Alternative budget action to reduce budget deficit

In a scenario where government expenditures exceed government tax revenues in a single year, it is said that the government is running on a budget deficit for that year. Budget deficit normally occurs when the government does not plan its expenses after taking into account all the savings it has. Debates about government debts and budget deficit reduction inevitably center on whether and how to reduce government spending or increase the rate of tax. In macroeconomic terms, we are faced with the decision of whether to implement fiscal policies, or monetary policies. We recall that, fiscal policy (as a method of reducing budget deficits, involves revenue collection: which is in essence, raising taxes. Therefore, our alternative budget action is use of monetary policy.

We aim to focus on the use of a monetary policy in a closed economy. A closed economy is one that does not interact with the economy of any other country and disallows exports and imports. Further, it disallows any other country from participating in its stock market. Nonetheless, the monetary policy is mainly concerned with controlling the rate of growth of the money supply and/or the interest rate levels in the economy. There are three principle tools with which the monetary policy is conducted with: 1) Open market operations – which alter the monetary base. 2) Alterations in the levels of bank reserve requirements and 3) Changes in the Federal Reserve’s discount rate (to influence the magnitude of the banks’ ‘working reserve’). (Baumol, William & Blinder 72) notes “the most widely used and most important monetary policy tool is the open market operations. Whereby, It involves purchase and sale of government bonds on the open market by a central bank/Federal Reserve (Fed).” The aim of this tool is to control the short term interest rate and the supply of base money in an economy and ultimately, but indirectly the total money supply. A monetary policy that attempts to increase the level of employment and output, in the short-run involves increasing the money supply.

Effects of the Monetary policy on the new Macroeconomic equilibrium

In the government’s quest to reduce the budget deficit using the monetary policy, some aspects in the long run equilibrium will be affected; given the ‘closed’ nature of the economy. “In macroeconomic analysis the long run is a period in which wages and prices are flexible, employment moves to its natural levels and real GDP to potential” (Baumol, William & Blinder 56). The accepted level of employment comes about where the actual income alters so as to make the quantity of labor demanded = quantity of labor supplied. The economy achieves its potential level of output when it achieves its natural level of employment. “The real GDP ends up moving to potential because all wages and prices are assumed to be flexible in the long run.” (Baumol, William & Blinder 102)

Like the Obstfeld-Rogoff model, the closed economy model implies that the long run effects of monetary policy fall on prices, inflation and nominal interest rates. One implication is that the rate of inflation is a suitable ‘long-run’ objective for monetary policy, while the growth rate of real output is not. Pertaining to wages (in the closed economy) if the price-setting curve is flat and if prices are adjusted instantaneously to any changes in costs, then the economy would always be on the price-setting curve and real wages would not vary over the cycle. I.e. real wages would be acyclical.

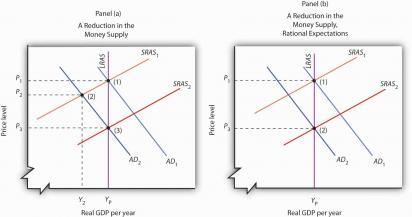

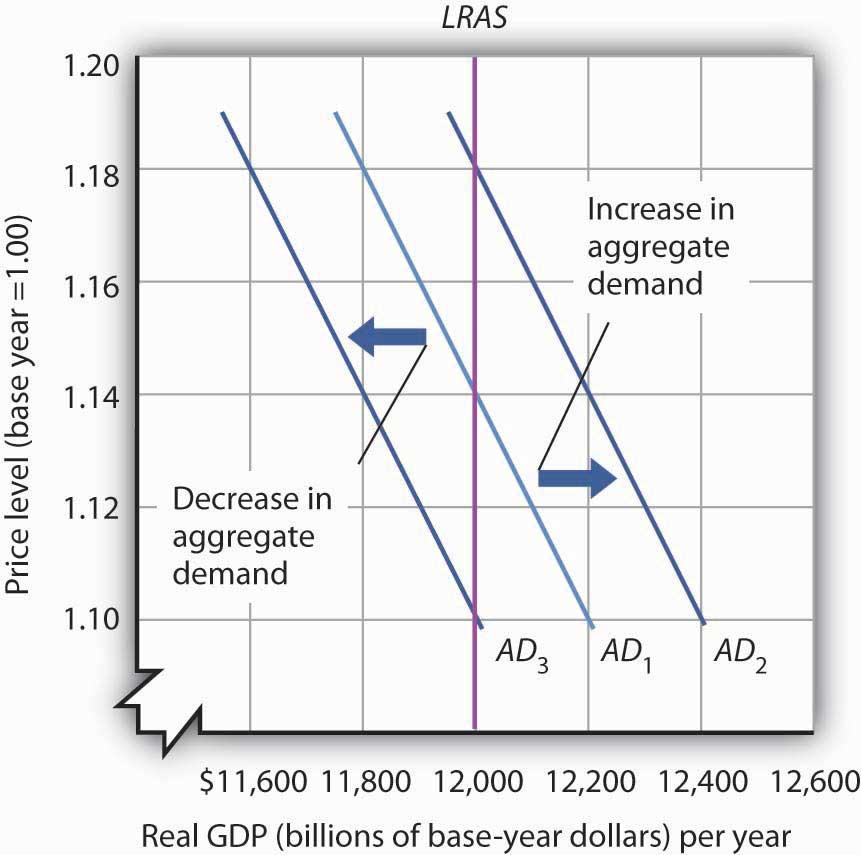

Changes in price influence the amount of the real money supply. That is, as the price level rises, the real money supply declines. Lower equilibrium levels of income are observed the higher the price level gets. In an economy with perfect price flexibility, the corresponding equilibrium levels of income can be used to generate an aggregate demand curve. When the price level-equilibrium income coordinates are plotted, they produce a normal downward sloping aggregate demand curve, that shows the level of real output demanded at each given price level. The slope of this curve is determined jointly by the slopes of the IS and the LM curve (which show short-term inferences) therefore are used jointly to forecast effects in the long run. The following graphs therefore show how the monetary policy affects the equilibrium levels of output (in the long run) given that prices are flexible and as earlier stated, instantaneously adjust to cost changes.

In the diagram below, it is observed that long run equilibrium takes place at the meeting point of the aggregate demand curve and the aggregate supply curve.

Changes produced by the policy

The monetary policy has various effects on major variables that influence the performance of the economy and in as much as most of these effects are more pronounced in the short run, they can also be observed in the long run as output returns to its full employment level. The following is observed during the transition to, and in the long run.

Real Interest Rate: Overworked workers demand (and get) higher wages which pushes up production costs in turn causing producers to raise prices. Higher prices translate to a further rise in interest rates.

Level of National Saving: In the new equilibrium private saving returns to initial levels (since income is unaltered) and therefore national saving falls by the full amount of the increase in government purchases.

Aggregate Investment: Due to the fact that interest rate levels have gone up so much in the long run, aggregate investment is observed to go down.

Aggregate Consumption: As output returns to its full employment level it is observed that interest rates are higher, inflation is higher, investment is lower but consumption is higher, although, it was tampered with by the soaring interest rate levels.

Influence of protectionist policies to the trade balance of the country

Economic interaction is an important part of economy for any country to develop a strong and respectable currency. Small countries like Iceland are more likely to benefit from interacting with bigger countries like the United States of America because if they hold more dollar-dominated deposits, then they are more likely to cushion their country against any unexpected declines. Protectionism agendas are economic strategies that aim at limiting the volume or amount of trade that is expected between countries. Sometimes free trade can be detrimental to the local economies of participating countries and thus governments need to introduce policies that would reduce the negative effects that may arise out of economic trade between countries (Baumol & Blinder 188). Techniques, such as setting tariffs, imports restrictive quotas, total and complete bans and other government policies are designed by economic gurus with the aim of setting a limit on the level of imports and also exports and reduce the likely hood of foreign take-over of local markets and companies by foreign economic powers.

It is therefore necessary for economists and financial advisors within the economy to consider both the pros and cons of protectionism policies. Countries which consider themselves as big trading partners may often allow more active trade exchanges between their counties as compared to a country where the level of exchange is minimal. Protectionist policies may at times be considered as a form of hostility by some countries because in some cases they hinder the level of trade between countries. As an advisor of the government, I would advise the government to use protectionist strategies to a certain extent as this will enable the country using the policies to execute them more effectively. Protectionist policies differ largely with free trade but it is impossible to find a situation whereby a country practices a 100% free trade policy because this may often end up injuring the local industry and local citizens.

Protectionists insist that protectionist laws are implemented with the aim of introducing some sort of balance in trade within the county by preventing economic disadvantages that may arise on domestic industries and businessmen who are bound by these protectionist laws, their companies and commercial institutions are most likely to be placed at a disadvantaged position especially when competing both domestically and globally, especially in the case where goods and services are produced by companies unregulated by such limits (Baumol & Blinder 174). Protectionists insist that for nations to succeed economically it is the duty of the government to put in place the necessary legal framework that will effectively safeguard the interests of their own corporations not forgetting their citizens, this way a more level playing field can be attained so that the competitive advantages of other companies do not actually surpass that of local industries and push down the demand of local products. It is thus very right to argue that in the absence of protectionist policies it would be impossible to ensure that there is a balance of trade within a country.

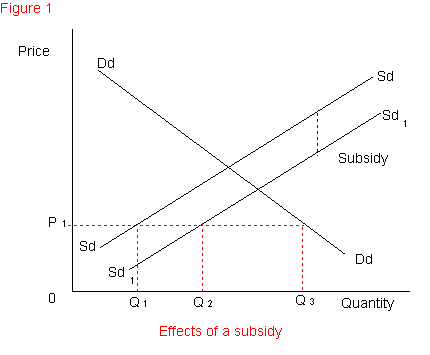

As the government’s political advisor, I would not advice my country to adopt a 100% free trade policy; in fact, I would suggest that the extent of free trade only be adopted so long as it introduces some sort of economic balance in the county. It is the duty of every government to protect the sovereignty of its territory because free trade may be abused and sometimes other countries may decide to dump cheap goods their goods in another country just under the pretext of taking part in free and fair trade. It is thus very important that protectionist policies be introduced to protect all parties in international trade. When governments hinder free trade and introduce subsidies local/domestic producers will often enjoy the benefit of having lower costs and sell the higher quantities at better prices as seen in the diagram bellow whereby subsidies assists and pushing up demand of domestic products when the graph moves from sd to sd1.

Economic growth and the boom of local/domestic industries and companies should also be put on the fore front. Also the level of free trade should be able to assist the country obtain goods and services that are not available locally and are necessary for various production processes within the country. Ensuring a balanced mix of free trade policies and protectionist policies will assist the county achieve a balance in trade and increase economic growth (Baumol & Blinder 150). A balanced free trade system will be achieved if the country introduces the right tariffs, import quotas, antidumping policies, subsidies, exchange rates and patent systems which are not oppressive and hostile to international trade. Friendly free trade policies are good for various countries and ensure that there is a balance of trade within a country by ensuring every country maintains its competitive advantage.

”Sticky Price Model” for constructing a short term aggregate supply function

The sticky price model insists that commercial enterprises do not immediately fiddle with the prices they charge on the goods and services that they provide when responding to changes/fluctuation in demand (Baumol & Blinder 718). Entrepreneurs and businessmen usually every now and then fix prices that are subject to long-term contracts among commercial enterprises and consumers.

The concept of sticky prices can be able to shed light and enlighten us on the upward-sloping aggregate supply curve. Initially, it is appropriate to consider the pricing decisions of individual firms within the industry and consequently and cumulatively attribute the decisions these many firms make to elucidate the behavior of the economy as a whole. In this instance, it will be valid to assume that firms no longer serve as price takers but as the price setters, while taking firms pricing decisions into action it will be appropriate to know that a firm’s preferred price (p) is dependent upon macroeconomic variables which are:

- The overall level of prices (P), and thus the higher the prices the safer to assume the higher the costs that the firm faces in the course of production.

- The level of aggregate income (Y), and therefore the higher the aggregate income the more likely that the demand of a firms products. Due to the fact that marginal cost goes up steadily, especially at higher levels of production, this thus means that higher demand levels lead to a higher desired price by firms. Therefore;

- p = Pe + a (Ye – Ye)

- a= (1-s) a/s

- P = Pe + [(1-s) a/s] (Y-Y)]

- P = Pe + [(1-s) a/s] (Y-Y)]

- Y = Y + a (P-Pe)

By using the above equations it becomes possible to construct a short term aggregate supply function.

The press opinion is justified because; fair flow of information is a good aspect of developed economies information asymmetry does not always enable investors carry out investment activities within the economy. If the Bank of England decides to use an expansionary monetary policy it will be better for the bank to ensure that it releases all the necessary information. Information fair policies under the rational expectations will enable investors plan ahead of time and this will in turn result for more positive outcome within the economy. If firms within the U.K are armed with all the relevant information this will enable them set their prices make better budgets and even plan on how to employ individuals (Baumol & Blinder 417). This is because and expansionary monetary policy will increase the supply of money within the economy and this will in turn increase aggregate demand which will force the firms to employ more resources which will be used to increase the production and output of firms within U.K.

Restrictive monetary policies usually aim to reduce the amount of money in the economy. Such policies usually stabilize the prices of goods and services within the economy and also regulate interest rates to the desired levels. If the bank of England was to accurately send out information to firms in England by communicating its monetary policies then in the presence of more accurate information, firms would be able to take appropriate action even through unsuitable. Although unemployment would be the most likely result, the firms may even then operate with most of its employees operating as part time laborers whereby, when output and demand of goods and services falls during implementation of restrictive monetary policies companies would operate with a higher degree of certainty. Central banks usually ensure that they carefully evaluate economic circumstances, such as retail and wholesale prices, unemployment levels, and other economic variables before enacting monetary policy (Baumol & Blinder 768). If the central bank does not apply them on time, restrictive monetary policies could adversely obstruct consumption of goods and services and investment within an economy and should thus be only applied only when the economy of the county is not on equilibrium as a corrective measure.

Works Cited

Baumol, William & Blinder Alan. Macroeconomics: Principles and Policy. Nartorp Boulevard: South Western Cengage Learning, 2010. Print.