Corporate Structure

EarthWear Clothiers (EWC) was founded in 1973 by Calvin Rodgers and James Williams and headquartered in Boise, Idaho. The organization’s main specialty includes the manufacture of superior quality open-air clothing used in outdoor sports like skiing, hiking, white-water kayaking, and fly fishing. Over time, the firm’s line has significantly grown to include accessories, luggage, casual clothing, and shoes.

Its products can be found in retail outs, company websites, and catalogs. The firm has involved Willis & Adams in auditing its operations since 1975 (Kieschnick & Moussawi, 2018). According to the consolidated annual financial statement reports of EarthWear Clothiers, the organization has increased its net sales by over 10.8% since 2015. However, the pretax income has been down by 3.58% from 2014, which has led to a decrease of 27.8% in its general net income.

There has been a rise in the organization’s total current liabilities, which can be attributed to the increasing credit lines and the upsurge in the outstanding payable accounts. Additionally, it had 44.9% of total revenue as gross profit margin in the period. It has also experienced inventory purchases decreases by 2% and an increase in amortization and depreciation by 13.1%, which has been caused by computer software. Generally, EarthWear Clothier’s whole team has shown great indications of maintaining operative internal controls. This is in line with its long-term objective of continuing with its growth irrespective of the difficult year of operation coupled with unfavorable global economic conditions (Kieschnick & Moussawi, 2018). Currently, the firm is making stable financial business operations.

External Auditing Firm

Independence

Willis and Adams’s operations have indicated its independence as a company from EarthWear Clothiers Inc. The business involves using processes and policies that ensure both team members are independent from EarthWear Clothiers. Being one of the publicly traded corporations, EWC has to adhere to the guidelines and regulations of the securities laws and PCAOB concerning auditor independence. To maintain optimum objectivity, Willis & Adams is not obliged to offer whichever non-audit services.

Such agreements have ensured that the company retains its maximum impartiality in delivering key audit services. Additionally, it is a requirement that auditing firms are changed after every five years to ensure their independence. As such, it has been established that such autonomy had been violated in auditing activities of EWC. In correcting the situation, EarthWear Clothiers will be compelled to use another CPA firm in authenticating the approval seal provided by Willis and Adams.

Knowledge of Client Industry

As a global auditing firm, Willis and Adams CPAs has been committed to achieving success for both the firm and the clients. The company is devoted to learning its clients’ businesses to offer high quality and authentic audit reports that improve customers’ competitiveness. The firm understands the consumer operations by identifying real needs and their urgencies, then provides optimal quality expert services.

Willis and Adams had offered auditing services to the EarthWear from 1975 when it was incorporated. As a result, the company has gained a valuable required understanding of EarthWear operations and the industry in which it operates. The Willis and Adams personnel also have acquired tremendous experience in working with research and manufacturing companies. Additionally, they have high-quality proficiency in auditing using computer technologies (Kieschnick & Moussawi, 2018). Due to the EWS’s adoption of new software and the high professionalism of Willis and Adams personnel in the field, it is sensible that company can deliver high-value performance.

Staffing Capabilities of Willis & Adams

The auditing activity would be headed by three key Willis & Adams employees and CPA as a quality appraisal partner. Two of the workers will be experts in computer technologies, which will increase the task’s quality delivery. One of them will be the manager who has represented the firm in the prior engagement on the same subject of an audit with EWC from 2000. The arrangement would ensure client familiarity and proficiency in delivering high-quality work (Hassan et al., 2019).

Based on the audit of records and procedures adopted by EWC in the production of statements, it was established that the company’s financial statements fairly reflect the client’s financial position and results. Additionally, also integrate the recommended frameworks by CPA. Which can be achieved through establishing effective internal control measures as a matter of priority (Holt, 2019). The opinion is based on the fact that if financial reporting is leveraged at the expense of internal control, then it can make internal control insufficient due to conditional changes.

However, there are misstatements in financial declarations that exists. As such, materiality assessments will be valuable when diverse insights are gathered from the internal and external environment. All of them will work closely with the CPA to ensure the proper audit is carried out following the international standards.

Internal and External Factors Considerations

Based on the evaluated internal and external factors, Willis & Adams’s firm will accept audit services provision to EarthWear Clothiers for the previous and current financial years. Following the evaluations done on the last annual reports of EWC, potential areas exposed to internal control deficiency risks have been noticed. One such threat has been specified as inventory.

Key components of EWCs operations that are critical in decision-making processes, including corporate executives, were evaluated to ascertain the viability of the system. Although there have been concerns regarding the change of leadership and their roles, it was concluded that the management needs to maintain promotion and practice integrity to ensure client acceptance.

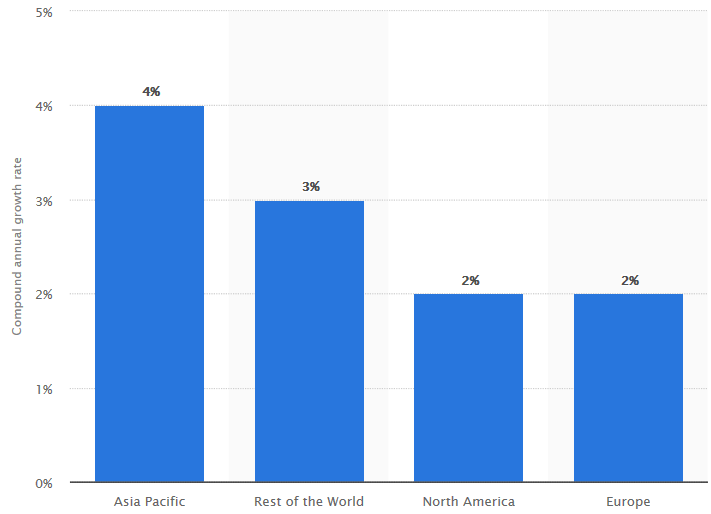

Figure 1 below indicates compounded global apparel market growth by region from 2015 to 2020. It shows that from 2015 to 2020, Asia Pacific holds the highest compound growth at 4%, followed by 3% by the rest of the world. North America and Europe have 2% of the compound annual growth rate, respectively. Even though the outdoor apparel retain industry is considered to be a seasonal market, its growth and adoption across the globe have sustained over the years. According to empirical research analysis, millennials have been critical in driving outdoor apparel (Holt, 2019). Similarly, increased sporting activities across the globe have also increased the demand for the products globally.

Control activities were realized in certain situations where some employees’ job responsibilities were not related directly to their activities (Holt, 2019). It can be mitigated by implementing effective management systems that allow the organization to achieve strategic objectives. It is important to note that internal audit addresses all kinds of fraud, which include potential threats that are internally driven.

In line with the auditing role that your organization gave to Willis & Adams firm, the following internal control deficiencies have been established. First, the role of the board of management in internal control, information and reporting gaps. Secondly, oversight and documentation roles, risk and fraud assessment gaps. These weaknesses can be remediated by involving the management in internal control oversights, enabling them to generate and adopt quality information on possible risks, and providing formal documentation and definition of internal control atmosphere.

Milestone 2: Audit Planning

Business risks are considered issues that prevent a firm’s ability to achieve its short-term and long-term goals and objectives. Industry risks are factors that emerge from such topics as economic climate, competition, geographic location, technology change, and business volatility (Duff, 2018). To survive in such harsh conditions, EWC has developed plans to expand its customer base by introducing new sports products. Management assertions include claims prepared by the management concerning certain business aspects. In this case, the auditor often relies on various business assertions and tests their validity through several audit tests.

The major gaps in the control environment of EWC are the role of the board of directors within the internal environment and evidence and reporting. These can be mitigated by involving the board of directors in internal control oversight, competencies, responsibilities, establishment, and regulatory measures. The leadership needs to be enabled to obtain, produce, and utilize quality information related to risks. It would allow them to prevent the risk of reporting and information system risks.

Its objective is to acquire sufficient audit evidence to determine if the organization’s financial position is viable. It will reveal the financial part of EWC and its operations impacts and cash flows. EWC has increased its economic viability by expanding its markets and differentiation of the products (Duff, 2018). This has given the company a stable financial background that has enabled a strong financial statement. Audit risks are referred to as residual risks that may be issued in an incomplete report due to the auditor’s inability to detect misstatement due to fraud or error.

Internal controls as a mechanism of procedures and rules have been adopted by EWC to ensure the promotion of accountability, guarantee financial integrity, accurate accounting information, and avoid fraud. EWC has prioritized its objectives to achieve operational efficiency and effectiveness, compliance with the law, consistent financial reporting, and legal compliance with policies and regulations. The effects of audit procedures before auditing CPA was involved in the approval of the designs.

This was done in all areas of audit operation, including planning, functional, and in conclusion. Audit procedure selection was based on material misstatement risk. EWC provided all the bank accounts for auditing, which facilitated assurance on cash balances. Similarly, confirmations were also sent to the client banks of EWC to promote transparency.

Materiality determination; materiality was determined by gathering varied insights from both internal and external shareholders. This was done by conducting initial shareholder outreach and making them aware of the need for their participation. The variables to be measured were equally identified and ranked per the needed sustainability indicators that provided the necessary insights (Duff, 2018). The materiality survey was designed to be formal and structured to ensure good results. The major risk assessment gap is the absence of an asset-liability management platform in EWCs operations. This should be adopted to assess liquidity risk or interest rate risk and to exclude credit risk.

References

Duff, A. (2018). Intellectual capital disclosure: Evidence from UK accounting firms. Journal of Intellectual Capital, 19(4), 768-786. Web.

Hassan, N. A., Zailani, S. H. M., & Hasan, H. A. (2019). Integrated internal audit in the management system. The TQM Journal. Web.

Holt, T. P. (2019). An examination of nonprofessional investor perceptions of internal and external auditor assurance. Behavioral Research in Accounting, 31(1), 65-80. Web.

Kieschnick, R., & Moussawi, R. (2018). Firm age, corporate governance, and capital structure choices. Journal of Corporate Finance, 48, 597-614. Web.