Introduction

The world is at this instant becoming a global village. So, the market’s chunks are now combined with different areas and thus the concept of the global market arises. To demonstrate in a global market, first a firm has to decide how they can enter a new region. Among the different types of market entry modes, franchising is the most familiar type of entry mode currently. It is getting higher attention because of its unique features, entrepreneur friendly and hazard free stepping. It has established the concept of the different circumstances that demand diverse entry modes. There is no single appropriate strategy to enter a new market. This essay will discuss the concept and show the different aspects of the Franchising entry mode.

There is no single appropriate strategy to enter in a market:

Kotler & Keller, (2006) argued that a global firm is an organisation, which spreads out its completion in different countries and thus gets advantages in its all departments including R & D, production, logistics, marketing and finance. When a firm decides to enter a global market from a domestic one, it has to face different types of steps. Firstly, it has to decide which market to enter; it can be the new product in a new or existing market or an existing product in a new market. Secondly, deciding on the market entry strategy. Thirdly, it has to decide the planning for the marketing program. Finally it has to decide on the market organisation.

Among these steps, decisions regarding how to enter the new market are the most important step. When a company chooses a new country to expand its business, it has to select the best entry mode. There are many types of entry modes. The most important modes are:

- Exporting,

- Licensing,

- Franchising,

- Joint Ventures,

- Direct investment

The basic concepts, which actually make the differences among these entries, are the commitments of the firm, risks, control and profit potential. Here is a graphical representation of the changes of these concepts in different types of entry modes:

The major types of market strategies

Exporting

Kotler & Keller, (2006) said that exporting means the promotion and direct sells of a domestically produced product in a foreign market. Most of the costs incurred here are considered as marketing expenses. Exporter, Importer, transport provider and government are the four players here. Coordination among them is very important.

Kotler & Keller, (2006) argued that an organisation can follow two types of Exporting strategies. These are:

- Indirect Exporting: Export the domestic produced products to a new country through intermediaries.

- Direct exporting: Directly export the products into the new market without any intermediaries.

Advantages:

- Lower risk and investments is required,

- This is the fastest entry mode among all.

- Maximization of scale is possible, as existing facilities are being used.

Disadvantages:

- The cost may be higher because of trade barriers and tariffs,

- Transport cost may be higher.

- There may limit access to local market information,

- Dhar, (2006) argued that the company will be treated as an outsider in the new country.

Licensing

Kotler & Keller, (2006) mentioned that licensing is a strategy of permitting a company in a target market to use the property of the licensor. These properties are usually of intangible nature, such as; trademarks, patents and production techniques.

Advantages:

- Less risk involved here because the investment is low.

- It can ensure the speedy entrance in the market.

- Earning of higher ROI is possible.

- Licensing is the most appropriate way to avoid the trade barriers.

Disadvantages:

- Less control over the licensee can hamper the ultimate goal of the licensor,

- Decrease in potential profit, which is enjoyed by the licensee.

- There may be a threat of unwanted competition from the licensee. That is the licensee may become a competitor of the licensor.

- Knowledge spillover is possible here.

Franchising

Franchising is a more inclusive version of licensing. Here, the franchiser gives the right to use the brand and gives training to local firms of the operation systems. Kotler & Keller, (2006) argued that the franchisee bears the whole investment and gives a certain amount of fee to the franchisor.

Joint ventures

Joint venture means joint production and marketing of product with a local firm. A joint venture can be considered as a partnership of a foreign firm with a local firm. Kotler & Keller, (2006) argued that there are five common objectives in a joint venture: The market entry, sharing of risk and reward, joint product development and conforming to government regulations.

Advantages:

- Overcome of the ownership restrictions and cultural distance is possible,

- Higher resources because two companies are combined.

- It will lessen the required investment.

Disadvantages:

- It is a difficult to manage various features,

- Loss of the power control as because the firm has to share the controlling power.

- Here the risk is much higher than exporting and licensing.

- Dhar, (2006) argued that the local firm can become a competitor because the market is familiar to it.

Direct investment

Foreign Direct Investment (FDI) is the last strategy where a company has direct ownership of properties and facilities in the target country. Here the company has to transfer its resources including capital, technology and personnel or starting completely newly using the resources of the selected country or through acquisition of an existing entity in the new country.

Advantages:

- The firm can enlighten its image as it creates new job offerings,

- Specialized skills and direct full control over the operation is possible,

- It will lessen knowledge spill over.

- Getting the whole profit for and do not need to share it with others.

Disadvantages:

- Higher risk is involved than any other strategy,

- It requires more resources and investments, and

- There is a huge chance to arise problems to manage the local resources.

Different strategies for different types of organisations

The market entry mode differs based on the type of the firm. There are mainly four types of firms. These are:

- Large organisations

- SME (Small and medium sized enterprise)

- Manufacturing organisation

- Service providers

In the case of large organisations, the investment capacity is huge. Its size also helps to handle high amounts of risks. For these reasons, a large organisation can take FDI or joint venture as an effective entry mode.

Blair & Lafontaine, (2005) argued that SME should take exporting or licensing as because they have lack of investments and they are not capable of handling high risks.

Manufacturing organisations can take franchising or joint venture as a market entry strategy because of the low amount of capital and attention to the continuous development of the operation system. Because service is being consumed simultaneously after the service is served, there associated a lower amount of risks. For this reason, Zeithaml & Bitner (2006) argued that a service provider can use exporting, licensing or franchising as a market entry mode.

Different levels of risks

A major reason, for which the single market entry strategy is not appropriate, is the risks associated with business. There are different types of business risks and these are shown in the following figure.

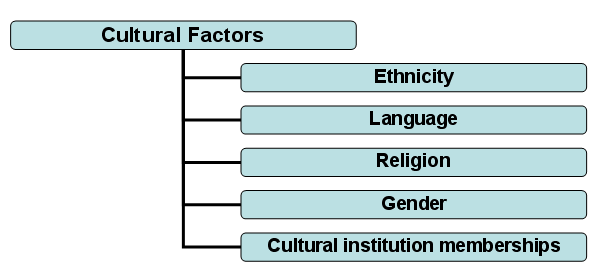

Cultural and demographic factors

Culture is the summation of learned beliefs, values and actions, which form the behavioural pattern of the consumer. The major cultural factors are language, religion, ethnicity, gender and membership of different cultural institutions, which play a significant role for market segmentation. These factors shape the mindset and behaviour of the consumer and thus create a problem for the firms to establish within the market.

Schiffman & Kanuk, (2007) argued that geographic and regional aspects may also effect the market entry decisions. All the places of the world have differences in its geographic and regional dimensions. The environment, as well as the climates, is not similar. For this, the resource availability and process of operation restrict the strategies to gain a good market share.

Franchising: A special attracted strategy

According to Zeithmal & Bitner (2006), franchising is a relationship or partnership where the producer or the franchiser produces or develops the products and production system and gives the license to deliver or sell the product to a particular region by the franchisee. There are different types of benefits and drawbacks of franchising for both the franchiser and the franchisee. The table is showing this bellow:

Table: Benefits and drawbacks of franchising

Business format franchising

There are two types of franchising, such as:

- Traditional

- The business format

Blair & Lafontaine, (2005) argued that in the traditional franchising, franchised dealers emphasized on the product line of only one company and the extent of their business relies only with that company. Here, the franchisers impose little restrictions regarding the operation and practices little control power.

Accourding to Blair & Lafontaine, (2005), the business format franchising refers to sell of the production and operation system and procedures to its franchisee. Here the franchiser teaches the techniques and ways of production and give the license to use the procedures for a fee.

Use of franchisees own capital

In the case of franchising, the franchisee will have to invest and to hold all relevant risks solely. Blair & Lafontaine, (2005) argued that franchisers need not to invest any thing financial; rather they invest their reputation and knowledge. That is the franchiser can get the advantage of using the capital of the franchisee. Franchisers can get financial advantages in two ways. Firstly, it can get a huge amount from the franchisee as royalty or license fee. Secondly, it can increase its brand values and reputation without using any money. The risks regarding doing business is also held by the franchisee. So, franchising acts as an additional income source for franchiser. Again, the franchisee spends solely in advertising campaigns. Thus, the franchiser gets free marketing advertisements.

Franchisee versus employee

There is a crucial difference between the franchisees and the employees. The main dimensions are:

- Share of business operation system: Murray, (2006) argued that franchisers share their production and operation techniques with the franchisees but they do not share these with its employees.

- Share of external and internal information: Employees are informed about only required information but franchisee is informed about almost all information.

- Give the power of control: Murray, (2006) also said that franchiser should give some exclusive power to control over the business operation to the franchisee. For this, some important decision making power is held by the franchisee. But the firm gives no or a little decision making and controlling power to employees.

- Earning of money: Blair & Lafontaine, (2005) argued that franchisor get money from franchisee because franchisors have to pay royalty or license fees. But, the franchiser as a firm gives money to the employees as salary, fringe benefits and bonus.

For the above reasons, franchisees are more motivated than the employees. Franchisee can enjoy freedom in many cases, which can not be enjoyed by employees.

Knowledge regarding the local conditions of franchising

The most advantageous aspect of the franchising is the franchiser can use the knowledge regarding the region of the franchisee. When the franchiser wants to enter a new market, it is impossible to gather all relevant and accurate information regarding the regional and geographical dimensions. Murray, (2006) argued that the franchisee is a local firm which has the exclusive knowledge about all the possible situations and also have the experience to work with the environment. Another aspect is that, a local firm can identify and understand the values, beliefs and expectations of customers more easily than an external one (Franchiser). For this reasons, a franchiser uses the knowledge of the franchisee to exact the knowledge about the local market.

Technology and business transfer

Every organisation has some unique features regarding its technology used in the operation. When a firm becomes a franchiser and gives the franchisee the license of franchising, it has the obligation to train the franchisee to use the relevant production related technologies. Besides, it has the obligation to transfer its business strategies. There are different types of strategies in a business process for example market segmentation strategies, Competition analysis strategies, distribution channels production and technological strategies, packaging strategies, pricing strategies and advertising strategies.

Strength of a franchisee

Murray, (2006) argued that franchisee has the business set-up and the apposite support from the franchiser. So, it gains some strength. These are:

- An established and tested business concept: A franchisee gets the business format from the franchiser, which is complete, tested, implemented and established by the franchiser. So, there is no need to test the feasibility of the business concept by the franchisee.

- Reduction of risk: the franchisee is using the tested and established business format, as a result, the risks of the business operation is low.

- Share of the strength of the franchiser: The franchiser have some strength in the market, which is transferred to the franchisee by the franchising agreements.

- Easiness in financing: it can easily find the sources and ways to getting financial helps because the franchisee gets the investment strategy from the franchiser.

- Enjoyment of possible independence: the franchiser gives ultimate independence in all types of decision making. So, a franchisee can take a decision and implement it independently and without any pressure from others.

Conclusion

In a global market, if a firm takes only one market entry strategy, it will lose its all strengths. The basic reason behind this is, business has no certainty. Every sphere of business is full of uncertainty and problems. These problems are most of the time unique and never seen before. So, treating only one strategy to enter a market is not appropriate.

Bibliography

Blair, R. D. & Lafontaine, F., 2005, The economics of franchising, Cambridge University Press, Web.

Dhar, S., 2006. Market entry strategies, The institute of chartered financial analysts of India. Web.

Kotler, P. & Keller, K., 2006, Marketing Management, 12th edition, New Jersey: Pearson prentice hall, ISBN: 0131457578

Murray, I., 2006. The franchising hand book, Kogan Page Limited, Web.

Schiffman, L. G. & Kanuk, L. L., 2007, Consumer behaviour, 9th edition, New Jersey: Pearson prentice hall, ISBN: 0-13-186960-4

Zeithaml, V. A. & Bitner, M. J., 2006, Services marketing, 4th edition, New York: McGraw Hill, ISBN: 0-13-205676-3