Executive Summary

The increased property development in Dubai has an unprecedented increase in debts for the country that has experienced huge financial benefits due to foreign investments in the past. Following the fear that gripped many investors in the West, Dubai was seen as a safe haven for the investments as it presented little signs of being hit by the global recession that began in 2006 in the United States. The foreign investors were highly affected by the global recession hence the reduced or complete withdrawal of money invested in the region. Again, the development of huge property by the Dubai World in conjunction with other firms like Emaar has left the once booming economy with little support. The government therefore resorted to pump money into the economy of Dubai through huge infrastructure projects that has left financial balance sheet of many lenders in deep imbalance. With more support, there’s hope that by 2011, the crisis will decline and business is expected to pick up as far as trade is concerned.

Introduction

The global financial crisis has presented an unprecedented scenario where the economies of major industrialized nations and those of emerging economies have been dealt a blow in unprecedented fashion. The financial crisis has presented a historic turning point in our economy and culture. The first recession crisis was realized in 2006 in the United States, which was characterized by “a lot of speculation in the housing market, causing financial ruptures across many other countries in the form of financial failures and global credit crunch” (Azis, p. 16). What was believed to be a short term crisis has turned out to be the longest crisis due to its toll on both established and emerging economies of the world. More importantly, its impact has been felt in terms of “collateral damage, setting in motion fundamental societal changes- changes that affect consumer habits, the societal values, and relatedness to each other” (Azis, p. 17). According to Azis (p. 31) the financial crisis in the global; arena has changed the way we will be doing business with each other, considering the trend in the income of individuals.

A prominent investor was quoted in 2008 as saying, “a year ago, I didn’t expect the U.S. economy to fall into recession in 2008 because I was confident consumers would continue to do what they do so well: spend money. I had plenty of company, and ultimately we were all wrong” (Azis, p. 25). It is indeed difficult to accurately predict crisis and recession, let alone to comprehend how a small segment of a financial market could bring down the world’s biggest economy into the worst recession since World War II. In the Dubai market, the impact of the recession has been a tale of pain and frustrations as many companies strive to cope with the most difficult moment of their life.

According to Dubai’s real estate price index, an increment of about 41% has been observed some of the residential apartments of major property companies like Emaar from the last three years and about 42.7% in the commercial sector for the same period of time (Dawala 21). The rental environment is currently worse off especially for the residential property dealers. They are not getting what was anticipated due fall in property sale. Recently, it was announced that Dubai World was being asked to help out the region withholding debt repayment for a period of a half an year.

It has been stated that some of the “key factors that have generated the Dubai crisis are related to the boom-bust policy spearheaded by the UAE Central bank” (Mandaro & Watts, p. 69). This report will outline the issues related to the Dubai financial crisis, which includes historical trends, causes, the proposed solutions to the crisis, and the expected time of the end of the crisis.

Causes of the Crisis: The Historical Background

The Dubai financial crisis can be traced back from the United States economic meltdown that began in 2006. In December 2007, the then American president George Bush continued to argue that the U.S economic fundamentals were strong enough to with stand the banking crisis and the Wall Street meltdown. Many people could not comprehend the possibility of United States’ house of card going down. However, it must be noted that something unusual does not necessarily mean unlikely to occur, hence the unexpected collapse of the global economy. In the beginning of 2008, what people considered impossible began to set its root the global scene. The economic numbers in the United States were terrifying the global market. Banks, especially those in the US stopped lending or were in the verge of significant reduction in their lending rates, businesses and consumers were spending less, and manufacturing went down across all corners of every economy. This situation has been compared to what happened at the beginning of the Great Depression. The financial market, especially in the United States were destroyed despite its size and strength, production across all sectors experienced the biggest decline in the history of the United States and the world, and labor market dipped further and there was massive loss of jobs and firms struggled to cope with the involuntary problems associated with the problems.

There were emerging conflicts as the world’s largest economy strived to solve the problem. It required some policy trade-offs as the solution to the crisis. Many policy analysts had predicted that it would be detrimental to approach the problem through policy analysis as this would create further policy conflicts. For example, it was predicted that any measure to avert the problem of output would negatively affect the currency value and inflation rate. Furthermore, bailing out troubled financial institutions would definitely lead to serious conflict of interest since it meant giving resources to the very sector that had led to the problem.

The regional banks in other countries thought that the United States’ financial crisis would not have any impacts on their operations as indicated in the early stages of the crisis. However, the problem began to spill over in other regions including Dubai and Middle East, and the hope of avoiding it for long faded. The problem is linked to the United States’ rush to acquire properties in Dubai. Many members of the Congress criticized the government of United States for speedy and inconsiderate acquisition of several US port operations by state-owned Dubai Ports World (Mandaro & Watts, p. 71). This financial sector buyout was not expected to be rushed before proper laws were established to strengthen the vetting process. The Dubai port deal situation got worse as the Wall Street investments were being questioned.

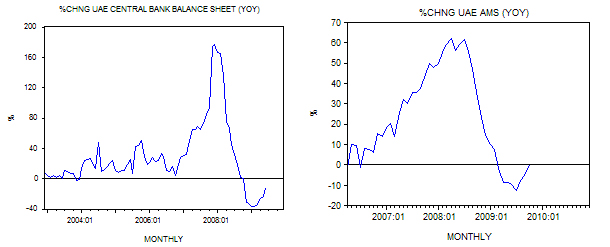

Currently, Dubai’s debt stands at $80 billion, putting the country under one of the most affected regions in the world (Mandaro & Watts, p. 76). In an attempt to salvage the situation, Banks lent out money for property development in the region, putting them in massive debts and developing of serious financial crisis in the meantime. The boom-burst policy adopted by the United Arab Emirates central bank has led to further problems and complexities in the overall financial and property management in the region. After it closed at 4% in October 2006, the annual growth of the central bank’s financial balance sheet had increased to over 170% by December 2007 (Mandaro & Watts, p. 77). Consequently, the annual growth rate of United Arab Emirates’ monetary measure had increased from a mere 6% to over 60% within the same period. Although this pumping has helped the situation as many projects have been accomplished, it has become apparent that they cannot stand on their own.

But since the beginning of 2008, central bank has significantly reduced the pace of pumping for these projects, leading to a serious fall on the balance sheet (-36%) and fall in the annual rate of monetary supply (-12.5%) (Martin, p. 3). It is stated that the fall in monetary pumping has pressurized several activities that were initially supported by this venture, hence creating an unprecedented scenario of massive crisis reminiscence to the Great Depression.

Considering the fact that the costs of these projects have been astronomically increasing, and it has become an expensive affair to manage these projects. The massive spending has led to unprecedented growth of debts, compounding the crisis in the rapidly grown region.

The Players in the Dubai Financial Market Collapse

Hosting world’s tallest building, Dubai has seen quite a number of big projects emerging in its attempt to grow to its own unique style. However, this growth has come with huge costs of financial needs to continue with the expansion and support of the projects. Generally referred to as Dubai World the city and the entire region have experienced rapid growth with a lot of financial support from the central bank and other financial institutions.

One of the companies that have played major role in this growth is Nickeel Company, which has been dealt a blow by the increasing the cost of property maintenance and sudden increase in imbalanced financial supply. The fear that has gripped the entire nation is based on the fact that these debts may be difficult to pay as per agreed time frame. According to Martin (4), problem emerges from lack of transparency, as there is not clear information about what happens at present, hence putting to a confusion on what type of rollover is about to take place, voluntary or forced. According to him, forced rollover may not be the best alternative as it is apparent that it may lead to “technical default”, hence making every market to increase their desire to sell in order to eliminate the fear (Martin, p. 4).

The state –owned Dubai Ports World has been in the center of crisis. Since its acquisition, observers believed that the problem related to its collapse is linked to increased borrowing for its maintenance and operations. These foreign investments did not match the need to maintain and operate the property developed.

Prosperity before the Financial Crisis

There are two main factors that contributed to the decline of world’s inflation rate: the production and outsourcing costs to low-cost regions such as India and China, and smaller fiscal deficit due to fiscal consolidation and economic reforms (Azis, p. 21). For instance, in the United States the low rate of interest was ignited by the fear of a deflationary pressure following the 1997 Asian Financial Crisis (Azis, p. 21). In the United Arab Emirate, the government adopted a more accommodative policy to forestall looming problems created by the bursting stock, high technology, and telecommunication bubbles that came along the periods before 2006.

However, as growth was being realized with huge asset developments, the environment of easy money increased the home equity borrowing as well as home sales, which were funded among others by creative financial companies that operated like hedge funds, but with the intention of emerging with the best deals for business development. This increased the borrowing intensity that was fueled by speculative spree particularly in the housing markets. The overall rules that used to guide these financial companies were less restrictive hence the increased affinity to the property developing companies in the region. One of the major activities emerged from the increased lending by Asset Backed Securities that were used to finance mortgage firms.

But with more mortgages sold and more securities issued, mortgage firms received a lot of income, hence the desire to buy more risky assets and attract more investors by paying them with the income from the assets. As more investors developed interests, it became apparent that more investment money spread through the entire sector, prompting the central bank of United Arab Emirate to develop trusts in property investments.

The Slump in Dubai World

Dubai World, an investment company responsible for the managing and supervision of investment of business portfolios and initiative by the UAE government has been at the center of this crisis. The regional government uses this initiative to build various sectors of the Dubai economy that have been associated with the increased tendency of Dubai developing further into business hub of choice in the world. The company is also known as the UAE symbol of unity in terms of global investments, playing a major role in determining the status of the Dubai economy. Some of the major assets that are under its management are DP World, Nakheel the builder of The Palm Island, and Istithmar World, among many other investment groups that have pitched tents in the regional market and abroad. For example, DP World wanted to take advantage of the struggling property prices in the United States when they attempted to purchase about six US ports, setting a precedent of the increased buyout of companies in the struggling economies.

Established and ratified in 2006, Dubai World is the single most important investment vehicle in the Dubai region, creating a scenario where the government through its highly regarded Sheikh Mohammed Bin Rashid Al Maktoum, involve in many business centers. The launch that took place on July 2, 2006 preceded the employment of over 50 000 staff, spread across the globe. In fact, the group is represented by wide range of real estate ventures in major cities of US, UK and South Africa.

When European nations under their umbrella body European Union attempted to impose new set of rules and laws of investments, Dubai World threatened to withdraw its foreign investment funds in the region, thus creating an unprecedented fear of further problems in the economy of major European nations like UK.

To solve the inherent problem that came with the accumulated debts, the investment company placed a proposal that would see the delay in the debt repayment, raising the risk of the biggest government default comparable to what happened in Argentina in 2001. That is, the company resorted to ask for the delay of repayment of the over $25 billion that it held as debt. This proposal took a toll on the financial market of Dubai leading to the collapse of many indices, including the prices of petroleum products.

The spillover from the United States stock that had fell deeply later rebounded from the lowest level as many investors gained confidence that the problem could be contained in the long run. This led to a state of static thinking among many analysts. In fact, the Dow Jones industrial average status had lost approximately 160 points in some of the shortened training days, among other stocks that had literally sunk in the deep crisis on the onset (Martin, p. 17). But later in the same day, the petroleum products went down to about seven percent before it recovered its ground as the day progressed in the meantime.

The Persistent Debt in 2009

As the world witnessed the worst hit business hub in Dubai, the financial crisis reached the highest apex between 2007 and 2010. In fact, the real estate market in Dubai had declined after it had experience huge boom in 6 years. On the 25th November of 2009, the Dubai government put on notice to the effect that Dubai World was in the verge of asking its major subsidiaries like Nakheel to retain its bond to mature for a period of six month (Martin, p. 2). Currently, due to the problem, Dubai World has sent home over 10,000 employees in its global businesses. The status of the company was worrying as it carried the majority of the debt ($59 billion) out of the total $80 billion debt facing the regional business hub (Martin, p. 2). The debt includes the $3.5 billion loan which the company was unable to settle by the December 2009 deadline they were set for.

To save the situation of the Company’s debts, the UAE government announced the need to right off some of the Dubai World’s debts, the value of property were seriously downgraded to an extent that investments linked to the government, especially in the property, utilities, commercial trading and operations were becoming lower in value almost everyday.

As a sign of its importance, the Dubai debt crisis brought about the negative impacts in many other European stock markets. For example, the EU stock indexes fell by about 3 percent in 26th November, 2009 (Martin, p. 3). Consequently, there was a significant drop in the Asian stock market the following day. Fortunately to the European investments, there was a significant rebound in the European Stock market as investors’ fears were reduced when it was predicted that debt was not all that big in the long run. This would subsequently increase property businesses within the economic empire of Dubai. Analysts still believe that Dubai debt crisis is just a storm that will not last long as seen in other economies of Europe and US. For example, the American markets got closed on the November 26, 2009 but its market fell the next day at midday as fears gripped the Wall Street operators. In fact, the crisis led to many nations including Dubai resorting to use US dollars as a cushion on the global crisis, due to belief that the dollar is considered safe during uncertain times.

After many government officials sensed danger of further deepening economy, it was proposed that the government find a way of solving the problem. The UAE government announced that they would choose the best way to assist the company, through one-on-one basis, and sorting out the issues related to the problems associated with the problem. According to the government officials, it did not mean that Abu Dhabi would be in a position to underwrite the debts affecting the financial markets. Twin (p. 5) states that one of the best ways to approach the problem solutions is to study the developments, where we can measure the level of problem and how it has impacted on the economy of UAE.

In an attempt to restore confidence among the investors, the government of the UAE started to develop strategy to calm down investors and the sway public opinion in the need to invest in the Dubai financial market. The Dubai World decided that they were willing to renegotiate the $26 billion in the form of obligation that was under threat real estate developed by Nakheel Company (Twin 5). The share prices in Dubai had gone down within two consecutive days by about 7% and that of Abu Dhabi had also slid by approximately 8% (Twin 5). Towards the end of 2009, the government of Dubai received about $10 billion from Abu Dhabi to help sort out some of the inherent debts the region was going through.

A deal was mooted in 20th May, 2010 between Dubai World and its lenders to change the restructuring of the company’s debt of about $24 billion so that it can be left with an approximate amount of $14 billion (Martin, p. 7). As part of agreement, the banks were to convert about $9 billion of debts in equity. Several negotiations had led to this agreement being mooted between the bank and the government of Dubai and Dubai World during this period of time.

The General Impact of the Crisis

Towards the end of 2007, problems emerged from mortgages under security deals which were being unearthed, and the global banks acknowledged for the first time that they had run at losses. However, banks in the Middle East and the entire Asian region had refused to accept the reality that there would be spillover effect in their regions of operations. Probably this was as a result of limited losses these banks experienced in the early years of economic slump down as compared to other regions like United States and Europe. It was becoming obvious that the financial institutions could not avoid the problem for long as it was becoming a trend in the global financial scene.

Since the crisis hit the region, it became apparent that Dubai economies were to bear the burden of the entire process as it was literally booming in terms of property development. Basically, analysts believed that although North Africa was also affected, they were not exposed to the bigger scale of the problem as compared to other parts of the economy in the entire Gulf region

The liquidity Crisis

Lehman Brothers, the United States’ investment bank went down in 2008, causing a lot of anxiety among the institutions that had relied on it to finance their projects. Subsequently, the stock market fell, prompting the “liquidity drought in west to be leaked through to the economies of the Middle East” (Azis, p. 64). Compounding the problem was the sudden termination of billions of dollars financing of the projects in the region. The huge financing that foreign investors had placed in the region was believed to be the best bet in terms of currency revaluation that was anticipated in the near future. However, as time proved, it became just a speculation and thus many projects were grounded when the funding was withdrawn. This was the beginning of the liquidity problem that was realized in the region for awhile.

In the region, there is also the issue of family business, where large companies belonging to a family like the Saad Group of Saudi Arabia had made everything difficult for the many banks in the entire region. The difficulty is perpetuated by the reluctance expressed by the international banks to lend the local investors. Basically, these banks refused to commit to the many long-term loan deals with local firms, thus restricting their activities that came with such deals.

The Rise of Inter-bank Lending Rate

The Dubai region experienced an unprecedented rise in the inter-bank lending rates, while the inter-bank activities fell to the historical lowest as the economy of the once booming market struggled to cope with the problems that had emerged due to foreign investments withdrawal. To salvage the crisis emerging from the dollar fund shortage, the governments in the Gulf region decided to pump more money into the economic system to encourage financial institutions to increase their lending (Elliott & Stewart, p. 2). This was meant to fill the gap that had existed due to foreign funding withdrawal. It was estimated that United Arab Emirates Government pumped about $33 billion to the economy for the banks to continue their lending spree to other banks and financial investors (Elliott & Stewart, p. 3)

Fall in Project Financing

Due to withdrawal of the international banks in the lending scene, the projects activities went down due to shortage in funding. This has created unprecedented worries among the investors. For example, Shuweihat 2 Power Project under the development of Belgium-based Suez Energy in Abu Dhabi failed to access any substantial source of fund for over one year, while it was expected to begin its operations as soon as planned. Failure by the company to acquire the funding promptly forced it to raise capital in short, grounding most of its activities. The fall in project financing created a different scenario on what is expected to occur in the wider financial market in the Dubai market. According to Michael Crosland of Royal Bank of Scotland, “it is important now to go out to as many sources of liquidity as are available to get deals done” (Elliott & Stewart, p. 3).

It therefore presents a scenario where syndication market is completely downed and banks have developed little desire to indulge in the risks “when they are not able to sell their exposures in the secondary market” (Elliott & Stewart, p. 4). In place of such financing endeavors, deals receive financing through such areas as club loans. In this development, mainstream banks and export credit agencies as well as bond markets are being targeted in an effort to acquire various currencies that would help finance the projects and develop a strategic approach to business ventures in the greater economy.

The fall in Inter-governmental Relationships

The sentiments that have emerged from Dubai Financial crisis have created a scenario where many governments are not in good terms with each other. The increased sentiments against takeovers of assets by foreigners may lead to political and economic conflicts as foreigners look at it as a protectionist move. This is especially common during such a crisis because asset prices fall, making them good bargain for foreign buyers. For example, before Dubai was hit by the financial crisis many investors from the region attempted to purchase many of the companies in Europe and United States, considering the slum on the respective regions economies.

Considering the reduced involvement by the foreign investors in the Middle East and the entire Asian region, the foreign investors from countries whose economies have started experiencing growth may want to experiment by buying out the properties in the Dubai region whose prices have fallen to the lowest level. This may create bad relationship with local shareholders whose businesses and investments are family linked hence reluctance to cede ownerships to the foreigners.

Solution to the Crisis

The government Efforts

The status of the Dubai region financial status shows that property pricing has not changed much in the recent past. Although margins indicate that there is a 50% rise since 2007 to date in some deals, it is important to note that property prices have remained very low in the overall perspective (Twin, p. 3). However, the drastic fall in the interest rates in the United States, which many Dubai business tie their currency is what has given the country a lease of life. Specifically, the United States interest rates fell from high of 5.25% in August 2007 to a low of 0.25% by December 2008, indicating that the overall costs in repaying the debt has not improved much in the general terms (Twin, p. 4).

Through combined efforts, the two governments of Abu Dhabi and Qatari raised $9 billion to rescue the financial sector in Dubai region (Martin, p. 7). This money has been used to help lift Aldar Properties, a company based in UAE and the State-owned investment company Mubadala Development Company, creating a space to uplift the state property industry amid skepticism in the overall global economy. But still, it was indicated that by the beginning of May 2009, there were indications that interests in the clearing of the regions debt as far as lenders attitude were concerned was in place. This was clearly illustrated by the below standard cost f Aldar transaction immediately after the deal was launched, which made some investors develop a belief that the property demand was basically falling in an unprecedented fashion (Martin, p. 8).

To further help out the situation, the Dubai Government sold about $10 billion bond to the Central Bank of the United Arab Emirates in an effort to ease the situation (Martin, p. 8). This gesture from the government of Dubai gave investors some reassurance, although government-associated companies still possessed huge debts to warrant immediate success. Specifically, concerns revolved around $3.5 billion debt that remained in the form of Islamic bond, popularly known in the region as Sukuk (Martin, p. 9). This bond belonged to real estate developer Nakheel, which was required to be repaid in by the end of 2009, although it became impossible to accomplish it as required.

In fact, investors had predicted that how the UAE government handle the crisis would definitely affect the financial situation of the entire region. Investors still view Nakheel debt in terms of testing whether the governments’ efforts to support local firms would present the actual goal of these governments in practice as predicated in the past. According to their belief, failure to solve the Nakheel case would definitely present a blow to the confidence of the investors in the region (Martin,p. 11).

On the other hand, Kuwait and Qatar governments have also approached the whole issues with different approaches to financial solution. Doha bought real estate worth $4.1 billion which allowed them writing down of the investments due to fall in equity market (Dawala, p. 61). The two governments had attempted to provide direct investments in the equity to save the banks from booking the inherent losses that they had experienced. For example, the Kuwait government decided to approve the $5.2 billion stimulus package that helps banks to begin the process of lending once again through provisions of loans (Dawala, p. 62). However, delay has been experienced because the governments have faced opposition from the divided parliaments.

The Burj Khalifa

Burj Khalif, the world’s tallest building which stands at about 2700 feet was developed at a cost of $1.5 billion. Officially launched in the first month of 2010, the building has developed one of the most prominent issues related to costs of maintenance and costs of operations. For example, tickets that were sold during the official launch were in short supply as people struggled to have a view of the 124 floored building, where temporary issues have put on hold the exercise as the maintenance had taken most of our investment boss. According to Martin (p. 13), maintenance issue has presented one f the biggest challenges in the property development industry as there is a lot of time consuming and cost associated with its operations as a business entity. The developer, Emaar properties had announced that the restructuring of the property scene of the people meant that the stakeholders wanted better deals from contractors and sub-contractors completed as fast as it could.

To help itself out from the problem, it has been rumored that Dubai is contemplating selling the property together with QE 2, its one of the most famous ship type in the world. Istithmar World, the Dubai Bank investment arm is believed to be planning the sale in order to use the income from it to settle the debts and help them restructure the financial balance sheet of the investor. Although the rumor has been going round for sometime, the associated parties are yet to respond to them. Admittedly, Buri Khalifa, Palm Islands and Dubai World have shown what creativity can achieve with great imaginations, but the high costs of achieving this feat has presented an unprecedented challenge to the proprietors of the property. This could explain why it has been reported that the proprietors are planning a sale of properties to help ease the pressure coming from the maintenance costs and also get the needed income to settle the debts

The restructuring is expected to involve the settling of US$22 billion debts, with the constructor of the Buri Khalifa, Emaar ready to dispose off the assets in a similar fashion (Martin, p. 13). Dubai Holding is also involved in the process looking to shop for about 40$ share in Bank Islam of Malaysia. While there’s a lot of speculation as concerns sales and acquisitions, it has become apparent that the value of these properties are likely to go down further as some economies pick up while the Dubai region remains stuck with huge debts.

The Expected Time of the End of Crisis

According to the recent survey results conducted by UAE in 2008, there was an indication that all the observers have similar view point that the property market in Dubai is likely to drop because supply is likely to outstrip demand (Dawawala, p. 16). Even though percentages vary from different individual analysts, majority of them have concurred that the property will drop by 50% in the next periods. This is a clear indicator that the market revenues and profits for most of property developers such as Emaar will decline.

However, this situation is predicted to go better in 2011 according to the researchers. This positive projection is associated with the completion of the metro project in Dubai that will attract investors, creating a balance back in supply- demand (Dawawala, p. 17). In fact, they have predicted that bank profitability will thrive, albeit in a less intensity as those in the previous years of the economic boom before the crisis.

The regional banks are predicted to capitalize on the increased involvement of the government through increased financial intervention and boosted budgetary allocation for more infrastructure developments. From these initiatives, it is expected that the revenue will increase for the government to continue supporting the expanded problems. In fact, the main challenge that banks faces so as to keep high the profit level is how they will be able to “deal with non-performing loans, the extent of which will largely depend on the magnitude of the real estate correction” (Dawawala, p. 18).

Conclusion & Recommendations

While is acknowledged that liquidity is soon making a comeback to the market, the high lending rates between banks (inter-bank lending rate) suggest that there’s still some substantial need to change in order to reduce this trend. In fact, according to Shayne Nelson of Standard Chartered Bank (UK), a gap still exists “between Emirates inter-bank offered rate and London inter-bank offered rate, since banks are still paying to attract large deposits” (Dawawala, p. 17). It is observed that inter-bank lending rates have been on the downward trend for quite sometime, and by May 2009, the Emirates inter-bank offered rate was as low as 2.5%, from the January 2009 recorded figure of 4.3% (Martin, p. 21). However, Twin (4) observes that certain banks in the UAE still maintained offers of 9% interest for the corporate deposits. This was an attempt to balance their loan-to-deposit ratios, a comparable figure to the loan to the 1% base rate that the Central Bank of the UAE had set.

To ease the problem, it is important if the banks avoid the exceeding the regulatory limits set by the Central bank and continue attracting more deposits so that they would be able to clear the loans that they have accumulated in the past. This will help them overcome the pressure and take advantage of the government’s directive to its ministries to increase deposits to the local banks.

Works Cited

- Azis, Iwan. Crisis, Complexity and Conflict. London. Emerald Groups Publishing, 2009.

- Dawala, Aamir. Economic Analysis of Emaar Properties. New Delhi. Grin Verlag, 2009.

- Elliott, Larry & Stewart, Heather. Fears of double-dip recession grow as Dubai crashes:

- Debt crisis in millionaires’ playground could herald new phase in global financial meltdown. The Guardian, 2009.

- Mandaro, Laura & Watts, William. Dollar propelled higher by Dubai worries. Market Watch. 2009.

- Martin, Mathew. Gulf governments act to restore financial confidence. Middle East Business Intelligence, 2010.

- Twin, Alexandra. “Stocks slip on Dubai debt woes”. CNN Money, 2009.