Introduction

Statistical methods used in business and economics for the purpose of description and summarizing the data collection. Modern mathematical science identifies different types of statistical methods taking into account the way of data modeling. It should be noted that descriptive and inferential statistics are used in various spheres of business and economics activities being interfered with applied statistics.

Data mining, being one of the basic notions in modern business activities, is considered to be the process of exploration and modeling of various databases for the purpose of patterns and models discovering. The paper will concentrate on the basic peculiarities of statistical methods described in economical and business publications taking into account practices and experience of true specialists in this area.

Statistical Methods in Applied Data Mining

Current information society lives I the atmosphere of increasing data availability leading to the necessity of various tools for the purpose of modeling and thorough analysis. One of the most important aspects is to be able to extract appropriate knowledge from the data available; so, statistical methods and data mining are considered to be the most convenient and proper tolls for this. Application is usually the part of many different areas such as computer science, statistics, economics, machine learning, finance and marketing. (Waters, 2003)

According to Paolo Giudici, statistical modeling and the adoption of rigorous and coherent approach to it form a perfect bridge between the applications in industry and business and data mining methods. (Guidici, 2006)

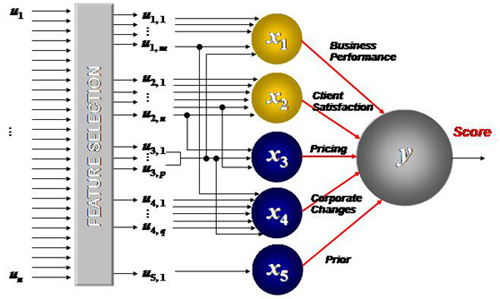

Modern data-based intelligence is centralized in business cooperation activities; as a result statistical analytics and its role are of great significance. According to the business researcher and analyst, Yasuo Amemniya, the statistical methods development influences the processing, storage and capture of business monitoring data; it is an integral part of forecasting, understanding and decision making activities. Business analytics challenge estimates the model parameters; one of the basic methods in the sphere of innovative business approaches is highlighted by Yasuo Amemniya, who devoted it to the description of risk factors model evaluating the company output in the customer’s termination to the business contract:

- Clients’ financial stability;

- The cooperation level with service provider;

- Competitiveness and price of the service;

- Possible impact on service cancellation;

- Renegotiations history.

It should be noted that conventional methods are usually characterized by termination estimation allowing seeing the level of influence decision making factors. Traditional methods, for example logistic regression, disclose relationships between hidden variables demonstrated on the principle of five-risk-model. The data in such cases is captured for the purpose of procedure estimation. (Amemiya, 2003)

Statistical Methods Typology

Statistical projects are usually aimed at the investigation of various causalities in order to draw an effective conclusion as to the change benefits or losses. Statistical methods in causal data analysis are divided into two basic types:

- Observational studies;

- Experimental approaches.

Both types are considered to be effective; the basic differences lie in the way of study and data analysis conduction. (Connors, 2003)

Observation method is merely built on the principle of data evaluation and comparison statistically effective factors. In contrast to observation approach, experimental study is a complicated one covering the investigation of system measurements and the determination of manipulations modification. It is necessary to underline the fact that the Western Electric Company practiced this method in the process of changes testing for the purpose of productivity increase and the impact of increased illumination. This case involved the measurement of the plant productivity and check of all changes levels taking into account their impact on the productivity of the company. The experimental conditions managed to improve the productivity though this type of statistical methods cannot be considered as the perfect one. The spheres of business and economics still criticize experimental studies and data analysis for blindness and lack of group control observed in the process of data analysis procedures. Modern statistical science calls this method Hawthorne studies; grave mistakes of this method have been generally criticized. The basic stages of this statistical method are considered to be the following:

- Data search and project planning;

- Complex design of system models;

- The involvement of descriptive statistics;

- Consensus reaching;

- Presentation of the documented data survey.

This method is usually used in accordance with all steps necessary for its effectiveness. (David& Sweeney, 2001)

Statistical forecasting is one of statistical methods which is widely used in business. This aspect is concentrated on future prediction on the basis of past data for the purpose of forecast development. As a matter of example, sales forecasting in business and economics can be analyzed. This process needs sales phase division into manageable parts to forecast them separately. Usually this method of statistical methods is used for annual sales forecast. It should be noted that the following stages are aimed at the development of sales prediction which can be used in various business types and economics.

Firstly, it is necessary to create a customer’s profile and identify the basic industry trends. In most cases perfect determiners make about 20% of clients’ account for sales in 80%. The trends determination is built upon the results of trade suppliers’ cooperation and Business Periodicals Index search.

Secondly, it is necessary to establish the location and size of trading area taking into account all available statistics and trading characteristics. The analysis of distribution and promotion ways will be of great importance for future sales forecast. Besides, it should be stressed that the analysis of other trading companies and their trading reputation will be helpful.

Then, forecasting method requires making profile and list of all competitors selling in neighboring areas. The analysis of the competitors’ products, services, promotional techniques and various business handouts together with the prices and customer volumes may help in forecasting personal business sales profits.

The next step is devoted to sales estimation on the basis of past annual activities. It is necessary to take into account the reduction by 50% for first months of sales. Such factors as economic growth and population needs should be centralized in forecast process. One should develop all possible ways of customers’ attraction and consider personal market share; besides, the figure should be personally reduced to 15%. (Sales Forecasting Techniques, 2006)

Statistical Methods in Industry and Business Activities Control

One of the principle problems for investors bearing responsibilities for a number of active portfolios is connected with the determination of the products to which one should pay attention in business partnership. It was fount out that in most cases this process of identification can take years. The usage of statistical methods will give an opportunity to evaluate the productivity and profitability in comparatively short period of time. (Lee Carlson & Thorne, 1997)

The scheme CUSUM being under complete control of statistical process is closely connected with ration test of Wald’s Sequential Profitability providing the effective result in about 2 years though underperformance of data collection and presentation can be observed much faster. The CUSUM method gives an opportunity for the investors to concentrate on the most significant issues which potentially have very influential consequences.

The principle of method functioning is built upon the principle, that for every false alarms rate, no any faster detection of underperformance can be observed. It is used in cases of $500 billion monitoring in managed assets, as well as in fixed income, equities and currencies. (Phillips & Stein, 2003)

Conclusion

The role of statistical methods application appeared to be of crucial importance for many fields of industry and business development. The true management problems of the information society lie in the necessity to interpret, analyze and describe business data being the background of successful cooperation and industrial development. Such areas as marketing, finance, and computing, management and industry are built on the principles of wide statistical methods usage.

The paper managed to focus on basic statistical methods typology disclosing the role of every aspect for business and economics development. Besides, it disclosed the place of data analysis in applied data mining showing the example of data model building. The investigation of such methods as observation, experimental and forecast appeared to be widely used in all industries in order to predict annual sales, profits, or even possible problems.

The process of data interpretation, analysis or forecasting allows reaching success and obtaining beneficial results from the available data.

Annotated Bibliography

Guidici, P.G. Applied Data Mining: Statistical Methods for Business and Industry. Wiley-Blackwell Ltd. 2006. Web.

The article under analysis disclosed the peculiarities of data mining processing in the information society; the work is devoted to the disclosure of applied statistical methods and appropriate ways of data processing used in modern industry.

Amemiya, Y. Statistical Methods for Business Intelligence. Innovation Matters. 2003. Web.

The author of the article focused on the most efficient business-oriented problems connected with statistical operations; he stressed the significance of survey and experimental design in the information handling. The article is provided with a number of statistical models and vivid assessments used in business practice.

Connors, Michael. Applying statistical methods to the loss reserve calculation. Business Credit. 2003.

The article discloses the basic steps to be done by any company for the purpose of statistically appropriate data calculations; it should be noted that the author stressed the significance of scoring and in the customer treatment.

Phillips, Thomas and Stein, David. Using Statistical Process Control to Monitor Active Managers. CUSUM. 2003. Web.

The article is devoted to the description of CUSUM statistical method being widely used in the sphere of management control; the author strived to show the benefits of the method usage for the investors through the possibility to control the process of productivity and calculate the most effective deals.

Sales Forecasting Techniques. Statistical Forecasting. 2006. Web.

This article is devoted to the disclosure of forecasting method in business oriented processes. The information is aimed to demonstrate how forecasting statistical calculations can be used in annual sales and budget prediction through following basic stages of forecast planning and organization.

David, R. & Sweeney, D. Quantitative Methods for Business. West Pub. Co. 2001.

The publication is related to the depiction of business models in statistical operations through quantitative analysis of business data; the authors paid special attention to the depiction of observation and experimental statistical approaches providing vivid examples form companies operations.

Lee Carlson, W. and Thorne, B. Applied Statistical Methods: for business and economics. Prentice Hall. 1997.

The book is devoted to process of building and designing statistical methodologies through the description of various business samples components and testing configurations; the data strive to present the planning of statistical documentation and present its appliance in different spheres of business and economics development.

Waters, Risk. Market Risk Modeling: Applied statistical methods for practitioners. 2003. Web.

The book is devoted to the description of designed models and practices of statistical methods usage in business operation; the information is aimed at practitioners demonstrating for them true examples of industrial statistics and its role in making forecast and effective data analysis.