The Federal Student Aid Application is the most prestigious study grant funded by the US government. The application is submitted online or on paper. It’s absolutely cost-free. This grant is available to citizens and green cardholders. Since deadlines and budgets are tight, you need to fill out the application as thoroughly and accurately as possible.

Students often make many mistakes when completing the appropriate forms and the FAFSA in general, which can make getting the desired grant challenging. In the article below, our team explains how to avoid widespread errors and lists tips on how, when, and where to apply them.

📝 Top 13 Mistakes to Avoid

Let’s start by exploring the main errors that are made when applying for funding. In a hurry, students can even get confused and start filling out forms on phishing websites. Therefore, here we will analyze all the common mistakes, even the most obvious ones, and tell you how to avoid them.

❌ Choosing the wrong website

Sometimes, students complete forms on phishing sites. It’s the greatest mistake you can make. Cybercriminals will steal any data you post on these pages. Check out the official website and fill out the proper form.

❌ Missing the earliest FAFSA deadline

Since FASA has limited funds, the aid is often given to the students who fill out the form as soon as possible. So, don’t leave your application process till the very last minute. Typically, the FAFSA opens on October 1 of the following academic year.

❌ Forgetting about FSA ID

The FSA ID is the name and password you get when creating an account on the official FAFSA website. Remember that creating and verifying your account may take up to three days. We recommend completing this step beforehand. This way, you won’t waste time when the FAFSA application opens. Moreover, with your FSA ID, you can be sure that your data in the FAFSA form matches your FSA ID.

❌ Typing tax information by hand

Entering financial data is one of the most challenging steps. But we have good news! A partnership with the IRS allows students and parents to automatically transfer necessary tax information into the FAFSA form using the IRS DRT. Take advantage of this method. It’ll save you time.

❌ Not reporting all financial data required

Check that you know what financial data you have to submit. You may still consider a dependent student, even if you fully support yourself financially. In this case, you should provide your parents’ financial data. Don’t forget to include your additional sources of income (pensions, child support, disability income, etc.)

❌ Skipping or skimming instructions

Take time to read the instructions carefully. Sometimes, even the most minor misunderstanding can lead to adverse outcomes. Visit the FAQ section on the FAFSA website if you experience difficulties filling out the form.

❌ Ignoring the definitions listed

It’s crucial to read every application definition carefully and ensure you fully understand them. Sometimes, questions that may seem obvious can be pretty tricky. Thus, take enough time to figure out the meaning of each definition in the FAFSA application.

❌ Leaving blank spaces

Blank spaces will lead to application rejection. Therefore, enter “not applicable” instead of leaving an empty field.

❌ Adding other symbols in the numeric fields

Only enter numbers in the numeric fields. No letters are allowed there. Also, you cannot use commas. Always round to the nearest integer number.

❌ Specifying only ONE college

The application accepts up to 10 schools at a time. Don’t miss the opportunity to increase your chances of receiving a FAFSA scholarship. It costs you nothing to add more than one school.

❌ Mixing up student and parent data

Ensure you and your parents have separate accounts. You should use your FSA ID, and your parents should use their own FSA IDs to complete the form. Failing to do so correctly will lead to delays with your financial aid or even the rejection of your application.

❌ Entering information that doesn’t correspond to your FSA ID

Data mismatch between your FAFSA form and your FSA ID will lead to an automatic rejection. It’s essential to enter valid information and double-check every single detail in your application. If you complete all the steps following the instructions, your personal data will automatically transfer from your FSA ID to your FAFSA application.

❌ Failing to sign and date the form

Use your FSA ID to sign the form, and let your parents do as well. There is also an opportunity to mail a signature page. Check this page for mailing details. To verify that your application is submitted, you can check your status right after you complete the form.

And the most crucial tip:

💻 How to Apply for FAFSA: Step by Step

After reviewing the main mistakes, you can make the next stage. Learn how to fill out the FAFSA form correctly. In the following sections, we’ve gathered everything you need to know. Check out our beneficial guide.

Before Applying FAFSA: Preparation

Any significant work starts with preparation, and this applies even to our case. That’s why, before completing the FAFSA form, you should take all the preparatory steps, which we’ve listed below.

✅ Figure out the deadlines

Due dates can vary from school to school and from state to state. Long before submission, check your dates to ensure you do not miss a due date. Ensure you submit the FAFSA form as soon as possible according to the assigned deadlines.

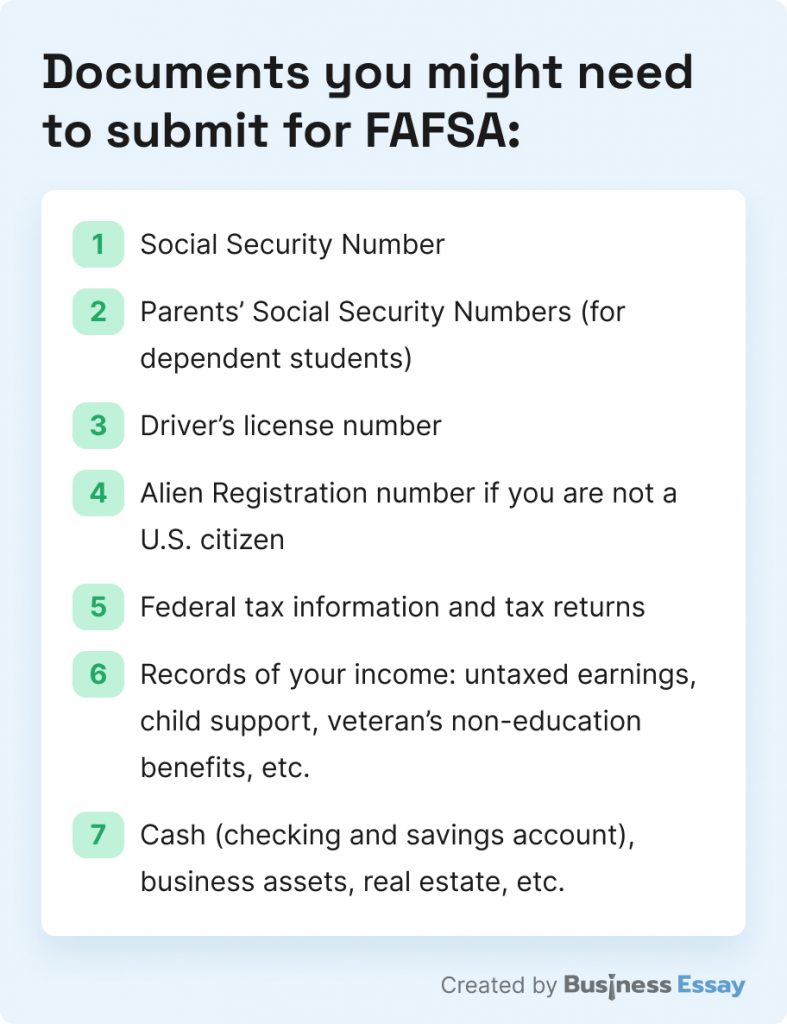

✅ Get all the required documents

Gather all the significant documents required for the application. It includes Social Security Card, Driver’s license, Green Card Number, etc.

✅ Create an FSA ID

You should create an FSA ID at fafsa.gov. Don’t wait till FAFSA starts to register your ID! It will be handy to have everything ready when the application window opens.

✅ Check if your parent needs FSA ID

If you have a defendant status, your parents have to register as well. They will need to provide the information listed on the FAFSA site. Give your parent enough time to gather all the data and submit it.

✅ Gather your financial data

The FAFSA uses tax information from the two class years. It also relies on the most recent bank accounts. You can also use a printout from your bank statement.

✅ Choose colleges for the form

Choose a college list for your FAFSA application. You need at least one school for it to be processed. Since it is a state grant, it is good to have one public state college.

How to Fill out the FAFSA Form

We can now go to the main part of the FAFSA application: filling and sending it. Here, we have elaborated on everything a student will need to do:

- Go to fafsa.gov. Have you created your FAFSA account before? Go to the website and start filling your form. If the colleges did not open their deadlines, you should complete the 2022-23 one.

- Start with the Student Demographics section. Here, insert your name, date of birth, gender, and other personal information. Make sure you enter your SSN information as it appears on your card. This section will be auto-populated if you have logged in using your FAFSA ID.

- List the colleges you’ve picked. List the schools you would like to enter. You can put up to 10 colleges or universities into your application. Don’t worry: school officials do not see this list. We suggest that you put more options than you decided initially. Plus, you can swap the schools if needed.

- Explain your dependency status. Read the U.S. Congress dependency guidelines carefully as those are different from IRS ones. Even if you live alone, pay your bills, and file your taxes, you can still be regarded as a dependent for federal student aid purposes. If that’s the case, provide information about your parents.

- Proceed to the Parent Demographics section. In the FAFSA form, you will see a series of questions that will help determine your status. As a dependent student, you need to enter data about your parents. If you cannot supply specific information based on your circumstances, there is a particular guideline for that.

- Add info about your finances. Next, you need to provide information about your and your parents’ finances. Insert all the required tax returns, real estate, banking accounts data, etc.

- Transfer your tax data automatically. Use the IRS Data Retrieval Tool for that. It will reduce the number of forms you need to submit. This is one of the benefits of applying for FAFSA online.

- Review and check for blank fields. Before submitting, you should reread your application carefully. Look for empty spots to ensure that you didn’t forget anything. Check the list of colleges and your personal and financial information for any errors and typos.

- Sign your form and submit it. Your application is not completed before you sign it. The fastest way is to use your FSA ID. If you log in using it, you will not need to provide this information again. In case you have a dependent status, your parents need to do so before you. However, be careful not to mix up your FSA ID and your parent’s ID.

If you still have questions while filling out the official form, you can try getting help on the official page. There are several options you have:

- Go to the FAFSA “Help” page. There are FAQs for more information.

- If you did not find the answer to the question, you could click on “Contact Us.” You will have an option of calling, emailing, and chatting with live technical support staff.

- You can also contact the financial aid office at your university.

After Applying FAFSA: Waiting

First of all, congratulations on successfully filling the form! What’s next? We have several tips on how to wait correctly (and patiently) after submitting the form.

✅ Ensure your form was processed

See the application status by logging in to fafsa.gov or contacting the Federal Student Aid center directly. If it is still being processed, wait for a bit as it usually takes 3-5 days. There may also be a missing signature or action required for your form. In the latter case, contact your school to find out what is needed.

✅ Consider your Student Aid Report

Once your form is processed, you will get a Student Aid Report. It is not the same as a Financial Aid Award Letter. Your SAR will have the information you have provided on your FAFSA form. Plus, it will include the list of schools you are considering.

✅ Supply the verification if needed

Your college might request additional data from you if you are selected for verification. It is the process of providing documents that support the info you have reported. People are selected for verification randomly. So, it does not mean you’ve done something wrong. Just send the requested documents timely and meet your school’s deadline.

✅ Correct any mistakes in the form if needed

If you realize that there was a typo or mistake, you can correct the form at any given time. For that, login into your FAFSA account. It is more convenient to fix everything online.

✅ Update the application if needed

Suppose there were some changes to your name, marital status, address, financial circumstances, etc. Not a problem! You can continually update the application to reflect the most current information. After that, the college of your choice will determine your eligibility. If you’re considered suitable for help, you will receive a monetary award letter. It will include the cost of the college academic year and some form of financial aid.

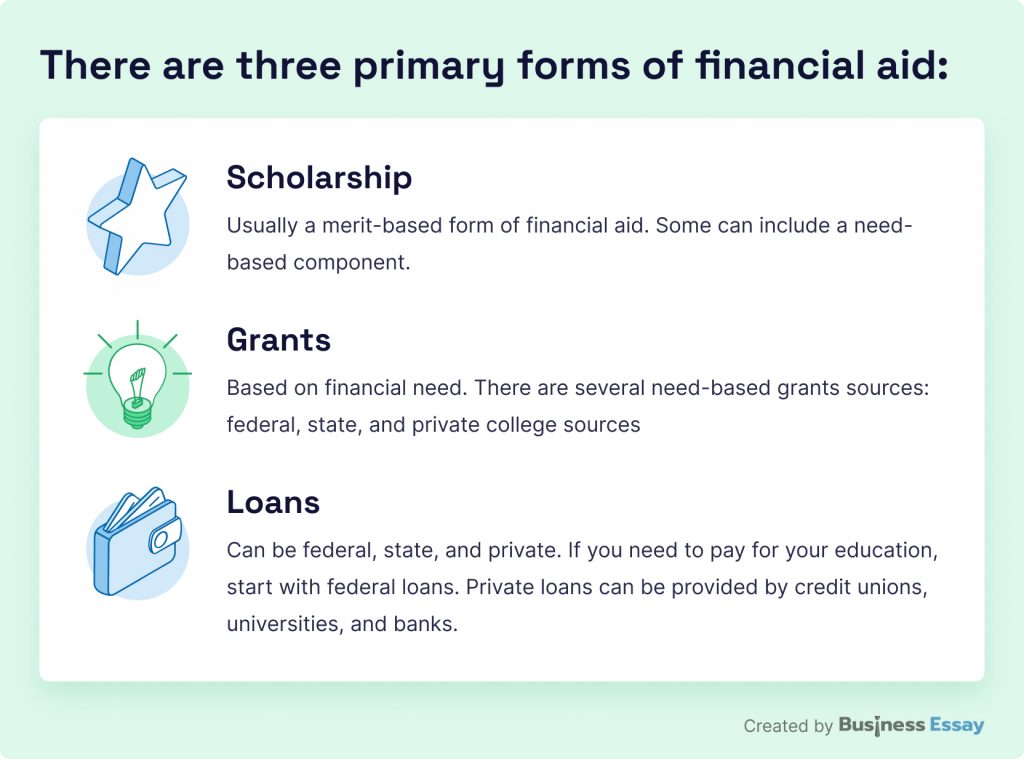

Most universities allow students to use a combination of different forms of financial help to sponsor their education. For instance, you can get a scholarship to pay for your living expenses and a federal loan to pay for your tuition.

Keep in mind:

Colleges will send the financial aid award letters around the same time as admission letters. So, see what each school is offering, evaluate the proposals, and choose the one that fits your budget and academic expectations. Besides, you can re-apply for financial help every single year.

That’s all! Thank you for reading the article. We hope filling the FAFSA application will be easier for you. If your friends are thinking about financial help, share this article with them.

📌 References

- Filling Out the FAFSA® Form – Federal Student Aid, an Office of the US Department of Education

- 10 FAFSA Mistakes that Affect Financial Aid – Shawna Newman, Fastweb

- FAFSA Tips & Common Mistakes to Avoid – NASFAA, National Association of Student Financial Aid Administrators

- 6 FAFSA Tips – Elizabeth Nubel, Nevada Admissions Blog

- 5 Things to Do After Filing Your FAFSA® Form – U.S. Department of Education

- How to Complete the 2022-2023 FAFSA Application – Nitro College

- Eight Steps to Filling out Your FAFSA – Melissa Elliott, Vernon College

- Completing the FAFSA Everything You Should Know Paying for College – Farran Powell, Emma Kerr, and Sarah Wood, US News