Executive Summary

Business is now driving factor of world economy. From the ancient time, economic stability followed a centralised system where different countries performed as an organ of world economy. For many centuries, the world economy has been dominated by western countries. However, the functioning of globalisation makes it easy for many Asian countries, like India and China, to participate in shaping the economy of the world. However, as the recent financial crisis stumble the overall world economy, India and China continued their efforts to strengthen their economy. The central governments of these two countries are driving fiercely for the economic betterment. Other institutions are also working with the government to redesign suitable policies for creating a business friendly economic, financial, and ecological environment. Though these two countries have considerable development in the business background, China is in better position in contrast with India.

Higher political unrests, elevated corruption, and poverty are the main reasons for these differences. The findings of this study, comparative analyses of the financial, economic, and ecological environment will show in local, regional, and international level. Financial environment has been compared by banks and capital market development of these two countries. From these findings, China is in a better pose to provide financial support to borrowers and new industries than India. Economic environment is also better in China than India in terms of FDI flows, GDP etc. China is also improving ecological environment than India, from deforestation, soil degradation, and environmental pollution. The problems regarding comparative analysis are also measured, where some opportunities of both of these countries are shown, on the other side, lacking of these are also focused.

Therefore, to improve the problems of comparative analysis, China and India has recommended financial, economical, and ecological environments. Lastly, a proper conclusion has ended the study comparing the relationship and advantages of these two countries.

Introduction

The world has now become a global village and in many sense all the countries of the world are not only connecting with each other but also dependant on each other. Thus, the world is now experiencing a fundamental shift in its overall economy. The concept of Globalisation refers to access the products and market of any part of the world by any nation or entity. A nation may not fulfil all requirements of resources by itself but it have to depend on other nations for some of its requirements. Because of globalisation, the economic development becomes widespread to many countries in the world and previous centres of economic development are facing a substitute economy. India and China are the most impressive economies in present world (Hill 2009, p. 4-5).

This report is to discuss the aspects related with the emergence of these two economies and to compare the different economical, financial, and ecological environment of these two countries.

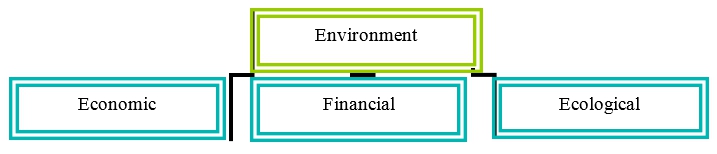

Environment

India and china both are Asian nations. However, the environment is quite different. Here the environment refers to the factors, which have effects on the business and economic activities of a country. Certainly, the global nature of business has to cope up with some national constraints. The environments discussed in this report are of three types. These are:

Thus, the report will concentrate on the comparison and discuss the economic, financial, and ecological environment of India and China.

Problems

The territories selected for the report is India and China and for this the problems will associated with these two countries. No doubt, these two nations are the future economic leaders in the world but still they have problems. The business environments in these two countries also have problems like political unrest, corruption, labour unrest condition, mismatch between demand and supply, and many more (Ball et al 2008). This report will discus these problems and tries to find other problems.

Organisations

Related organisations like the Central and provincial government, Central bank, financial and economic policies of the country, Chamber of commerce and many other businesses, economic and financial organisations and their activities have discussed in this report. As these organisations run the economy of a country, contribution of these organisations are important to compare among countries.

Business Activities

Another key concern for the business environment of a country is the activities related to the business (Griffin 2006). This report will also consider these business activities because analysing these business activities reflect the environmental orientation of a country.

Overview of Report

The report will follow the appropriate format starting with a well-described executive summary. This part will be the precise reflection of the issues discussed in the report body. This part will make in a way, which will facilitate any reader to understand the related topic in an easy and precise manner. The next part will be the introduction of the report where the overview and the reason of the report will discuss. Then the overview of report will give the development of the report at a glance. The next part will discuss the previous works and their summaries. Later based on the literature review Findings of Comparative Analysis and implications of these findings and recommendation will provide with the concluding discussion of the issues.

Purpose of Report

The primary purpose of the report is to find out the present economic, financial, and ecological environments of India and China and to compare these factors.

Methodology

This report will be a descriptive research where the issues of the report would present in a descriptive manner. The findings of the research will design based on the descriptive research.

Constraints

There are many constraints associated with the report. Firstly, as the data related with issues may be more than enough to portray a clear picture, data redundancy may occur. Secondly, the data available may not recent which will direct to wrong direction. Thirdly, different sources may dictate differently to an aspect, which will result in contradiction. Finally, much information may yet to be a matter of test, implication of that information may be impossible.

Data Collection

Secondary sources will be used as the primary way of getting data. Secondary sources mean the other published data, which was attained before for another purpose. This report will use data collected from internet mainly. This paper will also use different web sites, articles, journals and other publications collected from internet.

Literature Review

The CIA (2009) argued that India has a diverse economy, which is a combination of traditional village farming, developed agriculture, handicraft, widespread industries with modernization, and multiple services with wide range of diversity. The key source of economic growth is the service sector of India. Almost one third of the labour force is now working in the service sector, which generates almost half of the total output of the country. However, more workforces remain in agriculture but most of them are poor. However, the Government is playing an important role by developing different measures.

Besides the economy is getting more liberal as the government is reducing controls over the foreign trade and investment. The role of government is so crucial and the government is scheduling its foreign direct investment policy by imposing high tariff in many sectors and liberalizing for many sectors. Privatisation in many sectors is also a key scenario of Indian economy. The economic development of India becomes transparent by the 10% reduction of poverty in last decade along with continuous GDP growth rate. The growth rates for the previous three years are 9.6%, 9.0%, and 6.6% in 2006, 2007, and 2008 respectively (EDC, 2009).

The base of economic development in India is the skilled workforce with high expertise over English language. The manufacturing sector has also increased significantly and this results expansion in the economic sector comprising with mass capitalisation. India is a beneficiary of globalisation as it is showing future possibility of high economic turnover as it is emphasising on technology sector like software and telecommunication. India is exporting significant number of software. The highly sophisticated tax administration is another key success factor for the economic growth. Government is getting high tax revenues and it is using these revenues for the betterment of the economy. National understanding was set as all political parties agreed to take care about the present national economic growth.

Rangarajan (2009, p. 7-11) stated that the present financial crisis over the world has also keep impact on India’s financial and economic environment. However, the impact is not direct. The present financial crisis has related with banks and Indian banks have few branches outside the country. For this reason, the banking sector of India is facing no direct impact. However, there indirect impact is not ignorable. The trade and capital flow has negatively affected by the price increase of the high priority commodities like crude oil. Besides, this price increase is reducing the import bill for the country and increasing the exporting bills of goods and services.

The decline of the growth year for 2008 was also result of this imbalance between export and import. The domestic production of textile, automobile and jewellery declined significantly with decrease in the export of these and by this, the total export of the country declines in last many years. The capital circulation within the country became negative for instance the flow of portfolio capital has taken. The falling nature of the international share market prevents the Indian firms to collect money from international stock exchanges. These circumstances created barriers for the Indian firms to grow on a constant rate. All these domestic and international consequences directed the market to become more unpredictable and have negative impact on the exchange rate.

The liquidity in the financial market of India was effected because the fall of the reserve. In the financial sector in the banking sector, there was a crisis of credit accumulation. Here the reserve bank of India played a vital role by expanding liquidity, reducing interest rate and repeatedly reversing the interest rates. Besides the financial crisis is being overcome by the fiscal policy which are in action through two forms. Firstly, the policy designed to cut off fiscal policy and secondly enlarge the expenditure of the government.

The budget of the central government expected of 6.8% GDP, which is highest in the decade. It has designed in a way, which strengthens the investment in the infrastructure sector. The budget will help the poor but still have shortage in achieving necessary reforms. The performance based on the GDP for India is not enough to run its economic development programs. In the last quarter of 2009, the GDP was only 6.2% and it has expected to remain bellow in upcoming quarters. The natural disasters like flood and heavy rainfall freezer the economic stability of India. In 2009, the heavy rainfall dimples growth prospects.

Up to August, the industrial production experienced an increase and achieved 10.4%, which is a symbol of faster expansion. Also in this year, the tax revenue of the government decreased from 11.6% and 10.9% but the total expenditure was increased. The rise in central government’s expenditure is a result of higher investment in food subsidies, government’s welfare program, and job creation activities. To strengthen the agricultural sectors of the economy the central government has taken different schemes such as debt waiver and debt forgiveness. Improvements in essential infrastructure spending, sacrificing the consolidation for short-term growth, and decreasing emphasise on private and foreign led business is some of the fiscal policies to overcome the present financial crisis. In the monetary policy, the government trough the RBI is trying to hold off the additional monetary loosening.

The cash reserve requirements is going to rise and the banks are experiencing the lower policy rates, which will decreasing the commercial bank loan rates. However, this does not attract the business, as the risks with banks are still a truth. India is also facing a deficit in the current account, which is mainly a result of increase in the commodity prices. The local currency “Rupee” has depreciated. The Balance of Payment (BOP) showed unstable nature, which is positive for 2008 but afterward-experienced a negative figure and now it is showing its possibilities to become positive again.

Chauhan and Chauhan (2009) stated the present scenario of Indian ecological environment, which has also closely related with the business environment.. India is a large country with different diversified environmental aspects in different regions. However, the environmental degradation paces threats to the overall economy. Various regulations have designed to prevent it, but more consideration will have to give in implication of these laws.

Now the discussion will have to concentrate on China. The CIA (2009) stated that in the last 30 years China experienced dramatically change. It moved from the centrally planned system to complete privatisation in recent years. Previously, the internal market of china closed for international trade but now its orientation is changing towards a market-based economy. The private sector is developing extensively and played the major role for not only local but also in the international economy. The change started in the 1970s.

The collectivized agricultural system was the base for previous economy, which has phased out. Afterwards the liberalisation and decentralisation took place which made attractive price, fiscal policies, increased autonomy for state business entities, structuring the banking system with high diversification, development of stock markets, rapid growth of private sector and made open the market for international trade and investment. The reform took place in the economy of China is gradualists or piecemeal style which helped to increase its economic activities. For example, the foreign direct investment in 2007 was 84 billion USD.

The economic movement of China has based on the ‘economic security’, which means whatever is necessary for economic stability; the central government will do that. The evidence of its present economic emergence can portrayed by the strong position of the local currency “Yuan”, which is currently named as “Renminbi”. It has revaluated recently with a 2.1% growth against the USD. China liberalised to exchange rate system, which comprises a basket of currencies. The overall redesigning of the economy along with its resultant efficiency gains increased the GDP of the country rapidly which is now about 7.992 trillion USD based on purchasing power parity. In this sense, China is the second largest economy in the world after USA. However, if the per capita income has taken as the basis, China is still a middle income earning country. The central government is facing some difficulties in economic development. These are:

- Continuous failure of matching the domestic savings and domestic demand, leads to increase social safety net comprising pension and healthcare systems. China needs a high domestic savings but it has low domestic demand.

- Increasing numbers of migrants pace problems as they also strive to achieve jobs. This led to sustain the increasing job growth with welcoming the new entrants. However, this tendency is failing because of the worker layoff in the state owned firms. All these also decreasing the worth saving.

- Increasing corruption in almost every level of the business and government, all relevant entities will have to invest heavily to prevent corruption.

- The rapid transformation of the economy towards industrialisation increased the destructive effects on the overall environment. These also affect the social structure of China.

The coastal provinces of China are experiencing more economic growth than the interior. The industrialisation also introduced an Urbanised economic development where about 200 million workers leave the rural areas to urban for work. China is the most populated country in the world and this creates lots of problem. To keep the population under control government had taken “One child’ policy. However, this also creates problem with high number of aged people in the country. Industrialisation makes china vulnerable for the environmental deregulation. It is loosing significant number of arable lands. Air, water, sound and other sorts of pollution introduced as the by-products of economic development. However, the government is trying to overcome the negative impacts on environment. Government is tying its officials to environmental welfare, taking long-term national climate change policy and organising leading groups associated with the ecology.

Uthaisangchi (n.d.) stated that the present recessionary impact over the business in China is under control now. Besides, the slowdown in economy has not seen extensively in China compare to all over the world. China experienced optimism in many sector while it is impossible for the other countries of the world. With the economic and financial crisis, China has expected to have a GDP growth of more than 9 percent in upcoming years. However, some negative affects of the crisis over the Chinese economy can not avoidable as the business are more global in nature. The most effected area is the export sector of the country.

The cause for the decrease in the export amount is the commodity China usually exports has imported by the European and North American countries mostly. These countries have affected heavily and as a result, tendency to import commodities have decreased. Other sectors like construction materials, steel and cement has affected as the decrease in construction worldwide. Many construction contractor firms of China were compelled to hold their activities abroad for the economic recession. However, these will not keep any pressure on the rising of China as an economic superpower.

Quinn (2008) informed that India and China are now waiting to play and pivotal role in the union of financial stability forum named G-8. These two countries are now striving to reform the international institutions like international monetary fund. The emerging economies like India and China is shaping the economic and financial unions of the world. For example, Lula Da Silva who is president of another rising economy Brazil, said that the G-8 must be renamed as G-20 as many other economies besides the previous eight super powers are emerging.

Findings of Comparative Analysis

Comparison of Financial Environment: (Dobson, 2007)

In 1940s, India and China were taking initiatives to mobilising the domestic savings and to channel up themselves into the development of industrial sectors. After revolution of 1940s, China had planned to close down private property and institutions for taking over the financial system. India was choosing mixed economic system with continuation of public institutions, banks, and capital markets with regulations in financial system in most developed emerging markets.

Banks

From 1980s, China and India have reformed and modernised by banking system, but public ownership and social objectives are retaining their importance and distortions. The bank managers of China have tightened by prudential standards and oversight of incentive structures according to central government. On the other hand, India has also tightened to have diverse ownership of banks. The relationship between state banks and state enterprises are differed in both countries. In China, initially, government owned banks and capital industrial borrowers, because government are getting priorities to maintain sufficient economic growth to solve the problems regarding layoffs. In India, banks have financed by public treasury.

The ownership of banks from enterprises is being less transparent in China into mix of state and non-state forms. Indian banks are concentrated in government sectors to remove the cost of bad loans to Indian taxpayers and financial appear in public accounts, which is shown that, government is not defaulted on theses bad loans. In recent years, bond prices are rising to attract banks to potential profits from investments to extend credit growth to led interest rates and sale of bonds.

Indian Banking system is reducing government ownership, with the dominance of public banks, which are motivating profitable business modes in the country. The owners and banks are subjects to consider in enquiry and debate, which has shown that, specific banks are evidences of greater efficiency with only weak differences.

China is being different from India, which has transformed into commercial banks from original policy banks with government priorities. It has following three step strategy for state owned commercial banks, which are:

- To inject capital for strengthen capital bases of banks according to standards initially.

- In 2005, 10 of thousands government banks’ profits are appeared much less certain.

- Unsustainable government approaches are being slower with proper guidance on sections of banks.

Capital Market

Corporate bond markets of China is in work in progress for several reasons with regulatory restrictions, adoption of bankruptcy laws, procedures of market principles, less transparency of investors, modern accounting standards, and insufficient market discipline. The stock exchange markets are also facing liquidity and credibility problems to make easier innovations of increasing demands from foreign institutions to offer new shares to larger state owned banks. India has corporate bond markets, which is under developing according to rivals, strict government regulations, costly and difficulties to domestic bonds, legal recourses, and bankruptcy costs.

The banks of India are also issued 5 years credits for reducing incentives of corporations, which is also helpful for satisfy Indian companies to finance in long run. Therefore, capital market development is important for both countries for developing institutions and instruments of direct financing with the help of regulatory frameworks, which can facilitate market forces and discipline.

Comparison of Economic Environment

India and China, both countries are highly urbanised since 18th century, although rural areas are populated. China has advanced in technology and sciences, like gunpowder, printing, paper, paper currency inventions and many more, on the other hand, India is famous for its mathematics and philosophy. However, both countries were similar in exporting of fine textiles, silks, muslins since 1500. These two countries became economically vibrant from late 18th century. From the history evaluation, it is clear that, both countries were emphasised on industrialisation, rather than developing economy (Maps of India 2003). The industry was only concerned about steel and machinery, rather than consumer and low-tech goods. Both countries are also common in eco- agriculture, with common uniform revenue collection and land ownership, which had effective power in economic variation. The FDI flows in China and India is leading, where per capita income of India is $440 and China is $990.

In China, 3% population are under poverty line, where as, India has 30-40% population is under poverty line. The FDI inflows of China are $52.7 billion, and India is received $4.67 billion in 2002. FDI inflows are larger than India than China, because market size of China is bigger, which is offering easy accessibility in export marketing, government incentives, infrastructure, cost effectiveness, and suitable macro economic climate. India is also advance in skilled and efficient work force, management system, law and regulations, transparent system in working, cultural, and regulatory environment. The following figures show the true GDP of China & India: (Meghnad 2009)

Factors Leading China in Economic Environment

- Government Policy: The main comparative advantages of China are in openness of trade and industrial policies, which has given economic efficiencies. Further development of economy has greater opportunities to become successful with the help of government. The government of China is also promoting growth of economic development with public research, trade protection, financial incentives, government procurement, control foreign participation, antitrust regulations, and training of specific skills (Costa et al, 2006).

- Foreign Investments: China has open door policy in foreign investments in economic transformation. In 2005, the FDI flows of China is $153 billion, which is helpful for built factories, create job opportunities, link to international markets, and transfer of technologies.

- Infrastructure Investment: One of the most important success factors of China’s economic is infrastructure, where resources have used as power supply and facilities are prevented interruption of production. The government of China is paying closer attention in the investment in infrastructure, like road and transportation, machineries, and communication systems.

- Human Capital: China has major advantages with cheap labour, from local businesses to many hi-tech firms. The cheap supply of skilled and educated human capital is not only sources, but also foreign educated people have also added. China is producing 600,000 new engineers every year, which are technical resources of human capital.

Factors Leading India in Economic Environment

- Government Policy: The growth of economy is depending on implementation of reducing imports and customs duties in raw materials and automotive components in India. The government also provides high quality infrastructure and support services with duty free import of goods and raw materials.

- Human Capital: India has also skilled engineers and technical experts, which are available in U.S. and Singapore. China has declined in skilled labours from 2010, where India has predicted to grow with human skills in next 20 years. India’s human ability is not only emphasised in engineering and technically, but also management capabilities (Costa et al, 2006).

- Larger Domestic Market: India is very fast moving in rising incomes and consumerism, which is attractive foreign investment with lower costs. The domestic consumption is also rising; the initial investment has facilitated with limited sources of growth and export from India.

- Quality & Trade Standards: India has viable option of exporting quality and trade standards with high quality management programmes, like ISO, TQM and many more.

Comparison of Ecological Environment

Factors Related to China’s Ecological Environment

- Improving Energy Consumption: The future Chinese energy intensity has given projection, which demonstrated from historical data from World Bank and International Energy Agency. The agricultural energy is being decreased 2% per year from 2006-2010 and 1% per year until 2020 (Hubacek et al 2007).

- Increasing Demand of Residencies: The residential energy consumption will be increased 3% per year until 2020, which has calculated by incorporating all components. The per capita income will also increase in China by 20% with average growth rate of 1.3% annually in terms of current world averages (Library of Congress 2006).

- Reducing Ecological Footprint of Housing: The Housing sector is playing significant role to driving resources directly with construction and operational requirements and indirectly by influencing the lifestyles of China. It is also adopting international practices in housing development in terms of smart design and social cohesion. The ecological development can be possible with following features:

- Natural, renewable, and recycled sources in housing materials;

- Developing heat and electricity from tree wastes;

- Designing energy efficiencies with south facing houses,

- Using water saving appliances, like rains and recycled water;

- Emphasising on green transport plans;

- Recycling system in every home.

Factors Related to India’s Ecological Environment

- Deforestation: India has important natural resources, which are forests, which is influencing against floods and protecting soil erosion. The forests are also important in ecological balances and life support system with covering 76.52 million square Kms forest areas. However, geographic areas have recommended 33% of forest areas, where there are only 23.28% forests in India (Dewaram 2002).

- Land/ Soil Degradation: Farming activities are contributing soil erosion, which has direct impacts agricultural development. Land exploitation and water resources accomplish green revolution. Extensive usage of pesticides and fertilizers are causing land degradation. This soil erosion is causing landsides and floods, deforestation, overgrazing, traditional practices of agriculture, mining projects in forest areas and many more. Food security of India can maintain by forestry agriculture and controlling soil erosion with rural developments.

- Environmental Pollution: Environmental pollution means the ways people pollute surroundings, air, water and other substances, and soil. Pollution has caused degradation of environment with results of socio-economic, institutional, and technical activities. Many factors have related with environment changes, like economic growth, population growth, urbanisation, agricultural development, increased energy usage, and transportation. Poverty is also main problem of environmental pollution, which happened in rural areas and posed threats to urban life of India.

Problems Regarding Comparison of India & China

Vij (2009) argued that China and India is fastest emerging leaders of world with growth and development in industries, economic and financial environment. Both of these countries have huge resources, capital, skilled human resources, technological advancement and globalisation, stabilised government and economics, strong demand, affordability and state of art and attitudes toward lifestyles. Although there are many similarities, but there is some other, differentiated factors are acting as competitiveness of these two countries, which are problems of others, discussed in below:

- India is following quality driven approach, while China has quantity driven approach;

- Costing of India is high compare with China;

- Customers’ requirement of India has fulfilled by India with outsourcing from China, Hong Kong, Bangladesh etc in fabric, but China has vast technologies and diversified approach to manufacture all kinds of fabrics (Doing business, 2008).

- India has several export location, like Delhi, Tirupur, Bangalore, Gujarat, Ludhiana and Chennai with facilitation of transportation system. However, China has only Hong Kong to maintain global business;

- China is specialised in casual and simple garments, on the other side, India is specialised in handwork, smocking, embroidery, fabric printing, placement printing, chiffon fabrics etc.

- India is capable of handling diversified factories at same time, but China is specialised in big factories with specialised labours to maintain its operations;

- India is maintaining proper communication with skilled English spoken worldwide, but China has lacked behind with availability of speaking in work force;

- India is more flexible to accept changes, alterations, modifications, but China is rigid in changes, which has considered as high charges;

- In addition, export costing of India is higher for high investment in design as well as research (Library of Congress 2004). However, China has needed less export costing with cheap labour and big size of orders;

- The labour costs of India are higher, as Central and State Government are selected minimum wage rates. China is also facing problems of high costing, but it is comparatively low than India;

- India has few renounced colleges and universities in globally, but China has many internationally recognised universities, which are helpful to grow professionals and country as well in global market.

- India is lacking behind in FDI flows compare to China, because of having high tech industries and adept workforces;

- India is slower to adopt technological advancement as fast as China;

- Foreign investment of India is also lower than China with regulatory quality and corruption of India.

- The government has binding various regulations like, labour and tax provisions, which is reducing foreign investment flows of India than China.

- The growth of infrastructure is big opportunity for India, with low labour costs, can made power supply in telecommunications and transportation than China.

Policy Implications & Recommendations

If financial conditions of both countries are considered, then the main constraints have related with state ownership of banks, which are tightening prudential standards. India is also strengthening creditors’ rights as bearing fruit as private banks, which are creating more competition in financial sectors. The efficiency has to increase by allowing consolidation of private banks. The fiscal requirements and buoyant growth have declined in China according to Central government. The financial institutions in China not only have competition, but also have greater efficiencies with modern management technologies and incentives for managing risks.

Therefore, more competition, new knowledge, and skills, allocation of capital is opening more opportunities in banks of India and China. Financial sectors can be improved more efficiency with foreign entrants, stimulate competition, and inject new products, skills and technologies. The modern market of China is encouraging transparent and responsive domestic and industrial patterns, which has seen, when Hong Kong Stock Exchanges are permitting foreign entrants. (Dobson, 2007)

Another policy implication relates with stimulating competition according to ownership changes. Current market indicators are making ease of performance comparisons in both countries by market capitalisation, assets, and loans. The averages of net profits, ROA, and ROE of Indian institutions are higher than China, where as net interest margins are reflecting on the opportunities. Therefore, these two countries should maintain large spreads, competition, and productivity.

Costa, Guntupalli, Rana & Trieu (2006) argued that China and India have also different development paths in terms of economic development. Each of these countries has to develop own industries. China is emphasised more on manufacturing sectors rather than service sectors. On the other hand, India is very successful in service sectors, but lacked behind in manufacturing sectors. Therefore, these two countries have to learn from each other. Library of Congress (2004) also reported that India has to improve infrastructure, to develop human capital, to increase FDI for the development of manufacturing sectors. The government of India also has to allow free import of capital goods and raw materials, like China.

It also has to develop quality infrastructure facilities and support services to improve manufacturing firms. It has to lower nationalism, which is making difficult for liberate FDI flows and resistant to MNC in India. China has to focus on growth of exports to develop its service industries. However, China also has to emphasise not only in domestic markets, but also in global enterprises to expand in borderless markets. The intellectual properties of China should be internationalisation with extra efforts by reducing rights violations. Future growth of China’s service industries is required less government regulations and more entrepreneurial activities to compete in global economic conditions. With addition, trade associations are also important to ensure a better regulatory environment for allowing organisations, which are outside the government, to better service industries in China.

These two countries should control population growth to improve ecological environment, with efforts of educating mass and local leaders about the bad impacts of larger population. It can be possible by IEC, which stands for Information- Education- Communication (Dewaram 2002). Forestation and Social forestry programmes can implemented to increase green covers in these countries (Hubacek et al 2007). Other factors are related with controlling air pollution, wastewater treatment plants, penalty imposition for industries to disposing off wastes in rivers, preventing groundwater contamination, water and sanitation facilities to slums, environmental education to school level and overall to make people aware about environmental protection for not only need of protection but also ensure better environment for future generations.

Conclusion

From the overall studies, it has been seen that China and India have productive comparisons on success factors of different environments on local, regional, and international levels. The structures of comparative advantages are acting as vice versa in these two countries, but they are being successful in specific sectors in global economy. These two countries have a competitive relationship in various factors, with high capital demand, skilled work forces, technological advancements, and resource availability with competitive competition in the global market.

Reference List

Ball, D. McCulloch, W. H. Minor, M. S. McNett, J. M. (2008) International Business: The Challenge of Global Competition, 11th ed. NY: McGraw Hill.

CIA. (2009) The world fact book- India. Web.

Chauhan, K. S. & Chauhan, S. S. (2009). Ecological Destruction vis-à-vis Environmental Jurisprudence in India: A Survey. Web.

Costa, P., Guntupalli, M., Rana, V. & Trieu, H. (2006) China and India: A Comparative Study of the Manufacturing and Services Industries. Web.

Dr. Dewaram A. N. (2002) Environment and Health in India. Web.

Doing business, (2008) Country Profile: China. Web.

Dobson, W. (2007) Financial reforms in China and India: A comparative analysis. Web.

EDC (2009) India –Economics. Web.

Griffin, R. W. (2006). Management, 8th ed. Houghton Mifflin Company, Boston New York. Web.

Hill, C. W. L. (2009) International Business. 7th ed. New York: McGraw-Hill.

Hubacek , K., Guan, D., Barrett, J. & Wiedmann, T. (2007) Environmental implications of urbanization and lifestyle change in China: Ecological and Water Footprints. Web.

Library of Congress (2004) Country Profile: India. Web.

Library of Congress (2006) Country Profile: China. Web.

Maps of India. (2009) Comparative Analysis of India’s and China’s FDI Flow. Web.

Meghnad, M. (2003) India and China: An Essay in Comparative Political Economy. Web.

Quinn, J. (2008) Emerging economic nations underline status at G20 summit. Web.

Rangarajan, C. (2009) The International Financial Crisis and Its Impact on India. Web.

Srinivasan, T. N. (2004) China and India: Economic Performance, Competition and Cooperation. Web.

Uthaisangchi, P. Impact of the Financial Crisis on China’s Business Environment. Web.

Vij, D.S. (2009) China vs. India – Comparative analysis of their Strengths. Web.