Abstract

When analyzing company performance, it is essential to take into consideration the different methods and techniques that are recommended for company analysis. The paper explores what sensitivity analysis is all about and how analysts use it in making decisions that relate to capital budgeting. This is only possible where one can ask himself or herself the what-if questions. For instance, what would be the effect on Net Present Value, if the cost of capital increased by 1%? The paper also gives details on two alternatives in the financial statements of Republic Airways. The Net Present Value has been used to determine the viable alternative between the two. Further, the weighted cost of capital has been calculated and it has been used to aid in the calculations of the Net present Value.

When analyzing any company, various techniques can be used, the paper gives detailed discussions on how the WACC, NPV, and sensitivity analysis have been used in the analysis of Republic Airways.

Weighted Average Cost of Capital

A company must be able to make considerable returns to satisfy the providers of finance who basically include the owners, creditors, and providers of debt. If a company has its shareholders as the only investors, then the required rate of return on the equity capital would be the company’s cost of capital. This is however not the case in most companies because of the presence of different components that make up the capital structure, and hence the concept of the Weighted Average Cost of Capital (Brigham & Ehrhardt, 2010).

The different components of capital that companies use usually have different risk profiles; they, therefore, have different required rates of return. Each component’s required rate of return should be calculated before the cost of capital can be determined effectively. The value found after calculating the different required rates of return is known as the component cost of the capital component. The Weighted Average Cost of Capital is therefore the weighted average of the different component costs, and it is this value that provides a basis for analyzing and making decisions on capital budgeting (Brigham & Ehrhardt, 2010).

Essentially, For Republic Airways which is financed by both equity and debt capital, the Weighted Average Cost of Capital can be calculated as follows:

WACC = E/V × Re + D/V × Rd (1 – T)

Where:

- Re = cost of equity

- Rd = cost of debt

- E = market value of equity

- D = market value of debt

- V = market value of debt + market value of equity

And T = Corporation’s tax rate

Optimal WACC = 9.2% + 8.97% + 8.48%

___________

3

= 8.88%

= 9 %

This means that a 9% return is the most favorable return that Republic Airways can pay its providers of finance without compromising its profitability and liquidity levels.

Net Present Value

When determining the viability of taking a project or multiple projects, the net present value proves to be an essential technique. This is because it helps a decision-maker to decide upon the best course of action to take when faced with uncertainty. The Net Present Value is the value derived after deducting the initial outlay from the sum of the present values of expected future cash flows discounted at a firm’s cost of capital.

Where a decision is to be made based on one alternative, then the alternative should only be considered if the Net Present Value is positive or greater than zero and it should however be rejected when it turns out to be less than zero. When faced with two or more alternatives, provided they are mutually exclusive alternatives, then the alternative with the highest Net Present Value will be the most viable between the two (Gitman & McDaniel, 2008).

In the case of Republic Airways, using the optimal Weighted Average Cost of Capital of 9%, the NPV of the two scenarios, A and B can be calculated as follows:

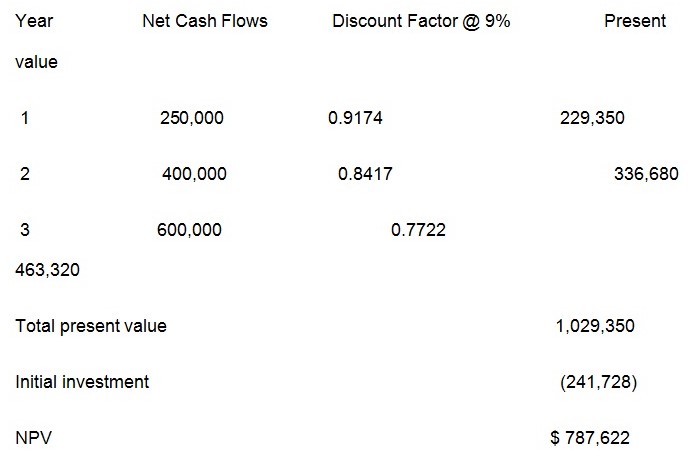

Alternative A

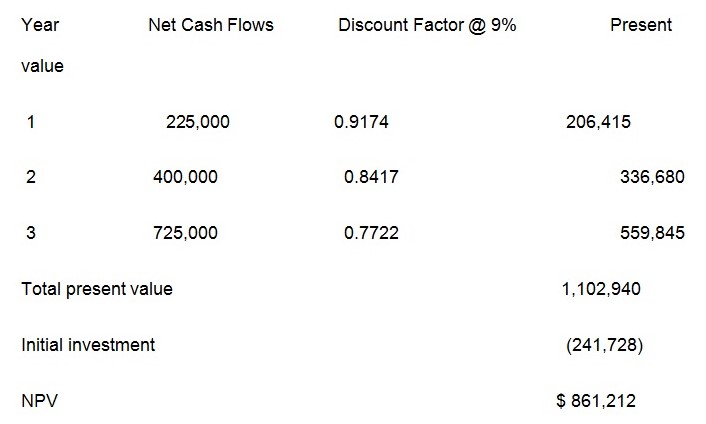

Alternative B

From the NPV calculations, it is very evident that the most viable alternative for republic Airways is alternative B, as it gives a higher NPV value than alternative A.

Sensitivity analysis

This type of analysis is used to establish how various independent variables’ values will affect a given dependent variable when there are specific assumptions given. Basically, the technique helps an analyst to forecast the possible outcomes from decisions made during any decision-making process. In analyzing companies, for instance, sensitivity analysis can be used to determine the impact of variations in interest rates in relation to the price of a loan note or bond. It, therefore, provides a valuable means by which one can measure the effects of the real outcomes as compared to the forecasted outcomes of a given set of variables (Pratt & Niculita, 2007).

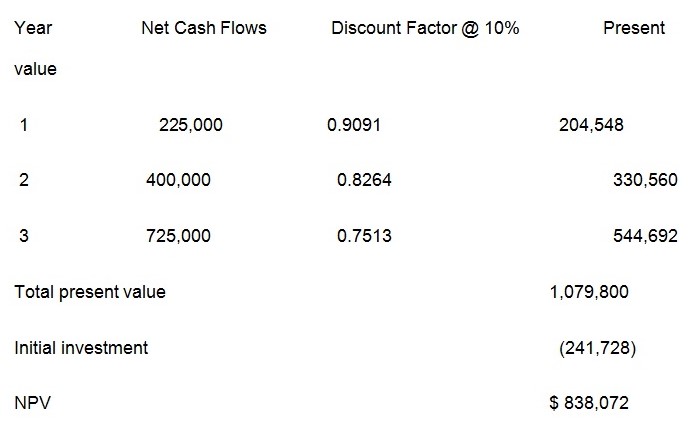

From the Financial information of Republic Airways, sensitivity analysis can prove useful in choosing which alternatives to invest in. For instance, from the above calculations of Net Present Values, analysts of the company can ask themselves what the effect of changes in future cash flows (the independent variables) would have on the Net Present Value which is (the dependent variable). Another variable that could affect the Net Present Values of the alternatives would be the change in the cost of capital. For instance, what would be the net present value of alternative B, if the cost of capital increased to 10%?

Alternative B

If the discount factor increases to 10%, the NPV will decrease by 2.6% which is a significant amount, hence Republic Airways should strive to keep its cost of capital at a lower level if it can not manage to increase its future returns to compensate for the increased capital costs.

Multiple Valuation Techniques and Risk Reduction

There exists several techniques that can be used in valuations within a company; different techniques have different effects on the risk profile of the company. Some of them include:

Discounted cash flow methods where the NPV plays an important role. The risk factor of the investments involved can be included in the cost of capital to ensure that values found are risk-inclusive. Where NPV values show favorable results then the firm is said to have a strong potential for cash generation and hence performing well despite its risk profile (Scott & Richard, 2002).

Other techniques include the WACC and Price Earnings Multiple valuations. The most important thing to consider while using all these techniques is to ensure that they are neither too low nor too high. This is because either one of the options can be detrimental to the company. Very high valuation techniques in a bid to earn high returns can be very risky as they can lead to sudden losses if they do not go according to plan. On the Other hand, very low valuations to avoid risks, limit a company’s ability to attain maximum profitability (Scott & Richard, 2002).

The Weighted cost of capital is an essential aspect of company analysis as it provides a means through which a company can make its returns towards capital providers.

References

Brigham, E.F., & Ehrhardt, M. C. (2010). Financial Management Theory and Practice. Cengage Learning

Gitman, L. J., & McDaniel, C. (2008). The Future of Business: The Essentials. Cengage Learning.

Pratt, S. P., & Niculita, A.V. (2007). Valuing a Business, 5th Edition. Mc-Graw Hill.

Scott, G., & Richard, B. (2002). The Business Valuation Book: Proven Strategies for Measuring Company’s Value. AMACOM