Introduction

Recently, the business environment has become very complex due to increased rate of globalization. In an attempt to succeed and acquire a significant market share, firms are formulating various operational strategies. Amongst these strategies include formation of mergers which have become very popular. In the corporate business world, mergers refer to the process through which one or more business firms are fused together thus operating as a single entity (Gary, 2007, p.1). In this case the dominating firm absorbs the other smaller firms. There are diverse reasons used to explain formation of mergers. These include the increase in the level of competition, need to improve the operational efficiency, scarcity of resources and improved marketing of the products. During the 20th century, there has been a rampant increase in the number of mergers. This trend has also continued into the 21st century. Amongst the recent mergers in United States of America involve that of PepsiCo and Pepsi Bottling. The discussion of this paper aims at illustrating the impact of mergers on the two firms.

Impact on the employees

Mergers result into diverse impacts on the employees of the firms involved. The impact can either be positive or negative. With regard to positive impact, the formation of mergers involves the formulation of various mechanisms that would result into an increase in investment of its human capital. For instance; some of the policies that are formulated include training of employees (Donald & Kenneth, 2008, p.5).

Despite the fact that mergers enable a company to experience a higher growth rate, they have a negative impact on the employees in relation to various aspects. One of the impacts is in relation to rewards and compensation such as the salaries and wages. According to a study by Donald & Kenneth, the wages and salaries that are most impacted by the merger involve those of the non- production staff (2003, p. 4). This means that the wage of the employees in white collar tasks is greatly reduced compared to that of the production staff.

According to Donald & Kenneth (2008), if the two firm’s involved in the merger are related, the new firm formed may lay off some of the employees. This results into an increased reduction in the level of employment (p.5). This mainly occurs in the event that the dominating firm is more efficient in relation to its business operation. In such cases the firm will not need to employ a large number of employees. The laying off of some employees’ results from the firm incorporating strategies aimed at downsizing its personnel (Donald & Kenneth, 2008, p.6). In most cases, the layoffs mainly involve the employees whom the firm considers to be of less value to its operation. This means that it would be difficult for these employees to secure a job in other sectors of the economy.

On the other hand, upon the laid off employees getting an opportunity to do a job in other fields, their compensation may not be appealing as the job that they left.

The employees who are retained upon completion of a merger will also be affected. This is due to the fact that the two firm’s involved in the merger may not have adopted a similar corporate culture. The effect is that there is emergence of conflict in the culture of the firms involved resulting into cultural shock for the employees (Pritica, 2009, ¶. 12). This means that for the new firm to operate effectively there is need for formation of a new culture. This may involve changing the entire procedures and the firm’s operation environment. The effect is that it results into stress amongst the employees due to the increased uncertainty. This may affect the employees emotionally and also physically culminating into a decline in the employees’ level of motivation and productivity. This may result into a failure of the merger. In relation to PepsiCo and Pepsi Bottling merger, there are high chances of success. This is due to the fact that these firm’s have shared the same culture in their operation.

Impact on the management

Apart from the negative impact on the general employees, mergers have got a negative impact on the management. This is mainly due to the fact that there might be chances of there being a clash in relation to corporate cultures. This may arise from the role that may be assigned to managers such as the implementation of various policies (Gary, 2007, p.6). The employees may resist change in such situations resulting into a high level of stress for those in the management level. In relation to PepsiCo and Pepsi Bottling merger, the degree of employee resistance against the new management formed is minimal. This is due to the fact that there will be minimal divergence in relation to the policy adopted.

For a merger to succeed, redundancy in the management level must be reduced. In order to achieve this, some of the managers may be demoted or in the extreme end terminated. In most cases, the demoted managers prefer quitting from that organization. This is due to the fact that the demoted managers may not be comfortable to receive directions from others while before the merger; he was in a command position (Gary, 2007, p.14). In the case of PepsiCo and Pepsi Bottling firm merger, the management redundancy is very low. This is due to the fact that these firm’s are characterized by a strong leadership.

In the event that some of those in the top management level leaving the organization and their skill are high, there are high chances that they will get a job in another organization. This is due to the recommendations that they receive from the management which may be lacking in other categories of employees.

Impact to the shareholders

In most cases, purchase acquisitions are mainly involved in the process of formation of mergers. According to Garry, purchase acquisition refers to the process through which the dominant firm purchases all the common shares of the other firm. In this case, the acquiring firm offers to buy the stocks of the other firm at a given price which is paid in either cash basis or inform of stocks. This means that the stockholders of the firm that is acquired will have to surrender all their shares for cash or receive a given amount of shares in the new firm. In entering the merger agreement between PepsiCo and Pepsi Bottling, a purchase acquisition was involved. In this case, the price of the stock was fixed at $ 36.50 for every share (Richard, 2009, ¶.3).

In order to ensure that the stockholders tender their shareholding, the tender price that is mainly issued is higher than the current stock’s market value. This means that the shareholder benefit from the merger in terms of the returns from the stocks. This effect benefits the local economy if most of the shareholders were local.

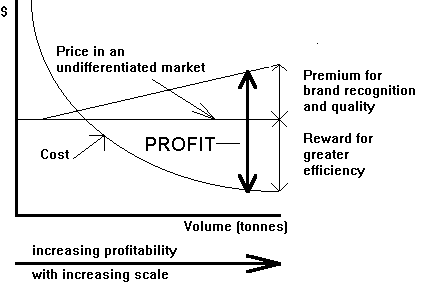

As a result of a merger, the new firm formed operates more efficiently. This is due to the fact that it attains the benefits of economies of scale. This means that the cost of production for the firm is greatly reduced while the volume of production increases. The increased economies of scale achieved results into a reduction in the unit cost of production. Mergers also result into transfer of skills from one firm to another. This means that the products produced are of high quality. For instance; the PepsiCo and Pepsi Bottling merger will result into increased innovation of their products making them to be more differentiated in the market. The effect is that the firm’s volume of sales will increase since it can be able to sell at a lower price relative to the competitors. This results into an increase in the profitability level of the firm as illustrated by figure 1.

In the case of PepsiCo and Pepsi Bottling merger, the increase in profit will result from the increased efficiency in the cost of manufacturing and the increases in the recognition of the firm’s brand due to its high quality (Richard, 2009, ¶.7). The effect is that the firm can be able to pay higher returns to the shareholders in form of dividends. For instance; due to the synergy that is created in merger of PepsiCo and Pepsi Bottling, the management has forecasted an increase in the pre tax earnings to $ 300 million by the year 2012.This shows that mergers result into an increase in the value of the shareholders wealth.

On the other hand the shareholders of the firm undertaking the merger are negatively affected. This is due to the fact that the merger has to include a premium with regard to the shares of the firm being acquired. The magnitude of financial loss experienced by these stockholders is equivalent to the amount of the acquisition premium (Gary, 2007, p.15).

In order for the merger agreement to be successful, the dominating firm may be required to source for finance from external sources. This may result into the firm incurring huge debts. The result is a reduction in the amount of dividends that are issued to the stockholders since servicing the debt will be the firm’s first priority. In worse situations, the firm may go into bankruptcy if the debt was huge which may be further instigated by economic downturns.

Alternatively, the shareholders are affected in relation to the number of shares that he will hold at in the new firm. This mainly occurs if the alliance results into elimination of one of the firm. The shareholders of the eliminated firm may receive fewer shares than they had initially. This is due to the strategies incorporated in the merger. For instance; the management may decide to undertake a stock swap (Richard, 2009, ¶.10). In this case, the shareholders may receive a single share of the merger for every four shares that he had. This results into a reduction in the level of returns from his investment since he will hold fewer stocks.

The shareholder’s returns also decline due to the fact that the merger results into an increment in the number of outstanding shares for the firm. The effect is a dilution in the par value of the stock. For instance; in the recent merger of PepsiCo and Pepsi Bottling, the total value of outstanding shares that PepsiCo will acquire amount to $ 7.8 billions signifying an increase in its total number of outstanding shares.

Impact on the stock investors

Upon the announcement of a proposed merger, the investors in the particular industry are affected. This is mainly reflected by the fluctuations in the price of the stocks of the involved firm’s. The stock price of the dominating firm depreciates while that of the firm being acquired appreciates. This will result into a decline in the demand for the stocks of the acquiring firm amongst the investors while that of the firm being acquired increases (Gary, 2007, ¶.14).

This may culminate into the shareholders selling off their stocks before the merger is complete. After the merger is completed, the stock of the firm being acquired that had attracted a large number of investors will not be in existence. This is due to the fact that the stock will have been exchanged with the stock of the new firm. For those who will retain or purchase the shares of the firm being acquired, they will have minimum share holding after the merger is completed. For instance in the case of PepsiCo and Pepsi Bottling, the shareholders of Pepsi Bottling will acquire 0.6432 of the PepsiCo shares (Richard, 2009, ¶.10).

Conclusion

It is evident that mergers have got significant impact on the operation of the firm. Mergers affect the employees in various ways. These include the decline in their level of productivity. This mainly results from the cultural conflict that arises especially if the two firms merging are not related in their operation. The effect is a decline in the motivation level of the employees of the firm. They are also affected with regard to economic terms. This is due to the fact that mergers may result into downsizing its operation. One of the strategies that are incorporated is laying-off some of the employees. The employees laid off are the ones whom the firm considers to be of less value. The prospects of the laid off employees getting employment in other organization is lean. If they get jobs in other sectors, the financial remuneration may be low.

Mergers benefit the employees in that the chances of an increase in the wages and salaries are high. This is due to their increased efficiency of performance as result of the training that they receive. Those in management are also affected in that some of them may be demoted. This results into their quitting the organization. The management may also experience resistance from the employees of the new firm culminating into an increase in the level of stress. Both the shareholders of the two firms’ are affected. Those of the dominant firm suffer from the fact that the firm may become heavily indebted. This arises from the need to source finances from external source in order to complete the merger process. On the other hand the shareholders of the firm being acquired benefit from the high price of the stock that is offered as an enticement so that they can tender their shareholding. Mergers result into a depreciation of the share price of the acquiring firm resulting into a decline in demand for these shares in the stock market. The huge amount of finances that tare invested in the process of the merger result into a reduction of the dividends for the shareholders.

Reference list

Donald, S& Kenneth, L (2008) Evaluating the effect of mergers and acquisitions on Employees: evidence from matched employer-employee data. University of California: California. Web.

Gary, E.M. (2007) Mergers and acquisitions: Boon or bane? University of Wisconsin: Steven Point Publishers. Web.

John, D.L, Rody, J.B & Bentley, C (n.d) The impact of merger on acquiring firm shareholder wealth: the 1905-1930 experience. Jacksonville University: New York. Web.

Pritika, B.(2009) Impact of mergers and acquisition on the employees. Web.

Richard, E (2009) PepsiCo reaches merger agreement with Pepsi Bottling Group and Pepsi Americas, Fox Business publishers: New York. Web.

Ross, Stephen A., Randolph W. Wethersfield, & Bradford D, Jordan, (2008) Fundamentals of Corporate Finance, 8th Edition, McGraw-Hill/Irwin: New York. Web.