Introduction

Due to the innovation these days, one fruitful film can be dispersed everywhere throughout the world, which is in movies or DVD formats. Cinema animation is a media that circulates everywhere throughout the world. Actually, the animation industry is a fast-paced industry, which rapidly grows robustly (Prahalad and Hamel 16). The interest for the animated films is expanding from the rising number of links and satellite TV and the internet’s fame. What’s more, previously, the objective of the animated film business was just to entertain children. However, currently it extends to cover customers of varied ages. The business’ pattern has changed from drawing images and using photos (which is tedious and time-consuming), to utilizing PC innovation as a part of a request to make the real and higher quality pictures. Creating the animation films is still time-consuming and tedious; this pushes the expense of generation to be high. Currently, there is the pattern of outsourcing the creation of animated films from North America to Asia Pacific zone, which has a lower expense, fantastic PC activity generation, and lower overhead costs (Morgan 57).

Overview of the Walt Disney Company

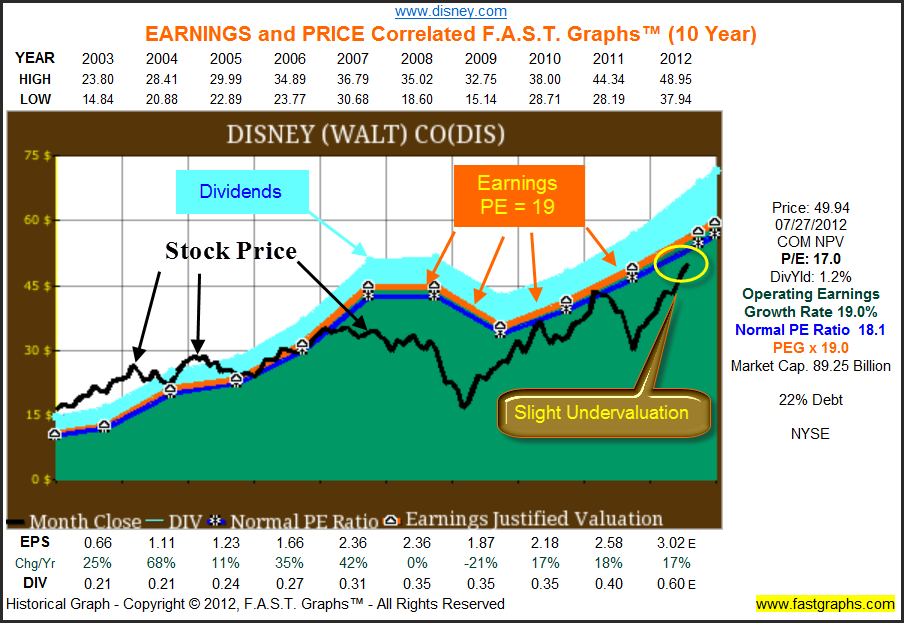

Walt Disney is one of the main organizations on the planet that specializes in entertainment since the year 1923. Walt Disney Company and its auxiliaries and partners have four business sections, which are media systems, entertainment parks and resorts, studio excitement, and customer goods. The Walt Disney studio is the first branch of the entire Walt Disney (Miller 8). Since its establishment, the company produces animated films and real to life movies. The Walt Disney studio does not just produce movies; it is also involved in the circulation of Disney and different movies to the rental markets and home markets across the world. It is likewise one of the biggest makers of Broadway musicals. Additionally, it has the music bunch under Walt Disney studio that produces unique music and film soundtracks. A summary of the stock price trends is in Figure 1.1 below.

Another branch of business is the venture in entertainment parks and resorts. The company established its first entertainment park and resort in the year 1952 in Anaheim, California. The entertainment park is the famous Disneyland Park. From that point forward, Walt Disney extended its entertainment park and resort business to other parts of the world. This incorporates the Disney Cruise Line, and eight other Disney vacation resorts. Walt Disney additionally has five resorts spread over three continents. The third branch of Disney’s business is the Disney consumer items. The Disney Consumer Product (DCP) produces different sorts of items, for example, children’s toys, attires, home adornment, books and magazines, play station and PC games, foodstuffs and refreshments, stationery, hardware, and expressive arts. To have the capacity to create the greater part of this, DCP has different lines to deliver the items. Furthermore, Walt Disney possesses the biggest distributor of youngsters’ books and magazines, which spread into 75 nations (Lundberg 18).

Walt Disney likewise gives the site to shopping entry and Disney stores retail outlets. Notwithstanding, the Disney store retail chain is claimed by the other party in Japan, under the permit from the Walt Disney Company. The last section is Media systems. They display the wide cluster of television, link, radio, publications and internet organizations. The company possesses two popular TV groups, which are the ABC Network and ESPN. The Disney-ABC TV network telecasts all of the Walt Disney programs and news segments. The target markets are concentrated on children and families. Besides, Walt Disney Company likewise owns ESPN, which is one of the main stations in broadcasting sports news and features (Haspeslagh and Jemison 88).

Overview of the Pixar Company

Pixar has won the Academy Award severally for computer games animations. The company has technical capabilities to make creative films and different items. The Pixar Company specializes in movie entertainment and other PC games entertainment. On February 3, 1986, Steve Jobs bought the PC graphic unit of Lucasfilm, Ltd for $10 million to build up Pixar as an autonomous organization. In addition, Ed Catmull who had worked with Lucasfilm was a fellow benefactor and a boss of Pixar Company. The organization’s goal is to create PC animated movies that attract a wide range of fans with characters and stories by utilizing innovation and inventive ability. Along these lines, Pixar’s group invented a few programming software, which were utilized to make various items (Haley 462). Figure 1.2 provides a summary of the Pixar Company’s stock prices.

In the year 1987, Pixar produced the short film Red’s Dream. This short film got the Golden Gate Award for Best PC-generated film at the San Francisco International Film Festival. In addition, it also won a Golden Nicas at the Prix Ars Electonica Festival in Austria. In the year 1988, Tin Toy claimed the best short animated movie. It earned the First prize for PC produced animation at the third LA International Animation Celebration. In addition, it earned the Blue Ribbon Award courtesy of the American Film and Video Association. The year 1989 characterized the production of Knick Knack and RenderMan giving rise to the first business (Cho and Pucik 562). Moreover, in July 1989, the CEO of Pixar, Steve Jobs needed to build the organization’s abilities, so he worked together with the Colossal Pictures in San Francisco to enable Pixar engage in airing TV commercials and other films for promotions. The partnership was exceptionally fruitful. In 1990, the organization office shifted to Point Richmond, California, in a one-story building. In the new location, the organization produced five new ads. In May 1991, the association went into the Feature Film Agreement with Walt Disney Pictures for the advancement and generation of three PC animated movies. Disney had the mandate to distribute the movies. At that point, the partnership was started (Chernow 39).

Data and methodology

There were two modes of acquisition discussed in the deal. There was the sales alliance, whereby, the partnership between the two organizations focuses on building sales. Both sides can advertise its creation together and get more benefit. The other mode is investment alliance, whereby, both Disney and Pixar will contribute the involved costs in the agreement. They will contribute to the costs equally and claim an equal share of the benefits from the sales. The partnership between Disney and Pixar expects to produce extraordinary advantages to both sides. The Walt Disney-Pixar merger conveys various persuading focal points for Disney, yet Pixar shareholders ought to be less excited about such an arrangement. Pixar’s assets and capacities have set a standard that is amazingly hard to mirror. Through its exceedingly capable worker pool, a society of inventiveness and coordinated effort, and exclusive 3D PC activity programming, Pixar has made an upper hand in the film world that yielded normal aggregate film industry offers of $538 million with only six motion pictures.

Pixar shareholders ought to be careful about the potential breakdown of these assets and abilities, which fundamentally are its center capabilities. Though a merger could translate to more money coming in for Pixar, it will probably bring about the end of an organization whose assets and capacities give favorable position in the film industry. A renegotiated value organization together that allows Pixar to win more than 40% of aggregate benefits of a film versus Disney’s 60%. would be a superior vital choice for Pixar (Chernow 78). Taking the VRIO system, Pixar’s abilities take advantage of chances to make value or avoid the environmental threats. Pixar’s human resource is a phenomenally important resource for the organization.

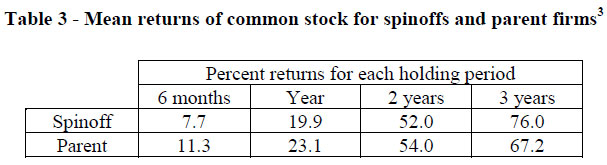

With an accentuation on employing the best and the brightest, (the vast majority of its specialized workers have PhDs) and keeping up a nearby eye on developments in the scholarly world, Pixar situated itself in front of the rivals when it bridged the gap between workmanship and innovation. Due to the working rule that Pixar took after, the organization stayed on top of things and utilized the steady implantation of better innovation further bolstering its good fortune. This intellectual resource, a delicate resource, is more qualified for a value alliance rather than a merger. Delicate resources largely include individuals; studies demonstrate that the workforce of acquired organizations gets to be ineffective because of a sentiment separation and a feeling of working for the predator. At the point when there is an acquisition, the assets become soft resources. An equity partnership is encouraged to be the best vital choice (Barney 111). The computation of the abnormal returns is in Figure 2.1 below.

Notwithstanding its powerful human resource, Pixar concentrated on making a society of development and teamwork. The “mixing” of the inventive division and specialized office was vital; something that the CEO (Steve Jobs) of Pixar noted. This did not simply occur without any forethought. In any case, it was this steady trusting, and group driven society that let joint effort prosper. Notwithstanding the dedication to remain nearby to developments in the scholastic world, Pixar worked under two other essential working standards: open correspondence and flexibility to share thoughts. These standards made a populist situation. As opposed to Disney, which worked under a top-down administration style where the officials managed the direction and assessed each employee’s performance, Pixar urged the whole group to cooperate to make a prevalent finished item. In case the group bumped into an issue, John Lasseter, imaginative head, and a director – esteemed the inventive mind trust – would take an interest in a conceptualizing discourse on the most proficient method to enhance a motion picture. Eventually the choice on what to do rests with the group, however.

From this kind of engagement and backing, emerged exceptionally steadfast workforce that worked freely. With no contracts signed, Pixar held on to its workers for quite a long time. The workers had the task to take a shot at innovative work ventures if there was no work required on a film. At Disney, Michael Eisner and Jeffrey Katzenberg controlled the choices and supervised the whole creation procedure and would contract and terminate workers in light of undertaking interest. The intangible brand dedication that the Pixar’s workforce had been immense as it implied the firm did not run the danger of losing its pool of talent – the inventive and specialized brains behind the movies hits. Likewise, with the solid practical connections, this brand dedication is to a great degree hard to impersonate and an upper hand to the firm.

Another exceptional point of preference Pixar has over different studios is its three exclusive (protected) innovations: RenderMan, Marionette, and Ringmaster. RenderMan improved composition and shading to 3D PC created models, which were progressive, contrasted with the customary 2D liveliness. These product projects gave Pixar the capacity to shift from scene to scene or from character to character all through the models. This capacity turned out to be a colossal help and along these lines an expense advantage over different studios that utilized 2D movement, which was exceptionally time concentrated and required a substantial staff of drawers. As a case, Pixar created Toy Story in 1995 with just 110 staff and $3 million as the working costs. In addition, since the developing the animation took less time, the group could dedicate more energy in the storyline and building out the characters, which brought about fantastic movies.

Marionette and Ringmaster improved character movement and creation administration separately. These interior mechanical abilities are a noteworthy motivation behind why Pixar had the capacity delivers such effective movies in the cinema world (Lundberg 19). The blue-ocean development of the animation programming turned out to be excessive for different studios to emulate, and Disney in the end returned to concentrating on 2D film ventures. In this way, the movies’ nature delivered by Pixar was unmatchable. What’s more, in light of the fact that these product innovations were exclusive, it implied they were quite expensive in the commercial center. The best way to mirror was for a studio to attempt to copy the capacities, which would be excessively expensive.

Analysis

In 1991, Pixar entered into a contract with Walt Disney dubbed the ‘Feature Film Agreement’ for the production of three PC animated movies. Disney’s mandate was to specialize in the promotion and marketing of the movies. In 1995, Pixar produced Toy Story and in the business sector and it was effective in terms of innovativeness and technicality. In 1997, Pixar went into a Co-Production Agreement, which supplanted the previous agreement in 1991, the Feature Film Agreement with Disney. Pixar on selective premise consented to create five movies. Disney distributed these five movies. The films were ‘A Bug’s Life, Monsters Inc., Finding Nemo, The Incredibles, and Cars’. There was a disagreement concerning the production of Toy Story 2. The disagreement arose in regards to the launch date and the format of the movie. Pixar wanted Toy Story 2 to as a video rather than a film. Disney went ahead to launch Toy Story 2 as a movie but refused to include it among the list of the five movies that had been agreed.

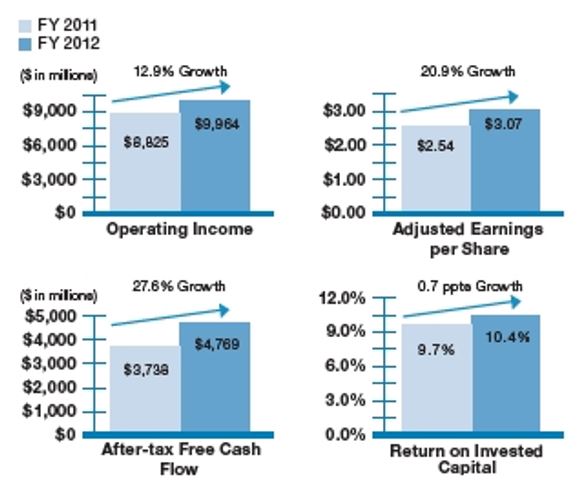

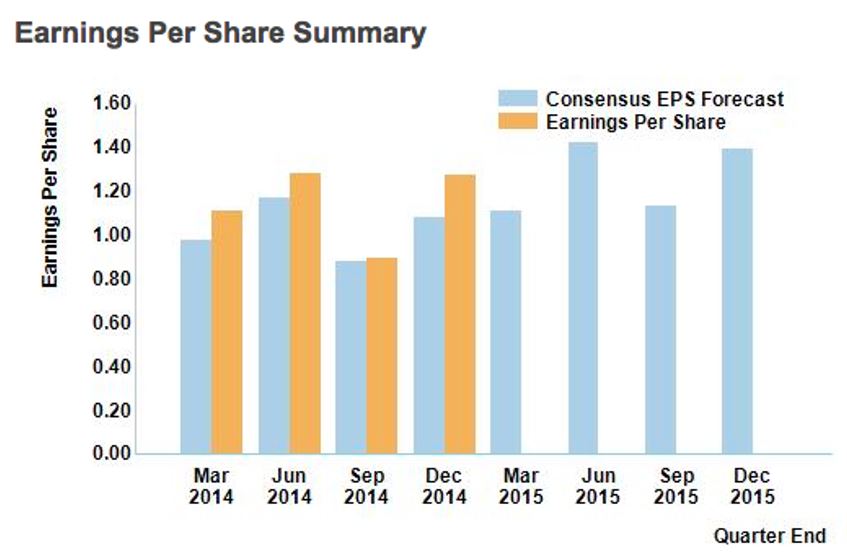

In 2004, the two organizations endeavored to reach a new understanding. Pixar arranged for Disney to specialize in the distribution. Pixar’s role would be the control the whole products and get the patent for the movies exclusive rights on the profits. Disney’s share would be between 10 to 15 percent out of the distribution fees. Pixar expressed that it did not get the decent amount of movies’ incomes, and it attempted to stop the agreement. In this way, both organizations would not surrender to the partnership and it finally fizzled. In 2006, Disney purchased Pixar and combined the two organizations valued at $ 7.4 million in all stock arrangement (Haspeslagh and Jemison 120). Pixar Executive Vice President, John Lasseter, would get to be Chief Creative Officer of the consolidated Disney-Pixar movie studios and the Principal Creative Advisor at Walt Disney Imagineering, which plans and constructs the organization’s amusement parks keeping in mind the end goal to assist with outlining new attractions at Disney amusement parks. Current Pixar President, Ed Catmull, would get to be President of new consolidated Disney-Pixar movie studios. Figure 3.1 provides the computation of earnings per share for Disney Company.

Because of these three noteworthy abilities (human resource, collective society, and innovative assets), Pixar holds a firm upper hand over different studios in making movies. Scrutinizing whether these capacities are reasonable is the issue. Pixar needs to perceive that innovation is always improving and in due time, well able rivals will emerge (Crossan and Dusya 226). DreamWorks emerged as the latest rival to Pixar’s capacity. It has delighted in awesome accomplishment with the creation of Shrek and its continuation, Shrek 2, which got $919 million as the total sales. Somewhere around 1998 and 2005, DreamWorks had various effective PC produced releases and garnered a total value of $317 in film industry deals. Nevertheless, this was still over $200 million a drift what Pixar was garnering. Pixar’s other two center abilities are harder to mimic and have greater hindrances to transferability. Pixar’s authoritative schedules, team‐embodied attitudes, and brand faithfulness develop a center competency that is not about the item in essence, hence much harder for different firms to reproduce.

Pixar keeps up a manageable upper hand that dangers being outdated if a merger with Disney were to happen. Shareholders ought to perceive that Pixar’s quality originates from its human resource and capacity to enhance and work together. It is the choice of quality over quantity. A merger would translate to the disintegration of Pixar stock. Figure 3.2 gives the summary of Pixar Company’s earnings per share. Pixar’s dependence on Disney laid exclusively on Disney’s capacity to venture in movie distribution. Instead of a merger, which raises a ton of warnings because of Pixar’s exceptionally important delicate resources, Pixar needs to concentrate on making a value organization together with Disney. The organizations are additionally determining successive collaborations. Pixar specializes in film production and Disney specializes in film distribution. This is another marker as per the system introduced in the article “When to Ally and When to Acquire” that a value alliance is the better key alternative. Rivalry for assets will begin to climb as more individuals are getting to benefit in PC created animations.

Nevertheless, Pixar will probably keep up its capacity to pull in the best, causing the rivalry failing to reach much over a medium level. Along these lines, this is another marker that equity cooperation is the best alternative for Pixar and Disney as put forward in the coordinated effort structure (Prahalad and Hamel 16). What Pixar needs to concentrate on in a renegotiated value organization is a more noteworthy value stake in the different income streams that Disney has and lower conveyance charges, above all gaining by its amusement parks and resorts. A merger would advantage Disney as it hopes to build its stakeholder esteem; however, for Pixar it implies the disintegration of significant stock. Disney ought to be wary of the potential mass departure of Pixar’s inventive ability because of a merger, leaving Disney with nothing of much esteem by any means (Prahalad and Hamel 16).

Conclusion

For the partnership to have a long fruitful relationship, both sides must perceive the variables that empower the success of the union. Both Disney and Pixar offer each of their center qualities to the organization together, which complement each other. In any case, the partnership will never be fruitful if the two cannot confide in sharing the data to another (Prahalad and Hamel 16). For this situation, Pixar needs to share its ability in creating the animated films and HR to Disney and the other way around. Another element is resilience. Since Disney is a major organization with a great deal of capital, Pixar may need to remember that Disney can assume control Pixar whenever. However, in the event that they cannot endure their accomplices, the union will obviously come up short.

Pixar has been popular for its human asset management in giving the favorable workplace. Pixar’s work office is not a desk area, yet rather a territory that the workforce can improve their working environment. Pixar likewise gives an opened space, parlors, and amusement zones. Plainly, Pixar plans the workplace that supports the workers’ inventiveness. The second primary society is populism, which is the accentuation on collaboration. Pixar concentrates on the most proficient method to coordinate the thought of all levels of the organization keeping in mind the end goal to improve quality. The top administration additionally supports the representatives by developing an open correspondence. Besides, the issue of trust assumes a major part in the organization. The specialized artists, rather than top managers, with the goal that they can produce genuine innovative work, do the animation of the movies. The organization points on harnessing the talented workforce within the organization, with the goal that they can likewise make the most inventive films.

Disney, as the enormous organization that corporate for quite a while, has a progression administration style. On the other hand, it distinguishes as Power Distance. With the removed top administration, the weight lies on the mid-management and lower levels. Disney in contrast with Pixar points more on making the benefit rather than giving the quality movies. For instance, there is no consistency of the quality of animated films. Presently, there is worry over how Pixar will adapt to safeguarding its corporate society against Disney. They ought to put a few measures in securing their way of life and give the quality item without Disney’s impact.

References

Barney, Jay. “Firm Resources and Sustained Competitive Advantage.” Journal of Management 17:1 (1991): 99-120. Print.

Chernow, Ronald. Titan, the Life of John D. Rockefeller, New York: Vintage Books/Random House, 1999. Print.

Cho, Hee-Jae and Vladimir Pucik. “Relationship between Innovativeness, Quality, Growth, Profitability, and Market Value.” Strategic Management Journal 26.6 (2005): 555-575. Print.

Crossan, Mary and Vera, Dusya. “Strategic Leadership and Organizational Learning.” The Academy of Management Review 29.1 (2004): 226-227. Print.

Haley, James. “Economic Dynamics of Work.” Strategic Management Journal 7.1 (1986): 459-471. Print.

Haspeslagh, Philippe, and DB. Jemison. Managing Acquisitions: Creating Value through Corporate Renewal, New York: Free Press, 1991. Print.

Lundberg, Curt. “Toward Theory More Relevant for Practice.” Current Topics in Management 6.1 (2001): 15-24. Print.

Miller, Roger. “How Culture Affects Mergers and Acquisitions.” Industrial Management 2.1 (2000): 8-8. Print.

Morgan, Gareth. Images of Organization, Thousand Oaks California: Sage Publications, 1997. Print.

Prahalad, Krishnarao and Gary Hamel. “The Core Competence of the Corporation.” Harvard Business Review 2.1 (1990): 13-18. Print.