China is the world’s most populous country and one with a very rapidly growing economy. In fact China’s gross domestic product has been estimated to have grown at 9.9 percent in year 2005 which is astronomical for any country to achieve. It is forecasted that China will perform just as strongly in terms of it economics in the coming years. Other statistics that indicates faith in China’s future include inflows of foreign direct investment into China totaling $86.1 billion in 2005 and China’s merchandise trade surplus rose to $102 billion in 2005 largest ever in the history of China. (Energy Information administration)

This tremendous change in China’s economic future is largely contributed to its opening up to the world market. With the China’s entry into the World trade Organization and its commitment to further liberalize its market it is expected that the tremendous growth rate will continue. It is clear enough that in the 20th century the country that has been greatly impacted by trade liberalization has been China and not only that China has also been pivotal in shaping the economics of trade and even the economics of energy sector in the world. (Energy information Administration)

To understand China’s growth we need to understand its history and the events that have propelled it into the world market arena and ultimately how these events have impacted its trade policy.

In the early 20th century foreign powers operate, located around most of the coastland and Eastern China. China’s main trading partners at that time were United States, England, France, Germany and Japan. Therefore the ports were open to foreign commerce and administered by Chinese Maritime Customs office. However from the 1950s till the 1976s China has largely been a closed economy with little trade. During this time period there was also US led trade sanctions imposed on China for its support of South Korean War. This pushed Chinas trading relationship to grow towards Moscow. (Commanding Heights)

The most significant time period for China’s booming international trade started with the decisions made under the economic reforms of Deng Xiaoping. He proposed an open door trade and investment policy. Special Economic Zones along the coast were set up for foreign investment. From that point onwards there was no stopping China from becoming the fastest and most threatening international competitor. By the 1985 trade represents 20 percent of China’s gross national product.

Textiles are the nation’s leading export with petroleum and food also doing well. Leading imports were machinery, transportation equipment, manufacturing goods and chemicals. China’s most dominant trading partner was Japan at this time followed by Hong Kong and the US. The 1980’s and early 1990’s saw China becoming increasingly decentralized and integrating itself into the world trade system.( Commanding Heights)

In the 1990s the foreign investment grew tenfold between 1990 and 1995. Despite the unwieldy contractual and legal obstacles present in China’s policies, China managed to lure in many investors, especially ethnic Chinese in areas near Hong Kong and Taiwan.

In the 1999’s China’s global trade totaled $353 billion. Its trade surplus was $36 billion. During this time period China’s trading partners were Japan, Taiwan, and United States South Korea, Hong Kong, Germany, Singapore, Russia and Netherlands. An important landmark of the 1999 was when China and US arrived at a bilateral market access agreement that paved the way for China’s accession to the World Trade Organization. In 2000 China reached a bilateral WTO agreement with the European Union and other trading partners and began to work on a multilateral WTO accession package.

To increase the volume of exports China came up with the strategy to encourage the formation of factories that assembled imported components into consumer goods for exports. Under Bill Clinton, US approved permanent trade relationship with China and Clinton signed the China Trade Relations Act of 2000.In the years 2001 till 2003 Shanghai hosted the annual APEC leaders meeting. After 2001 China had become a permanent and a powerful member of WTO. Many tariffs and regulations have been removed by China after it became a permanent member to show its cooperation but still there are strong allegations that China because of its undervalued currency.

However china’s exports have become increasingly diversified and penetration of the industrial country market has accompanied by surge in China’s imports from all regions especially Asia where China plays an increasingly central role in regional specialization (Thomas, Rumbagh, Nicholas, Blancher). Its overall share of exports to industrial economies has increased and has become more diversified than ever. China has also become very important to Asian Regional economy.

Vertical specialization has caused it to become important in the sense of volume of imports coming into China from that region. The trade reforms and commitments made as apart of China’s accession to WTO have been crucial in its integration with the global trading system. These reforms include substantial tariff reduction and dismantling of most no tariff barriers.

China’s export has diversified from an initial heavy reliance on textile and other light manufacturing. In the early 1990’s light manufacturing accounted for more than 40 percent of China’s exports. These included footwear, clothing, toys and other miscellaneous manufactured articles. A large part of the exports was accounted for by the manufactured goods (mostly textiles) and machinery and transport (small electronics).

In the recent years China has managed to make strides in other export categories including more sophisticated electronics (office machines and automated data processing, equipment, telecommunication, sound equipment and electrical machinery), furniture, travel goods and industrial supplies. The statistics show that the electronics increased from 17% in 1993 to 41 % in 2003 while the share of miscellaneous manufacturing declined from 42 percent to 28 percent (Thomas, Rumbagh, Nicholas, and Blancher).

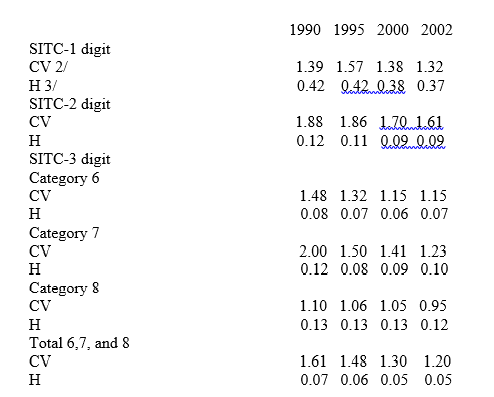

Statistical indicators also show a marked dispersion and overall increase in the export. For example, detailed U.S. import data show that based on changes in the share of U.S. imports accounted for by China; there was a significant increase in diversification between 1990 and 2000 at both the 2-digit and 3-digit levels (Table 6). (Thomas, Rumbagh, Nicholas, Blancher).

- A lower number indicates more diversification (i.e. less dispersion in shares). Categories 6, 7, 8 refer to basic manufacturing, machinery and transportation, And miscellaneous manufacturing, respectively.

- Coefficient of variation (standard deviation relative to sample mean).

- Herfindahl index (sum of squared export shares).

The new issues that have cropped up because of the China’s strong economic growth have mainly been related energy shortages. China’s demand for energy has been surging rapidly. EIA( Energy Information Administration ) forecasted that China’s oil consumption will increase by almost half a million barrels per day in 2006 or 38 percent of the total growth of demand for oil in the world. China today has become the third largest net importer of oil behind the United States and Japan. Competition to gain access to the oil is on the rise and the stakes run very high.

Even though China’s GDP growth has been no less than impressive, it has proceeded unevenly. The urban costal areas have perhaps experienced the most rapid economic growth. In fact as the high growth rates continue the government has taken measures to slightly slow down the economy to a manageable level. In August 2006 the central bank raised the interest rates by 0.27 percent and the central bank has also raised the reserve requirement for commercial bank by 0.5 percent. The aim of the government to take these measures was to take the money out of the money supply to help ward off the economic heating.

The other issue that China faces is large world wide criticism for devaluation of its currency. China delinked its currency the renmimbi from the US dollar in July 2005 resulting in the initial devaluation of 2.1 percent. The renminbi now floats within a narrow band of 0.3 percent against the basket of currencies from the country’s major trading partners. The devaluation obviously caused Chinese products to become cheaper and more attractive to the international market, thereby creating a huge stir.

There have also been other allegations bought against China. An article in Times Magazine bought attention to the fact that due to the massive production and import from China it has become virtually impossible to have a decent measure of quality control. The massive quality of products that arrive in America are uninhibited by regulation, lawsuits until recent public outrage over some incidents that bought light to this matter.

Bibliography

“Energy Information Administration.” 2007. Web.

Thottam, Jyotti. “The Growing Dangers of China Trade.” Times. 2007. Web.

“Commanding Heights”. 2007. Web.

Thomas, Rumbagh and Nicholas Blacher “ China: International Trade and WTO Accession” IMF Working Paper, IMF.