Ingham’s is a company majoring in the production of poultry and its related products. The company’s business framework is vertically integrated, with 345 various facilities and firms in Australia and New Zealand. The firm generates its revenue from selling poultry, poultry products, and stockfeed, which it produces in its different factories (Ingham’s, 2020).

Ingham’s generally focuses on poultry production, which includes raring and processing chicken and turkey. The company processes various products of these birds, such as meat and eggs. The firm also manufactures the feeds used by the birds it keeps and sell the rest to the other small-scale farmers (Ingham’s, 2019).

Ingham’s production facilities are mainly located in Australia and New Zealand. Specifically, the company has one quarantine, ten feed mills, 74 breeding farms, 11 hatcheries, 255 broiler farms, seven primary processing plants, and seven further processing factories. In addition, the firm has nine distribution centers, and one rendering facility in the two countries (Inghm’s, 2020). The company mainly sells its products within the two countries where its facilities are located. Specifically, the firm has a long history of working with major retailers, quick service restaurant facilities, wholesalers, and food distributors.

The organization’s customer relationship is mainly built on the principles of collaboration in terms of sales, marketing, product development, planning and execution, technical service provisions, sustainable operations, and supply chain management (Ingham’s, 2018). The business builds its marketing success by utilizing its strategy and extending its collaborations with suppliers in both countries. Moreover, the company works with different people in the market to ensure it remains relevant in terms of pricing its products and services.

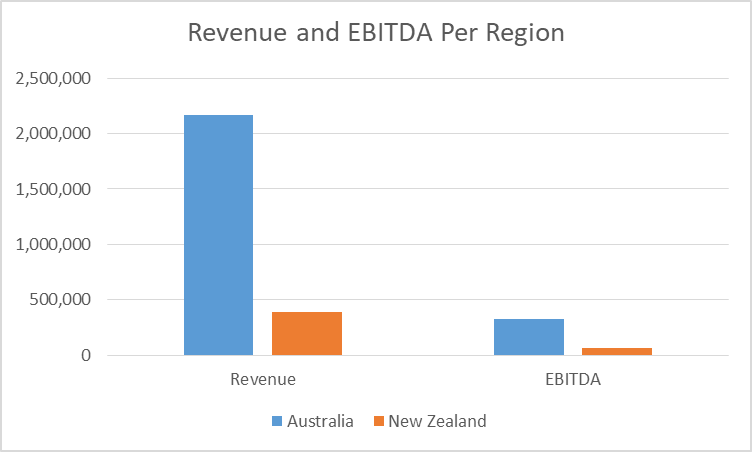

Since Ingham’s Poultry mainly operates in Australia and New Zealand, the company revenue can be segmented based on how much it generates from each region. In Figure 1 below, the revenues from both countries are indicated based on the 2020 report, which is the latest revenue disclosure (Ingham’s, 2020). According to the 2020 annual report, the earnings from the Australia segment grew by 2.9%, which is attributed to poultry, feed, and other products (Ingham’s, 2020). Moreover, it is revealed that the revenue growth resulted from the increase in operations in wholesale and demand from the quick service retailers.

On the other hand, the New Zealand income rose by 1.3%, attributed to poultry production, offset by the low demand for dairy feed products. Moreover, both country’s EBITDA growth was due to the AASB 16 Leases implementation (Ingham’s, 2020). Furthermore, the COVID-19 restriction affect the demand for products until the countries were opened for operations.

Although Ingham’s is one of the dominant poultry firms in Australia and New Zealand, it also has great competitors operating in the international market and within the two countries. Fieldale Farms is one of the greatest rivals in the poultry business. Fieldale Farms competes with Ingham’s, covering multiple markets within the region instead of focusing its operations within the two nations. The other main competitor is Sanderson Farms, which majors in producing chicken meat. The company believes that by concentrating on one product, it delivers better quality meat. Other competitors existing in the market are not as fierce against Ingham’s as they do not have specific strategies in the Australian and New Zealand markets.

Strategy Analysis

This section analyzes Ingham’s strategic approach to its business operations. In particular, it assesses two of the primary market forces affecting the company, its competitive strategy, and how the firm approaches core issues regarding macroeconomic, environmental, and regulatory risks.

Porter’s Five Forces

Porter’s five forces is a tool developed by Michael Porter to help in analyzing how attractive an industry can be and how likely it can profit businesses. According to Porter (2008), five specific factors affect how an organization can perform in any specific industry. These factors include competitive rivalry, supplier power, buyer power, the threat of substitutes, and new entrants. Each of these forces can have varied impacts on any company’s operation, which is why it is critical to understand them. However, this analysis considers competition and consumers’ power on the operation of Ingham’s products.

Competition is one of the main drivers of any industry, whereby other potential companies introduce the same product or service to the same market. The company faces competition from internal firms operating in Australia or New Zealand and the international ones. Some of the top firms striving against Ingham’s include Fieldale Farms, Foster Farms, Koch Foods, Peco Foods, Perdue Farms, Pilgrims, and Sanderson Farms. Some of the companies are larger than Ingham’s, hence have a more significant market share. This impedes Ingham’s growth into new markets or serving the entire customer base in the two regions.

Buyers’ power is another factor, which affects Ingham’s operation in the poultry industry. According to the company’s 2020 report, its revenue was mainly affected by demand shifts due to the effects of COVID-19 and the following restrictions to the movement (Ingham’s, 2020). Buyers’ power also comes in handy when the purchasers have to dictate the price of the products, especially when they have alternative products (Isabelle et al., 2020). For instance, some consumers may consider buying dairy products when they believe that poultry is becoming more expensive. Moreover, new entrants or established firms can decide to sell at lower prices, which subsequently shift the buyers’ attitude from Ingham’s, even if the latter offers better quality and fresh products than other manufacturers.

Competitive Strategy

Ingham’s competitive strategy lies in its robust leadership, made possible across all its branches in the two countries. The company has a qualified and committed management team, which comprises the company’s chief executive officer, financial manager, and heads of operation for Australian and New Zealandia segments. Other leaders include customer officers, agribusiness officers, strategic management teams, human resource managers, and legal officers. All these officials and their respective teams ensure that the company’s operations remain optimal at all times. The firm’s leadership gives it an advantage in the industry where a slight mistake or failure can result in an immense failure.

Macroeconomic, Environmental and Regulatory Risk

Ingham’s faces several macroeconomic, environmental, and regulatory risks in both jurisdictions where it operates. The macroeconomic risks include commodity prices and price controls, limiting the company’s pricing power (Nugroho, 2021). It also suffers from the effects of exchange rates, especially between Australia and New Zealand, where it functions. The company also faces environmental risks such as handling its byproducts or factory refuse and its water management practices. However, the firm has an elaborate environmental management plan, which details how it complies with the risks and manages them for sustainability.

D. Ratio Analysis

This section of the analysis provides the interpretation of the return on net operating assets ratio and return on capital employed.

RNOA interpretation

The return on net operating assets (RNOA) ratio helps an analyst compare a company’s net income using its operating assets. This analysis assists investors in understanding how the organization generates its profits from all its assets. According to Yohn (2020), higher earnings of the business relative to its operating assets indicate how effective the organization is regarding its asset deployment. In particular, RNOA is an essential metric, which helps companies controlling intensive capital, especially those using fixed assets.

The financial report provided for this case outlines the operation for the period 2018 to 2020; the RNOA has shown a steady increase over the period. Moreover, the AT and PM values also show steady growth, all of which are above 192% and 4.61, 5.29, 6.10, respectively, in the three financial years. Since an increase in RNOA is an indicator of healthy financial performance, this indicates that the company has used its assets well over the period, enabling it to convert and reuse its raw materials. Therefore, this shows that the company learns and improves its performance over the years.

The company’s annual report reveals that the firm has been increasing its operation points from time to time. Specifically, Ingham’s has one quarantine, ten feed mills, 74 breeding farms, 11 hatcheries, 255 broiler farms, seven primary processing plants, and seven further processing factories. It also has nine distribution centers and one rendering facility in the two countries (Inghm’s, 2020). The increase in the factories, warehouses, and distributions are the main factors behind the company’s better performance. Moreover, according to the firm’s 2020 annual report, then there have been increased purchases of feeds and other byproducts, which means that the company improves its value addition strategies.

ROCE Interpretation

Return on capital employed (ROCE) is used when comparing an organization’s performance in terms of capital-intensive industry. This ratio is particularly essential because it considers the effects of debt and equity. This helps the firm to neutralize the business’s financial performance (Maeenuddina et al., 2020). Consequently, this tells the analyst the profit, which the company generates from employing $1. Consequently, the higher it gets from the dollar, the better is its capital performance. The higher the ratio, the stronger the profitability of the firm. A trend over the operating period is also an important indicator of its performance. Investors prefer a business with a stable and increasing ROCE ratio compared to those with volatile or decreasing values.

The financial data used in this analysis reveals that the company’s ROCE is 1770.23%, 2097.76%, 3659.03%, which shows a steady increase. The firm’s ROCE shows a comprehensive increase compared to its RNOA, which is also a critical indicator of its financial performance. Decomposing the current analysis ROCE, such that,

ROCE = RNOA + FLEV(RNOA – NBC) = RNOA + (FLEV*SPREAD)

This helps to determine the firm’s profitability, its financial leverage and spread of operation. Based on the above formula for calculating ROCE, if the company’s FLEV is 0, ROCI will be equal to RNOA. However, the analysis indicates that ROCE is 99.55%, 104.88%, and 212.46%, respectively. The organization’s spread is positive since its RNOA is greater than NBC, which indicates that it has a favorable leverage.

References

Ingham’s (2018). Ingham’s Annual Report 2018. Web.

Ingham’s (2019). Ingham’s Annual Report 2019. Web.

Ingham’s (2020). Ingham’s Annual Report 2020. Web.

Isabelle, D., Horak, K., McKinnon, S., & Palumbo, C. (2020). Is Porter’s Five Forces Framework Still Relevant? A study of the capital/labour intensity continuum via mining and IT industries. Technology Innovation Management Review, 10(6). Web.

Maeenuddina, R. B., Hussain, A., Hafeez, M., Khan, M., & Wahi, N. (2020). Economic value added momentum & traditional profitability measures (ROA, ROE & ROCE): A comparative study. TEST-Engineering and Management, 83, 13762-13774. Web.

Nugroho, M. (2021). Corporate governance and firm performance. Accounting, 7(1), 13-22. Web.

Porter, M. E. (2008). The five competitive forces that shape strategy. Harvard business review, 86(1), 78. Web.

Yohn, T. L. (2020). Research on the use of financial statement information for forecasting profitability. Accounting & Finance, 60(3), 3163-3181. Web.