Introduction

A change in the political environment can change how corporations are governed and the models of business to adopt. Large companies like Almarai have historically depended on the supportive political framework that helped boost the country’s consumption and, thus, the demand for consumer goods. Almarai was founded in 1977 at a time when the government of the Kingdom of Saudi Arabia (KSA) was seeking to achieve food security. Saudi Prince Sultan bin Mohammed bin Saud Al Kabeer realized that there was an opportunity in the domestic dairy industry. At the time, the KSA did not have any large scale production and the cold supply chain needed to store and distribute fresh dairy products. With innovations and the subsidies from the government, these challenges were overcome and Almarai became one of the most popular dairy brands in KSA and the Gulf Cooperation Council (GCC). Times are changing, however, and the company may no longer enjoy the same political environment. Besides having internal issues such as business units failing to turn in profits, the change in the political climate would be expected to have massive implications for the company.

This report analyzes the current case of focusing on the dynamics of the business environment. The analysis is founded on the idea that the current political changes will have significant impacts on the company’s wellbeing. The problem statement will highlight the scenario in greater detail, followed by a brief examination of the trends, opportunities, and constraints. The report will discuss the organizational structure, business environment, market strategies, SWOT analysis, success factors, segmentation strategy, positioning strategy, and customer analysis. Lastly, the report will present alternatives, recommendations, and an implementation and control framework.

Problem Statement

In the last few years, the Saudi society has been going through structural changes that affecting the operations of businesses. The companies are now living and operating in ‘a different world’ from the one where the government provided its citizens with fuel, electricity, and subsidies for foods (Fabbe et al). In the ‘different world,’ the country seeks to integrate more Saudi citizens into the labor market, to reduce the subsidies, and to implement a new tax system that will result in the people having less disposable incomes. Additionally, the people will be required to work to supplement their incomes, the only way that will see the disruptions in demand for products and services restored.

The attempt to force businesses to employ more Saudi citizen has a far-reaching implication. Firstly, the government makes it expensive to hire expatriates which in effect makes labor more expensive. Almarai’s success and that of most enterprises have historically depended on the cheap labor imported from India and other Asian and world countries. Secondly, the companies will not benefit from the expertise imported from the developed countries. Experts like the outgoing CEO Schoderet who has held senior roles in large industries like the Swiss airline and aluminum industries, bring business management and leadership skills that help companies prosper (Fabbe et al). The companies will only hope that the country’s education system can produce similar competencies to fill in the voids left by the foreign workers. The new shape and look of the company under these changes remains highly uncertain.

While the political changes pose the greatest challenges, Almarai already faces internal challenges that remain unresolved at the time of Schoderet’s exit. Firstly, the company has for long ignored the cost inefficiencies that have resulted in high operational costs. The underlying factors include rising energy prices and taxes on foreign workers. Labor and energy expenses have become a serious concern at the company. Secondly, the company faces channel pressure due to the strategic threats from the rising outlays in operating the bakalas and stiff competition from competitors and modern retailers. Loss of foreign customers due to a series of international embargoes and the tightening of the household budgets also pose strategic risks. An interesting point is that the company has enjoyed a comfortable lead for years but now the competitors are catching up. For example, the recent merger between Nadec and Al Safi Danone encouraged by the Saudi government to improve competitiveness is a huge threat to the company (Fabbe et al). As of now, the company needs to find new sources of growth, some of which will be examined in the alternatives section.

Trends, Opportunity, and Constraints

Trends

The major trends in the agricultural sector are illustrated by a shift from import-dependency to self-sufficiency and almost back to import-dependence. The embargo of 1970 set the foundation for the industry’s transformation. The country is rich in oil and depended on oil to purchase food and other key commodities from the global market. KSA set a strategy for food security with the main goal being self-sufficiency. Direct subsidies to agricultural companies that produced products such as wheat not only made the country self-sufficiency but also a major exporter by the 1990s (Fabbe et al). The self-sufficiency was a risky approach considering the water shortages.

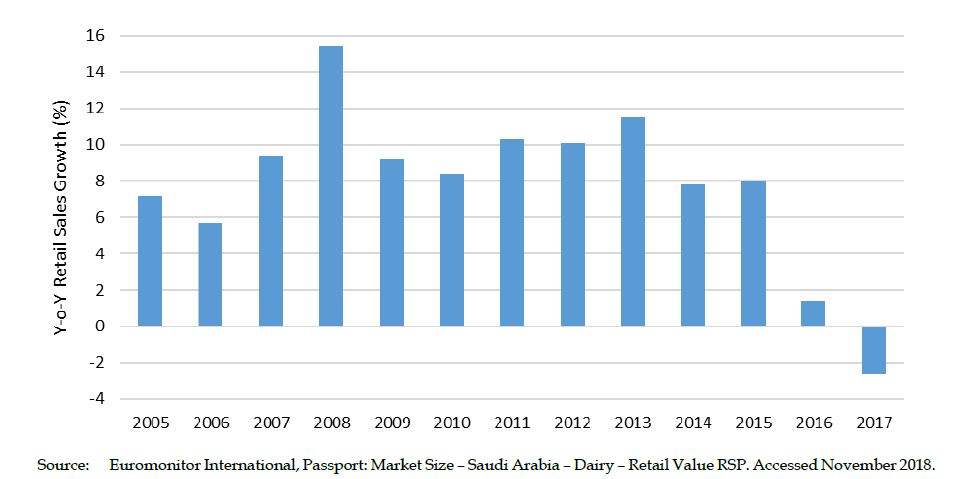

By the early 2000s, the water reserves had been used up and the country again resorted to discouraging water-hungry crops and other practices. The self-sufficiency targets were scraped off and the country went back to importing (Fabbe et al). However, the country did encourage businesses to acquire and rent land from other countries to carry on with the farming whereby the produce (some or all) would be exported back to KSA. The trends in the political environment have largely been expressed in the problem statement. It is the policy changes in KSA that have caused these trends. The figure below illustrates the trends in the production and sale of dairy products in KSA:

Opportunities

The growth opportunities are very few considering the changing dynamics of the Saudi society. The consumption patterns differ between Saudis and foreigners. With fewer foreigners expected, the country can find growth opportunities for the fresh milk among the Saudis or find a means to export fresh milk. The perishability of the fresh products and the logistics involved would make such a move extremely costly. The company can, alternatively, find growth opportunities in the market for longer shelf-life dairy products, including powdered milk. Exportation for other products such as poultry depends on the embargo situation and finding new international markets to export the products. The company has a stronger brand than most competitors meaning that the company can also find and exploit new niche markets in KSA more effectively.

Constraints

The key constraints faced by Almarai are the political changes and environmental challenges such as water scarcity. The political regulations mean that the company cannot implement cheaper alternatives like local production of animal feeds and hire cheaper workers from abroad. In terms of the environment, the government is seeking to phase out all water-intensive production meaning the company has to rely on imports that could become more expensive. Renting land from other countries is a good alternative, but one with government red tapes that could see the company lose some control over the production and exportation of the produce. The environmental changes experienced worldwide mean that there is also a possibility that other countries would strictly regulate water consumption in the agricultural sector.

Organizational Structure

Almarai has a complex organizational structure as a result of the numerous business segments and joint ventures. The structure has not been outlined by Fabbe et al meaning that it can only be inferred from the details available. The CEO occupies the top position, below which other critical divisions such as finance and operations are headed by chief financial officer (CFO) and chief operations officer (COO) respectively. Below the COO, the various business segments are headed by managers and assistant managers for various business units. The lowest level of the hierarchy is occupied by the organizational staff.

Environmental Analysis

The environmental analysis focuses on examining the internal and external factors affecting the operation of a business. Among the key tools for environmental analysis is PESTEL that explores the external environment and SWOT analysis focusing on internal and external factors. In this section, the attention will be paid to PESTEL framework as SWOT will be discussed in a later section. PESTEL is an acronym for political, economic, social, technological, legal, and environmental elements. Each of these factors and how they affect Almarai will be explained briefly.

Political climate

The fluctuating policy regime of the country makes the business very uncertain for Almarai and other firms in the agricultural sector. The government has tight control of the economy and the economic activities carried out in the nation. Currently, the self-sufficiency regulations have been changed to accommodate emerging issues such as water scarcity (Fabbe et al). The greatest impact, however, is on the labor market. The government has initiated steps towards increasing the employment of the Saudis in a move that makes it expensive to employ foreign workers. Companies that relied on cheap imported labor will experience a rise in operational costs that could reflect on consumer prices. The burden will be transferred to a consumer who is already faced with taxes and reduced subsidies making it hard for them to spend.

Economic climate

The economic climate of KSA has also become uncertain following the recent structural changes initiated by the government. The consumption patterns of the dairy products have included the foreigners consuming fresh milk products while the Saudis preferred powdered milk and longer shelf-life milk. The uncertainty is that the fewer expatriates will mean fewer consumers of fresh milk while the consumption of powdered milk will not be expected to rise. Additionally, the overall demand is expected to decline due to the falling purchasing power resulting from the fewer subsidies and more taxes.

Social factors

The Saudi society can be seen as relatively rigid when consuming products and services. Firstly, the consumers are loyal to certain brands as testified by Schorderet who states that in Saudi Arabia people do not just buy products, rather they buy the products of their trusted brands (Fabbe et al). With such a society, the company’s brand can enjoy prolonged demand from loyal customers. However, things can change when the brand fails to live to its reputation. According to Fabbe et al, Saudi consumers almost gave up on Almarai when the company raised its prices. A rigid society can derail a company’s progress, especially if the progress is founded on major organizational changes.

Technology

Technologies are fast advancing across the globe and most of the advances are forced by the business needs. The case of Almarai’s dairy product is a perfect example in the sense that the country is a desert and not suited for dairy farming. However, the company pursued novel technologies like refrigeration and cooling systems to address the challenged. KSA is a country that can take advantage of both novel and existing technologies to solve the emerging problems of water scarcity that has derailed the pursuit of the self-sufficiency goal. As an example, there are countries across the world converting ocean water to usable water in a process called water desalination. Almarai has a huge capital base that could help it import this technology. The technological environment in KSA is favorable for businesses to operate.

Environmental factors

KSA is a country that hardly has a favorable environment to support agriculture. However, environmental implications of business practices such as waste management and energy consumption are critical. Today, the plane is seeking to go greener in pursuit of sustainability goals. KSA has a reputation of converting the hostile desert environment into hospitable and livable conditions. Almarai should not work against such goals and should adhere to the country’s policies regarding sustainability. Issues like plastic pollution and the use of chemicals in agriculture are also becoming environmental issues as people’s attitudes towards global warming change.

Legal factors

The legal factors entail the changes in the legislature of a country. Such fluctuations have already been witnessed in KSA starting from subsidy policies to labor policies. At the moment it is hard to classify the current legislative framework as good for business. The changes in laws have resulted in a scenario where the labor will no longer be cheap and where consumers will no longer have as much disposable incomes as before. The commodity prices will be affected significantly unless the country can find ways to supplement the citizens’ disposable incomes.

Market Strategies (4Ps)

Product

The term product is used to denote what a company offers to the buyers. Almarai produces and sells a variety of products that are highly demanded by the KSA residents. Initially a dairy production company, Almarai has diversified to bakery, juice and poultry products (Fabbe et al). These products can be classified as fast foods that are a mainstay in many countries, KSA included. The demand for some products like dairy is unlikely to deteriorate significantly except for the fresh milk. The products are highly perishable meaning they have to get to the consumers as quickly as possible.

Place

Place denotes the locations where the company engage the clients or where the actual consumption of the products is done. In the case of Almarai, its products are primarily sold in KSA and the GCC with other regions such as Southeast Asia and Africa also having been targeted. The company was established to address the country agricultural problems so it can be said that Almarai’s main market is KSA. With expansion, the company can successfully deliver products to other regions (Fabbe et al). The concept of place also involves the distribution networks used by a business to deliver goods and services to customers. The bakalas remain a critical distribution channel for the dairy products. However, other products like the infant formulas have not performed well due to the selection of the wrong channels.

Pricing

The price is the amount of money the customers pay for commodities sold by producers. The pricing strategy adopted by a firm determines its profitability and the affordability of the products. Almarai has expressed that some of its products are sold at prices higher than those of the competition (Fabbe et al). The pricing strategy used is cost-plus pricing where the costs are added to a mark-up. Additionally, value-based pricing is also visible with the company trusting that its premium brand can effectively attract premium prices. However, with the current political situation, the price sensitivity of the consumers and the expected diminishing purchasing power, the company should re-examine the applicability of value-based pricing.

Promotion

Promotion can be defined as getting the message to the customers and arousing their interest to purchase something. Almarai’s promotion currently depends on its strong and trusted brand with the brand message being “Quality You Can Trust” (Fabbe et al 3). The consumers in KSA are known to be loyal to brands and the fact that Almarai has managed to achieve it means their product promotion is relatively inexpensive. Additionally, the presence of branded refrigerated facilities close to the consumers (in the bakalas where consumers frequent) communicates the company’s message. The main aim of promotion is to create an awareness of the product and the company’s presence is visible throughout KSA and other markets it serves.

SWOT Analysis

SWOT analysis summarizes the internal and external factors that affect the success of a business. SWOT is an acronym for strengths, weaknesses, opportunities and threats. The strengths and weaknesses are internal to the business and are things a firm can do successfully or the gaps that are yet to be filled. Threats and opportunities are external to the business and are the things that can boost or derail the progress. The SWOT analysis for Almarai is as explained below:

Strengths

The strengths of a firm include the things a business does well, the qualities separating it from the competition, internal resources or the tangible assets that a company can rely on for growth. Almarai’s strengths are vast, including a strong brand name and customer loyalty that can guarantee sustained demand for its products. The company has a large capital base that allows it to invest in emerging opportunities and even to comfortably absorb temporary financial shocks caused by the changing legal landscape. Additionally, the company has a diversified portfolio that allows several revenue streams (Fabbe et al). Lastly, a vast market presence and a leading status in KSA and GCC give the company an edge.

Weaknesses

The weaknesses can be the things that an organization lacks, those that a competitor can do better, limitations on resources, or even an unclear selling position. For a powerful corporation like Almarai, the weaknesses are expected to be few. The main weakness of Almarai is the high operating costs that make it hard to sell at low prices. As things that competitors do better, Almarai faces a scenario where rivals can produce and sell more cheaply (Fabbe et al). Lastly, the company is overly reliant on its powerful brand as a promotional tool. The sensitivity of the consumers can place the whole company in jeopardy if major changes in aspects like prices occur.

Opportunities

The opportunities may include gaps in the market served by a firm, fewer competitors, or an emerging need for its products. KSA is a market full of opportunities for businesses like Almarai. The current legal climate has, however, diminished most of the opportunities that the company has been exploiting. However, the company can explore new opportunities to solve the water scarcity problem, including investing in water desalination technologies. There are other growth opportunities for Almarai as explained by Fabbe, Al-Amin and Cekin, including improving the efficiency of the bakala network and building dairy plants in new markets. Additionally, Almarai can sell distribution services to third-party producers of non-competing products.

Threats

The threats faced by a corporation can include emerging competitors, changing regulatory environment, changing consumer behavior, or even cases of negative media coverage among others. In the case of Almarai, the changing regulatory environment is a major threat in that the shifts from foreign to local workforce increases labor expenses. The reduced subsidies threaten the affordability of the company’s products and hence their demand. Competition is also a key threat considering major rivals such as Nadec and Al Safi Danone are merging to become an even more powerful competitor (Fabbe et al). With competitors affording to sell at lower prices, the changing consumer purchasing power could devastate the company’s market share.

Success Factors

Capital base

Almarai has a large capital base that can be invested in profitable ventures. The financial snapshot presented by Fabbe, Al-Amin and Cekin reveals that as of 2018 the company’s revenues totalled SAR 13.9 billion and the total assets values at SAR 31.9 billion. Additionally, the company is also backed by the Saudi government meaning any cases of financial shortage can be sorted through the sovereign wealth fund. Even with the emerging challenges in the business environment, a company with readily available capital can easily navigate through the challenges.

Novel technologies

The company has been exploring novel technologies that have enabled it to address the serious problems in dairy production. In all the decades it has been in operation, the company has shown that new technologies can be a success factor. Almarai has all the experience and knowledge needed to pursue growth opportunities availed by new technologies. A good example is the cooling systems used in the daily plants that allowed the company to improve the milk productivity of the cows (Fabbe et al). Innovativeness can also be classified alongside novel technologies, for example, refrigerated services that allowed Almarai to sell fresh milk.

Market leadership

Market leadership can be a powerful tool to propel a business to success. Almarai is indeed a market leader in the dairy production industry alongside other segments it serves. As a market leader, Almarai can enjoy a competitive edge when investing in new niche markets and in building a successful brand. Additionally, being a market leader could also mean having a vast knowledge base that can become a critical asset.

Logistics and distribution channels

Logistics and distribution channels explain how a firm gets products to the market to service their customers. In many cases, these two aspects can hardly be a success factor. However, Almarai has invested heavily in its logistics and distribution channels in a move that has availed new and sustained growth opportunities. The bakalas are the primary point at which the customers get their products. Almarai decided to make them the key delivery points and invested in refrigeration facilities rather than tasking the retailers to do so. Without these facilities, niche markets such as fresh produce and the growth they bring would not have been possible.

Segmentation Strategy

Psychographic segmentation strategy is adopted by Almarai whose products in the dairy segments are tuned to the needs, beliefs, and attitudes of different people. According to Fabbe, Al-Amin and Cekin, KSA’s dairy market comprise two broad segments namely long-life (shelf stable) and fresh. The segmentation was based on the consumer preferenced where some saw the chilled fresh milk as more nourishing and delicious that the shelf-stable (UHT) milk. Other consumers preferred the taste and convenience that comes with the UHT. The company notes that culture and the upbringing of the consumers resulted in the variances in the preferences. For example, foreign residents preferred fresh milk than the UHT milk while the Saudi locals were more in favour of the UHT.

It is also important to acknowledge behavioral market segmentation as another strategy used by Almarai. Behavioral segmentation includes varying products or tuning the products (and their delivery) to suit certain market segments. Examples include purchasing habits and brand interactions. In terms of purchasing habits, Almarai noted that Saudis usually got their supplies from the bakalas. The company then decided to use the bakalas as their main distribution channel and went a step further to improve the capacities of the bakalas to stock more products, including the perishable ones (Fabbe et al). Regarding brand interactions, Almarai acknowledges the importance of brands as many Saudis buy from specific brands.

Positioning Strategy

A positioning strategy allows a company and/or its products to stand out among the competition. It is important to acknowledge that the strategies can be derived from the competition, application, types of consumers, and the product attributes among others. Almarai’s positioning strategy can be described as a quality positioning strategy. The brand message for Almarai “Quality you can trust” as stated by Fabbe et al. Rather than responding to quality issues in a reactionary way, Almarai continuously seeks to offer customers quality products. A perfect example of how the company pursue quality is how it addressed the problem of packaging poultry products. The packaging was deemed to be messy because it would leak and the problem did not reflect the company’s premium brand. Almarai transformed the user experience by using better packaging techniques that were not only leakproof but also neat and clean. Additionally, the company sold its poultry fresh as opposed to the competitors who sold frozen products, and this could be deemed as another aspect of quality.

Customer Analyses

Customer demographics

Consumer demographics describe the characteristics of the targeted customers in the various market segments. KSA can be described as a metropolitan state comprising of people from different nationalities, ethnics, and cultural backgrounds. The country has been relying on imported labor from Southeast Asia and India among other countries. With several nationalities being present, Almarai does not see the need to tailor products to suit specific people. The dairy products are only classified into two (fresh and long life) to reflect the fact that foreign nationals prefer fresh milk while Saudi nationals prefer the UHT. Additionally, the company targets the larger GCC and Africa further increasing the diversity of the markets (Fabbe et al). Lastly, the products are consumed by all genders and ages, apart from the infant formula that is intended for infants.

Target customers

The products offered by Almarai are general goods that are usable by the general populations. The company does not have to target extremely specific populations, apart from the infants who have a specific product designed for them. Almarai targets all consumers of dairy products (Fabbe et al). The three target markets are, therefore, infants, foreign nationals, and Saudi nationals. The other market segments served by the company also display similar characteristics. In other words, the juice market and the poultry market are not highly specialized eliminating the need for Almarai to tailor-make any products.

Consumer behaviors

Consumer behavior explains the decision-making process through which the customers choose which goods and services to consume. Historically, KSA residents have been loyal to their brands, meaning that a company’s success is tied to the success of its brand (Fabbe et al). Almarai has been a successful brand and this can explain why most of the products have also been successful. Another major point to note is that the customers are sensitive to changes in quality and prices of the commodities. Varying the prices regardless of the changes in the operational efficiencies and costs will most likely alter how consumers purchase the products.

Alternatives

As the outgoing CEO outlined, the current legislative changes put Almarai in a tricky situation and with multiple alternatives that can be pursued to deter any deterioration in the company’s business. All the possible sources of growth explained by Fabbe, Al-Amin and Cekin are potential alternatives that can make matters easier for the company and the incoming CEO. A set of alternatives is as outlined below:

Outsourcing non-critical operations

Almarai hardly considers outsourcing any of its operations mainly because the company wants to be in full control of the quality of the products. However, operational inefficiency is a major problem that makes it difficult for Almarai to sell at cheaper prices as compared to the competitors (Fabbe et al). To improve the efficiencies, however, the management may need to consider outsourcing those business activities that are not critical to the quality of the goods. In the logistics, for example, the company can outsource all the delivery of the products (at least the long-life category) to the retailers as long as there will be significant cost savings.

Dairy production plants in other countries

The country may have some poor relations with others like Qatar that have enacted trade embargoes with KSA. However, international markets remain relatively open for companies like Almarai. Establishing large scale dairy plants in other countries where access to resources such as water and cheaper labor can save the company millions and at the same allow it to match the prices of the competitors. Declining demand due to diminishing purchasing power may become a reality if Saudi nationals fail to alternatives to supplement their incomes and replace the lost incentives. Lowering the prices offers Almarai a possibility to sustain the demand for its products.

New product segments

Almarai is in a good financial situation to enable it to explore new product segments that will turn a profit. However, going for further diversification at a time where there are segments that are yet to turn a profit may not sound prudent. It can be argued that Almarai would do better to divest in those unprofitable products are invest in new ones with better prospects. The country is yet to experience the true effects of the regulatory changes on the dynamics and composition of the Saudi population. It is yet to be understood how the foreigners will react to the looming unemployment in KSA. A plausible guess would be that the percentage of foreigners may reduce as more Saudis take up the jobs. Expensive segments like the fresh milk may be adversely affected if the portion of the consumers purchasing fresh milk disappears. Divestments in capital-intensive segments may allow the company to improve operational efficiencies in the less capital-intensive segments.

Exploit pharmacies to sell infant formula

It can be seen that Almarai is using the wrong channels to promote infant formula products. According to Fabbe et al, may consumers use the pharmacies to purchase infant formula products. Competitors have successfully exploited these channels and are performing better than Almarai in the segment. The management should, therefore, consider increasing their presence in these channels where they can exploit their strong brand to attract more consumers.

Recommendations

The business environment of KSA remains uncertain and companies like ALmarai can hardly make huge financial commitments to effect huge organizational changes. Currently, it can only be prudent to implement short term solutions and adapt as the changes brought about by the new regulations take shape. Even the short term solutions should not be allowed to cost exorbitant amounts of money. The three major recommendations that Almarai can consider both in the short term and long term (based on the alternatives above) are as follows:

Cease production of non-profitable goods

Such a move is largely intended to save costs for the company as management weighs alternative segments. The rationale for this recommendation is that the business landscape is likely to change allowing the company no time to improve the performance of the non-profitable segments. Saving the money will allow the company to explore alternative segments and to boost those segments with better prospects. As a short term solution, divesting in these segments will boost the profits as expenses go down.

Long-term solution to water scarcity

As KSA hopes to pursue sustainability in energy consumption and other areas, the private sector can seek potential opportunities in certain areas. The long term problem for the country and businesses is water scarcity. In some parts of the world, there are technologies that cheaply convert ocean water into usable water. Agriculture in KSA has overly relied on water reserves that are non-renewable. If companies can pursue technologies such as water desalination either by themselves or jointly with the government then the water scarcity can be solved in the long term and agricultural practices can resume to normal. However, the success of this option depends on how cheaply water can be produced and the quantities needed to carry out the water-intensive farming.

Consider shifting labor to other countries

Understandably, that the government of KSA seeks to solve serious issues facing the country by requiring the citizens to get more engaged in the country’s workforce. However, the nature of Saudi consumers makes it hard for businesses to prosper when forced to make huge changes to the quality and price of the products. Almarai has experienced a situation where changes in prices did not go down well with the consumers even after lowering the prices to levels that are still higher than what the customers were used to (Fabbe et al). The government’s decision to reduce foreign workers and making labor expensive will not allow companies to operate normally without having to raise the prices. Raises the prices in such a market may mean the difference between survival and collapse of the businesses. Exploring opportunities for cheaper labor from other countries may be both a short-term and long term solution to Almarai.

Implementation and Control

Depending on the recommendation adopted by the company, the management will pursue it in the form of change management. The biggest issue is the labor costs, and it is estimated that the immediate issue to be addressed by Almarai is seeking affordable labor. To implement such a move, the company will need to undertake an environmental analysis to determine the potential success factors and the threats to the successful implementation. It is also critical to examine how moves such as shifting labor-intensive operations to other countries will the government’s agenda. It might cause problems with the government that finances the company if the company works counter to the interests of the government. A stakeholder analysis of every major decision will need to be undertaken.

Conclusion

Almarai faces an uncertain future as the aspects of the business environment it has relied on for its success are taken away. While it may seem like a small decision, eliminating the subsidies makes it harder for Saudis to afford products and services (or diminished demand). One of the best ways to handle the situation would be to lower commodity prices to sustain demand. However, companies will find it hard to lower prices at a time when operational costs increase as labor expenses increase. The analysis of Almarai’s case presented here reveals that the company will need to reconsider various investment decisions, including divesting from segments that are not turning profits and investing in alternative segments with greater prospects. The situation is made worse, as explained in the customer analysis, by the nature and the changing composition of the Saudi population. Various alternatives and recommendations have been posed for the company to consider, both short term and long term.

Work Cited

Fabbe, Kristin, et al. “Almarai Company: Milk and Modernization in the Kingdon of Saudi Arabia.” Case Study. 2019.