Eastman Kodak Mini Case Study

Kodak has started as a photography company in Rochester, NY, offering a range of services and products to amateur photographers. Due to the shifting market needs and demands, the company had to change according to the latest trends and launch Research and Development (R&D) initiatives to facilitate innovation and market expansion. In the 1980s, Kodak’s R&D resulted in the development of products embodying new electronic technologies to stay up to date with customers’ demands and the shift of photography toward electronic technologies (Kmia, 2018).

Between 1993 and 2012, Kodak has been working on transforming itself from a traditional photography company into a leader of digital imaging, which was a significant stretch for the company, which had to implement a new business strategy associated with harvesting the traditional photography business as well as the belief that customers would be surprised by the speed of technological innovation.

However, for Kodak, competitive advantage was associated with differentiating between its strengths and weaknesses and realizing that success would be based on capitalizing on its individual capabilities. From a photography-focused company, Kodak has transformed into a digital imaging company that specializes predominantly in commercial imaging, such as 3D printing, motion picture, and commercial films.

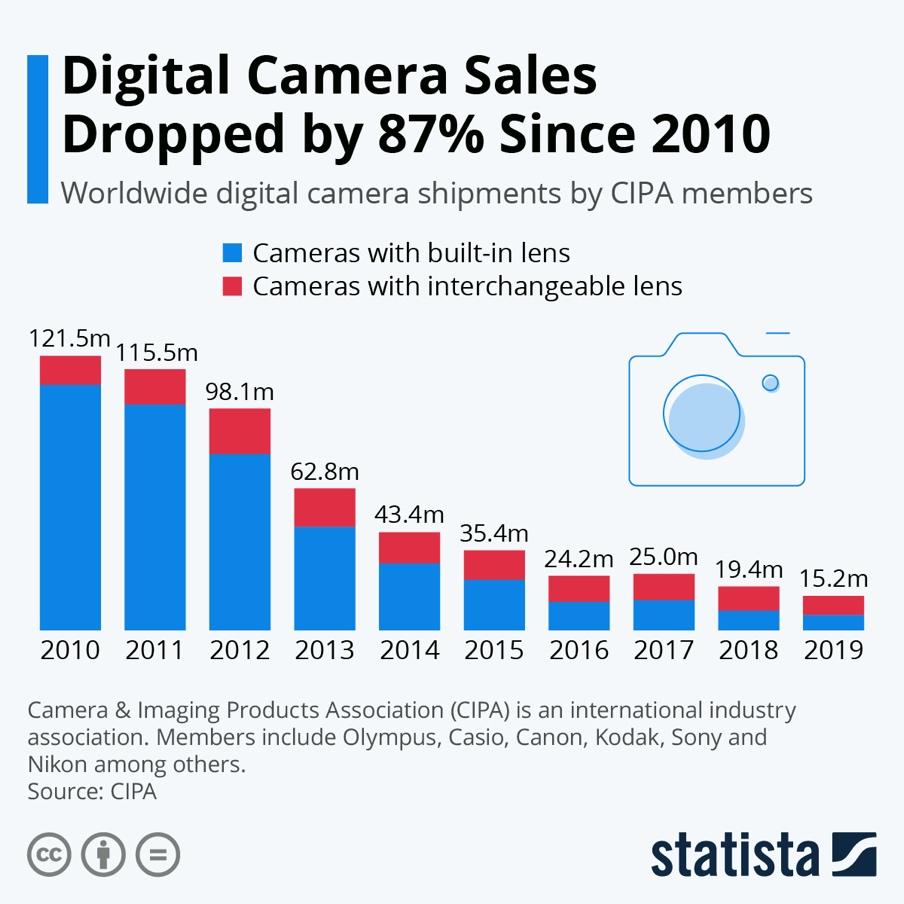

The key strategic issue for Kodak is associated with staying competitive in the technology-heavy industry despite the fact that the products and services the company provides do not meet the need of modern customers. Recent trends, such as the use of smartphones for taking photos and storing them digitally, have not been friendly to the industry of digital imaging. According to the findings of Richter (2020) for Statista, the sales of digital cameras dropped 87% since 2010, reaching a record low of $15.2 million in 2019 compared to $121.5 million (Figure 1).

For Kodak, changing consumer trends presented a significant strategic disadvantage as the numbers of customers who would buy digital or film cameras would get significantly limited, with limited opportunities for market expansion. Specifically, smartphones represent the most challenges to the industry because the digital cameras placed in phones get improved on a regular basis, which makes digital cameras not essential for producing high-quality images. In addition, the social aspect of image sharing that occurs online on social media platforms makes customers more likely to use their phones to take photos and be able to send or share them immediately.

Porter’s Five Forces

Kodak’s strategic issue is best illustrated with the help of Porter’s Five Forces framework, which is intended for analyzing the competitive environment of a company, which includes its competitive rivals, customers, suppliers, and substitute products, all of which have an impact on the profitability of the organization. In addition, it is necessary to consider the Product Life Cycle strategic framework that will help determine the stage at which the company’s products and services are currently placed. Each stage is linked with the changes in the marketing position of a product or service.

Within Porter’s Five Forces framework, the bargaining power of Kodak’s buyers is high, particularly in regards to digital imaging and consumer electronics products. The demand for such goods is volatile, while the rapid changes in the technological environment can lead to the closing of some of the company’s subsidiaries or departments, such as photographic or video film manufacturing. The bargaining power of suppliers is low for Kodak as the majority of materials and supplies necessary for the company to produce its products and services are widely available. There are numerous suppliers with which Kodak collaborates located around the world, and the company usually has one to three-year contracts with several suppliers.

Within the digital imaging industry, the threat of new entrants is low since the R&D of new technologies and products have to stay in line with the demands of the volatile industry. Meeting such demands is complex, which suggests that inexperienced players are unlikely to pose any significant threat to market giants that have been operating in the market for decades, such as Canon, Nikon, Kodak, or Fuji. In addition, the high capital required for entering and succeeding in the industry makes the threat of entrants low. Although attaining a high budget is possible, new companies in the industry are required to invest in printing equipment, computer hardware, and software, chemicals, photographic paper, equipment for producing cameras if the manufacturing is their focus, logistics, human resources, and more.

The threat of substitutes in the industry is high due to the rapid pace of technology development and the creation of new products, predominantly smartphones, which reduce the need for digital cameras and printing. The quality of the photos taken on the latest Apple or Samsung smartphones is comparable to those taken by expensive digital cameras, thus eliminating consumer interest in purchasing portable cameras. Consumers are more likely to invest in a phone with a high-quality camera because the device is multi-purpose and also allows for instant image sharing.

The power of rivals in the market is also very high in the digital imaging and photography industry. Among the companies that produce digital cameras, Kodak faces competition from market giants such as Canon, Sony, and Nikon which hold the largest share of the digital camera market. In the area of consumables, the company faces competition from 3M, Xerox, Hewlett-Packard, and Oji.

Product Life Cycle

Being a company that has operated in the market for more than 100 years and has long been considered a globally renowned company, Kodak was among the first in the US to establish a large-scale plant production of standardized products and maintain a fine chemical lab. The company has gone through the organizational birth, growth, decline, and death stages, filing for bankruptcy in 2012. The birth of the organization dates back to the 1880s when George Eastman created the Eastman Dry Plate Company in the city of Rochester. The growth occurred through the 1880s to 1960s as the company introduced a film from the paper roll, moved to perforate celluloid film, brought the Brownie box camera to customers with the $1 price, moved further to color film, and introduced the Instamatic camera to the market in1960s.

The emergence of Fuji around the 1980s posed a significant threat to Kodak which was recognized as one of the leading companies in its field, thus marking the stage of organizational decline for the company. For instance, in 1984, Kodak terminated the work of its drug company to start focusing on digital imaging Research and Development. Around the year 2005, which was characterized by the increased demand of customers for digital photography solutions that are more convenient and efficient to use compared to film photography, Kodak’s move toward digital technologies meant closing film factories and eliminating up to thirty thousand jobs.

The organizational death stage for Kodak began in 2010 when Standard & Poor’s eliminated the company from its S&P 500 index. In 2012, the company filed for protection under Chapter 11 Bankruptcy and obtained funds through a credit to continue its operations (Smith and Yousuf, 2012). In the same year, Kodak stated that it would exit the image capturing business. The company failed strategically because it did not change its focus during the period of rapid technological expansion on the market and feared that any changes would hurt its film businesses. At the point when digital products were reshaping the market and companies such as Fuji diversified to meet industry needs, Kodak did not consider the impact of its inaction.

Operating in an industry that has to respond to the latest digital trends, the strategic problem that Kodak faced could have been resolved had the company looked at the broader picture. The company had a near-sighted view in terms of its future operations and focused too much on the film business and felt that it could protect a significant market share with the help of marketing. Any arising strategic issues could have been solved if the company’s leadership was not focusing too much on the past success of the company. The leadership approach was an issue due to the hierarchal structure of the company focusing on a leader’s omnipotence.

An innovative and dynamic work culture alongside the engagement of workers in the decision-making process could have helped Kodak to overcome the blinded stage of the organizational death phase and return several steps back and enable a new strategy. Besides, to respond to the competitive threat on the part of Fuji, the company could have invested in innovation and the R&D of new products that could have provided an advantage over market rivals. At the inaction stage, the company showed a lack of decision-making to enable the drive of innovation and the study of the rapidly-evolving market.

Briefing Note

Solving the identified strategic problem called for the complete reconsideration of its general strategy of Kodak and the manner in which the company did business to identify the key strategic issues and address them accordingly. Therefore, it is not the mere focus on innovation that would not help the company solve the problems with the strategic direction. The following is the analysis of the recommendations as to resolving the strategic problem identified in the case study.

Ambidextrous Marketing Strategy

The ambidextrous marketing strategy could have helped Kodak as it outlines a sequence of actions allowing companies to extend and use the resources available to them for exploring and attaining the most significant market opportunities. An ambidextrous marketing strategy for firms is associated with external awareness, innovation resource congruity, as well as internal awareness (Scott, 2014). Establishing external awareness is a tool for the methodological and logical consideration of the external threats and opportunities facing an organization in order for the radically innovative outputs matching the environmental changes in the market (Scott, 2014).

For Kodak, external awareness implies considering the shifting needs and trends in the digital photography market characterized by the rapid expansion of smartphone technologies that make digital photography not essential and even inconvenient (Shu, 2016). Initially, Kodak had the resources to respond to the changing market needs, but the nearsighted look on the market enabled the leadership to think that the digital technologies would have the power to overrun the firm so wholly and quickly (Beatty, 2012).

Internal awareness could have helped Kodak if the company would harness its inner strengths and worked on overcoming the weaknesses in order to modify its marketing-related capabilities in order for the incrementally innovative outputs to help them handle the threats that come from the external environment (Khessina, Goncalo and Krause, 2018).

With the help of internal awareness, the organization would have the capability to match the inherent nature of exploitation and exhibit significant focus in terms of addressing efficient and defensive goals of its business, such as the minimization of uncertainty in the digital market while maximizing the efficiency of production by responding to the latest market needs.

Finally, innovation resource congruity could have helped Kodak reach a balance in addressing issues that may emerge with too much exploitation or exploration. Resource congruity is essential for companies struggling with resolving their strategic issues because the practice enables both internal and external analytical decisions by meeting cross-unit commitments, in which the relevant levels of human capital, financial resources, and time are put toward innovative marketing activities (Scott, 2014). The practice is essential for firms to set realistic market performance goals while assessing the scope and scale of innovation that would help them remain competitive.

Kodak did not consider innovation resource congruity when faced with the problem of having to adjust to the changing digital photography market. According to Avi (2012) for Forbes, companies have to adapt to the requirements of the market, even in cases if that means competing with themselves. The potential of technology is that it can be disruptive both to the market and companies despite the fact that it benefits consumers. Survival as a strategy cannot bring long-term benefits in the modern marketplace because of the need for companies to strive for innovation and entrepreneurial greatness.

The lack of consideration for the advantages of the ambidextrous marketing strategy prevented Kodak from being successful because the company could not embrace change. The example of its principal competitor, Fuji, shows that there was a solution to the strategic challenge. The two companies have been considered similar both in their product focus and approach to market penetration (Sirk, 2020). However, Fuji succeeded while Kodak failed since the former forecasted turbulent times ahead in the market associated with the decline of the demand for film photography and the rapid expansion of digital technologies. The company’s leadership made a difficult decision to close the majority of its film manufacturing facilities and downsize the company overall, cutting more than five thousand jobs and lowering operating costs by $500 million (Sirk, 2020).

By following the technology-driven direction, Fuji moved on. This is evidence of an ambidextrous marketing strategy since the company considered the internal strengths and weaknesses, external threats and opportunities, and created a balance between the two. Fuji diversified into developing anti-aging skincare products and new drugs, cancer and Alzheimer’s research, the development of viral vaccines and gene therapies, medical applications and diagnostic systems, and many more.

In addition, the introduction of the widely popular Fujifilm Instax camera was evidence of the company’s consideration for consumers’ appreciation of old-school aesthetics combined with the instant image production technologies. While the product was a definite risk, the marketing strategy that the company adopted enables consumers to rediscover the joy of tangible and physical media. According to Sirk (2020), Instax sold 5 million units in 2015, with sales in Europe and America doubled each year since 2014.

Conclusions

Thus, the example of Fuji’s success points to the inability of Kodak to abandon its institutional memory of past success and discover new avenues for development that could have brought fruitful results. The application of the ambidextrous marketing strategy to overcome the strategic challenge is intended to show the company how to apply its strengths, such as century-long industry experience, and apply them in the context of the current digital market instead of trying to dictate the way in which customers should behave and which outdated technologies they should adopt. Therefore, it is recommended for Kodak to explore innovative applications for technology and products to re-deploy the existing assets and attempt to capture new markets.

A growth in mindset, in such a case, is also highly important to encourage accommodated learning, innovation, and learning from mistakes. By doing so, Kodak can enable the cultivation and nurturing of its innate organizational talents and find ways in which they can be expressed. It cannot be doubted that Kodak had some good ideas for capturing new markets through innovation; however, the leadership likely dismissed such ideas due to the limitations in the mindset.

Reference List

Avi, D. (2012). ‘Kodak failed by asking the wrong marketing question’. Forbes. Web.

Beatty, R. (2012). ‘Kodak really could have survived’, Herald Sun. Web.

Digital camera sales dropped by 87% since 2010. (2020). Web.

Khessina, O., Goncalo, J. and Krause, V. (2018). ‘It’s time to sober up: the direct costs, side effects and long-term consequences of creativity and innovation’, Research in Organizational Behavior, 38, pp. 107-135.

Kmia, O. (2018). Why Kodak died and Fujifilm thrived: a tale of two film companies. Web.

Richter, F. (2020). Digital camera sales dropped 87% since 2010. Web.

Scott, N. (2014). ‘Ambidextrous strategies and innovation priorities: adequately priming the pump for continual innovation’, Technology Innovation Management Review, 4(7), pp. 44-51.

Shu, L. (2016). How digital photography reinvented itself to become better than ever. Web.

Sirk, C. (2020). Fujifilm found a way to innovate and survive digital. Why didn’t Kodak?. Web.

Smith, A. and Yousuf, H. (2012). Kodak files for bankruptcy. Web.