Introduction

Economic development is the ability of any country/economy to be able to achieve its goals for raised standards of living for its citizens and ensuring that the high standards of living are sustainable. This way, the population within the country can move from a status where it earns a low income to one where it can earn a high income and hence can afford a more comfortable, modern life. Moreover, the population can access its basic needs such as food, shelter, clothing, and education as well as other facilities such as healthcare, recreational facilities, improved means of transport and communication, and other important factors of modern life.

Methods that determine the development of the economy

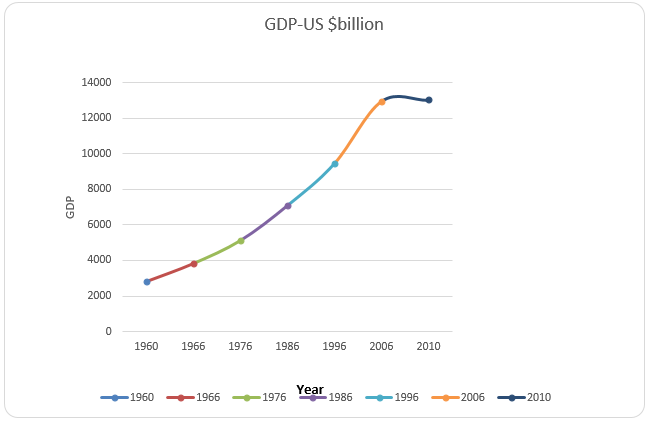

The economy of any country is measured through different methods, which determine if it is moving upwards through attaining development, whether it is stagnant in a state of low or under-development, or even whether it is moving downwards. Some of the methods that determine the development of a nation include the determination of gross domestic product, rate of inflation, and the levels of unemployment. Gross domestic product is the gauge of national economic value through which the economic situations are determined and this helps in making the budget of that state after the computation of the net national product.

Since GDP relates to national accounts, it can be determined using the product, income, and spending approach methods. Hence, GDP may be viewed as the total of all the factors of production, expenditure by locals and the government, savings, investments as well as the overall imports and exports within a country.

In a given country, GDP keeps on changing with time and as a response to changes in different factors. It may increase or decrease as the rates of such factors like inflation rates and government policy implementation strategies affect the economy of the country. The GDP of the US has kept increasing with time and hence the country has over the year’s registered positive GDP growth. The 10 years between 1976 and 1986 were characterized by the Reagan tax cuts, which were a part of the government policies and strategies meant to reduce the taxpayer’s burden. As a fiscal policy, the tax cuts worked to encourage Americans to save more, invest more, and work even harder.

As Samuelson (123) notes, the reduction in tax rates undeniably boosted long-term economic growth. The enforcement of the 1986 Tax reform Act also had a major effect on the GDP registered in the 1986-1996 period. Like the Reagan tax cuts, the Act means that people in the low-income groups were had more disposable income, and were, therefore, able to spend or save and invest in the economy some more. Such actions by the citizenry contributed to GDP growth.

It is worth noting that the value of money as determined mainly by the inflation rate has a direct effect on the rate at which GDP changes. Hence, using the nominal GDP of a country, which is the GDP value at a given point in time, maybe misleading as it does not consider the value of money at the given time. Due to this drawback, the real GDP is used in the determination of the trend of a country’s GDP. Real GDP considers the inflation rate at the given point in time and so indicates the actual value of money at any one given time. This means that the monetary policies adopted by a government are very vital since they affect the value of money.

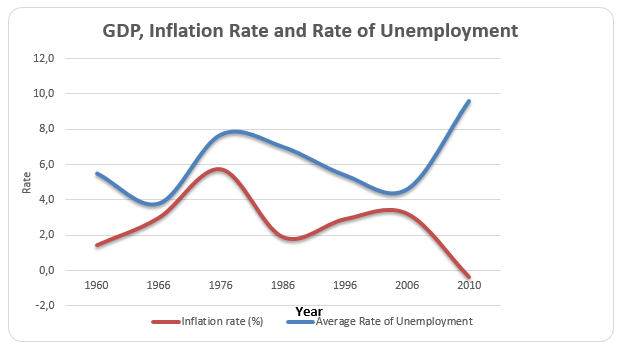

Inflation rate and unemployment are two economic factors that are correlated and which have a great effect on the GDP and hence the economy of a country. Inflation is observed when commodity prices increase at a tremendous rate. High inflation rates lead to loss of value of the national currency against the common currency. When the currency loses value against other major world currencies, then it becomes a big hindrance to economic growth. It also lowers the business investment rates and the efficiency of the factors of production put in use. This is a very bad situation which makes citizens suffer since the cost of living rises unexpectedly.

Unemployment is the state whereby you find that the majority of citizens in a given nation are not employed. High rates of unemployment lead to poor living standards in a country. Many economists have argued that unemployment is a form of market failure. At high levels of unemployment, the economy is believed to be working below capacity. High rates and long-term levels of unemployment hurt economic growth. The graph below shows the rates of unemployment for the different months each year between 1960 and 2010. The table that follows shows the average rates of unemployment for 5-year intervals for the same period.

There are various forms of unemployment including structural unemployment, frictional, cyclical, and seasonal. Unemployment also leads to many problems such as social deprivation, offense, and societal dislocation (Basij 236).

Legend

Bureau of Labor Statistics; usgovernmentspending.com

The tables above show the rates of unemployment, inflation, and the GDP for the period between 1960 and 2010. The table shows that the rate of unemployment had a relationship with the rate of unemployment. This is because, for most of the period in consideration, an increasing rate of inflation was accompanied by increased unemployment rates. The converse was also true. However, in the period between 2006 and 2010, there was a reduction in the inflation rate yet the rate of unemployment portrayed an increasing trend.

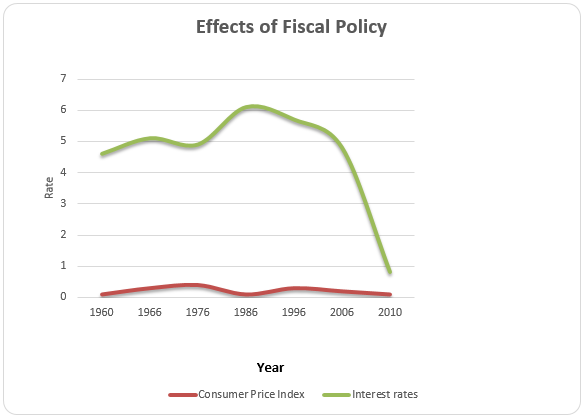

Fiscal policies are the processes through which the financial controls of a given country regulate the country’s spending as well as the rates of interest and the supply of money for the process of promoting stability and economic growth.

The graph above shows the relationship between different aspects of fiscal policies and interest rates. With a proper policy in place, the government can regulate interest rates and hence encourage economic growth in the economy. With regulated interest rates, consumers can purchase and consume more products due to the increase in the consumer price index and hence spend more, a factor that results in an eventual increase in spending and a controlled rate of inflation.

The different aspects of fiscal policy that were implemented by the government were able to help improve the living standards of the population in the US hence aiding in the development of the country. Through these policies, the unemployment rates decreased while the rates of interest were optimal hence encouraging borrowing and spending, resulting in the eventual ability to improve the living standards of the population. Also, the incomes of the population increased gradually leading to increased spending and improved standards of living.

Monetary policy is the method by which the government, financial authorities, or the central bank of a nation controls expenditure, accessibility of money, and rate of interest to attain a set goal and accomplish economic growth. It rests on the connection between the charges of interest in the saving. It aims at influencing outcomes such as inflation, exchange rates with other currencies, economic growth, and unemployment.

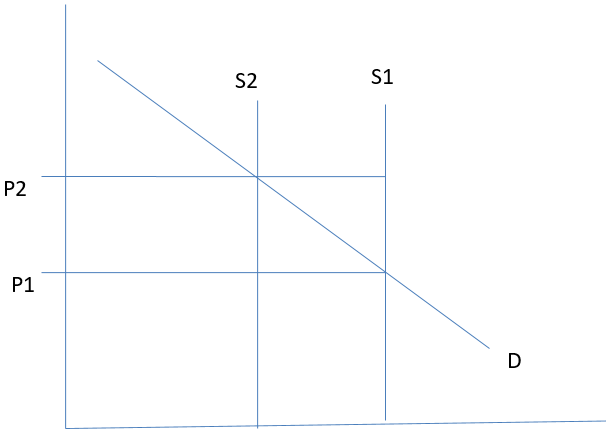

The main goals for the use of monetary policies in the economy are to influence and regulate employment levels through reducing rates of unemployment, increasing the productivity of the economy, reducing the rates of inflation through regulating interest rates as well as regulating the demand in the market by increasing it hence shifting the demand curve upwards.

Monetary strategy is hence the method by which the government, financial authorities, or the central bank of a nation controls the accessibility of money, controls the rates of interest to attain a set goal, and controls the supply of money, all to accomplish economic growth. It rests on the connection between the charges of interest and the savings (Gravelle and Rees 21). Among outcomes that are affected by monetary policies, include levels of unemployment, the growth of economies, exchange rates, and the value of currencies.

Monetary policies may be implemented in the form of either contractionary or expansionary policies. Expansionary policies are intended to rapidly augment the supply of money in an economy while contractionary policies augment the supply of money in an economy at a slower rate. Expansionary policy is mainly used to try to skirmishing joblessness. On the other hand, contractionary policies are intended to slow down inflation dislocation.

By adjusting the interest rates, a government can attain a specific level of economic activities that control the inflation rate. The rates are charged on money loaned between financial institutions. Usually, banks and other financial institutions lend money to each other to facilitate liquidity in the market. This rate is maintained for a specific period using open market operations (Colin 24).

The monetary policy entails revenue collection measures used by governments and the ensuing government spending of the same revenues. The policy attempts to calm down the economy by controlling the interest rates and the currency supply. The two key instruments used are the levy and government expenditure. Two factors force the variables of the economy to change. The two factors have an impact on the variables of the economy.

The government spends money on a variety of things such as education, health care, and defense. These expenditures are can be funded through different ways such as; taxation, borrowing money from the residents, utilization of monetary reserves, and sale of fixed assets. A fiscal deficit is funded through issuing bonds and sale of securities while a fiscal surplus is saved for prospect use. Governments use monetary policies to control the level of cumulative demand in the economy in an attempt to achieve economic objectives of full service, price immovability, and fiscal growth (Friedman 97).

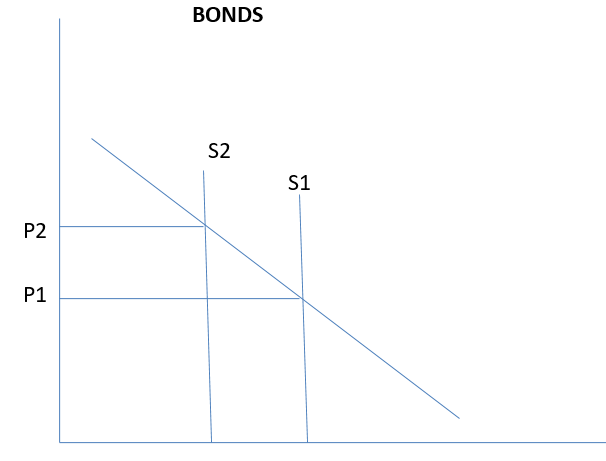

Regulation of interest rates by the government has different effects on the demand and supply of goods and services and a consequential effect on prices of goods, a factor that determines inflation rates. An increase in interest rates results in a decrease in the supply of bonds, as in the table above. Since the demand for the goods is still high, then the prices rise eventually resulting in an increased inflation rate. This is the main concern of the government in regulating interest rates to keep the inflation rates low.

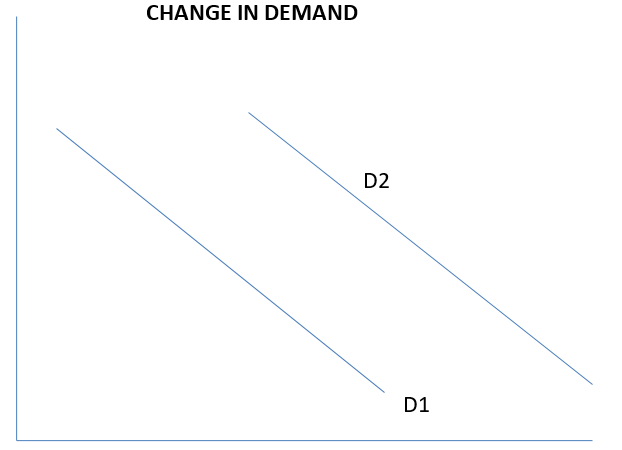

The government regulates inflation rates through decreasing interest rates to encourage the population to borrow more funds from financial institutions hence increasing their expenditure. This results in a shift in demand (from D1 to D2), a factor that ensures that there are more economic activities hence reducing the inflation rate in the economy.

The graph above shows the effects of changing demand and supply of bonds on the Federal Reserve, which have an important place in the economy as far as control of inflation rates is concerned. When there is an increase in the prices of bonds resulting from an increase in interest rates, the demand for the bonds decreases resulting in an increase in supply that results in to increase in the Federal Reserve. This way, the government can be able to easily regulate and counter instances of inflation.

The government always tries to achieve an optimum point in the effects of its monetary policies on interest rates to avoid inflation in the economy while on the other side guarding against occurrences of recession. With the increase in interest rates, the demand for goods and services decreases causing a decrease in the supply of goods and services, a factor that can result in inflation.

Before the year 1971, the economy of the US was in a crisis due to the effects of the high costs of the war in Vietnam and due to other economic factors such as increased domestic spending. These factors resulted in increased rates of inflation, which devalued the dollar. This led to high standards of living, increased unemployment as well as low productivity in the country. In 1971, the government took an initiative that saw a formulation and immediate implementation of monetary policies, which led to great effects on the economy of the country, gradually resulting in a regulation of the economic situation to stability and later on to an acceleration point in the economic development of the country.

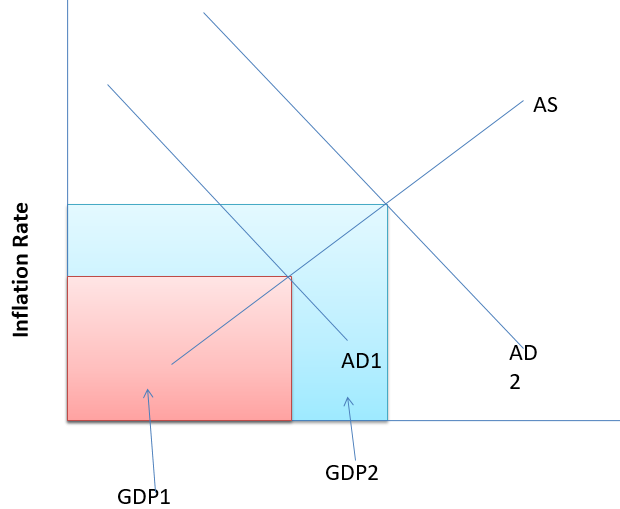

Figure 7 shows that when the actual supply is low and the demand is at the normal rate (AD1), the GDP is also at the normal value, GDP1 and hence the inflation rate is low. However, an upward shift in demand (AD2) increases actual supply resulting in a further increase in GDP (GDP2). This consequently results in a lowered inflation rate that ensures that the rate of unemployment also decreases.

Works Cited

Basij, Moore, Horizontalists, and Verticalists: The Macroeconomics of Credit Money, Cambridge University Press, 2008. Print.

Bureau of Labor Statistics. Labor Force Statistics from the Current Population Survey. 2011. Web.

Colin, Rogers. Money, Interest, and Capital: A Study in the Foundations of Monetary Theory, Cambridge University Press, 2009. Print.

Friedman, Milton. A Program for Monetary Stability. Fordham University Press. 2004. Print.

Gravelle, Hugh, and Ray Rees. Microeconomics. Essex, England: Prentice Hall, Financial Times. 2004. Print.

Samuelson, Paul. “Reply” in Critical Essays on Piero Sraffa’s Legacy in Economics, Cambridge University Press, 2000. Print.

Usgovernmentspending.com. US Gross Domestic Product GDP History. N.d. Web.