Introduction to working capital

Working capital refers to the difference between current assets and current liabilities at a given time of the year. A firm should strive to balance its working capital (Siddaiah, 2009, 307). Inadequate working capital signals the firm’s inability to meet its obligations when they arise. However, too much working capital signals that a firm is not utilizing its available funds prudently (Minaxi, 2011, 351). Current assets refer to those items which are expected to last for a short period usually one year. They include stock, trade debtors, cash at bank and cash in hand. Current liabilities refer to obligations which are expected to be paid within one year and include trade creditors or accounts payable and bank overdraft. Any business firm, having a profit objective or not, needs working capital to operate effectively. The following essay discusses ways in which a firm can manage its working capital effectively.

Ways in which companies manage working capital

Management of Cash

Cash refers to demand and currency deposits and it is the most important current asset held by a business enterprise. According to economists, there are three main reasons why people hold cash. The three reasons include; for daily transactions, for emergency purposes and speculative purposes (International Monetary Fund, 2006, 89).

A study which was carried out by Moyer, McGuigan and Kretlow (2008) suggests that financial managers have the role of planning when to have cash for investment purpose and when cash requires to be borrowed. The following factors determine the amount of cash to be held by a firm; cash management practices, the liquidity position of a firm, liquidity risk preferences by the senior leadership team and the company’s ability to borrow funds, among others. Cash inflows are cash receipts which can take the form of cash sales, cash received from credit customers, cash received from sale of fixed assets, cash received from investment, and cash received from borrowing funds. Cash outflows are cash payments which include payments to suppliers, payment of operating expenses and finance expenses, payment of taxes, acquisition of assets, redemption of shares and bonds among others (Moyer, McGuigan, & Kretlow, 2008, 108).

The main objective of managing cash is to ensure that sufficient cash is maintained at all times. It aims at investing excess cash most productively while at the same time; retaining liquidity to cater for future needs. Cash management ensures that a firm is adequately liquid. Financing current needs with short term loans may cause bankruptcy. An entity could be making huge profits but suffer from cash shortages due to such reasons as inflation, losses, organizational delays and seasonal businesses among others (Graham & Coyle, 2000, 6). Liquid assets include cash in hand and bank, current accounts and assets are easily convertible into cash. Liquidity is the means of survival for any business. The senior leadership team should therefore make sure that cash is readily available. Controlling finances is a major challenge for many firms (Madura, 2009, 600).

To control liquidity of a firm, the management should take the following into account; management should know the amount of liquid cash that should be upheld, the time when the firm requires this liquid cash, the economical aspect of maintaining a certain level of cash and the risks associated with maintaining liquid cash. The management should ensure that optimum cash levels are maintained at all times. Speedy transmission of payments should be encouraged. With this regard, financial managers should ensure that there are no lodgment delays. Lodgment delays refer to failure to bank cash and thus exposing a firm to risks of loses. Financial managers should adopt a centralized banking approach. Other ways of improving cash management include; reducing the amount of stock which is carried forward, refraining from investing in non-core activities, ensuring that debtors pay on time and delaying capital expenditure. For small firms, owners may decide to borrow cash from banks which offer low interest rates. The management should ensure that the firm maintains good relationship with the banks and other financial institutions (Siegel et al., 1997, 45). Management should also prepare cash forecasts by using cash flow statements or cash budget. Cash forecasting plays an important role in indicating the amount of cash that should be maintained at all times. A cash budget is a very important tool used in planning and controlling the use of cash. A cash budget is prepared based on forecast. Financial forecast which does not exceed one year is known as short term forecast and forecast which is expected to extend beyond one year is known as long term forecast. Financial managers should correctly forecast the amount of funds that is required and the sources of fund. Forecasting plays an important role in enabling the financial managers to determine the company’s financing and debt repayments (Sihler, Crawford & Davis, 2004, 74).

Cash management requires the financial managers to determine the amount of funds that should be invested at a particular time. The following are some of how a company may invest its funds; time deposits, money market funds, demand deposits and U.S Treasury securities. It is unwise for a firm to hold cash in large amounts as it may be misappropriated. Moreover, holding cash in hand is costly to a firm. According to Plewa and Friedlob (1995), financial managers should ensure that the firm does not have excessive cash balance. This is because, excessive cash balance does not earn returns. Thus, a firm should only have cash to compensate balances and for emergency purposes. However, the management should ensure that sufficient liquidity is maintained to reduce the risks of insolvency. There are various cash management models which have been developed to determine the amount of cash in hand. They include; Stone model, Baumol Allais Tobin model, Cash budgets, Mirror Orr model and Breakneck model (Plewa, & Friedlob, 1995, 119).

Baumol Model Approach of Cash Management

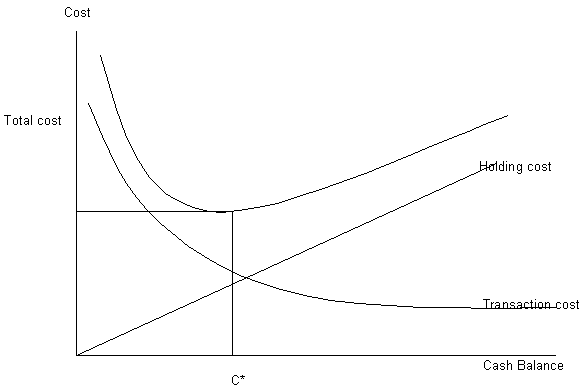

Baumol’s model approach of cash management was developed by William Baumol and it is deterministic model which assumes certainty in variables. According to Baumol’s model, a firm should maintain optimum level of cash at a point where both transactions and carrying costs are at minimum. This model of cash management assumes the following; the model assumes that an enterprise is capable of forecasting its daily cash requirements rightly, it also assumes that the firm has fixed cash payments, the firm has fixed cash inflow requirement and that shortage of funds does not cause any cost to the firm (Rolfe, 2008, 530).

A diagram of Baumol Model Approach of Cash Management

The average total cost (C) =Qi/2 + FS/Q

Where:

- S represents the annual cash requirement

- F represents the transaction cost

- I represents the cost of holding cash and

- Q represents the total amount of cash raised

Baumol model approach of cash management has major drawbacks which include ignoring that a firm does not use cash flows uniformly. This model is not accurate in predicting the future cash requirements of a firm. The model does not allow for buffer cash and thus, a firm may incur costs due to insufficient cash (Bose, 2006, 232).

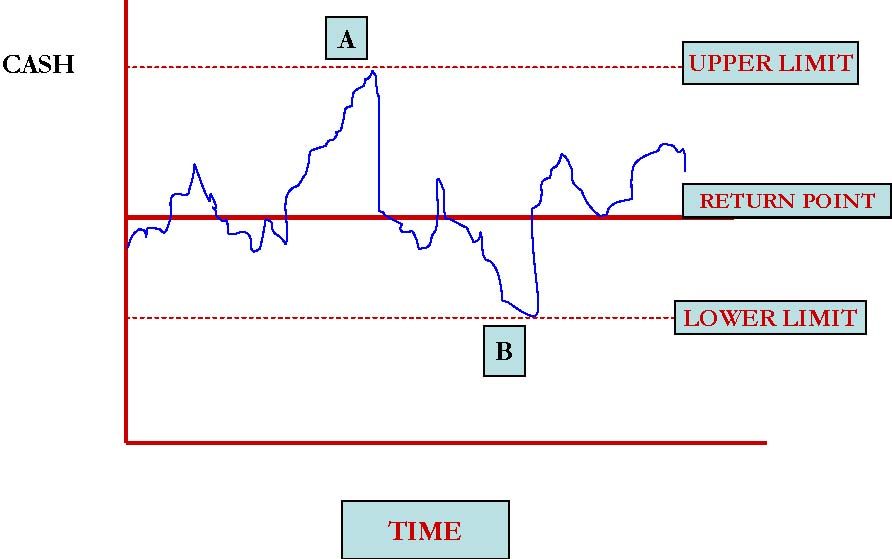

The Miller-Orr Model of Cash Management

The Miller and Orr model of cash management was named after two proponents; Morton Miller and Daniel Orr. The model was aimed at producing a more practical approach with regard to cash management. The Miller-Orr model assumes that it is hard to predict cash flows. It assumes that a company sets both the upper limit and the lower limit to maintain adequate cash flows. According to this approach, if cash balances hit an upper limit, the firm is then bound to buy adequate securities to bring cash balance back to the original level. However, the firm sells its investments to bring back the balance to a set normal level when the cash balance hits a lower limit. The following factors determine the amounts of upper and lower limits that a firm should set: interest rate, transaction costs and the differences between net cash flows.

Graphical representation of the Miller and Orr model

The difference between the upper limit and the lower limit is referred to as the spread

Inventory Management

Inventory management is concerned with determining how often a firm orders an item to be replenished and the quantity that the firm should order at a particular time. There are two main systems of inventory management which include the P system and the Q system. With regard to the P system, the ordering time is always fixed. However, the quantity ordered varies each time under the P system. Usually, the management notes the inventory time at the trigger time and orders are placed to achieve a set level (Brigham & Ehrardt, 2010, 661).

With regards to the Q system, the quantity to be ordered is usually fixed but the ordering time varies. Thus, the management places an order whenever the stock level falls to a set level. The optimal amount of stock to be ordered by a firm to minimize the total relevant costs is known as the Economic Order Quantity (EOQ). The basic EOQ model assumes that the only relevant costs are ordering and carrying costs. Other costs associated with holding of stock such as stock out cost and cost of obsolescence are ignored (Lowe & Chhajed, 2008, 135).

According to Puri (2011), total ordering costs are costs which are incurred from the time a company places an order up to the time goods are received. These costs include transportation charges, insurance of stock-in-transit, clerical costs, loading and offloading of stock among others. The model for determining total cost per annum is obtained as D/Q where D is the demand per annum and Q is the number of units (Dolgui, Morel & International Federation of Automatic Control, 2006, 257).

Carrying cost is also referred to as the stock holding cost. It includes such costs as material handling cost, insurance of stock, installation of antitheft devices and opportunity cost among others. Carrying costs are based on earnings (Brandimarte & Zotteri, 2007, 195).

Total carrying cost p.a = ½(E.O.Q) * opportunity cost per unit p.a

=1/2(Q) i

Where (i) is the opportunity cost p. a

The basic EOQ model is based on the following assumptions; that annual demand is known and constant, the cost per order is known and remains constant, opportunity cost per unit is known and constant, that the purchase cost is constant and lead time is known and constant. The model also ignores stock out cost (Lewis, 1997, 94).

There are two techniques which are used to control inventory of a firm. The two techniques are just in time technique and ABC analysis. Just in time (JIT) inventory control system is a Japanese model in which stock is acquired only when it is needed for management. Stock of raw materials is therefore acquired during manufacturing process. A firm adopts this approach to attain the following objectives; to maintain zero stock balances, to minimize cost of obsolescence, to avoid or minimize opportunity cost and to enhance quality of products produced by the firm (Holdford & Brown, 2010, 240).

ABC analysis is a technique used to differentiate stock based on their contribution to turnover. This technique is used by companies that sell multiple products like the supermarket. According to this approach, inventories should be grouped into three main classes: class A items, class B items and class C items. Class A is comprised of items of high value. In this classification, only a few items can be sold but their contribution to sales value is high. Therefore, it’s advisable to carry out an EOQ analysis of items falling in this class. Class B is comprised of items of moderate value. Moderate control effort is therefore recommended. Class C consists of items of lower value. A firm may sell many items but their contribution to turnover is not much. Thus, control efforts are not economically justified (Ghiani, Laporte & Musmanno, 2004, 321).

Management of accounts receivables

Accounts receivables arise when a firm sells its product on credit basis. Accounts receivables are a source of investment on the part of the seller and a source of short-term funding in case of a buyer. Accounts receivables are quite liquid and can be recovered in case the buyer becomes insolvent (Droms, & Wright, 2010, 158). Consumers who purchase huge volumes of goods can gain by paying late. Smaller businesses are forced to pay earlier as they don’t have a strong bargaining position. Disadvantages of accounts receivables are that the borrower may be defrauded by the lender in case the latter pledges nonexistent accounts. Also, there are huge costs associated with processing the accounts receivables especially in a case where the company has many invoices with small dollar amounts (Norton & Porter, 2010, 163).

Jain and Khan (2007) in their studies suggested that financial managers should determine the right amount of credit that is extended to borrowers. The terms of credits have a major influence on the opportunity costs and the revenues generated from the accounts receivables. For instance, tight credit terms imply less bad debts losses. However, tight credit terms lead to lower sales and in turn less profits. A firm which is harsh with its debtors risks customers in the future. On the other hand, a firm which is too soft with debtors may experience funds shortages. A firm should therefore have clear credit policy because a firm’s credit policy influences its profitability (Longenecker, Estala, & Loeza, 2010, 581).

Economic conditions as well as the company’s credit policy determine the collection period for accounts receivables. Financial managers should thus follow the following procedures in managing the accounts receivables; first, they should set up a credit policy for the firm. This step involves a critical examination of customer’s financial status. The financial soundness of potential customers should be carefully assessed. This is facilitated by examining their financial statements and other supportive documents. The financial managers should also consider the current marketing conditions to avoid loses (Moore, 2008, 581-583).

The second step of managing accounts receivables is to establish a billing policy. Financial managers should ensure that financial statements from clients are sent at an early period. Revenues should also be billed once they are earned. Invoices should be issued to buyers after the processing is done. Financial managers should also consider using seasonal dating.

The final step of managing accounts receivables is to establish a collection policy. With this regards, financial managers should ensure that accounts receivables are aged properly. Aging accounts receivables enable a firm to determine high-risk buyers (Moore, 2008, 573).

Management of short-term loans

Short term loans are a source of financing for many businesses. This is because they have lower interest rates compared long-term loans. However, short-term loans are very risky as they are payable over a short period of time. Also, the borrower has to incur transaction costs of obtaining new funding every few months. There are two main types of short-term loans which include: line of credit and self-liquidating loan. A company is required to sign a promissory note when it is obtaining new financing. Self-liquidating loan refers to a short-term loan obtained from banks whereby proceeds from the loan are used to purchase assets that will in turn be sold to facilitate repayment of the loan. The line of credit refers to the maximum total balance of loans that a firm can obtain at any given time. The firm needs to understand the loan agreement before taking a short-term loan (Minaxi, 2011, 349-354).

Management of accounts payable

Accounts payable refers to debts that a firm owes to others. To effectively manage accounts payable, a firm should ensure that it records and pays all the authorized payables. The Chief Financial Officer thus, has the role of paying the accounts payable, checking manuals, recording both merchandising and non-merchandizing accounts payable and documenting them (Moore, 2008, 581-583).

Conclusion

Management of working capital requires financial managers to regulate the various types of current assets as well as current liabilities. It involves making decisions concerning the financing of current assets. For instance, current assets can be financed through equity or short-term debt. The management of working capital also requires management to consider the risk-return trade off. This is because holding more current assets than fixed assets signifies a reduction of liquidity risk. It also signifies greater flexibility because current assets may be converted into cash more easily. However, current assets have lower rate of return compared with fixed assets. A firm maximizes its rate of return, business and liquidity risks if it optimally manages cash, inventory and accounts receivables. Financial managers thus have the role of determining the amount to be invested in a particular asset. However, the amount to be invested is not constant. It varies from time to time and calls for critical examination of account balances.

Reference List

Bhattacharya, H., 2004. Working Capital Management: Strategies and Techniques. New Delhi: PHI Learning Pvt. Ltd.

Bose, D. C., 2006. Fundamentals of Financial Management. New Delhi: PHI Learning Pvt. Ltd.

Brandimarte, P & Zotteri, G., 2007. Introduction to distribution logistics. New York: Wiley-Interscience.

Brigham, E. F., & Ehrardt, M.C., 2010. Financial Management Theory and Practice: Edition13. London: Cengage Learning.

Dolgui, A., Morel, G. & International Federation of Automatic Control., 2006. Information control problems in manufacturing 2006: a proceedings volume from the 12th IFAC Conference, 17-19 May 2006, Saint-Etienne, France. Amsterdam: Elsevier.

Droms, W. G., & Wright, J. O., 2010. Finance and Accounting for Nonfinancial Managers: All the Basics You Need to Know. London: Basic Books.

Ghiani, G., Laporte, G., & Musmanno, R., 2004. Introduction to logistics systems planning and control. Hoboken: John Wiley and Sons.

Graham, A. & Coyle, B., 2000. Cash Flow Forecasting and Liquidity. New York: Global Professional Publisher.

Holdford, D. A. & Brown, T. R., 2010. Introduction to Hospital and Health-System Pharmacy Practice. Farnham: ASHP.

International Monetary Fund. 2006. International financial statistics yearbook, Volume 59. Washington D.C.: InternationalMonetary Fund.

Jain, D. & Khan, J., 2007. Financial Management. New York: Tata McGraw-Hill Education.

Lewis, C. D., 1997. Demand Forecasting and Inventory Control. London: Routledge.

Longenecker, J. G., Estala, G., & Loeza, T., 2010. Small business management: Edition14. London: Cengage Learning.

Lowe, T. J., & Chhajed, D., 2008. Building intuition: insights from basic operations management models and principles. Berlin: Springer.

Madura, J., 2009. International Financial Management: Edition10. London: Cengage Learning.

Minaxi, R., 2011. Introduction Management Accounting. New Delhi: Pearson Education India.

Moore, C. T., 2008. Managing Small Business. London: Cengage Learning EMEA.

Moyer, R. C., McGuigan, J. R. & Kretlow, W., 2008. Contemporary Financial Management. London: Cengage Learning.

Norton, C. L. & Porter, G. A., 2010. Using Financial Accounting Information: The Alternative to Debits and Credits.Edition7. London: Cengage Learning.

Plewa, F. J. & Friedlob, G. T., 1995. Understanding cash flow. Hoboken: John Wiley and Sons.

Puri, S. K., 2011. Introduction to Retail Math. California: ABC Clio.

Rolfe, T., 2008. Financial Accounting and Tax Principles: Edition5. Amsterdam: Elsevier.

Siddaiah, T., 2009. International Financial Management. India: Pearson Education India.

Siegel, J. G, et al., 1997. Chaum’s quick guide to business formulas: 201 decision-making tools for business, finance, and accounting students. New York: McGraw-Hill Professional.

Sihler, W., Crawford, R. & Davis, H. A., 2004. Smart financial management: the essential reference for the successful small business. New York: AMACOM Div American Mgmt Assn.