Introduction

Monopolistic power is a source of profit earner for many companies. Even with the presence of government regulations against the formation of monopolistic power in the market, which brings in deformity in the competitive scenario, prevails. One such example is the monopolistic power Microsoft has enjoyed (Burrows, 2009). A monopolist has the power to charge whatever price it deems to earn excess profit. However, a monopolist cannot set both the price and quantity to be purchased at the same time. This article shows how a monopolist can charge whatever price it deems to but it is not under her power to set the quantity of the product demanded. Therefore, a monopolist must increase price in order to gain market share. Further, a monopolist sets a different price for a different location. This price discrimination depends on the demand of the product among different subgroups of the target customers.

This essay is a review of the article, which was published on 16 July 2009 in Businessweek regarding the new strategy that Microsoft has employed to reduce the prices of its products. Microsoft has a history of gaining monopoly power and bringing in deformities in the market. However, with the economic recession, there has been a decline in demand for the products of Microsoft so it strategically took the decision to reduce the prices of its chief revenue earners i.e. the Office software and Windows operating system (OS). The article in Businessweek relates the strategies taken by Microsoft to regain competitive power and combat the global financial recession.

In this paper, we will first provide a brief summary of the article that is being reviewed. Then we will analyze each section of the article using theories from microeconomics (Pindyck & Rubinfeld, 2009). The article will analyze the events mentioned in the article in light of microeconomic theories.

Article Summary

The article that is reviewed is “Microsoft’s Aggressive New Pricing Strategy” written by Peter Burrows (2009). The article relates that Microsoft had enjoyed monopoly power throughout its history, however with the advent of financial recession in the global economy; there has been pressure on the company to meet its revenue targets. The article states that Microsoft had used its “monopoly power” to keep prices for its software high even during “tough times”. However, the company has been facing competition from other software giants like Google, and with the economic downturn found itself in a position wherein it could not use its monopoly power to sustain high prices of its products. Therefore, the company was forced to decrease the prices of its products. Microsoft so far had reduced prices on its OS Windows, and Office products to even the new launched internet products.

The main aim of the company was to reduce price and increase sales volume that would rejuvenate their low profit margins. The CEO of Microsoft, Steve Ballmer, intended to get into the growth opportunities provided by other avenues like entering into very lucrative and growing emerging markets in Europe and Asia. Microsoft has concentrated more on gaining corporate buyers for its software and reducing price for individual customers. The main aim of the price reduction was to increase sales of original software rather than selling of the pirated versions.

apart from reducing the prices of the products, it has also altered its revenue model. As in case of newly showcased Office 2010, Microsoft has two versions – one for which customers are expected to pay the price for the product and the other is a less powerful free online version which is supported by advertisements. The company has also shifted its sale more through online transactions, which effectively reduces its price and increases profit by almost three times.

The article then relates how Microsoft has launched its new OS, Windows 7 and shows that the price of this product is prices almost $40 less than the price of the earlier OS, i.e. Windows Vista. This is the first instance when Microsoft has charged a lower price on its products ever than its earlier counterpart.

The article reports that in China the company has prices its Office at $29 with other versions like Words, Excel, etc. free in order to counter competition from Google. Further, with loads of promotional offers available the effective price of Office in countries like Brazil and India, it comes down to $100 from $150. Using price reduction as a tool, the company has reported to increase its sales figure by 4155 in the second half of 2008.

With increased use of pirated version of the software in countries like China – where it is reported to be 95% – Microsoft has induced a price reduction, which has effectively increased sales of Office in China by 800% more sales. This has heavily crippled the pirated software industry in China. As the trial of $29, Office was so successful; Microsoft has decided to keep the prices at this level permanently.

In a more innovative marketing strategy, Microsoft has decided to have the CDs for Windows 7 loaded with different versions. People who buy the cheapest version will just have to upgrade to the premium versions by paying extra surcharge. But still Microsoft faces competition from competitors like Google who are willing to provide similar features at a cheaper rate.

Analysis

The article first refers to Microsoft’s pricing strategy as a monopolist. It states that Microsoft had “enjoyed Olympian profit margins, using its monopoly power to maintain prices on its software” (Burrows, 2009, p. 51). The company used its power as a monopoly to price its products high and gained market share through other measures. We will first understand how Microsoft could achieve this.

A monopoly is a market condition wherein there is only one seller. Microsoft had long been accused as a monopolist as its dominating share of the software market share especially for its Windows OS and Office software. Due to this, Microsoft gained a lot of power as a monopolist and enjoyed pricing its products in order to gain maximum profit. Thus, as a monopolist Microsoft was in a position to influence the price of the products and the buyers had no power against the price set by the company.

From the article, it is clear that Microsoft faces a downward sloping demand curve for its products. As there is an increase in price, the quantity demanded declines and vice versa, provided cetirus paribus assumption holds true. Now as there is a change in the external environment of the market, the demand curve shifts. Due to an economic downturn, cash crunch was created in economies, thus, reducing the income of people. This shifted the demand curve to the left.

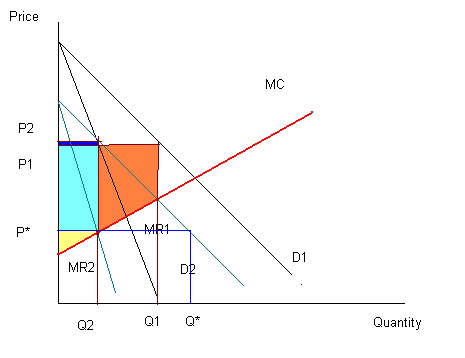

Figure 1 shows that the initially the demand curve faced by Microsoft was D1 which now moves leftward due to changes in economic condition to D2. Initially, when Microsoft faced demand curve D1, its marginal revenue curve was MR1. Given marginal cost MC, the profit maximizing price and quantity was P1 and Q1. Assuming that Microsoft used to price its products at profit maximizing price, the company earns a producer’s surplus equal to the region colored in orange, light blue, and yellow. With a shift in the demand curve to D2, the marginal revenue curve too becomes MR2. The profit-maximizing price increases from P1 to P2 and quantity demanded reduces by Q1 to Q2. However, due to excess competition from the industry, Microsoft decides to price its products at a lower rate (say P*). At this price, the quantity demanded increases from Q2 to Q*. The producer’s surplus reduces drastically to only the yellow region. However, it sells more products. Thus, Microsoft foregoes to its surplus, in order to gain market share and increase sales.

From figure 1 it should be noted that at price P, the monopolist still enjoys producer surplus, even though it is less much lesser than the profit maximizing case. Further, due to the downward sloping demand curve of Microsoft products, the price reduction is accompanies by an increase in sales of the products, which is exactly what has been experienced by Microsoft in case of China, India, and Brazil.

The pricing strategy that has been employed by Microsoft also provides monopolistic power to the company. The company charges different prices in different geographic locations. For instance, office in India costs $100 (after the promotional offers included) and that in China costs $29. There is effectively a $71 in the prices of Office in both the countries. This is a third-degree price discrimination practiced by the company. Here Microsoft has divided the consumers of China and India depending on the demand curves and price elasticity of the consumer demands.

As Chinese consumers have many alternatives in terms of cheap pirate versions of the software, a switch from the pirated version to the original cannot be induced without reducing the prices at almost the same level as the pirated versions of the software. In China, demand for Office is highly price elastic as there are pirated versions of the software that are sold at a very low price. Thus pricing has to be kept low in the country in order to gain higher sales volume. Whereas in India, the price elasticity of demand for the software is less elastic than that of Chinese consumers. Therefore, prices can be kept higher than that of China. Further, in China, Microsoft Office faces competition from pirated versions of the software, whereas in India, this competition is comparatively lower.

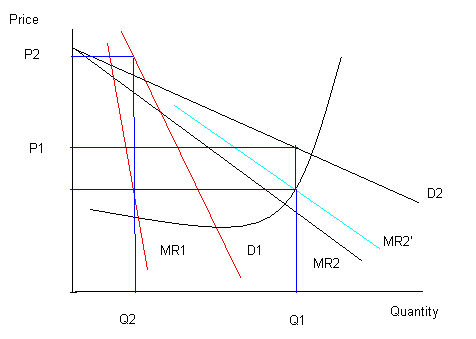

Figure 2 shows the third degree discrimination followed by Microsoft. Here D1 is the market of India with a less elastic demand curve and D2 is the highly elastic demand curve of China. As a necessary condition for profit maximization in case of third degree discrimination is that the marginal revenue earned from both the markets must be equal to the marginal cost, it can be deduced that the altered MR curve is MR2’. The price thus at which the product is offered in China is much lower (P1) than that offered in India (P2). However, in one market, the company earns supernormal profit and in the other, it does not, but the company maximizes the profit earned in both the markets together.

In case of the launch of its new OS, Microsoft has decided to price it lower than the initial price launch price of Windows Vista. This is so because of two main reasons: (1) economic recession has cringed demand for the product, and (2) advent of competitors and increasing competition pressure.

Here it must be noted that Microsoft had been enjoying monopoly power in its OS and Office software. However, with increasing pressure from competitors like Google, Microsoft is facing a market which has become oligopolistic (rather duopolistic) in nature. This has brought in competition for Microsoft. Thus, increased competition has forced Microsoft to aim of the market, which it had so far neglected and had continued to charge a high price for its products. However, with the advent of competition, Microsoft is forced to look forward to markets, which are emerging, and has not been penetrated. That is why the company’s promotional pricing in countries like China and India.

The present market for software is oligopolistic in nature where there are two major players for the Office software industry – Google and Microsoft. Google follows a different business model wherein it does not charge any price for the software it allows consumers use and they earn revenue through advertisements, while Microsoft believes in traditional pricing of the products. This creates more demand for Google’s word processor and spreadsheet software as they are free, especially in a market where price elasticity is relatively high. A firm in an oligopolistic market attains equilibrium when it attains Nash equilibrium, which states that a firm will attain equilibrium when it adopts the best possible alternative given the competitor’s actions.

In case of Chinese market, Microsoft competes with pirated versions (which we will call company X), which are sold at a much cheaper rate. The demand for the products for each of the firm depends on the price they set and on the price set by their competitor. In case of Microsoft, it chooses $29 for the Chinese market, assuming a price that will be set for the pirated versions. In this case, we see that the product sold by the two companies is a homogeneous product as both sell Office. Therefore, we will consider the Bertrand model of oligopolies in case of homogeneous products. Therefore, the companies assume that they will treat the price of their competitor as fixed and they simultaneously decide what price they should charge for the product. Usually in such a situation Nash equilibrium is reached when both the firms set the price equal to marginal cost. Thus, in order to bring the market into equilibrium, Microsoft has tried to price its product closer to marginal cost. In this case, profit tends towards zero.

Conclusion

The article shows two conditions wherein the Microsoft acts first as a monopolist then as a company in oligopolistic market facing competition. Initially as a monopolist Microsoft priced its products much higher however with increased competition and need to keep their overall profit intact, the company reduced its price drastically. The article shows this aspect of the company’s pricing strategy. In the oligopolistic market, Microsoft has not will other than to reduce price in order to face a very low prices competitor. Thus, overall the company has taken to follow the revenue generation model of the pirating companies and price its products low.

Reference

Burrows, P. (2009). Microsoft’s Aggressive New Pricing Strategy. Businessweek , p. 51.

Pindyck, R. S., & Rubinfeld, D. (2009). Microeconomics (7 Eds.). NA: Prentice Hall.