Introduction

Starbucks is the largest coffee company in the world that since its foundation in 1971 in Seattle, the United States, has expanded into more than sixty countries. In North America, Starbucks is a phenomenon: it is a universally recognizable and beloved brand. Outside the North American market, however, Starbucks’ success was not as stable and predictable. Ever since its entrance to the Australian market in 2000, the Seattle-based company has been struggling to build a solid customer base. What followed was an embarrassing retreat when the corporation had to close many underperforming locations. The present paper provides a new perspective at Starbucks’ Australian failure and offers a new marketing strategy that could help the company regain its position.

Starbucks Australia Situation Analysis

As of now, Starbucks is trying to conquer the Australian market, where it was once shunned. The Seattle-based company opened its first coffee shop in the country down under in 2000. By 2008, the number of stores had grown to 90 locations (Statista 2019). However, the rapid expansion was not precisely aligned with Australian customers’ appetites. The most feasible explanation is that Starbucks was growing too fast and did not consider customers’ interests. They did not have a chance to warm up to the idea of the new player on the coffee market and ignored the newcomer en masse. Besides, Starbucks might have failed to accommodate the new customer’s tastes and preferences: Australians refused to pay more for the drinks that they found too artificial and sugary.

In the same year, the coffee company announced the closure of more than 70% of the stores. The losses were tremendous: in the first seven years, the company had accumulated more than $105 million in deficits (Statista 2019). Since then, Starbucks has been attempting to regain its positions and find a good market fit. So far, it has only resonated with tourists in big cities – Melbourne and Sydney. The number of locations has slowly grown to 39, but the coffee company has yet to strike a chord with the natives.

Starbucks Australia Target Market

Market Demographics

Half of the revenue generated by Starbucks comes from customers within the 25-40 age range. 40% of the said annual revenue comes from young adults in the 18-24 age group (Gaille 2016). The core demographic grows economically at an average of 3% per year. Interestingly enough, Starbucks is popular with underage consumers: teenagers under the age of 18 generate up to 2% of the yearly revenue of the coffee company. More than half (52%) of Starbucks are not parents or grandparents yet. Every fifth (18%) Starbucks customer still lives with their parents, another one-third rents an apartment or a house.

Market Need

To say that coffee is a popular product in Australia is an understatement. While the country does not have a long history of coffee production and consumption, nowadays, it has become an indispensable part of everyday life and even cultural identity for many Australians. As Statista (2019) reports, the Australian coffee market is among the largest in the world, generating a revenue of more than 1.4 billion annually. An average Australian consumes 1.9 kilograms of coffee per year: 1.4 kilograms of roasted coffee and 0.5 kilograms of instant coffee (Granwal 2019). Based on the per capita consumption metrics, Australians fall behind Finland, Scandinavian, and Western European countries. However, globally, the continent ranks among the top-30 countries with the highest coffee consumption. Two facts mainly justify the market need for coffee companies: the popularity of the product explained above and low domestic coffee bean production.

Market Trends

It appears that Australian coffee market trends are consistent with global trends. Square (2018) presents a report that reveals that Australians show a strong preference for milk substitutes: oat, soy, and almond milk. The trend may be explained by consumers’ growing awareness of animal cruelty and the desire to cut on animal products. Another possible explanation is consumers’ openness to the new alternatives as well as health concerns. Aside from their own health, Australians are worried about the environment: coffee companies, are looking for sustainable, environment-friendly solutions. Some examples of initiatives that Australians support are recyclable cups, swap programs, reusable straws, and coffee bag recycling.

One more trend that shows a significant potential is iced coffee: 7.3% growth as compared to 4.6% growth for regular coffee. The cold brewing method is on the rise with unsweetened variants taking the front stage. In the context of the Australian market, the trend may be explained by the hot climate that pushes many people to buy iced drinks. Lastly, the Australian market demonstrates the need for more precision when it comes to coffee grinding. The consistency of grinding machines has long been a problem for baristas. Still, with the introduction of new technology, the dosing will become more comfortable and account for better taste and quality.

Market Growth

Research and Markets (2019) reports that the Australian coffee market is projected to grow at 5% annually during the forecast period from 2019 through 2024. The factors that fuel the market are its steady growth and sophistication, customers’ willingness to pay more for quality goods and services, and the affordability of home-grown production. However, there are also significant counterforces playing against the observable positive tendencies. The Australian market faces certain limitations due to the high degree of market fragmentation and low production volumes.

Customer Analysis

Starbucks considers urban and affluent people who work in white-collar office jobs and are often on the go to be its target demographic. This stance is reflected in Starbucks’ business strategy: the company usually opens stores in upscale neighborhoods and prioritizes quality over quantity. Besides, the pricing policies are such that the prices often surpass those for similar drinks at other coffee shops, which also hints at the expected purchasing power of the average customer. The company is working on improving the two core types of customer experience: ordering coffee for here and to go. In alignment with these two types, the customers who like to order the product here are looking for the right vibe and ambiance. For them, going to a coffee shop is not only about enjoying the taste and smell properties of the goods offered: they want a wholesome emotional experience. The other group of customers does not care that much about the interior design, zonation, and comfortable washrooms: they prioritize the convenience of the takeaway option.

A survey exploring Starbucks’ customers’ preferences has also led to some curious results. Half of the respondents stated that they have no religious affiliations and do not see faith as an essential part of their life. 25% of customers are committed to clean eating: they make an effort to purchase organic foods and coffee (Bowman 2018). Starbucks customers are avid social media users: 80% of them have an active SM presence on Facebook, Twitter, Pinterest, and Linkedin (Bowman 2018). They also prefer modern gadgets and technologies: 66% of the respondents own a smartphone, and half of them prefer streaming services to over-the-air broadcasts, satellite, or cable.

SWOT Analysis of Starbucks in Australia

Strengths

One of Starbucks’ apparent strengths is its presence and market position. Over the last decades, the American company has gained substantial domestic and global brand recognition: it maintains its market share at a healthy 36.7% in the United States and operates in more than 60 countries (Trefis Team 2016). Starbucks is the largest coffee company in the world and ranks among the most recognizable brands in the coffeehouse segment. Such a strong position at home and overseas provides an inarguable competitive advantage. If Starbucks wishes to penetrate a foreign market, it does not have to put as much effort into raising its brand awareness. It should be noted that Starbucks owes its popularity to high-quality products. McArdle (2010) writes that the US company gained customers’ trust by adopting a strategy that seemed counterintuitive at first: it ordered its baristas to slow down. Employees were trained to prioritize quality over quantity and handle only two drinks at a time. In general, human resources development is Starbucks’ forte: not only does it train its employees comprehensively, but it also offers various benefits, which account for better talent retention.

One more element that contributes to a positive consumer experience is the vibe and the ambiance that Starbucks offers. On its official website, the company expresses its commitment to sustainable design and collaborating with local designers (Starbucks n.d.). Starbucks avoids standardization: instead, it strives to make the Starbucks cafe experience steep in the local culture. Sustainable design is not the only trend that the US coffee company is making the best of: as of late, it has been capitalizing on technology and online presence.

Weaknesses

The widely recognized coffee quality at Starbucks literally comes at a price. The company is known for its high prices, and in times of economic instability, consumers might find it more favorable to switch to a coffee chain that offers similar products at a lower price. Besides, the current pricing policies might prove to be problematic in developing countries where customers do not have as much purchasing power. Further, the Western coffee-drinking culture might come off as too outlandish in the countries where coffee is seen as something exotic and not part of daily consumption. Another weakness is Starbucks’ aggressive expansion that can lead to self-cannibalization. When a company oversaturates a market, it might as well end up competing against itself and diminish long-term growth targets. Further, given that the majority of Starbucks stores are concentrated in the US, the company is sensitive to the country’s economic situation. The lack of portfolio diversification that might hurt the company was a critical situation to arise.

Opportunities

The oversaturation of the US market and the threat of self-cannibalization may lead to Starbucks’ further expansion into developing markets. The company has already made a successful case for penetration of Asian, North American, and European markets. At present, the following countries have the largest number of locations (excluding the US): China – 3,684. Canada – 1,542. Japan – 1,415. South Korea – 1,260, United Kingdom – 1,002, Mexico – 715, and Turkey – 457 (Trefis Team 2016). South Asia and Australia are promising but underdeveloped destinations that might be converted if Starbucks finds the right approach. Another opportunity that Starbucks might want to make use of is expanding its product mix and offerings, and by doing so, the Seattle-based corporation might tackle one of its major weaknesses: a homogeneous business portfolio. As of now, Starbucks has been adding tea and fresh juice with a smart acquisition strategy. The existing and new products may be distributed through new channels if Starbucks introduces a delivery system Mobile Pour.

On the topic of technology, of a particular note is Starbucks’ advancements in adjusting to customers’ new mobile use habits. The company has already launched a mobile application that has an integrated payment system for users’ convenience, but that is not the only exciting feature that it has to offer. As Sokolowski (2019) reports, Starbucks has recently started using reinforcement machine learning algorithms that customize user recommendations based on previous choices and external feedback. If the system proves to be efficient, the company will be able to provide the same level of care that baristas do online.

Threats

Starbucks is operating on a market characterized by a high level of competition. It contends with major players such as Tim Hortons and Costa Coffee. The adverse effects of the competition might become especially prominent, given the oversaturation of the North American markets. The situation overseas might put Starbucks at risk of financial losses as well: developed countries have seen an inflow of newcomers as well as the growth of local producers. Lastly, the US company might be sensitive to social trends: consumers might start giving up on coffee as part of their commitment to healthy living.

Competition

One of the defining characteristics of the Australian coffee market is its high fragmentation. It is represented by both prominent global players, regional market leaders, and small businesses. Robb (2015) reports that as of now, there are around 6,700 coffee businesses in Australia, with not a single one of them having leverage over more than 5% of the market. The most significant market shares belong to the following businesses: the Coffee Club (4%), Gloria Jeans (3%), and Michel’s Patisserie (3%) (Lock 2018). Robb (2015) explains that the Australian coffee culture is quite unique, and it does not welcome externally operated businesses. At the same time, within the country, the barriers to entry are low, which allows independent coffee shops to set up their business quickly, minimize establishments, and stay afloat past the first year. These small businesses are able to gain more trust from customers, partly because they have a less commercialized, “impersonal” approach to coffee-making. Local companies such as Barista made manually ground coffee and manually steamed milk a standard. Taking all these facts into account, it is safe to say that global companies need to be careful with aggressive expansion because of the well-established coffee consumption traditions in Australia.

Key to Success of Starbucks Australia Strategy

The key to success in the Australian coffee market lies in the understanding of and respect for the local coffee culture. In the United States, coffee consumption is intrinsically tied to the concepts of work and productivity. Milkman (2016) explains that in North America, prominent coffee chain locations such as Starbucks have become not the third place to be aside from home and work but the second place. If one enters a coffee shop in a medium or big American city, they will observe people wearing headsets and staring at the screens. For them, coffee is a “drug” that keeps them going; they do not associate the beverage with relaxation. Australians take a different approach to coffee consumption: as Milkman (2016) rightfully notes, for them, it is “not fuel for work but a way of life.”

In the country down under, the coffee culture is first and foremost associated with leisure and beach-centric lifestyle. Stenback (2017) adds that Australians are hedonists when it comes to coffee: for them, it is more about the entire experience than a simple grab-and-go. The writer points out that in the 1950s and 1960s, European settlers established rich cafe culture in Australia, which is why local customers are accustomed to sitting down and having a meal or a snack with their coffee. Aside from that, Australians are appreciative of uniqueness; in fact, it is something that they are quite used to. Given that 95% of coffee shops in Australia are independently owned, one can only imagine the variety in interior design, graphic design, and architecture. This diversity adds more flavor to the sophisticated experience of coffee consumption. For this reason, big, commercialized coffee brands with staple design solutions rarely make the cut.

Lastly, because of the overwhelming supply and diverse offerings, Australians have learned the difference between bad and good quality. The local customer refuses to put up with subpar taste and service and will quickly switch to alternatives that are widely available in any town. Quality flavors and aromas are the key factors driving customers’ decisions; they demand quality roasting and brewing, as well as excellent customer care. Stenback (2017) provides a simple example that showcases the difference between Australians’ and North Americans’ preferences. The writer points out that Australians are sensitive to slight changes in taste and flavor: if a grinding machine is not readjusted on a particular day, they may quickly notice and become dissatisfied. In those countries where coffee is seen as something that is merely instrumentation to productivity and upbeat mood, taste variations might not be as critical or even noticed.

Critical Issues

Below are the issues that stifled Starbucks’ success in Australia:

- Lack of adaptation. Starbucks took a bold but miscalculated step when it relied on its usual expansion strategy that worked in Canada and Europe. It did not take the differences between North American and Australian coffee consumption cultures into account and, therefore, failed to deliver. In comparison, other global food companies would typically localize their products and services to achieve success overseas. For instance, McDonald’s, despite being a household name across the world, changed its menu to appease Indian customers. Apparently, Starbucks was wrong when it expected its popularity and worldwide recognition to be enough for attracting customers on the new market;

- Aggressive growth. Starbucks attempted to grow an empire by opening multiple locations at once instead of slow and thoughtful integration into the Australian coffee market. Therefore, Starbucks became too readily available and merely one more option in the oversaturated environment. Australians did not have a chance to really understand the difference and need the new product, so they easily disregarded the newcomer;

- Market misfit and oversaturation. Australians are spoiled for choice: as has been mentioned earlier, they have a plethora of options to choose from. Besides, they have unique coffee consumption habits that date all the way back to the 1950s when Greek and Italian immigrants started setting up their coffee businesses. They laid the foundation for modern coffee culture and turned coffee shops into a place where one meets their friends, chats with a trusted barista, and enjoys their time. Apart from that, over the last decades, local producers have come up with specialties unique to Australia, such as flat white and Australian macchiato. Taking these facts into account, it is no longer surprising as to why Starbucks failed miserably in the country down under. It overcharged for the sugary drinks that Australians did not like nor took pride in, and it was unable to provide the friendliness and the chilled vibe that local customers cherished so much.

Starbucks Australia Marketing Strategy

Mission and Vision

The official mission statement of Starbucks is “to inspire and nurture the human spirit – one person, one cup, and one neighborhood at a time,” which is also applicable to Australia. Its mission and vision for the new expansion strategy will be “localizing” the product stepwise, in a caring, thoughtful manner. To achieve this goal, Starbucks will harness two conflicting trends: the need to fit in and the need to differentiate itself. The new mission respects the existing coffee culture in the country down under and wishes to meet customers’ needs and preferences for product quality and customer service. At the same time, Starbucks will retain the unique American vibe that has made it iconic in the first place. If those two tendencies are intertwined in a meaningful way, the company will be able to create a culture of warmth and belonging. Starbucks will no longer rely on its global brand image and instead will try to be present and connect with local communities with respect, dignity, and transparency. The company will hold itself to the highest quality standards and promote ownership and accountability in everything it does.

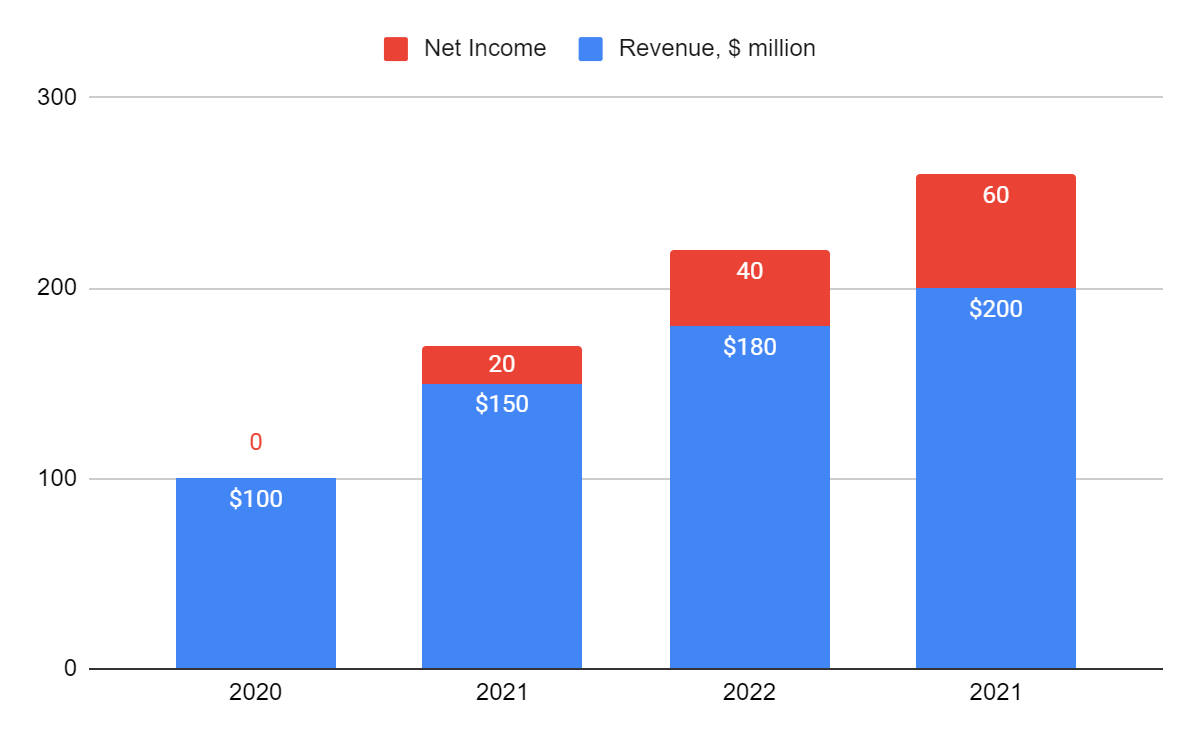

Financial Objectives

As much as Starbucks prioritizes quality over quantity, it needs some feasible financial objectives for its 20th year in the country down under. In its latest annual report, Starbucks (2019) states that in one year, it was able to take the revenue from $16 to $86 million. However, as much as this figure looks optimistic at first glance, in actuality, Starbucks has yet to make a profit. Therefore, the first and the principal financial objective, for now, is to cut the losses and make the net income positive.

Target Markets

One of the reasons why, initially, Starbucks did not strike a chord with Australian customers is because it misunderstood the critical market segments. In North America, Starbucks targets affluent, hardworking young people in their 20s and 30s. Its takeaway system is adjusted to its hectic, on-the-go lifestyle. While Australian and North American market segments do overlap, there is one significant difference that needs to be taken into consideration: the importance of social relationships. In Australia, Starbucks needs to get rid of the association of coffee with work and emphasize coffee consumption as a bonding experience. This shift will open doors to a variety of segments: friends, families, couples, and coworkers relaxing after a workday. As for the rest of the characteristics, Starbucks is likely to find them in Australia too: the lack of religious affiliation, open-mindedness, and regular social media use.

Positioning in the Market

Starbucks might want to strengthen the focal point of its Australian customer base, North American tourists, all the while building rapport with the locals. In big cities frequented by tourists, Starbucks will provide a safe and familiar space where they could reconnect with their home culture. In smaller towns, however, Starbucks needs to become a novelty and capitalize on exoticism.

Strategy: Marketing Research and Marketing Mix

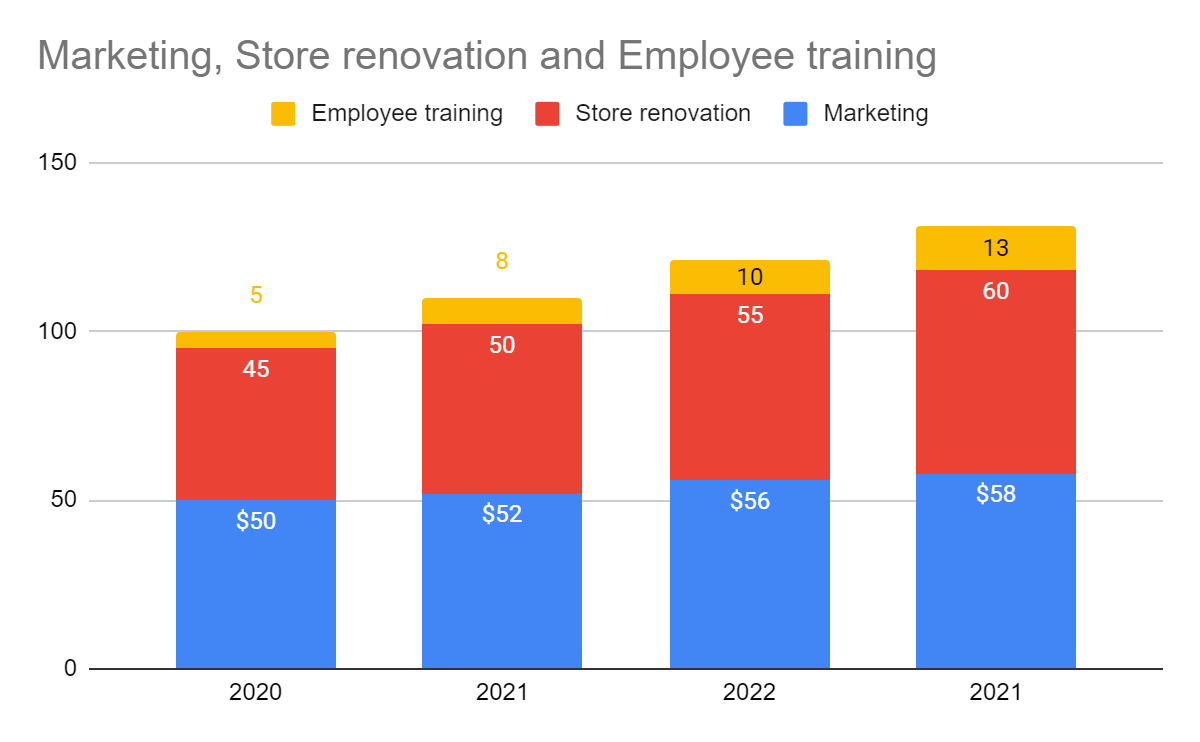

The new strategy will be built upon the following elements of the marketing mix: corporate social responsibility coverage, social media, and customer experience. Below are the elements described in more detail:

Revised value proposition

In North America, Starbucks built its customer base by offering a brand new experience: coffee as a lifestyle choice. Before the Seattle-based company made an appearance, coffee shops prioritized the speed of production and delivery because their clients were always on the go. Weirdly enough, when entering Australia, Starbucks strayed away from what made it famous in the first place and capitalized on impersonal metrics such as customer turnover per hour. Employees were trained to speed up their activities, which, of course, did not let them engage with the customer in a meaningful way, for instance, through small talk. To tackle this issue, Starbucks will recalibrate its priorities: it will no longer rely solely on quantitative data but will also consider qualitative feedback. The staff will not be pressured to reduce the queue time; instead, baristas will be encouraged to communicate, give recommendations, and in general, act welcoming and friendly;

Augmented sensory experience

Since Australians appreciate the complexity of coffee consumption, Starbucks will capitalize on providing an augmented sensory experience. Previously, the coffee company would prioritize speed over quality, and it worked in countries where human contact and entertainment value were not of high importance. The Seattle-based company used vacuum-sealed coffee and automated machines, which at first, made coffee making 40% faster and significantly reduced queue wait (Statista 2019). However, it deprived customers of the grinding and preparatory rituals of the drink as well as the hedonic aroma. The pleasure of watching and smelling a drink in making needs to make a comeback to win the Australian audience;

Online presence and collaborations

So far, Starbucks has been consistently building its social media presence: at present, it has 37.32 million Facebook likes, 6.56 million Twitter followers, and 2.98 million Instagram fans (Statista 2019). Building on its success online, Starbucks will customize its social media content for Australia. Because for Australians, coffee is associated with close relationships and socializing, Starbucks will focus on storytelling with subtle calls to action. Aside from that Starbucks might want to start collaborations with local influencers and celebrities, which also needs to have a heavy emphasis on storytelling and less aggressive advertising;

Community outreach

So far, Australians have been feeling that Starbucks entered their market, seeking an easy profit, which must have been disappointing. The company might want to try and counter this initial impression by taking on more corporate social responsibility (Starbucks Coffee Australia n.d.). The right solution would be to launch programs and initiatives that would help underprivileged demographics and help young people. Admittedly, these actions will need proper news and online coverage to communicate to customers that Starbucks holds itself accountable and seeks to have a positive impact on the communities. This will help the Seattle-based company achieve two goals: differentiate itself among its contenders and rectify its reputation.

Starbucks Financials

Recommendation

To sum up, Starbucks’ situation is Australia is critical but not exactly dead-end. In order to rectify it, it needs to make amends and not repeat the same mistakes again. First, the Seattle-based company needs to carefully pace its expansion into the Australian market and let customers build up the appetite for the product. Every step needs to be accompanied with a great deal of market research. Second, the marketing mix shall include elements such as enhanced customer experience, corporate social responsibility coverage, and online presence. The first on the list will align with Australians’ coffee consumption habits while the latter two will improve the company’s reputation.

Reference List

Bowman, J. 2018. Who is Starbucks’ favorite customer?. Web.

Gaille, B. 2016. 30 curious Starbucks demographics. Web.

Grewal, L. 2019. Australian coffee market – statistics & facts. Web.

Lock, S 2018. Starbucks – statistics & facts. Web.

McArdle, M. 2010. Starbucks puts quality over quantity. Web.

Milkman, A. 2016. Australian coffee culture is inspiring a new wave of American cafes. Web.

Number of Starbucks stores globally, 1992-2019. 2020. Web.

Research and Markets. 2019. Australia coffee market – growth, trends and forecasts (2019 – 2024). Web.

Sokolowski, J. 2019. Starbucks turns to technology to brew up a more personal connection with its customers. Web.

Starbucks n.d. Mission statement. Web.

Starbucks n.d. Store design. Sustainable design is part of who we are and what we do. Web.

Starbucks Coffee Australia. n.d. Community involvement. Web.

Stenback, K. 2017. 5 things you should know about Australian coffee culture. Web.

Square. 2018. The 2018 Square Australian coffee report. Web.

Trefis Team. 2016. How Starbucks plans to grow its international operations. Web.