Macroeconomic Shocks: Excess Demand Cases

Six shocks will initiate the macroeconomic coordination process (MCP) of an organization. These shocks are external (they do not respond to a prior change in the level of interest rates or the level of GDP) and involve an initial rise or fall in GDP, APE, or ASF. The shocks may occur either in singular, combination, or in sequence. In this chapter, three shocks will be considered namely; an increase in APE, an increase in ASF, and a decrease in GDP. A common feature of the three shocks is that after initial the funding adjustment, the level of funded demand is likely to exceed the currently available domestic supply of goods and services (GDP < APE = ASF) (Ashby).

In this chapter, it is assumed that the economy has a macroeconomic equilibrium i.e. GDP = APE = ASF. In this type of economy, several things are constant. These include levels of employment, output, interest rates, and prices. Also, an assumption that no other shocks will be prevailing before this shock will be made (Ashby).

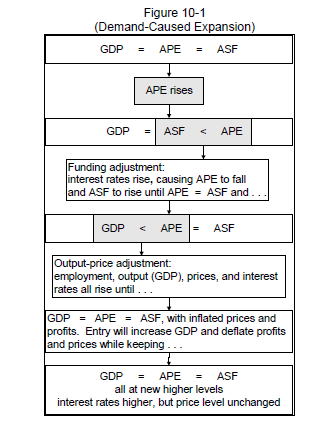

Case 1: Demand-Caused Expansion

In this case, the APE will be increasing because of the increase in demand from either domestic sources, foreign sources, or both.

The figure above represents a response to an increase in APE. As can be seen, after there is an increase in APE, the level of interest will increase during the initial funding adjustment. In the output-price adjustment, the interest rates are going to increase and this will be followed by a rise in employment output, prices, and profits. This will continue until the GDP = APE = ASF. At this point, the levels of employment and output will be expanding until the prices and profits contract. At the end of it all, employment, output, and interest rates will be up but the levels of prices, profits will be unchanged, and this will continue until the economy is hit by another shock (Ashby).

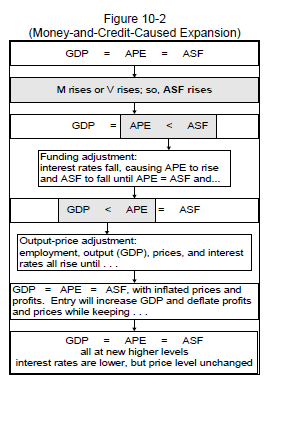

Case 2: Money-and-Credit-Caused Expansion

Focus in this section is on situations when the ASF increases. ASF in this section will include increases involved in the rise of M X V relative to the price index (p). in this case, the conditions to be investigated will be if M x V were to rise, if p were to fall, if M x V were to rise more than prises, or if M x V were to fall less than p falls. Factors that are going to affect the ASF will include policies made by the Federal Reserve and the banks. ASF will rise when the banks avail or extend loans to the public. The desire by banks to increase their lending will increase the level of ASF by increasing the available amount of money (even though M will not increase until the new loans are made). When non-bank lenders expand lending the ASF will increase. This is because of the velocity of money increases (Ashby).

When the ASF increases, interest rates levels will drop in the initial funding adjustment. Following this will be an output-price adjustment where the rates will rise as a result of rising employment, output, prices, and profits until GDP = APE = ASF. There will be an expansion of employment and output until the prices and profits drop. At the end of it all, “employment and output will be up, interest rates will be down, and the levels of prices and profits will be unchanged.” Until the economy is hit by another shock, there new levels in employment, output, interest rates, and prices will remain the same (Ashby).

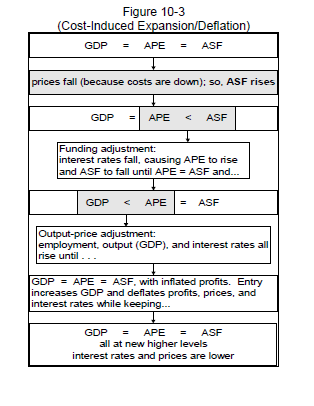

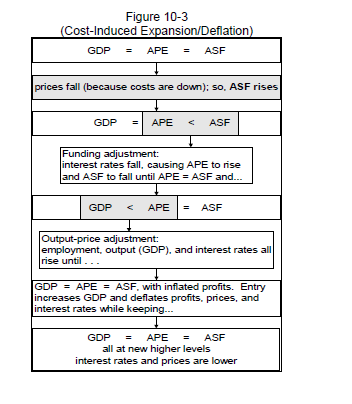

Cost-Induced Expansion/Deflation

While looking at the cost-induced expansion/deflation, the main concern here are the impacts upon the levels of employment, output, interest rates, and prices that result from widespread reductions in businesses’ operating costs. The result for this case is the same as seen above in Money-and-Credit-Caused Expansion that is Employment and output are up, and interest rates are down. The major difference in both outcomes is that in this case, there is deflation i.e. Level of prices is down, and it will stay down (Ashby).

Case 3: Supply-Caused Inflation

When a country is faced with reduced economic growth, (this can be a result of wars among others) then it will have a larger supply of ASF than APE. There will also be a drop in the GDP and a short-lived drop in interest rates will follow this drop. The prices and interest rates will increase sharply until the levels of APE and ASF drop to the level of the GDP. All these happenings are temporarily but it does not mean they are brief. The former GDP level is attained when the stressing factor has been overcome and at this time the whole adjustment process will reverse itself, returning employment, output, interest rates, and prices to their original levels. The graph below shows the effect of supply-caused inflation (Ashby).

Macroeconomic Shocks: Insufficient Demand Cases

The chapter explores the remaining three external forces namely a decrease in APE, a decrease in ASF, and an increase in GDP. The common thing among the three is that after the initial funding adjustment all will have insufficient demand for the currently available domestic supply of goods and services (APE < GDP = ASF) (Ashby).

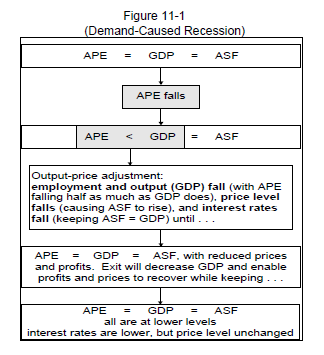

Case 4: Demand-Caused Recession

This case is different from case 1 because it is triggered by a decrease in APE. The drop may be attributed to reduced household and business demand. One other thing that may offset the reduction could be reduced government purchases of current domestic output or reduced foreign demand for U.S. products (Ashby).

The figure above shows the effect of an APE decrease.

When the APE decreases or falls, firms will wait to see how the market reacts specifically if the demand will return to normal. If it does not, there will be an output-price adjustment that will involve declining employment, output, interest rates, prices, and profits until GDP = APE = ASF. The fall in levels of employment and output will continue until the prices and profits increase to levels that are going to eliminate the negative economic profits. At the end of it all, the employment, output, and interest rates will be down, but the levels of prices and profits will be unchanged (Ashby).

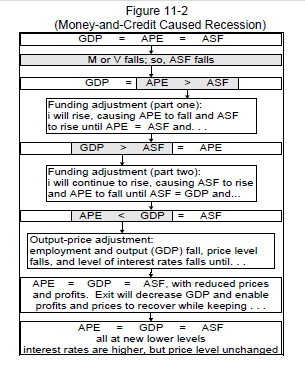

Case 5m: Money-and-Credit-Caused Recession

In this case, the situation is the opposite of case 2, and involves a declining ASF. The ASF decreases will involve a fall of M x V relative to the price index (p). This situation is true when M X V falls and prises, or if M x V rises less than prises, or if M x V falls more than p falls. In this section, we will focus on the situation when M X V falls and p rises. This can be as a result of banks or non-bank lenders deciding to reduce their outstanding volume of loans. It will also be caused by other factors such as recessions and factors that are going to cause M and V to reduce. The figure below shows the effect of money-and Credit caused by recession (Ashby).

If the ASF is down in a country, it will trigger a sharp rise in the interest rates and the output-price adjusting that ensue will see the fall in prices (deflation) employment, output (recession), profits, and interest rates until equality has been restored among GDP, APE, and ASF. The employment and employment will be down while the interest rates will increase and levels of prices and profits will stagnate. These new levels will prevail until the economy experiences another shock (Ashby).

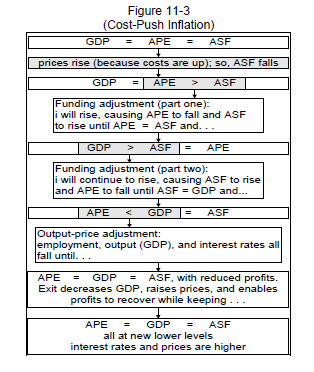

Case 5c: Cost-Push Inflation

In this case, the concern is primarily that of levels in employment output, interest rates, and prices that result from widespread increases in businesses’ operating costs. The ASF, APE, and GDP will be falling as a result of employment, and output will be falling while prices will be rising, and employment and output decreasing. The interest rates will increase as it tries to equalize the ASF levels to those of GDP. Results, in this case, are more the same as those witnessed in the money-and-credit-caused version of Case 5. The difference in both is that the level of prices is up, and it will stay up (inflation) and this will cause an inflationary recession (Ashby).

In the case of rising costs in production, profits, output, and employment levels will fall. This will then be followed by interest rates increasing as well as prices of products and services. The negative economic profits will see the output and employment levels fall and the interest rates levels rise. This situation will persist until the negative economic profits are eliminated. This can be through reducing output enough to permit prices to rise by the full amount of the cost increase. These new levels will remain until the economy is hit by a new shock (Ashby).

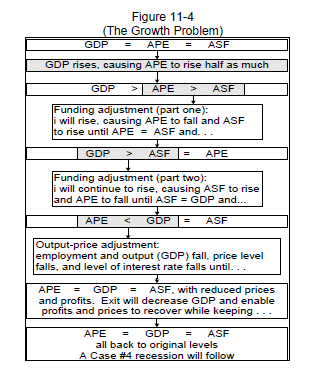

Case 6: The Growth Problem

When the GDP increases due reasons such as firms bringing their new capacity into production or any other factor, there will be more demand for goods and services. There will be an insufficient- demand problem that will arise from the APE growing less than the GDP. However, the rise in GDP does not automatically reflect an increased ASF, but it creates a more need for funding. Although the GDP can increase without the ASF changing, the new high GDP cannot be sustained unless the ASF increases with the increase for more funding. The figure below represents the growing problem and its implications (Ashby).

When the GDP rise, the interest rates will also rise. Producers will react to the insufficient level of demand, and the interest rates are going to fall as well as the employment levels and output back to their initial levels. The net price level will not change and the economy will be affected as was seen in case 4. The price level will remain unchanged, but the levels of employment, output, and interest rates will fall below the initial levels (Ashby).

Monetary Policy

The government can intervene in the macroeconomic coordination process from the purposes of influencing the levels of employment, output, interest rates, and prices. The intervention can come in various ways, but in this section, we shall look at intervention in the form of monetary policy that is conducted by the Federal Reserve System for Congress (Ashby).

Federal Reserve System

The Federal Banks were created and are primarily run by the Federal government. It plays an important role in regulating banks and their activities. The Federal Banks realizes far more revenue than operation costs, and the excess is funneled into the U.S Treasury Department. Here, the excess money issued is used for general purposes (Ashby).

The Federal Reserve System plays a crucial role including;

- Regulating the amount of money that is in supply

- Serving as a bank for the federal government

- Banker to U.S banks, foreign governments and other international agencies such as World Bank

- Collaborating with other regulatory agencies to ensure that other banks are working according to regulations set

- Serving as a banker for other banks in the country where it also acts as the lender of last resort to the banks (Ashby).

Monetary Policy

The Federal Reserve defines it as the deliberate use of the open market operations, alterations in the discount rate, and adjustments in reserve requirements to exert the desired influence upon the levels of interest rates, prices, employment, and output.

The general goals of monetary policy are specified in the Federal Reserve Act. The monetary policy will influence the levels of employment, output, interest rates, and prices through an indirect three-step process (Ashby).

- The Federal Reserve uses either the open market operations, changes in bank reserve requirements and or changes in discounting requirements to influence the money supply M and the key interest rates.

- The money supply, M, changes the size of the ASF.

- The change in ASF ultimately affects the levels of employment, output, interest rates, and prices via the operation of the macroeconomic coordination process (Ashby).

Monetary Policy Methods

The Federal Reserve System has three options it can use to influence the money supply. They are

- Open Market Operations: The Federal Open market Committee meets to evaluate the current economic operations occasionally. From the meeting, they formulate a broad directive for open market operations, which is transmitted to the manager of the System Open Market Account Manager. From the directive received, they can either buy or sell securities.

- Reserve Requirement Adjustments: the Federal Reserve can influence M, and thereby ASF, by either raising or reducing one or both of the reserve requirements, (r’ and r”).

- Discount Rate Adjustments: the adjustments in the discount rate will have no direct effect on M. M will only be affected by the willingness of the banks to respond to changes in the discount rate by altering w (Ashby).

Monetary Policy ─ Ease

The monetary policy adopted is always restrictive in the fact that it is made to control the money supply and ASF. The Federal Reserve will refer to this restrictiveness as either tightening or easing (Ashby).

Monetary Policy ─ Ease

The Federal Reserve will adopt money easing policy when the economy is facing a money-and-credit-caused version of Case 5 in which ASF has fallen because of an autonomous. It can also be used when the GDP has increased as well as times when ASF levels increase and begin affecting the Output, employment, and price (Ashby).

Monetary Policy ─ Tight

This is the method used by the Federal Reserve to stabilize prices. Unluckily, this method when used to fight inflation has a temporary effect on the prices and will cause the output and employment to reduce, which is a clear violation of the “maximum employment” mandate. It is, therefore, an ineffective way to stem out inflation (Ashby).

Fiscal Policy

The Federal government can and is mandated with playing a role in helping the economy to avert any risks of recessions and inflation by formulating the appropriate fiscal policies. Although the US Congress formed a separate organization, the Federal Reserve, which conducts monetary policies on its behalf, is responsible for designing and enacting fiscal policy measures (Ashby).

Fiscal policy will take two forms namely

Automatic stabilization

These measures are aimed at reducing the effect of APE on the GDP. They are going to affect and will reduce the magnitude of the potential output and employment changes during the macro-economic coordination process. The automatic stabilizers are the fixed features of an economic system that are going to reduce the movement of GDP and employment especially in cases where they move out of the country. This reduction is achieved by reducing the responsiveness of APE to changes in the level of income (Ashby).

Discretionary Fiscal Policy

This is the deliberate manipulation, which will be aimed at the levels of Federal tax revenues and federal government demand for current domestic output. This will be aimed at influencing the national aggregate demand for current domestic output i.e. the APE. There are two steps involved in this process (Ashby).

Step one

- The alteration of the levels of

- tax receipts from households

- current domestic output purchases

- tax receipts from businesses

Step two

- All the resulting changes that will change the APE, will adversely affect the levels of employment, output, interest rates, and prices via the macroeconomic coordination process (Ashby).

Discretionary Fiscal Policies: Final Comments

The government will purchase domestic current domestic output so that it can provide services to the public. Therefore, the government should take preventive and helpful measures that will ensure that it can continue offering these services. However, fiscal policy measures should involve only adjustments in government tax revenues. The congress has been experiencing problems in implementing fiscal policies because of its view of wanting to do all things by following monetary policies. The Congress should pass a stand-by automatic tax rebate, which would help to trigger new automatic stabilizers. Another approach could be to turn over the responsibility of the whole process to professionals (Ashby).

There is a need for federal legislation, because the country as a whole may not need a fiscal stimulus, but a specific state economy may be depressed and in need of a boost. This legislation would be important in helping permit the federal government to direct economic aid to that specific state following the governor’s declaration of an economic emergency (Ashby).

Works Cited

Ashby, David. “Wholly Macro!.” Macroeconomics Re-engineered. 2009. Web.