Executive Summary

The chosen ASX 300 organisation for examination is Hansen Technologies Ltd. The analysis of the annual financial report is conducted based on AASB 16 standards from the perspective of Property, plant and equipment (PPE). The types of financial reporting included in the paper are qualitative characteristics of useful financial information and general-purpose financial reporting. Based on the analysis, the recommended action is to increase the number of PPE details in the report to improve the comparability characteristic. Ultimately, Hansen Technologies provides sufficient information in regard to PPE disclosures but omits smaller details that might be useful for cross-comparison between companies and time periods.. Introduction

In the modern realities of COVID-19 restrictions, comprehensive financial reporting has become more significant to identify any potential risks of investments. Therefore, it is crucial to ensure that the organisations follow contemporary accounting standards, such as International Financial Reporting Standards (IFRS) or the criteria prescribed by the Australian Accounting Standards Board. Consequently, for the sake of the current work, it is vital to analyze the Property, Plant and Equipment (PPE) component to ensure the integrity of the annual report. The examined organisation is Hansen Technologies Ltd – an ASX 300 firm with a comprehensive financial report that ended 30 June 2020. The company has implemented AASB on 1 July 2019 and meets the requirements of the assignment. Ultimately, the current business research analyzes the annual financial report 2020 of Hansen Technologies Ltd in regard to disclosure requirements for PPE.

Property, Plant and Equipment

As mentioned briefly before, PPE is one of the major and illustrative components that define the financial value of the company. At present, the criteria of PPE are prescribed by the Accounting Standard AASB 116, which has implemented several changes to AASB rules (Australian Accounting Standards Board, 2019). The new amendments to the AASB were designed to ensure the transparency and consistency of financial reports, which is particularly significant in the period of economic stagnation (KPMG, 2020).

As a result, investors can make more weighted decisions concerning the assets of the firm due to AASB 16. Regarding PPE, AASB 16 is regulated under section 334 of the Corporations Act 2001 and administers annual financial periods after 1 January 2019 (Australian Accounting Standards Board, 2019). Ultimately, the standard presents the objectives, accounting criteria, scope, definitions, disclosures, and other significant factors concerning PPE.

Hansen Technologies Analysis

The annual report 2020 of Hansen Technologies provides thorough information on PPE as per AASB 16. Nevertheless, the organisation explicitly states that there are certain deviations from the standard protocol due to the adoption impact of AASB 16 on previous data (Hansen Technologies, 2020). For instance, the company decided not to include short-term leases, low-value assets, and initial direct costs of right-of-use assets (Hansen Technologies, 2020). Consequently, Hansen Technologies excludes detailed information on residual values, useful lives, and depreciation of PPE unless it has changed since the previous financial year (Hansen Technologies, 2020). Ultimately, while the report follows the AASB protocol, the organisation omits some information regarding PPE disclosures and explanations.

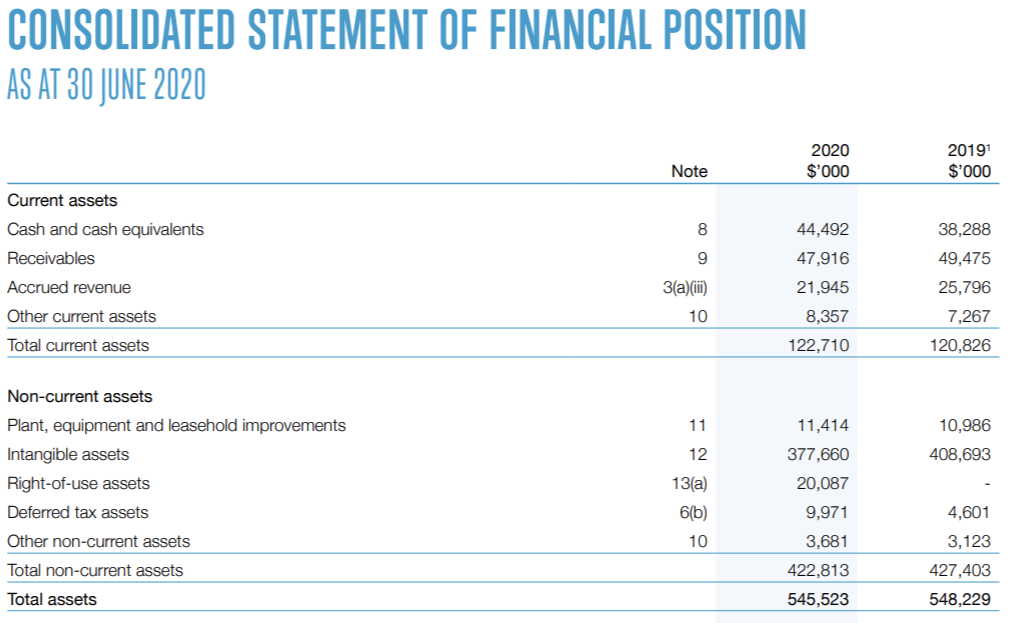

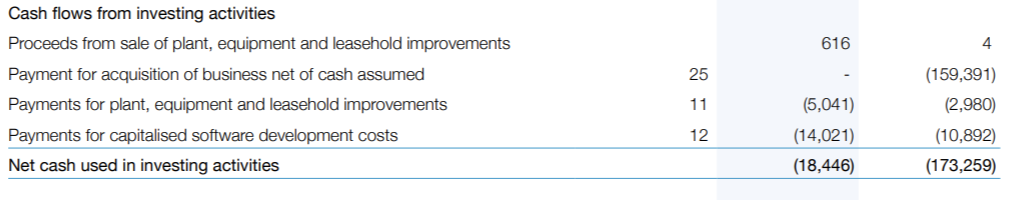

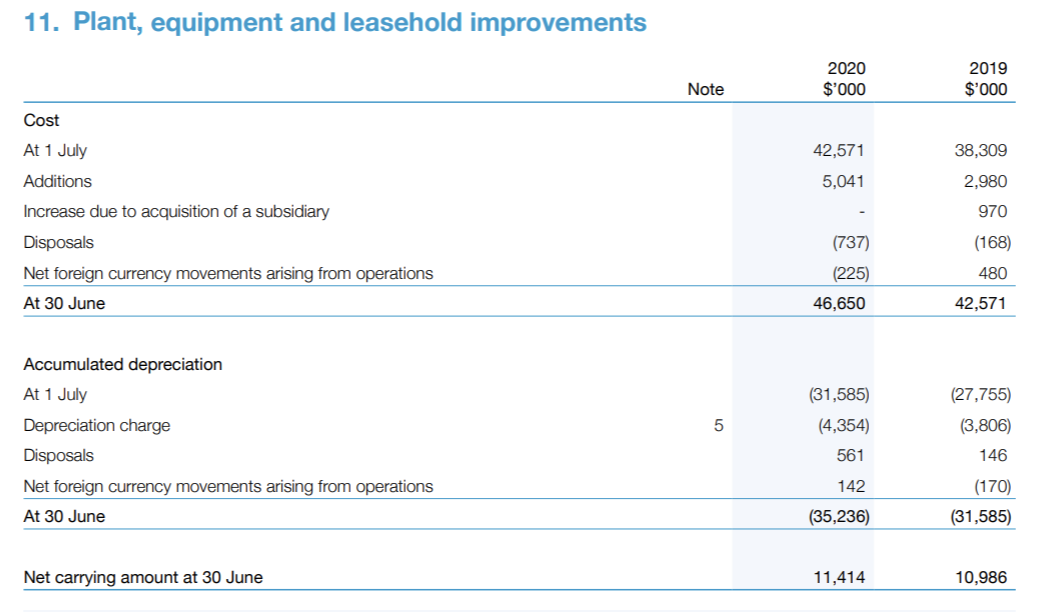

Nevertheless, it is possible to conduct a comprehensive analysis based on the presented information. To avoid confusion, the standard Property, Plant and Equipment (PPE) is designated as plant, equipment, and leasehold in the annual report (Hansen Technologies, 2020). Appendix A provides the data on current and non-current assets, including PPE improvements and right-of-use assets, from the consolidated statement of financial position (Hansen Technologies, 2020). Appendix B presents information on cash flow activities in regard to PPE (Hansen Technologies, 2020).

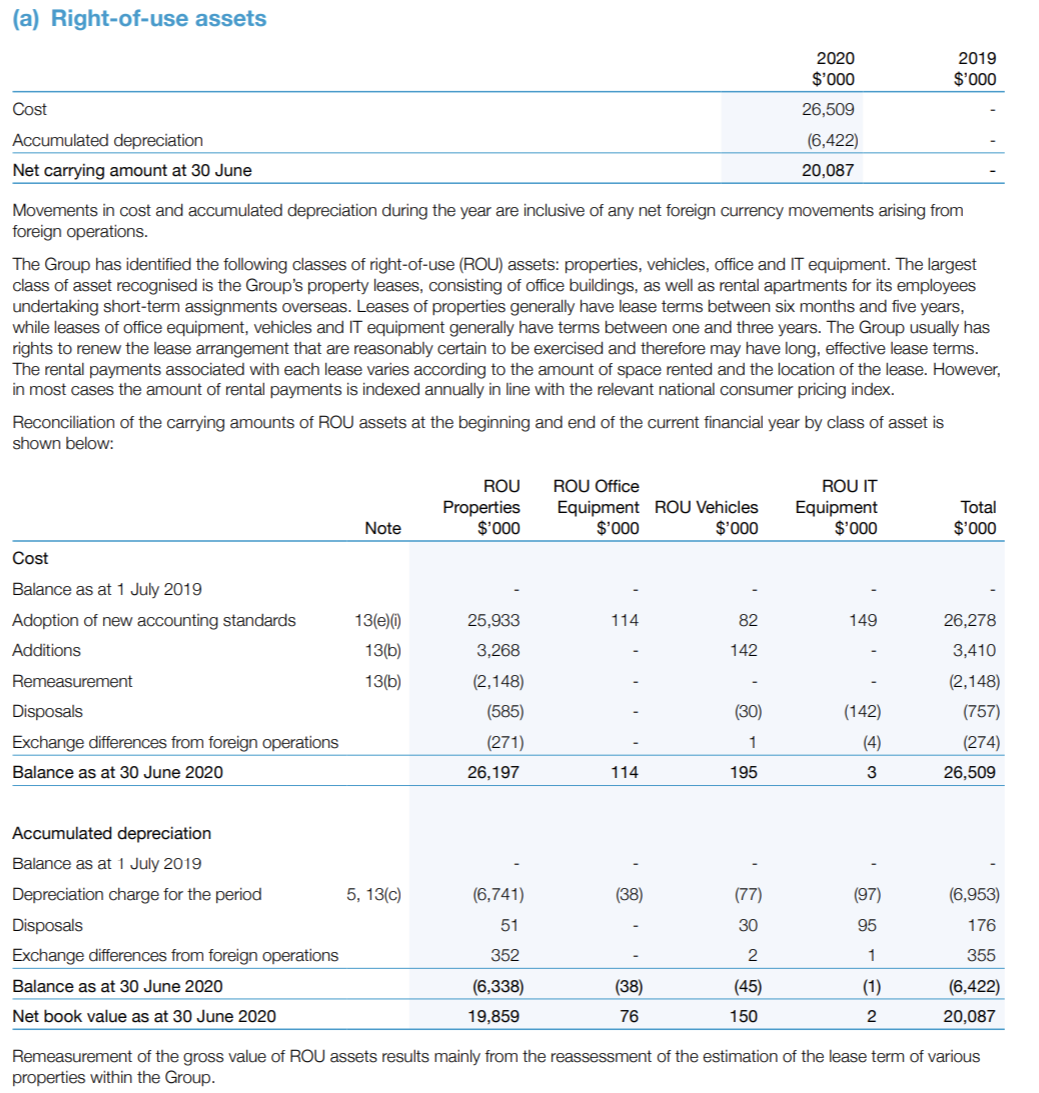

Appendix C illustrates the depreciation expenses from PPE improvements and right-of-use assets (Hansen Technologies, 2020). Consequently, the report provides detailed information on cost and accumulated depreciation to PPE improvements, which is presented in Appendix D (Hansen Technologies, 2020). Lastly, Appendix E presents the data on the cost and accumulated depreciation of various classes of right-of-use assets (Hansen Technologies, 2020). Ultimately, the said five appendices illustrate the most relevant PPE information in the annual report.

Based on the retrieved data, it is possible to compare the disclosures presented in the report with the requirements postulated by AASB. Appendix F provides the complete list of regulations for every PPE class. AASB 16 states that the organisations are encouraged to follow all these requirements; however, the primary principles are recognition, depreciation, and impairment losses (Australian Accounting Standards Board, 2019). As seen from Appendix D, Hansen Technologies provides essential information, such as costs (impairment losses are calculated prior) and depreciation as per AASB standards (Hansen Technologies, 2020).

However, upon thorough comparison, it is evident that the organisation omits a large number of smaller details. For instance, depreciation methods and sources of acquisition are not explicitly shown for each financial year (Hansen Technologies, 2020). Furthermore, some of the characteristics are already incorporated into more significant values, such as cost and valuation, which makes the report less transparent for investors (Hansen Technologies, 2020). Ultimately, Hansen Technologies presents the essential PPE factors in the report and omits smaller details.

Qualitative Characteristics of Financial Information

Consequently, it is crucial to examine the annual report from the perspective of fundamental and enhancing qualitative characteristics of useful financial information. In general, the former refer to essential factors of reporting, such as relevance and faithful representation (Jan, 2020). The latter concern characteristics that increase the transparency and usefulness of the statement, and they include comparability, verifiability, timeliness, and understandability (Jan, 2020). The annual report of Hansen Technologies performs considerably well in the fundamental characteristics. Namely, the organisation provides the most significant and up-to-date information, which is sufficient for investors to make weighted decisions and is, therefore, relevant.

Additionally, the presented information appears reliable and neutral from the outer perspective; thus, it meets the faithful representation requirement. However, comparability – an enhancing qualitative characteristic – needs more attention from the accounting perspective. Hansen Technologies omits a considerable number of PPE details, which might obstruct the cross-comparison process with other companies. Consequently, the report provides the information for the last two years, which is not an illustrative period for analysis. Therefore, Hansen Technologies need to improve the annual report from the comparability perspective.

General-Purpose Financial Reporting

According to the appendices, the PPE disclosures fully satisfy the requirements of general-purpose financial reporting. In general, this term refers to broad information about the finances of the company (Fincyclopedia, 2021). While the omission of smaller details concerning PPE may be considered a disadvantage for comparability and thorough analysis, it is an advantage for general-purpose reporting. The selected approach emphasizes the most significant financial factors and makes it easy for the less knowledgeable audience to comprehend the information. Therefore, the annual report 2020 of Hansen Technologies fully satisfies the objectives of general-purpose financial reporting.

Recommended Actions

Based on the analysis of qualitative characteristics and general-purpose financial reporting, it is possible to propose suggestions to improve the accounting process. First, it is advisable to add more details to the annual report, such as a transparent indication of depreciation methods and low-value assets, to improve comparability. Secondly, it might be more illustrative to include the longer period of financial information (e.g. five-year period instead of two-year period). While there are certain complications due to the implementation of new AASB criteria, the addition of the said recommendations might make the annual report 2021 more attractive for investors.

Conclusion

PPE is a significant component of financial analysis, and it is vital that for-profit organisations follow the regulated AASB protocols to ensure the transparency of their annual reports. According to the current business research, Hansen Technologies provided the essential PPE information in the 2020 financial report. However, it omitted a large number of smaller details that were either incorporated in more significant values or not mentioned at all. As a result, the comparability characteristic is not highly illustrative, and investors might choose a different organisation upon closer examination and cross-comparison. Therefore, the primary recommendation for Hansen Technologies is to improve the transparency of the annual reports by providing accurate data on smaller details.

Reference List

Australian Accounting Standards Board. (2019). Property, plant and equipment. Web.

Fincyclopedia. (2021). General-purpose financial reporting. Web.

Hansen Technologies. (2020). The ability to enable future: Annual report 2020. Web.

Jan, O. (2020). Qualitative characteristics of useful financial information. Web.

KPMG. (2020). AASB 16: What does it mean for the public sector?. Web.

Appendix A

Appendix B

Appendix C

Appendix D

Appendix E

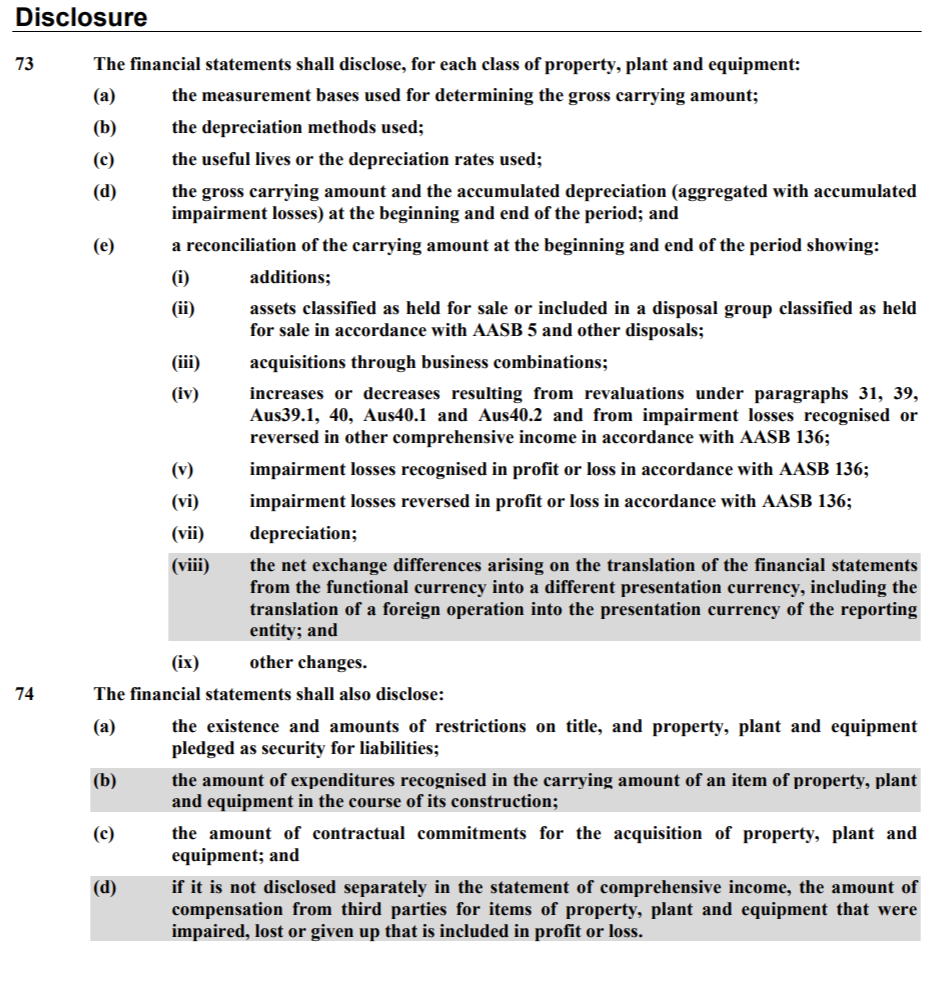

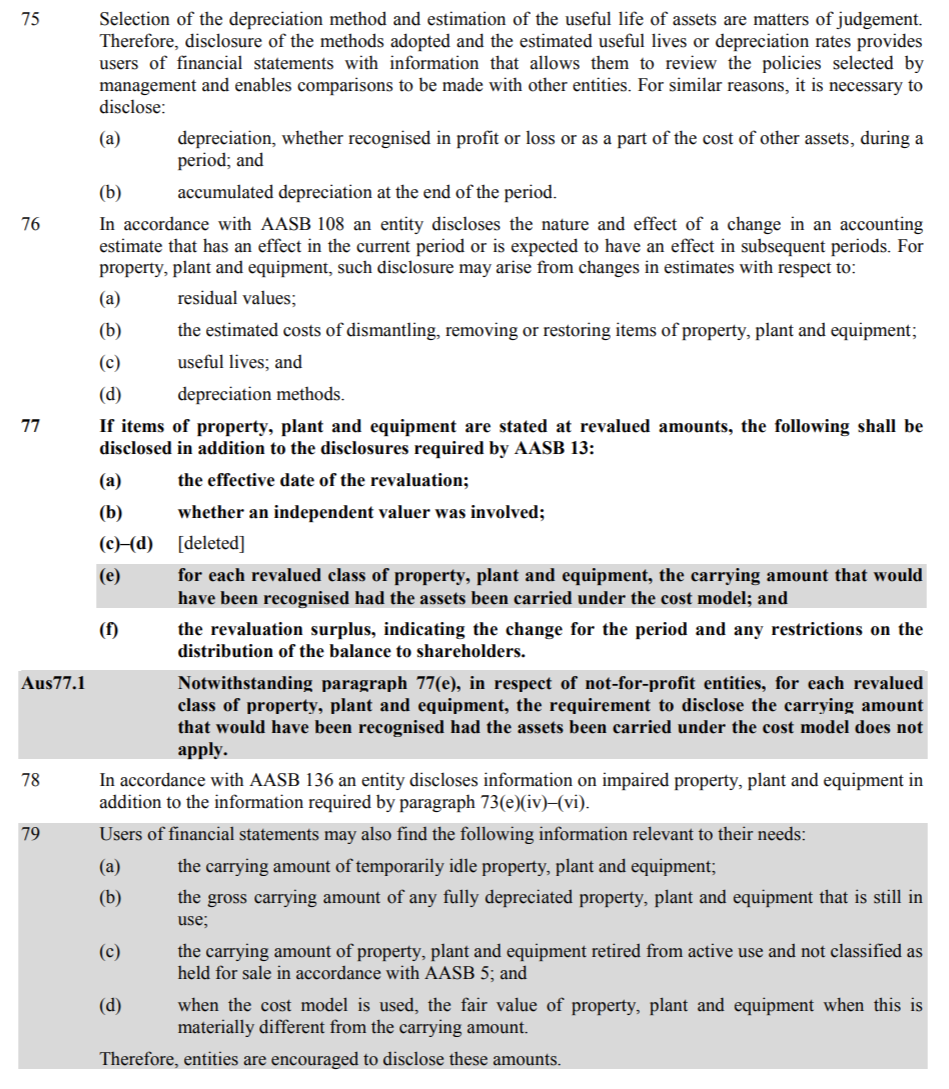

Appendix F