Outline

Introduction

Compaq and Digital Equipment companies merged into one company in 2008. As a result of the new setup, Compaq shipped impressive 4.2 million units. But even as the company realizes these impressive results, there remains a dire need to streamline the use of the already installed information infrastructures in terms of order taking and shipment of these orders.

Phases in the Merge Process

There are three phases involved; assessment, design, and lastly continuous implementation. The two companies are independently evaluated before to establish the underlying differences before the merge process

Merger issues

Apart from the obvious problems of smooth implementation of the financial departments and organization structure reengineering, there are other issues that a merger would spur.

The integration processes

Many of the mergers that fail don’t fail because of lack of strategy but because of poor integration. To ensure that the Compaq group doesn’t fall victim to a failed merger then there are some factors that top and mid-level management need to consider.

Change Management

When IT firms are merged, there are many resultant complexities. There is a need to improve and integrate different levels of the organization. There is however a need for a systematic and organized change process to be put in place to make sure the information system, as well as the organization structure, is optimized.

Conclusion

As has already been established, Compaq’s union with Digital has already begun yielding good fruit. When Compaq hired Capellas Michael as the CIO of the new-look company after the merger, there were still discrepancies that had not been solved especially as far as the different information systems were concerned. One of the major fault lines was in the ordering process availed by the system which was not impressive.

Introduction

August of 1998 saw Compaq undertake a merger with digital equipment. The new-look company hired Capellas Michael as CIO. He helped revolutionize the companies operations as seen in the impressive 4.2 million units shipped following the merger. But even as the company realizes these impressive results, there remains a dire need to streamline the use of the already installed information infrastructures in terms of order taking and shipment of these orders. This thought is shared with the vice president who although he acknowledges that the company is doing well, still believes that the biggest room is room for improvement (Capella, 2004).

As Capella observed, Information technology is not just a tool that would help Compaq In its business. On the contrary, Information Technology was the business for the company. There is, therefore, a need to have a stringent information system that will facilitate the getting of orders as the orders are what translates into sales. Lessons can be learned from Compaq’s former CIO who was called White John. He had helped put in place a system that was centralized and it greatly helped Compaq in reduction of overheads and speeded up their decision making.

On the flip side, Digital’s CIO, Fishburn Dick, employed a decentralized approach. The rationale was to give the different manufacturing groups some level of autonomy. This translated to extra overheads and sometimes it was hard to establish cohesion points. The new Management ought to borrow from two models and take the best course of action. I would recommend the adoption of the system that was already in use by Compaq. The centralized system of management of information has previously proved to be a cost-cutting measure that works out well for profit maximization.

Merger issues

Apart from the obvious problems of smooth implementation of the financial departments and organization structure reengineering, there are other issues that a merger would spur. The organizational culture will be shaken and the fault lines in the company will come out even more strongly unless corrective controls are adequately put in place. But even more significant especially for an I.T company like Compaq, is the restructuring of the information system.

Different companies have different types and different approaches to the IT systems which are further built on different infrastructures. Digital for instance had a highly decentralized information system where each subset of the organization had its own system and carried out its computations at group level. Compaq on the other hand had a robust centralized system that treated the whole as one. Bringing the two companies together raises the issue of which system is superior to the other and which one should be incorporated or whether a hybrid should be developed by combining the two.

There is also the issue of the organizational structure resulting from the merger of the two companies. Even before the merger took effect, there had been a worry from both quarters as to who will be who from all levels of leadership the Information Technology being one of them. While this is a normal tide in any business merger, it can have far-reaching effects on the productivity of the firm. The personal get involved in the politics of the organization too much and downplay the more important things. When the politics don’t bend in their direction, the person will almost predictably lose the morale they had before the merger and this might lead to decreased productivity in terms of human resources.

The integration processes

One of the problems that arise from the acquisition of digital by Compaq and the subsequent merger of the two companies is the question of the integration of the two companies’ processes. Compaq felt that what they had in place was more established and advanced and the system analysis team eventually recommended that the Compaq classical design be implemented. Many of the mergers that fail don’t fail because of lack of strategy but because of poor integration.

To ensure that the Compaq group doesn’t fall victim to a failed merger then there are some factors that top and mid-level management need to consider. Firstly, there is a need to have a comprehensive analysis of the organization and the process. This will not just look at the information system but also the people, the strategies, and also the processes involved. Not having a comprehensive analysis and rather concentrating on the process alone would have the negative effect of minimization of the profits.

The role of competent and effective team management can not be bargained. The long-term success of the Integration is reliant on the quality and competence of the project management team. When Compaq merged with Digital and subsequently hired Capellas Michael as the CIO, there was a notable improvement in production with the company shipping over 4 million units. But management also needs a good team of employees to work together in realizing the long-term goals of the organization. This team could include the employees of the company as well as outsourced business professionals.

There is also the need for comprehensive planning. While management will want to move speedily in the integration process, it is of utmost importance that they put in place critical priorities. This is important because doing the right job is superior to doing the job right. For instance, management may want to prioritize the ordering process of the information system

Lastly, it is important to point out that many integration processes usually leave out the opinions and wishes of many stakeholders and even shareholders. To ensure that Compaq doesn’t fall victim to this, there is a need for planning and prioritization but above all, there is the need for feedback. The best way to guarantee the long-term creation of value is by having a way of interacting with the clients’ base of the company in the integration process.

Integrated Infrastructure

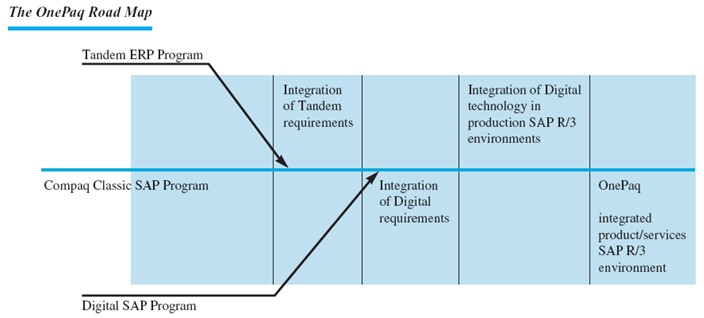

The need for an integrated infrastructure came long before the merger was realized as there was a need to have some prior collaboration. When the merger was realized, the Information systems needed to be exported to one platform to merge the company as one whole unit. These needs lead management to set up committees that would foresee the realization of what came to be known as phase one and phase arranged and grouped according to the chronological implementation schedule.

The main issue was that the Compaq system had been designed on a highly centralized system while digital had used a highly decentralized system. In addition, both of the networks of the two companies had become congested over time and were presently working albeit independently to upgrade their system. The merger saw the two networks become one hence upgrading as one unit.

The figure below illustrates how the different infrastructures of the different companies was managed to realize one infrastructure that would be the backbone of one company

Change Management

When IT firms are merged, there are many resultant complexities. There is a need to improve and integrate different levels of the organization. There is however a need for a systematic and organized change process to be put in place to make sure the information system, as well as the organization structure, is optimized. There are a couple of things that the management needs to consider in the restructuring after the merger of Compaq and Digital.

In the very initial stage, there is a need to understand the different business parts of the two companies that were incorporated in the merger and which ones were scraped of. This will help in the development of a new form of organizational structure and culture and will help to create cohesion in the different departments of the company with the new ones that were formed after the merger.

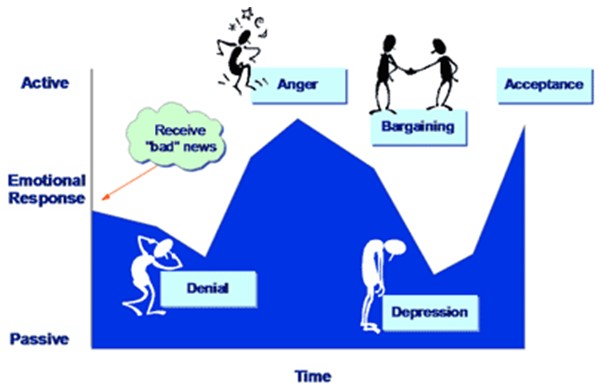

Different models have traditionally been used in the change management process. These include the Kubler-Ross model and the Satir model. The Kubler Model is based on the human responses/reactions to death. Kubler-Ross observed that the responses to the death of a loved one can actually be used to understand the responses to the changes in a company. The five stages are the denial stage, the anger stage, the bargaining stage, the depression stage, and finally, the acceptance stage. This model is important for the management of Compaq as it will be possible to predict the reactions of the employees during the change process.

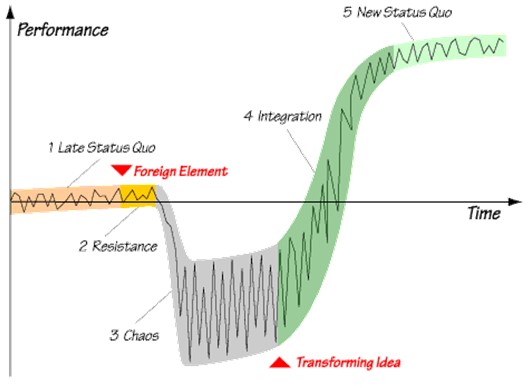

Just like the Kubler model, the Satir model is also based on five steps. However, the steps of the Satir model are more scientific. The first stage is the initial status quo. At this stage, everything is happening in the domains of “business as usual”. When change comes, the second stage is seen when people resist the change. People tend to settle in comfort zones.

The third stage is the chaos stage which is seen when the old system is abandoned and there is a culture shock within the organizations as the employees try to adapt to the changing environment. This will lead to the second last stage, the integration stage, which is seen when the employees eventually realize the benefits of the change process not only to the entire organization but to them individually. This makes them develop a new status quo which is the last stage of the Satir model of change management.

Conclusion

As has already been established, Compaq’s union with Digital has already begun yielding good fruit. When Compaq hired Capellas Michael as the CIO of the new-look company after the merger, there were still discrepancies that had not been solved especially as far as the different information systems were concerned. One of the major fault lines was in the ordering process availed by the system which was not impressive.

This notwithstanding, there was a notable improvement in production with the company shipping over 4 million units. This can be attributed to the good and competent management team as well as the able and dedicated personnel at the various levels in the corporate ladder. If these initial results are anything to go by, it can only be expected that the company will continue to be even more profitable in the coming years especially after full implementation of the merger.

References

Capella,M.(2004). Merging Information Technology and Cultures at Compaq-Digital (B): Becoming A Single Firm. Web.