The pricing strategy and pricing principles that would allow the firm to meet its objectives effectively are being developed in parallel, and working on a pricing strategy is a long-term economic process because it is impossible to create a plan that could then be used for many years. The pricing strategy is dynamic, it should be continuously reviewed based on actual results and, if necessary, adjusted according to the current market conditions (Gallo, 2017).

The development of pricing policy and strategy of the company involves carrying out several works and calculations. Firstly, the optimal cost of production and marketing of the company’s products is calculated. Secondly, the value of the enterprise’s products for potential buyers is determined (the consumer properties are defined) and the measures for substantiation of the price level correspondence to their consumer properties are taken (Gallo, 2017). Thirdly, it is projected the sales volume of the product, or the market share for the enterprise for which production, will be most profitable.

The process of pricing strategy development consists of three stages.

- Gathering baseline information: cost estimation, refinement of financial goals, identification of potential buyers, improvement of marketing strategy, identification of potential competitors.

- Strategic analysis: business analysis, market segment analysis, competition analysis, state regulation impact assessment.

- Strategy formation: setting the final pricing strategy. Price strategies are incredibly diverse. The feasibility of applying each of them is determined, first of all, by the goals of the pricing policy, as well as by what pricing guidelines the firm has chosen for itself: production and sales costs, consumer demand, price policy of competitors.

Company Performance Summary

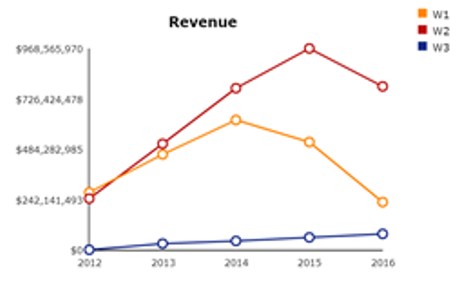

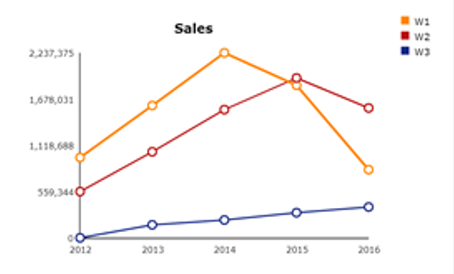

During the simulation, the price strategy for all three product categories was changed. The avoidance of prior mistakes and the review of CVP analysis indicates that the W1 product’s price should be decreased to $280 to capture more consumers. The R&D for this market can also be reduced due to the consumers’ preferences. In this case, R&D becomes 25%.

The price for W2 should be $490, with 38% of R&D investments. The W3 product requires a price increase to $190 for higher revenue and more investments in R&D (up to 37%). Such steps are essential for the 2013 strategy, as they set up a growth tendency for both revenues, profits, and market performance.

Table 1: Wonder Co. Revenue and CVP in 2012.

Table 2: Wonder Co. Revenue and CVP in 2014-2016.

Product W1 Analysis

Table 3: Product W1 Analysis.

The strategy for W1 was changed. The price was decreased to cover more consumers on the market. Each year the R&D investments were reduced to allocate them for more promising W2 and W3. In this case, the product reached market saturation in 2015, when its R&D reached 0% from the company’s performance. As a result, the maximum possible gain was accomplished.

Product W2 Analysis

Table 4: Product W2 Analysis.

The product W2 strategy was based on the continuous increase in both price and R&D investments. In this case, the 2013 price was set at $490, while R&D got 38%. The company maximized profits and performance of the product. Nonetheless, the 2015-2016 period became a failure, as the strategy could be executed better. Even though the approach did not show the best performance, in the end, the company gained maximum profitability from W2 before saturation.

Product W3 Analysis

Table 5: Product W3 Analysis.

The W3 product price strategy is based on the moderate increase in the price in the 2012-2013 period from 185 to 190. In this case, the product is valued following the market competition. R&D investments are continuously growing to increase performance and attract more clients. As a result, the 2015-2016 period becomes profitable for the company, which is far better than the former manager and approaches have provided. Nonetheless, the weak points in 2015-2016 could be improved by making more accurate projections and product performance analysis.

Recommendations

The analysis of strategic decisions shows that the company could perform better on the market if the following steps are taken:

- The W1 product R&D should be 0% in 2014, while the product should be disjointed in 2015 to avoid significant damages for the revenue statement (see Chart 1).

- The W2 product should not be supported after 2015 to avoid financial losses, as the product has already reached the market saturation and stake out (Gallo, 2017).

The rationale for these actions can be found on the sales curve, which represents the market performance of all three products. In this case, the company should accurately forecast changes on this curve, which cannot be done only by CVP analysis (Gallo, 2017). Saturation factors and consumer base should be also scanned to identify possible period before the stake out.

References

Gallo, A. (2017). Contribution Margin-What It Is, How to Calculate It, and Why You Need It. Harvard Business Review, 1-3. Web.