Introduction

Wakame is one of the most successful fine dining restaurants in downtown Dubai. It specializes in modern Asian cuisine and prides itself in its simple, but adventurous dishes. This family-run restaurant invites guests to “experience the theatre of open-kitchen preparation, bar mixology and chef-selections” (Wakame, 2020). Alawi Al Braik serves as Wakame’s managing director (Wakame, 2020). However, he is also the restaurant’s co-founder, along with his brother Saleh Al Braik. Saleh and his subordinates have impressive background in the finance and hospitality industries (Wakame, 2020). Alawi argues that Wakame’s unique selling point is that the restaurant is family-run, which means that all the employees know and respect each other.

Background

Al Braik brothers note that Wakame’s values go beyond family and include diversity, high quality of service, and elegance. The restaurant tries to “create, innovate, and inspire” with its dishes (Wakame, 2020). As of 2020, Wakame consists of 38 employees, including Saleh and Alawi, Tracey Meskin as marketing and operations facilitator, Blackwell Chadzamakono as general manager, and Hanan Karim as Wakame’s brand manager (Wakame, 2020). Shane Silva is the restaurant’s head chef, infamous for his innovative Japanese cuisine (Wakame, 2020

). Blackwell Chadzamakono has thirty years of experience in the food and beverage industry in Africa and the Middle East (Wakame, 2020). Wakame defines its mission as bringing people together. The restaurant’s owners emphasize that they envision Wakame growing into a global food industry franchise. Wakame’s objectives include international expansion, building customer loyalty, and establishing a strong social media presence. Based on the restaurant’s long and short-term goals, it is apparent that all of them require strategic management planning and expert consultancy.

Past Issues

As for the issues the restaurant faced at the start-up phase, there were quite a few. First of all, Wakame had wrong cash flow projections, which affected budget, salary, and tax planning. There was no extensive financial and market analysis, which led to setbacks, misunderstandings, and eventual financial losses. However, the lack of an evidence-based financial report was a symptom of a larger problem. The main issue was that Wakame’s key stakeholders did not have enough data in order to make feasible projections and make decisions based on such insights. Therefore, the underlying problem was the lack of necessary data.

Data collection has also been detrimental to the restaurant’s franchising. Kawai by Wakame serves as a fast-food alternative to the luxury menus at Wakame Lounge in downtown Dubai. The restaurant’s owners admitted that their main concern with Kawai’s expansion is the lack of information regarding the economic and cultural backgrounds of prospective markets. As a result, without much business intelligence, franchising Wakame Lounge has turned out to be not as profitable. Alawi and Saleh decided to postpone franchising Kawai due to a disappointing experience with Wakame Lounge. It is apparent that both major issues the restaurant faced in the past can be viewed as symptoms of a larger problem – insufficient data collection. Wakame has hired an operational facilitator and a financial advisor in order to battle the first issue, which has manifested into the restaurant’s success and adequate profits. However, the issues related to franchising remains unresolved.

Phantom is a consultancy firm that could help Wakame in regards to management optimization and marketing changes. The role of a consultant is primarily focused on (but not limited to) collecting internal business intelligence, interviewing the team and customers, as well as creating a recommended course of action for Wakame. The initial tasks would include analyzing the local F&B industry, identifying Wakame’s resources and capabilities, as well as prioritizing the restaurant’s issues. Wakame’s main problem is figuring out how to successfully expend internationally and market its services in new markets. Entering unfamiliar markets requires Wakame to rethink its marketing strategy.

Food and Beverage Industry in Dubai

The UAE continuously leads the F&B industry in the Middle East region. According to the KPMG International report, Dubai is the fourth city in terms of overnight visitors (2018). Moreover, Dubai is ranked first in terms of the visitor’s spend per day. Therefore, it is evident that sector growth is aided by an increasing amount of tourists. Another factor that affects the profitability of the F&B industry in Dubai is the emergence of various global and national brands. The restaurant footprint in Dubai is higher than anywhere else, except only Paris. The UAE foodservice market is predicted to grow almost five percent during the next projection period of 2019-2024 (KPMG International, 2018). However, the increasing amount of foodservice channels as well as the emergence of international competitors could affect the local cafes and restaurants negatively. The effect of competition is already apparent to small Dubai-based businesses.

SWOT Analysis

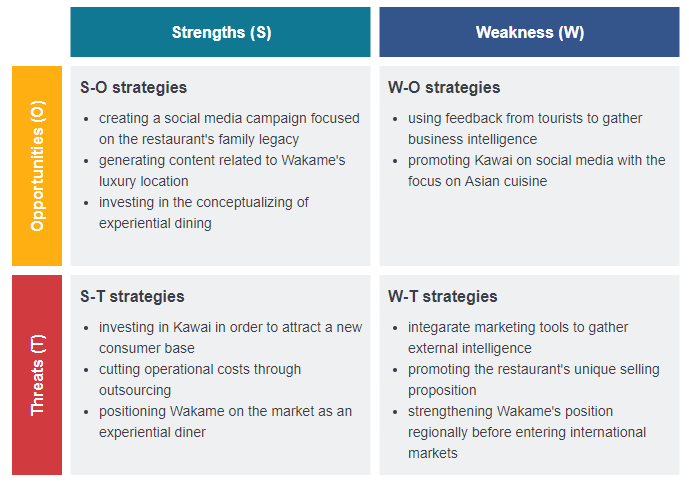

SWOT Table.

Wakame’s Strengths

Wakame has a number of strengths in terms of business management and operational decisions. Firstly, the restaurant’s family legacy provides a sense of exclusivity for customers. With the emergence of a new trend for traditional, family-run diners among tourists, Wakame attracts a lot of visitors due to its unique selling proposition. Secondly, Wakame employs an experienced team, members of which have the necessary background in finance, F&B management, and marketing.

As for the other strengths, the restaurant’s location in an elite Dubai district demonstrates the quality of its services and helps to increase the guests’ expectations. Wakame also participates in the adoption of new industry trends, including experiential dining. The incorporation of cooking classes is a major strength since there is only a small amount of Dubai-based restaurant providing such services. Wakame’s executives have put a lot of effort in social media promotion and targeted online communication, which has manifested itself into a major strength. Such online initiatives do not only have immediate positive effects of attracting customers, but also establishing the brand of Wakame. Brand recognition impacts the profits and helps companies expand due to the consumers’ favoritism of well-known establishments.

One of the most crucial strengths of Wakame is the small size of its team. All the operational decisions go through Saleh and his brother, which affects the discipline among the team members. Centralized decision making works the nest for a local restaurant like Wakame. It serves as an effective managerial model because employees can avoid misunderstandings and confusion by having a limited amount of supervisors. In addition, such a form of internal governance allows Saleh and Alawi to collect all the necessary internal intelligence in order to make decisions and future projections regarding the restaurant’s direction.

Wakame’s Weaknesses

Centralized decision making can also be a major weaknesses, depending on the circumstances and the executives’ approach to management. For example, the fact that there are only two key leaders within Wakame limits the restaurant’s opportunity to make innovative decisions. Since all the operational competence lays with the Al Braik brothers, there is little to no room for significant change and experiments. As far as communication goes, employees at Wakame rarely voice their ideas and suggestions. Saleh and his brother need to look at the business’ current trajectory from a different perspective from time to time.

They cannot be the only ones who contribute to the discussion and make all the decisions. As an example of centralized model’s failure, Saleh and Alawi have failed to expand Kawai by Wakame because they did not have enough business intelligence. They needed the help of external expert knowledge and market analytics in order to assess the prospects of regional and international franchising. Al Braik brothers also had to involve their team in the process of conceptualizing Kawai.

Wakame employees come from different backgrounds and have unique personal experiences, all of which could serve as an idea pool for the concept of Kawai. Moreover, the restaurant’s team could serve as an appropriate demographic for the lower-price, fast-food café. Employees could provide integral data regarding the preferences of middle- to lower-class customers. It was hard for Saleh and Alawi to make the right decisions regarding Kawai by Wakame because they are both upper-class.

Opportunities

Even though increased competition presents a concern to local restaurants, new opportunities emerge in the UAE F&B sector. Firstly, Dubai residents have high disposable incomes, which is why they tend to favor premium-priced products and services (KPMG International, 2018). Secondly, rising tourist arrivals serve as an excellent opportunity for small-scale, family-run businesses to collect more profits and eventually expand (KPMG International, 2018).

Riyadh can be a viable option for regional expansion due to relative familiarity with the culture and societal trends. Increasing urban lifestyles in the UAE present an opportunity for Dubai-based restaurants to expand locally and stabilize themselves in a familiar market. In addition, evolving consumer preferences have been detrimental to the growth of the UAE foodservice industry (KPMG International, 2018). Lastly, the lack of recreational activities available to tourists in Dubai serves as another opportunity for local F&B businesses.

The lucrative opportunity for Wakame lies in the popularization of Asian cuisine in the United Arab Emirates. Japanese, Chinese, and Thai restaurants have been among the top choices for UAE residents and visitors for several years (KPMG International, 2018). Asian cuisine is expected to see greater acceptance in the future due to the increasing number of tourists from Asia. Therefore, Japanese and Chinese tourists may have been a challenge to some businesses but have served as a profitable opportunity to others, including Wakame Lounge and Kawai by Wakame.

Threats

Despite the UAE foodservice sector being lucrative, it is also one of the most competitive industries. On the one hand, consumers have no shortage of choice in a highly saturated market that is full of new options and innovative trends. On the other hand, shifting customer preferences, economic setbacks, and market diversification lead to numerous challenges restaurants and cafes have to face in order to remain profitable.

High operational costs are the main challenge that businesses in the United Arab Emirates are facing nowadays due to increasing rental and labor prices. KPMG International report emphasizes that restaurants in Dubai often have to optimize their costs by reviewing all the aspects of the business’ operations from “relevance of the concept in the market, to operational agility, to support function efficiency, and result-driven financial monitoring” (2018, p. 8). Despite the optimization efforts, the cost of running a foodservice company in the UAE has increased significantly over the course of a few years. There has been understandable concern among the industry experts since F&B companies failed to meet the margins in 2017 (KPMG International, 2018). Apart from the increasing operational costs, restaurants face a shorter average brand lifecycle (KPMG International, 2018).

The pace of F&B businesses openings and closures has been hectic over the past couple of years. High labor costs contribute to the challenge most locally-based foodservice companies are subject to. The United Arab Emirates’ F&B sector experienced high staff attrition rates in 2017, primarily due to a plethora of job opportunities provided by the competition (KPMG International, 2018). Therefore, staff turnover control and potential training are a part of a larger issue UAE-based restaurants face today – high operational costs.

The Middle Eastern market is subject to economic setbacks and financial implications, which is most evident in tax reforms. In 2018, the UAE introduced a value added tax (VAT), which affected F&B businesses’ pricing strategies, billing, and reporting (KPMG International, 2018). The VAT regulations require all publicly displayed prices to include VAT. Many restaurants and cafes needed to absorb the costs of re-pricing and other strategies. The introduction of VAT has led to an initial downturn in consumer turnover. Governmental consultants have initially presented this adjustment as a part of the regulations’ integration. However, the prognosis failed to establish the time windows for the financial downturns, which led to profit losses and market instability (KPMG International, 2018). The introduction of VAT created a challenge for retail businesses and the service sector in regards to pricing strategies.

Emerging market conditions within the UAE F&B sector led to the consumers’ value-seeking behavior. In turn, there has been an apparent shift in customer preferences, which resulted in the popularization of quick-service restaurants (QSR) (KPMG International, 2018). Established global brands perform better in the QSR sector, which puts locally-based Dubai restaurants at risk. Fine dining outlets have been affected the most due to the fact that there was a significant decline in the number of luxury diners. Apart from the patronage of famous brands, the majority of independent, luxury outlets have experienced a decline in profits and ticket sizes (KPMG International, 2018). Due to the increasing number of international hotels and associated restaurants, the competition for non-hotel businesses has grown. The line between premium casual and fine dining segments has started to blur. This presents a number of threats to the success of Wakame Lounge. Firstly, there is a notable challenge in regards to pricing. Secondly, Wakame’s customer loyalty is at risk due to changing preferences. The restaurant’s promotional activities depend upon the inclusion of the premium casual segment in order to remain relevant. However, the decline of the luxury outlets and the rise of QSR sector present an opportunity for Wakame to continue its initiative to franchise and expand Kawai by Wakame regionally.

A number of various geopolitical factors have also affected the F&B industry in the Middle East. The changing demographics among tourists present a challenge for foodservice outlets. Even though the total amount of UAE visitors has grown, the increase has been primarily from the Asian hemisphere (KPMG International, 2018). Therefore, the number of Western tourists (whose F&B spends are usually much higher) has been relatively the same. Low oil prices, the economic disturbances, and a relatively modest GDP growth have had a significant impact on the current state of the UAE F&B industry as well. All of these factors present a challenge for Wakame, in particular, due to subdued consumer confidence.

TOWS Matrix

Trends Shaping the Industry

Due to the increasing competition, the F&B industry in Dubai is subject to various changes, innovations, and trends. The key trends within the foodservice sector include experiential dining, food trucks, and healthy nutrition. There are also numerous management strategies popular among the restaurant executives, all of which are going to be explained in further detail.

The first trend that is evident among the UAE consumers is experiential dining. Customers are becoming more aware of the way they spend their free time, which is why they tend to seek something beyond the traditional restaurant experience. The premium sector, in particular, is subject to higher expectations from guests who are willing to pay for the experience, rather than just food (KPMG International, 2018). Guest chef appearances, live entertainment, and cooking classes are among the options that are popular within the Dubai fine dining segment. Wakame, for instance, incorporates weekly cooking classes with their top chefs. Such small alternations to a traditional dining experience helps restaurants differentiate themselves among the competition by providing guests with something more than just a simple meal.

Consumers are seeking convenience and speed in terms of foodservice. Therefore, Dubai’s food trucks, delivery services, and domestic caterings have experienced a surge in popularity over the past years (KPMG International, 2018). The takeaways and food deliveries provide customers with an opportunity to optimize their dining experience according to their schedule and location. The takeaway and delivery app trends are more applicable to Kawai by Wakame. However, Wakame Lounge can still incorporate the domestic catering and chef-for-hire services in order to stay ahead of the trends.

Global obsession with organic foods, healthy lifestyles, and vitamins is apparent due to the amount of vegan restaurants and juice bars internationally. The United Arab Emirates is starting to participate in the trend since the amount of ‘healthy’ restaurants and cafes continues to grow (KPMG International, 2018). The use of organic and ethical ingredients is rather expensive, which is why fine dining restaurants can integrate the healthy menu options without re-pricing.

As for the managerial trends for the UAE-based F&B businesses, there are various business models favored by the most profitable outlets. Firstly, a lot of restaurants focus on cost optimization and operational effectiveness since the operational costs have increased significantly (KPMG International, 2018). The main challenge restaurants face is optimizing the costs without it affecting customer experience, employee satisfaction, or overall food quality. Dubai-based foodservice outlets often hire expert advisors to create the right procurement plan (KPMG International, 2018). When it comes to business models, there are two practices that are trending among the UAE-based F&B businesses. They include innovative profitability evaluation and outsourcing the kitchen spaces (KPMG International, 2018).

Restaurants often calculate their profits by using a traditional method of calculating net profits, which implies contribution-led evaluations. It is “based on revenue generated net of food costs and commission paid to the delivery partner” (KPMG International, 2018, p. 24). However, some diners now prefer to use a new method. It is based on the net profitability of the food delivery business, “considering its share of the costs proportional to revenue contribution” (KPMG International, 2018, p. 24). Assessing delivery economics comes down to evaluating which approach is right for the specific restaurant and its operational model.

Delivery kitchens are the second trending practice among the restaurant managers in the UAE. Such rental kitchens allow foodservice outlets to address the demand without the high rental prices of increasingly lucrative Dubai districts. Delivery kitchens provide restaurants with a space for delivery-only services. Twenty percent of operators utilize a rental kitchen, while another thirty percent are interested in integrating at least one delivery kitchen (KPMG International, 2018). Rental kitchens gain higher acceptance on the market due to the increase of consumer demand and operator interest.

Porter’s Six Forces

In order to analyze the strategic position of Wakame on the market, Phantom Consultancy could introduce the Porter’s six forces model. The six forces model could be used as an effective tool to assess the prospects of Wakame individually as well as the attractiveness of the F&B market overall. The model includes new entrants, end users and buyers, competition, suppliers, substitutes, and complementary products.

The threat of new entrants is high for Wakame Lounge and Kawai. Firstly, the restaurant is not well-established and does not have a brand built over multiple decades. Wakame is relatively new and, despite the strong social media presence, remains not very well-known locally. Secondly, there is an increasing amount of competitors in Dubai’s foodservice industry, according to multiple reports and expert projections (KPMG International, 2018). Both of these factors make it apparent that while the competition continues to grow, Wakame does not have enough brand recognition to remain relevant on the market.

Consequentially, Wakame has a relatively high threat of new entrants. As for end users and buyers, Wakame manages to attract an emerging consumer segment of Asian tourists. However, with the decline of fine dining, the restaurant’s prices may not be the most acceptable, even among the upper-class guests. Therefore, the bargaining power of customers is moderate. When it comes to suppliers, their bargaining power is moderate as well since Wakame has numerous long-term suppliers that value the restaurant’s contribution. However, the increasing competition in the UAE foodservice industry makes it easier for suppliers to find new clients.

Due to the rise of lower-budget, takeaway competition within Dubai’s F&B industry, there is a high threat of new substitutes emerging for Wakame. As for complimentary products, Wakame manages to provide cooking classes and exclusive chef appearances in order to enrich the customer experience. However, there are still various opportunities for Wakame to expand the range of its services. Lastly, when it comes to competition, Wakame has a number of strong rivals in terms of Asian restaurants of a premium segment. Some of them include Zuma and Buddha Bar. However, the majority of them does not utilize social media at a large scale, which puts Wakame’s online campaigns at a significant advantage. Still, the amount of competition in Dubai has increased tremendously, which means that Wakame does not have a high competitive advantage.

References

KPMG International. Food for thought: UAE 2018 food and beverage report. Web.

Wakame (2020). Wakame restaurant and home delivery. Wakame.