Introduction

The current business environment is characterized by stiff competition and ever-changing customer demands. Moreover, globalization, the emergence of new technologies, and mergers and acquisitions have dramatically increased competitive pressure. Coupled with the COVID-19 pandemic, many financial institutions in the banking sector are now facing significant economic crises. Given the unfavorable macroeconomic environment, managers must analyze their business practices to inform investment decisions. This paper examines Barclays’ bank quality management practices and quality management systems to support investment decisions. The report also analyzes the key trends in quality management and how it can align its QM system with these trends. Barclays bank should integrate its QM with these trends to gain a competitive advantage in the industry.

Background Information

Barclays has two main divisions: Barclays UK and Barclays International. These divisions are supported by its service company, Barclays execution services. The bank operates in about 40 countries with approximately 83,500 employees working in its dominant markets, the US and UK, and other global regions (“Our strategy,” no date). Barclays’ primary products/services include personal banking, business banking, investment, corporate, and online banking services. It offers retail banking services to individual consumers and small businesses and corporate and investment services to large companies.

Task 1: TQM Principles at Barclays and its Significance

Employee Engagement

The TQM principles adopted by the HR department include employee engagement and communication. One of the bank’s core strategies is to capitalize on human capital to achieve its goals. The company states that “we want to support their health and wellbeing… to empower and motivate them to provide excellent services (“Making a difference,” 2021, p. 33). It invests heavily in employees’ well-being, professional development, and mental health to improve its performance. The bank reports an 83 percent employee engagement rate, with the surveys receiving a 67% response rate (“Making a difference,” 2021, p. 4). The employee surveys show that about 74% and 78% of the employees have manageable stress levels and a healthy work-life balance (“Making a difference,” 2021, p. 5). The bank provides training, workshops, seminars, etc., to encourage employees’ creativity and innovation to serve customers better.

Employees are regarded as internal customers and are equally important as external customers to a company’s performance. According to Akbari, Chaijaru, and Aletaha (2019), service organizations can achieve a sustainable competitive advantage by improving the services offered to internal customers (employees) and external customers. Studies further reveal that HR practices such as organizational commitment, employee engagement, and training are linked to optimal company performance that translates to financial profitability for shareholders.

(Gracia-Alcaraz et al., 2018). Barclays’ current HR practices can enhance its sustainable competitive advantage.

Communication

The company conducts an annual employee engagement survey, which allows for two-way communication between organizational leaders and employees. The opinions of employees, customers/clients, investors, and stakeholders are all taken into account in the decision-making and strategy formulation processes. The company also claims that it openly shares information about its financial services to allow customers to make informed decisions (“Making a difference,” 2021, p. 157). The company achieves this engagement through surveys, social media platforms, and other broadcast tools to obtain feedback and stakeholders’ suggestions.

The company’s communication’s organizational impact can be viewed from Kaplans and Nortons Balanced Scorecard (BSD). The BSD deals with attaining employee and society satisfaction through effective communication (Assaker, O’Connor, and El-Haddad 2020). According to Kaplan and Norton’s model, the company’s management needs to communicate to build relationships and satisfy customers. The leaders must communicate priorities to stakeholders to improve performance and customer satisfaction.

Management

Deming recognized the role of leadership in helping an organization realize its quality objectives. The banks’ leaders motivate and steer employees towards seeking continuous quality improvement. Deming argues that solid leadership and management are required to lead the drastic changes needed to achieve continuous improvement to reduce errors to near zero (Smith,2018). Dwiyanto et al.’s (2020) study demonstrated a link between Deming’s leadership theory and effective QM. According to Dwiyanto et al. (2020), transformational leadership can improve the whole process’s quality, increasing productivity and greater profits. Barclays’ leaders develop the bank’s vision and core values and set the direction for change. They are also personally involved in supporting employee efforts in achieving their quality objectives.

Continuous Improvement

The bank has a department designated explicitly for continuous improvement of its services and operational efficiency. The company achieves continuous improvement through the lean six sigma model, which asserts that a company can improve product/service quality by eliminating waste in the value chain (Bazrkar et al., 2017; Ganesh and Marather, 2018). Focusing on the theory means that the company takes appropriate measures to prevent defects and improve operational efficiency.

The company claims that it focuses on achieving and driving better operational performance to maintain cost discipline and productive capital use by recycling risk-weighted assets. It has also adopted innovative technology to improve the billing and documentation processes to lower waste resulting from inefficient work practices. As Choi et al. (2020) demonstrated, investing in continuous improvement can help banks improve their financial and non-financial performance and supply chain management activities. The ongoing improvement initiatives can help the bank improve its performance through achieved operational efficiency and enhanced customer experiences.

Customer-Focus

Customer-centered service is one of the bank’s core value propositions. Its business goals, activities, and strategies are centered on satisfying customers’ needs and improving relationships. It offers customized/personalized investment plans tailored to meet individual customers’ needs. Clients can access and track their investments online. The bank also provides free on-phone updates and money-mentoring services to educate clients on managing their finances effectively. Barclays Bank also offers innovative products and services as an offering to improve client experience. For example, customers can self-serve and access most products/services through the bank’s mobile apps and online banking system, reducing queuing/waiting time.

The apps have a simple design to allow customers from different backgrounds to access their services easily. Customer-centered services increase client satisfaction, customer loyalty, and retention levels in accounting firms and banks (Gill, McCarthy, and Grimmett, 2019; Pattanayak, Koilakuntla, and Punyatoya (2017). These findings imply that customizing technology to meet clients’ needs can help the firm to retain clients. In this high competition age, client retention and loyalty are critical to a firm’s survival. The bank claims that the improvement of their service delivery process reduced the complaints rate by 32%, accentuating the need to invest more in customer-centered service (“Making a difference,” 2021, p. 27). The company acknowledges the importance of customer service and has taken appropriate measures to enhance it.

The bank can enhance productivity and generate lower costs due to operations that result in low defect numbers and waste generation. The bank can also obtain customer loyalty and retention, which, in turn, could generate more significant financial profitability (Hamadamin and Atan, 2019). The TQM social benefits include customer satisfaction and brand acceptance in society. Adapting these TQM principles is important because it supports the bank’s quality strategy. The bank’s diversification strategy comprises four propositions, and the TQM principles can help IT achieve these strategic objectives (“Our strategy,” no date). A study conducted by Khanal (2020) showed that TQM influences competitive strategy formulation and is also a dynamic resource for sustainable competitive advantage. These findings imply that the TQM model can influence strategy formulation to give the bank a competitive advantage. Another study by Khanal (2020) demonstrated that the 14 TQM principles could offer a company a competitive advantage, improve financial performance, and improve customer satisfaction levels. In the 2020 annual report, the company states that the increase in customer satisfaction scores can be attributed to its quality initiatives, confirming the above studies’ findings (“Making a difference,” 2021). The bank’s focus on TQM principles has positively contributed to its business performance.

Task 2: The Importance of Total Quality Management

Barclay’s Quality Management System (QMS)

The first step of creating a QMS is to design it based on the organizational context, i.e., governance structures, organizational culture, leadership approach, etc. The design of Barclays’ QMS was influenced by its multi-functional processes to ensure customer satisfaction.

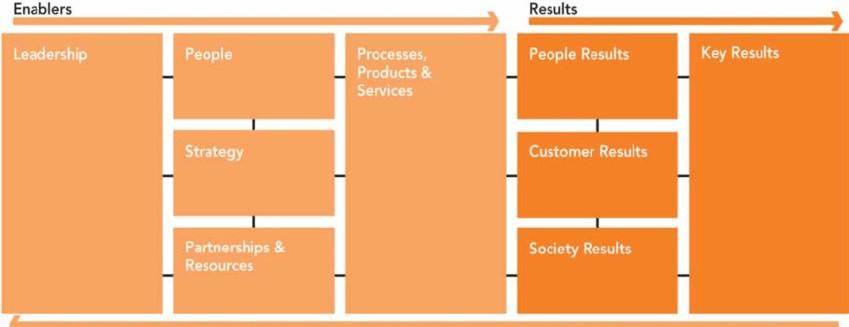

A close analysis of the bank’s practices shows that it has adopted the European Foundation for Quality Management (EFQM) model.

The EFQM is based on nine TQM guidelines: five enablers and four results. The enablers focus on what the firm does while the results focus on what it achieves. The enablers cause the ‘results,’ while the enablers are improved using feedback from results. This model allows the firm to analyze the actual situation relative to the European quality metrics and subsequently identify its strengths and weaknesses in achieving excellence. In its annual report, Barclays states that it collects and reviews data on the nine EFQM model criteria and adopts the relevant improvement strategy to enhance each criterion’s performance. (N/B: more on this is discussed in the ‘stakeholder quality metrics’ section).

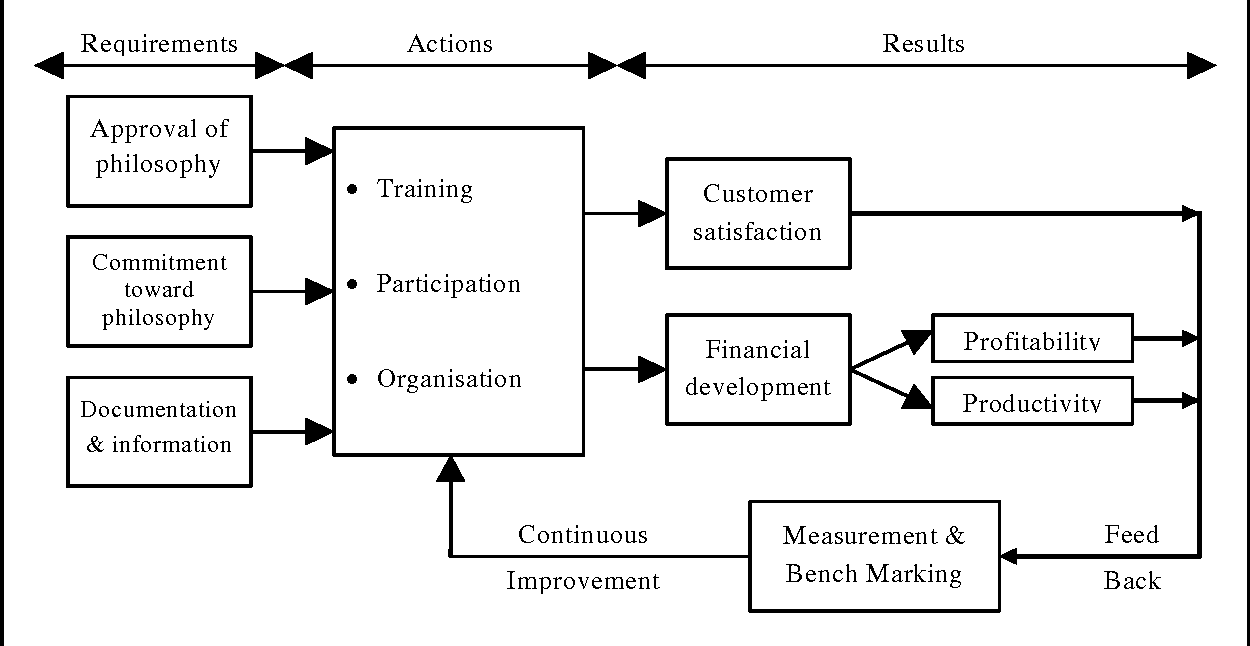

The following model is a proposed QMS for the bank.

From the figure above, it is evident that the EFQM model lays the groundwork for QMS quality metrics’ focus. The system collects data from EFQM, such as people, leadership, strategies, and products/services, which are EFQM enablers. Data from financial development is used as a metric for the products and services criterion, while customer satisfaction feedback data is a quality metric for the people criterion. Embedded in these quality metrics is the organization’s leadership that supports training, participation, and the organization as a whole. This structure allows for continuous improvement of both the QMS and products/services. The next step is to establish quality policies, define QMS roles and responsibilities, plan on risk and opportunity management, and, lastly, methods in which change will be controlled.

TQM Building Blocks and element

The QM building blocks and elements include ethics, integrity, trust, training, teamwork, leadership, recognition, and communication (Padhi n.d.): Ethics refers to the code of ethics that outlines the guidelines to which employees must adhere when performing their work. Integrity is a value that internal and external customers expect to receive from the bank. Trust is the by-product of ethics and integrity and influences ownership and commitment to the company. The company’s corporate social responsibilities (CSR), embedded in the EFQM society criterion, are evidence of the bank’s ethics and integrity.

Training, teamwork, and leadership are the system’s building blocks, especially in an industry characterized by high interpersonal interaction between employees and customers. Training helps employees develop the necessary skills and knowledge required to implement TQM principles successfully. For the bank to achieve its quality objectives, teamwork among employees is required (Abuzid and Abbas, 2017). The management’s commitment to QM initiatives is evidenced by the number of investments channeled towards quality assurance.

Quality assurance standards

The bank is ISO 9001 certified, implying that it complies with the quality standard requirement. ISO 9001 is an international quality assurance standard that defines specific QMS requirements that specifies quality requirements in the company’s leadership, planning, operations, evaluation, and improvement practices. Organizations use such measures to demonstrate the ability to provide products/services that meet all relevant customer and regulatory standards. The TQM system aligns with the banks’ strategic objectives by meeting stakeholder requirements. By addressing stakeholder needs, the QMS can help the bank achieve its strategic goals. Aligning the QMS with stakeholder needs is how the system is mapped with banks’ strategic objectives.

Stakeholder Quality Metrics

The bank ensures quality for all organization’s stakeholders by collecting data on all stakeholder groups and continuously evaluating how these metrics can be improved to meet their needs. The following metrics are collected for different stakeholder groups (“Making a difference,” 2021, p. 25):

Customers

The bank measures the following:

- Client digital engagement rates

- Complaints scores: used as a proxy of customer satisfaction

- The number of employees who would recommend the bank as a good working place

- The number of customers that would recommend the bank’s services to other consumers.

- The number of employees that report feeling connected to the bank’s value; This metric aims to measure employee alignment to the desired organizational culture.

Society

- The annual carbon emissions rates

- The number of people engaging in the bank’s LifeSkills program; the bank aims to improve the community’s financial literacy and employability skills.

Investors

- The bank measures financial outcomes, including bank revenues, market shares, operational costs, and equity, which inform how to generate attractive returns for their investors throughout the economic cycle. The operating cost metrics intend to improve cost discipline and maximize the company’s efficiency

Task 3: Key Trends in Quality Management

Quality management is mainly driven by competition and growing customer demands. A study conducted by Weckenmann, Akkasoglu, and Werner (2015) demonstrated a paradigm shift to “perceived quality,” human-focused quality management,” and “intelligent quality management.” Perceived quality refers to stakeholder perceptions of a firm’s brand and the overall quality/services. Intelligent quality management refers to using new technology and intelligent systems to achieve the desired quality standards in business operations and process and product quality (Jaksic and Marinč, 2019). The human-focus approach focuses on using people as valuable assets in meeting the company’s value propositions and stakeholder satisfaction.

These trends are relevant because the case company operates in a highly competitive industry characterized by constant market changes. For example, the banking industry is currently one of the largest cloud technology consumers (Elnagdy, Qiu, and Gai, 2016). In line with these technological trends, Barclays has also moved to cloud technology to personalize their customers’ digital experience. Thompson (2020) showed that first-movers and fast-follower companies are likely to be more competitive than later movers. This finding demonstrates how fast-paced the business world is and why it is vital for a company to keep up with recent trends to remain competitive and relevant in the market.

Embracing cloud technology to keep up with market trends demonstrates its ability to adopt intelligent quality management systems (Oztemel, 2020). Additionally, Barclays is heavily invested in corporate social responsibilities, i.e., it is committed to improving climate change and environmental sustainability. Perceived quality is strongly associated with brand image relative to its CSR (Secinaro et al., 2020). Studies have demonstrated a link between a company’s CSR practices and customer loyalty, trust, satisfaction, and financial performance (Assaker, O’Connor & El-Haddad 2020; Konuk 2018). A company’s eco-friendly/green activities improve customers’ perception of the company (perceived quality), which influences brand loyalty.

The bank’s culture of getting feedback from its stakeholders to improve its business practice is evidence of its human-centered approach. Employee commitment and organizational performance are all outcomes of the human-centered approach. Hamadamin and Atan (2019) study demonstrated a positive relationship between human capital development, organizational commitment, and sustainable competitive advantage. The bank can also attain its quality objectives at low costs by adopting intelligent quality management systems; these technologies could monitor and predict failures with little human intervention and enable real-time communication with stakeholders. Furthermore, Barclays can also drive evidence-based continuous improvement and decision-making processes through data analysis.

The Expectations of Aligning QM s with These Trends

The company needs powerful resources and capabilities to facilitate the adoption of these new trends. The requirements for a successful transition include financial resources, expertise, and effective leadership. Furthermore, the organization can support these adoptions by realigning its strategy with the current QM trends. It can create new strategic goals that incorporate the QM trends and then realign its plan to achieve these new goals. Strategy alignment will ensure that resource allocation to the recent trends is prioritized. The management can support adopting these trends by empowering and motivating employees to accept the organizational change. They can train or reskill employees to encourage competence and acceptance of the change.

The company might experience challenges in sustaining stakeholder support for its new quality initiatives. According to Suarez (2017), QM commonly fails due to a lack of CEO commitment. Suarez (2017) states that unless the top management is committed to the initiative, achieving success is nearly impossible, even if the middle management is effective. The lack of CEO commitment to the developed initiative can be attributed to the culture of risk aversion and ignorance of the QM’s importance. Adopting and sustaining the QM trends, including intelligent quality management systems, is a costly process that may discourage investment. Unless the project has a positive return on investment, the administration might be reluctant to support it continuously.

Conclusion

Barclays has adapted employee engagement, customer focus, leadership, continuous improvement, and communication principles in its quality management process. The bank’s TQM positively contributes to its performance by enhancing financial performance, productivity, and customer loyalty and retention. Considering the competitive pressures in the business market, investors should seriously consider TQM as an alternative competitive advantage source. Without their full support, the company cannot achieve its optimal performance. They should support the company by providing financial resources and leadership capacities to influence and sustain positive changes.

Reference list

Abuzid, H. F. and Abbas, M. (2017) ‘Impact of teamwork effectiveness on organizational performance vis-a-vis the role of organizational support and team leader’s readiness: a study of Saudi Arabian government departments work teams’, Journal of Engineering and Applied Sciences, 12(8), pp. 2229–2237.

Akbari, M., Chaijaru, M. H., and Aletaha, S. H. (2019) ‘Internal marketing and the internal customers’ citizenship behavior in higher education’, International Journal of Schooling, 1(3), pp. 15–28.

Assaker, G, O’Connor, P. and El-Haddad, R. (2020) ‘Examining an integrated model of the green image, perceived quality, satisfaction, trust, and loyalty in upscale hotels’, Journal of Hospitality Marketing & Management, 29(8), 934–955.

Bazrkar, A., Iranzadeh, S., Farahmand, N., and Liu, S. (2017) ‘Total quality model for aligning organization strategy, improving performance, and improving customer satisfaction by using an approach based on a combination of balanced scorecard and lean six sigma’, Cogent Business & Management, 4(1), pp. 1–16.

Choi, S., Lee, T., Yoo, H. and Song, G., (2020) ‘A study on the impact of continuous improvement activities of defense SMEs on the SCQM and business performance’, Journal of the Korean Society for Quality Management, 48(1), pp. 149–169.

Dwiyanto, F., Wijaya, P. W., and Indrayathi, P. A. (2020) ‘Association between transformational leadership, organizational commitments, and application of Total Quality Management (TQM) to employee performance in Sanglah General Hospital, Bali, Indonesia’, Intisari Sains Medis, 11(3), pp. 928–933. Web.

Elnagdy, S. A., Qiu, M., and Gai, K. (2016) ‘Understanding Taxonomy of Cyber Risks for Cybersecurity Insurance of Financial Industry in Cloud Computing’, Proceedings of the 3rd International Conference on Cyber Security and Cloud Computing (CSCloud), Beijing, China, 295-300.

Ganesh, L. S., and Marathe, R. R. (2019) ‘Lean Six Sigma in consumer banking: an empirical inquiry’, International Journal of Quality & Reliability Management, 36(8), pp. 1345 – 1369.

Gill, L., McCarthy, V., and Grimmett, D. (2019) ‘Voice of the customer: creating client-centered cultures in accounting firms for retaining clients and increasing profitability’, Journal of Accounting, Business and Management, 26(2), pp. 46–58.

García-Alcaraz, J. L., Flor-Montalvo, F. J., Avelar-Sosa, L., Sánchez-Ramírez, C. and Jiménez-Macías, E. (2019) ‘Human resource abilities and skills in TQM for sustainable enterprises’, Sustainability, 11(22), pp. 1–22.

Hamadamin, H.H. and Atan, T. (2019) ‘The impact of strategic human resource management practices on competitive advantage sustainability: the mediation of human capital development and employee commitment’, sustainability, 11(20), pp. 1–19.

Hollings, P., Crush, D., Williams, B., and Green, A. (2018) Consumer attitudes to identifying vulnerability through the use of data. Web.

Jakšič, M. and Marinč, M. (2019) ‘Relationship banking and information technology: the role of artificial intelligence and FinTech’, Risk Management, 21(1), pp. 1–18.

Khanal, K. (2020) ‘Total quality management: a source of a competitive advantage-a comparative study of manufacturing and service firms in Nepal’, South Asian Journal of Marketing & Management Research, 10(7), pp. 34–40.

Konuk, F. A. (2018) ‘The role of store image, perceived quality, trust and perceived value in predicting consumers’ purchase intentions towards organic private label food’, Journal of Retailing and Consumer Services, 43, pp. 304–310.

Madanat, H., and Khasawneh, A. N. (2017) ‘Impact of total quality management implementation on the effectiveness of human resource management in the Jordanian banking sector from employees’ perspective’, Academy of Strategic Management Journal, 16(1), pp. 114-148. Web.

Making a difference: Barclays PLC annual report 2020 (2021) Web.

Our strategy (no date) Web.

Oztemel, E. (2020) ‘Introduction to intelligent quality management’, in Li, P., Pereira, P. A. R., and Navas, H. (eds.) Quality Control: Intelligent Manufacturing, Robust Design and Charts. London: Intech Open, pp. 46–79.

Padhi, N. (no date) The Eight Elements of TQM. Web.

Pattanayak, D., Koilakuntla, M. and Punyatoya, P. (2017) ‘Investigating the influence of TQM, service quality and market orientation on customer satisfaction and loyalty in the Indian banking sector’, International Journal of Quality & Reliability Management, 34(3), pp. 362–377.

Secinaro, S., Brescia, V., Calandra, D. and Saiti, B. (2020) ‘Impact of climate change mitigation policies on corporate financial performance: evidence‐based on European publicly listed firms’, Corporate Social Responsibility and Environmental Management, 27(6), pp. 2491–2501.

Smith, J. L. (2018) ‘Defining quality leadership’, Quality Magazine, Web.

Suarez, E., Calvo-Mora, A., Roldan, J. L., and Periáñez-Cristóbal, R. (2017) ‘Quantitative research on the EFQM excellence model: a systematic literature review (1991–2015)’, European Research on Management and Business Economics, 23(3), pp. 147-156.

Thompson, A, (2020). Strategy: core concepts and analytical approaches. New York: McGraw Hill Publishing.

Weckenmann, A., Akkasoglu, G. and Werner, T. (2015) ‘Quality management: history and trends’, The TQM Journal, 27(3), pp. 281–293.

Yousaf, M., and Bris, P. (2019) ‘A systematic literature review of the EFQM excellence model from 1991 to 2019’, International Journal of Applied Research in Management and Economics, 2(2), pp. 11-15.