Introduction

The performance of any business entity is of great importance. Different parties have different interests in the business and hence require a sound basis on which to evaluate the business performance which helps them make informed decisions. Investors are greatly concerned about the performance of the company as this determines the profitability of their investments as well as the level of safety. A company that is performing well definitely attracts investors while one which is performing poorly puts risk to the investor funds hence putting off investors. Creditors are also important parties to the company.

They offer short-term credit facilitating the operations of the business entity. Their interest in establishing the performance of a business entity emanates from the need to ascertain how safe their interests are in the hands of the business entity under consideration. Customers are interested in establishing the future prospects of the entity in a bid to ensure that their relationships will last and that they will continue enjoying the products offered by the company in the foreseeable future.

The management is greatly interested in establishing how sound the company’s performance is due to the fact that they are the people with the power to change the performance. In cases where the business entity is not performing as expected, there is the need to establish the causes of poor performance and subsequently take relevant corrective measures to reverse the trend. If the performance is okay, then the management is still charged with the responsibility of enhancing the good performance by strengthening the company operations towards even higher performance.

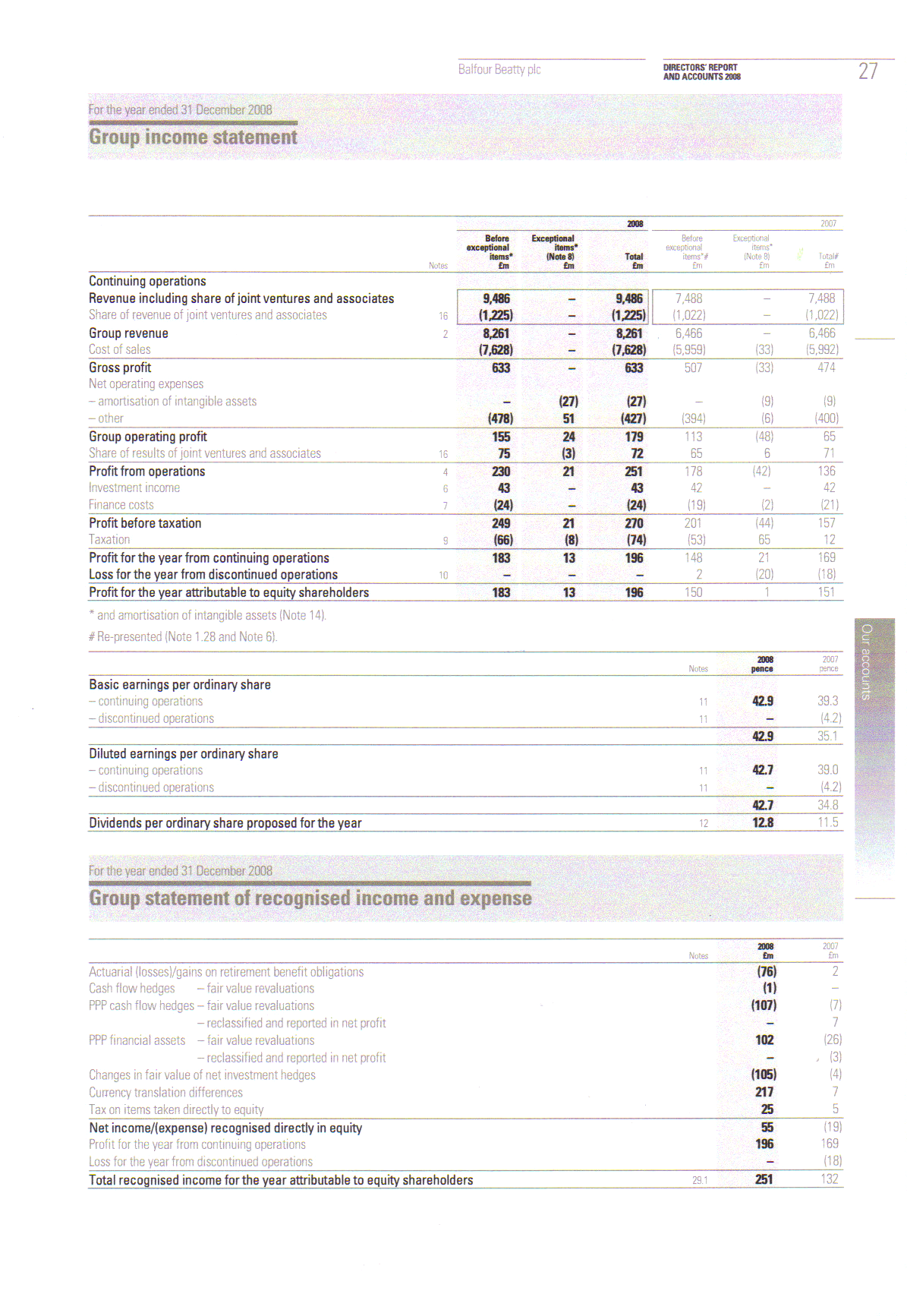

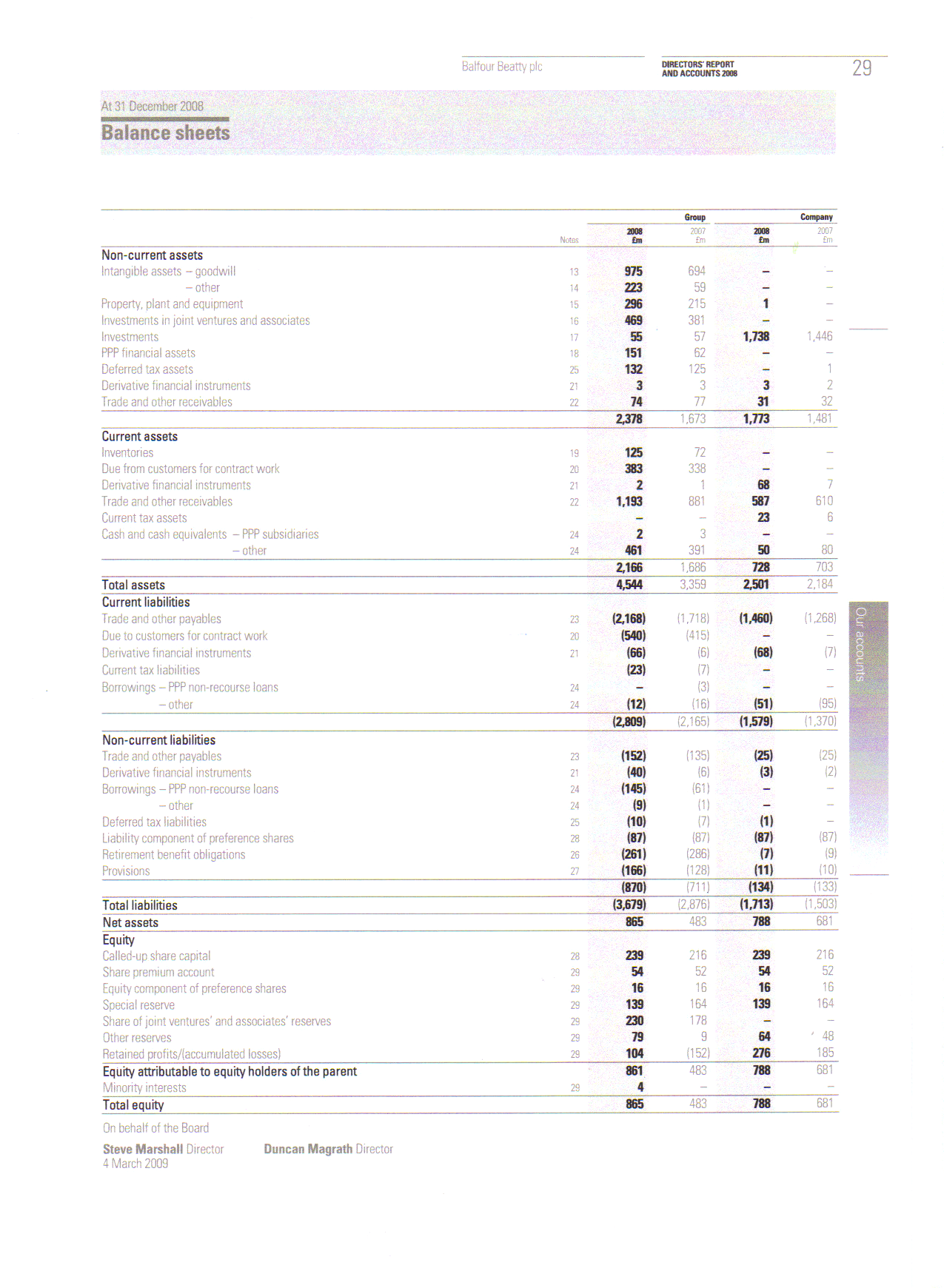

In determining the performance of a company, there are a number of considerations made which when aggregated, give rise to a holistic view of the company’s performance. The most basic tools of financial analysis are the business reports produced usually on an annual basis. The two basic reports include the profit and loss account (P&L a/c) and the balance sheet. The P&L a/c gives an analysis of the economic activities which occurred throughout the year. It matches the inflows to the corresponding outflows to give a clearer picture of the profitability in that particular year. The balance sheet on the other hand gives an assessment of the improvement or otherwise of the financial standing as a result of the activities which occurred during the year.

Financial ratios are also an important tool of financial analysis. They are based on the P&L a/c as well as the balance sheet. They are better indicators of the performance of a business mainly due to the fact that they offer a better analysis of performance through a comparative analysis. This paper compares the performance of two construction companies Balfour Beatty Inc. and Granite. It analyzes the performance in reference to the respective financial statements of the companies by calculating accounting ratios and using them to develop a compare the performances of the two companies for the year 2008. It goes on to evaluate the objectives and strategies of the two companies as well as the governance and policies adopted in critical issues such as the valuation of depreciation and inventories. In addition, it conducts a segmental analysis for the two companies (Csanad, 2010, par5).

Company profile

Belfour Beatty is a global construction, engineering, investment as well as services business. It undertakes major construction projects such as roads, schools, hospitals, and any other infrastructural projects involving constructions. The company deals with a sophisticated customer base necessitating quality and timely delivery to ensure reliability in the sensitive market. According to the chief executive, the challenge is always to maintain the high momentum which keeps the company ahead of the rest.

The company engages in four major businesses. The first is the segment dealing with building management. Here, the company offers specialized services developing designs, undertaking constructions, maintaining as well as managing buildings. Secondly, the company is a market leader in the construction as well as maintenance of railway lines and systems. Again, the company offers sophisticated services in civil engineering in the development of infrastructures such as energy generation, transportation systems, and water systems. Finally, the company engages in the development of privately owned infrastructural developments in some sectors. Indeed, the company has been ranked as the 19th biggest contractor worldwide. The company leads in the development of railway systems in the world (Balfour Beatty, 2008, par3).

The company is headed by a strong board of directors drawn from diverse disciplines. The Chief Executive Ian Tyler is a chartered accountant and has vast experience as a finance director. The Chief operating officer Andrew McNaughton is a chartered engineer and has a wealth of experience as a director in engineering-related projects. Other executive director’s include peter Zinkin who is the planning and Development Director who has held many senior finance positions in the past and is active in the committee of leadership, management and governance at the Higher Education Funding Council in London: Duncan Magrath aged 45 years is the finance director and is a chartered accountant who holds an engineering degree.

The non-executive directors include Steve Marshall who is also a chartered accountant and who holds executive and non-executive senior positions in other equally big corporations. Robert Walvis has worked with the Royal Dutch shell Group and is a chemical engineer. Hubertus Krossa has experience as a chief executive officer at the KION group. Others include Gordon Sage, Mike Donovan, Graham Robert, and Iain Ferguson.

Granite on the other hand is a mega construction company with a global presence. The company also specializes in undertaking major infrastructural developments. Most of the projects undertaken include roads and highways, paving and grading services excavations and mining services, and the development of unique infrastructural designs. Others include the construction of airports, bridges, railways dams, residential houses as well as commercial developments. These activities highly relate to those undertaken by Belfour Beatty.

The company is also headed by a group of skilled and experienced business leaders. Most members of the senior management team have been in the construction industry throughout their careers while others have external experiences which offer valuable insights to management. William Dorey is the president and the CEO and has worked at the company since its inception in 1968. James H. Roberts is the Executive vice President and Chief Operating Officer. He has been with Granite since 1981. Mark Boitano is the Executive Vice President while LeAnne Stewart is the Senior Vice President and Chief Financial Officer and joined the company in 2008.

Michael Donnino is a senior Vice president and Granite east manager while Jigisha Desai is vice president and treasurer. John Franich is a vice president and heads Granite west while Kent Marshall is a vice president and directs the development of the large project. Randy Kremer manages construction materials while Michael Futch is the General Counsel. Others include Laurel Krzeminski, the controller, and Peg Wynn the director of human resources (Annual Report 2008, par4).

As can be seen, the two companies’ organizational structure differs. Belfour Beatty has a highly centralized leadership structure but is composed of a larger number of both executives as well as non-executive leaders meaning that roles are spread across a larger number. However, granite has a less centralized system. It has a few central officers who head the company and has divided the company’s operations into two that is; granite East and Granite West which have their own appointed leaders.

Objectives and strategies

The two companies have strong objectives and strategies aimed at strengthening their operations as well as their level of profitability over time. Balfour and Beatty seek to constantly position themselves within the infrastructure market in a way that offers growth opportunities in the future. The company has honed skills internally to ensure that customers are always achieved. The most important long-term strategy is specifications to ensure continued growth in shareholder value responsibly.

The company has four areas in which it intends to grow its business in keeping with its short and long-term targets. The first is expanding the contracts undertaken within the UK. Secondly, the company is to offer technical and professional services within the traditional market areas as a diversification measure. Thirdly, it seeks to expand into new markets for growth, and finally, it seeks to establish domestic businesses abroad as an extension of the already successful UK model.

Granite on the other hand seeks to constantly offer reliable long-term growth in shareholder value. It does this by developing a stable record of excellent performance which attracts customers and leads to better growth prospects. The company aims at building a strong character and positioning itself favorably in the market. It has a strong code of conduct on which all decisions and operations are based on. Honesty is the hallmark. The company is committed to being truthful and transparent in its dealings. Secondly, the company seeks to operate with integrity in the sense that everyone is expected to do the right thing at all times. Thirdly, elements of fairness in dealings are upheld in addition to ensuring that partnerships are respected at all times.

Again, accountability should be upheld at all times and corrective measures taken in cases of defects without complaint. Other values adopted include reliability, meaning that the company should only commit itself if it is certain of keeping the promise, and citizenship implies full compliance with the law and environmental protection. These values are expected to drive the future prospects of the company.

Comparison of performance

As can be seen above, the two construction companies are strong and have global operations. There being public companies imply that a thorough financial analysis would serve to enlighten the investors on the best place to invest in. The analysis focuses on performance in terms of the ability to generate returns as well as the financial standing of the two companies.

A brief outlook at the two companies’ performance in the year 2008 as compared to 2007 shows significant improvement. Balfour Beatty had an improvement in revenues from £m7488 in 2007 to £m 9,486. This led to a jump in profits before taxation from £m157 to £m270 in 2008. Granite on the other hand had its revenues drop from $2,737,914,000 to $2674, 244,000. However, net income rose from $112, 065,000 to $122, 404, 000 in the year 2008. Clearly, there is an improvement in the annual performance of the companies.

Profitability Ratios

We start with the earnings per share (EPS). This refers to the ratio of net incomes against the number of ordinary shares. It determines the return on each share and is affected by dilution in shareholding (Liquidity Ratios, 2010, par2). For Balfour Beatty, the EPS is 42.9pence ($0.65) an improvement from 39.3 pence ($0.59) recorded in 2007. On the other hand, Granite recorded an EPS of $3.25 an improvement from $2.74 recorded in 2007. This implies that returns per share in granite are higher than in Balfour and Beatty.

The Gross profit ratio assesses the profit margins generated by sales before deducting indirect costs. For Balfour Beatty, the ratio stands at 6.67% a drop from 6.77% recorded in the previous year. In Granite, the gross profit ratio stands at 17.5% an increase from 15%.

The net profit ratio shows the ability of revenues to generate profits taking into consideration the expenditure incurred. For Balfour Beatty, the net ratio stands at 2.85%. This means that for every 100 part of revenues 2.85 is the net profit generated. For Granite, the ratio stands at 4.6% an increase from 4.1 recorded in the year 2007. Again the indication is that granite is more profitable than Balfour Beatty.

Return on assets assesses the ability of the company assets to generate returns. It is obtained by dividing the net income by the average total assets. For Balfour, the ratio is 0.05. For Granite, the ratio stands at 0.10. Again this implies that assets in Granite are able to generate more returns than at Balfour Beatty.

The conclusion is that Granite is performing far much better than Balfour Beatty in terms of profitability. A closer look at these ratios portrays a very impressive performance by Granite. This is because its revenues actually dropped but profitability went up. This could result from an improvement in efficiency a key determinant of competitiveness in the industry (Rashid, 2010, par4). Granite is showing strong signs of improved internal efficiency a factor which could prove very useful in shaping the future of the firm.

Liquidity and gearing ratios

Financial analysis cannot be complete without a look at the ability of the company to meet its obligations. This is what defines the risk associated with investing in the company’s stocks (Leverage / Gearing Ratios, 2010, par2).

The current ratio assesses the relative amounts of current assets in relation to current liabilities. It helps establish the ability of the company to meet its short current liabilities using the current assets. For Balfour Beatty, the current ratio is 0.77. The fact that the ratio is less than one means that the company is not able to meets its current obligations using its current assets. For granite, the ration stands at 25.1. This implies a strong ability of the company to meet obligations.

Borrowing ratio on the other hand defines the indebtedness of the shareholders of the company. It is a ratio of total amounts borrowed and the total equity. For Balfour the ratio stands at 0.24 while for Granite the ratio stands at 0.43. This implies that Balfour shareholders are less indebted than those holding shares in Granite.

The debt to asset ratio shows the extent to which the company’s assets are geared or committed towards debts. For Balfour, the ratio is 0.19 while for Granite it is also 0.19. This implies that the company’s assets are equally committed to the liabilities

A look at these ratios clearly indicates that Granite has performed better than Balfour Beatty. All the ratios regarding profitability and incomes favor Granite while the gearing ratios do not present any significant difference in the level of risk for the two companies.

Valuation of Depreciation and Inventories

Both companies amortize assets after purchasing at equal rates. The qualifying value is the purchase price. Since the construction industry is capital intensive, the values of amortization have significant effects on the profitability of the firms hence the financial analysis.

Inventories are valued at the current market prices. This is due to the fact that the construction companies have a large portion of work in progress at any given time. Again, these are spread across a vast area of operation. It is therefore prudent to use the records available to establish the total value of the inventories for accounting purposes.

Environmental policies

The two companies have strong concerns for the environment. In most circumstances engaging in major infrastructural developments can lead to significant degradation of the natural environment. The two companies have devised ways of minimizing the impact of their operations on the environment.

Granite is committed towards becoming the leader in environmental conservation for the construction industry worldwide. In this regard, the company engages its entire workforce in a bid to influence them to adopt environmentally favorable approach to whichever work. In ensuring that the best practices are used, the company seeks to exceed the environmental regulations in whichever jurisdiction it operates in. Secondly, it uses technology to ensure better use of resources such as energy while at the same time engaging processes of recycling where possible. The company is also committed towards upgrading internal operations with the aim of becoming even more environmental friendly. Finally, it seeks to constructively engage different stakeholders with the aim of establishing sustainable conservation programs.

Belfour Beatty understands the enormous responsibility bestowed on them. Therefore they are committed to building infrastructure with minimal negative if not positive environmental impact. The company has developed accurate measures of environmental impacts which it uses to design the projects and later share the ideas developed for application in subsequent projects.

In addition, the company is constantly seeking ways of reducing carbon emissions within its operations as well as through developing efficient transportation infrastructure. It has also adopted sound waste management techniques in addition to developing techniques which use less water.

The analysis above gives a clear picture of the organizational structure as well as the performance of the two global construction companies. The two companies have great future prospects based on their sound performance as indicated by the financial analysis. It is however clear that Granite is performed better than Balfour Beatty for the year 2008. Again, the companies display similar environmental concerns and policies.

References

Annual Report 2008. Granite. Web.

Balfour Beatty, 2008. Web.

Csanad, D., 2010. The Importance of financial statements. Web.

Leverage / Gearing Ratios, 2010. Accountancy. Web.

Liquidity Ratios. 2010. Accountancy. Web.

Rashid, J.,2010. Meanings and Importance of Financial Statement Analysis. Web.

Appendix 1

Accounting Ratios

Borrowing Ratio

Borrowing Ratio = Total Borrowings (Short-term and Long-term) / Total Equity

Current Ratio

Current Ratio = Current Assets / Current Liabilities

Earnings Per Share (EPS)

Earnings Per Share (EPS) =

Net Income / Weighted Average Number of Common Shares Outstanding

Gross Profit Ratio

Gross Profit Ratio = Gross Profit x 100 / Sales

Where Gross Profit = sales – direct costs

Net Profit Ratio

Net Profit Ratio = Net Profit x 100 / Sales

Return on Assets

Return on Assets = Net Income / Average Total Assets

Where Total Assets =

(Beginning Total Assets + Ending Total Assets) / 2

Return on Equity (ROE)

Return on Equity (ROE) = Net Income / Average Stockholders´ Equity

Where Average Stockholders´ Equity = (Beginning Stockholders´ Equity + Ending Stockholders´ Equity) / 2.