dispute to the Commission for the Settlement of Dispute. The Commission then gives its propositions or suggestions as appropriate to the Supreme Council to take the necessary and appropriate measures..

Ministerial Council

The Ministerial Council consists of the Foreign Ministers of the GCC member countries or other assigned ministers. The executive position of the Ministerial Council is given to the Foreign Minister of the member country which chaired the previous ordinary meeting of the supreme Council or if needed, the member country which is set to chair the next assembly of the Supreme Council. The meeting of the Ministerial Council is convened four times a year on a quarterly basis. An extraordinary assembly can also be convened if necessary (Hashem 8).

The Consultative Commission for the GCC Supreme Council

This body of the GCC was first inaugurated in 1997 following the recommendations made by the GCC Supreme Council during its 8th assembly convened in Kuwait in December 1997. The main objective of the Consultative Commission for the GCC Supreme Council is to act as the advisory commission for the Supreme Council. The Commission is made up of 30 members (five members from each GCC member country). The contracts of the members are three years but can be renewed once the contract expires. The first convention of the Commission took place in November, 1998 (Hashem 9).

Secretariat General

The Secretariat General is made up of “a Secretary-General, Assistant Secretaries-General and several officers as deemed necessary,” (Hashem 9). The head office of the GCC Secretariat General is located in Riyadh, Saudi Arabia. The Secretariat General has a number of sectors under it which include: “Secretary-General’s Office, Political Affairs, Military Affairs, Economic Affairs, Human and Environment Affairs, Legal Affairs, Finance and Administration Affairs, Information Centre, Information Department, The Technical Telecommunication Bureau in Bahrain, and GCC Delegation in Brussels,” (Hashem 9).

Objectives of the formation of the GCC

The main objectives of the Gulf Cooperation Council include:

- To achieve harmonization, assimilation, and interconnectedness of the member countries in all areas so as to realize unity in the region

- To intensify and reinforce the associations, relations and fields of collaboration which now prevail among the GCC members in different areas

- To design and implement laws that govern different fields such as: “Economic and financial affairs; Commerce, customs and communications; Education and Culture; Social and health affairs; Information and tourism; Legislative and administrative affairs,” (Hashem 7).

- To motivate scientific and technical advancement in sectors such as “industry, mining, agriculture, water and animal resources,” (Hashem 7).

- To institute scientific research, form cooperative undertakings and support collaboration with the private sector for common good of all members

Members of the GCC

The GCC is made up of six Arab states namely: “The United Arab Emirates, the State of Bahrain, the Kingdom of Saudi Arabia, the Sultanate of Oman, the State of Qatar, and the State of Kuwait,” (Hashem 5).

Geographical location of the GCC

GCC member countries are situated within “the Arabian peninsula southwest of Asia between the latitudes of 15 and 35 north of equator and longitudes of 35 and 60 east of Greenwich,” (Hashem 5). The bordering countries of GCC include: Iraq and Jordan northwards, Republic of Yemen and the Arabian Sea southwards, Arabian Gulf eastwards and the Red Sea westwards. The GCC is indeed a region rich in oil and gas deposits.

It is situated on top of more than 40 per cent of the globe’s oil resources and 20 percent of the globe’s gas deposits. Over the years, GCC has garnered extensive experience and skills in the management of its extensive hydrocarbon resources. The geographical location of GCC is significant in that it acts as a transit focal point between the thriving emerging economies of Asia and the developed economies of the West. Over the years, the GCC has been able to take advantage of its strategic location as an important transit hub. The geographical map of the GCC region is shown in the figure below.

Business environment in the GCC

The GCC economies have grown to become focal centers for innovation in an international business setting that is characterized by increasing demand for energy and high rate of globalization. The stability of the region avails the GCC member states with the prospects of concentrating on strengthening their human capital at different levels and spending more money on education while progressing cautiously with political and institutional transformations to sustain their booming economies and communities. The prolonged high oil prices that result from unrelenting demand and international economic growth offer GCC member states with adequate resources.

Thus, along the Persian Gulf contemporary, highly aggressive economies take advantage of the benefits of globalization, as a result of competent institutions and markets as well as a large base of domestic, highly trained workforce. Increasing anxieties and insecurity prompt a number of mutual conventions that involve the heads of the GCC member states (Davis and Hayashi 132).

The challenge of regional hostility is tackled at political and cultural stages, leading to improved regional stability. At the same time, acknowledging the significance of education and innovation, several of the GCC member states’ heads decided to expend their accumulated riches on educating their citizens and supporting research and development in a far-reaching and impressive manner. Consequently, huge funds have been set aside for education and R&D programs, by private, commercial and the GCC governments.

In addition, the friendly business environment has been facilitated by the support of entrepreneurship through the creation of more business-friendly regulatory and institutional settings through the improvement of business law and the significant reduction of the bureaucratic procedures needed to start a business. Equally vital was the institution of funds that both offer incentives and facilitate the creation of new business ideas. The incorporation of the private sector in these economic reforms is a vital element of the GCC success, and is at any rate somewhat responsible for the region’s impressive real economic growth of more than 6 percent per annum (Davis and Hayashi 132).

The combined share of GCC crude oil reserves from the world

Gulf States are characterized with accumulations of vast wealth and sovereign wealth funds to increase their influence and scale in the world. The oil industry has maintained its lead as the pillar for development in the gulf region although stimulus packages of the government and development of the non oil sectors are likely to be crucial in channeling economic growth and stabilizing the oil industry following lower dependence on the same.

The Gulf region economies enjoy interdependence and tightened bonds economically driven by modernization and demands of energy. The concerns of the analysts in the energy sector have led to disputes surrounding the transparency of information of world oil reserves’ actual volumes and the reliability of statistics. A significant amount of Gulf oil reserves of approximately 112 barrels lies with Iraq which though torn by war plays a significant role in the global oil markets and is estimated to hold 11% of world reserves of about 1,050 billion barrels with potential to increase in international oil supply for long term significance.

There has been increment in the drilling of development oils in the Gulf so as to increase the production of crude oil and raise reserves. Forecasts estimate “the supply of about two thirds or more than half of the world’s crude oil to come from the Gulf by 2020,” (Fasano and Iqbal 20).

The member countries of the GCC; Kuwait, United Arab Emirates, Bahrain, Qatar and Oman, over the last decades, have experienced unprecedented social and economic transformation. The proceeds from oil have been effective in “the creation of employment, improvement of social indicators, modernization of infrastructure, accumulation of reserves, maintenance of external debt at a minimum and dominance in donations to poor countries,” (Fasano and Iqbal 21). The interdependence of GCC countries is revealed by the contribution of oil of three fourths to government revenues and exports annually and one third to total GDP.

The Gulf countries, while excluding Saudi Arabia, have significant crude oil reserves. The UAE makes up about 8.1% of the global reserves while containing approximately 97.8bb of crude oil reserves. Kuwait comes in the fourth place in the global reference to crude oil reserves. This represents approximately 8.5% of the global reserves of crude oil. The oil reserves of Kuwait are estimated to be about 101.5bb with an increase over the years followed by eventual stabilization.

Qatar has more reserves of gas compared to crude oil, thus making it the fourth in the GCC region with an estimated amount of 15.2bb. Oman ranked after Qatar with an estimation of 5.6bb of proven crude oil reserves. Bahrain is ranked least with a proven estimation of 125mb of established crude oil reserves. Together, the Gulf countries excluding Saudi Arabia account for approximately 18% of the total world reserves of crude oil (Global Research, 2008).

Table showing the crude oil reserves of GCC countries.

Effects of high oil prices on GCC economies

The increased oil prices affected the GCC economies both individually and collectively. Concerns have been raised over the strength of the global demand for oil which could outpace supply. This is evident from the rapid developments of the major oil exporters with less oil left for international markets due to increased use domestically.

This has had spill over effects on the availability and pricing mechanisms of oil. Global oil market were predicted to tighten due to the increased demand by China, India and developing nations, geopolitical factors and increased money flow into the market. The tightened market was predicted to change due to planned additions to boost OPEC capacity and non- OPEC production with projections in the levels of production capacity to surplus (Global Research 8). The research further emphasized on the need to maintain balanced demand and supply in the energy markets though a challenge in the maintenance of prices at reasonable levels.

High oil prices prevailing in the market between 2008 and 2009 provided GCC economies with surpluses in their current accounts and huge trade. The huge surpluses have enabled GCC economies to shift focus to expansion of refineries and oil production by creating allowances for foreign investments in the region and continued investment in huge infrastructure projects together with other development projects. Oman expanded its refining capacity from 85,000b/d to 106,000b/d and initiated mergence of two of its refineries to form Oman Refineries and Petrochemical Company with higher capacity. Qatar embarked on building of a new refinery of 0.15mb/d to take advantage of the high prices.

Bahrain subsequently increased investment for its modernization projects for its Sitra refinery and other refineries and introduction of low sulphur diesel unit of 0.4mb/d capacity. Kuwait has been efficient in its maintenance of full refining capacity with the initialization of heavy oil production (Global Research 9)

The increased oil prices had positive multiplier effects on other projects such as the pipeline which consequently attracted greater foreign investment and greatly improved the hydrocarbon sector through introduction of new international players in the sector. Bahrain experienced increased percentage contribution of oil with ranges of 27% from 25%. Oman initialized plans for increased exploration and production of natural gas. Qatar focused on taking advantage of skyrocketing oil prices and heightened demands in Asia to steer its economic development through the development of several growth projects. The United Arab Emirates also focused on increasing investment in the development of both downstream and upstream projects especially in the hydrocarbon sector (Global Research 10).

The high oil prices had effects on the financial systems of the GCC through ensuring adequacy of liquidity. This in turn boosted balance in the economy and promoted growth in other sectors of the GCC economies. In view of this, the GCC economies have experienced stabilization while taking the lead globally following the decline of major world economies. The buildup of reserves has served to the advantage of GCC economies through sustaining them through the periods of financial crisis globally. High oil prices have also led to steady production levels hence fuelling the economic growth of GCC economies.

There has been notable dominance of the energy sector in the exports and revenues of GCC economies. In Bahrain, the oil exports and revenues’ share of the gross domestic product stands at 27%. The income of Qatar from exports of petroleum amounted to US$24.3mn with Asia pacific and US as the main importers with a contribution of 61.9% to the GDP from gas and oil sectors in 2006. In 2006, Kuwait’s net exports of petroleum were approximately 2.2mb/d with a value of US$54.7bn while maintaining its leading position of export to Asia pacific nations especially Taiwan, Thailand, South Korea, Japan, Singapore and India.

In the United Arab Emirates, the revenues from oil and gas contributed one third of the total GDP of the economy. (Global Research 10) The high oil prices had effects on other sectors of the economy such as infrastructure, communication among others. GCC economies embarked on massive infrastructure development and pipeline development.

The United Arab Emirates launched petro gas; a satellite channel specialized in natural gas and oil. The investment of GCC economies in non oil sectors is to lower the dependence on oil and through this diversification achieving economic growth. This effect is also aimed at ensuring the GCC economic vulnerability to shocks in oil prices is reduced. This move has been necessary for “the maintenance of unwavering exchange rate and control of inflation through monetary policy and achievement of equity, employment and growth through the fiscal policy due to the volatility of proceeds from oil exports,” (Global Research 12).

The development of non oil sectors is done by allowing foreign possession and reforming the procedures for investment authorization and reduction of the maximum corporate tax. This has also necessitated the enactment of investment laws regarding the establishment and ownership of business particularly in the energy sector that is unrelated to oil. The high oil prices also created a favorable environment to the United Arab Emirates to develop it into a global hub for scientific growth and development projects. Bahrain took advantage of the high oil prices to embark on privatization projects especially in incineration, tourism facilities, collection of waste , public transport and the liberalization of postal and telecommunication services. Kuwait focused on establishment of frameworks comprehensively to allow for privatization in large scale (Fasano and Iqbal 6).

General Economic Profile

Energy Sector

The economic growth of the GCC economies was channeled by high oil prices and production that was steady in 2007. Despite the effects of this of change on development of non oil sectors to increase economic growth, lower dependence on the oil sectors and ensure economic stability, the energy sector still remains the highest source of the revenues of the GCC economies. The contribution of the energy sector can thus not be undermined.

To increase the benefits from the prevalence of high oil prices, the GCC economies have focused on expansion of refineries and oil production through measures and incentives to allow for increased foreign investment in the sector. This move has been motivated by the estimated growth in world demand in 2007, forecasts of growth especially of fast industrialized economies that have heavy dependence on energy such as; China and Asian countries with a focus on the industrial fuel and transport sectors and optimalization of capacity by OPEC (Global research 14)

The increased demand and high oil prices have necessitated the GCC economies to focus on heavy investment in downstream and upstream projects and follow international trends of establishment of integrated petrochemical complexes and increased refining capacity. For the period of 2007- 2012, GCC economies have invested in planned and active projects in the petrochemical, gas and oil sectors valued at approximately US$500bn. High liquidity prevailing in the GCC economies has facilitated increased refining, spare production and privatization concerns of hydrocarbon projects through increased foreign investment (Global Research 20).

Table Showing the Key Energy Indicators for 2006.

The GCC’s goals in power reforms include; reduction of electric cost to governments, creation of efficiency and environmental sustainability in the electric sector, sale of government owned assets to increase public revenue and attraction of private capital through removal of policies that are bureaucratic. Due to financial demands to meet power demands, the GCC economies have embarked on unbundlement of their power sectors to form separate segments for generation, transmission and distribution to provide opportunity for the segments to specialize in their core areas and hence the private sector to engage in capital investment. They have focused on instituting reforms to allow for this (Al- Asaad, 5).

The transformation of GCC countries into a new kind of soft power has been due to the massive investments, oil wealth and massive injections of capital. Regulators, policy makers and investors have gotten interested in GCC countries due to their accumulations of foreign assets, current account surpluses, investment booms and sound government revenues following their high receipts from oil exports, non- hydrocarbon sector growth and high prices. GCC countries are slowly offering incentives for foreign investment in selected sectors and domestic equity markets such as; launch of new free trade zones, streamlined procedures for non- GCC firms and eased rules.

There are changes in trends in respect to investment strategies, development plans and attitudes regarding foreign investment with growth in tourism, real estate, infrastructure, industry and manufacturing especially of metals and petrochemicals (Deutsche Bank Research 2).

The structural nature of the oil boom has enabled GCC economies to build up reserves, accumulate surpluses and pay their public debt. GCC economies have embarked on diversification with shifts to the private sector from public sector and this has been the driving force of their growth. This has increased social infrastructure investments especially in health care, innovation, training and education. The emergence of new global players has been evident by the increased sovereign investments in the regions. Increased investment in the GCC region is likely to increase diversification, deepen financial markets and generate jobs for GCC nationals.

There are expectations of expansion of the regional trade with the launch of the common market thus increasing opportunities for investment and inter- GCC trade. Despite the benefits, the GCC countries are likely to face vulnerabilities and risks especially from reliance on hydrocarbons that come with geopolitical risks and price fluctuations, high unemployment and inflation (Deutsche Bank Research 3).

Agriculture

Food security being a major concern in the gulf “GCC nations have embarked on shifts in agricultural policies to broad based and flexible efforts from self sufficiency nationalistic goals,” (Deutsche Bank Research 4). Research conducted by the Deutsche Bank reveals that compared to emerging market counterparts with 10- 20% agricultural contribution to GDP, GCC economies have only 1% – 4%. Despite agriculture’s lowered economic importance in the GCC, its political and social importance remains relevant especially due to the increased food price pressures. This has caused the shift in focus for the policy makers with emphasis on agriculture.

The GCC have been experiencing an increased food demand outpacing the supply. This is mainly due to the increased per capital consumption and rising population. In the decade of 1998- 2008, the population grew at a rate of 3% per 40mn. Rising prosperity and increased income levels have necessitated shifts in consumption patterns with declined consumption in cereals and increased demand for animal produce encouraging more intensive use of land (Deutsche Bank Research 4).

The constraints that limit agricultural growth for the GCC are mainly scarcity of arable land and water making agriculture expensive. Renewable water availability per capital for the GCC ranges between 35- 550 cubic meters per year with arable land forming less than 2% of total land mass.

Table showing arable land as a percentage of total land.

As the GCC countries embark on ensuring measures for the sustainability of water use, the farmland expansion remains minimal. The options of government incentives and price support mechanisms proved successful following increased production which consequently drained the water resources shifting the focus back to food security from self sufficiency. Between 1980 and 1990, there was dramatic improvement in agricultural yields which was attributed to mechanization and greater usage of fertilizers. The improvement rates in yields declined following declined support from regional governments.

The pace of modernization slowed, water availability decreased, while government subsidies on inputs reduced all leading to the diminishing of returns. It is predicted that the GCC region is likely to maintain its position as among the leaders in food import in the coming years. This is due to the slowed improvement in yields, production deficits, increased demand domestically and shrinking farmlands. The GCC import of food in 2007 was valued at US$10bn which accounted for 1.3% of the region GDP for that year (Deutsche Bank Research 5).

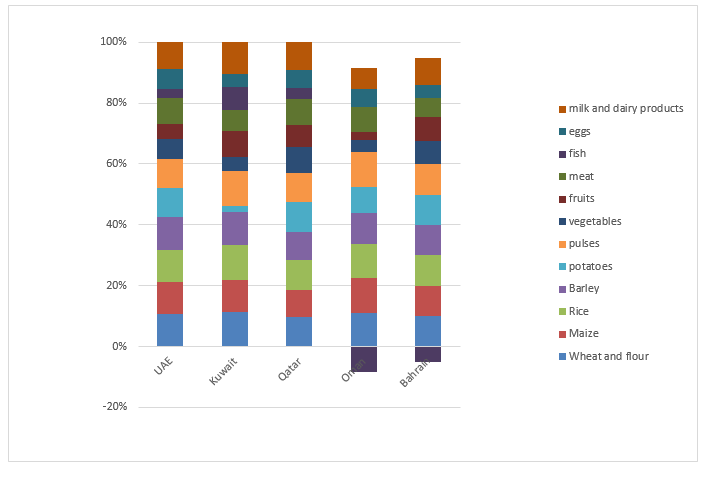

Graph showing imports as a proportion of consumption (2007).

The diversification of food grain to bio fuel and increased global consumption, has contributed to the volatile nature of agricultural products prices. Growth of demand has been evident over the years due to increased incomes and population with bio fuels causing competition for agricultural land. Supply on the other hand has been limited by slow growth in production, minimal inventories of food grain and fall in acreage.

The food price index grew in 2007 by 26% and 33% in the second half of 2008.The inflation was due to structural mismatch of demand and supply (Deutsche Bank Research 13). In the 1990- 2002, the GCC economies focused on monetary policies of maintenance of exchange rates and fiscal policies to ensure employment, equity and growth. This was characterized by initiation of great infrastructural projects thus lowering the priorities given to agriculture. The high population growth and unemployment meant increased import of food for the governments (Fasano and Iqbal 12).

The food price inflation of 2007-2008, was accelerated by the growth in popularity of bio fuels such as bio diesel and ethanol production by the use of rapeseed and maize. In the last three decades, there has been a consistent fall in the levels of agricultural stock for main consuming nations. Price volatility has been contributed by the diminishing stock levels and slowed productivity. The exposure to quantity risks and inflation is evident for GCC countries due to their heavy reliance on imports and external price shocks (Deutsche Bank Research 16). The mechanism for controlling volume and price changes for GCC countries is by stocking food grains in national food stores.

The strength in the fiscal position of the GCC countries, allows them to outsource agricultural production through increased investment and promotion of the private sector. This however poses weather and geopolitical risks. They have also embarked on prioritizing sustainable agricultural policies such as research, price support, agricultural modernization, among others such as lowered rates for inputs and encouragement of the private sector investment (Deutsche Bank Research 12).

Telecommunication in the GCC region

High population growth for the GCC countries has influenced growth of the rates of penetration to the telecommunication sectors hence increasing the competition rates in the sector. The ARPU Mounted pressure on the GCC telecommunication companies in 2009 due to the changes in the sector. The telecommunication sector in the GCC region is characterized by differences in operation for individual countries. Companies in the region have dynamic differences in operation which depends on the stake and influence in the domestic market, strategies for funding and expansions externally (Al-Asaad 9). The main telecommunication companies are; Zain prevalent in Kuwait, Wataniya telecom in Kuwait, Omantel in Oman, Bareko in Bahrain, Qatar telecom in Qatar and Etisalat in UAE.

Table Showing Global Research Telecommunication Coverage.

Where * is the market price as of 8th November, 2009 (Global research).

UAE GSM sector indicators

The total GSM subscriber at the end of September 2009 was 10.58mn with 413,000 additions of new customers in the third quarter of 2009. The UAE is likely to shift focus to high quality added services due to the near saturation condition of its mobile market. Etisalat which has great strength of presence domestically and internationally is likely to benefit through introduction of greater value added services following the shift of UAE to next generation network (NGN). The high ARPU iphones introduced in UAE are likely to enhance the maintenance of wireless ARPU. Internet and data services are forecasted to be the potential growth areas in UAE. The profitability of Etisalat is likely to help it pursue eye strategic acquisitions and strategies for expansion (Al-Asaad 7).

Kuwait GSM sector indicators

The total GSM subscriber base for Kuwait was 3.56mn by the end of June 2009, an increase of 10.7% with new additions of 208,000 for the first six months of 2009. The mobile operators experienced revenue losses following the scrapping off of fee charges for calls on their networks from fixed line. Wataniya telecom experienced declines of 1.0% in revenue and 27.7% in profit. Zain experienced 24.7% increases in consolidated revenues with 4.0% in net profit growth (Al-Asaad 8).

Oman GSM sector indicators

Competition was intensified in Oman due to the end of the monopoly powers of Omantel following the issue fixed line license to Nawras. The pricing technique for international calls is likely to be the main strategy of players in the sector (Al-Asaad 9).

Bahrain GSM sector indicators

Bahrain has the greatest penetration rate in the GCC. Players in the sector are likely to face the challenges of competition due to the entry of STC as a third mobile operator. Bahrain telecom had an increase of 4.4% in consolidated revenue for the first quarter in 2009. Its revenue improved by 1.0% while its profits declined to BD25.3mn by 8.2% (Al-Asaad 9)

Qatar GSM sector indicators

The volatility of wireless ARPU led to decline in customer base for Indosat. The core operations for the sector in Qatar are under pressure due to the shifts in call traffic and increased competition. Qatar telecom recorded an increase of 22.1% (Al-Asaad 10)

GCC Countries Telecom profiles in 2008.

Foreign Direct Investment in the GCC region

The GCC economies have witnessed economic and social transformations following the increased oil proceeds. These have been efficient in “the improvement of social indicators, creation of employment, modernization of infrastructure, maintenance of minimal external debt, accumulation of reserves and donations to poor countries,” (Fasano and Iqbal 7). Over the years, the challenges of reliance on oil sector have been pronounced in the GCC region due to the price shocks and the volatility of the industry.

High population growth rates have adversely affected the unemployment rates in the GCC creating the need for foreign direct investment in other non oil sectors to lower the negative impacts. The GCC have focused on privatization of state enterprises and speeded structural reforms to enhance market competition and reduce subsidies.

There has been increased reliance on foreign direct investment to manage and fund projects in the sectors such as water, agriculture, energy among others which has been enhanced by reduction of regulations, implementation of time specific projects and treating investors commonly to enhance efficiency.

GCC economies have offered incentives to encourage foreign direct investment in many different ways such as the liberalization of trade and exchange system, initiation of institutional, regulatory and legal reforms for the government of foreign capital inflows, streamlining administration in investment approvals, improving access of foreign investors to the local stock markets, allowing 100% foreign ownership of companies especially in the non hydrocarbon sectors and reduction of corporate income taxes to foreign corporations (Fasano and Iqbal 10).

Kuwait has a law in place which gives aliens the rights to complete ownership of its firms, while minimizing corporate taxes by more than 30% and speeding up the process of foreign direct investment applications through the establishment of foreign investment capital office.

In many economic sectors, Oman permitted complete foreign possession, renting of land and buildings to foreign firms and restructured foreign firms by increasing the proportion of foreign possession to 70% while lowering the income tax disparities.

Complete ownership of the service sector by foreigners was implemented in accordance to WTO trade pacts. Bahrain established efficient processes of approving licensing, relaxed laws on leasing land and possessing buildings for foreign firms while allowing complete foreign ownership of firms especially in the non-critical sectors. Qatar embarked on “reduction of corporate taxes to 30% from 35% while allowing 100% foreign ownership of businesses in crucial sectors such as agriculture, tourism, health, education and industry,” (Fasano and Iqbal 12). The UAE engaged in launching of free trade zones and reduced foreign investment restrictions in real estate projects.

Most of the GCC economies engaged in massive privatization to allow foreign direct investment. There is likely to be disparity in attraction of foreign direct investment in the GCC region from one country to another. Al-Ammari and Fournier (10) predict rapid developments in the telecom, infrastructure, alternative energy, financial services, health care and real estate sectors in the order of priority.

The diversification of thought for the GCC region from self sufficiency in agriculture to food security requires heavy reliance on foreign direct investment. Deutsch Bank Research (8) points out the encouragement of foreign investment in the GCC through incentives, simplification of the investment process and infrastructure boost. Opportunities for foreign investment lie in: the advancement of irrigation equipment and water management through introduction of modern technology and introduction of new seeds that increase yield and consume less water.

Al-Ammair and Fournier (5) identify that Qatar is likely to attract the highest foreign investment due to its promotion of non oil sectors and expansion especially for the tourism sector. Bahrain and Oman are predicted to have investments in the transportation sector due to their high populations.

Foreign Direct Investment over the next 1 year (where 6= most activity and 1= least activity)

Construction sector in the GCC region

The GCC region is expected to take leadership in the emerging markets due to its accelerated economic growth and enlargement of its sphere of influence. Developments in the GCC have focused on the crucial sectors which include; energy, telecommunication and infrastructure which have consequently attracted investment for both the GCC firms and the foreign non GCC firms. The region has adapted joint ventures for its sectors to increase the participation of foreign and domestic investors.

The high oil prices, increased oil demand and high population has influenced the growth of the energy sector. This has been evident by the major construction activities to increase production capacity and refining levels. The GCC countries for the period 2007- 2012, have embarked on investment of around US$500bn for construction investment in petrochemical, oil and gas sectors. “The UAE has had heavy investment for development of its downstream and upstream projects mainly in the hydrocarbon sector,” (Global Research 12). Kuwait Oil Company has offered contracts for phase 2 construction at its oil field to increase production by 2020 to 4mb/d and also had a launch of Lower Fars Oil Project for the production of heavy oils with sand. Qatar is building another refinery of 0.15mb/d capacity (Global Research).

The GCC has had heavy investment in infrastructure such as construction of union rail at a value of US$60bn to be completed by 2016 for the linkage of the GCC countries, initiation of Abu Dhabi metro at a value of US$7bn for completion in 2015.

Qatar is engaged in the construction of the new Doha Port a project valued at US$4.5bn. Bahrain has been involved in steel manufacturing mainly by united steel company through a project that begun in 2009 at a value of US$1.2bn.The construction in the transport sector has increased due to the increased foreign direct investment in the sector especially in Bahrain and Oman due to their high population growths (Al-Amaari and Fourier 6).

The telecommunications sector has had massive construction due to desire to have global expansion for the GCC countries. This has been necessitated by the privatization of telecommunications sector and postal services. Construction has also been evident in airport services, water distribution and management and tourism facilities which have been enhanced through offering of incentives to foreign investors in the major sectors (Fasano and Iqbal 7).

The diversification of the agricultural sector to provide food security for the GCC countries encouraged foreign investment. The nature of the land in the GCC region requires heavy machinery and projects if production is to be enhanced. Development has been initiated for construction of drainage systems to avoid soil salinity and water logging, water treatment plants, irrigation equipment, research centers and manufacturing plants (Deutsch Bank Research 13). Construction is enhanced through deals such as; joint ventures, mergers, sale of assets, privatization among others.

Business Cycle

The measurement of the GCC business cycle has been effective through construction of the coincident indicator. The characterization of the macroeconomic variables movements in respect to direction and timing is possible courtesy to the coincident indicator. Comparisons of the economic variables observed to latent factors behaviors’ are efficient in obtaining reliable economic interpretation of the factors. The launch of a single currency is top on the agenda of the GCC The achievement of this by 2010, requires the economic indicator which allows for efficient conduction of a sound monetary policy.

An indivisible and single common monetary policy and GCC monetary union creation requires wide financial and economic developments in the GCC region through the scrutiny of economic variables at regional and national levels. This is faced by several challenges such as; Kuwait’s de-peggment of its currency to the US dollar and the hindrance of Oman’s massive infrastructural projects in meeting the convergence criteria (Al- Hassan 4).

According to Burns and Mitchell (21), a business cycle is a fluctuation type in reasonable time series across the economy’s different sectors at the same time. Al-Hassan (2009) presents a construction of a coincidental indicator for tracking the evolution of the business cycle for the GCC area which is effective even in circumstances of partial information and high frequencies. He emphasizes the need to construct a large database for the GCC area in the extraction of business cycle information. He further asserts that to explain the business cycle for the GCC area, the coincident indicator has to meet the properties of; intertemporal smoothing, updating and cross- sectional smoothing.

The coincident indicator goes through estimation procedures of; covariance matrices estimation, static factors estimation and the cyclical component of the GCC GDP growth estimation. In the production sector of the GCC are, the GDP of the economies apart from Oman respect to the reference cycle, reveal a behavior that is pro-cyclical and coincident, that is, the tendency of industrial production tendencies falling with the decline in GDP growth and vice versa.

The lending and deposit interest rates for the GCC area exhibit a pro-cyclical and coincident behavior in relation to the reference cycle. In the financial variables, the fixed exchange rate regime for the GCC area causes the movements in the bill rate of the US treasury to coincide with the nominal interest rates. The market expectations of future outcomes economically are reflected by the prices of financial assets (Al-Hassan et al, 9).

The average variance of GCC consumer prices stands at around 40%. There is mixed timing of consumer prices in relation to the reference cycle, 50% of prices for the consumer tend to be lagging and coincident to the reference cycle while more than 67% is the degree of the consumer prices that are pro-cyclical. The dependence on revenues from the oil sector causes the oil prices movements to be coincident and pro-cyclic. A rise in foreign consumer prices, depreciates the GCC economies’ currencies in real terms while increasing exports. The positive change in net exports increases the GDP for the GCC nations while the behavior of money supply is cyclical.

The accumulation of oil revenues over time causes a decrease of the debt position for the central governments which shows consistency in cyclical behavior of the net claims to government. International reserves in totality respect to the reference cycle tend to be pro-cyclical and coincident except for Kuwait and Bahrain which reveal counter cyclical behavior. Imports are normally pro-cyclical and lagging due to the time lag in adjusting the government and private spending. Exports tend to be pro- cyclical and coincident. This is due to the dependence of the GCC economies on the oil sector that causes their GDP to increase as the exports of oil rise (Al-Hassan et al. 9).

The proposed test by Ng and Bai (6) is normally applied to the data set to establish the usefulness of the statistical latent factors economically. The nominal shocks from the test are for the latent factors strong proxies. The nominal shocks have an appearance of greater importance in the explanation of the driving forces in the GCC area of the business cycle evolutions than real shocks.

Testing the Observed Macroeconomic data Against the Latent Factors.

Financial sector in the GCC region

The interdependence of the GCC countries and dominance in the oil export allows them to adopt a fixed exchange rate regime which exposes their financial systems to risks and vulnerabilities from the international oil prices shocks. The financial system in the GCC has a dominance of banks which are well supervised, profitable and capitalized with compliance to international codes and standards (Fasano and Iqbal 7).

The GCC has taken gradual steps in the implementation of monetary policy that is fixed through credit ceilings and interest rates. The GCC countries have “different regulatory practices of banks especially concerning; loan classification and provisions, requirements for liquidity and restrictions on entry,” (Fasano and Iqbal 7). The banking sector of the GCC economies has maintained flexibility to fluctuations in prices of oil thanks to effective monetary strategies in place, which have facilitated the strengthening of the sector’s supervision and capitalization. The financial sector has had reforms over the years. “Bahrain issued Islamic government bills for complementing the work of Islamic financial institutions, while in 2001 engaged in ratification of anti- money laundering regulations,” (Fasano and Iqbal 8).

Oman has been engaged in expansion of facilities for repossession to the interbank market and restructured its securities market. In order to manage liquidity, Oman’s central bank engaged in reactivation of the issuance of certificates of deposits. It also engaged in measures for risk reduction while combating terrorism financing and complying with anti- money laundering recommendations. In 2001, Qatar embarked on reinforcing bank oversight, introducing new strategies for improving the liquidity administration and removing interest restrictions which were on domestic currencies. The UAE has been active in adopting legislations for anti- money laundering, combating the finance of terrorism and adopting risk management modules for banks (Fasano and Iqbal 8).

Bahrain has the largest retail banking sector with least concentration in the region. At the end of 2008, the assets amounted to 260% of the total GDP. It also has wholesale banking sector that is vibrant with the largest involved in projection of financial services and offshore investment banking. Kuwait has a highly concentrated banking sector and investment companies which though have been adversely affected by the fall in prices and liquidity conditions globally. Oman has the smallest banking system which holds 66% as a share of the GDP. Qatar has a highly concentrated banking system with three major local banks. The foreign banks are involved in investment and finance of infrastructure projects. In the GCC, the second largest banking sector is UAE though with the least concentration (Espinoza et al. 10).

Islamic banks have grown over the years with an average of 24% of the banking system assets of the region. Though there are exceptions, there is limited presence for the non financial institutions in the region with scarcity of non bank finance companies. There has been growth in the stock market capitalization with lack of institutional investors thus increasing the volatility of the GCC markets.

There is under development of local debt markets following the drawing down of outstanding debt by the government. Ownership of the banking sector is mainly domestic due to barriers of entry and restrictions of licensing for foreign banks with significance in quasi public sector and public sector ownership ranges. In the private sector, the GCC has experiences rapid credit growth which has been indirectly influenced by the international oil price increases which have boosted non oil GDP growth and government spending.

As a result, business confidence has been spurred thus increasing investment. The banks in the GCC are well capitalized with high quality assets and tightened liquidity. The GCC countries have maintained reliance on the stable deposits as the source of funds thus requiring the evaluation of liquidity management practices (Espinoza et al. 11).

Population and population growth in the GCC region

Since oil was discovered in the Persian Gulf, the Persian Gulf Arab states have experienced a radical transformation from being desert sheikhdoms to being modern states. This transformation process has gone hand in hand with a rapid population growth. The population in the contemporary GCC member countries has increased more than eight-fold within a span of 50 years. To be specific, the population in the region has grown from a mere 4 million in 1950 to approximately 40 million by 2006, which represents one of the highest rates of population growth globally (Kapiszewski 3).

This population growth has not resulted chiefly from a natural growth of native population but by the immigration of foreign workers. The hiring of large numbers of foreign workers has been a structural policy implemented by the GCC member states because the oil-related progress relies on the importation of foreign technologies and requires knowledge and skills which are lacking in the local Arab population. As a result, contrary to Western Europe where foreign workers only complement the domestic workforce typically by taking up lower-status employment positions, in the GCC member countries the foreign workers are the main, prevailing labor force in many sectors of the economy as well as the government sector.

The proportion of foreigners in the GCC region has steadily been rising over the past decades. The population increased from 31 percent in 1975 to more than 38 percent in the mid-1990s. It then leveled and declined a little at the beginning of the 2000s, and only increased again lately. By the end of 2004, the year when the most recent comparatively dependable statistics were released, the GCC member countries were occupied by approximately 12.5 million aliens, who made up 37 percent of the overall population.

In Qatar, the UAE, and Kuwait, aliens represented a majority of the countries’ population with more than 80 percent of the entire population in the United Arab Emirates. Only Oman and Saudi Arabia have been able to keep the proportion of foreigners at relatively low rates: at approximately 20 and 27 percent respectively (Kapiszewski 4).

The large number of foreigners in the GCC region has even been more prominent in the workforce than in the general population. Foreigners made up a greater part of the labor force in all the GCC states, with the standard proportion standing at almost 70 percent in the year 2004. Besides Saudi Arabia, only Bahrain had a low proportion of foreign workers. But even in these two countries’ labor force, the proportion of the alien workers was more than half that of the national workers. In Kuwait, Qatar, and United Arabs Emirates, the proportion of the foreign workers in 2004 stood at 82 percent, almost 90 percent, and 90 percent respectively (Gulf Cooperation Council 2; Fasano and Goyal 22; Girgis 2). This high number of foreigners in the GCC region creates security, economic, social and cultural threats to the native population.

Table showing the population of the GCC countries (excluding Saudi Arabia) as of 2004.

Labor market in the GCC region

The most unique feature of the GCC labor markets is that they have a great proportion of foreign workers. “The number of the expatriate laborers in these states grew five times between 1970 and 2000, from 1.1 million to 5.2 million,” (Fasano and Goyal 6). The estimate given by the United Nations is that these workers will increase to approximately 5.5 million by the end of this year, out of whom 3.7 million are located in Saudi Arabia (Fasano and Goyal 6).

The expatriate laborers in the GCC states presently vary from 50 percent of all employees in Saudi Arabia to 90 percent in the United Arab Emirates. The first influx of expatriate laborers happened in the 1970s and the early years of the 1980s. This influx resulted from the high oil prices during that time which in turn contributed to the high demand for labor to construct the GCC states’ physical and social networks. To meet this high demand, and taking into consideration the moderately small size of the national populations of the states, the GCC countries implemented an open door policy to alien workers. The small size of the local population of the GCC countries was not adequate to meet the high demand for laborers.

The open door policy of employment is still in operation today in all the GCC states although some limitations to the policy have been introduced during the past years to promote the growth of the non-oil economic sectors. Moreover, a scarcity of skilled local labor contributed to the sustained dependence on foreign labor, while at the same time managing to maintain the costs of labor at a low level.

The availability of a highly elastic supply of foreign laborers at globally competitive wages and on flexible employment terms has also led to the avoiding a severe worsening of the competitive edge of the non-oil sector typically seen in economies with abundant oil or other natural resources. This availability has also been vital in enhancing the adjustments of the GCC economies to shocks resulting from imbalanced terms of trade particularly in the framework of “de facto” fixed exchange rate regimes (Fasano and Goyal 7).

Alien laborers are subjected to a comparatively elastic labor structure. They are employed on limited-duration job assignments which are founded on a sponsorship system. This system aids their employment and firing by the firm that facilitates their entry into the country on a work contract. Foreign employees are drawn to the GCC region due to the fact that their anticipated earnings are higher than in their home countries. Majority of these laborers originate from India and other countries in the Asian continent, including Indonesia and the Philippines. They also enjoy great benefits such as subsidized public services, for instance, energy, education, and health (even though they are charged higher rates than the local people), as well as the lack of income and utility taxes, thereby improving their saving capabilities.

As a matter of fact, during the last half of the last decade, the amount of money transferred abroad by the foreign workers ranged on average between 6 and 11 percent of the gross domestic product of the host country on an annual basis. This translates into between $2,500 and $4,500 per person (Fasano and Goyal 8).

The unrelenting high number of expatriate workers in the GCC states is also mirrored in the division of the labor market on the basis of earnings, expertise, and sectors of employment for locals and foreigners. Inherent in this division of labor has been the assurance of work opportunities in the public sector extended to the locals, who have a preference of working in this sector due to the relatively high wages, job security, social benefits, and generous retirement packages.

In addition, career progression in the public sector is done according to the rank instead of work performance, whereas shorter working schedules in this sector as compared to the private sector (as well as limitations on foreign investment) make it possible for public employees to start and manage other income-generating activities on the sideline. All these factors have contributed over time to a wide gap between the private and public sectors’ wage and benefit schemes, thereby resulting in high reservation wages. As a result, in majority of the GCC states, apart from Bahrain and Saudi Arabia, over 60 percent of the local labor force is hired in the government sector, which has also taken in majority of the female locals entering the labor market during the last decade.

On the other hand, majority of the foreign workers are employed by the non-oil private sector and represent, on average, more than 85 percent of the total hired workers in that sector. Private employers have a preference for employing foreign laborers due to the lower cost (wage and nonwage benefits) they incur as compared to the local workers. Nevertheless, the disparity in the costs incurred in hiring foreign vis-à-vis local employees becomes narrower if the foreigners hired have high skill levels. Foreign workers have also comparatively better training and have, practically, a more flexible contract agreement that aids their hiring and firing. Moreover, they are paid more flexible wages (Fasano and Goyal 9).

Real Gross Domestic Product in the GCC region

From the international viewpoint, the Gulf Cooperation Council is still a small but significant region, having a nominal gross domestic product (GDP) of 1.5% of the globe’s total, similar to ASEAN the countries (Deutsche Bank Research 10). With its current total population standing at approximately 38 million, the GCC is small compared to its economic allies (see the figure below).

Figure showing the GCC population vis-à-vis the population of its economic peers

Nevertheless, based on the rates of economic growth rates, the GCC has performed better than the Middle East and Latin American growth rates. Additionally, the GDP per capita income (that is, per head), particularly in the United Arab Emirates and Qatar, is one of the highest in the globe (see the figure below).

Table showing the GDP per capita and real growth rate in GCC countries as of 2006 (excluding Saudi Arabia)

The high economic growth in the GCC region is expected to persist during the next several years due to skyrocketing oil prices and growth in other non-oil sectors. The GCC region still depends heavily on the hydrocarbon sector for its exports and GDP growth; but the region GCC has witnessed impressive benefits resulting from the diversification of its economy during the last few years. As a matter of fact, the real GDP growth from the non-hydrocarbon sector surpasses that of the hydrocarbon sector in each of the GCC states apart from Qatar (Deutsche Bank Research 3).

The GCC states are in a good position to take on a seriously vital role in the up-and-coming new international order. The region’s combined share in the total world’s GDP has been progressively rising, from 0.85% in 1990 and 1.08% in 2000 to 1.54% in 2008 and is additionally expected to rise to 1.8% by the year 2020. The region’s international weight goes far beyond the total figures because of its strategic significance as a supplier of hydrocarbons and one of the top international repositories of government assets.

The GCC has also become more and more skillful at taking advantage of its geographic location as a transit focal point between the thriving emerging economies of Asia and the developed economies of the West. The longer-term growth possibilities of the GCC economies are underpinned by desirable elements in the form of rapid population growth and extensive hydrocarbons riches, which are now being reallocated to promote the development of a more varied economy. Indeed, the GCC region is on its way to “establish itself as a USD2trn (see the figure below) economy in the course of the coming decade, a near-doubling of the current size,” (NCB Capital 11).

Figure showing the GCC economic growth forecast

Export and import in the GCC region

The role of the GCC in international and regional trade is increasing considerably. The global economic outreach of the GCC is significantly larger than that of majority of other Middle Eastern economies. The major export commodity of the GCC is oil, where it made up approximately 83 percent of the GCC member countries’ overall exports between 2003 and 2007 (Fasano and Iqbal 3). Moreover, the GCC comes out as an international focal center of finance and heavy manufacturing industries, where the trade of the GCC in commodities different from hydrocarbons increased tremendously after 2003. Between 2003 and 2007, GCC economies’ contribution to the global trade increased from 1.9 percent to 2.7 percent (Fasano and Iqbal 4).

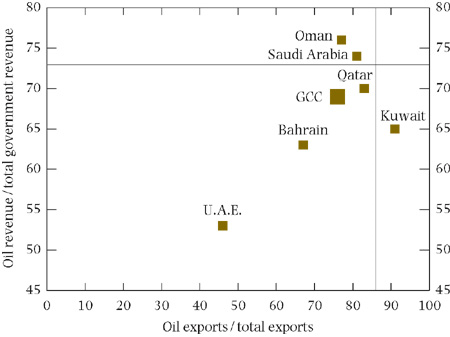

Total exports’ value of commodities was USD 86 billion in 1990, USD 110 billion at the close of the last decade, and USD 422 billion in 2006. On the other hand, the imports’ value was USD 48 billion in 1990, USD 82 billion at the close of the last decade and USD 238 billion in 2006. A greater proportion of the GCC economies’ total exports were composed of oil and natural gas (see the figure below). On the other hand, the GCC economies chiefly imported “machinery and mechanical appliances, vehicles and parts as well as electrical machinery and equipment during the same period,” (Insel and Tekce 6).

Figure showing GCC countries’ oil dependency

Figure showing merchandise imports across the GCC (1995, 2000, 2007E)

Examining the GCC states’ international trade patterns, Asia is the leading destination for GCC states’ exports in commodities, while the European Union makes up nearly 30 percent of GCC imports (see the figure below). In 2006, almost 60 percent of the GCC countries’ products were exported to Asia, of which 30 percent of the GCC exports were destined to Japan and Korea, whereas the EU and the US made up only a small portion, with 10 and 9 percent respectively.

On the imports side, the EU exported more than 31 percent of the GCC total imports, which renders it the GCC’s largest trading partner. Asian economies, on the other hand, made up only 30 percent of GCC economies’ imports. Trade among the GCC states continues to be minimal, but is anticipated to increase with further development in the diversification of the GCC countries’ economies as well as regional integration (Insel and Tekce 4).

Figure showing GCC main export markets

Figure showing GCC main import markets

Another vital feature of the GCC is that the region attaches huge significance to trade liberalization both among the member countries and with the rest of the globe. For an intensive regional economic integration, the GCC has been implementing a plan of action that has three stages; the first stage involves the creation of a customs union, which begun in 2003, the second stage involves the creation of a common market, which was inaugurated on 1 January 2007, and the third stage involves the launch of a single common currency by 2010. By implementing these three stages, the GCC economies’ goal is to create an economic bloc that is similar to the European Union.

At present, even though the customs union has been established and trade barriers among the member countries have been mainly eliminated, the trade between the GCC member countries accounts for only approximately 10 percent of the total foreign trade. This rate is considered to be too low compared to the desired rate which ought to be approximately 25 percent. GCC is also implementing Free Trade Agreements (FTAs) at different levels with a number of countries. So far, the FTAs that have successfully been finalized include those with the EFTA and Singapore in early 2008. FTAs negotiations that are still ongoing include the agreements with “the EU, Turkey, Australia, South Korea, India, China, New Zealand and Japan,” (Insel and Tekce 5).

Inflation in the GCC region

Inflationary pressures have increased in the oil-abundant Gulf Cooperation Council (GCC). The average inflation rate experienced in the region was estimated to have risen to approximately 11.5 percent in 2008, a sharp rise compared to the inflation rate of 6.3 percent the previous year (Kandil and Morsy 5). Price changes have however not been the same across the six GCC states, with the highest increase in inflation experienced in Saudi Arabia and the lowest in Bahrain.

The increase in inflation rate has been strongly associated with increasing oil revenues and the ensuing spending boom. The GCC member states have been enjoying a boom of oil revenues thanks to the record crude prices (see the figure below). Whereas the increase in revenues has spurred the region’s economic growth, it has left the states flooding in cash. The high liquidity rate contributed to enormous growth in credit and total demand, which tackled the structural bottlenecks on the supply side, especially in real estate (Kandil and Morsy 6).

Figure showing the inflation rate in GCC between 2000 and 2008

The depreciation of the U.S. dollar is another factor which led to the inflationary pressures, thus creating doubts as to the sustainability of the peg in GCC. The declining trend of the U.S. dollar translated into a depreciation of GCC domestic currencies vis-à-vis the currencies of their trading partners, especially the Euro. Consequentially, the prices of imports skyrocketed in most of the GCC countries. It is predicted that at least a fifth of the inflation rate resulted from the increase in import prices.

This forced Kuwait to desert the peg of the dinar to the U.S. dollar in May 2007 and implement a (weighted) peg to a combination of currencies for its predominant trading partners. There are however debates surrounding the likelihood of abolishing the peg of the GCC states’ currencies to the U.S. dollar in the other GCC countries. In the recent past, however, the inflationary pressures in the GCC region have declined as a result of declining domestic demand and a considerable fall in import prices (Kandil and Morsy 7).

Monetary union in the GCC region

The formation of a common monetary system, through a common currency, is a clear objective of the Gulf Cooperation Council states. This objective was officially affirmed in June 1982 immediately after the inception of the GCC.

The model offered by the successful initiation of the third phase of the European Economic and Monetary Union (EMU) in early 1999, which symbolized the implementation of the euro by 11 European countries, as well as the ongoing work by the GCC member countries to promote the integration of their economies have led to the renewal of this objective. The adoption of a common currency in the GCC region has both potential advantages and disadvantages to the member countries (Jadresic 3).

Advantages of a common currency to the GCC countries

The major direct benefit of adopting a common currency in the GCC is the elimination of costs that arise from foreign exchange of intraregional trade. A common currency would eradicate the present costs incurred by businesses and households in form of foreign exchange commissions and disparities that arise from the buying and selling rates during varying regional currencies. A common currency would also lead to the reduction of the accounting and other internal costs incurred by businesses whose operations are established in more than one country in the region, and most likely the expenses and time spent on intraregional transnational payments.

Another economic advantage of adopting a common currency is the elimination of uncertainties surrounding bilateral exchange rates. While at the moment these rates are unchanging because of the overall dominance of individual pegs to the dollar, there remains the likelihood of the unilaterally alteration of the exchange rate pegs by one or more of the GCC countries. As a result of the existing time-lag between the time of making a contract and the time of obtaining or making a payment by the investor, this uncertainty may lead to the impairment of the intraregional trade and investment activities of risk-averse agents (Jadresic 5).

Whereas in theory this uncertainty can be avoided through forward or future markets, in practice such markets either are not in existence or are too costly to utilize. It is important to emphasize that the elimination of these intraregional foreign exchange expenses and risks would be vital because of their ability to improve the overall economic efficiency of the region.

In addition, because these expenses and risks are fundamentally a tax levied on intraregional trade and investment, their abolishment would lead to the promotion of the region’s extent of economic integration. Moreover, because trade between the region is chiefly non-oil-related, their abolishment would also lead to the growth of the non-oil economic sectors (Jadresic 6). Compared to the equivalent benefits that other regional blocks may gain by unifying their currencies, however, these benefits pertaining to the case of the GCC countries are not likely to be huge.

The main reason for this is that the size of these gains is reliant critically on the volume and value of the intraregional foreign exchange deals, which in turn rely heavily on the magnitude of intraregional trade. Regarding the GCC member states, intraregional trade is modest. Another rationale explaining why the gains of a unified currency in the GCC states are not particularly great is that bilateral rates in the region are almost fixed. Jadresic argues that, “the reduction in the uncertainty about bilateral rates that can be obtained by pegging them near-irrevocably is thus much less important than in other potential common currency areas,” (7).

Nevertheless, this evaluation should be made keeping in mind at least two vital observations. First, when assessed in terms of the contribution to the GCC’s major goal of establishing the region’s non-oil economy, the prospective gains of a common currency in the region are much more considerable. Second, a currency union, particularly if adopted together with a wider economic and political integration policy, would lead to an increase in the intraregional trade and investment and therefore render the size of the efficiency benefits more significant as time goes by.

Disadvantages of a common currency to the GCC countries

One of the major challenges that can be brought about by the adoption of a common currency is that each member country would be forced to give up the likelihood of unilaterally modifying the value of its national currency. Whereas in the past the states of the region have not used this alternative, the repercussion is significant because of the likelihood emanating from cases in which a specific country encounters adequately extensive macroeconomic imbalances that would make it want to alter unilaterally the value of its nominal exchange rate.

For example, the country under consideration may be challenged by a huge idiosyncratic shock that necessitates a considerable alteration of its real exchange rate, and may evaluate that without the alteration of its nominal exchange rate, the adjustment to such a shock would necessitate the reduction of nominal wages and prices via an inappropriately huge recession. With the adoption of a common currency, no single state would be in a position to implement such a strategy on its own (Jadresic 7).

A second potential challenge of adopting a common currency is that countries that encounter no essential challenges of their own may end up experiencing harmful monetary spillovers that arise from the macroeconomic discrepancies in the other members of the region.

For example, one prospective problem is that a particular member state may be completely content with the current monetary and exchange rate regime, but the currency union may opt or be mandated to change it regardless of the preferences and economic conditions prevailing in that particular state. Perhaps most significant, it is likely that financial problems in one or a subgroup of countries would lead to a universal loss of reliability in the regional currency peg, with consecutive undesirable effects on the member countries’ interest rates and liquidity, in spite of their unique conditions (Jadresic 9).

Obstacles and Challenges towards GCC Integration

The last few decades have seen a growing integration effort of the GCC countries in the global economy. These efforts are apparent from several manifestations. First and foremost, there has been an increasing participation of the GCC member states in foreign trade through a higher rate of export of the GCC abundant natural resources – oil and natural gas – to other regions, as well as an increasing importation of processed goods, capital goods, and foods from other regions. The greatest portion of commodities exported from the GCC region has been crude oil which made up approximately 88% of the overall exports in 2000. The predominant import commodities in the same year were “machinery and transport equipment 39.5%, manufactured goods 17%, food and live animals 15%, and chemicals 9%,” (Al-Yousif 4).

Second, the oil boom which began in the 1970s has enabled the GCC member states to siphon their high oil revenues to other countries especially the developed world. Presently, some studies place the GCC member states’ foreign assets at higher than $500 billion of comparatively liquid cash (Henry and Springborg 180). Third, due to the relatively small size of the GCC population, the states of the GCC rely heavily on foreign labor to execute their development strategies. Lastly, the low tariff levels in the GCC economies are projected to decline to less than 10 percent following the adoption of the customs union in 2003.

It is evident that the GCC countries are assimilated in the global economy. Nevertheless, integration in the global economy is different from enjoying the prospective benefits from the integration. Evidence exists that the GCC countries face many challenges regarding their integration in the global economy. These challenges include weaknesses in “economic growth, trade, investment and unemployment,” (Al-Yousif 4).

Economic growth challenges

Although it is effortless to kick off economic growth, it is more challenging to maintain it. This is evident in the GCC member states that have attained high levels of economic growth thanks to the skyrocketing of oil prices beginning in the 1970s, yet the countries have had the poorest performing economic growth during the past twenty years as measured by global standards. The IMF states that the GCC economies have witnessed a considerable fall in their real per capita gross domestic product and universal growth in the last two decades. This record is attributed to the poor general performance of the Middle East and North African Countries (MENA) economies during the same era.

For instance, “between 1980 and 2001 the region’s real per capita GDP did not increase at all, compared to an average annual growth of 6.3 percent in the East Asian countries, and 1.3 percent in the other developing countries,” (World Bank 67). Moreover, there is proof that the MENA countries that experienced low total factor productivity were countries that produce and export oil and that recorded low rates of economic growth (Abed and Davoodi 8).

The growth outlook of the GCC member states in the next years is also discouraging. Forecasts developed by the World Bank show that the global economic meltdown had an adverse effect on both oil prices and the exports of the GCC. In the coming years, the region’s rate of economic growth was predicted to be approximately 2.6% per annum, which translates into a real fall of 0.4% in per individual earnings.

Trade challenges

The GCC countries are considered to be small and liberal economies that rely heavily on the other economic regions for the sale of their main source of earnings, oil, as well as for the purchase of other commodities that they do not produce. As a result, the liberalization of trade provides the GCC region with several opportunities that, if coupled with suitable economic policies, can enhance the sustainability of the region’s economic growth (World Bank 52).

Undoubtedly, the openness of the region’s countries to the global economy has offered the countries a market access for their oil and gas resources and thus the foreign exchange earnings required to purchase the commodities and services they need from other regions. As a result, foreign trade was a vital element in the region’s economic growth that started during the oil boom experienced in the early 1970s (Al-Yousif 5).

Despite this, the GCC economic growth remains non-self-sustaining because of two significant and connected factors. As observed by several scholars, the boom of the East Asian economies is linked to a mixture of liberal trade and government expenditures spent on human and physical capital as well as high import volumes of capital and technology (World Bank 52). Studies undertaken on the correlation between trade strategies and economic growth support this observation, which give two major reasons for the observation. First and foremost, no country can develop by merely implementing liberal trade regimes. Rather, booming economies like East Asia have resulted from embracing opportunities provided by global trade as well as local investment and institution-building.

The second observation is that free trade enhances the allocation of resource allocation by distributing the factors of production from less fruitful to more fruitful economic sectors. In the short term, nevertheless, free trade can have some negative effects on the countries, including an increase in the rate of unemployment, an increase in poverty levels, and a decrease in government revenues (Winters 49). This implies that free trade should be implemented slowly to reduce these expenses and should be accompanied by safety nets to alleviate its negative effects.

Investment challenges

Investment, which is the movement of capital between countries, is an important component of globalization. Investment in the GCC region has been quicker than trade in the recent past. Investment has a great potential of steering the growth of the region’s economies by availing it with technical skills, training, and modern technology (Borensztein et al. 125). Foreign direct investment also enhances the increase in production and exports.