Introduction

The portable personal computer industry has many viable and successful competitors who, for the most part, offer similar products. While considering cost alone, several groups generally define the industry competition. Firms compete in groups at the low-end, middle range, upper-middle-range, and high-end.

Within these competitive groups price typically equates to several features or capabilities (Apple Inc. 2006). the highest-end firms offer specialized products with certain consumer groups in mind. These firms compete based on what the computer is designed to be used for, while firms at the lower end of the price spectrum compete essentially on price value. This study examines the cost and budgeting techniques as applied by Apple Inc.

Company and industry background

Apple Inc.

This multinational corporation operates in the U.S. The company designs and manufactures computer electronics, computer software, and personal computers. Some of the manufactured products of the company include Macintosh computers, iPod, iPhone, Mac OS X operating system among many other products.

The company was established in 1976 in California. The company changed its name from Apple Computer Inc. in 2007 to Apple Inc. to reflect the growth and expansion undergone by the company in the electronics industry. The company focused traditionally on personal computers. The company has employees of about 37,000, both permanent and temporary. The employee turnover in the company is about 20%.

Apple Inc. has a very good reputation established over time in conjunction with its philosophy of comprehensive aesthetic design. The good reputation has led to increased loyal customers of the company who are devoted to the brand of the company.

The vision of Apple is that because man creates changes in the world, he should be above systems and structures.

The industry profile

We can glean insight into the history and composition of the PC Industry from its eponymous title. The industry is comprised of many players. By 1983, the market share of the Apple II fell to 8% while the PC had 26%. The market share of Macintosh peaked at slightly more than 10% in the early 1990s and has since tapered to between 2-3%. The IBM PC and its clones became the standard due to the success of the open nature of the PC. This allows product developers to offer vastly more products for the platform (Apple Inc. 2010).

Some argue that not licensing the Mac OS was a mistake. Bill Gates and Microsoft were encouraging Apple to license their OS in the early 1980s because they were developing software for Apple and had much riding on the success of the company. When Apple did not license, Microsoft began developing their operating system, Windows. (Apple Inc. 2010c).

Apple Corporation also operates in the music industry. The company enjoys a dominant market share in the music industry through the competition is tough. Deutschman (2000) notes that Apple’s sales in the music industry amounted to between 66% and 75% of downloads and 80% of music players (Apple, 2005).

The other players in the download market are (the revised) Napster, Yahoo Music, Rhapsody, and illegitimate file-sharing services among others. Portable music players competing with the iPod include those made by Creative, Samsung, iRiver, and Sony. A major point of contention between these services and player manufacturers is the control of a variety of incompatible Digital Rights Management (DRM) schemes.

Cost Behavior and Cost-Volume-Profit (CVP)

According to Horngren, Sundem & Stratton (2002), costs can be grouped into several types such as fixed costs, variable costs, and mixed costs. Cost behavior and analysis are concerned with the changes that costs undergo under different circumstances. Under different conditions, costs behave differently. The analysis of the cost behavior is important to the management because it helps the management to budget, predict cash flows, plans on how they will pay dividends, and establish the price at which to sell the products.

‘Costs’ (n.d) notes that costs can be grouped into four types depending on their behavior. These are variable costs, fixed costs, step variable costs, and mixed costs. Variable costs do not change for every unit of production.

Fixed costs are costs that do not change but vary whenever per unit cost is reduced. It is not mandatory to incur avoidable fixed costs such as rent, depreciation, and property tax.

Step variable costs stay fixed over a given range of activity and vary after the range is over. The costs vary in increments. According to ‘Costs’ (n.d), step variable costs have characteristics of both fixed and variable costs such as changing as the level of output increases and changing when a given level of productivity is achieved. A good example of a step variable cost is the wages paid to employees that vary with the level of production.

According to ‘Costs’ (n.d), the fixed component of a mixed cost is the minimum cost that is associated with the supply of the resource to the firm. The variable component of a cost fluctuates based on the level of activity in the firm. Examples of mixed costs are equipment rental charges, consultation fees, charges for the photocopier, etc. All organizations aim at maximizing profit while minimizing revenue. The attainment of these objectives requires production within a given cost range. The relevant range of costs is the range in which all fixed costs remain fixed and any increase in output leads to an increase in costs (Huzefa, Deepti, and Harmanjeet, 2009).

Apple inc. breaks down its costs according to the behavior of the costs and separates the costs using three methods: scatter graph, High low method, and the method of least squares. In addition, the firm separates direct costs from indirect costs. Direct expenses are traced openly to their exact cost essentials, unlike indirect expenses that cannot be traced.

CVP is an important factor in the decision-making of Apple. The company utilizes the accounting tool to make decisions on the choice of products, the price to be charged on its products, the strategy to be employed in marketing, and how to utilize production facilities effectively. They can utilize the contribution margin to measure the extent to which the change in sales can affect the profit of the company (Huzefa, Deepti, and Harmanjeet, 2009).

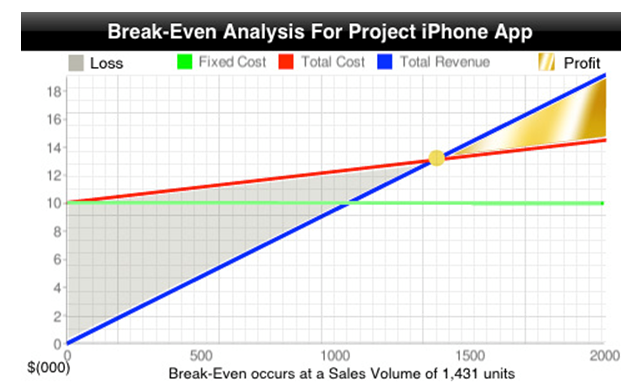

In addition to the contribution margin and operating leverage, Apple Inc utilizes the breakeven analysis. The breakeven point is the level at which the revenue realized by an organization is equal to the expenses incurred by the firm. The contribution margin of the firm can also be equal to the expenses of the firm at the breakeven point. Apple estimates its breakeven point for its products using either the equation method or the unit contribution method. For instance, the breakeven point for the iPhone project for apple was as indicated in the fig below.

These concepts on cost behavior are highly utilized by Apple Inc. the methods are important to the decision making in the organization. For instance, the management utilized the above accounting information on the breakeven point of the iPhone to production and sale. The breakeven point is at 1431 units and the firm cannot produce less than this figure because it will not be able to cover all its expenses. Any production above the breakeven point generates profit. It is recommended that the company continue to use these accounting tools to determine the best levels of production (Huzefa, Deepti, and Harmanjeet, 2009).

ABC, Job Order, Process costing, and Cost allocations

Activity-based costing

ABC allocates expenses to activity centers in an organization. In addition, costs are also assigned to company products. According to Horngren, Sundem & Stratton (2002), the performance of the firm can be improved by activity-based costing. This could also result in the improvement of the value of investors.

ABC is important because it helps an organization to identify channels, clients, and profitable products. Using the method enables, the firm to identify detractors to high financial performance. Since the costs are evaluated from a given cost center, accurate costs of production are estimated while it becomes easier to know the cause of the poor financial performance of the company (Daly, 2002).

Job Order Costing

This method of costing allocates work to different batches that are comprised of several jobs from the same product. Every batch is differentiated and separated from the rest of the batches. Several events are involved in the job order costing method. The process is initiated by the reception of an order for the given batch.

After the reception of an order, the sales order necessitates the issuance of a production order. Materials involved in the production process are ordered and they are tracked specifically for the given batch of products. The allocation of manufacturing to the specific job follows. According to Daly (2002), the actual manufacturing overheads can’t affect work in progress accounts. A job-costing sheet is used to track the amounts of labor and materials used.

This type of costing is applicable in various situations in many industries, although it cannot be applied to all situations. Despite its applications, the method is most useful to industries and organizations that sell their products in batches. However, the method cannot be well applied in Apple Inc. Given that the company manufactures many general products that it sells to different distribution centers and outlets, each order from a distribution center or outlet cannot be taken as a batch.

Process Costing

Process costing is an important costing method to organizations that manufacture products that are similar or identical. The method determines the mean cost of production by apportioning manufacturing costs to specific products. According to Horngren, Sundem & Stratton (2002), organizations that utilize this method operate in different industries such as food processing and refinery.

Despite the disparities, this method has some similarities to job order costing such as using a similar basic purpose of calculating the unit cost, using similar manufacturing accounts. However, the two methods are different in several ways such as differences in batches and batch accumulations. The costs involved under job costing are recorded on an order sheet. However, the costs are indicated in a production report in the relevant department in the process costing method. However, process costing may not complete all units as per the balance sheet date.

Cost Allocations

Allocation of costs is an important factor in every organization. According to ‘Costs’ (n.d), “allocation of costs refers to the assigning of common costs to several cost objects.” For instance, a company can allocate its fixed costs to different departments in the organization. Costs are allocated differently based on the company priorities and objectives.

However, the most common is to allocate costs to cost centers or departments. According to ‘Costs’ (n.d), costs should be linked to their associated causative objects based on various factors. The drivers for the cost determine the base of cost allocation. An item-by-item basis can be used to allocate some costs such as newsprint costs for a newspaper based on the tones of newsprint. Costs can be pooled together and allocated to a given job using only one driver.

Costs are allocated to their cost objects for different reasons. There are three main reasons for the allocation of costs. First, costs are allocated to different cost objects so that the desired motivation is obtained. Costs are sometimes made to influence the decisions of the management to promote the goals of the firm and the efforts of the management in meeting the goals of the firm. Therefore, cost allocation is mainly done for planning and control in the organization.

The second reason for the allocation of costs is to compute income and evaluation of assets of the firm. Thirdly, costs are allocated specifically to justify costs or obtain reimbursement. This reason is used to determine the price to be charged on the produced products. All these reasons for the allocation of costs are also applied in Apple Inc. the company allocates the costs that are used to manufacture its different products on cost centers and departments in the organization.

The allocated costs are relevant for the price charged in the company products. The allocations made include the allocation of joint costs to their appropriate cost centers, the reallocation of costs from a given responsibility center to another, and the allocation of costs associated with a given product to its output.

Budgeting and Variance Analysis

Every organization aims to maximize revenue while minimizing costs. A budgeting tool is utilized by most organizations to estimate the total costs to be incurred in various business processes. The aim is to minimize costs as much as possible so that the actual costs fall within the budget estimates.

According to Horngren, Sundem & Stratton (2002), the drawn budget of the firm should be realistic for effective analysis. After the budget is drawn and costs incurred, the budgeted cost should be compared against the actual cost and the variances analyzed in the process referred to as variance analysis. It is meaningless to analyze the variances of actual costs from an unrealistic budget (Horngren, Sundem & Stratton, 2002).

The variances between the actual and budgeted costs are caused by several factors. Variances in costs are caused by faulty arithmetic in the budget figures, errors in the computation of actual cost results, wrong reality, and differences in the assumptions made for the budget and the actual costs.

Faulty Arithmetic: The budget of an organization can have errors such as errors of omission, commission, duplication, and actual arithmetic errors. The action taken against the error is to ensure that there is no repetition and the magnitude of the error determines other actions.

Errors in actual costs computation: errors can also occur during the computation of actual costs of the firm. Errors may include using the wrong category, cost omission, and double counting of income among many others. According to McNair & Carr (1994), upon the discovery of the error, efforts should be made for it not to be repeated. However, there needs to be a corrective measure for the cumulative figures (Horngren, Sundem & Stratton, 2002).

Variance analysis contains four major steps. First, there is a need to flex the budget, analyze the variances, identify causes and take the necessary actions. Apple Inc calculates materials variances that are determined by the comparison of budgeted material costs and actual material costs.

Variances in overheads are also calculated by the computation of the differences between the actual overheads and budgeted overheads. Lastly, the company also similarly calculates labor variances. The responsibility concept of cost hypothesizes that costs are analyzed according to the specific segments that the costs are incurred. The organization shares incurred expenses among its many identified cost centers such as Investment and revenue centers.

The approach to top cost by responsibility enables the costs incurred in the firm to be allocated to departmental managers. Apple Inc is a large multinational corporation that has segmented the cost centers with different responsibilities. The cost centers of the firm are similar to the centers listed above and different managers in the organization manage them (Horngren, Sundem & Stratton, 2002).

The use of the budgeting and variance analysis in the organization is viewed as an important tool cost minimization strategy in Apple Inc. The employees of the organization especially in the accounting and finance section view the strategy as a means to reduce costs to meet the company goals. Under the flexible budget, the budget is recalculated using the actual volume resulting invariances.

Cost, Profit and Investment Center

The decision-making in Apple Inc is decentralized. There is the top organ of the organization that is responsible for making important decisions of the organization. However, the decisions made by the top management team in the organization depend on the decisions made by managers of the different cost centers.

As indicated above, the costs incurred by an organization are shared among different cost centers in the organization such as investment, cost, and profit centers. According to McNair & Carr (1994), the cost center must calculate all expenses incurred by the firm and not the revenue realized by the firm.

The other center for costs is the profit center that has the duty of establishing the total profit of the firm. To obtain the profit, the center must have costs incurred. Therefore, the cost center establishes the expenses incurred. On its part, the investment center determines viable options for the company and establishes the investment capital required. After the investment, the center determines the returns from the investment.

According to McNair & Carr (1994), the evaluation of the costs of the firm is important because it helps the management in making important decisions for the firm. The decision made by the management aims at fulfilling the objectives of the company are to maximize revenue and minimize costs.

Apple Inc measures its performance using financial reports that are prepared after every financial year. The financial performance is measured in terms of profit realized by the firm, the growth in sales revenue, the costs incurred by the firm in its operations, return on assets, and return on equity among many other measures.

McNair & Carr (1994) argue that accounting is an important tool in evaluating the costs incurred by an organization, revenue, and profit. However, these are not the only uses of accounting. Accounting data is useful to the management in the determination of strategies to be pursued to meet the company objectives.

For instance, the firm utilizes accounting information on various costs to decide on the best cost methods to monitor costs and reduce expenditures. After a decision has been made, it is implemented by the respective cost center and the outcome reviewed to find out whether it meets the expected results. The implementation process is usually monitored to ensure that it does not deviate from the laid down procedures.

According to McNair & Carr (1994), every organization must evaluate and act accordingly. Using the accounting processes, the company monitors its financial performance in terms of revenue, costs, returns and compares with estimated values. The evaluation process leads to the management decisions on whether the performance is good and according to the plan or not.

A balanced scorecard is utilized by Apple Inc. to measure the performance of the firm both internally and externally. The utilization of this tool is one reason for the excellence of the firm in its industry. According to Masi (2009), Apple Inc. uses a balanced scorecard to measure four aspects of the firm. The business perspective of a balanced scorecard measures all internal business processes that Apple Inc is involved in. The company has its way of determining the metrics to measure internal business processes that are designed by skilled employees of the firm.

The financial perspective of a balanced scorecard measures the financial performance of the firm. A corporate database of Apple has enabled the company to decentralize and automate its processes. The success of the company in the industry is attributed to reliance on all perspectives of a balanced scorecard and not only the financial perspective. Learning and growth: The perspective includes training of the labor force and improving the corporate culture in the firm.

Such efforts would promote the improvement of the skills and knowledge of employees and the development of the organization. It is important that employees continuously learn and train to increase their knowledge. The employees in Apple are allowed to increase their knowledge and the learned knowledge has increased skilled employees in the firm hence increasing research and development and innovation.

Apple Inc must satisfy its customers by producing high-quality products that fit directly into the needs of consumers. According to McNair & Carr (1994), the satisfaction of clients is necessary to increase customer loyalty. The dissatisfaction of customers will lead them to leave the organization and purchase products elsewhere in search of their satisfaction. Customer dissatisfaction is a signal of the dismal performance of the company in the future in all perspectives of the balanced scorecard. Customer focus and satisfaction are other reasons for the success of Apple.

Apple Inc.’s decision-making is decentralized due to the decentralization of the cost centers. Each cost center deals with specific costs associated with the center. The outcome of specific cost centers is utilized by the management to make the strategic decision of the firm. There is more emphasis on the financial performance of the company when compared to other perspectives in the balanced scorecard. For the guaranteed future success of the company, I would advise the management to consider all four perspectives of the balanced scorecard equally.

Decision-making policies

Apple Inc follows the accounting decision-making policies. The decisions of the company are made based on the financial reports of the company. When the costs of the company increase, the company makes decisions to minimize the costs using various strategies such as reducing transaction costs using information technologies. Following information obtained from financial reports, the company decided to differentiate its products.

Strategy for its portable personal computer business is one of broad differentiation targeting a range of customers from sophisticated power users to inexperienced new users and from individual buyers to bulk purchasers like schools and businesses. The firm differentiates on exceptional design, consistent quality, and outstanding customer service.

The real evidence of Apple’s strategy reveals that its commitments are directly in line with its stated goals and strategy. Apple’s goal is to provide customers with the “best personal computing experience” by offering products with “superior ease-of-use, seamless integration, and innovative industrial design” and a “high-quality sales and post-sales support experience” (Masi. 2009).

References

‘Costs,’ (n.d). Cost allocation and activity-based costing. Web.

Apple Inc. (2010c). “Apple Retail Store: Genius Bar.” Apple Inc. Web.

Apple, (2005). The Apple Corporate Culture. Web.

Daly, L. (2002). Pricing for Profitability: Activity-Based Pricing for Competitive Advantage. John Wiley and Sons: Washington. p57.

Deutschman, A. (2000). “The once and future Steve Jobs.” Salon. Web.

Horngren, C.T., Sundem, G.L., & Stratton, W.O. (2002). Introduction to Management Accounting, (12th ed.). NJ: Prentice-Hall.

Huzefa, A. N. Deepti, D. and Harmanjeet, S. (2009). A Strategic Analysis of Apple Corporation. Scribd. Web.

Jade, C. (2006). Apple to “upgrade” retail outlets. Web.

Kroll, K. (2004). The Lowdown on Lean Accounting: A New Way of Looking at the Numbers. Journal of Accountancy. 198(1), 69.

Masi, B. (2009). Strategic analysis of Apple Inc. Web.

McNair, C. J. & Carr, L. (1994). Responsibility redefined: Changing concepts of accounting-based control. Advances in Management Accounting: 85-117.