Introduction

Toyota Motor Corporation is a leading company in the automobile industry by market share and sales volume. The companies headquarter is located in Toyota City in Japan. The company has a capital base of 397,050,000,000 Yen as of 31/ 04/ 2010 (Toyota Motor Corporation). The core business activity of the company is the manufacture and sale of vehicles. The company produces a wide range of passenger cars that are tailor-made for the specific needs of the consumers. As of 31/ 04/ 2010, the company’s market share for Toyota and Lexus cars was 48% while the overall market share including other car models such as Daihatsu and Hino was 44% (Toyota Motor Corporation). Other business activities include investments in housing, communication, and financial sectors. The company is known for its superior technologies in the automobile industry through research and development. These achievements have earned it the status of a market leader in the industry. However, the company has challenges which include the recall of faulty cars and declining profitability. The recalled models for the current financial year include the Lexus GX 460 which had stability problems and Toyota Camry which had a problem with the braking system (Toyota Motor Corporation).

Current Strategy

To maintain its competitiveness in the market, the company is pursuing the following strategies. First, the company seeks to concentrate on the needs of its customers. This involves listening to the opinions and perspectives of its customers as well as incorporating such opinions in the manufacture of its cars (Toyota Motor Corporation). This is will help in producing cars that meet the expectation of the customers thus winning their loyalty and confidence. This policy is justified on the ground that it reflects the mission statement of the company. The company’s mission is to contribute to the development of a prosperous society by manufacturing automobiles (Toyota Motor Corporation).

Second, the manufacturing and sales activities will be pursued from the customers’ perspective. This means that the company intends to produce cars that are tailor-made for the needs of the customers. Thus the company’s car designs will be informed by the needs and expectations of the consumers while car prices will be informed by the budgets of the potential customers. This will involve designing a developmental process that ensures the quality and safety of customers in every region (Toyota Motor Corporation). This strategy is pursued in response to the safety regulations imposed by various governments. It also aims at reducing the car recall rates which leads to high customer confidence in the cars. The company is keen on reducing prices in response to the effects of the 2008/ 2009 recession that has lowered the purchasing power in most countries. However, lowering prices might not be easy to achieve, given the fact that the cost of production is rising with time. Besides, low prices coupled with low sales as a result of the 2008/ 2009 recession are likely to reduce profitability instead of improving it. This happens when the revenue cannot fully cover the operating costs. It is also difficult to take into consideration the needs and demands of every customer. Striving to meet the demands and expectations of every customer involves higher costs as it will necessitate the production of several models of cars that might not have demand.

Third, the company has resolved to focus on research and development to improve its production technologies and the quality of its products (Toyota Motor Corporation). The new technologies are aimed at reducing energy consumption and environmental pollution. This will be done by developing low-cost hybrid cars and expanding the business in electric cars. This policy helps the company to address the issues related to the regulation of car emissions. It also helps the company to be competitive in the market that is characterized by the rapid development of new technologies among competitors. New technologies make cars cheaper to buy and operate. This makes them more attractive thereby increasing their sales. The success of this strategy is threatened by the fact that the company will use its internal funds to finance research and development. With the current trend in making losses, the company might not have enough funds to implement this strategy.

Fourth, the company is concentrating on developing its human resources (Toyota Motor Corporation). This will help it to achieve self-reliance in each region it operates in so that it can produce the best cars. By developing its human resources, the company will be able to maintain its corporate culture of producing quality products and high standards of competence among its employees. It will also help in motivating the staff as well as promoting innovation. However, by focusing on the internal staff the company is ignoring the benefits that it would derive from recruiting experienced staff from other firms in the industry.

Finally, the company is focusing on implementing the above business reforms to develop a profit structure that is stable and sustainable in the medium and long term (Toyota Motor Corporation). This will be achieved through reviewing the above policies and implementing them accordingly in the current financial year. Sustainability is meant to help the firm to maintain its market share in a challenging business environment. The weakness of this strategy is that the above policies have no alternatives. Thus if they fail to be effective in achieving their objectives then the company’s overall development plan will fail. The company is focusing on sustainability rather than growth. This explains why it is forecasting an increase in net revenue by just 1.3% in the 2011 financial year (Toyota Motor Corporation). This undermines the efforts to achieve higher growth by aiming at greater revenue.

Environmental Analysis

External Macro-Environment

The external macro-environment is defined by the political, economic, social, technological, legal, and environmental factors in the automobile industry (Groucutt, Leadley, and Forsyth 132). In this case, the external macro-environment will be analyzed about the market in which the company is operating. Political factors relate to the stability of the governments of the economies in which the company is operating. Most European countries and America enjoy political stability. This means that the company can enjoy operating in a business environment that is characterized by good governance, rule of the law, and justice systems. Japan also enjoys strong political ties with most countries and this leads to better terms of trade with other countries. This presents an opportunity for exporting cars to overseas markets. However, the Middle East markets and parts of Africa are characterized by civil wars and this limits the possibility of conducting meaningful trade in such areas.

The economic factor that hurts the industry is the 2008/2009 recession. The decline in the company’s profitability is largely attributed to it (Toyota Motor Corporation). Currently, most economies are yet to fully recover from the recession. This means that the global car demand is still low. The instability in the financial markets has to lead to fluctuations in the exchange rates and this negatively affects earnings from the foreign markets (Davies and Lam 78). Social factors have favored the industry in that car ownership is increasingly becoming a need rather than a want. Besides, in regions like Africa car ownership is a symbol of status. This leads to higher demands for cars. Research and development in the industry have yielded better technology that leads to lower costs of production, higher quality, and energy efficiency. These provide an opportunity for growth in the industry.

Legal requirements such as quality of standards help in streamlining competition in the industry (Cusumano 550). Each country has its standards of quality and this promotes healthy competition by eliminating firms that seek to lower costs through poor qualities. Taxation varies from country to country with African economies charging the highest rates on car imports. Other devolved countries especially in Europe have imposed quotas on the importation of cars to protect their domestic car manufacturers. These issues work against growth in foreign markets. Environmental factors involve the regulations on car emissions. This is in the form of charges on car emissions that form a significant percentage of costs in the industry. However, most African economies are not keen on environmental regulations. Hence the charges on car emissions in their economies are relatively lower.

Market Analysis

Market analysis, in this case, will take a global perspective and the factors that influence the operation of the market are as follows. The first factor is the suppliers’ bargaining power (Groucutt, Leadley, and Forsyth 97). There is a high concentration of suppliers in the industry against a few manufacturers. The inputs for car manufacture are also not differentiated at high levels since all cars are manufactured using similar materials. Advancements in technology have led to the discovery and use of materials such as plastics as substitutes for metal. Consequently, the suppliers have low bargaining power. This means that the manufacturers can obtain their supplies at reduced costs. However, the inputs form a significant percentage of cost in car manufacture. Thus if the suppliers increase their prices then the prices of the cars must rise and this can lead to a decline in sales (Groucutt, Leadley and Forsyth 95). This strengthens the suppliers’ bargaining power.

The buyers’ in the automobile industry have great bargaining power. This is because they usually price sensitive and will not easily accept price increases. Brand identity has made it difficult to convince customers to change their cars in favor of models from a different company. For example, every fourth passenger car in the United Arab Emirates is a Toyota due to brand loyalty. The industry is also characterized by a high level of customer awareness especially in the developed economies (Toyota Motor Corporation). There is a high level of product differentiation in the industry. All these give the buyer a higher bargaining power (Groucutt, Leadley, and Forsyth 87). Consequently, the manufacturers can not easily increase prices.

The automobile industry is characterized by high concentration ratios in which Toyota commands about 48% of the market. This means that the market is dominated by large corporations. Thus Toyota for example does not experience the effect of rivalry associated with competition for the market share. However, rivalry in the industry is experienced through price changes whereby each firm aims at positioning its cars as the cheapest in the market. Rivalry is also felt through product differentiation. Currently, there is intense rivalry in the industry due to the slow growth of the market. The slow growth in the market is attributed mainly to the effects of the last recession. Rivalry is also intense due to high fixed costs (Groucutt, Leadley, and Forsyth 99). This means that every firm is straggling to produce at near capacity to meet its cost. This leads to large outputs and the firms will compete for the market share to sell all their stocks.

The fourth factor that determines the operation of the market is the threat of subsidies (Groucutt, Leadley, and Forsyth 102). Most countries especially the developing economies are focusing on mass transportation systems such as railways and buses. Domestic air transport in most countries is also becoming cheaper. These factors have lowered the demand for cars. The final factor that influences the market is the threat of entry into the industry. Car manufacture requires huge financial capital and this makes it undesirable for most firms to venture in. Besides, new entrants in the industry are finding it hard to compete with the incumbent firms (Wad 174). This favors the existing firms in the industry. Using the BCG matrix, Toyota’s products are considered to be stars in the market. This is because they have the largest market share and thus generate higher revenue especially in high-performing markets like China. In underperforming markets like Africa, the firm’s products are considered to be cash cows. This is because they command the largest market share despite the slow growth of the markets. Thus revenue in the long-term will be high.

Internal Micro-Environment

The company has three strengths. First, it commands the largest market share of about 48% in the industry (Toyota Motor Corporation). Thus it has a greater opportunity to generate more revenue by maintaining its market share. Second, it has established brands. Toyota cars are the most popular and this can be proved by their sales volume in most countries. Third, the company has a stable capital base of over 397.05 billion yen. This is why it can pay a dividend of 25 yen per share even when it is making losses (Toyota Motor Corporation). The weakness of the company includes its inability to achieve100% quality assurance on its products. This has led to the recall of its cars due to mechanical failures. Most economies are already recovering from the 2008/ 2009 recession. This provides an opportunity for the firm to increase its production and hence increase its revenue. The main threat to the company includes fluctuating rates of foreign exchange and the effects of the last recession since they continue to limit the growth in the company’s revenue as discussed above.

Critical Success Factors

The company has three critical success factors. First, it has superior production technologies. This has enabled it to produce high-quality cars at a lower cost. It has also helped the firm to comply with environmental regulations by reducing car emissions and energy consumption (Cusumano 551). This has led to high sales for the firm’s cars. Second, the company commands the largest market share (48%) in the industry by production and sales volume. This has been achieved through producing cars that meet the specific needs of the users, aggressive marketing strategies, and proper distribution channels. This has led to stable and sustainable income in the company. Finally, the company has a stable capital base of over 397.05 billion yen. This has been achieved through resilience in the production and sale of cars. The company has also used its sound management principles to diversify its investments in housing, communication, and financial industries (Toyota Motor Corporation). This has led to higher revenue.

Objectives

There are two objectives to be considered. First, the company has to return to profitability. Second, it has to withstand the competition and maintain its current market share in the automobile industry.

Strategy

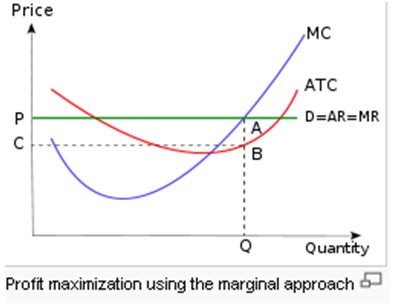

To achieve the above objectives the company should pursue a cost leadership policy. This means that it will aim at being the lowest cost producer in the industry (Davies and Lam 76). To be the lowest cost producer the company must develop new production technologies that lower costs. Currently, the company is pursuing a similar policy. However, it is aiming at producing new products, hybrid cars, at low costs. In this proposal, the policy should be amended in favor of producing its current range of car models at the lowest cost. As the lowest-cost producer, the company can sell its cars at the average industry prices in economies where it has the largest market share. In this case, it will be making more profits per unit than its competitors (Davies and Lam 78). It can sell the cars at less than average industry prices to increase its market share in the European markets that are characterized by high competition. This is because its products will be cheaper than any other in the market. Using the marginal benefit approach, profit can be maximized as follows.

Assuming a perfectly competitive market, the company will have a demand curve, D, at a price, P. Profit= TR-TC. Using this function we can derive the marginal quantities as follows. MC=dTR/ dQ, MR= dTR/ dQ. The demand curve will be equal to the average revenue since AR= TR= P*Q. Thus the company will be making a maximum profit as long as MR> MC. This means that if Toyota focuses on reducing its marginal costs, then its marginal revenue will increase at the same level of output, Q. At point A, MC=MR thus profit is equal to zero. This means that it is the maximum level of production. Production above this point leads to losses since MC>MR. Therefore, economic profits will be made in the area marked PCBA.

Justification

The cost leadership strategy is suitable for the company since most economies are yet to fully recover from the recession. Thus customers have low purchasing power and the best way to encourage sales is to lower prices (Groucutt, Leadley, and Forsyth 112). Besides, the company will still make profits even if it sells at a price lower than the average market price (Davies and Lam 80). The strategy is feasible because of four reasons. First, the company has a stable capital base as discussed in the environmental analysis. This will enable it to invest in technology that lowers production costs. Its competitors like Land-Rover have had to change management due to financial instability. Second, the company has skilled employees who are experienced in designing efficient cars that can be manufactured with minimal resources. This will lower the costs of production. Third, the company has a highly efficient production line that focuses on the minimization of inputs in terms of size, quantity, and packaging and this also reduces the overall costs. Finally, the company has efficient distribution channels through independent dealers. This helps in efficient distribution while the company saves on the costs of establishing sales outlets in overseas markets.

Current Strategy Versus Recommended Strategy

The company is currently focusing on producing hybrid cars through new technology. This is risky since it involves establishing a new market for the product (Groucutt, Leadley, and Forsyth 101). This is because the success of the new products in the markets is not guaranteed. On the other hand, lowering the costs of the current products has no risks as long as the same quality standards are maintained. Thus the company can increase its profits due to higher revenue that will be attributed to lower production costs. It can also consolidate its market share by focusing on market penetration.

Second, the company is focusing on sustainability rather than rapid growth. This is not advisable because its competitors are focusing on growth and are likely to overtake it in sales. This will mean losing its market share (Davies and Lam 83). Besides, most economies are already recovering from the recession which is the main cause of the company’s financial problems. This means that the demand for cars will rise in the medium and long term. Thus the company should focus on growth to prepare itself for the anticipated rise in demand. This will help it to increase its revenue and be profitable.

Works Cited

Cusumano, Michael. “Competing to be really, really good: the behind-the-scenes drama of capability-building competition in the automobile industry.” The Journal of Japanese Studies 34 (2008): 548-552.

Davies, Howard and Pun-Lee Lam. Mnagerial Economics. New York: Prentice Hall, 2001.Print.

Groucutt, Jon, Peter Leaadley and Patrick Forsyth. Marketing. London: Kogen Page Publishers, 2004.Print.

Toyota Motor Corporation. “FY 2010 financial summary.” Toyota Motor Corporation. 2010.

Wad, Peter. “The automobile industry of Southeast Asia: Malasia and Thailand.” Journal of the Asia Pacific Economy14 (2009): 172-193.