Assume that the policymakers in a closed economy want to increase output without changing interest rates. What kind of policy mix would you recommend and how would your policy mix affect the components of GDP? Explain your answer and the adjustment processes that take place with the help of an IS-LM diagram

Since the closed economy suppresses the import and export of goods, meaning the policy mix is to be implemented, one will see some adjustments in the components of the GDP to be able to increase its output (Blinder, 2011).

As per the components of the GDP, net export is ruled out since the economy prohibits the export of its excess GDP, which means the adjustments will only affect three components of the GDP that are personal consumption expenditures, business investments, and government spending. It means that with an inelastic interest rate, the policy mix would see a reduction in the overall expenditure of the economy i.e. the GDP components will be affected by a reduction in the government and personal consumption expenditure to see an increase in the output as portrayed with an increase in business investment.

Recommended policy mix

The most viable policy mix that would be relatively significant to the economy is saving. it is done by cutting down the personal consumption and government expenditure to be able to save for investment. The investments are likely to boost the output of the economy internally. But since it’s quite impossible to control the personal consumption expenditure of consumers, the government will have to reduce its expenditure by saving to experience the change in Business investment as a component of the GDP.

The IS-LM curve shows the relationship between the interest rates charged on goods and the actual output of the goods and services in the market which grossly affects the GDP components (Froyen, 1996).

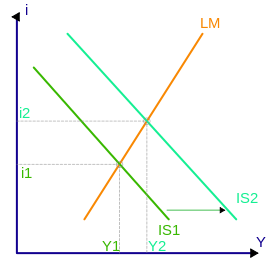

This can be explained using the IS-LM curve below:

The IS curve constitutes the total spending of an economy i.e. individual spending, government spending, and business investments which sum an economy’s total output. it means that every business investment done within the closed economy is saving to the overall economy. Hence, every saving that is done by a reduction in the consumption of the personal expenditure; government expenditure with constant interest rates will relatively influence increased investment which affects real GDP (Froyen, 1996).

The LM curve represents the income level and the interest rate. Higher-income and lower rates will result in high liquidity and thus fixed investment in the economy. But if an equilibrium is achieved where the income level is equal to the rate of interest, then there is no investment which means that the level of output will below.

As per the graph, the general government expenditure affects the demand for goods and services at an individual interest rate which is likely to result in a low saving rate or fixed investment. Thus, increased government deficit spending affects the IS-LM curve. The IS curve will shift to the right as shown in the graph above from i1 to i2. And the LM curve from Y1 to Y2. The point of intersection is aggregate demand.

It means that increasing interest rate as a result of rising deficit spending from the government side leads to crowding out i.e. deterrent from investment especially in the private sector; this happens because the level of income of an individual will be consumed by the high-interest rate hence low fixed private investments. This in the long run affects the GDP which will get reduced.

Thus the most recommended policy mix is the one of reduced deficit spending on the government. This will result in reduced expenditure from the government and personal consumption from the individual level as components of GDP. Hence, a lot of savings will be done which will be reflected in the increased private investments, thus increased output in GDP (Froyen, 1996).

Effect of Recommended Policy Mix on the components of GDP

There will be a reduction in expenditure of two components of the GDP i.e. there will be a reduction in the government expenditure and personal consumption expenditure; as a result, there will be a shift in the business investment that will experience increasing investment as a result of saving culture hence, increased GDP with constant interest rate.

Explain what is meant by income elasticity of money demand and interest elasticity of money demand

The income elasticity of money demand is the measure of the reaction of the consumer on the demand for specific good due to increased or decreased income levels of consumers while interest elasticity of money demand is responsive to the nature in demand for money with the adjustment in the interest rate (Barro, 2004). It means that the income elasticity of money depends on the cost of goods and the level of income. Hence, a consumer is likely to purchase a specific well as long as there is money to buy it, and is likely not to purchase the commodity if he or she lacks the money to acquire it.

Interest elasticity of money demand depends on the interest charged on commodities and the money value needed to acquire it (Froyen, 1996) The higher the interest rate in a commodity, the higher the charges are, hence, more demand for money to purchase the commodity.

The effect of an expansionary fiscal policy on the output level in a closed economy is very large when income elasticity of money demand is relatively high and interest elasticity of money demand is relatively low’. Do you agree or disagree with this statement? Why? Use the appropriate diagram(s) to explain your answer

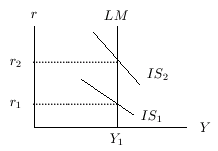

I strongly disagree with the statement above. As shown in the graph below:

The LM line curve represents the constant income level of the consumer population while the IS curves represent the total spending expenditure of the economy which is what will only be affected with low-interest elasticity money demand since with inelastic interest rate there will be no effect in the income, and because of low-interest rate, there will be no much output of the economy. Since much of the government expenditure and source of income is derived from the interest rates charged on almost every commodity in the market, the liquidity of money which is on-demand is not likely to cause any shift in the output of the economy, but there will only be increased spending from the consumers as the income level of the consumer population is constant (Chowdhury, 1996).

Explain why an increase in government spending has a larger effect under a fixed exchange rate system and perfect capital mobility than in a closed economy model. Use the appropriate diagram(s) to explain your answer

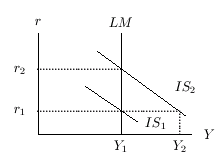

Under a fixed exchange rate system, increased government expenditure means that because this will try to drive the economy to an equilibrium level of income (Blinder, 2011). As shown in the graph below:

The graph explains an increase in aggregate spending. This will create a money elastic economy where there will be an increased demand for money from the consumers and the government; this will see the IS curve move from IS1 to IS2 with a constant income level. It will also create a situation known as “crowding out” since the same interest rate is what the government consumes through increased expenditure which will result in a decrease in investment spending.

As to the perfect capital mobility, this means that there is an allowance for import and export of goods in an economy hence an increase in government expenditure will not be that much affected since the fixed interest rate system is likely to draw more investors into the economy at a time that the interest rate favors them due to the liquidity level of money which is likely to favor the economy hence an increase in investment (Sun, 2003).

In a closed economy, the increased government expenditure will have a shift in the expenditure, which will generally be consuming the interest gained from goods and services. (Agarwal, 1991) This somehow creates an inelastic economy where increased elasticity for money is constant, and the interest rate elasticity demand will also not affect the consumer population hence, there are no changes in a closed economy in terms of investment and vice versa in a perfect capital mobility economy. (Tom, 2011)

References

Agarwal, V. &. (1991). Financial Liberization, Money Demand, and Monetary Policy in Asian Countrikes. International Monetary Fund, New York.

Barro, J. (2004). Economic Growth.MIT Press, Cambridge.

Blinder, A. (2011). Economics: Principles and Policies. CCengage Learning, Oxford.

Chowdhury, A. e. (1996). Monetary and Financial Policies in Developing Countries: Growth and Stabilization. Routledge, New York.

Froyen, T. (1996). Macroeconomics, theories and policies. Prentice Hall, Pennsylvania.

Sun, Y. (2003). Do Fixed Exchange Rates Induce More Fiscal Discipline? International Monetary Fund, New York.

Tom, H. (2011). Macroeconomics: Cengage, Chicago.