Problem Statement

China is the world’s most populated country, with over one billion potential customers. In addition, the nation has been seeing intense economic growth over the past decades, which also contributed to its business attractiveness. Following this development, China has become an attractive destination for many international businesses across various industries. Among them, the retail sphere can be seen as one of the most promising directions. Wal-Mart, one of the leading retailers in the United States, always envisaged a strong international presence.

Therefore, China became an evident choice for the eventual expansion of the industry’s giant. However, upon launching its Chinese-based operation, Wal-Mart encountered serious issues. As such, the chain was unable to reach a similar level of performance and presence as the one it had in the United States. Furthermore, Wal-Mart’s results were inferior to the performance of not only local chains but also European players. Accordingly, the primary problem consists of determining the causes of such a sub-optimal outcome while outlining the potential avenues and strategies of resolution.

Key Elements of the Case

Wal-Mart is considered to be one of the world’s most prominent retail chains. The company was founded by Sam Walton in Arkansas, U.S.A., in 1962 (Chang & Hu, 2020). In fact, Wal-Mart has repeatedly been named as the world’s largest retail network, successfully entering the list of 500 best-performing organizations worldwide. At the same time, Wal-Mart has been able to reach such a status primarily through its immense domestic success. Evidently, the company’s leadership encountered the necessity to expand the operations to other markets across the globe.

Within this context, China was seen as a desirable destination due to the size and the growth rates of the market. Hardaker (2018) refers to the country’s development over the past decades as the “retail revolution” due to the magnitude of transformations and the rapid economic growth (p. 14). Therefore, a successful entry into the Chinese market was projected to be a highly beneficial outcome for the company in terms of both revenue increase and global presence.

By the end of the 20th century, Wal-Mart’s management was able to add a practical dimension to these plans. In 1996, the first Wal-Mart location was inaugurated in Shenzhen, China (Chang & Hu, 2020). From that point, the company began an active expansion in the emerging Chinese retail market with the aim to withstand the competition of local players and secure a leading position in the country.

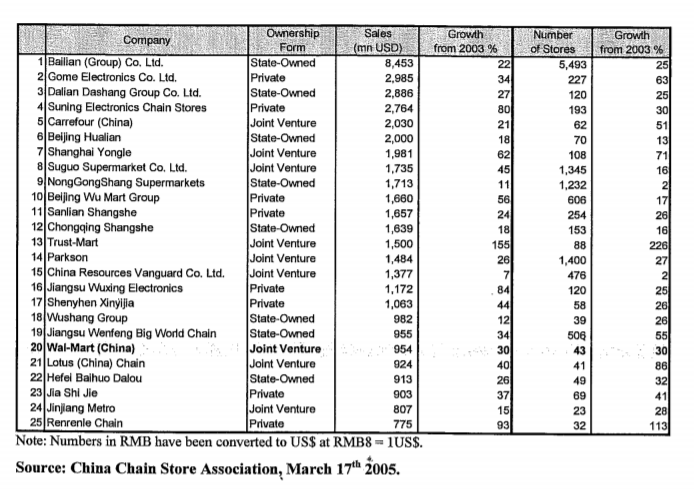

However, in many ways, Wal-Mart encountered considerable obstacles, which prevented it from attaining the global objective. Furthermore, by 2006, the company was losing competition with other foreign retailers in China. Farhoomand and Wang (2006) state that Wal-Mart performed visibly worse than its European counterpart Carrefour. Overall, in its ninth consecutive year of operations in China, Wal-Mart’s stores continued to lose money, causing serious concerns within the company’s international leadership. Within the nationwide ranking of retail chains, Wal-Mart only occupied the 20th position by 2006, which was not acceptable for the global leader of the industry. Figure 1 suggests that Carrefour earned twice as much in sales, and the competition against local retailers was lost, as well. Therefore, urgent intervention was required to change Wal-Mart’s position in the world’s largest market.

Stakeholder Analysis

In order to outline the potential avenues for the resolution of the issue, it is vital to acquire a profound understanding of the environment in which Wal-Mart China operated. The Chinese market is generally viewed as a highly attractive destination for many contemporary companies across various industries. By the end of the 20th century, the country showed an unprecedented rate of economic growth, which rendered it a highly favorable environment for business. Nevertheless, the entrepreneurial landscape of China demonstrates an array of particularities, which are to be considered by international companies. If neglected, these impediments may potentially reduce and even fully negate the benefits of a large-scale, growing market.

First of all, the mentality of Chinese customers is different from American stakeholders. According to Farhoomand and Wang (2006), the rapid development of the country was not equal in terms of the personal income of its citizens. As a result, Chinese society experienced a considerable increase in the level of socioeconomic disparities. In other words, the gap between the rich and the poor became wider, virtually dividing China into two separate markets. In terms of the purchasing behavior of Chinese customers, there are also important factors to consider.

Farhoomand and Wang (2006) state that the local public prefers frequent visits to stores, during which people purchase few goods or nothing at all. This tendency contradicts Wal-Mart’s home tactic, as the American customers demonstrate an opposing approach, preferring less frequent yet abundant purchases at such stores. The Chinese buyers remain in constant pursuit of value, which is why it is normal for them to execute prolonged shopping trips and select the best value among many options.

Another important factor influencing the purchasing behavior of Chinese customers is related to their living conditions. The country’s colossal population is concentrated in its most developed regions, thus raising the density. As a result, most of the Chinese customers live in small apartments with little space. Therefore, they are physically unable to purchase large quantities at once, as they would simply have no space to store them. Such a mode of consumption has nurtured a habit of freshness among Chinese consumers.

As a result, the public has become rather demanding in this regard, making it vital for suppliers to provide only fresh products. This factor is tightly related to a global issue of poor transportation in early 20th-century China. It was simply inconvenient for customers to execute long yet frequent commutes to remote Wal-Mart facilities on a regular basis. Such a situation pushed the public toward small local shops located in better areas closer to their places of living.

In addition to these aspects, there exist other variables, which make China a highly particular destination for retailers. As mentioned above, the economic growth of the country was uneven, and this tendency comprises the infrastructure, as well. In 2006, the country experienced a lack of affordable and efficient means of transportation, and even expressways were rare. In addition, the implementation of digital technology was not on par with the West. As a matter of fact, the global social and political processes play a pivotal role in the Chinese market.

Unlike the developed democracies of the West, China’s economic aspect is closely connected to politics. In this regard, Farhoomand and Wang (2006) observe a considerable degree of protectionism, which favors local companies. Therefore, foreign retail companies experience additional pressure, which may prevent them from reaching full capacity through artificial obstacles (Bai et al., 2021). Nevertheless, the example of Carrefour confirms that even organizations from outside China can select an optimal route and compete with local players effectively.

Options for Resolutions

In order to address the issue faced by 2006, Wal-Mart could take different routes. First of all, Hinings et al. (2018) lay a strong emphasis on digitalization and innovativeness of business as the primary instrument of performance improvement. While this may have been instrumental in Wal-Mart’s home market, its Chinese department would have been unlikely to benefit from it.

The lack of digital infrastructure in early 20th-century China would prevent the population from actively engaging in digitalized operations, making this an ineffective expenditure. On the other hand, Wal-Mart could attempt to overcome the institutional barriers through closer collaboration with local companies. A merger with another retail chain from China under the country’s jurisdiction would bypass the local protectionism and relieve some of the pressure. However, Wal-Mart would have to lose its unique identity in the process, which would contradict the company’s image.

Recommendations

Ultimately, the optimal route for Wal-Mart would be to accept the reality of the Chinese market and adjust its operations accordingly. This idea suggests abandoning the patterns used by the company in the United States, where the purchasing behavior is inherently different. The core of the problem lies in the Wal-Marts strategy of placing immense malls in remote areas, which imply infrequent visits with massive purchases. Evidently, it would be highly expensive to reorient the chain toward smaller shops in urban areas fully.

However, it appears possible to open several new locations of this type. Wal-Mart should establish smaller supermarkets with its trademark perfect logistics to provide the residents with fresh, affordable products at any moment. This way, the customers will become familiar with the company and its offer, which is likely to instigate interest in Wal-Mart’s larger formats.

References

Bai, H., McGoll, J., & Moore, C. (2021). Motives behind retailers’ post-entry expansion – Evidence from the Chinese luxury fashion market. Journal of Retailing and Consumer Services, 59. Web.

Chang, Y., & Hu, J. (2020). Analysis on the mode of multinational retail enterprises entering Chinese market. Modern Economy, 11(1). Web.

Farhoomand, A., & Wang, I. (2006). Wal-Mart stores: everyday low prices in China. University of Hong Kong.

Hardaker, S. (2018). ‘Retail revolution in China’ – transformation processes in the world’s largest grocery retailing market. Die Erde, 149(1), 14–24.

Hinings, B., Gegenhuber, T., & Greenwood, R. (2018). Digital innovation and transformation: An institutional perspective. Information and Organization, 28(1), 52-61. Web.