Introduction

Mergers and acquisitions are terms that members of the corporate finance world use to mean the strategy and management that involves buying and selling, consequently combining of various companies or business (Sherman and Hart, 2006). This is with the aim of helping such small companies grow faster without involving financial burden on these companies.

This kind of business transaction has become a great fortune for those who are involved. It has created a great opportunity for new entrepreneurs to rise up very first and have their businesses running maturely. That is why these transactions are always on the increase. The big question is why several investors hold such transactions dearly. This research will, therefore, focus on the reasons why investors are getting involved in mergers and acquisitions, and the consequences of the same actions.

Literature review

The main reason companies come together is shown by the equation 1 + 1 = 3, which is the alchemy of mergers and acquisitions (McClure, 2006). The fundamental principle for creating mergers is to build up an investor worth, which is much higher than that of the sum of the two business entities while separate. Companies use this strategy to achieve efficiency by gaining more shares in the market and making the resultant company more effective in terms of managing costs. The companies that accept to bought are usually sure that the competition in the market does not favour them.

Even though the two terms are used always at the same time, they do not mean the same thing. The acquisition means that one company buys another one completely. The bought ceases to exist (Weston and Weaver, 2004). The company, which has been bought lets its stock to run and the name of the buying company. On the other hand, a merger usually happens between two equal companies. They both surrender their stocks, which will later run under a new name. McClure (2006) gives this example, “Both Daimler-Benz and Chrysler ceased to exist when the two firms merged, and a new company, DaimlerChrysler, was created” (McClure, 2006)

It is not common to find mergers of equals. Acquisitions are the ones that are common though they are not usually termed as acquisitions because it is never a positive thing for the company that is bought off. In that case, the term merger becomes friendlier and is used to replace acquisition. The target company is bought but the deal is termed as an acquisition.

Synergy

This term is used to show the magnitude of the result when two companies come together in business. This is always used to imply that the result is usually greater than those of two companies separately combined are. It means that when they come together they will be able to create a cost-effective operation, make use of economies of scale, and easy application of the new technology that companies acquire at such a time. Due to these mergers and acquisitions, companies get new opportunities to reach the market and resources they need easier than before. The other fact that companies look at is the staff numbers, which comes down considerably in a merger and acquisition. Creating synergy is easier to picture than to practically implementing it.

It is expected that the process of mergers and acquisitions pay a greater premium on the value of the shares of the companies that are acquiring others. This will still point us to the expectation of synergy. This implies that after a merger or an acquisition, the value of the share will increase, thereby become of great gain to the stakeholders. On the other hand, we also know that the companies being bought will not expect to get a loss, demanding the buyers to pay the premium (Egan, 2007).

The acquiring company should pay regardless of the value the company is assigned before the merger or the acquisition. For those selling, this payment equates to their future company’s value. For those who are buying, the payment is pegged on the results they expect from the perceived synergy thereafter. This will leads me to the first hypothesis:

- Mergers and acquisitions are a source of synergy.

- Companies cannot achieve synergy if they are not careful to get it.

Types of Mergers

The types of businesses that the two companies come together run determine the relationships, and consequently the type of the resultant merger. Some of these factors would be the type of products the two companies sale, the geographical location of the companies, and their target market. From these, we will have,

horizontal mergers – two companies that are in direct competition and share the same product lines and markets, vertical mergers – a customer and company or a supplier and company, and market-extension merger – two companies that sell the same products in different markets (McClure, 2006).

Under the same category, we have “conglomeration, which are two companies that have no common business areas” (McClure, 2006). The other category is determined by the way of financing the merger. Purchase Mergers are the ones that one company finances the whole activity and the whole process are taxable. Consolidation Mergers are those where the two companies form a different entity altogether. The taxation is similar to that of purchase mergers.

Type of acquisitions

We have one type where one company buys everything from another company. They may also combine stock and cash. Another type is a reverse merger. In this case, a public company identifies a registered private company that is not active in the market and strikes out a deal with it to buy it. The private then roles back to the public company and they form an entirely new company. Both acquisitions and mergers aim at building synergy, and in turn, become successful businesses. The second hypothesis then will be:

- Mergers and acquisitions do not differ greatly.

- Mergers and acquisitions are of different types depending on the circumstances under which they form.

Valuation

The other thing that has to guide mergers and acquisitions are the valuation matters. This will determine if another company will or will not buy another one. The fundamental question is what value does the company they want to buy have. Since there is a potential of disagreement on the exact value of the target company, there are various legitimate ways for coming up with the appropriate value of the target company. One of the ways uses relative ratios (Romanek & Krus, 2002).

This may come in the form of Price Earning ratio, which is looking at the returns of the target company and thereafter making an offer for it that is a multiple of these returns. The buying company should scout out for the ratios in the same industry, and that will form a good basis of guiding it in establishing the right ratios. Another way is “Enterprise Value to Sale ration, which is the acquiring company makes an offer as a multiple of the revenues” (McClure, 2006).

Another way is by determining the replacement cost of the company being bought. This method will not be easy when it comes to valuing the process of assembling the right resource in terms of human and physical resource. A very important method is the discounted cash flow, which uses the forecasted income flow of the target company. This will help us formulate our third hypothesis:

Even though discounted cash flow is a tricky method to arrive at a value, most companies use it as a tool for valuation during mergers and acquisitions.

Breakups

These breakups occur in three ways. Sell-offs are the literal selling of the smaller entity. This happens when the entity does not much with the overall strategy of the parent company. It, therefore, would be causing a negative value to the synergy expected. The other method for this is by creating a company through selling an Initial Public Offer, which the mother company will still control and this method is the Equity Curve outs (Laabs, 2009). The other one is the spinoff, which a separate entity forms but the mother company also controls it. This forms through the mother company giving out dividends to the stakeholders. Tracking stock is a method whereby the parent company will let investors value its smaller entity differently. All other things remain. That is to say that they will share the same facilities and management.

Advantages

When such corporate companies grow and flourishes there may be a need for breakups. One main aim for mergers and acquisitions is to help small slow-growing companies grow. This is why at some point we see some of the companies demerge. This points out some advantages of demerging. This shows that after an observation, the companies realize that the smaller units are more profitable than the whole. These breakups can help the people working in separate entities to grow and help the managers in the mother company focus on vital issues.

Disadvantages

It is hard for small companies to get credit and costly financing that would otherwise be very easy with the larger companies. The smaller companies also lose the position in the value indexing hence lose recognition from lucrative investors. Both companies lose the synergy that was expected they would have if united. This comes from several ends beginning from the human resources to the physical resources that the company needs to run. The forth a hypothesis is:

- Growth causes breakups of mergers.

- It is equally good as it is bad for a merger to brake.

It is also wise to have the right intension while making a strategic move to start a merger. Some companies have an intention flawed by some factors. One such factor is going in for a merger when the stock market is very high. This is blinds the eyes of the buyers. It is quite dangerous to go in for a merger when the stock is very high. The other thing is that executives should not be imitating others. Mergers are not transacted simply because others succeeded.

Another thing that compels the buying of other companies in mergers and acquisition is the fear of the unpredictable future. Factors such as globalizations, the ever-changing technology, and the economic instability of the business environment will also cause businesses to move to quick mergers. This is all to do with the competition than that is growing stiffer as days go by. Hypothesis 5 therefore is:

Globalization, technological advances and the growing competition are the major factors that are causing premature mergers and acquisitions.

It is also hard to maintain the mergers. We have some obstacles that make it tough for managers to keep the mergers and acquisitions running. Some times managers can only focus on the mergers forgetting the root of the business. This over focus on the mergers ruins businesses. Another thing is the harmonization of human resource after mergers. The other issue is getting into mergers just because the other CEO of the other company succeeded, and therefore you copy them to rush into creating a merger. Situations are usually different and companies should avoid Cookie – cutter approach at all costs (Egan 2007).

It is usually assumed that the business will run normally so long as the companies merging have taken care of other factors such us merchandise and market synergies. The environmental changes and the working conditions of different companies are not the same. Since the cultures differ, the managers of the companies merging should work on a strategic program to harmonize the two different working teams. The other weakness that mergers encounter is the over emphasis on cost cutting, which eventually turns out negatively on earnings, and proceeds. The last hypothesis is that:

Companies that merge fail because they do not consider cultural differences of the separate companies before mergers.

Research question

To come up with a clear research question, I will look back at the hypotheses I have formulated.

- Mergers and acquisitions are a source of synergy.

- Companies cannot achieve synergy if they are not careful to get it.

- Mergers and acquisitions do not differ greatly.

- Mergers and acquisitions are of different types depending on the circumstances under which they form.

- Even though discounted cash flow is a tricky method to arrive at a value, most companies use it as tool for valuation during mergers and acquisitions.

- Growth causes breakups of mergers.

- It is equally good as it is bad for a merger to brake.

- Globalization, technological advances and the growing competition are the major factors that cause premature mergers and acquisitions.

- Companies that merge fail because they do not consider cultural differences of the separate companies before mergers.

Basing on the above hypotheses, we can have a number of research questions. One main question guiding this research can also be established from these hypotheses. The research looks through the various aspects of mergers and acquisitions, leading to the understanding of the factors that motivate their formations and the consequences of such transactions. The research questions will therefore be; what are the factors that make companies to get into mergers and acquisitions, and what are the results of such transactions in the current corporate world?

Methodology

The first thing is to look at the trend of the mergers and acquisitions in the last 10 years. This will therefore call for using secondary approach to research. In this, I will carryout a search from business database and other trusted databases such as Emerald to get reports on mergers and acquisitions in the past 10 years. This will involve taking the approximate count of all the announced mergers across the United States and Canada.

The variables will be the numbers of the mergers and acquisitions forming and braking, and the facts about the escalating rate of globalization, technological advancement, and finally things like economic recessions. I will tabulate the quantitative data and later draw graphs to show their trend. This will eventually give distinct periods when the mergers we being formed at a high rate and times when mergers were being formed at a lower rate.

From this quantitative part, I will match the data with the qualitative data, which I will have also tabulated. I will assign them to columns and rows that show the time and the factors such as state of globalization, economic hard times and the technological advancements of the various periods. This will probably give an agreement with what Gell, Kangelbach and Roos (2008) say, “This isn’t surprising, M& A go in cycles, rising and falling with the ebb and flow of economic tide” ( Gell, Kangelbach and Roos, 2008). This will therefore suggest the clear reasons why the mergers and acquisitions were forming at a higher rate, consequently insinuating the factors influencing the formations of mergers and acquisitions.

The second pert of my research will now involve the primary methods of data collection. In the fieldwork I will be taking samples of a number companies (about 100) from both Canada and United states, both whose mergers were a success and a failure. Besides getting their information from business news, I will conduct interviews to inquire more about the factors that are leading to success and the factors that are leading to failures.

Some examples of the companies that have had success in mergers are Dell and Cisco from USA, CGI Group and Nurun from Canada. The examples of the companies that have not had success are, Penn Gamming and Yahoo Inc. The main method of data collection in this case will be through questionnaires I will carryout the interviews in the various companies and establish facts that lead to the success of the mergers and failure in the case of failed mergers (Coyle, 2000). This will help me get the current events in the corporate finance world involving mergers and acquisitions. This will mainly involve personally administering the questionnaires. I prefer this method because it will help me ask leader questions, which will easily help me get the required answers from the respondents.

Apart from interviews, which will involve the use personally administered questionnaire, I also intend to use the electronic and telephoned questionnaire. I would prefer using these methods because they will make the process cheaper. These methods will also help me carry out the survey in as many companies as will collaborate. In this, I will need to establish a prior rapport by phone or by e-mail conversations informing them of my intention, then e-mail to them the questionnaires.

Most of the questions in the questionnaire are for establishing the strategic reasons to why the companies get into mergers and acquisitions. Secondly they are for establish reasons fro success and reasons for failures. From my hypotheses, I formulated the questions that will consider all the aspects of the research question.

Some questions are as outlined aim at establishing acquisition strategy below:

- Is there a specific method that companies use to determine if getting into a merger and an acquisition is in accordance with the strategy that the company has?

- Do you consider the market position of the target company as you look out for one to merge or to acquire?

- How do you establish the probable turn of situations?

- Which methods do you use to establish the complementary skill and knowledge of the workers of the target company with yours?

- What would be the adverse effects of neglecting or assuming the complementary skill set of a merger?

- What are the competitive intensions of companies while considering geographic spread out moves?

- How do you forecast the synergy value of the company after a merger and an acquisition?

- What are the factors that make an acquisition or a merger successful?

- What factors lead to the failures of these transactions?

These and more questions are the ones that I will include in the questionnaire. The questions will help me establish the methods that that companies use to establish the right targets for mergers and acquisitions (Mergers & Acquisitions, (n.d)). The questions also will aid me in establishing the strategic approach in which the various successful companies used to establish mergers. On addressing the factors that lead various companies to fail, the questions will help me determine the risks involved and so make recommendations on how to have successful mergers, avoiding the risks involved.

Questionnaire layout

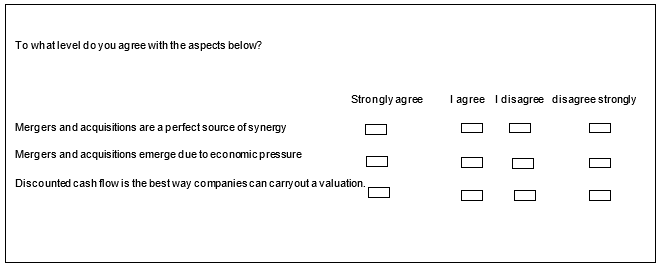

For the questionnaire will have an introductory cover page. This will explain my purpose of the interview in a very cordial manner to encourage the respondent to go through the form and respond to the questions (Gill and Johnson, 2002). I will keep in mind, while formulating the questions in the questionnaire, to keep the questions concise and simple (Survey Design, 2010). I will use different types of question layout depending on the response that I will want to get from the respondents (Hair 2007). These include the multiple-choice questions, which will provide options from which the respondent would pick an answer. An example would be,

Which type of merger is your company?

- Horizontal mergers.

- Market-extension merger.

- Conglomeration.

The other types of questions are the open-ended questions, which will allow the respondent to explain clearly the facts, to the level best of his or her knowledge. The third types of questions are the text open-end questions, requiring that the respondent should give specific answers but can do it extensively. Rating scale questions will also be necessary especially when asking questions that demand that the respondent show their attitudes towards certain aspects (Crowther and Lancaster, 2008). The first type is where I will provide the options of bad, fair or good. The second type is the use of the 10 scale, where 10 will mean excellent, and 1 may mean very poor. If it is interest, the rating 10 means someone is completely interested in the fact, while rating 1 means someone is not interested with the fact. Thirdly, I have the agreement scale, where it is still focusing on the respondents’ attitude towards an aspect. The table below will shows an agreement scale.

Generally, that would be the lay out my questionnaires. I will use the variety of questions also to avoid monotony that makes the respondent bored with what I ask the survey (Bryman, and Bell 2007).

Ethical issues that observed in this survey

The procedures of interviews should be shown very clearly to the interviewees. This is done well in advance before the interview session begins; to prepare the respondents and make them expect an interactive session with the interviewer. The location or the venue of the interview should be a place that the respondents are gland to be. This will enhance ease during the time of interview. Mostly, if possible, this place should be in accordance to the interviewee’s preference. The safety of the interviewers is also on thing of great concern. Places that interview take place must be safe and friendly.

Another thing that the surveyors should assure their respondents is the confidentiality of all the matters that they discuss. This will encourage openness and so the possibility for giving more information for the facts being researched. All the surveyors should take the permissions seriously (Lancaster, 2005). All the information given to them must be used with the interviewee granting the permission for use.

Limitations of research using interviews

Interviews my be time consuming if field surveys are used instead of phone calls or through sending mailed electronic questionnaires. It is usually hard to get information from people who are not responsive. If the interviewees are not responsive, it amounts to a waste of time, money and effort. If one uses the method of mailing questionnaire, full interaction between the respondents lacks. This will not achieve the aim of getting full answers. Conducting a field survey would help in attaining of full interactions, for the main purpose of clarifying of the matters that arise. Another thing is that this method is very susceptible to biasness (Saunders, Lewis and Thornhill, 2003). Those people responding will always answer questions with some level of infidelity in order to favor themselves.

Overcoming the limitations

In order to reduce the expenses, one would choose to carryout an on-phone interview. This will highly reduce the field expenses. For the issue about biasness, one can reduce it by large percentage when the respondent is assured of confidentiality. As we have stated earlier, this will enhance openness. To get the reality of the same issues a survey should also be carried out amongst several people. Their results are compared and a fact be established.

Conclusion

This research will focus on mergers and acquisitions, establishing the reasons why companies form the acquisitions, the factors that lead to their establishment and to their failures. For clear understanding of these factors, the research will also briefly look at the structures and basic components of the mergers and acquisitions. The results from the research will be analyzed both quantitatively and qualitatively, and finally answer the research question which is; what are the factors that make companies to get into mergers and acquisitions, and what are the results of such transactions in the current corporate finance world?

References

Bryman, A., and Bell E., 2007. Business research methods. Oxford University Press.

Coyle, B., 2000. Mergers and acquisitions. Chicago: Lessons Professional Publishing.

Crowther, D. and , Lancaster G., 2008. Research Methods: A Concise Introduction to Research in Management and Business Consultancy. Hungary: Butterworth-Heinemann.

Egan, M. 2007. Mergers and Acquisitions. Finance and Performance, 44(48). Pp 1 – 19.

Gell, J., Kangelbach, J. and Roos, A., 2008. The Retun of Strategiest, Creating Value with M & A in Downturns. Boston: The Boston Consulting group Inc.

Gill, J. and Johnson P. 2002. Research methods for managers. London: SAGE.

Hair, F. J., 2007 Research methods for business. New York: John Wiley & Sons Ltd.

Laabs, J., 2009. The long-term success of mergers and acquisitions in the international automotive supply industry. Germany: Gabler Verlag.

Lancaster, G., 2005. Research methods in management: a concise introduction to research in management and business consultancy. Burlington: Elsevie.

McClure, B., 2006. The Basics of Mergers and Acquisitions. Web.

Mergers & Acquisitions, (n.d.). Frost and Sullivan. Web.

Romanek B., & Krus, C., (2002). Mergers and Acquisitions. New York: John Wiley & Sons.

Saunders, M.N.K., Lewis, P. and Thornhill, A. 2003. Research Methods for Business. London: Pitman.

Sherman, J., A. and Hart, A. M., 2006. Mergers & acquisitions from A to Z. New York: AMACOM Div American Mgmt Assn.

Weston , J. F., Weaver, C. S., 2004. Mergers & Acquisitions. Chicago: McGraw-Hill Professional.