Introduction

The concept of the Efficient Market Hypothesis (EMH) is fairly simple. According to the primary tenets of the theory, the available information encrypted in share prices reflects the current situation completely. Herein the crucial assumption of the theory lies; based on the concept of information availability, it is practically impossible to “beat the market” (Konak & Seker, 2014). The concept of beating the market in the identified scenario implies that the investors try to gain the return that exceeds the one stated in the S&P 500 index (Singh, Dimri, & Rawat, 2013). In other words, beating the market is similar to gaining the returns that are greater than the market average. It should be borne in mind, though, that the concept of beating the market may also be interpreted as succeeding in becoming more successful than the current leaders in the identified industry (Sultan, Madah, & Khalid, 2013).

It should be noted, though, that the concept of EMH is taken with a few grains of salt by a range of contemporary theorists (Shaik & Maheswaran, 2016). The irrationality of buyers’ behavior, as well as the choices made by people in the context of the global economy, in general, is viewed as a strong argument against the legitimacy of the theory (Rabbani, Kamal, & Salim, 2013). While some of the choices made by consumers can be justified by the current economic trends and the characteristics of the target environment, on a range of occasions, the human factor contributes to making the decisions that cannot be justified from the perspective of rationality. As a result, the very foundation of the EMH is undermined.

Nevertheless, the theoretical framework in question remains a foil for developing a better understanding of the way in which investment-related decisions are made in the identified environment. Consequently, it can be used as the means of locating the opportunities and challenges that investors may face in the context of stock markets, including not only the global one but also the ones that are state-specific and, therefore, are affected by a range of unique economic, financial, technological, political, legal, and culture-related factors. Understanding the share price behavior, therefore, is critical to the identification of the available options and the process of decision-making.

Literature Review

Although EMH seems the integrated concept that can be referred to as a well-rounded framework, it, in fact, is typically split into three categories. Particularly, the concept of the market efficiency is categorized based on a taxonomy containing three groups. Particularly, weak, semi-strong, and strong market forms are typically distinguished as the environments in which investments can be made. By definition, in weakly-efficient stock markets, the stocks contain the information that is referred to their past performance in the identified market. Although the specified data can be viewed as the means of modeling the strategy for managing the current situation, it can hardly be considered a reliable foundation for making forecasts.

The semi-strongly efficient markets, the data contained in the stocks concerns both the previous operations and the current situation. Finally, the strongly-efficient stock markets provide the information that can be used to not only determine the past performance of the stocks and the current market situation but also model the future changes in the identified environment. Consequently, the decision-making process is bound to have a largely positive effect, and the choices made in the process will become the building blocks of the investors’ success in the target realm (Ng, Wong, Yap, & Khezrimotlagh, 2014).

It would be wrong to assume, though, that the current EMH framework is fully authentic and does not rely on any other theory whatsoever. Quite on the contrary, the tool under analysis has been linked and is based on a variety of other models and assumptions. Furthermore, the issue of relevance of the EMH theory to the concept of an investment, as well as the environment of the contemporary global market, remains dubious. On the one hand, the approach toward explaining the choices made by the target audience is quite sensible. On the other hand, as stressed above, there is an obvious issue associated with the human factor, which poses the question regarding the legitimacy of EMH as a theory. Some scholars tend to view it as half-true due to the limitations thereof (Sharma & Thacker, 2014).

One must give the theory credit for being especially useful in the environment of the global economy and the recent increase in the development and production of disruptive information technology. In the era when the speed and quality of data transfer define the success of organizational performance, the theory that views the investment-related issues from the perspective of information management is especially important. In other words, as the means of describing the relationships and processes that occur in the data management processes of the stock market realm, the EMH framework is impeccable.

However, as stressed above, because of its rather straightforward approach that does not allow taking the human factor and many other aspects of the contemporary stock market into account, EMH can be viewed as dubious, at best, and deeply flawed at worst.

Nonetheless, EMH proves to be quite applicable to the contemporary global market environment. Specifically, the weak-form efficiency as a part of the theoretical framework is often referred to as comparatively viable notion in the context of the contemporary economic environment, especially as far as the global stock market is concerned. Indeed, the announcements of the changes that organizations experience in the environment of the global economy affect the stock price to a considerable degree. For instance, in retrospect, the events such as mergers and acquisitions trigger an immediate alteration in the price of the company’s stocks and shares, therefore, changing its current position.

Discussion and Analysis

Bing rather pliable, the EMH hypothesis can be viewed as an important part of the analysis carried out in the context of stock markets of developing countries. Particularly, a detailed analysis of the way in which the EMH framework can be used in the environment of an Indian stock market will show that the theory is quite viable and trustworthy.

The connection to the unique economic environment of the Indian stock market should also be viewed as an advantage of the study. Indeed, a closer look at the context in which Indian stock companies operate will reveal that there is a need to relate the available data to the two key stock exchanges that define the changes in the target environment, i.e., the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The fact that the authors mention the two markets shows that they do not take the economic characteristics of the Indian stock market for granted.

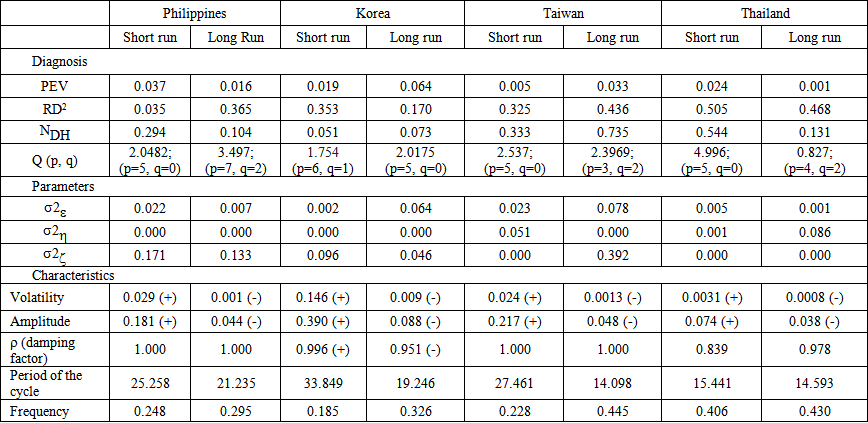

However, with all due respect to the effort that Gandhi, Bulsara, and Patel (2013) put into their research, the study also has its problems. For instance, the lack of the analysis of the social factors that shape the decision of the people operating in the identified environment can be considered a problem. Much to the credit of the authors, though, the methodology used to address the subject matter and evaluate the effects that the application of the EMH framework has on the Indian stock markets can be defined as rather impressive. The innovative analytical framework used by the authors can be deemed as very helpful in determining the opportunities and obstacles that investors are likely to face when exploring the Indian market. Particularly, the fact that Gandhi et al. (2013) referred to the error correction model, the unit tool test, and the co-integration test and as the frameworks for assessing the efficacy of the Indian stock market points to the fact that the authors of the study designed a well thought-out methodology. Therefore, the foundation for the analysis can be deemed as rather solid. Finally, the fact that the Indian stock market was reviewed along with the economic environments of other states shows that the results of the research can be considered objective (see Fig. 1).

Another study that puts the subject matter into perspective is the research carried out by Ananzeh (2014). The author considers particularly the weak form of the EMH and its efficacy as the tool or understanding the processes occurring in the Jordan market. According to the evidence provided by the author, the theory serves its purpose perfectly as it proves that the Jordan stock market does not develop properly in its weak form. Applying the random walk hypothesis to prove that the weak form of the EMH does not create the environment that investors can define as safe for the further operations, the paper provides a significant contribution to the overall discussion of EMH as a concept.

The application of the random walk model (see Fig. 2) seems a perfectly legitimate step to take when studying the specifics of EMH application to the Jordan market environment. By definition, the identified framework suggests that the evolution of the stock market occurs as a result of the effects of random factors. Therefore, creating a viable forecast that can be used as the foundation for the further decision-making process cannot be a possibility in an economic environment.

One might argue that the use of the specified framework introduces certain biases into the study. Indeed, the fact that the model implies a failure of the HM as a concept in the context of any market can be interpreted as a prejudiced approach. Nonetheless, the model allows assessing to what degree the analysis of the information about the past performance of the organizations operating in the Jordan stock market helps make the decisions about the current situation and design forecasts as far as the changes in the stock value are concerned.

The fact that the authors incorporated the information retrieved from the Amman Stock Exchange (ASE) into the study shows that the research was carried out with enough detail, precision, and understanding of the target environment. It could be argued, though, that the exploration of the weak-form EMH could have gone a bit further. Apart from viewing it from the perspective of a single test, the author of the paper could have included a wider range of tools that could help identify the success of EMH as applied to the Jordan stock market.

To give credit to where it belongs, one must mention that the research proves rather successfully the failure of the EMH framework in the environment of the Jordan market. However, when assessing the effects that the application of the EMH framework has had on the opportunities for making prognoses about the future changes, one must admit that it ultimately fails due to the lack of insight on the relevant factors.

The implications of Ananzeh’s study are, therefore, crucial to a proper understanding of how the Jordan stock market works and what decisions investors need to consider as plausible when operating in the specified environment. Though clearly having its problems, the EMH framework seems to be applicable to the environment of the specified market, which means that the price value of the shares cannot be predicted based on the progress that the market has been experiencing at a specific time slot.

One might argue, however, that the author of the study could have extended the research by considering some of the political, financial, and economic facts that had shaped the market by the time that the study was conducted. Particularly, the political background and the effects that it has been having on the changes in the stock price could have been explored somewhat deeper. As a result, the current EMH framework might have gained more depth with the incorporation of the extraneous variables into it. A closer look at the way in which the social, economic, political, financial, technological, and even cultural factors affect the changes in the stock market would be of a significant help for investors when considering some of the opportunities that the contemporary stock market environment has in store for them. Furthermore, the application of a sustainable approach toward the allocation of the financial resources that are available to the organization could be viewed as a possibility if the identified concepts were taken into account when carrying out the analysis of the market based on the tenets of the EMH framework. It would be wrong to assume that the author of the study deviates from the theoretical tenets of the EMH philosophy; however, an analysis of the identified factors would have added more weight to the study and allowed for determining a larger number of implications for the further research.

Last but definitely not least, the research carried out by Nisar and Hanif (2012) needs to be brought up as an interesting perspective on the use of the EMH framework in the context of a specific market. While being a rather general study of the subject matter as opposed to its application to the environment of a specific market, the article in question can be deemed as an essential addition to the overall analysis of the EMH viability in the target market. While Nisar and Hanif (2012) also focus on the Asian stock market and the opportunities that can be pursued in it, they address a slightly different issue. Particularly, they consider the implications of the crisis that embraced the realm of the global economy in 2008 and its consequences as the factors that determined the development of the stock investment strategy in the following years (see Fig. 3).

In fact, the authors contemplate the concept of a trading rule suggested by Branch and Chan for investing organizations as the means of increasing their tax advantage. As their study shows, the EMH theory, particularly, its weak form, does not seem to be applicable to the environment of the Asian market. To be more accurate, there is a distinct correlation between the past performance of the stock market and the current tendencies in it. Therefore, the study implies that the identification of the strategies that are likely to help an organization investing in stocks to increase its returns successfully is a possibility. Consequently, the EMH concept fails to prove that there is no tangible continuity between the information provided about the daily returns in the identified market environment and the share prices.

Particularly, the authors point to the fact that the discrepancies between the data represented in the Korean Stock Exchange (KSE) daily, weekly, and monthly distorts the current situation in the Korean market and, therefore, does not allow investors to gain a deeper insight into the issues that the identified economic environment is facing at present. Consequently, the choices made by the companies investing in the businesses in the Korean stock market are likely to be based on erroneous assumptions at least partially. Hence, the organizations providing financial support to the firms operating in the Korean stock market are bound to face at least some risks associated with wrong financial choices. As a result, different outcomes can be expected, including the one in which companies are likely to make the choices that will possibly lead to them achieving the success that goes beyond the opportunities that are determined as possible in the EMH framework.

Therefore, an overview of the existing studies on the subject matter shows that EMH needs further testing. Despite having a range of interesting ideas and being based on a seemingly sensible premise, the theory has a flawed foundation since it immediately discards the numerous factors that shape the processes occurring in the stock market. In other words, a variety of economic, political, financial, and environmental aspects of the stock market’s operations are disregarded as irrelevant.

Consequently, the theory allows for a plethora of misguided assumptions. While the framework has a plethora of valid points, it needs further refinement and improvement so that it could become a reliable foundation for the further decision-making process. Unless the essential factors that prevent the existing information from being instantly available to all parties involved are taken into consideration, the EMH framework is likely to ultimately fail as an independent theory.

Conclusion

An analysis of the existing studies on the subject of SM shows that the theory, while working quite well for some countries and creating prerequisites for a rather detailed financial analysis, still needs further improvements to become the foundation for a decision-making process in the investment area. Although the EMH theory does provide several essential insights on the opportunities that investors have in the global market, it does not offer a strong framework that helps create forecasts and plan future steps to be made when considering the investment opportunities that an organization may have in a specific stock market.

References

Afef, M. T. (2014). Asian stock market trends. Web.

Ananzeh, I. E. N. (2014). Testing the weak form of Efficient Market Hypothesis: Empirical evidence from Jordan. International Business and Management, 9(2), 119-123.

Gandhi, S., Bulsara, H., & Patel, P. (2013). Conceptual study on efficient market hypothesis for the world markets: Finding opportunities for Indian stock markets. Management Journal for Theory and Practice Management, 336(67), 25-36.

Geometric random walk. (2016). Web.

Global car Indian market. (2010). Web.

Konak, F., & Seker, Y. (2014). The efficiency of developed markets: Empirical evidence from FTSE 100. Journal of Advanced Management Science, 2(1), 29-32.

Ng, K., Wong, S., Yap, P., & Khezrimotlagh, D. (2014). A survey on Malaysia’s banks efficiency: Using data envelopment analysis. Scholars Journal of Economics, Business and Management, 1(11), 586-592.

Nisar, S., & Hanif, M. (2012). Testing weak form of Efficient Market Hypothesis: Empirical evidence from South Asia. World Applied Sciences Journal, 17(4), 414-427.

Rabbani, S., Kamal, N., & Salim, M. (2013). Testing the weak-form efficiency of the stock market: Pakistan as an emerging economy. Journal of Basic and Applied Scientific Research, 3(4), 136-142.

Shaik, M., & Maheswaran, S. (2016). Market efficiency of ASEAN stock markets. Asian Economic and Financial Review, 7(2), 109-122.

Sharma, A., & Thacker, K. (2014). Predictability of asset returns in developed and emerging markets. International Research Journal of Finance and Economics, 103(1), 44-60.

Singh, K. K., Dimri, P., & Rawat, M. (2013). Fractal Market Hypothesis in Indian stock market. International Journal of Advanced Research in Computer Science and Software Engineering, 3(11), 739-743.

Sultan, K., Madah, N., & Khalid, A. (2013). Comparison between Kuwait and Pakistan stock exchange market: Testing weak form of Efficient Market Hypothesis. Academy of Contemporary Research Journal, 2(2), 59-70.