Introduction

Tesla Motors is a car manufacturing company located in California in the United States of America. Its area of focus is on the production of electricity-powered vehicles, solar equipment, and lithium batteries. The company seeks to manufacture automobiles that meet the price and quality demands of the common customer. Many car-manufacturing companies such as the Audi A3, Lexus IS, Mercedes-Benz E-Class, and BMW 4 Series among others have focused on high-end vehicles, a strategy that leaves out the average clients unattended to, owing to their financial constraints and consequently the need for cheaper maintenance costs. Tesla Motors’ boss, Elon Musk, identified this gap and decided to produce automobiles that were reasonably priced to capture this class of customers. Hence, with less than 15 years in operations, it is crucial to examine the company’s market entry strategy, use the already attained client numbers to gauge its profitability, and the overall expected evolution of the car industry.

Tesla’s Entry Strategy

At the time of establishing Tesla Motors, giant corporations such as Toyota and General Motors among others dominated the American car bazaar. This obstacle did not hinder Tesla from doing business in the same market. In other words, the company developed a well-calculated entry strategy that entailed beginning with a minimum feasible invention, namely, the production of the top-quality magnificent electric car that would be sold only to the small number of clients who could pay for it. Thompson et al. emphasize the need for a business strategy since it helps a company to assess its course of action before adopting it (3). It enables a business to be aware of the expected threats and opportunities in the market. According to Van den Steen, the company’s initial exclusive car was the electric-powered Tesla Roadster (6). Appendix 1 shows an exhibit of this car. Here, the company had to deal with the issue of ensuring that this new technology was not rejected in the market.

On the same issue, the company was torn in terms of the options or range it had for electric cars, including the unknown time it could take to fully charge a vehicle and the limited number of locations where such charging could be done (Van den Steen 5). The issue of capital was another barrier that Tesla had to overcome. The original concept was to begin by producing a classy but low-volume vehicle that could pave the way for the company to join the market using the then limited financial resources. In its initial phases, the company struggled with raising capital to facilitate its business, a situation that forced Elon Musk to dispose of some of his assets, for instance, Zip2, to curb the delays witnessed in the corporation’s production lines (Van den Steen 6). Hence, regarding its entry strategy and relative to other companies such as Toyota, BMW, and the Mercedes-Benz, it is apparent that Tesla’s approach was not typical of a fresh market participant. In fact, according to Van den Steen, the company sold less than 2500 Roadster vehicles, although the number satisfied the market entry goal that Elon Musk had envisioned.

Hence, from the above approach by Tesla, other companies such as Nissan should borrow substantial lessons. According to Thompson et al., the company was to set the pace in the car industry through its Electric Vehicles (EVs), a move that may have informed Nissan’s decision to produce the Nissan Leaf (245). Besides, Nissan should learn the essence of introducing minimal units of any first car, instead of being over-ambitious to the extent of producing mass cars that bear a new technology. Customers are always hesitant to adopt vehicles that are equipped with new technologies such as electric-powered cars since they are unsure of their performance effectiveness.

In the case of Nissan, the company invested huge sums to produce its first car in large numbers with the hope of making colossal sales, a situation that frustrated it based on the outcome. According to Van den Steen, the corporation (Nissan) “invested over US$ 5.6 billion in the project, including US$ 1.7 billion for modifying an assembly plant and building a battery factory in Tennessee and another US$ 650 million for doing the same in the U.K” (5). Despite the anticipated sales of more than 500,000 units before 2013, the company had only sold roughly 47000 cars in the period between 2010 and 2013. Hence, it should borrow from Tesla’s plan of being calculative whenever it seeks to introduce new technology in the market.

Any strategy that yields recommendable results is worth adopting, especially by other industry players who may be recording losses because of their poor strategies. The car-manufacturing business is characterized by cutthroat competition whereby all companies that try to enter the market have to deal with the underlying threats to entry. This challenge enables company owners to narrow down to the best strategies to adopt to win clients, despite the apparent market rivalry (Thompson et al. 5). Tesla is not an exception. When the company joined the car production business in 2003, the CEO had to deal with barriers such as huge capital requirements, Research and Development (R&D) agendas, and balancing the economies of scale among others. However, from the above expositions, the company managed to secure market position, thanks to its well-calculated entry technique. Hence, it is very wise for other companies such as BMW and Mercedes-Benz to follow Tesla’s approach to enhance their profitability while reducing the losses they would have incurred when relying on their ineffective market entry approaches.

Tesla’s Profitability

Based on the sales that the company has been making since its establishment in 2003, it is surprising to realize that the numbers have surpassed the profits made by giant companies such as BMW, Toyota, and Nissan. In fact, according to the numbers presented by Van den Steen, the 2013 sales were outstanding relative to those of the aforementioned companies. Specifically, in 2013, “Tesla announced it had outsold both Nissan and GM in electric cars in the U.S.” (Van den Steen 2). In the same year, the company’s sales figures for Model S had surpassed the pooled numbers for both BMW 7 and Audi A8.

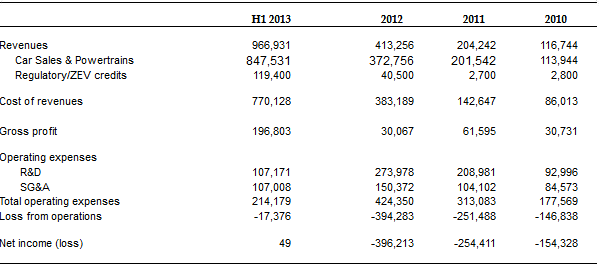

Hence, it suffices to conclude that the company has been profitable based on its sales performance. However, although Van den Steen confirms this profitability in his article, it is crucial to point out that the numbers presented are not updated (1). The article captures data of up to 2013 as shown in Appendix 2. Current figures show that the company may be plunging into losses. The 2017 figures reveal that the company is recording losses, although the CEO is implementing another innovative industry standard that is set to restore the situation. Musk’s strategy of securing the company’s financial condition has enhanced investors’ confidence since they are convinced that the struggles are short-lived.

In terms of competitive advantage, it is possible to argue that the company lags behind the rest such as General Motors and Ford because their unit prices are not as exaggerated as those of Tesla. Such companies have reported huge profits at a time when Tesla seems to be recording losses because of its inflated prices that have shunned customers from acquiring its units. Hence, the company cannot produce cars at a rate that is comparable to its competitors. However, examining the company from this perspective may be biased, hence making it possible to conclude that it lacks a competitive advantage (Thompson et al. 245). On the contrary, the company has an edge when viewed from the perspective of technology. Indeed, Tesla is a technology-producing corporation whose main agenda is to develop innovative hi-tech platforms. Here, it secures the position of being a global giant in the energy sector. With this advantage, it is possible that many of the current EVs such as the Mercedes B-Class or the Chevy Bolt may not be anywhere close to the company’s Model 3 in terms of technology.

By the end of 2014, Tesla’s position was destined to evolve by recording increased sales and profitability. As Van den Steen reveals, the company’s performance up to the first half of 2013 was stunning (9). The close to 11,000 units that had been sold by the mid of 2013 was an indication that the company was destined to grow. Musk had anticipated the performance to continue growing up to the end of 2014 where more than 40,000 cars, specifically Model S, would be sold. Based on the 2013 income statement, the company had made a gross profit of roughly 460,000 U.S. dollars. This figure almost doubled in 2014 when the company recorded a gross profit of approximately 900,000 USD.

However, some of these revenues or operational numbers are expected to change with time. Although EVs come as a new technology, customers may be hesitant to acquire units, owing to the uncertainty associated with new models in the market. For instance, the few who acquire the EVs may be frustrated by the cars’ performance issues, charging, and/or maintenance. Hence, as time progresses, profits may decline or rise based on the complaints or positive reviews raised by the current owners of the EVs. Specifically, as earlier mentioned, the company is recording losses. The 2017 quarterly financial report shows losses amounting to almost 620 million U.S. dollars, a situation that is attributable to Tesla’s struggle to manufacture its Model 3.

Conclusion: Evolution of the Car Industry

In conclusion, the car industry is expected to evolve not only to capture the latest technology but also to produce units that emit the least amount of carbon dioxide. This claim is attributable to the current international efforts to address the issue of global warming where virtually all countries are showing commitment to the agenda of saving the environment. Besides, efforts are underway to produce autonomous cars whereby owners will only assume a supervisory position when on the road. Although this technology is yet to be practically adopted, it has the potential of changing the car industry. Tesla is among the players who are planning to adopt this technology, although issues concerning imitation may need to be addressed. However, shortly, it may be impossible for Tesla to prevent imitation, owing to the expected advanced technologies whereby it would be possible to use a single unit to capture the technology used therein, hence enhancing imitation by competitors.

Works Cited

Thompson, Arthur, et al. Crafting and Executing Strategy Concepts and Cases the Quest for Competitive Advantage. McGraw-Hill Education, 2016.

Van den Steen, Eric. Tesla Motors. Harvard Business School, 2015.

Appendix

Roadster

Tesla Income Statement (in US$ thousand)