Introduction

Oil sands are also known as tar sands or extra heavy oil. It is a type of bitumen deposit. This is a mix of sand or clay, water and petroleum is called bitumen. Large quantities of oil sands are found in Canada and Venezuela. In Canada the vast majority of oil sands are located in Alberta.

In Canada the oil sand sector witnessed high record level of investment in past decades. Earlier the oil sands were vast but largely inaccessible resources. But now the condition changed drastically. This is mainly because of the advancement in technology.

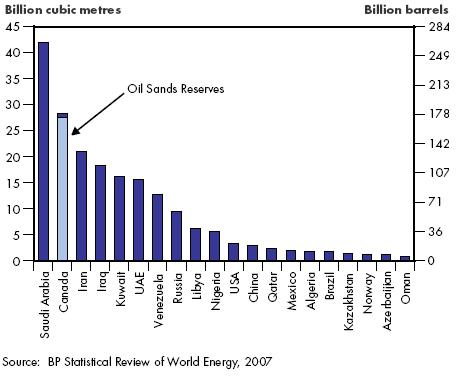

Canada is the one of the biggest possible supplier of energy. Canada’s tar and oil resource are second in size only to Saudi Arabia. The expansion of oil sands production is expected to have a beneficial impact on the Canadian economy. Oil sands activities increasingly contribute to economic activity in Canada.

Earlier the ambition of the Canadian economy is to produce 1 million barrel per day from the oil sands by 2020 but this goal was surpassed in 2004.This is mainly because of high market price of crude oil and growing uncertainty about the global supply of oil and growing demands from United States and India.

Oil sands Boom

Canada one of the country in the world were oil production is expected to increase. Right now the Canadian oil sands are booming. Oil shale production in the world is less than 30000 barrels per day, But Canadian oil sands make up over 40% of total crude production. Potential of oil has attracted a huge amount of investment in dollar.

(Kohl). The irony is that unlike traditional oil which is found in a few areas around the world, oil sand distribution is even more concentrated in even smaller areas. In Canada this is situated in the region of Alberta. “Alberta’s oil sands contain the biggest known reserve of oil in the world. An estimated 1.7 to 2.5 trillion barrels of oil are trapped in a complex mixture of sand, water and clay. The most prominent theory of how this vast resource was formed suggests that light crude oil from southern Alberta migrated north and east with the same pressures that formed the Rocky Mountains.” (The Oil Sands Story: the Resource).

Experts feel that this light crude which was mixed in the sands was transformed into bitumen. This bitumen is more viscous and rich in carbon than traditional crude. One challenge with regard to economic extraction is that the percentage of bitumen found may be as low as one percent. It can also be as high as 20 percent which is more practical to extract. Another challenge is the depth in which the oil sands are seen. The deeper the sands, the more difficult and costly it will be to extract.

Extraction process: Since this oil is more of a solid form, the traditional drilling process whereby oil gushes out on its own due to high pressure is not possible here. The sands have to be exposed and then transported to refining centers in trucks and conveyor belts like in the case of iron ore or any other metal mining. Taking oil from these sands started as early as the 1920s even though this was done from exposed sands. But later development of technology resulted in the extraction of oil from deeper deposits.

Bigger trucks and buckets (in conveyor belts) has now resulted in the transportation of larger quantities of oil sand in one go. This is more economical and time saving. Work usually goes on twenty four hours a day in shifts. Developments in technology have now resulted in newer techniques for extraction of deep deposits. One of the ways is to drill pipes into the deposits and heat the oil sands. This will decrease the viscosity of the bitumen which can then be pumped to the surface.

Oil sands Investment

Canada’s national energy board slightly lowered their initial production estimate just under 3 million barrels per day in 2015 and approximately 5 million barrel per day by 2020.Current production is little more than 1 million barrels per day (Nelder).

In order to attract foreign companies to invest in Canada’s investment sector they have to follow certain tips:

Understand the impact of national oil companie

In order to increase the competitiveness the Canadian producers must understand and high light the competitive advantage.

Address the talent management challenge

In oil and gas industry the women are treated under represented. Mostly qualified foreign workers are also unable to work on Canadian projects because of Government restrictions and lack of industry recognition of foregin credentials.In order to face this challenge ,Canadian stake holder must negotiate with Government and industry association to allow foreign workers and womens to work in oil and gas industry.

Explain initiatives for sustainability and greening

Canada’s producers must concentrate on greening and communicate their environmental efforts to public.

Focus on alternative fossil fuels and renewables

They must focus on alternative fossil fuel resources and renewable energy resources such as wind ,solar energy etc (Attracting investment to Canada’s Energy Sector).

Deloitte & Touche LLP – Canada (English) Oil in whatever form and the energy produced by it is non-renewable. Canada and other countries can certainly use the vast amounts of oil sand reserves. Once the technology to extract oil from sands in an economically feasible way has been developed, it will ease the burden on traditional oil producers. It will also be a competitor to those old oil producing countries. Most advanced economies and some developing ones are seriously looking at alternative sources of energy.

Wind energy is one of the cleanest sources of energy and windmills hardly require any human inputs once it is installed. Canada is a vast country and possibility of using water reservoirs for producing energy can also be looked into. Like wind energy, water energy is also renewable and environmentally friendly. But reservoirs need large areas that are inundated under water and this could cause environmental problems. This could also result in migration of population to other areas if the proposed reservoir will cover inhabited areas.

Economic Impacts of Oil sands

In Canada oil sands activities increasingly contributing to economic activity. Investments in oil sands have not only benifited in Western Canada but also through out the country in the form of spinoff benefits to the related industries such as biusiness services,manufacturing,retailing,finance and insurance.

The CERI study provides a comprehensive anaysis of this benefits and measures in terms of dollars and jobs. Using expected investment profile the study measures the impacts based on:

- Gross Domestic Product.

- Employment and labour incom.

- Revenues to Government.

Impact of the oil sands on Canada’s Gross Domestic Product

GDP is the total unduplicated value of the goods and services produced in the economic territory of a country or region during a given period. It is the total value of goods and services produced within Canada during a year. It is also known as economic output. An increase in GDP shows that economy is doing well, while decrease in economy shows the economy is not doing well. Changes in GDP are indication of economic output. (Gross Domestic Product).

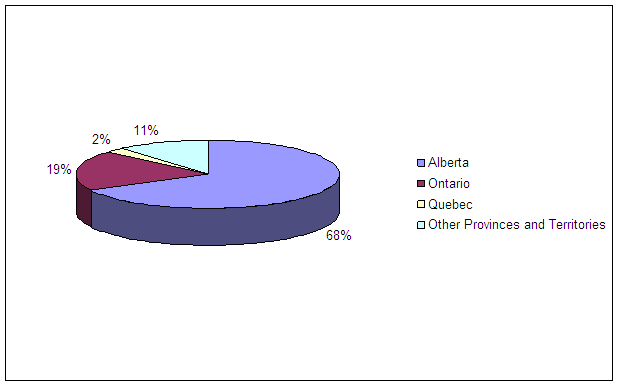

CERI (Canadian Energy Research Institute) estimates that value of bitumen and synthetic crude oil produced over 2000-2020 period total over $500 billion. CERI estimates that oil sands and the related activities together contribute around $789 billion to Canada’s GDP over the study period (2000-2020). Nationally CERI estimates thatoil sands and oil related activities account for about 3% of Canada’s GDP by 2020.Up from about 1.5% in 2000.Contribution of Alberta oil sands in GDP is 80%.Besides crude oil and oil sands sector it is finance, retail, manufacturing sector real state ,and insurance benefited mostly from the development of oil sands.

Impact of the oil sands on employment

Oil sands will increase employment opportunities in Canada. It will generate approximately 5.4 million person years of work in Canada over 2000-2020. But among them two-third of the employment opportunities is likely to be concentrated in Alberta.

The Oil sands and Government Revenue

The companies who are engaged in the oil sands sector are making healthy profit. It also generating considerable revenue for the Government also. The Canadian Energy Research Institute estimates that, in total, oil sands production and development activities could generate about $123 billion for governments in Canada during the 2000-2020 period, mainly in the form of corporate and personal income taxes, property taxes, and, in the case of Alberta, royalties. Apart from increase in GDP and employment opportunity development of oil sands also helps to generate high revenue. The CERI study shows that largest percentage of the Government revenue (taxes and royalties) accrues to federal government not Alberta. Government revenue is mostly generated from income tax, royalties, corporate tax, provincial sales tax, GST, property tax.

The revenue shared by the government are:

- Federal government – 41%.

- Alberta government – 36%.

- Other governments and municipal.

- lities – 23%.

Total Revenue Distribution by the Government:

- Personal Income Tax – 24 %.

- Property tax – 17%.

- Indirect Tax – 10 %.

- Royalty – 29%.

- Corporate tax – 20% (Oil Sands Economic Impacts across Canada).

Current and future challenges

One of the main challenges faced by oil sands in Canada is innovation and deployment of new technology. Significant challenges associated with growth and pace of development are

- Labor –Capacity for engineering , Procurement and construction.

- Costs – High construction cost.

- Society – Community infrastructure and services.

- Environmental sustainability – The development of oil sands helps to develop the economy in a sustainable manner. There are various important global environmental issues such as green house gas emissions and regional and local issues. Environmental impacts ( air , land , and water )and carbon emission constrains over long term.

- Infrastructure – The growth of oil sand industry must be constrained because the pace of growth may exceed the underlying infrastructure related to roada housing, municipal services etc.

- Permits – approval process which are overwhelming government or stake holder capacity.

- Government –Certainty of environmental policy and fiscal policy with higher crude prices.

Environmental impact: Even though this topic has been mentioned earlier, the importance of environmental safety needs more detail review. Take the case of Athabasca. “Extracting Athabasca’s oil is costly not only in terms of infrastructure, but also in water, energy used to produce steam, and the enormous amount of greenhouse gas that results. Some question whether the scale of new projects is wise”. (Tombs).

The clash between profits and environmental safety always exist is such high risk industries. Companies are more concerned about maximum profits and hence may not be bothered about additional spending in environmental protection. If the oil sands deposits are at the surface, then the impact is low when compared to deep deposits. This is because plant growth in such areas will be low because the bitumen in the sand is not conducive to it. Even then the pollution from the extraction and refining process will result in environmental concerns. In case of deep deposits, the area will have to cleared of trees and any other animal an human presence.

If the deposits are in economically sensitive areas, the concern is more serious. If the deposits cover wide areas more vegetation and other forms of life will be affected. It is estimated that to get one barrel of oil, two tones of soil has to be removed. Hence the impact of producing millions of barrels of oil can be imagined. This can cause large disruption for the environment. Moreover the heat needed to convert the bitumen into usable form is also enormous. Again estimates show that to produce eight barrels from oil sands, the energy equivalent of one barrel has to be used. But companies are now initiating planting of trees in areas where production has been exhausted. But this regeneration will take a long time to get back into its original form.

Conclusion

Oil sand sector is the area where we can find significant economic growth across the country and has the potential to continue over next number of decades. The huge investment in oil sands and the economic and employment benefits will result to the economic prosperity of Canada.

Works Cited

- Attracting investment to Canada’s Energy Sector. Deloitte. 2009.

- Chapter 4: Economic Benefits of the Oil Sands: GDP Impact of Oil Sands Development, 2000-2020.

- Gross Domestic Product (GDP). Statistics Canada. 2009. Web.

- Kohl, Keith. Oil Sands Investments: From Bitumen to Barrels: Can Oil Sands Delay Peak Oil. Energy & Capital: Practical investment Analysis in the New Energy Economy. 2009.

- Oil Sands Economic Impacts across Canada. CAPP: Canadian Association of Petroleum producers. 2008.

- Nelder, Chris. Today’s Energy and Capital: How to protect your portfolio from the Fed. Energy & Capital: Practical investment Analysis in the New Energy Economy. 2009.

- The Oil Sands Story: the Resource. Oil Sands Discovery Centre. 2009. Web.

- Tombs, George. High Stakes in Canada’s Vast Oil- Sands Fields: Huge Environmental Footprint. Global Policy Forum. 2008. Web.