Introduction

Sukuk is an Arabic financial certificate and is also regarded as an Islamic bond. As per the Islamic laws of Shari’ah, it is Haram – banned to charge or pay Riba – interest. Hence Sukuk securities are structured in such a way that Islamic laws that are against interest bearing transactions are avoided, yet they provide profit for the bearer and transacted of Sukuk. The global market for Sukuk in 2010 is estimated to be worth 1.2 trillion USD and in UAE and the Gulf region alone, the Sukuk market is worth more than 500 billion USD. The market is projected to grow at a rate of 15 to 20%. About 20 percent of the Muslim population of Persia and the gulf would select a financial product such as a Sukuk over other traditional financial products that would have a similar return and risk (Zawya, 2010). Considering the huge existing market and the potential market for Sukuks, the paper would examine these financial products in greater detail.

Rationale for the project

It is a well established fact that there are many middle class and super rich Muslims in the Gulf region, in Muslim nations such as Pakistan, Malaysia, Singapore and other nations with a sizeable Muslim population. These people have sufficient funds and the only investment opportunities available are in the traditional share markets. However, with the emergence of the Islamic Sukuk, investors have the opportunity to invest in the accepted Halal way (Vogel, 63). Accordingly, there is a need for a document that would examine these Islamic bonds, discuss their structure, their potential and how the bonds are accepted by Western stock markets. Existing documents either focus deeply on one aspect of Sukuk or treat the subject from a marketing perspective since the documents would be authored by people working with specific investment houses. This document provides a rational and balanced treatment of the subject and is directed towards lay investors and students of the Islamic bond market. At the same time, it would also serve as reference basic document for people who are active in this field and who would want a proper theoretical knowledge of the subject.

Literature Review

Sukuk can be traced to the period of medieval Islam in the early 10th century and referred to any document that could be used for trading and conveyance of rights. It was also a contract with certain obligations as per the Shariah. In those times, Sukuks were used frequently to transfer any trade financial obligations. Sukuk works by changing the cash flow of the future into the present. It can be issued as per the current asset or one that may become available in the future. Banks and certain financial institutions are allowed to raise Sukuk. When they sell a Sukuk, the buyer takes charge of the instrument and then rents it back to the issuing authority at a certain rent value. These bonds have a 10 year maturity period and at the end of the period, the issuer has to take back the bond at par. In the intervening period of 10 years, the buyer has obtained rent and at the end of the 10 years, he releases the bond back to the issuer at the same rate he bought. As per conventional bond, the buyer has obtained a regular interest for the 10 years and then he is selling of the bond at the original rate meaning he has got back the investment. The issuer has access to funds that the buyer has paid and can use the funds for 10 years. A certain interest rate in the form of rent is paid. This creates a win-win situation since the buyer is assured of at least obtaining the principal amount with the rent as extra income. These loopholes and adjustments are however viewed very severely by Islamic scholars (Presley, 26).

There are different structures for the bond and these are used as per different techniques. Sukuk endows partial endowment in a debt called Sukuk Murabaha or asset Sukuk Al Ijara. It can also give partial ownership n a project – Sukuk Al Istisna or in an investment called Sukuk Al Istithmar and even in business Sukuk Al Musharaka. The structures of Sukuk duplicate conventional cash flows and they are listed on international stock exchanges of London, Luxembourg and others. There are organisations such as Euroclear that carry out trading in these bonds. The buyer undertakes a promise that he would repurchase some types of assets and thus capital protection is achieved while circumventing the appearance of a loan. In some cases, a certain amount of rent is given and the amount is very often linked to Libhor and other interest rate scales. As per the Sharia, debt certificate should be put up for trade. Other instruments have also been censured and these include Sukuks: Al Istithmar; Al Musharaka and Al Mudaraba. As per the decision in 2007 by the Islamic board, only Sukuk Al Ijara, the asset certificate can be traded. The investor has to purchase the debt certificate before the finance part is dome and then the instrument should be retained till its maturity. As per the Sharia, money is used only for measurement of the value of an asset and it cannot be regarded as an asset itself. Therefore, one should not receive money from money. It must be remembered that Sukuk is one of the Islamic banking instruments. Other types are Zakat, Jizya, Nisab, Khums, Sadaqah, Bayt al-mal, Murabaha and Takaful (Muhammad, 3).

It is interesting to note that even in the conventional bonds, investors are usually not worried about the end investment of the bonds or what activity is financed with the bond. Islam does not allow such activities since the money could very well be used to fund alcohol sale. Very little attention s given to the value of the asset and then this raises the amount of risk that has to be carried by the investor. Payment default is one of the major risks that bonds face however, in conventional bonds; this risk is assessed by the credit rating system that is provided by credit rating agencies. The bond purchased can fairly rely on these ratings and is assured of the proper risk cover (Khan, 1991).

In Islamic finance, the funds should be given for trading or the creation of real assets. Simply providing find for buying financial instruments and securities would mean that the funds are being used for speculative trading and this is called Gharar. Therefore with Murabaha, goods are bought for a customer and again sold back to the customer. Ownership of the goods though temporary is used to rationalise the higher price for the financier. The concept of Istisna means that funds are provided for manufacturing by means of payments for pre production work. However, these are concerned with construction and purchase of equipment and the real capacity can be certified. Ijarah refers to the leasing process of real estate. By using the assets, the payment of rent to the owner is allowed. People who purchase Sukuk instruments are allowed to know where the money spent would be invested. Therefore only assets that can be identified arte used for backing Islamic bonds (Jaffer, 15).

Research Aims and Objectives

The research aim is ‘to research and analyse Sukuk structures, their risks and the market organisation’.

Objectives of the research are:

- To research the history and structure of Sukuks

- To understand how risks are managed with the Sukuk instrument

- To understand different types of Sukuks

Proposed Methodology

A secondary qualitative research would be conducted. Secondary methods would include a through literature review of technical and sociology journals, newspaper archives and other such sources. It is expected that gathering of the archival data relating to trends in the Sukuk market would be done by querying peer reviewed databases of Questia, ProQuest, Emerald and so on. In addition, there are a number of databases from Islamic financial institutions and these would offer the required content. An initial review of the literature has brought up some important keywords. A search would be run using the keywords to obtain the required articles and content. These documents would be further analysed and the required content would be rewritten to form the different chapters.

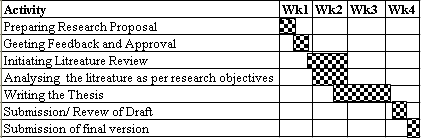

Project Management

The following Gantt chart gives details of the project management.

Methodology

The methodology chapter would discuss important aspects of qualitative and quantitative research. The chapter also presents the questionnaire that would be used in the research.

Qualitative and Quantitative Research

Studies that use data cover areas of economic study, unemployment, health of the economy, scientific study, patterns of demography and others. Different type of data is collected using methods such as databases, reliable government studies, secondary research published in peer reviewed journals, experiments, observations, interviews and others. Data that is collected can be designated into two basic categories, quantitative and qualitative. This also formulates what type of research a study will be conducting: quantitative or qualitative. Denzin (33) described quantitative research as “the research which gathers data that is measurable in some way and which is usually analyzed statistically”. This type of data is mainly concerned with how much there is of something, how fast things are done, and so on. The data collected in this instance is always in the form of numbers. In order to obtain quantitative data, one should have a specific framework about what has to be researched, what should be known, types of inputs that are admissible and so on. Such an approach can help in designing the questionnaire, make observations and so on. Denzin also defined qualitative research as “the research that gathers data that provides a detailed description of whatever is being researched”. Both types of research have their supporters and detractors and while some claim that quantitative research is much more scientific, others argue that qualitative research is required to examine a specific issue in depth.

Researchers who support that quantitative research argue that numerical data can be statistically analysed and in this way, it can be established whether it is valid, reliable and whether it can be generalized. By using numerical data, these numbers can be used to compare between other studies, which also use the same numbers, the same scales, etc. With qualitative research, it is not so easily possible to achieve this result, as no specific method or scale of measurement is kept. This is the main disadvantage of qualitative research, as findings cannot be generalized to larger populations with a large degree of certainty and validity. The reason that this happens is because their findings are not tested and evaluated statistically in order to establish whether they are due to chance or whether they are statistically significant and to what extent. Another advantage of quantitative to qualitative research is that qualitative research is descriptive and many times subjective too, as it depends on the researcher’s perspective or how the research registers certain behaviours. Another researcher conducting the same study may observe the qualitative data, which is given in a completely different way. Quantitative research does not show this disadvantage as all the data is in the form of numbers and, therefore, it may be translated in only one possible way, that which is given from the objective value of each specific number. However, qualitative research has many advantages to offer too, which are not offered through quantitative research. It is usually through such type of research that a rich, in-depth insight can be given into an individual or a group, by being far more detailed and by recognizing the uniqueness of each individual. This type of research realizes the importance of the subjective feelings of those who are studied (Denzin, 36).

Qualitative research analysis does not have to fall into the pitfall of being ‘forced’ to have all its values into certain numerical categories. It is clear that not all phenomena can always be adequately assigned a numerical value, and when this does happen, they lose much of their naturalistic reality. Qualitative research can simply describe a data for what it actually is without having to assign it to a number. Qualitative research can give attention to occurrences, which are not so common. For example, it is very difficult to find enough participants to conduct statistical correlations between nations on women being more accident prone and indulging in rash driving because women will not be willing to be used for such studies. In such cases, quantitative research is impossible and it is only through qualitative research that such cases can be examined in depth and conclude to specific findings and results (Byrne, 67).

Data Gathering

Gathering data is a very important phase and due consideration must be given for the period of the research.

Sample Selection

The sample to be researched largely determines the data collection method that is used. Surveys are better suited when used to obtain information from participants, while focus groups would require a different method since the groups are diverse. The sample size would also depend on the project requirements and the group that has to be studied. While considering large number of subjects is best since the results are more reliable, the costs of studying such large samples increase. If the project has sufficient budget allocations, then it is possible to include larger samples and members in the study (Byrne, 69).

Cost Considerations

Cost is an important aspect for research projects and choosing the method for data collection depends on the budget. For tasks such as running observations, program and project document review can be achieved with lesser costs, but tasks such as the design of the survey instruments, administering the instrument to subjects and analysing the results would need the help of an external evaluator (Byrne, 76).

Sample Size

The sample size used in research has always created disagreements and controversies. Various issues such as ethical issues and statistical problems arise and these need to be addressed properly. When very large sample data sizes are used, the ethical issue of wasting resources will arise, while selecting a smaller size will create another ethical issue. When the research objective is large, then a difference that is statistically significant may be observed even with a smaller sample. However, the difference that is statistically significant may happen when a smaller sample size has been used and such differences do emerge and when there is actually no difference (Freiman, 697).

Research Paradigm and Method

Typically, the research design, methodology and approach are driven by the research question being scrutinized. It can be inferred that depending on the field or research there may be several research approaches and methods that are considered appropriate. The research paradigm will influence the selection of an appropriate research method and approach by the researcher. They could choose either qualitative or quantitative research, in some cases mixed method procedures which incorporate both elements of qualitative and quantitative research are obtaining a level of validity within academia where it has aspired to a level of legitimacy within the social and human sciences. The author identifies that there are three paradigms evident in Information Systems research, which are, the: Positivist paradigm; Interpretivist paradigm and Critical theory paradigm (Vitalari, 515.

The ‘Positivist Paradigm Positivism’, as stated in Neumann (2007), sees social sciences as “Organized method for combining deductive logic with precise empirical observations of individual behaviour in order to discover and confirm a set of probabilistic causal laws that can be used to predict general patterns of human activity”. Interpretivism, as defined by Neumann (2007, 63) is the “systematic analysis-of socially meaningful action through the direct detailed observation of people in natural settings in order to arrive at understandings and interpretations of how people create and maintain their social worlds”. Critical theory is derived from the works of Marx, Freud, Marcuse and Habermas (Neumann, 67). Critical theorists disagree with what is viewed as the anti-humanist and conservative values of positivism and the passive subjectivism of Interpretivism. Critical theorists go beyond seeking understanding of an existing reality and critically evaluate the social reality being studied in order to implement improvements to it.

Sukuk Market Analysis

Literature Review

Literature on Islamic finance and debt markets is not extensive since the Shariah prohibits interest rate derivatives and swaps and trading in money. Hence there has been a rapid rise in Shariah complaint instruments. Specifically time bound analysis and yield ratios are not available since such activities are not allowed under the Islamic laws. However, what is generally known but not accepted is that the ‘rent’ that is paid for a Sukuk follows the international yield rates and interest. It must be remembered that the Sukuk is just one of the financial instruments but what is required is the financial institution that would support the release of bonds. To give an example, a demand draft is one of the instruments used by the bank but it is crucial that there should be a functioning bank that would honour and make the payment for the draft when it is presented for payment (Jaffer, 18-20). This chapter provides a detailed literature review on various important aspects of Sukuks.

Current structure of the Sukuk Market and the Islamic Finance

Islamic financial Institutions and Islamic Financial Services Industry are important for the issuance of Sukuk. While the structure of Sukuk would be discussed in the next section, this section provides an overview of the Islamic Finance Infrastructure. It must be noted that the following entities are involved in trading and marketing Sukuks (IFSI, 22-26):

- Islamic Banks: These are institutions that accept deposits from customers and offer finance to customers. Included in this group are Islamic subsidiaries and banks. Some conventional commercial and offshore banks also offer windows for these operations. The term Islamic window is the department of standard banks that provides services complying with Shariah. This would include services such as financing, deposit services, fund management, investment and so on. The funds are again invested in assets that follow Shariah norms. Therefore the Islamic windows are virtual branches in a bank but it will not have a separate legal standing. However, since it is a separate department, it would be taking up the full range of financial intermediation services. These would include sourcing of monies and financing extension. The Islamic window again responsibility for the fund providers just as a proper Islamic bank does.

- Non bank Islamic financial institutions and these would include Islamic factoring, finance and leasing firms. It would also include the mudarabah and ijarah companies, housing cooperatives and microfinance firms, subsidiaries that offer credit sale of trading firms, venture capital and private equity capital firms and also organisations that manage the Haj funds such as sadaqah, zakah and waqaf.

- Takaful and re-takaful firms also known as Islamic insurance and reinsurance operators

- Islamic brokers and capital markets, investment banks, asset management firms, fund management firms

- Islamic infra and architecture firms, systems used for settling payments, market microstructures, Shariah identification and product screening systems

Application and alternative basis for financial instruments

It is important to study the applicability of Islamic financial contracts since the instrument has to give the involved parties a reasonable profit and the manner of profit generation has to comply with Islamic law. Different traditional Islamic financial contracts are available and these can be configured so that they comply with the requirements of Gharar and Riba. There are three types and these are partnership contracts, exchange contract and financial assets contracts and these are explained in this section (Ebrahim, 37).

Partnership Contracts

While accepting profits instead of interest, Islamic finance system lets the use of partnership contracts to come to the fore. In Islamic finance, there are two main types of partnership contracts that allow values of profit and loss to be shared. The two partnership contracts are Mudarabah, and Musharakah and these are briefly explained as below (Cole, 16-19).

Mudarabah: This type of partnership contract is formed between the provider of finance and capital and the entrepreneur who would be servicing it. One party would provide the supplies for the capital to another entrepreneurial party called the mudarib. This would be done to initiate trade and certain conditions can be applied. An important condition is that any profit that may be realised must be distributed in mutually agreed ratios. If there is any capital loss, it must be borne by the capital provider. If there is a loss, the entrepreneur has to bear the loss of opportunity cost of labour and time. Mudarabah has properties and functions that are equated to interest. It offers the chance of having pure finance as the finance provider can invest without the need of personally managing capital investment. There is also no need to be exposed to a huge number of liabilities (Cole, 16-19).

Both mudarabah and musharakah are different from interest as they keep a proper relation between the capital owner and the entrepreneur who would be implementing it. Profit distribution is acceptable as per the pre-determined proportion of the total. If there is a loss, each entity would only forfeit their investment and this applies to funds or manpower. In musharakah and mudarabah, a fixed profit or the return of principal amount put in as fund cannot be guaranteed. The main model used for Mudarabah is a two-tiers these two tiers represent the liability and the asset side. The first tier is the liability side is created when customers deposit their money with an Islamic financial institution. The financial institution assumes the role of the mudarib. Mudharabah often refers to investment deposits in Islamic banks. The institution would then invest the funds with different entrepreneurs in the second tier also called the asset side. The bank would be serving the role of the capital investor. Islamic financial institutions’ profits are created when there are a percentage of returns from the asset side of the mudarabahs. In practical condition in a mudarabah, the deposit side is prominent as it is in the nature of investment deposits. On the asset side, the assets assume the form of debt receivables (AAOIFI, 25-28).

Musharakah: A contract under musharakah is very comparable to the standard belief of a partnership arrangement where each entity would put in capital as per their capability. Each partner has management rights as per the ratio of their investment. The amount of share of profit if any for each entity in the partnership is calculated as ratio of the total profit. It is not calculated as a ratio of the invested capital. If there is a loss, each partner would lose only the invested amount invested. Musharakah is of two types and Islamic financial institutions use in the equity of companies and they are permanent and diminishing Musharakah (Archer, 27-59).

In Permanent Musharakah, the Islamic bank would also be involved in raising the equity. It would also obtain a profit share on a pro-rata basis annually. If the firm is of incorporated type, the ownership would be the common stock. If the firm is not incorporated but has a private holding, then the ownership is the share. In Islamic banks this Musharakah is the capital of the bank. In Diminishing Musharakah there is a gradually ending of the asset ownership or the project for the client. It is a temporary in nature and like the redeemable equity in a firm (FSA, 8).

Musharakah and Mudarabah are treated as financing methods with a non debt load. The main amount of funding is not certain. As a result, the entrepreneur does not have to repay the total amount of funding. Issuer is allowed to pay a certain amount that is a percentage of the profit made. These two contracts are appropriate financial tools and have some important advantages. The tools follow the banks roles as financial intermediaries and they can also be used for different investment duration and have for different types of entrepreneurs (Haque, 28-32).

Mudarabah arrangements can have a certain disadvantage since there is a chance that moral hazard and asymmetric information can leas to problems in the arrangement of funds. An entrepreneur who is trustworthy is the basis of the Mudarabah contract. The bank or investor would be bearing the loss if there is a failure. This can induce the entrepreneur to act against the investors interests. This may in turn make investors to turn away making big investments with a single entrepreneur. The Musharakah contract can help to remove some of these disadvantages and asymmetries in information as a method for management control to the investors (Haque, 28-32).

Exchange Contracts

Financing of Working capital is important in all types of financial system. Though there are differences in the religion and culture among the nations, banks and financial institutions face comparable challenges in business transactions. Some of the challenges are to maintain sufficient capital ratios, fixed assets, obtaining finance for inventories, extending credit sales and so on. However, as per the Shariah, Islamic financial institutions are not permitted to offer credit lines that have carry interest. There are other means to finance the working capital and these are available in exchange contracts. These modes of contract do not require any intermediary relationships like the Musharakah and Mudarabah partnership contracts before. The main type of an exchange contract is generated by the deferred trading principle – DTP. Three main types DTP contracts are created and they can be grouped as Price deferred sale, Object Deferred sale and Object and price deferred sale (Tariq, 8-10).

Price Deferred Sale: This is created when a buyer who wants finance can obtain funds from a seller on the basis of credit. He can defer the payment of price for to any date in the future as agreed with the seller. The deferred price can also be more than the spot price. This type of debt finance is permitted as per the Shari’ah and forms the main basis of the core Islamic financing activity. Murabaha contract is the primary expression of a price deferred sale and this has become a frequently used Islamic financing method. About 80 % of total Islamic financing is carried out by this method. The structure of the Murabaha contract is simple and is made of a quoted mark-up that is built into the final selling price. To specify, a builder may require funds to buy goods and equipment of 100,000 GBP. He can ask for funds from an Islamic financial institution to buy the equipment on his behalf and would in turn buy it back from the Islamic bank at a deferred price after 6 months delay. The final sale price could be 150,000 GBP and this would depend on the mark-up used. The mark up would be related to a market benchmark reference. It would also include any associated transaction costs as well as a target profit margin (Archer, 60-64).

Murabaha financing has many advantages and hence it is used frequently Islamic financial institutions. The duration for bearing risk for the bank is lesser than other financing methods. The bank also gets the profit when the sale-purchase transaction is done. Assets of the financier are regarded as receivables or debts and they cannot be sold as per the Shari’ah. The institutions are however concerned about the liquidity of investments (Sundararajan, 70).

Object Deferred Sale: This type occurs when the buyer has sufficient funds or when seller has to finance the production and supply. In this case, the buyer can make advance payment and delivery of the goods will be postponed to a later date. The advance price paid can be less than the price expected in the future at the time of delivery. As per this type of contract or Salam, the financial institution would be willing to pay the price of an accepted quantity of goods in advance. Delivery of the commodity would be done at a future date. An intrinsic risk in this contract is that the bank may be unable to find buyers for the goods at that future date if the counterparty breaks the promise. Since this risk is faced by the bank, Islamic banks do not accept Salam contract unless there is a third-party guarantee. In many cases setting the price for a Salam contract is more complex than a Murabaha contract. It would involve documenting the credit risk of the buyer besides there would be changes in the asset value over the contract period. If the contract extends multiple nations, the bank would have to attach appropriate discount or premium after considering the forward exchange rate between subject countries (Archer, 67).

Object and Price Deferred Sale: Usually deferring both the object and its price is not allowed. In some exceptional cases, Islamic scholars have made crucial exemptions where both can be deferred. This arrangement thus gives birth to two important instruments used in Islamic finance. The instruments are Ijara in obligation and Ijara in leasing and these are special cases of exchange contracts. The tools can be used for both object deferred and price deferred routes and both can be appropriately designed. An Ijara in Obligation can refer to a rentable asset that may not be real but a rent contract can be created. As an example, a building may not yet exist and would be constructed after three years. It can however be rented now for 8 years. The amounts from the rents can be obtained now or later. If the rents are got later, say after the 8 years lease duration, it would imply that both the price or rent and the object or building is deferred. The building can also be sub-let and this means that the rent contract or the usufructs is sold to a third or fourth person. Another example of sale of object and price deferred is Istisna’. In this case, the project, road, etc. would not exist and has to be built and delivered at a later date. The price here is also paid at a later date and there is deferment of both object and its price (AAOIFI, 35).

Financial Assets

As per the discussions from the previous section a number of contracts and forms for the following Islamic financial assets are obtained. These are classified as per their tradability in the secondary market (AAOIFI, 35-40)

Tradable Islamic financial assets:

- Mudarabah certificates: These are certificates having a permanent ownership in businesses but there is no control and management right.

- Musharakah certificates: These certificates give permanent ownership in businesses and also give control and management rights.

- Redeemable Musharakah certificates: These are Musharakah term finance certificates; or MTFCs and give a temporary ownership in companies and either with or without control and management rights.

- Fixed rate Ijara certificates: The ownership of these durable assets is given on ownership or on rent in the form of usufructs of durable assets. The rent is fixed for the contract duration.

- Floating rate Ijara certificates: The ownership of these durable assets is either given on rent or on basis of ownership of the usufructs of durable assets. The amount paid as rent is re-priced in sync with activities of benchmarked instruments defined in the Master Ijara Agreement framework.

Non-tradable zero-coupon certificates:

- Istisna’ and the Murabaha certificates: It refers to the possession of debt that comes from an Istisna’ or Murabaha financing. As an example, road project construction is carried out as per a cost plus arrangement. In this case, the costs can be100 million USD and the mark-up rate is ten percent. The sum of110 million USD will be paid back in instalments without differentiating the principal and coupons. The $110 million could be in the form of non-tradable debt certificates and these are comparable to zero-coupon bonds for some features. Since debt cannot be traded as per Islamic law so these certificates cannot be traded.

- Salam certificates: In this type, salam, funds are given in advance and the product is turned into debt. The funds that are paid would be in the form of certificates that would stand for the debt. These certificates cannot be traded.

Types and Structure of Sukuk

Sukuk have a stable income and are asset-backed instruments that are, tradable and trust certificates compatible to Islamic laws. The main requirement of Sukuk issue is the availability of assets. The assets should be available on the financial reports of entities such as monetary authority, government, corporate offices, banks and financial institution and other bodies that wish to mobilize funds. Shari’ah requirements specify that the group of assets should not be only made of debts from Istisna, Murabaha and other Islamic financial contracts. It is important to classify the assets properly. This classification is used to indicate the certificate type that has to be issued. It is important to understand that these assets can be set up for issue of trust certificates in different methods that meet the need of the issuing entity (Jaffer, 11).

In this section, types of Sukuks available are discussed (Jaffer, 12-18):

- Pure Ijarah Sukuk: These are certificate issued for stand-alone assets. These assets have to be specified in the balance sheet. In this type, the assets that can be taken are land lots for leasing, capital equipment such as ship and aircraft. The returns of rental rates on these Sukuk can be fixed and floating and this would be based on the originator.

- Hybrid/Pooled Sukuk: These include assets that are made of receivables from Murabahah, Ijarah and Istisna. By creating a portfolio of assets made of various classes helps in enhanced mobilization of funds. This is possible since the earlier inaccessible assets such as Istisna and Murabaha can be used to make a portfolio. But, at least 51 % of the asset pool should be made of Ijarah assets. Receivables from Murabahah and Istisna’ would be from the pool. Therefore the returns obtained from these certificates can only be of the type that is pre-determined.

- Variable Rate Redeemable Sukuk: The previous two varieties of Sukuk would be a sizeable percent of the issuer’s balance sheet. In some cases, issuing Sukuk by giving the full strength of the balance sheet of the issuer can be very helpful. Many corporate bodies call these Sukuk as Musharakah Term Finance Certificates. These types of certificates are actually alternate instruments for Sukuk. These certificates have lesser advantages. By using Musharakah returns is acceptable from the perspective of Islamic scholars. This is because this process would support the paradigm of Islamic banking where partnership contracts are regarded to represent core ideals. The floating rate of return available of such certificates is based on benchmarked market standards such as LIBOR. This would again depend on the organisations balance sheet.

- Zero-coupon non-tradable Sukuk: In this type the assets are yet to be obtained. Therefore, the aim of the fund mobilization is to bring about more assets on the balance sheet by Istisna’. But this type of certificate cannot be traded easily due to restrictions of Shari’ah. The main asset pool that has to be created would be of the type specified by Istisna. Any instalment for the purchase and sale contracts would form debt obligations. For this reason, the certificate on such debt arrangements are called as fixed rate zero coupon Sukuk.

- Embedded Sukuk: These instruments are made of instruments such as Ijara, zero-coupon and hybrid. They would have embedded option and this would help to modify the sukuk into other types of asset forms when certain conditions are fulfilled.

Given below are a list of different investment Sukuk along with the description and the rulings of the Shariah. These are framed as per the recommendations of the Accounting and Auditing Organization for Islamic Financial Institutions.

Certificates of ownership in leased assets

- Description: These are types of sukuk certificates having equal value. The owner of a leased asset issues them. They can also be issued by a promise and by his financial agent. The goal is to sell the asset and get back the value from subscription. Here, the certificate holders become asset owners.

- Shariah Rulings: Issuer would be selling the leased asset or an asset to would be promised to be leased. Subscribers buy the asset while Mobilized Funds refer to the purchase price of the asset. Certificate Holders would ultimately become the asset owners jointly with the associated benefits and risks.

Certificates of ownership of usufructs of existing assets

- Description: These are documents that have an equal value and are issued by multiple entities. Issuing authorities are usufruct owner of an existing asset; financial intermediary who represents the owner. The aim is to lease or sublease the asset and obtain rental from the revenue of subscription. Certificate holders become owners of the usufruct of the asset.

- Shariah Rulings: Issuer would be selling usufruct of an existing asset and the Subscribers are buyer of the usufructs. Mobilized Funds are for the purchase price of usufructs and holders of Certificate would become the usufructs owner and also get any benefits while carrying the risks.

Certificates of ownership of usufructs to be made available in the future as per description

- Description: These are documents that have a value equal to what was issued for leasing assets. The leaser is liable has to give the value in the future but the rent value is got back from the subscription income. In this type, the certificates holder becomes usufruct owner of these future assets.

- Shariah Rulings: Issuer would be selling usufruct of an asset and this has to be available as per the requirement at a future date. Subscribers are the buyers of the usufructs and Mobilized Funds are from subscription for the usufruct purchase price. Certificate Holders would become owners of the usufructs jointly with its benefits and risks

Certificates of ownership of services of a specified supplier

- Description: These are documents having equal value and are issued to give or sell services using a specified supplier. Some examples are educational programmes in a specified college or university. The value has to be obtained in the form of subscription income and the certificate holders become owners of the services.

- Shariah Ruling: The issuer would be selling services and the subscribers are entities that buy the services. Mobilized Funds refer to the services purchase price and the Certificate Holders are allowed to sell all types of usufructs and also funds for resale of the usufructs.

Certificates of ownership of services to be made available in the future as per description

- Description: These refer to documents that have an equal value and are issued to give or sell services through non-existing supplier. There must be a description of the subject matter and examples are educational programs having a certain schedule, quality, duration, etc. There is no need to specify the educational institution. The value in the form of subscription income has to be obtained. Holders of the certificates become owners of the services.

Salam certificates

- Description: These are specific documents that have equal value and are issued to gather Salam capital. Certificate holders own the items that are to be delivered on Salam basis.

- Shariah: Issuer sells Salam commodity and the subscribers are entities that buy the commodity. Mobilized Funds refer to the purchase price of the commodity and this is the Salam capital. Certificate Holders are entitled to the Salam commodity and the selling price is on parallel Salam basis.

Istisnaa certificates

- Description: These are specific documents that have an equal value. They are issued with the intention to gather funds needed to produce a certain products. Certificate holders own the products to be manufactured on Istisnaa basis.

- Shariah: Issuer is the manufacturer or supplier while the subscribers are entity buying the product to be produced. Mobilized Funds refer to the cost of the item and certificate holders are allowed to own the item or the selling price of the manufactured product

Murabahah certificates

- Description: These refer to specific documents that have an equal value. They are issued for financing the Murabahah commodity. Certificate holders would own the Murabahah commodity.

- Shariah: The issuer would sell the Murabahah commodity and the subscribers are the ones who buy the commodity. Mobilized Funds refer to the purchasing cost of the commodity and certificate Holders would own the Murabahah commodity or the price of selling it.

Participation certificates

Description: Documents having equal value and are issued with the intention to use the mobilised funds to set up a new project. The funds can also be used to develop an existing project or finance a business depending on partnership contracts. Certificate holders become project owners of the project. They would also own assets of the activity according to their shares. Participation certificates can be managed by using Musharakah or Mudarabah and also by an investment agent.

Participation certificates managed on the basis of Musharakah contract

- Description: This is a set document that stand for projects or activities. The projects and activities should be managed on the basis of Musharakah. This can be done by appointing one of the parties or any other party to manage the operation.

- Shariah: Issuer is the entity that invites for a partnership to a certain project or activity. Subscribers are the entities who are partners in the Musharakah contract. Mobilized Funds refer to thee share contribution of the subscribers in the Musharakah capital and certificate holders would own the partnership assets and also obtain a profit.

Participation certificates managed on the basis of Mudarabah contract

- Description: These refer to certain documents that stand for projects or activities. A mudarib is appointed for management on the basis of Mudarabah.

- Shariah: The issuer is the Mudarib while the subscribers stand for the capital owners. Mobilized Funds refer to the Mudarabah capital and certificate holders own the Mudarabah operation assets and profit share, decided as per the agreement. The certificate holders, being the capital providers, bear the loss if any from the Mudarabah operation.

Participation certificates managed on the basis of investment agency

- Description: These refer to documents that stand for projects or activities managed on the facts of investment agency. This is done by appointing an agent who would manage the operation for the certificate holders.

- Shariah: Issuer refers to the investment agent while the subscriber is the principal. Mobilized Funds refer to the subject matter of investment and certificate holders would own the assets represented by the certificates with its risks

Muzara’a or sharecropping certificates

- Description: These stand for documents having equal value. They are issued to use mobilized funds in financing a Muzara’a contract. As per the agreement, the certificate holders are allowed to have a share in the crop.

- Shariah: The issuer would be the landlord while the subscriber is the farmer who would be investing on the basis of Muzara’a contract. Mobilized funds refer to the cultivation cost while as per the agreement; the certificate holders are allowed a share of the produce from the land.

Musaqa or irrigation certificates

- Description: These stand for documents having an equal value. They are issued based on a Musaqa contract and the intention is to mobilize funds for irrigation. The irrigation may be used for trees produce fruits and also to cover other expenses required for maintenance of the trees. As per the agreement, the certificate holders are entitled to a share in the crop.

- Shariah: The issuer becomes the land owner of the land having trees, etc. while subscribers are the ones who take the irrigation process on for Musaqah contract. Mobilized Funds would stand for meeting cost of the trees. As per the agreement, certificate Holders are allowed to have a share in the produce of the trees.

Mugarasa or agricultural certificates

- Description: These stand for documents of equal value. They are issued with the Mugarasa contract as the source and are used to mobilizing funds. The funds can be used for works such as tree plantation and covering expenses. The certificate holders would be entitled to a share of the plantation and the land.

- Shariah: The Issuer is the land owner of the farm considered appropriate for tree plantation. Subscribers are the ones that take the horticultural work for the Mugarasa contract. Mobilized Funds are used to maintain the farm and plantation while as per the agreement, certificate Holders get entitled for a share of the trees and land.

Concession certificates

- Description: These stand for documents of equal value. They are issued to utilize any mobilized funds for finance execution available for concession offer. In this certificate, holders of certificate get entitled to any rights available in the concession.

Risks for Sukuks

The instrument of Sukuk has filled the gap for liquidity management in Islamic banking and for Islamic investors. Earlier, this amount of liquidity could only be obtained by using Murabahah contracts and transactions. However, the global market would only follow conventional finance structures and the liquidity was available only through transactions that were restricted to certain Shariah conforming products such as oils, metals, industrial products and so on. The method of issuing Sukuk certificate helps the Islamic financial institutions to have a greater asset pool that was earlier not accessible. In some cases, Sukuks released by corporate bodies and by the sovereign has been criticised since there is a doubt if it would meet Shariah norms. Specific Sukuk instruments face a number of risks such as market risks, credit and counterparty risks, operational risks and institutional rigidity and these are discussed in this section (Tariq, 56).

Market Risks

This type of risk refers to the risk placed on instruments that are transacted in mature markets. There are two types and these are the general or systematic risks and the firm specific risks. General risks can occur due to changes in economic and government policy while systematic risk can occur die to different company specific Sukuks. The pricing can be out of the acceptable market price for similar instruments. The Market risk is made of commodity risks, foreign exchange risks, interest rate risks and equity price risks. These are explained as below (Tariq, 56-60).

Interest Rate Risk or rate of return risk: This type of risk can be regarded as a rate of return risk for the Sukuk. The Sukuk is created with the intention of fixed rate. It would also be exposed to market risks in the same manner as other fixed rate bonds are impacted. If there is an increase in the market interest rates, this would lead to a reduction in the fixed-income Sukuk values. As an example if on 1 January 1 an investor would buy a 2 year Sukuk with an annual return rate of 10%. On 2 January, the market rates go up by 5. Even though there has been an increase in the market rates, the customer would only get a 10% coupon payments. Therefore the asset would now give less than the 15% market rates. All fixed return assets that are obtained from Salam, Istisna or Ijara, would be facing this risk. There is also the reinvestment risk and the opportunity cost available of investing at new rates. This is more relevant when the asset is not very liquid such as the zero-coupon non-tradable Sukuk. The value of Maturity is also very important in increasing the impact of this risk. If the Sukuk had a maturity of 10 years instead of 2 years then the investor would face a risk for 10 years. In case there are unwanted changes in the market rates, then there would be an unfavourable impact on the issues. The credit rating of the issues would be impacted and the credit risk would also increase.

Sukuk certificates are often face indirect exposure to interest rate fluctuations by the practice of benchmarking with LIBOR. As a result, the very feature of these assets means that they face fluctuations in the LIBOR rate and also in the market rates. The mark-up process is an important feature of the Murabahah contract and it is commonly used in Islamic financial instrument as the asset. A contract that is benchmarked with LIBOR has the likelihood that in for later transactions, the LIBOR rates will increase. Connected to this is the liabilities side that has arrangements to adjust as per market conditions. The issuer of Sukuk would respond to variations in LIBOR since any increase in earnings will have to go along with the investors. Considering the asset side, Murabaha contracts re-pricing is not allowed since debts cannot be traded. So, the Murabaha contract would expose the buyer and the issuer also to a lot of indirect interest rate risk. Islamic financial institutions face a problem because the Sukuks are created by removing the assets from the balance sheets and then putting them for sale. Non-tradable debts tend to assume importance as the assets of Islamic financial institutions. Therefore there is no scope for these banks to issue Sukuk only if they take up extra Ijara contracts. The product mix and specifications of contract are decided by rivals from the conventional system. It thus becomes clear that though Islamic banks try to design Ijarah contracts based on a fixed rate basis, it becomes apparent that only floating rates can be the only suggestions (Tariq, 56-62).

Foreign Exchange Rate Risks: Risks in currency risk occurs from adverse exchange rate variations that would impact the foreign exchange positions. When there is a variation between the Sukuk denominated unit of currency and the currency in which the Sukuk funds are obtained, investors face an exchange risk. An example of this is seen in the IDB account. The unit of account for IDB is the Dinar – ID and this is placed as equal to one Special Drawing Right – SDR of the IMF. It would have a composition of 45% in USD, 29% in Euro, 15% in Yen and another11% in GBP. Sukuk certificates would have denominations in USD and so there is a currency mismatch. In some instances, the mismatch gave a profit as the USD was weaker in relation to the ID. If the USD gains more value then there would be a loss of the ID (Tariq, 64).

Therefore IDB would work to act as guarantor and protect the Soukuk investors for any fluctuations in the exchange rate. The investors in the Sukuk prospectuses are protected with the same set of provisions. This does not remove risks due to exchange rate that impact the originator. Risks from exchange rate would be enhanced by a quickly expanding and also by investment from different nations. Challenge for Sukuk would be to issue corporate entities and sovereigns and these help to frame a strategy for effective exchange risk management that would comply with Shari’ah. It must be noted that Chinese government has brought in a simple method to tackle such a risk. They split the issue in two sections and assume that the issue has a value of 1 billion USD. The first part would have 400 million USD and would be in denominations of the USD. The second part would of 600 million USD but the denomination would be in Euro. Hence it is suggested that the Sukuk could be based using this simple method and be based on multi currencies rather than forming a contingency claim on the balance sheet of the issuer.

Following table gives details of the different risk for the Sukuk structures.

Table 3.1. Market risks for different Sukuk Structures(Tariq, 67)

Credit and Counterparty Risk

Credit risk is the possibility of a loan or asset turning irrecoverable because of a delay in settlements. If a contractual arrangement is the relation and not counterparty risk, ten the risk is formed on the probability of the counterparty withdrawing from the arrangement. The results can be harsh and the value of a bank’s assets would be reduced. Islamic banks cannot gain admission to credit risk management instruments such as derivative because of Shari’ah limitations (Vogel, 63).

There are many unique credit risks that impact Islamic finance. Sukuk would function for in emerging markets and here the counterparties have reduced sophisticated risk management mechanisms. In some cases, the rescheduling of debt with an enhanced mark-up rate would also not be available since interest cannot be charged. As a result, counterparties would be more disposed to default for other parties. Some recent issues of large Sukuk are done for assets that are based on Murabaha, Ijarah, Salam and Istisna contracts. There would be many credit risk considerations that belong to these finance modes. Salam contracts are considered to be susceptible to the risk that commodities would be delayed or not of the agreed quality and quantity. Istisna contracts would also have performance risk issues. The customers of a bank can also default by not complying with the contract conditions and the sub-contractor may also fail to give the required service (Vogel, 65).

Shariah Compliance Risks

These risks refer to the loss that an asset faces when there is a flouting or Sharaih rule. There could be many instances of purposeful or unintentional violation. If this is violated, the Sukuk would be dissolved. As a result, the risk due to Shariah compliance must be identified as a rate of return that the fund has to forego. This is again the amount that would be lost since the fund would comply with Shariah. It is important that the fund must survive in the market even after being made to comply with Shariah (Presley, 37).

Islamic finance is a matter of faith and the way of life for Muslims. The pressure to observe Islamic financing in a Shari’ah compliant manner becomes binding. Therefore, the Sukuk structures have to reflect this faith and also retain the competitiveness. In some cases, fine balance is created between conformance to Shariah and feasibility of project considerations. Therefore jurists and Islamic scholars have an important and integral role in the creating the Sukuk drafts (Presley, 38).

There would be some differences about how Islamic financial instruments are applied and this reflects the different schools of thought and also the legal regimes where the Sukuk are issued. The theoretical application of Murabaha contract would be different for each school of though. There are different jurists like the Organization of the Islamic Conference and the Fiqh Academy that would agree that the Murabaha contract is binding on just the contract seller and not on the buyer. Others may state that both entities have to be obliged to observe the contract terms. It should be noted that any financial engineering that is made should be done with the intention to bring together Shariah views. Some years back, the floating rate Ijara was not regarded as being conforming to Shari’ah. It was deemed necessary since according to Shariah, is issuing entity can only give a guarantee for the rents on the fixed assets. However fixed rate Sukuk are susceptible to serious market risks. As per the market, there is a need for a floating rate for the Sukuk. But, the principles of Sharah specify only a fixed. Instruments such as Ijara Sukuk were formed to fulfil the requirements of the Master Ijara Agreement and this also had a number of subordinate Ijara agreements. These subordinate contracts of Ijara have rents that are revised semi-annually in as per the market benchmark (Muhammad, 15).

Investors can also bear interest rate risk but they would not be protected in the event as the floating rate went to a level that is greater than the fixed rate of the underlying assets. As the originator can only guarantee fixed return on underlying asset pools, floating rate returns would still be arguable. This is more so in the pooled and hybrid Sukuk.

Findings and Discussion

Sukuks have been issued in a number of Islamic settings and these would be presented and discussed. Consider the case of Malaysia, one of the attractions of conventional bills and bonds is that they are used as liquidity management tools, but Islamic banks cannot, of course, hold such riba instruments. The first attempt to overcome the liquidity problem facing Islamic banks was undertaken by Bank Negara Malaysia (the Central Bank) in July 1983, after the first Islamic bank in Malaysia began operations, as it was realised that Bank Islam Malaysia could not hold government securities or Treasury bills that paid interest. Therefore, non-interest-bearing paper was issued, namely, Government Investment Certificates and Government Investment Issues. Bank Islam Malaysia could acquire these certificates, which represented a beneficial loan (qard hassan) to the government. There was no pre-determined rate of interest on these securities, rather the rate of return would be declared by the government at its ‘absolute discretion’. A dividend committee, comprising representatives of the Ministry of Finance, Bank Negara, the Economic Planning Unit and the Religious Affairs Section of the Prime Minister’s Office, was established to regularly declare the rates. There was no fixed formula for determining the rate of return, the stress being on qualitative rather than purely quantitative considerations. Those setting the return considered a range of indicators including macroeconomic conditions, the inflation rate and the yield for similar instruments. Following the decision in Malaysia to allow conventional banks to accept Islamic deposits and offer Islamic financing facilities, Bank Negara recognised that these developments would be helped if an inter-bank money market could be established. On 18 December 1993, guidelines were therefore issued on how a new Islamic inter-bank money market would operate. The market was opened on 3 January 1994 in Kuala Lumpur, its main functions being to facilitate inter-bank trading of Islamic financial instruments, notably mudaraba interbank investments (MII). The MII scheme provides a mechanism whereby a deficit Islamic banking institution (the investee bank) can obtain funds from a surplus Islamic financial institution (the investor bank) by issuing a mudaraba certificate for a fixed period of investment ranging from overnight to 12 months.

On 13 June 2001, the Bahrain Monetary Agency offered, for the first time in the Gulf, government bills that were structured to comply with Shari’a Islamic law. The bills were worth US$25 million, and were in the form of three-month paper, referred to as sukuk salam securities. Although the Malaysian government has offered Islamic bonds since the 1980s, as already indicated, some governments in the Arab world have been forced to borrow in international markets rather than locally because of Islamic objections to trading in debt and interest-based securities. Governments have issued paper that the local commercial banks have held to maturity, but not traded. This, however, restricts the liquidity of bank assets and makes it more difficult for the government to raise finance directly from the public. With its new sukuk salam securities, Bahrain has overcome this problem by providing a fixed return, equivalent to 3.95 per cent at an annualised rate, for the first Islamic bill issue which is not based on interest. The return has been calculated in relation to the real benefit the government expects to obtain on the funds, rather than with reference to market interest rates. The first securities matured on 12 September 2001 and a new issue was launched, a process that has been repeated every three months. The establishment of the Islamic money market in Bahrain will, it is hoped, result in the emergence of markets in longer-term Islamic securities, notably bonds, with Bahrain playing a similar role in the Gulf and west Asia to that of Kuala Lumpur in South-east Asia. The initial offer of bills in June 2001, worth US$ 25 billion, was oversubscribed with almost USD60 million being offered. The minimum subscription was fixed at USD 10,000, which meant that relatively small financing houses could participate as well as private investors seeking a non-banking home for their dollar-denominated liquidity. The same minimum subscription limit was set for the longer-term ijarah leasing securities, worth US $100 million, that were offered in August 2001. These were issued on 4 September 2001 and will mature in 2006. They offer a rental return of 5.25 per cent per annum guaranteed by the government of Bahrain. By October 2003, the total sukuk portfolio managed from Bahrain exceeded US$1 billion and prospects for the years ahead look very encouraging.

As the Qatar Global Sukuk valued at US$700 million and offered on 8 October 2003 was the largest such issue to date, it is interesting to examine it as a case study. The certificates issued are redeemable in 2010; hence, the period for the issue is seven years. Distributions to sukuk holders are made twice annually on 9 April and October or the immediate business day thereafter commencing April 2004. The certificates were issued in minimum denominations of US$10,000 and integral multiplies of US$1,000 in excess thereof. The joint lead managers for the issue were HSBC Bank and the Qatar International Islamic Bank, with the co-managers being the Abu Dhabi Islamic Bank, Gulf International Bank, Kuwait Finance House, Commerce International Merchant Bankers of Malaysia, the Islamic Development Bank and the Qatar Islamic Bank. The registered issuer is the Qatar Global Sukuk, a joint stock company incorporated in Qatar under article 68 of the Commercial Companies Law Number 5 of 2002. The issuer was incorporated solely for the purpose of being involved in the sukuk. The nominal authorised and issued capital of the issuer is QR30 divided into three ordinary shares of QR10 each. The government of Qatar as seller delivered to the issuer a parcel of land, which it in turn leased back for seven years, after which ownership reverts to the government. Payments are made under a master ijarah agreement, with HSBC Bank acting as payments administrator. Returns to holders of the certificates are variable, and calculated on the basis of the London inter-bank offer rate (Libor) on dollar funds plus 0.4 per cent per annum, which makes the certificates competitive with, and similar to, conventional floating-rate notes. This provision can be criticised, but it should be noted that Libor is only used as a benchmark and the returns themselves do not represent interest payments, but rather rents related to a real underlying asset – the leased parcel of land supplied by the government of Qatar. It would nevertheless be desirable in the longer term if alternative benchmarks to Libor were identified, particularly if returns were calculated in relation to the profitability of the projects being financed by the sukuk. In the case of sovereign sukuk, macroeconomic indicators such as real GDP growth could be used, or non-oil GDP growth in the case of states such as Qatar, to avoid the returns being subject to direct oil pricing risks.

The Saudi market in government bills and bonds has become much more sophisticated in recent years, partly reflecting the growth of government debt and the consequent efforts to find more methods of funding it. The Kingdom has been increasingly innovative in its funding, with a growing use of very short-term repurchase agreements (repos). These are short-term loans in which Treasury bills serve as collateral or the asset the lender receives if the borrower does not pay back the loan. The Saudi Arabian Monetary Agency (SAMA) handles these through its transactions with the commercial banks, with the repos serving as their liquid assets. The average value of repos was SR1.8 billion and reverse repos SR3 billion in 2002, compared with averages of SR1.6 and SR1.0 billion respectively in 2000. Saudi Arabia’s commercial banks finance a large part of the government’s debt, with almost SR100 billion outstanding. Development bonds account for most of this debt, bank claims on public sector enterprises, which amount to only SR10 billion, being less significant. Internal borrowing has enabled the Saudi Arabian government to be less reliant on international credit to cover budget deficits. As a result of the policy of securing government funding on a longer-term basis, there has been a shift from bills to development bonds, the latter having increased significantly, reflecting government budgetary deficits. Despite their name, development bonds can be used to fund government current expenditures and are not earmarked for longer-term development projects. Yields move in line with those on Eurodollar bonds, reflecting the fixed exchange rate between the riyal and the dollar. Falling interest rates since 2000 have decreased bond yields, although the gap has widened between bill yields that reflect short-term interest rate movements and bond yields that respond to longer-term expectations that influence bond prices. There is an increasing variety of government development bonds on offer as SAMA has tried to offer terms that the market finds attractive. Two-, three-, four- and five-year development bonds were offered until 1997, when four-year issues matured and were no longer offered. In 1999, 10-year bonds were introduced for the first time and in 2001 seven-year bonds were launched. The development bonds are issued in denominations of SR1 million to wholesale investors and SR50,000, or multiples thereof, to retail investors. In practice, the local banks largely hold these bonds. The bonds are linked to SAMA’s repo facility, with the banks allowed to raise liquidity up to the value of 75 per cent of their gross bond holdings at the nominal value of the issues, with repos running from overnight to 28 days. Given the widening range of debt instruments in Saudi Arabia, it would be a natural progression to introduce Islamic bills and bonds to develop the financial markets further and extend investors’ choices. The establishment of the new Capital Markets Authority in 2004 presents an opportunity for Saudi Arabia to play a more pro-active role in launching sukuk. Islamic securities would mean that dedicated Islamic institutions such as the Al Rajhi Banking and Investment Corporation would be able to hold government paper. This would facilitate their liquidity management. As other institutions, such as Al Jazira Bank, convert their operations to ensure Shari’a-compliance, they would also be in the market for such securities. Furthermore, as the major institutions such as the National Commercial Bank increase their Shari’a-compliant liabilities by accepting Islamic deposits, there is a need for corresponding liquid assets such as Islamic bills and bonds.

Thus it is seen that the market for Sukuk bond sale and consumption is increasing steadily. As long as the issuing agency is sound, the Sukuk market is expected to grow steadily.

Conclusion and Recommendations

The paper has examined the Sukuk bond market and discussed factors such as the structure and function and the market potential. It is obvious that properly structured bonds that comply with the Shariah would find ready market among the millions of Muslim customers that want to invest as per the Shariah.

The paper has also discussed and analyzed a number of issues related to the evolution, underlying principles, structures, risks and competitiveness of Sukuk as Shari’ah compliant substitutes to traditional fixed income financial assets. It is expected that Sukuk will encourage many Muslims world-wide to participate in financial markets and hence will be instrumental in expanding and deepening these markets, particularly in the emerging countries. There are other benefits of Sukuk for the economies and financial markets in the sense of more discipline and more financial stability. The market for Sukuk certificates continues to grow and an important facet of this growth is the increased number of sovereign issuances typified by those issued by Malaysia, Bahrain and Qatar and, interestingly, Saxony-Anhalt in Germany. These certificates are appealing to global investors without having too much bearing on the underlying ‘Islamicity’ of the certificates. Accordingly, Islamic secondary markets receive a boost because such sovereign issuances and the subsequent attraction of global investments encourage increased corporate confidence in their private issuances. Nevertheless, Ijarah Sukuks continue to prevail as the most popular manifestation of Sukuk certificates. This is largely in part to their unambiguous Shari’ah conformity and familiar leasing formulae. However, leasing contracts on underlying real estate properties cannot single-handedly support the growing diversity of Sukuk investors. With increased global investors there will be a myriad of investment needs and thus other avenues of Sukuk issuances should be implemented to satisfy these demands. Istisnaa, Mudarabah and Musharakah certificates are established as part of the AAOIFI standard and can be garnered to offer a plethora of Sukuk structures. The recent Sukuk issuance by the Islamic Development Bank serves as an excellent case study in this regard with their Shari’ah compliant diversity of investments.

With the rapid emergence of Sukuk markets, risk management considerations have also come to the vanguard of the industry. Novel financial instruments bring with them original financial risks. An analogous situation represented itself in conventional financial markets in the early 80s with the emergence of interest rate derivatives to hedge against the financial risks of bonds. With the globalization of financial markets and increased convergence of Islamic finance and conventional markets, indirect interest rate effects as well as other financial risks will necessitate the development of Islamic financial risk management techniques. Derivatives are inherently against Shari’ah considerations because of the uncertainty associated with them that amounts to Gharar. However, we have discussed the possibility of extending the functions of embedded options to fit the needs of Sukuk certificates and Shari’ah considerations. This facility provides a debt structure framework that helps replicate the functions of traditional instruments and in turn benefit from the convexity gains of these instruments. Neftci and Santos (2003) identify two major hurdles in emerging markets for acquiring convexity gains. Firstly, there are no markets for liquid interest rate derivatives. Secondly, interest rate fluctuations lead to significant increases in credit risk and lower the bond’s price. Accordingly, investors in emerging markets suffer from the negative effects of volatilities but cannot benefit from the positive effects. Such benefits have been garnered in conventional emerging markets such as Brazil where interest rate volatilities in the 90s warranted a protective cushion against these fluctuations in the form of puttable and callable bonds.

The following set of recommendations is made. These are recommendations for IFSI and Islamic banks and institutions and also the non banking financial institutions:

- IFSI should facilitate and encourage the operation of free, fair and transparent markets in the Islamic financial services sector.

- Enhance the capitalization and efficiency of IIFS to ensure that they are adequately capitalized, well-performing and resilient, and on a par with international standards and best practices.

- Enhance access by the large majority of the population to financial services.

- Enhance Sharicompliance, effectiveness of corporate governance and transparency.

- Develop the required pool of specialized, competent and high-calibre human capital, and ensure utilization of state-of-the-art technology.

- Promote the development of standardized products through research and innovation.

- Comply with the international prudential, accounting and auditing standards applicable to the IFSI.

- Develop an appropriate legal, regulatory and supervisory framework as well as an IT infrastructure that would effectively cater for the special characteristics of the Sukuk and ensure tax neutrality.

- Develop comprehensive and sophisticated inter-bank, capital and derivatives market infrastructures for the IFSI.

- Promote public awareness of the range of Islamic financial services.

- Strengthen and enhance collaboration among the international Islamic financial infrastructure institutions.

- Foster collaboration among countries that offer Islamic financial services.

- Conduct initiatives and enhance financial linkages to integrate domestic IFSIs with regional and international financial markets.

References

AAOIFI. “Investment Sukuk – Shar’iah Standard No. 18”. Manama: Accounting and Auditing Organization for Islamic Financial Institutions. 2002: 23-42

Archer, S. “Islamic Finance: Innovation and Growth”. London: Euromoney Books and AAOIFI. 2002: 56-73

Byrne, D. “Interpreting Quantitative Data”. CA: Sage Publications Ltd. 2002: 67-78

Cole, M. “The Growth of Sukuk in the Global Capital Markets”. AsiaLaw, Singapore. 2004: 12-19

Denzin, N. (Eds.). “Handbook of Qualitative Research”. Thousand Oaks, CA: Sage Publications. 2000: 32-36

Ebrahim, E. “Pricing of an Islamic convertible mortgage for infrastructure project financing”. International Journal of Theoretical and Applied Finance, 5(7). 2002: 35-45

Freiman, J,A. “The importance of beta, the type II error and sample size in the design and interpretation of the randomized control trial”. New England Journal of Medicine, Volume 299 (1970), pp. 690-694

FSA. “Financial Services Authority Quarterly consultation, No. 22“. London: Financial Services Authority. 2009: 7-10

IFSI. “Islamic Financial Services Industry Development, Ten year network and strategy”. Saudi Arabia: IFSI. 2007: 19-80

Haque, N. “The Design of Instruments for Government Finance in an Islamic Economy”. Islamic Economic Studies. 6(2). 1999: 27-43.

Jaffer, S. “Islamic Bonds: Your Guide to Issuing, Structuring and Investing in Sukuk”. UK: Euromoney Books. 2009: 10-34

Khan, F. 1991. “Comparative Economics of Some Islamic Financing Techniques”. Jeddah: IRTI Research Paper No. 12. 1991: 51-57

Muhammad, Al. “The Islamic bonds market: possibilities and challenges”. International Journal of Islamic Financial Services. 3(1). 2001: 1–18

Neumann, A. “Ways without words: learning from silence and story, 2nd Edition”. New York. Columbia University, Teachers College Press. 2007: 56-83

Presley, J. “Islamic Economics: The Emergence of a New Paradigm”. Journal of Economic Theory. 1994: 34-39

Sundararajan, V. “Monetary Operations and Government Debt Management under Islamic Banking”. International Monetary Fund WP/98/144. 1988: 67-79

Tariq, Ali. “Managing Financial Risks of Sukuk Structures”. Thesis for Masters of Science, Loughborough University, UK. 2004: 5-82

Vitalari, N, P. “Computing in the home: shifts in the time allocation pattern of households”. Communication of the ACM, 28(5), 1985, pp. 512-522

Vogel, F. “Islamic Law and Finance: Religion, Risk, and Return”. The Hague: Kluwer Law International. 1998: 61-67

Zawya. “Global Sukuk market to reach $200bn by 2010”. 2008. Zawya Online. Web.