Executive Summary

The resource based approach is becoming recognized, as a very sound method of strategic management, it is viewed as good management science. It is attracting attention of growing number of researchers, as its framework encourages a dialogue between scholars from variety of perspectives. It lays emphasis on conversation as the medium used scientifically to address the management related issues. Three major research programs are intertwined in resource based framework. The first is the need for incorporating strategy and research with distinctive competencies. The theory is based on the rate, direction and performance implications in the field of strategy analysis. It also provides testable criteria’s within the diversification strategy. It has been analyzed that it has all the components of the organizational economics and research based view is complementary to industrial organization research. The incentive of the research based approach to give attention to research along with development of strategic methodology and analysis is the true strength if the research based approach in analyzing the company strategy. This is an important economic tool in which research and strategic thinking is brought together to determine the strategic resources which are available for the firm. This is targeted to achieve competitive advantage which can be sustained over time for the growth of the firm. The objective is to identify key resources for the company which may have future growth potential. The real essence of research based approach is competitive advantage which has been achieved by value created strategy and identification of characteristic resources which have potential for the company.

Introduction

The research based view approach has encouraged new dimension of conversation as the key to mainstream management strategy in which competitive advantage is the key to determining, the organizational economics and the industrial organization in the backdrop of the framework of discussion and research. This new approach presents an opportunity of dialogue and debate between scholars from various research perspective(Mahoney and Pandian, 1992).

The argument used for the resource based view is that the firm has the power, which is the access to the resources. These resources can be researched and optimally used to enable them to competitive advantage. Thus identification of resources which are valuable and rare is the key to superior level of long term advantage. The real challenge is to sustain these resources over long periods of time. It is necessary to safeguard against resource imitation, transfer and or substitution. The scholars have strongly supported this method of achieving strategic management for the benefit of the firm.

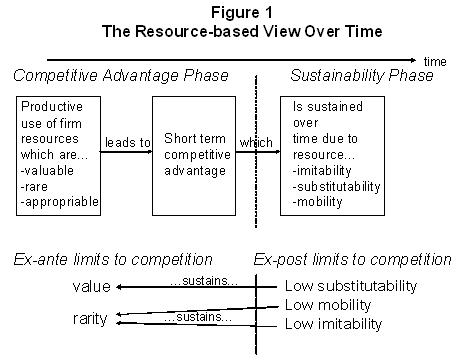

This is very effectively presented in a diagrammatic representation by Wade and Hulland, where the analysis of research based view over time has been evaluated against the competitive advantage achieved and the sustainability. The long term and short term aspect is evaluated, and analyzed in the context of different phases which determine the sustainability and the competitive advantage. Identification of the resource is the key to successful research base view, and based on that short term and long term competitive advantage is being calculated. Over time this can be very good indicator of successful and strategic advantage for the growth of the firm.(Appendix1).

Literature Review

The emphasis on the importance of assessing the resource profile of the firm has been taken as a very important focus for the strategic management. These resources can be classified under different classification which categories the resource to manpower, organization and industrial. The scale of resource identification is important to determining the potential of resource.

Research Based View

A resource may be conveniently classified under a few headings-for example, land and equipment, labour (including worker capabilities and knowledge), and capital (organizational, tangible and intangible) –but the subdivisions of resources may proceed as far as is useful for the problem at hand(Penrose,1959). Penrose argues that : “It is the heterogeneity of the productive services available or potentially available from its resources that gives reach firm its unique character.”(1959) According to him the top management in a diversified enterprise can be significant and distinctive resource if it uniquely contributes to the sustained profitability of the enterprise. A firm may achieve rent not to because it has better resources, but rather the firm’s distinctive competence involves making better use of its resource.(Penrose, 1959).

A rich connection is established among the firm’s resources, distinctive competencies and mental models or ‘dominant logic’ of magerial diversification process.(Grant, 1988) Penrose also argues that unused productive services of resources ‘shape the scope and direction of search for knowledge’(1959) Penrose(1959) considers the growth of the firm as limited only in the long run by its management resource. The total managerial services that a firm requires at appoint in tie are partly constrained by the necessity to run the firm at its current size, and is partly required to carry out the ventures which allow for expansion.. In Penrose’s theory ‘management is both the accelerator and the brake for the growth process’.

The resource based discussion of diversification-performance is linked with more general question whether any strategy that firm utilizes really makes difference. There is important debate concerning the significance of firm effects as concerning the significance of firm effects as opposed to industry attractiveness effects on performance. This study has been most comprehensively covered by Barney(1986c), he emphasizes the importance to distinguish two types of synergy, which he calls contestable synergy and idiosyncratic bilateral synergy. This diversification leads to financial synergy which is achieved with unrelated diversification and is more likely to offer with diversification greater potential for growth.

Three Case Studies

The three literatures and research materials are used as the case study for the analysis of research based view of the case studies which I have used for the literature review are presented with their details and their respective importance in adding perspective and new dimension to the analysis of RBV. This is done by analysis of three scholarly articles which offer information on different aspect of research based view, and has been supported by their abstract and case history and contribution.

Case study 1: (Appendix-2)

In this case study the scholar talks about the framework of the resource based approach and the three perspectives from scholars of the time. The first consideration is the impact on rent and the sources of rent, and the existence of rent and the maintenance of rent is highly dependent on the lack of competition and resources use. It employs resourced based view to determine the need of strategic management inorder to explain how firms generate rents.

Case study 2: (Appendix-3)

In this case study three concepts of competition has been evaluated and is aimed at developing theories which can be applied to determining and choosing the right strategy for generating high returns for the firm. This is based on the observation that the nature and the characteristic of the competitive conditions of the firm help determine the firm’s strategic opportunities which are the potential resources for future growth. This lays emphasis on integration as the tool for firm’s strategic growth. This is specially studied in the light of industrial Organization as the key to strategic implementation. This model believes that the returns to firms are determined by the structure of the industry within which the firm finds it. The key structure of the attributes of an industry are thought ot have an impact on firms returns this is highly affected by barriers of entry and the resource identification and optimization.

Case Study 3: (Appendix-4)

This case deals with the dynamic role of competition and business strategy, in the light of Porters Competitive Advantage, this is to identify that strategies need to be evaluated for the firm in opposition to its competition. Porters view allows firm to have two choices: it at lower the cost than its competitors or it can differentiate its product and services in number of ways to provide customers with higher quality of choices than its competitors. Here the economic theories are applied for competitive advantage and quantitative research methods are applied to boost productivity, return and service.

Strategic Initiatives

In Michael Porter’s Competitive Strategy: Techniques for Analyzing Industries and Competitors, he discusses in detail the five forces of competition in an industry. The five competitive forces are as follows: (1) rivalry between competing sellers in an industry, (2) potential entry of new competitors, (3) the market attempts of companies in other industries to win customers over to their own substitute products, (4) the competitive pressures stemming from supplier-seller collaboration and bargaining, and (5) the competitive pressure stemming from seller-buyer collaboration and bargaining (Porter, 1985).

Porter’s theory of five forces of competition is a widely used tool in determining the current strengths and competitive position of the company. And having a clearer and more holistic understanding of the balance of power in a competitive industry will help in coming up with a more efficient plan for a sustained growth in the industry (Porter 1985).

Companies craft strategies to profitably meet market demands and needs. Companies that do not have the ability to foster such strategy can never survive the continually changing business environment. A strategy is a composition of various competitive efforts and business approaches to meet market demands and achieve organizational objectives. Thus, a firm’s strategy reflects the managerial choices picked among number of alternatives and market opportunities. It also signifies the organization’s commitment to particular products, markets, competitive approaches, and ways of operating the enterprise (Thompson and Strickland, 2001).

Organizational Objectives

Setting of organizational objectives and goals is the cornerstone of any strategic move of the company. Objectives provide the direction to which the company is leading to. Along with the company’s objectives, managers would create specific game plan in achieving these goals. That is, it outlines the hows of company strategy:

- how to grow the business,

- how to satisfy customers,

- how to outcompete rivals,

- how to respond to changing market conditions,

- how to manage each functional piece of business and develop the needed organizational capabilities.

In summary, it outlines how the company firm will come to realize its strategic mission and vision (Thompson and Strickland, 2001).

Evaluation of Strategic Initiatives

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. The advantages of SWOT analysis lie in its ease of use, simplicity, and flexibility. It, likewise, allows the synthesis and integration of various types of information which are generally known but could still provide the clearer view of the subject if organized and synthesized (Thompson and Strickland 2001).

SWOT analysis can give the researcher (and the reader) the understanding of the core competency of the company that would give it a distinctive competitive advantage over its rival. More importantly, it provides the foundation on (1) how the company’s strategy can be matched to both its resource capabilities and the current market opportunities, and (2) how urgent it is for the company to correct which particular resource deficiency and guard against what particular threats. It also raises questions about what future resource strengths and capabilities the company will need to respond to the emerging industry trends and competitive conditions (Thompson and Strickland 2001).

Market Opportunities and Threats

Company’s strategy can be heavily affected by available market opportunities. Strategically, the market opportunities most relevant to a company are those that offer important avenues for profitable growth; those where a company has the most potential for competitive advantage; and those that coincide with the company’s financial and organizational resource capabilities. Furthermore, it is important to note not all opportunities are worth pursuing. It is often advised to pass on a particular market opportunity unless it has or can build the resource capabilities to handle the challenges accompanying the opportunity.

Methodology

The research methodology utilized in this examination has been based on the primary and secondary sources. This establishes the design and conduct of the evaluation of the research based view of management with regard to factors which affect the competitive advantage and strategic growth for the firm. These evaluations and adaptations are the measures taken by the firms in the light of the resources for determining and implementing the expansion and growth of the firm.. In making a determination of the research methods to be utilized, the selection was taken from primary and secondary sources, along with qualitative and quantitative data. This would provide a comprehensive coverage on the topic.

Discussion and Analysis

The framework of the study based on the literature review indicates th importance of the research based view, but also emphasizes the integration of the competitive advantage as necessary function of industry analysis, organizational governance and firm effects. The research based model has great potential to combine the research of various streams and diversified resources to provide a rich and rigorous theory of strategic firm. The study gives balanced importance to approaching research based view in the process to attain equilibrium to organizational economics and industrial organization on the bigger scale. This combined research and integration will ensure an approach which give full assurance to future growth of the company, based on competitive advantage, future research and growth strategy for management.

Reflection and Recommendation

Competitive strategy has been the topic of very serious consideration for the firms, and any new dimension which can help boost the firms position is a considerable option for the firm. The current thinking about market strategy focuses on firms strategic initiative by which it can create products or services which can meet competitive advantage and also allow for greater economic performance for future. This requires consideration of not just the economic performance, but also consideration for the cost which is part of the implementation of the strategies. The future value of the strategies can be evaluated by analyzing firms skill and capabilities which are already under control, along with consideration for environmental analysis and future value of the firms economic projections. In this context it can be recommended that the strategic choices of the firm requires good understanding of the economic performance and identification of the unique skills and capabilities, which can aid in analysis if the competitive advantage ad the environment.

Conclusion

The study is focused on identifying the purpose of research based view as strategy for adoption by the firm for future economic advantage. The purpose of the competitive strategy is to equip managers with core concepts, framework and techniques of strategic management. This will ensure better decision which will promote future growth. It is all about performance, identification of resources and competitive advantage derived from the potential of the valuable resources for future growth. Strategic management of the company after a recent merger is one of the most significant aspects of the company’s growth, management and expansion. (2441 words).

Work Cited

Barney, Jay B. 1986. Organizational Culture: Can It Be a Source of Sustained Competitive Advantage? The Academy of Management Review, Vol. 11, No. 3, pp. 656-665.

Barney, Jay B. 1986a. Types of Competition and the Theory of Strategy: Toward an Integrative Framework. The Academy of Management Review, Vol. 11, No. 4, pp. 791-800

Barney, Jay B. 1986b. Strategic Factor Markets: Expectations, Luck, and Business Strategy Management Science, Vol. 32, No. 10, pp. 1231-1241

Barney, Jay B. 1986c Returns to Bidding Firms in Mergers and Acquisitions: Reconsidering the Relatedness Hypothesis.

Strategic Management Journal, Vol. 9, Special Issue: Strategy Content Research (1988), pp. 71-78.

Barney, Jay B. 1986b Asset Stocks and Sustained Competitive Advantage: A Comment.Management Science, Vol. 35, No. 12, pp. 1511-1513.

. Bettis, Richard A. 1981. Performance Differences in Related and Unrelated Diversified Firms. Strategic Management Journal, Vol. 2, No. 4, pp. 379-393

Caves, Richard E. 1980. Industrial Organization, Corporate Strategy and Structure: Journal of Economic Literature, Vol. 18, No. 1, pp. 64-92.

Caves, Richard E.. 1984. Economic Analysis and the Quest for Competitive Advantage The American Economic Review, Vol. 74, No. 2, Papers and Proceedings of the Ninety-Sixth Annual Meeting of the American Economic Association, pp. 127-132.

Day, G. (1994). The Capabilities of Market-Driven Organizations. Journal of Marketing. 58 (4): 37-53.

Fahy, J., and Smithee, A. 1999.Strategic Marketing and the Resource-Based View of the Firm,. Academy of Marketing Science Review (99:10), pp. 1-21.

Grant, R. M. 1991.The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation,. California Management Review (33:1), pp. 114-135.

Kay, J. Mastering Strategy: Resource Based Strategy. Financial Times, 1999.

Lamb, Robert, Boyden Competitive strategic management, Englewood Cliffs, NJ: Prentice-Hall, 1984.

Mahoney, Joseph T. and Pandian, J. Rajendran.1992.The Resource-Based View Within the Conversation of Strategic Management. Strategic Management Journal, Vol. 13, No. 5, pp. 363-380.

Porter, M.E. 1985. Competitive Adanctege: Creating and Sustaining Superiror Peformance”, Free press, New York.

Penrose, E.T. 1959. Limits to Growth and Size of Firms. John Wiley, New York.

Thompson, A., Strickland, A., and Gamble, J., (2005) Crafting and Executing Strategy: the Quest for Competitive Advantage, McGraw-Hill Companies, New York, US.

Appendices

Appendix 1

Appendix-2

Abstract

Appendix-3

Abstract

Appendix-4

Abstract

Economic Analysis and the Quest for Competitive Advantage Author(s): Richard E. Caves Source: The American Economic Review, Vol. 74, No. 2, Papers and Proceedings of the Ninety- Sixth Annual Meeting of the American Economic Association, (1984), pp. 127-132 Published by: American Economic Association:

An extensive meeting of interests has occurred in the past decade between applied micro economists and those who study business strategy. Business strategists have cast up a series of questions for industrial economists, who have responded with numerous applications of economic theory and quantitative research methods.