Introduction

The car manufacturing industry is a cut-throat market, especially for vehicles that utilize alternative sources of fuel, which have become immensely popular due to increasing environmental fears. This strategic analysis will focus on the Tesla Motor Company and evaluate the different tactics it can employ to thrive in a market dominated by large and experienced car manufacturers.

Tesla’s strategic options include the expansion of its model range, the adoption of a differentiated strategy, and the intensification of research and development. A detailed evaluation of the organization’s strategic position is presented and analyzed using a PESTEL analysis, Porter’s five forces framework, SWOT analysis, and value chain analysis. The results from the assessment provide a framework through which specific recommendations aimed at strengthening the company’s position are derived.

Company Background

Tesla Inc. is a pioneer in the automotive industry. The organization was created in 2003 by two Silicon Valley engineers focused on developing electric cars that would help reduce humanity’s dependence on fossil fuels (United States Securities and Exchange Commission, 2021). Martin Eberhard, JB Starubel, Elon Musk, Ian Wright, and Mark Tarpenning came together to form one of the world’s most successful companies (Liu, 2021). The company’s first car, the Tesla Roadster, was brought to market in 2006 to revolutionize the industry.

In addition to producing its cars, Tesla has also developed powertrain components for other automotive manufacturers. The company is divided into automotive and energy generation segments. The automotive segment is tasked with producing multiple car models, such as The Model Y, the Model X, and the Model 3 (United States Securities and Exchange Commission, 2021). The company’s energy storage products include Megapack and Powerwall for home and commercial applications. It also deals with solar energy systems designed for home and industrial use.

Literature Review

Company Statistics

Tesla Inc. is a significant player in the global market. It employed 99,290 employees globally as of 31st December 2021 (United States Securities and Exchange Commission, 2021). The company sent 930,422 vehicles out of its production line and delivered approximately 936,222 cars to consumers in 2021 (United States Securities and Exchange Commission, 2021). It is worth noting that 3.99 GWh of energy storage and 345 megawatts of solar energy systems were deployed to consumers in the same year (United States Securities and Exchange Commission, 2021). The company reported exemplary performance figures even though it dealt with numerous hardships.

Financial Performance Indicators

Tesla’s financial performance indicators demonstrate the fact that the organization is recovering effectively. The organization reported total revenues of 53.82 billion dollars, which represented a 71% increase compared to 2020, while net income attributable to common stocks was reported as 5.52 billion dollars (United States Securities and Exchange Commission, 2021). The company ended the 2021 financial year with 17.58 billion dollars in cash and cash equivalents, which represented a 1.81 billion dollar drop compared to the previous year. At 11.5 billion dollars, the company’s cash flow peaked, representing a 5.55 billion dollar gain over 2020 (United States Securities and Exchange Commission, 2021). It is important to note that the organization has been able to finance its operations thanks to steady expansion.

Theoretical Frameworks Applied to Analysis

There are a number of authors that have conducted a comprehensive assessment of various aspects of Tesla Inc.’s operations. For instance, Liu (2021) presents a detailed PESTEL analysis of Tesla Inc., while Yang (2022) offers an evaluation of the attractiveness of the car manufacturing industry using Porter’s Five Forces Framework. Others, such as Jiang (2022) evaluate the company’s strategic preparedness by conducting a SWOT analysis. Han (2021) uses the VRIO framework to carry out an internal analysis to effectively contextualize Tesla Inc.’s position in a highly competitive market. Finally, Yu (2021) explains how Bowman’s strategy clock can be applied in various organizational contexts to formulate effective strategies.

One of the most significant political factors is the prevalence of environmental protection rhetoric in the organization’s jurisdictions. Liu (2021) notes that the U.S., China, and Europe have implemented legislation to protect the environment and its natural resources. Liu (2021) also emphasizes the fact that the intensity of competition in the electric vehicle market was seen in 2016 when Tesla Inc. produced a wide range of vehicles, which led to the growth of the automotive industry. Liu (2021) notes that while alternative energy vehicles convert half of electricity to power, combustion engines convert a paltry 17-21% of gasoline energy to power, resulting in wastage and environmental degradation.

The alternate energy vehicle manufacturing sector has seen an influx of new players. New companies are entering the market with established brands, such as Mercedes Benz announcing that all its new models from 2025 will feature pure electric architectures (Yang, 2022). The move by governments across the world to incentivize car manufacturers to produce eco-friendly vehicles has attracted a variety of new entrants in the market. Substitutes are a threat to Tesla Inc. because they address the consumers’ environmental concerns while addressing some of the challenges associated with electric vehicle ownership. Yang (2022) notes that Nissan’s hydrogen-powered vehicles address long charge time challenges that most electric vehicle manufacturers face.

There are various reasons why Tesla products appeal to a significant portion of the population. According to Jiang (2022), the focus on the judicious use of resources has positively impacted the company’s financial status, as evidenced by increased sales. However, Renadia (2022) notes that the company must develop strategies to address issues such as the 11 accidents occasioned by the use of the autopilot system, which may reduce overall desirability. Tesla has prioritized the development of high-productivity battery systems and electric powertrains that are superior to existing alternatives in the market. Tesla also prioritizes a lean management system that simplifies decision-making processes by virtue of the fact that bureaucracy is eliminated. Tesla has prioritized the formation of strategic partnerships with investors and other technology and automotive companies for the development of high-quality systems and products.

Various models have been proposed to assess an organization’s external environment. Han (2021) notes that the adoption of a resource-based perspective is essential because it facilitates the development of a theoretical framework that can be used to develop meaningful strategies. Tesla Inc. has a total of two hundred and three patents and two hundred and eighty pending patents (Han, 2021). Most of the company’s patents involve alternate energy powertrain and battery components, perhaps the most essential elements of an electric car. Tesla is determined to reduce battery costs by developing a battery manufacturing plant with the capacity to address all of Tesla’s needs. The Gigafactory is designed to integrate battery production at Tesla Inc vertically.

The company has partnered with battery manufacturing companies to reduce costs associated with logistics and optimize processes, thus eliminating overheads. It is estimated that the factory will supply batteries for half a million vehicles every year and lessen the cost of battery production by 30% (Han, 2021). According to Xu (2020) the company also opened a Gigafactory in China on the 7th of January 2019 to further boost its production capacity. The Gigafactory has the potential to make Tesla the leading producer of lithium-ion batteries globally.

Few chief executive officers in the automotive industry have the same track record and experience with alternative energy sources as Elon Musk. According to Zhang (2022), Elon Musk was appointed CEO in 2008, and he became its largest shareholder after investing a total of 6.5 million dollars. Bhadamkar and Bhattacharya (2022) note that despite the CEO’s numerous accolades, he is best known for his success with Tesla. Elon Musk’s determination to prioritize quality and technology bolsters the brand’s superiority.

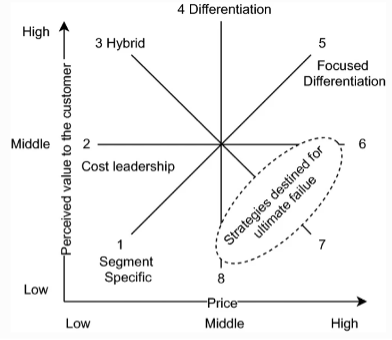

The Bowman’s strategy clock has long been applied in business to define strategies. Yu (2021) notes that the clock strategy posits that a competitive strategy may be defined by cost leadership, focused differentiation, or a hybrid model. Tesla Inc. has adopted a focused differentiation strategy, concentrating on a small group of affluent and environmentally conscious individuals who find stylish looks appealing (Yu, 2021). The move is informed by the belief that established automakers offer reliability, range, and easy fueling as key selling points for the common consumer.

PESTEL Analysis

The PESTEL framework is an effective instrument that companies can use to assess their external environments to facilitate the identification of the risks and opportunities associated with specific strategies. The political, economic, social, technological, environmental, and legal conditions are vital because they often result in significant transformations in a given industry. The comprehensive assessment of Tesla Inc.’s external environment allows for the discernment of elements that are likely to impact the organization’s position and performance in the market.

Political

The fact that Tesla Inc. is a multinational company means that it has to contend with various political conditions that impact business practices. Various programs have been developed across the world to encourage the population to embrace the use of electric vehicles (Liu, 2021). Specific pillars have been implemented to facilitate the sale of alternative energy cars in the international market. Firstly, governments are prioritizing the purchase of environmentally friendly vehicles (Liu, 2021). Secondly, the implementation of regional and national subsidies serves to encourage the purchase of electric vehicles. Finally, policies requiring vehicle manufacturers to sell a present percentage of electric vehicles have been implemented since 2019 (Liu, 2021). The factors above support the manufacture of electric vehicles, creating a conducive environment for the company.

Economic

The economic factors that determine Tesla Inc.’s performance include the rapid expansion of the alternative energy sector and the increase in fossil fuel prices. The organization had a direct impact on the U.S. economy through the generation of 5.5 billion dollars in revenue and the creation of approximately 50,000 employment opportunities (Liu, 2021). The increase in innovation has spurred interest in electric vehicles because of their efficiency and minimal carbon footprint.

Social

The growth of environmental concerns and the increased emphasis on eco-friendly products has a direct impact on Tesla Inc.’s performance. The consumer market is inclined to embrace energy-saving products such as electric vehicles, which have a less detrimental effect on the environment compared to internal combustion cars. The current social climate demands the purchase of green products, given that environmental conservation is considered an essential step in the protection of the planet.

Technology

Technological advancements and globalization have an immense impact on the automotive sector. The introduction of elements such as advanced driver aids on vehicles coupled with the refinement of electrically powered vehicles has spurred the growth of the automotive industry. Numerous firms have invested heavily in technological development in order to gain access to a consumer base that prefers green products. Enhanced safety and the increased focus on renewable energy sources such as electricity mean that the environment is conducive for alternative energy-based vehicle manufacturers.

Environmental

There is immense pressure on manufacturers to produce environmentally friendly vehicles to address numerous needs in the market. Factors such as the growing awareness of climate change among consumers have forced companies to shift towards eco-friendly production processes. All producers must be cognizant of the need to employ strategies that limit the harm caused to the surroundings. In addition, organizations have been forced to embrace sustainability as a means of maintaining market share.

Legal

The legal environment in which organizations such as Tesla Inc. must operate is riddled with legislative requirements. Nations across the world have implemented laws that govern the manufacture, sale, and use of electric vehicles. Most of the aforementioned requirements favor alternative energy-based vehicles owing to the fact that they are efficient and less environmentally hazardous. Fossil fuel-based vehicles are being phased out in many parts of the world, and the legal frameworks in these regions incentivize citizens to embrace green solutions.

Porter’s Five Forces Framework

Porter’s Five Forces Framework is an efficient tool that is used to evaluate the attractiveness of an industry. It was proposed by Michael Porter in the 1980s, and it includes five key elements (Yang, 2022). Each of the elements describes a specific aspect of the organization’s external environment that impacts its functioning. The forces shape and influence strategic decisions designed to increase an organization’s competitive edge.

Rivalry Among Existing Firms

The degree of competitiveness in the car manufacturing sector is high. There are a variety of alternative energy vehicle manufacturers such as NIO, BYD, XPEV in China, Mercedes Benz, Audi, and BMW in the international market (Yang, 2022). BYD is a powerful competitor in the Chinese market because it has numerous contracts with Chinese public travel agencies (Yang, 2022). Tesla faces stiff competition from automotive companies that are shifting from traditional fossil fuel vehicles to sustainable energy sources.

The Threat of Substitutes

The threat of substitutes in the alternative energy sector is quite low. Even though consumers have well received alternative energy vehicles in the automotive market, some alternatives appeal to some buyers. However, the development of hydrogen fuel cells faces a significant number of challenges that have limited the production of vehicles on a large scale. As a result, the threat posed by substitutes remains relatively low.

The Threat of New Entrants

The alternative energy car sector is highly attractive because it helps solve one of the planet’s most urgent concerns. Environmental conservation is a significant talking point in the business community. Established manufacturers are leveraging their capital and immense supply chains to focus on the development of electric vehicles. Therefore, Tesla faces an extremely high threat of new entrants, which means it must develop a strategy that addresses competition from existing firms as well as new arrivals in the sector.

Bargaining Power of Consumers

The overall bargaining power of electric vehicle consumers is moderate. Tesla is a market trailblazer in the alternative energy vehicle sector. While products from other manufacturers may appeal to a section of the population, a majority of buyers prefer to make their purchases from Tesla, given that the company has a long history of developing efficient electric vehicles. It is also worth noting that government incentives that offer tax deductions to buyers increase the demand for Tesla vehicles. The increased desire to own electric vehicles seen in the market diminishes buyer bargaining power significantly.

Bargaining Power of Suppliers

The bargaining power of suppliers is especially high in view of the fact that Tesla is dependent on the raw materials and components they provide. Any disruptions in the supply chain are likely to cause disruptions in production that may negatively impact the quality of products as well as the organization’s image. Tesla’s dependence on a very many suppliers has a substantial impact on its business. It is worth noting that the company has taken steps to reduce the aforementioned dependence by manufacturing its own batteries and car components. However, many suppliers remain the single source of components the organization needs to produce its vehicles.

SWOT Analysis

A SWOT analysis is a prerequisite in business planning and strategy development. It facilitates the systematic, comprehensive, and accurate assessment of an organization’s situation through the dissection of internal strengths and weaknesses, external opportunities, and threats (Jiang, 2022). Each of the aforementioned elements highlights aspects of the company that have a bearing on its functioning. The findings are instrumental in the development of strategies that can be applied to advance the organization’s place in the alternate energy car market.

Strengths

The efficient use of energy is one of Tesla’s main strengths. The use of a renewable source of energy, such as electricity, allows the organization to meet its sustainability targets while addressing key environmental concerns. Consumers are attracted to the application of sustainable energy sources to run automobiles.

The fact that the company often outsources components has allowed it to keep the cost of production low. The organization can then focus on technological advancement, which allows it to gain a competitive edge over rivals. The company has a highly efficient distribution network that prioritizes interaction with consumers and eliminates the challenges and costs associated with dealership agreements.

Weaknesses

The lack of liquidity is a significant weakness that Tesla faces. Even though the company often has a high volume of sales, the company’s large debt burden, coupled with the difficulties in implementing cost reduction strategies means that the high volumes do not necessarily translate to profit.

It should be noted, however, that the company has taken steps to remedy this problem through the construction of a new Gigafactory in Texas. The company’s heavy reliance on suppliers is likely to harm the organization in the event of shortages. Finally, Tesla is a relatively young company, which means that limited brand recognition and experience in the automotive industry may reduce the degree of trust among consumers.

Opportunities

The elements that define the automotive industry’s external environment provide a variety of opportunities for Tesla. Firstly, the increasing awareness of the need for environmental preservation across the globe and the rising fuel prices present an opportunity for the organization to create demand for its products.

Secondly, the increasing prioritization of subsidy programs geared towards increasing the adoption of electric vehicles can help the company grow. In addition, programs designed to incentivize consumers to purchase alternative energy vehicles create demand for Tesla’s vehicles. Finally, the technological advancements in the electric car industry, such as autonomous driving, provide an avenue for the company to lead the market with innovative and affordable products.

Threats

The main threat facing Tesla Inc. is the entry of established manufacturers with higher economies of scale into the electric vehicle industry. Such players have many years of experience in the car manufacturing sector and are capable of offering their products at lower prices, which would negatively impact Tesla’s growth strategy.

Finally, the challenges associated with the use of electric vehicles, such as long charging times, limited infrastructure to support charging stations, and the lowering of fuel prices are likely to discourage consumers from purchasing Tesla’s products.

VRIO Framework

To properly contextualize Tesla Inc.’s position in a fiercely competitive market, an internal analysis is essential. The resource-based perspective theorizes that an organization’s capabilities and resources are critical determinants of economic performance and help companies gain a competitive edge over rivals (Han, 2021).

It is essential for a firm to identify potential sources of competitive advantage and devise tactics that will help it leverage them for economic gain and an improved market position. The VRIO framework, which highlights a firm’s valuable, rare, inimitable, and organized resources, is the most common tool institutions use to assess their capacities.

Technology

Tesla Inc. has made significant technology investments and advancements since its inception. The company’s battery pack is designed to facilitate flexibility with regard to cell chemistry in order to allow future enhancements (Han, 2021). Tesla’s extensive technology portfolio has the potential to produce low-cost vehicles, which is a vital competitive advantage. The company’s powertrain and battery pack technology are rare because imitating the products is expensive and requires significant technical know-how (Han, 2021). Tesla captures value through the sale of its cars directly to consumers and supplying powertrains to other manufacturers.

The Gigafactory

Strategic partnerships are essential for success in highly competitive environments. Tesla has partnered with Panasonic, which supplies it with battery cells for two of the company’s best-selling models (Han, 2021). Tesla’s Gigafactory is intended to create scale advantages that will allow the company to meet its demand for batteries and produce a vehicle with an estimated 200 miles of range at half the price of the current Model S (Han, 2021). The increased range and improved performance would attract more consumers to the market.

Manufacturing

The ability to produce high-quality electric vehicles is vital for success in the alternative energy vehicle sector. Tesla manufactures its vehicles in Fremont California, in a factory that can produce approximately 500,000 vehicles annually (Han, 2021). Rather than utilize heavy equipment, the company uses robots and automated vehicles to move components within the facility (Han, 2021). Tesla Inc. is the sole car manufacturing company with a plant dedicated exclusively to alternate energy vehicles. In essence, the organization has the opportunity to maintain its competitive edge as an electric vehicle manufacturer whose competitors work to improve their facilities.

Company Stores

The adoption of an integrated distribution model has allowed Tesla to manage critical aspects regarding the sale of its vehicles. The model differs from conventional dealerships, which are run by independent parties. Tesla’s adoption of the model was informed by the fact that traditional dealerships tend to prioritize the sale of gasoline vehicles as opposed to electric cars (Han, 2021). Tesla is in a unique position to control the entire consumer experience. The store design is rare, given the fact that Tesla is one of the few automakers that have vertically integrated distribution models. The stores are also difficult to imitate, given the high investment costs associated with their establishment.

Supercharger Network

The availability of supportive infrastructure is a major hurdle that electric car manufacturers must overcome. Tesla has successfully done so through the development and installation of a dedicated supercharger network. The fact that the company’s chargers are faster means that they are a factor to consider when purchasing an electric vehicle. Tesla’s 85kW/h stations can charge a vehicle to half capacity in 20 minutes, 82% capacity in 40 minutes, and full capacity in an hour and thirty minutes (Jiang, 2022). The company has installed its supercharges in most parts of the United States, making it a leading player in the alternate energy car manufacturing sector.

Elon Musk

An institution’s leader sets the tone and is the face most people associate with a specific brand. Elon Musk has played a critical role in making Tesla products desirable (Han, 2021). Tesla’s chief executive officer has leveraged the power of social media to propel the company to hitherto unseen heights. Rather than depend on conventional advertising techniques, the company relies on word of mouth and media coverage (Han, 2021). Elon Musk is not imitable because he introduces a unique perspective when it comes to the management of automotive businesses. A summary of the VRIO framework is highlighted in the table below.

Table 1 – VRIO Framework for Tesla Inc.

Bowman’s Strategy Clock

The strategy clock represents varied situations in a market where consumers have different requirements based on what they consider as value for money. Tesla is facing challenges in adopting a cost leadership or hybrid strategy since the company does not have the scale or production ability to compete favorably with established brands. The company is heavily reliant on its technological advancements and brand image to maintain its consumer base. The main elements of Bowman’s strategy clock are highlighted in the figure below.

Conclusion

The situational analysis is intended to guide Tesla in the formulation of strategies meant to guarantee success in a highly competitive environment. The PESTLE analysis demonstrates the availability of opportunities for Tesla Inc. to expand and become a market leader in the electric car industry. Porter’s Five Forces Framework demonstrates that the electric car industry structure is likely to favor Tesla’s growth in the future.

The SWOT analysis demonstrates the fact that Tesla has a significant number of strengths and opportunities and few weaknesses and threats. Tesla occupies a strong market position but is under threat from emerging and established companies that have adopted cost leadership as their key strategy.

Recommendations

Tesla Inc. must shift from a focused differentiation strategy and adopt a differentiation strategy through the provision of perks that differ from rivals and are highly valued by consumers at the same price point. Such a move is likely to increase the company’s market share and boost productivity. The company must increase the range of models it provides its consumers to all segments in order to enhance competition with other players in the industry.

Tesla must prioritize investments in research to enhance its market leader status. Further improvements in battery technology, powertrains, and autonomous driving technology will keep the company a step ahead of the competition. Finally, the prioritization of cost-management strategies is essential to ensure that vehicles are produced at a lower cost. It is essential that the company leverages its internal resources to enhance efficiency and delivery quality.

References

Bhadamkar, A., & Bhattacharya, S. (2022). Tesla Inc. stock prediction using sentiment analysis. Australasian Accounting, Business and Finance Journal, 16(5), 52–66. Web.

Han, J. (2021). How does Tesla Motors achieve competitive advantage in the global automobile industry? Journal of Next-Generation Convergence Information Services Technology, 10(5), 573–582. Web.

Jiang, T. (2022). A business model to analyze Tesla based on SWOT Analysis and POCD. Proceedings of the 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), 648, 2896–2899. Web.

Liu, S. (2021). Competition and valuation: A case study of Tesla Motors. IOP Conference Series: Earth and Environmental Science, 692(2), 1–10. Web.

Renadia, S. H. (2022). Organizational learning and post-crisis management at Tesla Inc. in facing crisis communications. International Journal of Communication and Society, 4(1), 172-181. Web.

United States Securities and Exchange Commission. (2021). Tesla, Inc.: Annual report pursuant to section 13 or 15(d) of the securities exchange act of 1934 for the fiscal year ended December 31, 2021. Web.

Xu, J. (2020). Analysis of the operation strategy of Tesla Inc. in China. Frontiers in Economics and Management Research, 1(1), 21-25. Web.

Yang, X. (2022). Research on Tesla’s market based on Porter’s Five Forces and Ratio Analysis Model. Advances in Economics, Business and Management Research, 656, 773–777.

Yu, X. (2021). Firms’ strategies and their three elements. In The fundamental elements of strategy (pp. 77–100). Springer, Singapore.

Zhang, Y. (2022). Venture capital investment decisions on Tesla. Proceedings of the 2022 International Conference on Economics, Smart Finance and Contemporary Trade (ESFCT 2022), 150–156. Web.