Introduction

The modern Olympics games began in 1896 in Athens. Historically the games have survived many tribulations like wars and boycotts. Olympics are held every four years and the future of the mega event has grown due to the widespread perception that it has a positive impact on the economy of the host country and has positive spillovers.

Olympics being a mega-event require a large sum of money, which needs to be spent in order to develop the venue and infrastructure for the event. In order to justify the widespread expense at the public exchequer, economic impact studies become a part of the games. These studies invariable project and estimate inflow of large sum of money, which is supposed to have a sustainable effect on the economy as it, helps in the creation of long term of jobs. Apart from this, it is also believed to boost the tourism industry. Events, which are of the size and scale of the Olympics, are projected to attract a lot of foreign investment and are believed to have an impact on a large sum of money.

Apart from the socio-cultural impact, host cities stress the economic impact especially on the development of tourism. Though a plethora of research has shown that Olympics have advantages for the host, cities it is still unclear as to the benefit of the event over and above the cost of holding it (Kasimati 433). However, most of the analyses on Olympics games have been limited to the understanding of the macroeconomic effect of the event (Kasimati; Schulenkorf; Kirkup and Major; Owen). However, ex-post studies of mega sporting events have found no positive economic impact (Owen 1). According to the study conducted by Philip Porter, “no measurable impact on spending associated with the event. The projected spending and spillover benefits of regional impact models ever materialize” (Porter 61). Therefore, there is no consensus on the presence of economic impact of the Olympics. Further, no studies on the Olympics game have tried to ascertain the macroeconomic effect of the game.

In this paper, we will see if there is an economic impact of Olympics games on the economy as a whole. Here the element of analysis will not be constricted to the only macroeconomic effect rather we will discuss the microeconomic as well as the macroeconomic effects of hosting the Olympics game. The paper will thus try to identify (if any) the microeconomic or macroeconomic effects of the Olympics games.

Economic Impact

There is enormous evidence available, which will show the possible impact of the Olympics on the hosting city. Richard Coons observed that Olympics as the ground for increased public finance especially leveraged finance:

“Olympics in China is a culmination of 30 years of economic growth, which began with the country’s liberalizing economic reforms in the late 1970s. China has spent $42 billion on this Olympics, according to The Wall Street Journal. And it has spent $10.5 billion on environmental cleanup, as well as closed myriad factories and sidelined other economic activities in order to clean up Beijing’s notoriously dirty skies. Untold billions have also been spent in the last eight years on infrastructure for highways and airports to prepare for this culminating two-week coming out party. (Coons 32)

Thus, it is evident that Olympics and its hosting becomes a public project wherein mammoth expenditure on venues, infrastructure, housing, hotels, roads, urban revival, improving international reputation, increase in tourism, increase in employment, public welfare, etc. must be done in order to accommodate the project. These economists believe to be long-term benefits of the Olympics for which such public spending occurs. There are negative impacts that can be considered which are a high investment in public sports infrastructure which will become redundant after the mega event, crowding of cities, increase in rents of property, increase in business and employment which are, however, just temporary and cannot be sustained. Given this background, the paper will now conduct an analysis of the impact of the Olympics on the microeconomic level.

Microeconomic impact of Olympics

Before beginning a discussion on the impact of Olympics, it is imperative to understand what is meant by microeconomic impact of the Olympics. It means the effect of tthe he game on the profsportslity of the industry – here the industry is the Sports industry, which conducts such mega events. In this case, we will consider the Vancouver Olympics and its microeconomic effect.

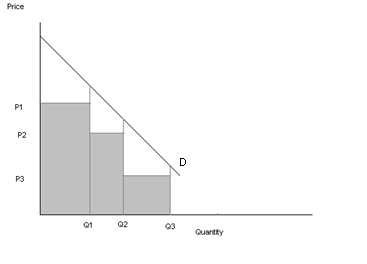

Revenue generated through the sale of tickets is obviously an economic impact of the Olympics. This is usually considered to an economic impact by the official measures of such games. However, conceptually this is incorrect as the gross benefit of the Olympics should be the area under the demand curve i.e. the demand for the tickets of the game. This is actually greater than the revenue generated from the sale of the tickets. Assuming that the tickets for Olympics are priced differently for different categories the demand curve can be represented as in the diagram in figure 1. The figure shows that the gross benefit derived from the Olympics games should be the grey area demarcated (revenue from ticket sale) and the white area is the consumer surplus. Further, it must be noted that the demand curve for Olympics games need not touch the axis or the edges of the revenue area.

Usually, the estimation would be to estimate the demand curves for each of the events and deriving the summation of the combined surplus for all the events in the Olympics. However, due to the complexity to estimate the demand curves and the area underneath them, this cannot be done.

Given the prices for the tickets for sale at the Vancouver Olympics and the number of seats available for sale, estimation for the overall revenue is available (Vancouver Organizing Committee ). Individual ticket prices at Vancouver games are taken to be the average of all the prices for the different events. Here the minimum cost of the tickets is $25 and the highest price is $1100. According to the official data, there are 1000000 tickets available at $25 (Vancouver Organizing Committee ). Here a simplified example is considered for the event, which has a low prices ticket, say $25.

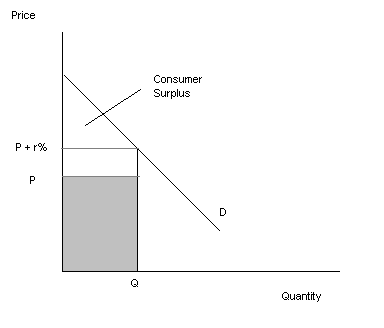

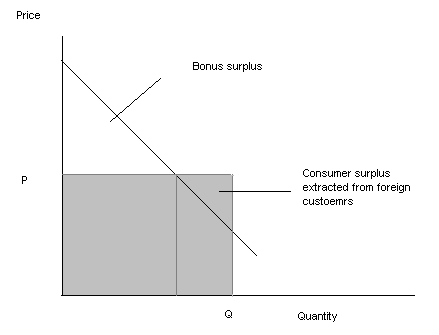

Figure 2 provides an analysis of the demand and consumer surplus in case of no bundling. In this case, there is no bundling of the tickets of different events in this case the approach that is usually followed is to discount a proportion of the surplus that is actually that of the consumer. In this case, the foreigners have priced a higher price than the domestic price. According to the figure, (figure 2) domestic tickets are priced at P and that sold to the foreigners is priced at P + r% where r is the extra cost that is applied. This is a means of differentiating the tickets. Now if bundling of the foreign tickets is done as is done in most cases, as shown in figure 3, then the committee will be in a position to extract a part of the surplus from the consumer.

Thus, the prices are fixed and the demand is downward sloping. Given this the there will be a downward-sloping demand curve. In such a situation when the price of the tickets is low then the consumer surplus is higher. Therefore, the tickets are at a fixed price for a downward-sloping demand curve.

However, the direction of the economic effect affecting the wages of the sports teams and players is uncertain. Sports economists have found that the economic impact of Olympics games to be lacking and therefore there is no evidence of it affecting the teams and facilities (Owen 3).

Macroeconomic Impact of Olympics

In this respect, the overall economic impact is measured as a percent of the GDP. The other impacts are on the level of infrastructure and the volume of inflow of investments (foreign and domestic), and the last is the impact of tourism. In order to understand the overall economic impact of Olympics on the economy, there are three kinds of effects that must be considered – direct effect, indirect effect and induced effect. The direct effect is considered the primary impact and the indirect and the induced together form the secondary impact (Kasimati 434). Therefore, the study in the previous section of the effect of game tickets is considered to be a direct effect.

Sustainability reports of the 2010 Vancouver Olympics show that there has been analyzed to understand the expected effect of the game on the city. According to the data derived from the report, we see that the excepted that tourism influx in Vancouver due to the Game will provide an increase in the GDP.

According to the estimates of the Olympics, committee there is estimated to be an increase in the GDP assuming a low impact on the economy, to be of $2.7 billion and if the best-case scenario is considered Olympics will boost GDP by $4.6 billion (Nebbeling 31). The event is expected to increase employment and is expected to add 37 thousand jobs in a worst-case scenario and in the best-case scenario is expected to be 83 thousand. In terms of taxes, the country is supposed to gain around $175 million when the worst-case scenario is considered and if the best-case scenario is considered then there is expected to be an increase in $467 million in federal taxes. Provincial taxes are too expected to increase by $426 million in the best-case scenario and $164 million in the worst-case scenario. Local taxes too are expected to rise by $37 million if the worst-case scenario occurs and if the best-case scenario is considered then there should be an increase in local taxes by $89 million. Therefore according to the estimates in the best case scenario tourism impact of the game is supposed to extend until 2020 (Nebbeling 29).

The idea that is portrayed here is that the economic impact of the Olympics is expected to create a multiplier effect and thus bring is further growth to the economy. The multiplier analysis is one of the most common means of studying the impact of the inflow of money and investment in the economy. The most common effects through which a multiplier effect is set in are sales, income, and employment (Kasimati 434). Sales are also known as a transactional multiplier which is measured directly through the sale of tickets or the boost in the sale of other industries due to the Olympics games like sports good industry, hotel industry, etc. Thus, this shows the effect on the business activity and turnover rate. The household income multiplier shows that effect of the multiplier on the household income and the employment multiplier shows the effect on the employment generation in the economy. Sales multiplier is the most used economic impact indicator; however, household income multiplier is more relevant according to some economists (Kasimati 434). The reason for this is the effect will show the effect of the money injected on the domestic income and the effect it has on their standard of living. The argument is that if there is a positive multiplier effect of holding the Olympics on the household income of the domestics of Vancouver, then it will be a more effective measurement of the economic impact than the effect of sales. Thus Kasimati states: “…the host community is not interested in knowing how many sales are attributable to the hosting of the Summer Olympics, but rather what proportion of these sales will end up as residents’ income.” (935)

In terms of employment multipliers, economists consider it the least reliable of the three multiplier effects as the basic assumption on which whole theory is based – that there is full utilization of the existing labor force – is flawed. Such a calculation may give erroneous results, especially in the case of one-time sports events like the Olympics. This is so because Olympics occur once in one city.

For the event employees from different countries flock in to participate in the infrastructure building and other activities. However, it does not guarantee that the whole of the labor force will be employed in the making of the infrastructure. Thus is believed that the “short duration of the Games does not necessarily justify the hiring of new employees, the generation of permanent full-time jobs and the sustainability of the employment effects.” (Kasimati 435)

In this respect, there is a high demand for skilled labor for a short period. Thus, other alternatives are resorted to i.e. by asking existing employees to work overtime or employing foreign workers. In this case, if we assume the case of construction workers, we will see for a short period there is a fixed pool of labor in the economy. As there is inelastic demand for labor, the laborers can increase the wage rate. However, the employers bring in labor from outside in order to increase the labor pool and thus, decrease the wage rate. Therefore, this does not have any multiplier effect on the domestic economy as a part of the income goes to the foreign country’s GDP.

Further with the increase in investment, we may see that there is an increase in the GDP. As there is an increase in the investment (assuming simple Keynesian model) there will be an increase in the amount of the fixed investment as well as the government spending of the economy due to the game. This will induce an increase in the aggregate demand that will again increase consumption because compunction is a function of aggregate demand or income. Therefore, there will be an increase in GDP by the amount of the multiplier. Thus, we see that there is an impact of the Olympics on the economy.

Conclusion

From the study, it is evident that there exists an economic impact of mega sports events like Olympics. The above study of the effect of Vancouver Olympics 2010 shows that it is expected that it will have a positive effect on the economy. Olympics’ games’ economic impact is manifold. First, the impact is on the consumers. The pricing strategy employed by the Olympics committee usually aims at extracting the surplus from the consumer. The second observable impact is on the overall economy. The impact is in the form of a multiplier effect that may be that of investment, revenue, employment or income. Thus, theoretically higher the level of investment, the greater will be the impact on the GDP, which will increase due to the positive impact of the multiplier. Further employment too will increase, however, due to the temporary and short-term nature of the increase; it does not leave any sustainable impact. Household income is of importance, as an increase in this will affect the overall standard of living of the people thus increasing welfare and sustainable development for the people.

Works Cited

Coons, Richard. “The Olympics: An Inflection Point In Leveraged Finance?” High Yield. 2008: 32.

Kasimati, Evangelia. “Economic Aspects and the Summer Olympics: a Review of Related Research.” International Journal Of Tourism Research 5 (2003): 433–444.

Kirkup, Naomi and Bridget Major. “The Reliability of Economic Impact Studies of the Olympic Games: APost-Games Study of Sydney 2000 and Considerations for London 2012.” Journal of Sport & Tourism 11(3-4) (2006): 275–296.

Nebbeling, Ted. The Economic Impact of the Winter Olympics & Paralympic Games. British Columbia: Ministry of Competition, Science and Enterprise, 2002.

Owen, Jeffrey G. “Estimating the Cost and Benefit of Hosting Olympic Games: What Can Beijing Expect from Its 2008 Games?” The Industrial Geographer 3(1) (2005): 1-18.

Porter, Philip K. “Mega-Sports Events as Municipal Investments: A Critique of Impact Analysis.” Research, Sports Economics: Current. John Fizel; Elizabeth Gustafson; Lawrence Hadley. Westport, CT: Greenwood Publishing Group, 1999. 61-74.

Schulenkorf, Nico. “An ex-ante framework for the strategic study of social utility of sport events.” Tourism and Hospitality Research 9(2) (2009): 120–131.

Vancouver Organizing Committee. Ticket Prices. 2009. Web.