Introduction

Since the early 1970s, financial markets have been affected by speculation and financial crises that have revealed that investor rationality and market assumptions cannot describe the actual individual behavioral patterns towards risks. Behavioral Finance (BF) tries to address the Efficient Market Hypothesis (EMH) anomalies that facilitate the financial market’s understanding.

Behavioral Finance violates Expected Utility Theory (EUT) because it does not fully support investor rationality, as an investment is based on both profit maximization and investors’ emotions. BF is the marriage between finance and psychology coupled with cognitive science to influence business decisions. The discipline was integrated to help understand human behavior towards investment and provide real solutions thereof.

The paper is structured in five sections, chapter 1 deals with classical theoretical problems and comparisons to the BF model, chapter 2 elaborates on BF theory at length, and chapters 3 &4 study Schiller’s Empirical Analysis concerning financial markets. Finally, the paper concludes and gives recommendations appropriately in chapter 5.

The traditional theory of Behavioral Finance

Traditional Financial Market Theory

In the 1970s, three economists James Tobin, Harry Markowitz including Eugene F. Fame, formulated an economic business theory to chance stock market operations. The Efficient Market Hypothesis (EMH) was birthed at a Chicago University in 1960 stating, and the market is efficient when prices fully reflect available data Pilbeam (2018). E. F. Fama published an article in the “Journal of Finance” named “Efficient Capital Markets: a review of theory and empirical work,” where efficient market theory found root.

Efficient Market Hypothesis

Market efficiency studies price mechanisms relative to financial assets where positive or negative information affects financial instrument prices accordingly. EMH assumes that investors are rational and have market information Fakhry, (2016). It assumes that price equals real asset value and projects increase or decrease in price according to prevailing market conditions. For example, company gains will subsequently increase the prices of shares or dividends earned accordingly.

Fama proposed to identify information in three types, Efficiency in weak form, a situation where it becomes difficult to formulate a business strategy to yield above the prevailing price. Temporary form Efficiency, prices are reflecting available public data in a series of prices where previous values and information don’t allow an extra profit. Finally, Efficient in strong form happens when prices contain all-time price-series, private and public information that prevents prices above current market value.

Rationality of investors

EMH encourages rational investors and facilitates expected utility function according to the Bayesian rule. The assumption is made that investors are rational in decisions, with unlimited capacity for achieving the expected utility function, which is unpractical because irrational investment still exists. The human mind is pound to errors, and memory limitations and can’t be purely rational because emotions play a role in decision making. Kahneman and Tversky found that the human mind act heuristically using cognitive filters to estimate information leading to errors and biased judgment Lu, Zhang & Wang (2020). Investors use heuristic intuitively as a mechanism to reduce complex problems to make quick choices for optimum satisfaction to achieve better results.

The Theory of Prospect

The theory of prospect was Kahneman and Tversky’s descriptive idea that values individuals’ responses and decision interpretation. However, the Expected Utility Theory (EUT) has been criticized for its complex economic models; people overestimate reliable results and underestimate possibilities Bellé, Cantarelli & Belardinelli (2018). Contrary, it is expected that a random event must yield a combination of every result. Kahneman found out that something exists that contradicts the EUT.

He discussed this contraction in three phenomena, including the certainty effect; this reveals that people prefer a lower-certain-gain to a projected higher value gain as opposed to an Expected Utility gain. Individuals believe that the latter has higher chances of gaining with high chances of losses than the former. The effect reflection, these are mirrored preferences as regards good and bad situations. Here, positive-certainty situations are preferred to uncertainty-positive situations. On the other hand, uncertainty-negative events became prioritized over negative-events certainty. These economic agents aversely behave at revenue potential and high risk of possible negative results. Finally, the insulation effect forms the decomposition of every possible alternative where individuals only chose parts of the alternative.

Therefore, prospect theory attempts to analyze the investors’ decision-making and scrutinize economic agents’ behaviors at points of uncertainty without the use of expected utility, and simplify matters to look realistic. Prospect theory is empirical experiments on certain subjects where decisions are formulated.

Behavioral Finance

Background study

Two psychologists, Daniel Kahneman and Amos Tversky brought the idea of prospect theory in 1979. Behavioral Finance (BF) challenges the assumption of the rationality associated with the traditional economic model. Amos and Kahneman studied three distinct areas, mental accounting and overconfidence and risk attitudes Dickason & Ferreira (2018). Later, Richard Thaler brought in a clear connection between economics and psychology that saw BF fully adopted in academics and the business world.

BF is a science that intertwines psychology with economics that explains how and why individuals make irrational decisions to save, invest, borrow and spend money. Some researchers assert that BF is a discipline that studies how psychology influences markets through human behaviors. It combines human behavior, finance, and cognitive psychology to find answers to why most people invest irrationally. They found out that behavioral biases make investors stick to information that may not reflect the true market information.

Behavioral Finance contains a strong empirical connotation that relates to behavioral principles that originate from sociology, anthropology, and psychology. It forms a series of plans that individuals use to manage information for decision-making. The strategies at times are used in uncertain situations to extract information from an environment with a high content rate.

Theoretical Principles

The stock market can be an expensive affair if you don’t know who you are as it relates to securities. You must be rational in classical theory or irrational in Behavioral Finance Suárez-Eiroa, Fernández, & Soto-Oñate (2019). The paper discusses behavior principles as follows.

Anchoring

This puts importance on irrelevant data as a reference to evaluate or estimate unknown value and information. Investors tend to hang on to losing investments until break-even prices are in a bar with cost, thus anchoring investment to an earlier value, although it may not have any significance to the current valuation.

Herding

This is investor behavior where they go around seeing what others prefer and do; they too follow the same direction. It is a zone that comforts those investing because they feel safe in a group.

Prospect Theory

In Kahneman and Tversky’s research, risk aversion at times describes the behavior of investors with gains; investors risk more when losses are realized. They keep investing or hang on in an attempt to recover the losses.

Mental Accounting

Mental accounting is the tendency of an investor to put things in boxes and monitor them individually. For example, an investor will consider dividends and capital gains differently as well as unrealized gains. Another example can be, buying dividends (stocks) to avoid digging in capital and selling the stock to finance personal expenses.

Framing

Framing deals with overlaying situations with implied thinking of gain or loss Costa, Carvalho & Moreira (2019). For example, one will prefer buying something at 5,600 when in reality it costs 5,500 than paying 100 for something meant to be free. At this incident, it looks like a loss added on a big figure sounds less hurting than when considered separately.

Theoretical financial principles and Markets

The paper discusses how previously analyzed theoretical principles are aligned to financial market realities. Since the neoclassical theory fell short of certain market issues, experts used the behavioral model to develop remedies to the problems. BF will be used to analyze the stock market behavior through Equity Premium Puzzle. Another area of interest is institutional investor behavior, and large financial organizations collecting and managing large sums of capital will be analyzed using a closed-end puzzle.

The Puzzle of Premium Equity

This was formed courtesy of Mehra and Edward C. Prescott after studying the US financial markets from 1889 to 1978 (Ngo, 2016). The premium equities are the gains on government securities and the stock market, while the equity premium puzzle creates a platform for equities to have high annual returns concerning risk-free securities Shirvani, Stoyanov & Rachev (2021).

The complexity of financial markets is a puzzle to investors because not all information is available in the domain. Investors prefer stocks with low returns to those with high returns to evade losses. BF approaches the idea in two dimensions; prospect theory and risk of aversion ambiguity.

Bernard and Thaler argue that investors are shy to bear risks associated with stocks with high returns. This concept encourages investors to buy equities and government bonds, which assumes that losses and gains relate directly to negative and positive changes in individual economic positions. Secondly, the principle of aversion to ambiguity is where a person refuses to bet because probability information is withheld or unavailable.

Disposition Effect

This is a phenomenon that encourages investors to sell the well-performing stock while leaving the nonperforming ones for an anticipated price increase. The model explains the idea in three behavioral principles. First, in prospect theory, the investor makes decisions subject to change and interprets alternatives as related to gains and losses. At the evaluation point, concave and convex curves represent gains and losses, respectively. Secondly, regret aversion is the dissatisfaction of an investor for making a bad investment decision. Lastly, self-control is the ability to make investment decisions rationally or irrationally.

Fund Closed-end puzzle

Funds pooled together mutually from investors by brokers are entrusted to corporations with financial muscles and legal capacity to manage. Mutual funds invest money from security underwriters and pool them together and the allocated shares accordingly. A subscriber owns a portion of the total holdings in a title. Buying a share is a part of an investment of securities in the same composition of the fund Fenaroli (2019). It acts as investment vessels to collect money and invest them later to mature. Until maturity, subscribers have no right to access the shares held.

Herding behavior and psychology of masses

Individual behavioral decision-making of uncertainty becomes profound if done in a group, a phenomenon compared to how animals move together called herd behavior. In financial markets, investors copy and learn from each other to make economic decisions without personal assessment. The theory applauds herding behavior for creating a social network for information exchange, encouraging informed group decisions. It imitates the current investment patterns; investors make decisions based on how the environment responds.

Market information inefficiencies

Fama’s efficient market theory has been an economic pathway since the 1970s because of its ability to tie financial rationality to the entire economy. Though critics published the theory’s anomalies, several market deficiency yields prevailed without illustrating their sizes in detail. Since the 1980s, econometrics analyses have been carried out to validate the efficient markets theory using time series price, profits, and dividends. Some anomalies were discovered, including excess volatility that was larger than expected. The section below tries to analyze excess volatility and how it affects markets.

Volatility of Market

Market efficient structures have conflicted with many theories; the paper studies those related to excess price volatility as more relevant Atkins, Niranjan & Gerding (2018). This was addressed in the early 1980s by Shiller when he saw limitations associated with price volatility as provided by efficient market returns.

“Ex-post Rational Stock Price” and Robert Shiller’s perspective.

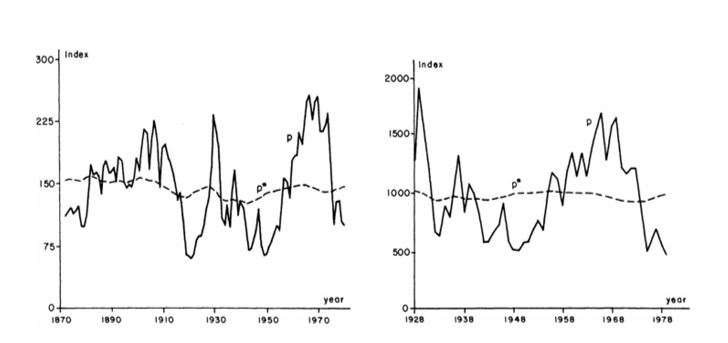

In 1981, Shiller used the “Ex post Rational Stock Price” theory to show the total discounted worth of the available dividends. He used graphical empirical analysis that almost came close to the excess volatility puzzle Fabozzi, Shiller & Tunaru (2020). The efficient markets theory brought balance, prevailing price to the ex-post that created a connection that maintained the current price below the prevailing value of the dividends in question.

Using efficient market theory, Shiller defines real price P of security when starting financial period t, given below:

Pt =∑∞k =0γk+1EtDt+k

Where E t Dt, the anticipated price the dividend is worth at collapse of period t, with available data at period t, where 0<γ <1 is the estimated discount constant. The data at t has Pt, & Dt, previous values including other factors. This is the estimated return for acquiring the shares at t, sales at t+1 where Ht = (Pt+1 + Dt)/Pt. The capital gain is represented by the first numerator from the difference at a price sold at t+1. At the end of time t, the dividend is paid to reflect in the second term. If constant at period r reflects the real situation, then Et (H)t = r. If r is used as a discount rate in (1), then the discount factor equals γ = 1/(1+r). The mode can be reformulated to reflect the factor of growth as pt = Pt / ƛt-T and dt = Ft/ƛt+1-T in the long run. The growth factor is given as ƛt-T = (1+ g) t-T, where g and T represent the growth rate and a base year, respectively. Dividing by the precious model’s growth factor is represented as follows;

pt =∑∞k =0(ƛγ)k+1EtDt+k = ∑∞k =0γ-k+1EtDt+k (2)

Final price equation will be g < r the assumption that γ = ƛγ<1 and r>0, the discount rate for pt, dt derived from y = 1/ (1+r). The discount is a ratio between average price and average dividend. When placing the expected operator for the two model terms, we get the following;

E(p) = γ/1-γE(d)

Using γ = 1/1+r to solve equation, it follows that r = E (d) /E (p). The model can be expressed as the fundamental asset value of pt*, and he present discounted future value of dividends at time t. pt is a calculated condition on prevailing data at time t relative to pt which means pt* is optional forecast of pt..

pt = Et (pt*)

p*t = ∑∞k=0 γk+1dt+k (3)

Terminal value pt may recursively show approximate outcome of p*t series, from date started p*t = γ (p*t+1 + dt)

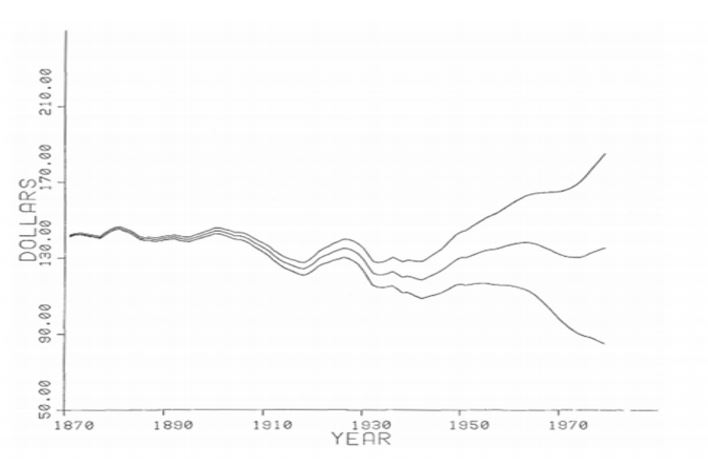

The research for a period of 108 years from 1871 to 1979, –γ is 0.954 and γ-108 where 108 is the terminal value = 0.0063, almost zero value. At the start of the sample time series, it is insignificant to determine p*t. choosing a different terminal value will change exponentially up or down from graph p*. This may be observed, in Chart A showing uncertainty for p*, calculated from terminal value alternative as expressed in the graph below.

Equation three observes the efficient market theory prices pt, the asset value the time t is the expected value of p*t, contemporary worth, condition with available data at time t. that implies pt as an approximated fundamental p*t, showing the very moment of prevailing prices originates from new data on the contemporary value assigned p*t. The EMT derives relation from p*t = p*t + u t, u t shows an error originated for estimating ex-post price as shown previously in a report u t, = p*t – pt. u t independent error on variable data at period t. At initial assumption (1) pt is data available at time t, pt independent error. pt and u t are independent variables with no correlation, indicating that their sum equals the variance of their summands as shown Var (p*t) = Var (p*t) + Var (u t).

From the equation, the error variable cannot be negative, Var (u t) = 0, the constant of the market price volatility in the EMT, where Var (p*t) ≥ Var (pt). Constant violation will cause increased fundamental value due to stock prices.

Shiller’s concept had shortcomings to be validated. One issue was taking stationary dividends and securities prices; it is argued that dividends follow a certain trend that yields, issues, and share purchases move dividends from a random trend, Shiller (2018). Again, when fund managers use dividends for a low payout by the firm’s activities, this directs the funds of the tittles to vary faster than dividends. Dividend smoothing ensures equal returns per share that create rice instability with high volatility than prevailing values. It is also argued that efficient markets have more complex relationships than the expected value model, where discounted value is assumed to be constant.

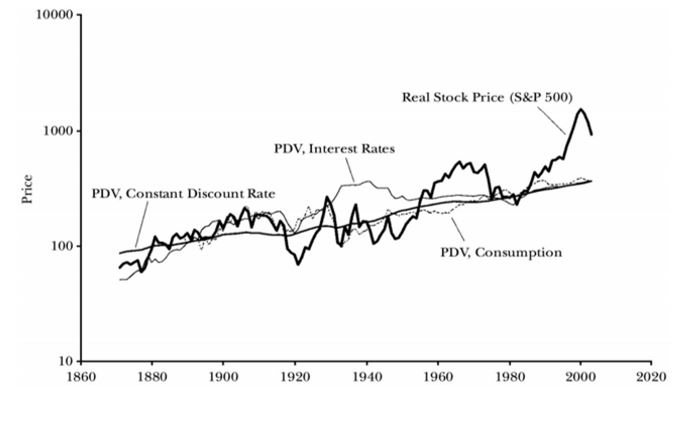

In an empirical analysis, variations in the interest rate in the current value formula cannot promote efficient markets because the current price is volatile. After studying a graph pattern, Grossman and Shiller related individual representation to the nondurable commodity that affected US capita Income, including their product accounts that had 3 as an aversion risk.

P*C1t = ∑∞ r=t+1(ct/cT)3 DT

This case reveals weak connections with prevailing prices that justify price volatility changes, with less than a highly exaggerated aversion coefficient of more than 3. This trend connects to performance assumptions that saw an increase in 1929 and a drop in 1933, expressing a foresight of impending depression. The theory shows a lower limit of marginal substitution rate based on the US data that exaggerates observation and lowers the risk of aversion to unrealistic levels.

The S&P500 of January is represented by the dark line while the light line represents a Constant Discount Rate, dividends real values, and discounted flat value equals to 6.61% mean. Dividends in 2002 are approximated to be equal 1.25 X dividends in 2002 (correcting lower payout) at a mean growth rate of 1.11% geometrically. The discounted present value of interest rates is represented by the narrow curve.

Conclusion

For many years, finance issues were based on the traditional way of doing business. Traditional finance fell short of preparedness to offer solutions to market problems. Markets operate in perfect market conditions, where market forces determine the pricing of securities. In Shiller’s argument, he assumed that the human mind evolves and changes desires. When the efficient market hypothesis fell shot, behavioral finance was born.

Behavioral Finance addresses the traditional finance shortcomings. It studies and analyses human behavior as an influence on investment. BF is a science studying market functions and human behavior to make investment decisions. It creates a platform for open-minded finance, and investors make decisions based on their thinking. Two major principles hereunder are Prospect Theory and Expected Utility theory courtesy, of Kahneman and Tversky in 1974.

The paper compared the traditional and modern finance structures. People invested in stocks to earn more returns because it was presumed all market information was available in the domain. BF surfaces as a solution since some stock’s real values couldn’t determine prices. BFT revealed that investors buy stock not necessarily for higher returns but through the psychological influence of the mind. For example, an investor may invest in security after seeing others flow in the same direction.

The objective of the study was to establish linkages and differences in the business models. Shiller’s EMT gave investors a platform to enjoy higher profitability on an investment relative to market conditions. This discourages irrational investment that BFT tries to empresses. Reality dons that EMT had several anomalies; therefore, BFT leads the day for providing required solutions. However, there are still unanswered questions regarding the future of the BF: how long can this “marriage” between finance and psychology together with cognitive science influence business decisions, and what can be the decisive factor in its success or failure. Furthermore, today human behavior, together with the economy as a whole, is heavily influenced by the global pandemic, which raises the question of how BF can further develop to constantly and efficiently adapt to the changing human behavior toward investment and what problems and solutions might arise as a result.

References

Bellé, N., Cantarelli, P., & Belardinelli, P. (2018). Prospect theory goes public: Experimental evidence on cognitive biases in public policy and management decisions. Public Administration Review, 78(6), 828-840.

Costa, D. F., Carvalho, F. D. M., & Moreira, B. C. D. M. (2019). Behavioral economics and behavioral finance: a bibliometric analysis of the scientific fields. Journal of Economic Surveys, 33(1), 3-24.

Dickason, Z., & Ferreira, S. (2018). Establishing a link between risk tolerance, investor personality, and behavioral finance in South Africa. Cogent Economics & Finance, 6(1), 1519898.

Fakhry, B. (2016). A literature review of the efficient market hypothesis. Turkish Economic Review, 3(3), 431-442.

Fenaroli, C. (2019). The Closed-End Fund Puzzle: New Evidence From Business Development Companies (Doctoral dissertation).

Lu, X., Zhang, Y., Zhang, Y., & Wang, L. (2020). Can investment advisors promote rational investment? Evidence from micro-data in China. Economic Modelling, 86, 251-263.

Ngo, M.H. (2016). The equity premium and its behavioral determinants. (Thesis). doi:10.13140/RG.2.1.2509.2081

Pilbeam, K. (2018). Finance & financial markets. Macmillan International Higher Education.

Shirvani, A., Stoyanov, S. V., Fabozzi, F. J., & Rachev, S. T. (2021). Equity premium puzzle or faulty economic modeling? Review of Quantitative Finance and Accounting, 56(4), 1329-1342.

Suárez-Eiroa, B., Fernández, E., Méndez-Martínez, G., & Soto-Oñate, D. (2019). Operational principles of circular economy for sustainable development: Linking theory and practice. Journal of cleaner production, 214, 952-961.