Corporate Governance

Audit and Risk Management Committee of NXT Limited

NEXTDC Limited (ASX: NXT) is an Australian data center operator that provides innovative connectivity services and data center outsourcing solutions enabling business transformation throughout the country. As an ASX-listed company, it must comply with financial reporting standards. The Audit and Risk Management Committee (ARMC) of NEXTDC plays a pivotal role in corporate governance and consists of the Board members (NEXTDC, 2019). As shown in Appendix 1, the ARMC chair, Jennifer Lambert, is independent, along with the majority of other members. In other words, no factors are involved that could interfere with independent judgment.

Furthermore, as indicated in Appendix 1, the proportion of ARC members with accounting and risk management expertise is 50%. Lambert has 25 years of experience in financial management and accounting, and Dr. Doyle has acted as a member of the Audit, Governance, and Sustainability Committees (NEXTDC, 2020). The role of the ARMC is to help the Board exercise its responsibilities and corporate governance in regard to NEXTDC’s financial reporting, risk management systems, internal control structure, as well as internal and external audit processes. Thus, the committee’s activity affects the value and efficiency of the company. The compliance of the NEXTDC’s ARMC with such characteristics as independent chair and members and their expertise in accounting and risk management imply stronger superior corporate outcomes.

Literature Review

Many researchers study the role and beneficial effects of independence and expertise of the audit and risk management committee (ARC) for a company and its shareholders. According to Toumeh et al. (2020), the independence of the ARC from management improves the overseeing function’s efficiency and financial reporting quality while also limiting earnings management practices. Toumeh and Yahya (2017) develop a conceptual framework applying the agency theory to explore the moderating role of independent ARC in the relationship between free cash flow and earnings management practices. They suggest a negative correlation between the independent audit committee and a company’s use of techniques distorting financial statements (Toumeh & Yahya, 2017). Therefore, such an ARC characteristic can increase the reliability of financial reporting of the firm to inform its stakeholders better.

Another aspect to consider is the effect of the ARC on the company’s value and performance. Research by Chariri and Januarti (2017) contributes to the discourse by establishing a positive influence of the audit committee’s expertise and meetings’ frequency on the quality of integrated reports, associated with increased reliability for stakeholders. Another study suggests a beneficial effect of the independent board and audit committee on net interest margin and market value (Chou & Buchdadi, 2017).

Furthermore, it emphasizes independence and expertise as critical to the monitoring function and, in turn, the company’s efficiency. Mohammed et al. (2019) focus on studying the firm’s financial performance and argue that it can be improved by audit committee existence and independence. Evidence provided by Barka and Legendre (2017) and supported by the agency theory suggests that an independent board increases the company’s equity and economic performance. However, the researchers state that a fully independent ARC is associated with less satisfactory firm performance (Barka & Legendre, 2017). Based on the literature review, it can be concluded that the corporate governance policy and practice of NEXTDC Limited imply a beneficial impact on the company’s performance.

Accounting Choice and Quality

Key Audit Matters Addressed by PwC

PwC, the independent auditor of NEXTDC Limited, provided a report on the compliance of the company’s financial statements with Australian Auditing Standards. According to NEXTDC’s (2020) annual results, PwC highlighted “data centre services revenue recognition” and “non-current asset additions” as the most significant for the audit procedure of the current period (p. 100). The first identified key audit matter (KAM), revenue recognition, is a matter of concern due to its importance to precise financial reporting and, in turn, the company’s performance. As per the Australian Accounting Standards Board (AASB), performance obligations must be identified under the firm’s contracts with the customer to ensure users’ understanding of the financial results (NEXTDC, 2020).

Another KAM, non-current asset additions, is critical due to the continued investment of NEXTDC Limited in new data centers during the reporting period to improve the data infrastructure. Capital outlay involved in this project presents significant additions balance to the consolidated balance sheet (NEXTDC, 2020). Moreover, increased value implies attracting more customers and boosting profits and revenue. Thus, PwC as an external auditor plays a critical role in highlighting KAMs and reducing aggressive financial reporting behavior.

Accounting Policies of NEXTDC Limited on Revenue Recognition and Cost Capitalisation

It is essential to consider whether the application of the accounting policies of NEXTDC Limited on revenue recognition and cost capitalization could lead to financial misstatements or opportunities for earnings management. As stated by Putri and Sujana (2018), the agency theory suggests different interests of the company principals and the management as a result of different objectives. The manager, or agent, is motivated to fulfill their economic needs, while the company owner, or principal, strives for increasing profitability. Revenue recognition poses a risk of material misstatement and must be addressed by an external auditor.

The report by NEXTDC (2020) identifies the following “major business activities” for revenue recognition: data center services, interest income, and distributions from investments (p. 64). Furthermore, the company reports that contracts with customers guarantee certain performance measures, including uptime and on-time service delivery (NEXTDC, 2020). The variability of income measurement and revenue recognition practices available imply risks of earning measurement processes. However, as the external auditor highlights, the company’s compliance with the core principle, AASB 15 Revenue from Contracts with Customers, implies better quality disclosures.

The accounting policy of NEXTDC Limited regarding cost capitalization is another critical aspect to address. Capitalized costs provide a clearer view of the total amount of capital deployed on assets. In contrast, inappropriately capitalized costs can mislead investors by making them believe that the company’s profit margins are higher than they are. According to Ofori et al. (2019), the positive accounting theory implies the possibility for the management to utilize earnings management practices, either through accrual policies or through real activities.

Hence, addressing the company’s cost capitalization policy and assessing the processes implemented to measure capitalized costs are critical due to this KAM’s significance. NEXTDC investments in new data centers are capitalized in accordance with the Australian Accounting Standards. As claimed in the annual report of NEXTDC (2020), “$411m has been capitalised as additions to Property, Plant and Equipment, while $7m has been capitalised to Intangible Assets” (p. 102). As PwC states, based on the audit conducted, no material misstatement was found to report to the date.

Key Audit Matters and Financial Reporting Quality

The impact of KAM disclosure in audit reports on financial reporting quality should be discussed. As research shows, key audit matters are associated with a lower expectation gap, which improves the quality of financial reporting and audits (Ofori et al., 2019). As Gold et al. (2020) report, a study involving “6,000 financial statement preparers” and backed by the accountability theory revealed that greater transparency due to KAMs causes higher accountability pressure.

Managers expect scrutinization of their judgments, which can positively affect the quality of financial statements. Furthermore, aggressive financial reporting tendencies are reduced with KAM’s presence in comparison to their absence (Gold et al., 2020). The precision of the information presented by the auditors appears to have little effect since improvements in reporting are found for various audit reports with key audit matters disclosure. Thus, it can be concluded that KAMs can serve as a beneficial mechanism for improving financial reporting quality by attenuating aggressive financial reporting behaviors.

Capital Market Research

Cumulative Abnormal Returns

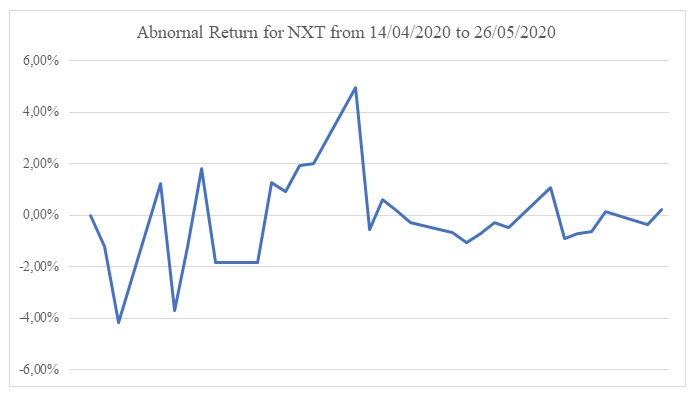

NEXTDC Limited announced the completion of its Share Purchase Plan (SPP) on 5 May 2020. According to NEXTDC (2020), the company “successfully raised $862 million via an institutional placement” and SPP (p. 19). Financial announcements are known as one of the factors affecting stock price reactions. Based on the data collected for NEXTDC, the calculations of stock returns, All Ordinary Index returns, and cumulative abnormal returns were conducted and are depicted in the table in Appendix 2. The graph of the results of the abnormal returns is presented in Appendix 3. This measure allows investors to estimate the actual extent of profits and losses.

NEXTDC’s Price Reaction to its Share Purchase Plan Announcement

The information perspective study findings suggest that while good news results in increased share price, bad news causes a decline in stock price. According to NEXTDC (2020), the SSP followed the firm’s completion of a $672 million placement to institutional investors in May, which was carried out at the placement price of “$7.80 per share” (p.20). As can be seen, a successful SSP resulted in more ASX stocks present in the market, with their price going down as the demand and supply curve shifted (Rankin et al., 2018). Due to this fact, SPP usually is offered at a discount. Plan-offering companies are characterized by positive abnormal stock returns on the preannounced days of investment (Rankin et al., 2018). Capital market research is based on the assumption of the efficiency of equity markets.

References

Barka, H. B., & Legendre, F. (2017). Effect of the board of directors and the audit committee on firm performance: A panel data analysis. Journal of Management & Governance, 21(3), 737-755. Web.

Chariri, A., & Januarti, I. (2017). Audit committee characteristics and integrated reporting: Empirical study of companies listed on the Johannesburg Stock Exchange. European Research Studies Journal, 20(4B), 305-318. Web.

Chou, T. K., & Buchdadi, A. D. (2017). Independent board, audit committee, risk committee, the meeting attendance level and its impact on the performance: A study of listed banks in Indonesia. International Journal of Business Administration, 8(3), 24-36. Web.

Gold, A., Heilmann, M., Pott, C., & Rematzki, J. (2020). Do key audit matters impact financial reporting behavior?. International Journal of Auditing, 24(2), 232-244. Web.

Mohammed, B. H., Flayyih, H. H., Mohammed, Y. N., & Abbood, H. Q. (2019). The effect of audit committee characteristics and firm financial performance: An empirical study of listed companies in Iraq stock exchange. Journal of Engineering and Applied Science, 14(14), 4919-4926. Web.

NEXTDC. (2019). Audit and Risk Management Committee charter. Web.

NEXTDC. (2020). FY20 annual report. Web.

Ofori, A. O. A., Gabriel, K., Owusu, N. A., & Kudjo, E. N. W. (2019). Financial accounting theories effects on accounting practice. International Journal of Recent Scientific Research, 10(12F), 36630-36636. Web.

Putri, Y. K. W., & Sujana, I. K. (2018). The influence of bid-ask spread and leverage on earnings management with good corporate governance as moderating variable. International Research Journal of Management, IT and Social Sciences, 5(3), 8-21. Web.

Rankin, M., Ferlauto, K., McGowan, S. C., & Stanton, P. A. (2018). Contemporary issues in accounting (2nd ed.). John Wiley & Sons Australia.

Toumeh, A. A., & Yahya, S. (2017). Stock market segmentations, free cash flow and earnings management: The roles of moderating independent audit committee and audit quality (The case of Jordan from an agency theory perspective). Global Business and Management Research, 9(4), 1-16. Web.

Toumeh, A. A., Yahya, S., & Amran, A. (2020). Surplus free cash flow, stock market segmentations and earnings management: The moderating role of independent audit committee. Global Business Review, 1-30. Web.

Appendix 1: Audit committee characteristics

Appendix 2: Cumulative abnormal return

Appendix 3: Graph of results