Introduction

Civil engineering projects are exposed to risks that can be potentially damaging due to the cost of investments incurred in such projects. That is the case especially if factors such as the regulatory constraints, environmental factors, stakeholder attitude, and the costs of investment in such projects are influenced by underlying risks and uncertainties inherent in civil engineering projects. Therefore, the need to implement the element of risk management in the project lifecycle specifically targeting every stage in the lifecycle cannot be disputed.

It is important to note that risks can be avoided or minimized at the early stages of a project once the stakeholder and the project manager have conceived the idea of a project. This is so because projects costs escalate as the project progresses. Therefore, every stage of the project lifecycle is subject to risk analysis to allow project managers to implement the most appropriate risk management strategies to minimize risks uncertainties associated with specific stages before moving on to the next stage. Moreover, it is important to note that the potential impact of risk at a specific stage is likely to spill over to the next stage with potentially adverse consequences. The severity of risk must always be evaluated at the appraisal stage of an engineering project to ensure the potential impacts of such risks are minimized. Potential risks are always evaluated against anticipated outcomes on a project. Risks may impede a project from accomplishing its set down objectives leading to a costly venture.

A risk is an effective tool in identifying future project uncertainties and any potential losses or damages that may be associated with a project. That ensures that potential risks are minimized to acceptable levels at every stage of the project lifecycle.

Project managers’ keenness in identifying different risks associated with engineering projects is vital to ensure accurate estimation of the impact of the risks on laid down project objectives. It can be noted that these separations enable project managers to select appropriate risk implementation strategies focused on specific project stages. These separations include local and global elements. Local elements include variables that have a direct impact on a project and which can be controlled by the project manager while global variables can be influenced by external factors. External factors include government-controlled factors, environmental factors, and regulatory constraints. These factors can be classified into political risks that legal requirements, statute laws, and competition. Changes in the law can adversely affect the progress of a project and may be a potential source of loss in equipment and other capital investments. These investments can be in the form of machinery and equipment for engineering projects. On the other hand, environmental risks are another source of global risks. Environmental risks incorporate changes or variations in established standards that engineering projects have to conform to. Some of these environmental risks include changes in environmental regulations and requirements targeted at maintaining and preserving the environment. It is noticeable that project managers and stakeholders cannot be comfortable until commercial risks are identified, evaluated and strategies designed to avert or minimize them in the stages of the project lifecycle particularly the appraisal stage. Commercial risks are characterized by the whole supply chain of products and materials used in the development of a project, consumer behavior, demand and supply for specific products or services, inflation, deflation, and other economic factors that may impact the economy of a country or region (Chadwick, Morfett & Borthwick, 2004).

Project managers are always keen on identifying, evaluating, and categorizing risks, particularly elemental risks associated with a project. Elemental risks span specific or target project factors. It can be argued that these include implementation strategy risks and risks associated with the operations of the project. In addition to that, the financial risks are also associated with engineering projects with the potential to stagnate a project. However, it’s worth noting that project financial risks are a subject of control and negotiation by project stakeholders.

The Risk

Based on the argument that risk is a choice and not fate in its implementation in the project management lifecycle, various definitions of risk has been argued across based on the context in which risk is defined. In the social context, it is argued that “risk is embedded in the same cultural values and norms that tell us what is right and what is wrong, what constitutes a democracy and what informs our political will” (Akintoye, Taylor & Fitzgerald. 1998). On the other hand, but in a similar context, the risk is defined as “a measurement of the chance of an outcome, the size of an outcome or a combination of both” (Akintoye, Beck & Hardcastle, 2003). In the same context, Lowrance (1976) defines risk as “the potential for unwanted or negative consequences of an event or activity”. However, an appropriate definition of risk in project management that answers the why and how in a typical civil engineering project can be based on a number of authors. One such definition coined across defines risks as “A combination or a frequency of an occurrence of a defined threat or opportunity and the magnitude of that occurrence” (Association for Project Management, 2002). On the other hand, in the light of Smith’s definition is that “risk is adverse but an unknown by its nature can have both positive and negative effects” (Smith, 2002).

McNeil, Frey, & Embrechts (2005) define risk in an engineering project as the uncertainty associated with future events that may affect project progress. Similar sentiments are shared by Lowrance (1976) and supported by (Benford, 2001).

Each of the definitions presents weak and strong points on risk to afford the project manager and stakeholders’ critical views of risk and risk management in its implementation the whole cycle of the project (Akintoye, Taylor & Fitzgerald, 1998).

Lowrance (1976) argues that these definitions of risk point to sources of risks that are critical in a typical civil engineering project lifecycle and specific criteria for risk appraisal. These sources of risk have the potential impact of adversely affecting the project objectives with consequences that may be desirable or undesirable, arguments supported by Chapman and Ward (2003) and (Akintoye, Taylor & Fitzgerald, 1998).

Project managers and stakeholders endeavor to steer their projects away from these uncertainties (McNeil, Frey, & Embrechts, 2005). However, project risks cannot be avoided completely. The potential impact on the outcome of a project can be disastrous (Montgomery, 2010). However, these uncertainties are not always anticipated beforehand, therefore, risks and uncertainties can arise at any point in a project’s lifecycle. It is well worth noting that opportunities for success always carry associated risks and uncertainties. Therefore, it can be argued that risk can be characterized by damage, time, and the extent or degree of damage that may be caused by the unanticipated event (Lowrance, 1976).

The severity of risk can be mathematically expressed in a relationship that is determined by the product of the probability of an event occurring, and the potential losses associated with the cost of investment in a project and project schedule or lifecycle, that can be summed up as the performance of a project.

Chapman and Ward (2003) argue that the importance to understand the definition of risk and risk management in the whole cycle of the phases of a project, beginning from the conceptualization stage of the project, then the planning stage, into the execution stage, and gradually into the termination stage cannot be underestimated. This is so because experienced project managers and stakeholders understand the consequences of the failure to identify and appraise risk at the earliest stages of the project initiation, and continue into the planning, execution, and termination stages. At each of these phases that are characterized by specific project phases, risk management uses risk analysis as a critical tool with specific roles at every stage of the project development lifecycle. However, the need to understand the rationale for risk management in the project lifecycle is critical in providing an appropriate answer for “why” risk management (Risk management, n.d).

Why the Need for Risk Management

Engineering projects are characterized by high project costs and high levels of uncertainty. Uncertainty, it has been argued, is based on the evaluation of an informed decision or opinion while the risk is argued to be a decision based on statistical data (McCallum, 1995). Chapman and Ward (2003) argue that despite civil engineering bearing similarities with other common projects in terms of the start and finish frameworks, these projects are complex in nature and demand large capital and other economic and environmental investments to their completion stage. Involved budgets are huge, the levels of complexity are high, and the environments of operation are dynamic (Risk management, n.d). Therefore, the need to deal with an aura of risks in the whole cycle of a project is important. In addition to that, successful projects that are driven by successful project managers target specific approaches of establishing goodwill as much as making profits in the long term. In addition to that, risk management is seen in the context of the social impact of a project. Adverse effects and consequences may be the result for a company that implements a project without integrating risk management in its projects. Therefore to comprehend risk is important by understanding what characterizes risk in terms of specific elements to be measured (Chapman & Ward, 2003).

The Probability of Risks

Chapman and Ward (2003) argue that it has been demonstrated that risk is mathematically expressed in probabilistic terms that have a strong correlation with the consequences or outcomes on project objectives. Probabilities are expressed in numerical values that lie between zero and one that provides a numerical judgment of the likelihood of an event occurring (Benford, 2001). An event can only be categorized as a risk if the potential for the event to occur lies between one and zero. Chadwick, Morfett and Borthwick (2004) argue that a zero probability specifies the potential for an event to occur while a probability of one signifies the potential for the event to occur with absolute certainty. Arguments abound about the importance to consider and manage risk, uncertainties due to risks, and the consequences of the risks on any civil engineering project on project objectives. Risk can be low but the consequences devastating. Skilled project managers endeavor to strategically minimize the project exposure to risk at every step of the project lifecycle. Benford (2001) argues therefore that managing risk begins at the very first step of the project lifecycle and goes through every phase and stage of the project until its completion. Moreover, it is important to the possibility of risks occurring in the project at earlier stages as later stages are characterized by escalating project costs. Investment into the project can be avoided if the consequences and the risks are identified earlier and identified to be undesirable (Chadwick, Morfett & Borthwick, 2004).

Risk management process and definitions

Chapman and Ward (2003) argue that one of the critical components of managing risk in the project lifecycle is the risk management process. It is worth noting that managing risk in the project lifecycle is a process that is integrated at every step of the project lifecycle, beginning with the conception to the post-implementation stages (Williams, 1993). It can then be argued that the risk management process incorporates the elements of identifying, analyzing, and responding to risks, as detailed in every phase of the process of risk implementation.

It is vital to note that engineers and stakeholders employ different tools to identify risk and respond to risks in different ways as discussed in the next section. In addition to that, engineers and stakeholders always assess the impact of anticipated and unanticipated risks and endeavor to respond to them in different ways (Williams, 1993). Chapman and Ward (2003) confirm that among the methods include risk planning, risk assessment, risk identification, and risk analysis (Vose, 2008).

Risk planning is defined as the process of identifying risk management strategies to mobilize resources to use them efficiently. It is defined as a strategy for identifying risks that may arise in an engineering project and identifying the best strategy to overcome to avert the risks. On the other hand, risk assessment is defined as a strategy for identifying specific technical processes and methods to enable the project manager to identify methods of meeting any costs that may arise in the process of the project development lifecycle (Vose, 2008).

Risk identification is defined as the process of identifying risks that may arise in project design techniques of overcoming the risks to minimize any arising impacts on the project objectives (Williams, 1993). On the other hand, risk analysis is the process of identifying the impact of risks that may arise in the project lifecycle using different and appropriate techniques to understand the final impact and identify the best options to mitigate the effects. However, this is an overview and brief discussion on the definitions and purpose of the variables in risk management (Vose, 2008).

Managing Risk in the Project Lifecycle

Impact of project phases on risk

The project team, under the project manager in collaboration with the stakeholder, understands that every phase of a project lifecycle is prone to risk and uncertainties. They know that risks are dynamic in nature and evolve as the project evolves (Benford, 2001). They continuously endeavor to conduct an appraisal at the end of every stage to assess and identify the risk involved in continuing with the project. Skilled and experienced managers see this as a continuous process spanning all phases of the project lifecycle and risks at each stage of the project can not only impact the specific stage but the next stages and the ultimate outcome of a project. It is imperative to assess and evaluate risks at every stage as changes may result in a different project, as is argued in engineering terms. Based on the arguments of Chapman and Ward (2003), it is clear, therefore, that implementing risk at the initial stage of the project with the right options is imperative. As the project progresses through the feasibility stage, risk management strategies remain focused towards the next phase o the project lifecycle. It is important to note that identification and evaluations of risks at every stage of the project lifecycle are critical in maintaining the status and confidence of the project stakeholders. In addition to that, the project manager maintains the confidence of the project team (Benford, 2001).

Risks in the Project Lifecycle

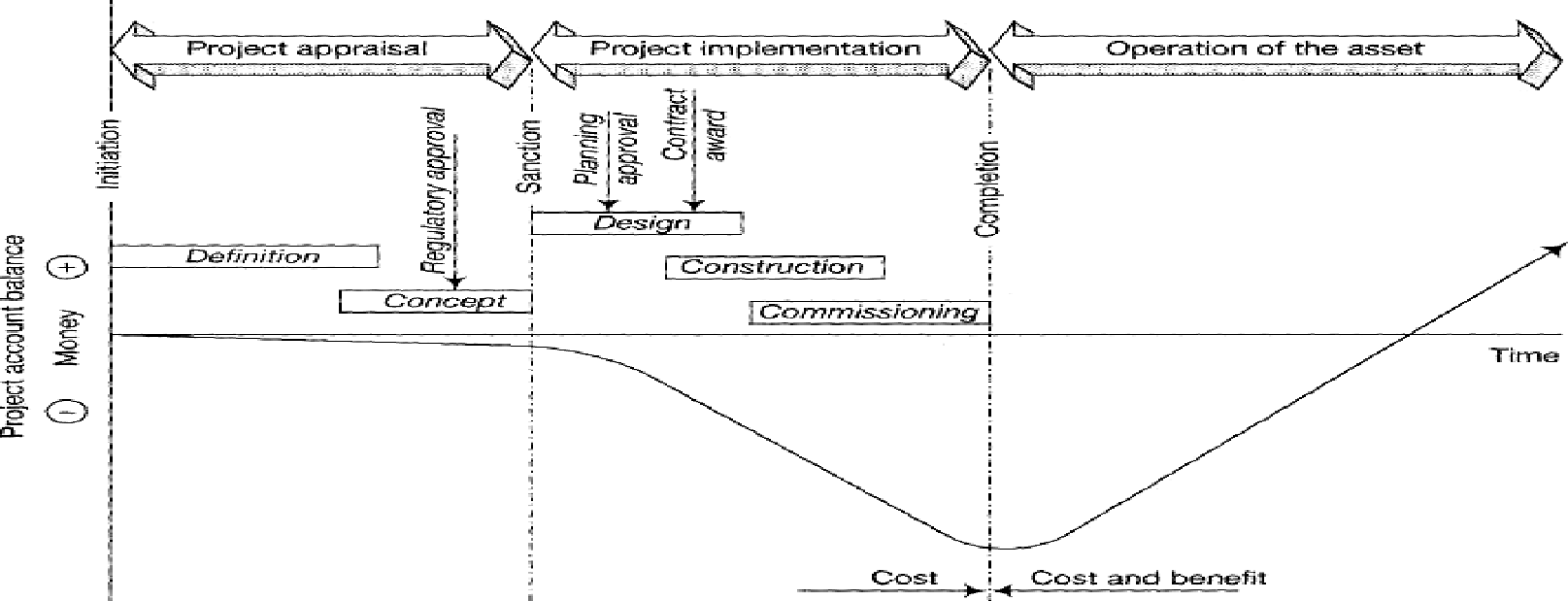

Projects evolve through different stages. Every stage of the evolution of a project is uniquely characterized by potential risks and uncertainties. These stages are uniquely identified by risk management activities unique to each stage. An overview of the stages indicates that different researchers identify different activities inherent and characteristics to each stage (Chapman & Ward, 2003). In particular, it is well worth noting that a project must start and end as a universal view of the whole cycle. Despite such views, the risk is a factor that is inherent at every stage of the project lifecycle. One such view of the project lifecycle is illustrated below (Benford, 2001).

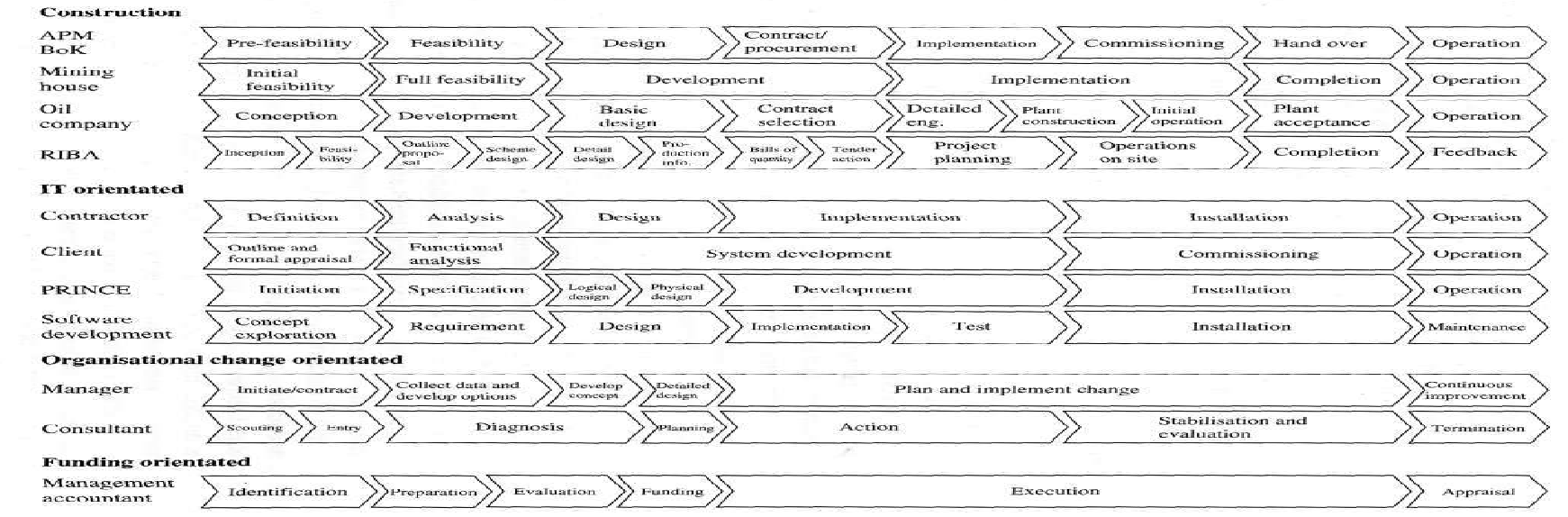

In the above illustration, risk management in the project lifecycle is optimized at the first stage of project appraisal, then to the second stage of project implementation, followed by the final stage of operation of the asset (Benford, 2001). On the other hand, other researchers see risk management to be an integral part of the project lifecycle that may be optimized with a uniquely different approach. This approach optimizes risk management at the conceptualization stage, followed by the planning stage, then into the project execution stage, and gradually into the project termination stage. Each of these stages is characterized by specific stages and particular steps. Below is an illustration of each of the phases, specific stages, and particular steps in tabular form (Risk management guideline, 2004).

Having motioned the stages above, it is important to integrate the idea of risk management in each phase, stage and step of the project lifecycle. Williams (1993) consents that project managers for any civil engineering project need to understand risk and the role of risk management in every stage of the project lifecycle a statement supported by (Chapman & Ward, 2003). Critical are the roles of risk analysis at every stage to afford discussion of the weaknesses and strengths based on specific approaches to the risk management process that is also specific to the approach used in the project risk management lifecycle (Kerzner, 2006). Of importance is to tabulate the risk analysis roles identifiable at every stage of the lifecycle, as illustrated below (Benford, 2001).

From Project Risk Management, 2003

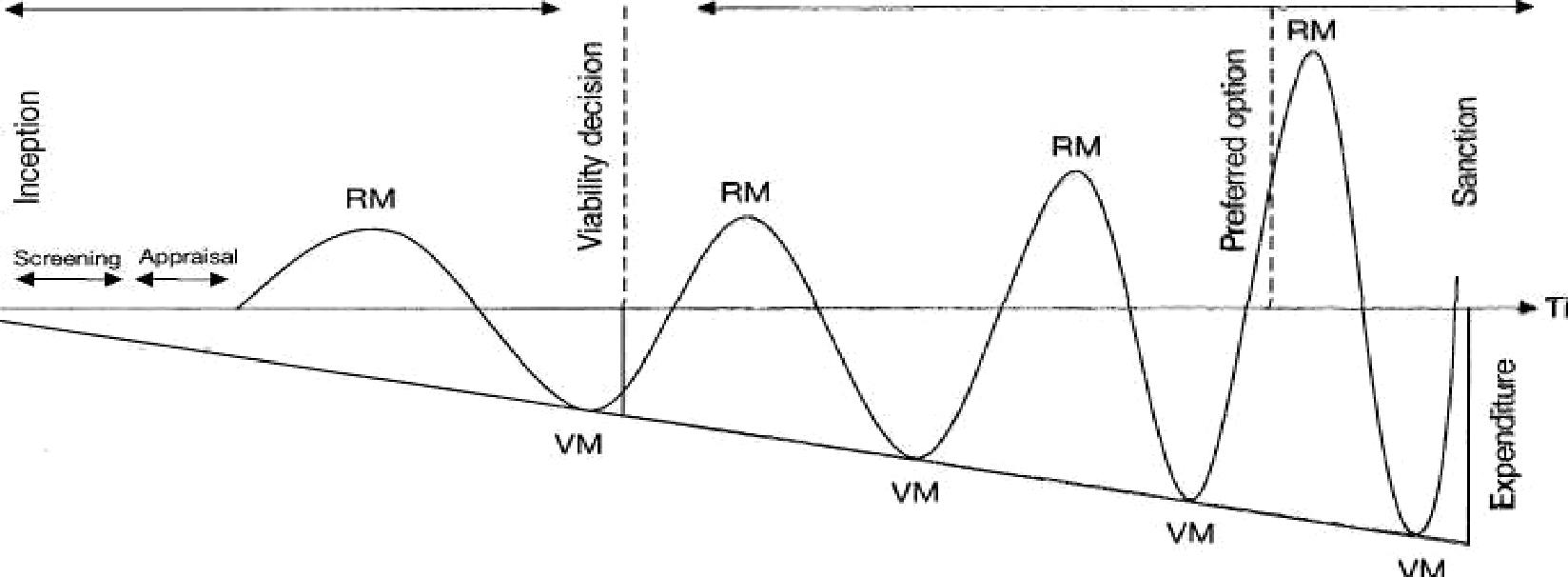

It is important to note that the implementation of risk at every stage of the project lifecycle is a concerted effort by the stakeholders, the project manager, and all others that are affected the final outcome of the project (Benford, 2001). Moreover, the impact of the project on the environment is a critical point that should ultimately optimize the knowledge on risk management in evaluating any anticipated effect and unanticipated effects of the risks involved. Chapman and Ward (2003) note that such an analysis of risk begins at the very first step of a project lifecycle identified to be the project appraisal stage. In addition to the above phases, yet another approach is here demonstrated below.

Project Appraisal

Projects, as mentioned elsewhere evolve through a number of stages, with the first stage is identified as the appraisal stage. Here, risk management implementation is a continuous process (Chapman & Ward, 2003). Other researchers contend that the phase-specific to the beginning of a project is the conceptualization stage. However, as illustrated above, construction projects, typically different from other technology projects, begin at the pre-feasibility stage. Once the project manager and stakeholders are through with this stage, the project enters the feasibility stage followed by the design stage (Benford, 2001). The implementation stage that follows the procurement stage is closely followed by the commissioning stage, then the handover stage and gradually the operation stage. Irrespective of the inherent dispute, sanguine project managers and keen stakeholders know well that this is the most important stage of the lifecycle of a project. These may be argued as two specific approaches to a single stage, the birth of a project. The appraisal stage is characterized by a number of steps (Chapman & Ward, 2003). The first of these is the initialization step. On the other hand, other researchers argue that this stage is the conceptualization stage. Both arguments are tenaciously unique to the activities and risk management tasks that occur here. At the appraisal stage, project managers and the stakeholder hold a common view, the feasibility study of a project. The feasibility of a project is strongly correlated to the investment curve at the initialization stage of a project. Risks are bound to be identified at this stage both by the stakeholder and the project manager at the initial stages. At this stage, the risk is analyzed and the potential for the occurrence of risk is expressed in terms of the probability of the potential to occur that is specific to the nature of the project (Benford, 2001). Civil engineering projects can be large or small and the potential risks associated with the project are inherently correlated. However, it is worth noting that consequences may be large or small irrespective of the possible risks associated with the size of the project. Inherent characteristics at this point are the evaluation of the availability of resources and the risk of investing in the project (Chapman & Ward, 2003). At this point, risk management techniques have to be optimized to ensure the potential to incur loss and the effect of uncertainties are clearly spelled out. No stakeholder could invest large sums of money and make other capital investments in a project prone to uncertainties and risks whose potential impact on the final outcome of the project is negative. Project managers on the other hand are very keen at endeavoring to maintain a good name for their companies to be tagged as having successfully driven a project to success without any adverse effect of risk on the project (Benford, 2001).

On the other hand, another argument tags this stage as being characterized by conceptualization where project managers and stakeholders have conceived a project and where they conduct risk analysis by clearly identifying project stakeholders and the driving force behind their involvement in the project defined as their expectations. Stakeholders not only hold their own view of risk management. The view of risk management in terms of the party owning the risk associated with the project should be clearly identified at this point (Chapman & Ward, 2003). Risk management is seen by the project manager at this point to be an organizational strategy that spans every stakeholder in the project irrespective of the impact that may be associated with each of the concerned parties. On the other hand, analytically, it may be argued that both the project manager and the stakeholder keenly understand that significant costs must be incurred at this point without immediate benefits accruing from the investment. The risk of loss at this point is high if detailed feasibility studies are not conducted, and if the project is sanctioned without a thorough analysis of the risks involved. As demonstrated in the investment curve above, a considerable amount of time must elapse before any significant returns are realized from the project. It is worth noting that, the curve clearly illustrates the need to critically identify every risk associated with investing in the project as it marks the entry-level of the project into the market (Chapman & Ward, 2003). Stakeholders at this point are clearly informed of the risks involved in the project in a detailed proposal to afford the stakeholder sanctioning the project budget. In addition to that, stakeholder involvement should be evaluated and the level of budgetary support clearly defined. On the other hand, other researchers argue that this point is characterized by a pre feasibility study. Here, the stakeholder and the project team led by the project team manager theoretically test the feasibility of the project and by conducting an overview of similarly successful and failed projects to determine the feasibility of conducting a feasibility study for the project. It explicitly implies that a general report about the risks involved in the project and possible investment strategies are identified in the process (Chapman & Ward, 2003). This stage commences the feasibility study stage. At this stage, an economic feasibility study that identifies the economic or capital investment risks is identified in the process. Technical equipment that may be at risk in addition to the technical expertise of the personnel involved in the project is analyzed and evaluated at this stage. It could be potentially dangerous and risky for a project to be sanctioned without the appropriate technology and technical expertise to run the project. It is important to note that each of the above three approaches is characterized by identifying risks and uncertainties that have the potentials to adversely impact the project in economic, technical, operational, and legal terms. Appropriate alternatives or options are identified at this stage for the project manager and project team to form a general consensus with the stakeholder on the way forward (Chapman & Ward, 2003).

Analytically, therefore, the risk is identification at this stage of the initialization of the project, which can be generally argued to be the beginning of a project is vital in determining whether other stages in the project lifecycle are initiated or not. When the potential for risk and the consequences are high, the possibility of continuing with the project to the next lifecycle is minimal. Risk management guideline (2004) notes that the project manager and the stakeholder know well what they ultimately want, minimal risks and consequences and optimal profits. It is well worth noting, therefore, that risks and uncertainties at this stage of the project influence the final decision and outcome of a project. If realistic cost estimates, project schedules, and performance benchmarks are not made, then the risk of the project running out of control is high. It serves the project team well to devotedly seek solutions to minimize risks and uncertainties within their abilities, the risk of incurring high project costs, identify risk mitigation and risk transfer mechanisms, identifying appropriate contingencies besides identifying tolerable project cost estimates, and comparatively evaluating other project options and inherent risks with the current one under consideration. Maintenance policies, risk minimization, risk transfer mechanisms, and risk aversion are clearly spelled here. Once risks and uncertainties have been identified using the analytical tool of the feasibility study, the risk implementation enters the next phase of project sanctioning (Benford, 2001). It is clear that each of these approaches affords strong evidence on the inherent strengths and weaknesses at the initial stage of a project unique to each approach. Having identified risks associated with the project, the team settles to make decisions based targeted at selecting options and sanctioning the project. Here, risks have been identified, evaluated, and assessed against stakeholder expectations and the project manager. Here, risks and consequences are prioritized acting as a driving force towards decision making (Risk management guideline, 2004).

The decision during Appraisal

The decision of the stakeholder and the project manager are important here. The certainty that the project will progress increases leading to the signing of a contract for the commencement of the project takes place. This is after appraisals have already been done (Chapman & Ward, 2003). An appraisal is important because the commitments by the stakeholder and the company of their financial resources in the face of project risks into the project are critically influenced by the outcome of the appraisal. An appraisal is important in the face of the impact of risks and uncertainties on the objectives of the project. This is after the viability stage. All constraints and risks have been evaluated at this stage (Benford, 2001). Having done the monetary appraisal and the risks and uncertainties associated with the stage, other risk assessments are done. These include risks associated with the environment, health and safety, ethical, and sustainability audits. The oscillatory nature and associated iterations in the appraisal stage with an associated degree of risks are illustrated below.

Sanction

Further arguments about the second phase of the project lifecycle and associated risks abound. The need to critically argue out specific risk management activities, why they characterize this stage, and how is important irrespective of the number of approaches specific here (Chapman & Ward, 2003). It is argued to be the design step specific to the planning stage of the project lifecycles. One argument identifies intense risk analysis activities to include evaluation and verification of the basic design of the overall project inclusive of thoroughly testing the feasibility, reliability, impact overall of changing the current project design, projected cost of the design, and accruing benefits from the design (Benford, 2001). Elsewhere, it has been argued that the stage is characterized by the intense activities of project feasibility study while it is argued on another platform to be characterized by objective identification, proviso of actual cost estimates, and project execution. However, there is a clearly inherent strength with this approach. While the project at this stage has not commenced, it is important to understand project objectives by both the project manager and the stakeholder as risk and uncertainties usually adversely impacting on project objectives and come with undesirable consequences (Chapman & Ward, 2003).

Planning

Civil engineering projects are implemented in environments with different regulatory constraints. These constrain can adversely or positively impact the progress of a project. It is therefore important for the stakeholder and the project manager to critically analyze the risks associated with the project at the planning stage. Here, risk planning optimizes an understanding of the feasibility of the plan by identifying risks associated with the duration of the project, cost, and changes that are likely to be introduced to ensure the project does not adversely impact project objectives (Chapman & Ward, 2003). If the consequences and the impact of the changes on the objectives are adverse and costly, alternatives are sought. Appropriate levels of contingencies are established in the process to ensure risks associated with costs are mitigated at earlier stages. The strength of this approach is that appropriate milestones and associated risks for each deliverable are estimated earlier on before financial commitments are made by the concerned stakeholders. In addition to that, contingency plans can be laid earlier to mitigate any anticipated risks and uncertainties. On the other hand, it is argued that this process takes place at the implementation stage. Further to that, it is argued that the planning of the project takes place here (Chapman & Ward, 2003). Approval and contract award characterize this stage. In addition to that, the construction and commissioning occur here. Analytically, the compaction of these stages into a single-stage crashes the program and associated risk management strategies are bound to fail if unanticipated risks far outweigh contingency measures put in place to overcome or minimize the risks. It may adversely impact the resources disposed to the execution of the project during an emergency. In addition to that, the phase is characterized by inherent weaknesses as the stakeholder and the project manager will have fully committed resources to the execution of the project. Therefore, in engineering projects, a balance is struck and the argument that this is the second stage of the project is tenaciously valid. Having successfully completed the second stage of the project with manageable risks, the project proceeds to the third phase, the execution stage (Chapman & Ward, 2003).

Execution

The execution stage is characterized by the project manager and the stakeholder’s keenness in monitoring project progress and the likely impact of risks at this stage. One approach to implementing risk at this stage follows this argument. Risks associated with the execution of the project cost estimates for the completion of the project, and schedule revisions characterize the critical elements in risk implementation at this stage (Benford, 2001). It has been argued that frequent sources of risk at this stage are changes in the design of the project that are introduced here. It is important to note that the stage is characterized by surprises and unexpected changes that are likely to alter project objectives or take the project back to its initial stage. Here, a keenness of understanding is required of the risks involved and the best methods to minimize these risks. This is the most critical point in project risk management (Vose, 2008). Unanticipated risks and uncertainties can directly lead to the failure of the project resulting in losses. It is important at this point to ensure risk management strategies are adequately implemented to minimize the impact of the risks particularly the unforeseen risks to sustainably run the project to the next stage (Benford, 2001).

The stakeholder and the project manager ensure with certainty that the methods used to transfer risks, the changes in the design of the project, the changes in schedule, and other associated mechanisms ensure minimal impact of risks and uncertainties of the outcome of the project at this stage (Benford, 2001). All controls are put in place to ensure the project risks do not alter from their original course and target objectives are continuously and iteratively evaluated. Changes to the controls may be necessary to optimize the project risk management controls to ensure the project remains on course and the risks are minimal. Once this is over, the risk management strategy moves on to the next stage of the project lifecycle, the termination stage (Benford, 2001).

Termination

Among the critical elements that characterize this stage in risk implementation and management are risks associated with project deliverables, reviews and the support offered in view of future liabilities (Smith, Clifford, Stulz & Rene, 1985). Elsewhere, other project managers and engineers argue that this stage should be characterized by the operation of the asset while others see this stage in the light of project completion and operation. Despite the differences in the light of their arguments, risk implementation at this stage is critical in relation to risks associated with the final phase of the project and delivery. Typical engineering projects must end and be delivered to the users (Lundgrun, 1994). Therefore, it is important to designate this stage of project termination to incorporate issues of delivery, review, and support as mentioned above (Smith, 2007). Moreover, a detailed discussion and analysis of the risks, their implementation strategies, the how, and why are worth noting as argued by Benford (2001) and (Tonn, Travis, Goeltz, & Phillippi, 1990).

Risk implementation at this stage of the project lifecycle is critical. The project manager and associated stakeholders typically identify risks associated with delivering the final project to the user. Importantly, the user’s expectations have to be met when the project is commissioned for use. It is a critical point as risks involved here are critical to the success of the project (Chapman & Ward, 2003). Consequences arising from the user rejecting the final product or the final project not performing to the expectations of the user are consequential of a failed project. This failure could be partly due to unidentified and unattended risks in the lifecycle of the project. In addition to that, the possibility of improving or changing the design is critical to avert the final perceptions that the project did not meet the set standards. Here, risk analysis is done to identify resources necessary to meet modifications in the design. An important point here is to ensure materials, equipment, and other machinery provide reliable performance capabilities in view of the risks associated with late modifications. A project can be modified at this stage only to lead to the worst outcome that is not modifiable, leading to the total loss in the whole investment. Once the project is finally delivered, a review is necessary here.

Lundgrun (1994) argues that a review is another approach to risk implementation that comes after the delivery of the product to provide an audit of how resources were allocated. There were important lessons that were leaned in the process. These lessons should be well documented to ensure a repeat in the future of similar occurrences are minimized and avoided where possible (Chapman & Ward, 2003).

One critical element of the review process is the document developed that clearly illustrates performance and risk management criteria that were implemented in every stage of the project lifecycle. In addition, the rationale that was the driving force behind changes that were made in the lifecycle of the project is documented. It is critical not that reviews do not provide a fallback to the previous stages to correct or redesign changes or make modifications due to uncertainties and risks identified at different stages in the lifecycle but acts as a pointer in informing practice for future projects that may draw from experiences gained in the process. It is a process that captures the best strategies of mobilizing resources and skills in minimizing risks in other projects and not punishing failure or weaknesses. In addition to that, future liabilities are identified at this point in the risk management process. While other researchers do not incorporate this approach in project termination, it is important for civil engineers to integrate this as it is a lesson on the need to mobilize resources, skills, and other elements in the process to ensure risk is minimized in future projects (Benford, 2001). At this point, the project manager, project team members, and other stakeholders review the profits generated from the project in addition to assessing and evaluating appropriate amounts of resources that may be required in future projects and strategic approaches to minimizing risk. It is important for project managers to realize the worth of this stage. The key strength that lies here is that the project manager and the project team are able to evaluate the returns in relation to anticipated and unanticipated risks that were involved in the process (Benford, 2001).

Conclusion

In conclusion, risk in an engineering project is the uncertainty associated with future events that may affect project progress and in the event that they occur, have the potential to damage the project progress with economic and environmental consequences that may be costly and undesirable. Therefore, risk must be continuously managed and implemented using risk management tools at every stage of the project lifecycle. This is also achieved by strategically designing risk implementation strategies and methods tailored towards project objectives for both the project manager and the stakeholder. Project managers and stakeholders use a number of tested and tailored risk analysis techniques that may be quantitative or qualitative for analyzing the probable impact of risk and design strategic approaches of mitigating risks and the potential consequences of such risks on a project’s lifecycle. Therefore, a keen project manager endeavors to integrate at all levels of the project lifecycle to drive a project from risk despite projects cannot be risk-free. Every project step has to be identified and every risk associated with the step critically evaluated using risk analysis tools to identify the level of the risks and approaches to mitigating or minimizing them and their impact and consequences on overall project objectives and consequences. Project managers and stakeholders should identify these risks at the appraisal, planning, execution, and termination stages of the project and specific risk aversion strategies such as modifications to attain the ultimate goal of user expectations, profitability and stakeholder confidence and enhance the overall image of the company executing the project. Moreover, the best approach to follow in implementing risk management in the whole project lifecycle is integrative. Based on the review document, the project manager and the stakeholder can evaluate the best strategy among the various lifecycle approaches that best fit the background of the project to be implemented.

References

Akintoye, A., Taylor, C. & Fitzgerald. 1998. Risk Analysis and Management of Private Finance Initiative Projects. Engineering, Construction & Architectural Management, 5 (1), pp. 9–21.

Akintoye, A., Beck, M. & Hardcastle, C. 2003. Public-Private Partnerships: Managing Risks and Opportunities. Blackwell, Oxford.

Benford, T., 2001. Probabilistic Risk Analysis: Foundations and Methods. Cambridge University Press; illustrated edition The Journal of Political Economy, 93 (3), pp. 488-511.

Chadwick, A., Morfett, J., Borthwick, M., 2004. Hydraulics in Civil and Environmental Engineering. Taylor & Francis; 4 ed. London: E & F N Spon.

Chapman, C., Ward, S., 2003. Project Risk Management – Processes, Techniques and Insights, 2nd ed, New York: John Wiley & Sons.

Kerzner, H. 2006. Project management: a systems approach to planning, Scheduling, and controlling, Hoboken, New Jersey., John Wiley. Insights UK: California: John Wiley.

Lowrance, W.W., 1976. Of Acceptable Risk: Science and the Determination of Safety. Los Angeles, CA: William Kaufmann, Inc.

Lundgrun, R.,1994. Risk Communication: A Handbook for Communicating Environmental, Safety, and Health Risks. Columbus, Ohio: Battelle Press.

Risk management (n.d). Capability definition. Web.

McCallum, D.B., 1995. Risk Communication: A Tool for Behavior Change, NIDA Research Monograph, 155, pp. 65-89.

McNeil, A., Frey,R., Embrechts, P., 2005. Quantitative risk management: concepts, techniques and tools. Princeton, New Jersey: Princeton University Press.

Montgomery, Douglas, C., 2010. Applied Statistics and Probability for Engineers: International Student Version. New York: John Wiley & Sons; 5th International student edition.

Risk management guideline (2004). Total Asset management. New South Wales Treasury. Web.

Smith, Clifford, W. Stulz, Rene, M., 1985. The Journal of Financial and Quantitative Analysis, December, 20(4), pp. 391-405.

Smith, N. J., 2007. Engineering project management, Oxford, Blackwell.

Tonn, B.E., C.B. Travis, Goeltz R.T., & Phillippi, R. H. 1990. Knowledge-Based Representations of Risk Beliefs, Risk Analysis, 10,169-184.

Vose, D., 2008. Risk Analysis: A Quantitative Guide. John Wiley & Sons; 3rd Edition edition

Williams, T M. 1993. Risk management infrastructures’ Inr. J. Project Manage, 11 (5), pp l-10