The Economy is experiencing the worst economic condition since the great depression of 1930, the credit facility is experiencing a freeze, liquidity has eroded, and already 2 million jobs have been lost in the last year with the forecasts of another 3 to 5 million jobs being lost this year. The economy is in a state of shutdown, major corporations are struggling to survive, major losses are being reported all around, and the stocks are in the situation of a free fall, people are unable to repay their debts and credit card payments.

The leaders are trying their best to provide a jump start to the American economy and for that sole purpose stimulus measures have been taken.

There are particular areas where these measures have been targeted:

- Clean, Efficient, American Energy

- Transforming our Economy with Science and Technology

- Modernizing Roads, Bridges, Transit and Waterways

- Education for the 21st Century

- Tax Cuts to Make Work Pay and Create Jobs

- Lowering Healthcare Costs

- Helping Workers Hurt by the Economy

- Saving Public Sector Jobs and Protect Vital Services

The extent of troubles being faced by the economy are so extensive that even with the stimulus package the unemployment rate is expected to be around 8% to 9% this year and the picture without the stimulus is even more horrific with the unemployment rates being predicted to shoot up to 12% which will be a disastrous scenario.

If the figures are analyzed since the year 2001, the level of productivity went up and resulted in the increase in income of 96% but the bulk of that income went to just 10% of the society, whereas the rest of the society resorted to borrowing to meet their needs and lifestyle requirements, they kept on borrowing till they could no more and that spurred the economic crisis, the stimulus plan has been designed in a manner to strengthen and benefit the middle class as well and not just big corporations and financial institutions.

The stimulus has a short term aim of countering the unemployment rates and in the long term strengthening the power of purchase of the middle class Americans so that they are able to live a decent life style.

Accountability will be the hallmark of this stimulus plan so that it is ensured that the tax payer’s money is not misused or does not end up in some wealthy executive or CEO’s pocket. All the information regarding creation of funds and their intended use along with the information of fund managers will be posted on special website overseen the President himself. The information about the cost of funds and the formulas used for disbursement of funds will also be available, also the mayors, governors or other officials who are overseeing the projects will be required to personal certify any allocation of funds that the allocation is a feasible and just use of the funds, this system will instill a sense of personal responsibility and accountability and will strengthen the system of accountability. (New York Times, 2009)

A board comprising of deputy cabinet secretaries and inspector generals will be formed for recovery and transparency, their job will include overseeing the use of funds and provide an early warning system for any problems that may arise in regards to the use of the funds. Furthermore these funds will be directed towards the areas mentioned below as these areas are expected to generate the maximum effect and efficiency that the government expects and intends to create:

- Clean and Efficient Energy: The idea is to reduce the dependence on energy products like oil by restructuring and focusing on development of renewable energy products and furthermore make the existing systems efficient so as to control the consumption of energy currently being done. This plan includes substantial investment in restructuring and reviewing the production, transmission and distribution infrastructure and facilities to enhance the level of efficiency. Furthermore, the focus will also be on development of alternative energy methods and systems for the future.

- Science and Technology, research and development: The focus should be in developing science and technology by investing more in scientific research facilities for the next great invention of our time, investment in technology like broadband access always results in multifold return hence the effort will be put in strengthening the structure of broadband and technology access.

- Modernization of civil infrastructure: By civil infrastructure the idea is angled towards bridges, roads, and transit ways. These infrastructure facilities are every important for pubic health and safety, another strong point is by focusing on this area a large number of jobs will be created and ultimate result will be a better and safer infrastructure and a growing economy.

- Education: The investment in and development of education is one of the strongest foundations a nation can be built, education is very important for the progress for any society, and that’s why the funds will be use din developing new educational facilities, developing new educational institutions, funds for establishing grants and scholarship programs, encouraging the youth to undertake higher education and creation of opportunities for lower income groups as well.

- Tax cuts: About 95% of the American population will receive tax cuts so that they can use that money to invest and start their businesses.

- Lowering health care costs: Up gradation of medical facilities, restructuring and development of systems to prevent medical mistakes and provision of better care to patients by enhanced and efficient systems is also an area which will be focused upon.

- Helping people who are suffering due to the economic turmoil: Millions of Americans have been hurt in one way or the other by the economic turmoil that has brought the economy to a stand still. It is important that the funds are used to assist and help these poor souls in surviving this downturn, conducting training to help them find new jobs and talents, and helping those families which do not have any source of income due to the crisis.

- Saving Public sector jobs and vital services: Many states are facing the same kind of liquidity and credit crunch that is being faced by the general public, it has become very difficult for them to continue working the way they were in the past without cutting jobs and halting important services, the goal of this fund is to not let the turmoil effect the ability of these states o function properly and minimize the level of job cuts as much as possible, programs and services which are threatened to come to a halt due to non-availability of funds will be supported and saved so that vital public services continue to function without any disturbances. (recovery.org, 2009)

Overview of States Share in the stimulus

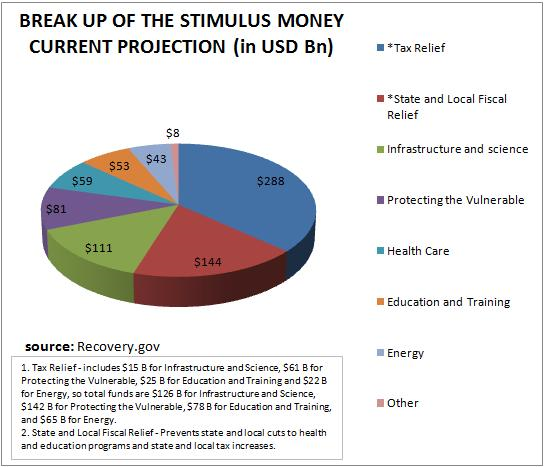

The above given pie chart is a representation of the allocation of funds to various areas like energy, healthcare, education, infrastructure development, tax relief, state and local governments relief, protection of people who have been hard hit by the economic crisis.

As it can be clearly seen that the major chunk of the relief program is centered on tax cuts to avoid putting further burden on the already crisis hit population and the state and local government fiscal relief programs which is a very important factor too. (Chritton, 2009)

Unemployment

The phenomenal rise in unemployment rates did not spare nay state in the last few months, and the start of 2009 has not been any different from east to west throughout the country. The jobless rates in Rhode Island and Michigan entered into double digits in December mostly due to manufacturing industry job cuts since the demand for goods has dropped significantly and manufacturers are not operating at full capacity due to lack of orders and liquidity problems.

Well known employers like Home Depot, Caterpillar and Pfizer have already announced lay offs ranging around a number of 40,000 jobs which has been another shock to people already battling the economic turmoil. Other then manufacturing job cuts are also being announced in retail, banking and financial sectors since the whole economic collapse began from the mortgage giants, banks and housing sector. States reporting higher jobless rates then the nationwide average of 7.2% also entered into double figures due to the economic turmoil.

The recession officially began in December 2007 and since then 4.4 million jobs have been lost in the US. In February 2009, 651,000 jobs have been lost alone and the trend seems to be continuing. South Carolina and Indiana have taken huge hits in the unemployment rates in recent months due to the large scale layoffs in the manufacturing sectors. The problem for people is that they had worked hard for years reaching to top positions in their organizations and companies earning good salaries but when suddenly they find themselves laid off its almost impossible for them to find a job that would pay them as well as they were earning and thus a drop in the standard of lifestyle occurs. Till now Wyoming, North and South Dakota are 3 states that have posted the lowest jobless rates in the country and seemed to have had minimum impact from the economic crisis. In short we are in for the longest downturn ever seen since the World War 2.

States Rejecting Stimulus money

“Led by Republican Governors Association chairman Mark Sanford of South Carolina, a group of conservative GOP governors has rejected or considered rejecting the unemployment money or other funding from the $787 billion stimulus package. Bobby Jindal of Louisiana, Haley Barbour of Mississippi, and Bob Riley of Alabama also have rejected the unemployment money even Sarah Palin of Alaska has only partly accepted the stimulus money.” (USA today, 2009)

A lot of people may wonder what’s the reason behind governors rejecting stimulus money, the governors have this belief that since the stimulus money is coming with certain strings attached which will require that the states change certain laws like covering part time job losses in jobless benefits, imposition of higher taxes on businesses that’s why the stimulus package wont be such a good idea because in the long run they would be getting their states deeper into the quagmire of debt resulting in more burden on businesses operating In the states to deal with the aftermath and that’s the prime reason the governors are vary of accepting the stimulus money, another reason for their reluctance maybe that many of them are planning to run for the Presidency in 2012 and they wouldn’t want to take any decisions which might have any implications on their future so hence they are sticking with a conservative approach, also worth noticing is the governors rejecting the stimulus money are all republicans. (Deslatte, 2009)

“I think what we’re seeing is some governors making political calculations with an eye toward their next job when they need to be making practical decisions on behalf of their constituents, And I think it will backfire.” South Carolina Rep. (James Clyburn, the third-highest ranking Democrat in the House)

Conclusion

The question that comes to everyone’s mind is whether the stimulus package work or not, this is a very complex question with no firm and definite answer, of course the stimulus will have some impact on the economy but the results wont be seen in the short term, the economy will still take a lot of time to get back to its tracks, a lot of people believe that just printing more money wont solve the problem since the whole system has collapsed but there is no denying that some effect of the stimulus will b there, at what point in time will the effects kick in that is the question.

Although the government is trying to jump start the economy with this stimulus package but it hardly seems to be enough and much more effort and planning will be required and then maybe by the beginning of next year the signs of recovery will emerge. It is also repeated that in the great depression of 1930’s the US did not fully recover until it entered the Second world war and it is somewhat true, but that does not mean we need a war to come out of the crisis, we need continuous efforts and correction of the flawed system that led to the collapse in first place.

References

Kirk Chritton, “White House releases state-by-state stimulus numbers”, Stimulus Marketing, 2009. Web.

Lee Hudson Teslik, “Backgrounder: The U.S. Economic Stimulus Plan”, New York Times, 2009, Web.

Melinda Deslatte, “GOP Governors Consider Turning down Stimulus Money”, ABC news, 2009, Web.

New York Times, “Economic Stimulus” New York Times, 2009, Web.

Recovery.org, “Track of recovery efforts throughout the US”, 2009, Web.