Background of the Company

Afterpay is a financial technology organization, which operates in different regions of the world. The company was founded in 2014 by two Australians, Nick Molnar and Anthony Eisen, in Sydney, Australia (Afterpay, n.d.). Afterpay has attracted millions of customers and thousands of merchant partners internationally since its inception. The firm’s current operations are in Australia, United States, Canada, New Zealand, and the United Kingdom. The company was floated on the Australian Securities Exchange on 4th May 2016. Afterpay launched operations in New Zealand in 2017 after gaining more than 7200 hundred partners and 1 million customers (Afterpay, n.d.).

The firm’s effort to penetrate the US market was supported in the first month of 2018 after Matrix Partners, an American venture capital, announced that it would invest A$ 19.4 million in the company (Afterpay, n.d.). The organization acquired 90% equity in Clearpay, a buy-now-pay-later service provider based in the UK, later in the same year (Afterpay, n.d.). As a result, Afterpay started operations in the UK market in 2019 under the Clearpay’s name.

Afterpay offers financial services to online and in-store customers that allow them to purchase various products of their choice and pay for them later. Although customers are not charged any interest when making repayments, late fee accrues if they fail to pay the money as agreed. The company’s current market share in Australian e-commerce is approximately 7.7 % (GlobalData, 2021). Afterpay directors include Anthony Eisen and Nick Molnar, the CEO and Co-CEO, as well as Elana Rubin, Gary Briggs, Pat O’Sullivan, Sharon Rothstein, and Dana Stalder, the independent non-executive directors (Afterpay, n.d.). Afterpay’s latest price-to-earnings (P/E) ratio in the industry is 13.9 (Investing. 2021).

The company has no clear divided policy since its holders have never received dividends. While Afterpay’s operations have no direct environmental impacts, its customers contribute ecological damage in various ways such as landfills from post-use clothing, and scrap textiles. However, PRNewswire (2021) indicates that the firm developed a “top-up” program that encourages its customers to add a one-dollar donation to Surfrider and Magpies & Peacock to help protect the environment. Surfrider and Magpies & Peacock are non-profit organizations that play a significant role in mitigating environmental impacts of the textile industry.

Share Price Statistics – History

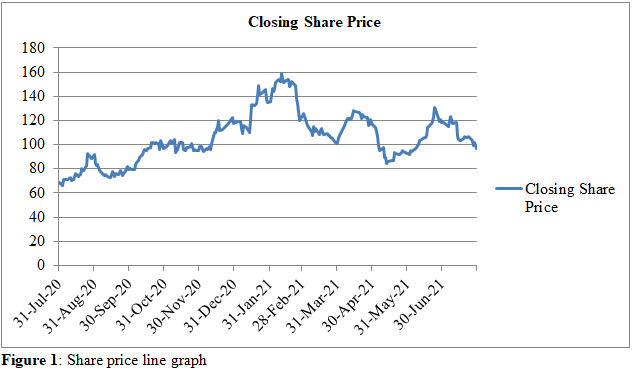

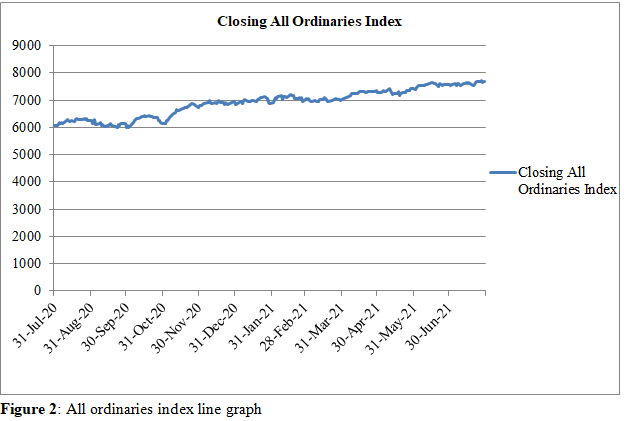

Table 1 (Appendix 1) shows Afterpay’s share price and all ordinaries index data for the financial year ending 30th July 2021. Although the price and all ordinaries index were fluctuating, there was significant growth by the end of the year as shown in the calculations below:

Growth or decline in share price = (price on 30th July 2021- price on 31st July 2020)/ price on 31st July 2020

Growth or decline in share price = (96.66-68.54)/ 68.53 = 0.41027 or 41.027 % growth

Growth or decline in All Ordinaries Index = (7664.20 – 6058.3)/ 6058.3 = 0.26507 or 26.507 % growth

The graphs above show the Afterpay’s share prices and All Ordinaries Index for financial year ending 30th July 2021. Both the share prices and the All Ordinaries depict volatility risk because there are sharp rise and fall in share prices. However, the volatility risk of shares is higher than that of the All Ordinaries Index. The company’s profitability and economic change are the most likely factors contributing to the rise and fall of share prices. According to Afterpay’s latest balance sheet, the firm’s capital mix is comprised of long-term debt and share equity, with each accounting for 50% of the company’s capital (Intelligent Investor, 2021). Therefore, the organization’s debt-equity ratio is one, indicating that investing in Afterpay has moderate risk.

Current and Recent Development

Various developments over the last twelve months and future planning have been impacting the company’s share price. The current capital structure that sees the debt-equity ratio being one positions the company at moderate risk (Frino et al., 2013). This factor restrains the rate at which the share price drops. Although the buy-now-pay-later market is not regulated by financial acts because players do not charge interest, possible regulations in the future are likely to hurt Afterpay share prices (Mehra, 2021). The Reserve Bank of Australia (RBA) is considering imposing tight regulations on the market, including burning rules surrounding the surcharging.

Increased competition is another factor impacting the company’s share price. The current competitors such as Zip and PayPal and new entrants are exerting considerable pressure on Afterpay’s share price (Mehra, 2021). Similarly, the announcement by Square, a US digital payment company, of its intention to acquire the organization is likely to impact its share price. The Covid-19 pandemic is another important factor, which has contributed to the rise of the company’s share price. The disease is leading to the increase of the customers who used the platform to purchase products. The increased number of customers and merchants utilizing the services accelerated Afterpay’s growth and generated a rise in share demand.

Investment Recommendations

An individual with shares at Afterpay should sell them at the current prevailing market price and avoid purchasing more shares. Indeed, the company has a considerable market share and is expanding operations in more countries. However, its competitors and new entrants are doing the same, which will reduce its profitability. Afterpay may be forced to borrow more to finance its expansion program to maintain its competitiveness and market share, making it riskier to invest in the company. Equally, the expected regulations of the BNPL market in Australia and other regions are likely to hurt revenue generated by the company.

References

Afterpay. (n.d). Our story. Corporate. Web.

Frino, A., Chen, Z., & Hill, A. (2013). Introduction to corporate finance (5th ed.). Pearson.

GlobalData. (2021). Square looks to expand into booming buy now pay later market in Asia-Pacific with Afterpay acquisition, says GlobalData. GlobalData. Web.

Intelligent Investor. (2021). Afterpay limited (APT) – Financials. Intelligent Investor. Web.

Investing. (2021). Afterpay touch group Ltd (APT) financial ratios. Investing. Web.

Mehra, P. (2021). Why is the Afterpay (APT) share price under pressure today?. finder. Web.

PRNewswire. (2021). Afterpay unveils sustainable shopping for earth month. Prnewswire. Web.

Yahoo Finance. (2021). Afterpay limited (APT.AX) history data.. Au.finance.yahoo. Web.

Appendix 1

Table 1: Share price and all ordinaries index (Yahoo Finance, 2021).