Introduction

Payroll costs refer to the costs that an employer incurs for services provided to an employee (Bratton 2007). This includes the amount paid to an employee as salary and benefits and the amount deducted by an employer and paid as tax to the relevant authorities (Brown 2001). If the turbulent economic times are anything to go by, then there is a likelihood that in the next couple of years there will be pressure for employers to reduce the payroll cost. This discussion examines the various ways in which payroll costs can be reduced whilst taking into account the need to maintain focus on the achievement of wider corporate goals and plans.

The global economic crisis that has engulfed the whole world seems to have hit almost all sectors of the economy really hard (Armstrong 2010). Every person seems to be feeling the pinch and drastic and sometimes desperate measures have been taken to avert the severe impacts of the crisis. Employers have been also badly affected and in an attempt to remain in business are now suggesting reducing the payroll costs (Armstrong 2002).

Since this issue first emerged, it has sparked a fair share of controversy as it is viewed by some people as an addition to the already existing problem rather than a solution. However, employers think that this can be done in a way not likely to worsen the already critical economic situation (Torrington 2005).

Performance rewards are incentives given to employees as a way of motivating them to work harder and thus increase the productivity of the company (Torrington 2005). The rewards given are based on an employee’s performance for a given period usually a year and the rewards may be either in monetary value or a promotion or both. It is not always that money is at the center of performance and reward management. Sometimes, the performance rewards are about adding motivation to an employee both intrinsic and extrinsic (Torrington 2005).

Practical and Theoretical Problems Associated with Performance and Reward Management

Despite having been practiced by many organizations for many years, performance rewards and their management has always brought about some challenges which most organizations are still struggling to deal with (Torrington 2005). One of the key challenges is ensuring that the performance rewards are in line with the goals of an organization and that they will help an organization achieve its objectives while at the same time keeping the employees satisfied (Brown, 2001). The ability of the rewards given to enable a company to remain competitive while at the same time be able to achieve equity internally has also posed a great challenge to many organizations (Kandula 2006).

The tough economic times have also been another milestone for most organizations who would want to cut their cost but at the same time ensure that the pay structure for the employees is reasonable and coherent (Brown 2001). Flexibility is yet another issue whereby organizations would like to offer performance rewards that are flexible to cater to the ever-changing and dynamic business environment (Grosser 2007). Being able to reward the high-achieving performers in the organization without appearing to favor some employees over others is yet another challenge (Wright 2004).

Impacts of changes in Business Environment on Rewards Policies and Practices

The reward policies and practices in organizations vary mainly depending on the needs and goals of an organization (Heneman 2002). When evaluating the reward policies and practices, several things must be put into consideration (Kandula 2006).To begin with, the objectives that the organization hopes to achieve must be put into consideration. The needs of employees on the other hand must also be considered to ensure that they are kept satisfied and motivated.

The business environment is quite dynamic. This means that it keeps changing and these changes have tremendous effects on the reward policies and practices of an organization (Armstrong 2010, 492). For instance, when there is an economic crisis, the volume of sales are likely to decline. This will in turn affect the amount of money given as rewards so that the rewards are reduced. When the business environment is experiencing stability, there is a high likelihood of the rewards policies to be adjusted to favor employees (Griffin 1993).

Link Between Reward Policies and Practices

Reward policies are guidelines that have been put in place to guide employers as they set the performance rewards to their employees in a bid to motivate them and thus ensure high productivity of the company (Currie 1997). Practice on the other hand refers to what goes on the ground, in various institutions and organizations as far as rewards are policies (Griffin 1993). The link between reward policies and practices only exist theoretically and not practically (Collings 2010). Looking at the practical scenario, each aspect seems to be departing from any link that may be in existence.

A comparative ratio is used to measure the actual rewards that are given to employees against what the policies of rewards stipulate (Collings 2010). When the comparative ratio is at 100%, this means that the rewards given to employees are in line with the reward policies. When the comparative ration is below 100%, this is interpreted to mean that the reward given is less than what is provided in the reward policy, and when the ration is above 100%, then it means the rewards are higher than provided in the reward policies (White 2000).

There are three types of comparative ratios that are used. They include:

- Individual comparative ratio- This looks at the position an individual holds in an organization against the reward given to such an individual and this is read together with the provisions of the reward policies (Bratton 2007,p. 345). Depending on the provisions of the reward policy, the individual’s rewards may be adjusted upwards or downwards (Armstrong & Brown 2005, p.456).

- Group comparative ration- This is the general evaluation of the rewards given to employees in the entire organization in comparison to the general performance of the company and the provisions of the reward policies regarding the same (Stone 2002). This means that if a company’s performance is high, then the rewards of employees, in general, should also be high as required by the provisions of reward policies.

- The average comparative ratio- This refers to the average rewards given to each individual and involved totaling up the sum of all rewards dividing by the number of individuals. This helps determine the highest and lowest rewards given to employees respectively (Thorpe 2000).

These comparative ratios help draw a line between reward policies and practices. These differences come about as a result of the following:

- The difference in performance ratings of employees.

- When the job tenures of different employees differ. This means that there are employees who come in for short contracts and later leave the company, others resign and others are promoted (Thorpe, 2000).

- When a new pay structure is introduced, there may be some anomalies and these may bring about the difference.

- The rate at which an organization is growing also brings about the difference in reward policies and practices.

In essence, therefore, it is more of a departure point than a link between reward policies and practices.

Examples

General Motors is a company that is involved in the manufacture of vehicles. A few years back, General Motors was faced with a crisis where a large number of their vehicles were found to be faulty and had to be recalled (Armstrong 2010). As a result, the company suffered immense losses (Armstrong 2010). During this time, the performance rewards given to the employees were affected and most of them had to be revised downwards. Most of the rewards were revised way low than what is required by the reward policies. This shows the departure or relationship between reward policies and practices.

Coca-Cola Company is multinational dealing with the manufacture of non-alcoholic beverages. Having a large market share of about 200 countries globally, Coca Cola was one time faced with a problem with one of their products known as Dasani Mineral Water (Bratton 2007). The negative publicity that the company was receiving as a result of this badly affected the performance of the company forcing it to revise downward all the rewards of their employees (Bratton 2007).

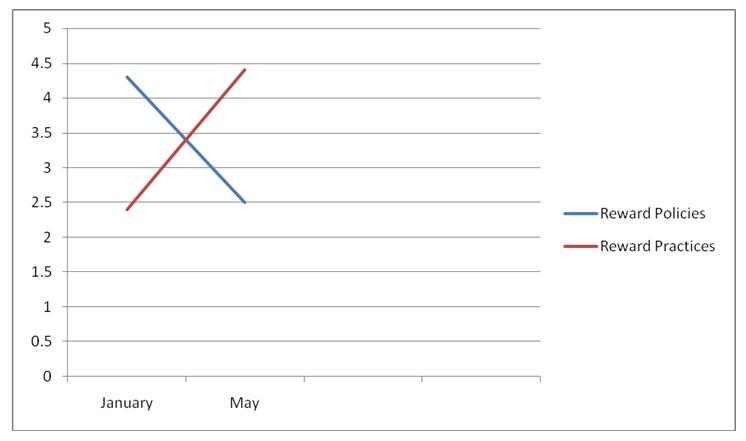

In essence, reward policies and practices rarely go hand in hand with most companies offering their employees rewards that are much lower than what is required by reward policies (Bratton 2007). The graph below shows the disparity that exists between reward policies and practices currently and that the link between these two aspects is very minimal.

Emerging Trends in Reward Practices

The business field is one of the most dynamic. This means that it keeps changing and organizations must therefore be flexible enough to change with the changing times (Hume 1995). Various trends keep emerging and organizations that are not ready to absorb these changes may find it difficult to survive in the competitive market. One area that seems to be having new trends almost every day is the area of performance rewards. There are four new approaches that most organizations are now considering embracing in a bid to remain relevant in the market (Hume 1995).

- Skill-based approach- This is where the pay a person receives is based on the skills that they possess as opposed to the value attached to the position they hold within the organization (Shields 2007). This means that the more skills an employee possesses, the higher the pay, and the vice-versa is true. This is unlike the current approach where an employee would be paid based on the position they hold.

- Broad banding- This is where organizations come up with a pay structure that contains job grades and respective remuneration (Hume 1995). Jobs are graded according to an evaluation that is carried out. Every job group has a range of pay. The higher-grade jobs get a higher remuneration (Hume 1995). This method has been said as one that motivates employees to work harder to jump to the next job grade. This is opposed to the current trend where a certain job position is valued in terms of remuneration based on the current market trends (Robinson 2006).

- Variable pay- This is concerned with the rewards that employees get for their performance aside from the basic salary (White, 2004). The traditional way of looking at it would reward an employee based on the ratings of performance. However, under variable pay, an employee is rewarded for attaining certain objectives that are predefined and within a given period. One has to re-earn this kind of reward each year and this means that if an employee does not hit the required targets and objectives for the next year, they will not enjoy these rewards (White 2004).

- Team Rewards is yet another emerging trend in performance rewards. This is where companies are encouraging and motivating employees to work as a group as it has been established groups or teams are better placed to achieve the set goals and objectives or an organization more than individuals. A team is then rewarded depending on their performance and based on how well they have managed to achieve the set goals and objectives (White, 2004). For example, most companies rated Fortune 1000 companies are already adopting this form of reward policy.

These emerging trends in performance reward practices are to be contrasted with emerging reward policies (Corby 2008). It has been noted that most policies that are emerging are pretty similar to the prevailing ones and thus defeating the purpose for harmonizing practices and policies. Most of the emerging reward policies have been formulated without taking into consideration factors like technology which has now opened up markets thus stiffening competition (Corby 2008, p.432). The policies have also not taken into consideration the dynamism of the business field. For this reason, there continued to be a disparity between policies and practices, Most of the emerging reward policies seem to emphasize rewarding an individual based on their performance over a given period. This policy does not take into consideration other factors like people who may have helped to make this achievement come true.

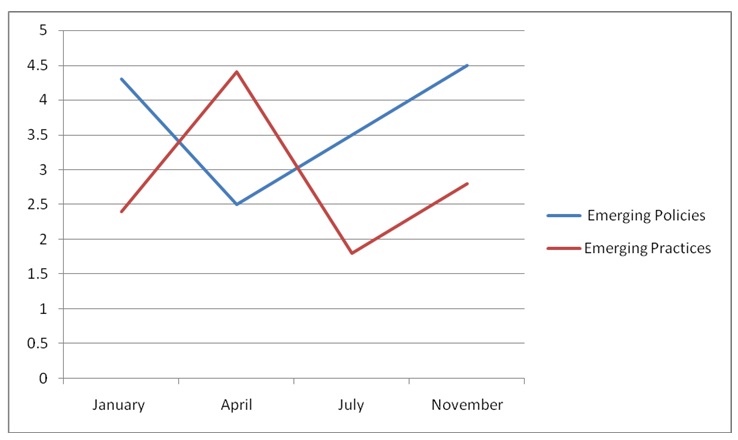

The emerging trends are also emphasizing rewarding employees based on monetary rewards while it has been established that there are other ways in which employees may be rewarded (Group 2001). With the introduction of new forms of rewarding employees other than monetary forms, employees are not only motivated to work harder but are also allowed to grow. The previous approach focussed on motivating employees so that they can become more efficient thus increasing productivity, ensuring the volume of sales escalates and as result the profit margins of the organization project (Corby 2008). However, the emerging trends seem to be balanced so that both the growth of the organization as well as the growth of an individual employee is taken into consideration. This approach is considered more holistic. Virgin Atlantic Airways is one of the companies that embraced the merging trends on reward practices and this has seen its profit margins go up by a considerable percentage (Corby 2008). The graph below shows the disparity between emerging trends in reward policies and emerging trends in reward practices.

Conclusion

Based on the above discussion, a couple of issues have emerged. Performance rewards are some tokens of appreciation given by employers to employees due to their exemplary performance in their work. They are meant to boost the motivation of an employee so that they can work even harder and thus increase productivity. By so doing, the volume of sales of the company will go up, and consequently, the company will record a higher profit margin. Reward practices on the other hand refer to the actual practice regarding employee rewards that take place in organizations. Drawing this distinction is important as it helps one understand that not all organizations and not in all instances that organizations follow the reward policies laid down to the letter.

There are several reasons why organizations are not able to keep with the policies stipulated, the main reason being the dynamism of the business field. This means that organizations are forced to change their practices as the business environment keeps changing so that they can remain relevant in a market where there is the cutthroat competition between various products and services.

If businesses always keep up with reward practices as provided by the policies, they face a threat of closing business, as the practices could be very rigid. The lack of flexibility leaves most organizations little or no option at all but to flout and overlook some of the laid down policies regarding reward policies. For this reason, there does not seem to exist any link or relationship between the rewards policies and practices. The graphs above show that these two concepts always move in converging directions because many organizations do not take the two hand in hand. There are times when these two concepts interact but this is very rare.

Comparing the prevailing or the current trends in reward practices and the emerging trends, one can draw a distinct difference in that the latter seems to be bringing some form of balance as far as the satisfaction of both the employee and the employer is concerned. These trends are not just about motivating employees to work hard so that the profit margins of the company can go up, but also that employees are allowed to expand in their career growth.

In a line with this discussion, it is can be concluded it is now possible for employers to reduce payroll costs. This will be done by revising the performance rewards downwards. The emerging trends of reward practices will help employers to do so smoothly without having to lay off some workers. By embracing these trends companies will not only cut the expenses of the company by reducing the payroll costs but will also increase the productivity of the company in general.

Recommendations

When companies are facing downtimes due to a financial crunch, the biggest headache of any employer is to be able to deal with the crisis without having to interfere with the employees. Those employers who have resulted in laying off some of their employees have hard it rough and know only too well why it is important to consider alternative methods of dealing with the crisis.

One way of effectively cutting the payroll costs is striking a balance between the reward policies and practices. The reward policies that are formulated should not be too stringent to ensure that companies can comfortably comply without fearing threats of being thrown out of the market by the highly competitive forces that are present in the market. When the policies are formulated in such a manner as to ensure flexibility it will pretty easy for an organization to follow them without deviating.

Another way out regarding the disparity between the policies and practices as far as rewards to employees are concerned is coming up with wholesome policies. The prevailing trend in rewards given to employees seems somewhat biased so that some employees feel as though some of their colleagues are being favored over them. Organizations are therefore encouraged to come up with reward practices that tend to recognize employees in terms of groups rather than individuals. This way, every employee is made to feel that they are part of the organization and that it is the collective efforts of every employee that has brought the success of the company.

Companies should also embrace the emerging trends in reward practice. These new trends seem wholesome and accommodating so that a balance is struck and that both the employers and the employees are satisfied. Once employers have embraced these trends, even in times of financial crunch and hard economic times, there will be no need to lay off workers and yet the business will still be able to run on smoothly without any hurdles. This is food for thought for all organizations looking to keep stable profits even in hard economic times. These basics are the cornerstones of all organizations. This means that every organization must take serious considerations and ensure that all attempts are made to strike a balance between the reward policies and practices. While it may not always be possible to have these two aspects linking, organizations must ensure that the disparity is not as wide as this would mean that there one of the parties is being unfair to the other.

References

Armstrong M. (2010), Handbook of Reward Management Practice: Improving Performance Through Reward. 3rd ed. London: Kogan Publishers.

Armstrong M. (2002) Employee reward. Michigan: CIPD.

Armstrong, M & Brown D. (2005) Strategic reward: making it happen. Kogan: Kogan Page Publishers.

Bratton, J. (2007) Reward management. California: VDM Verlag.

Brown, D. (2001) Reward strategies: from intent to impact, Michigan: CIPD.

Corby, S. (2008) Rethinking Reward (Management, Work and Organisations). New York: Palgrave Macmillan.

Collings, D. G. (2010) Human resource management: a critical approach. New York: Taylor &Francis.

Currie, D. (1997) Personnel in Practice. London: Wiley-Blackwell.

Griffin, R. (1993) Management. Houghton Mifflin.

Grosser, S. (2007) Reward Management. California: VDM Verlag.

Group, H. (2001) Reward management: the impact of current economic conditions on reward programs. London: Hay Group.

Heneman, R. L. (2002) Strategic reward management: design, implementation, and evaluation. New York: IAP.

Hume, D. A (1995). Reward management: employee performance, motivation, and pay. London: Blackwell Business.

Kandula (2006) Performance Management. Michigan: PHI Learning Pvt. Ltd.

Robinson, A. M. (2006), Employee Financial Participation and Productivity: An Empirical Reappraisal, BJIR, Vol.44, 1, pp31-50.

Shields, J. (2007) Managing employee performance and reward: concepts, practices, strategies. London: Cambridge University Press,

Stone, F. (2002) Performance and reward management. London: Capstone Pub.

Torrington, D. (2005) Human Resource Management, California: FT Prentice Hall.

Thorpe, R. (2000) Strategic reward systems. London. Financial Times.

White, G. (2000) Reward management: a critical text. London: Routledge.

White, P. (2004) Reward Management. London: McGraw-Hill Education.

Wright, A. (2004) Reward management in context. Michigan: CIPD.