Key person and his/her position in the organization

A.G. Lafly, chairman of the board, president, and CEO of Procter and Gamble is the main decision-maker.

Basic facts of the case

Founded in 1837 Procter &Gamble is an American company, one of the leaders of the world market of consumer goods. The headquarters of the company are in Cincinnati, state of Ohio. Over the past 20 years, Procter & Gamble – the world’s most sophisticated marketing machine – withdrew to the market many good brands. This Vicks, Oil of Olay, Pantene, Cover Girl, Noxzema, Clarion, Old Spice, Max Factor, Giorgio, Baby Fresh, Tampax, Iams, Spinbrush, Clairol, Wella, and Glide. But in fact, P & G bought all of these 16 brands and restart them as their own.

One recent acquisition could become Gillette – producer of shaving supplies, shaving cream, batteries, and toothbrushes. As a result of the merger, which should be called a unique opportunity and miracle-transaction, this will create the world’s largest in the industry. Buying Gillette was preceded by two more major acquisitions P & G: in 2001 for 5 billion dollars a manufacturer of hair dyes Clairol was bought, and two years later – German company Wella.

Now manufacturers of the consumer goods sector have been caught between declining sales, rising costs, and reduced opportunities for price manipulation. P & G expects that the increase in the number of super brands will help it cope with the severe situation in the industry. Competing for the attention of the consumer is now very tight.

P&G is the most important competitor to Unilever on the market of personal hygiene products, to which half of the business is fallen to Unilever. In turn, Gillette competes with Unilever as the producer of toothpaste, deodorants, and toilet water. After combining efforts, P&G and Gillette have to increase their chances by recapturing the positions Of Unilever. As history shows, competitors are adapted to the new medium on the market very rapidly.

But it is first necessary to determine, what value has the size of the company. So far it cannot be said with confidence that the companies, focused on several basic brands, as a result, will lose to giants in the adjacent categories. The supporters of the expansion of product briefcases assert that the important company can due to the effect of scale decrease expenditures, and the saved money be used to increase the investments into the advertisement and the innovations. However, one should consider that there is a risk of anti-savings on the scale. Company- giants are less maneuverable, and their expenditures tend to a sharp increase.

In particular, the completion of the transactions of confluence can last very long. Until now, P&G yet it did not solve all questions to complete the process of the integration with Gillette. However there it was, at the given moment the presence of a strong brand is more important than the size of the company. Therefore the CEO of the company has to choose one of the alternatives to assure further growth.

Alternatives

- A – Concentrate on developing products of distinction

- B – Concentrate on regions where the potential of growth rate is substantially higher (India, China)

- C – Increase expenditure on research and development and contribute additional innovation in the already formed brands

- D- Transfer the organizational management from a regional basis to global strategy

- E – Combination of B and D

Chosen alternative: The chosen alternative is E.

Justification for your choice

P&G should pass the control of business according to the regional sign (in individual countries) to the scheme, where each region of business is governed centralized by global bosses, including goods for child care, cloths care, hair, and goods for the health. Regional managers become accountable to the leaders of global subdivisions, but a large part of the marketing solutions are solved independently. The global brands of P&G the strategic solutions are received by the Presidents of those brands.

With the old, regional structure the brands cleaning products or toothpaste have less attention because they did not have the priority. Accordingly, alternatives B, D, and their combination met all the absolute criteria.

What do you expect to happen as a result of implementing your decision?

Reconsideration or simply the comprehension of the mission of the enterprise gives birth to the forces, which will lead the company to completely different prospects and possibilities. Many earlier questions arise and would be answered. On what market we do work? Which competition on the market, where we do work? What strong sides of enterprise will make successful its further development? How to avoid threats from the side of the weak sides of enterprise? How to in the best way carry out the formulated mission and lead the enterprise to an increase in its profitableness?

The divisions with the most potential will be primary and the divisions that lag in profits would be abandoned in favor of the prospective ones. Therefore the profit between divisions and the annual growth would be equalized, thus help to implement a global marketing strategy for the corporation as a whole.

Short Cycle Analysis

Who is the main decision-maker here?

A.G. Lafly, chairman of the board, president, and CEO of Procter and Gamble is the main decision-maker.

Key issue

How to continue the upward performance of the company and the trend.

Sub issues

- The lack of new products against popularizing the established trends.

- Fulfill the potential to grow more internationally.

- The possibility of affecting the image of the company due to reducing employee’s staff one company and increase in the new one.

- Competitors position

- Mediocre profits in the snack and beverages sector.

Why now?

The company is about to make a huge merger with Gillette which should require a different strategy and different approach since the market can be affected especially from the competitor’s side, so several steps should be taken now.

By when must the key person make this decision?

The decision should be made before the company starts restructuring its organizational and marketing issues due to the merger, especially the possible dismissal of the large number of employees that could affect the image of the company. Another issue in the merger is renewing the image of the company as an innovator and present new products along with a new marketing campaign to attract new customers.

What are the stakes?

Questions to ask

- Does the strategy keep the growth rate high?

- Will the global management fulfill its expectations?

- Will the expenditures be minimized?

Long Cycle Analysis

Statement of problem or aspiration: As the “Old” brands, where growth rates are relatively lower for manufacturers of consumer goods are not the source of faster growth. Lafly, the president of Procter& Gamble should be concerned about the possibility of the company reaching a steady state that could be overwhelmed by new brands and companies.

Importance-Urgency Matrix

SWOT analysis

Absolute criteria

- A1 – The brand is equally recognizable in all divisions of products

- A2 – Regionally and globally the brand has the same positive appreciation

- A3 – Demand for the product exceeds the demand for innovative approaches for re-branding

- A4 – Absence of weak follow-up brand products.

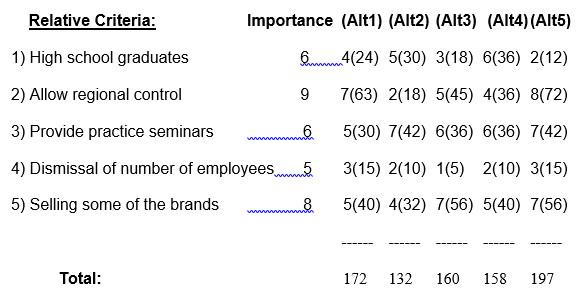

Relative criteria

Alternatives

- Alt1 – Concentrate on developing products of distinction

- Alt2 – Concentrate on regions where the potential of growth rate is substantially higher (India, China)

- Alt3 – Increase expenditure on research and development and contribute additional innovation in the already formed brands

- Alt4 – Transfer the organizational management from a regional basis to global strategy

- Alt5 – Combination of 2 and 4

Analysis of alternatives against absolute and relative criteria

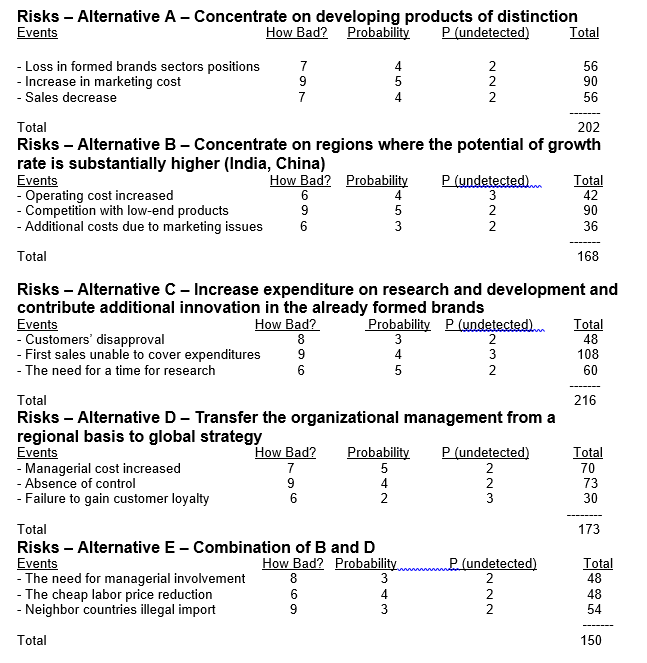

Risk Management