Background of Norway

Norway has a mixed economy that is composed of low trade barriers. Traditionally, Norway’s economy depended on local farming communities where fisheries, oil, and metal contributed the bulk. The oil industry is state-controlled through regulations and large-scale enterprises. Thus, much of the country’s revenue is gotten from the petroleum industry. Also, the service industry contributes a significant share to the Norwegian economy (Fan, Titman, & Twite 2012).

The services include engineering, banking, trade, insurance, transport, and communication. Despite the public voting in the rejection of joining the European Union, Norway remains a party to the European Free Trade Association (EFTA). It makes a substantial contribution to the EU due to being a member of the European Economic Area (EEA). Oil explorers expressed their concerns about depleting oil and gas reservoirs. Hence, the government saves a big chunk of the state’s revenue (Fan, Titman, & Twite 2012).

The fund is estimated to be slightly over $700 billion, thus making it the second-largest sovereign wealth fund. The wealth fund is dedicated to paying for financial expenses. The growth in GDP was high in the period 2010-2012. However, it slowed down in 2008, although it recorded an increase in the period of 2010-2012. As of 2013, according to IMF estimates, the GDP per capita was $64363. Since then, Norway maintains low inequality levels, comprehensive public welfare systems, and a high-income level.

Background of the US

According to Fan, Titman, and Twite (2012), the 1787 US Constitution is cited as being the footpath for the economic giant that America is today. It established a common market whereby interstate commerce was not subjected to taxes or tariffs. Later, Alexander Hamilton issued a directive that excluded infant industries from being overtaxed. This goal was achieved by the provision of overt subsidies and subjecting imports to tariffs. A technological boom in the 1980s is attributed to the growing list of tycoons who have developed an entrepreneurial culture among the Americans.

However, the technological effect has given rise to the US economy being labeled a two-tier labor market. Hence, lack of skills by those at the bottom impedes their chances of getting pay rise and health insurance coverage among others (Fan, Titman, & Twite 2012). Data from the non-profit Council on Competitiveness indicates that the USA controlled a third of the world’s economy from 1995 to 2005. However, it underwent a recession in 2001 but managed to get back on course in 2001 (Fan, Titman, & Twite 2012). To date, the US has maintained its competitive, productive, and large economy to remain at number one globally. As of 2015, the GDP per capita was $51,486.

Comparing the Macroeconomic Figures between the Two Nations

Norway and the US are both strong economies with robust GDPs. Concerning governance, Norway is a strong democracy that focuses on public accountability and transparency. Additionally, the corruption index in the country is perceived to be extremely low. Transparency International’s 2014 Corruption Perceptions Index ranked Norway the fifth least corrupt nation out of 175 countries. Additionally, the country has an independent judiciary with an effective court system. Private ownership of property is encouraged and protected.

The US is lauded as the strongest economy and democracy in the world. It is characterized by a stable two-level government system where power is decentralized. Just like Norway, the US’s judiciary is independent of the other two arms of the government. Congress is responsible for approving major spending by the federal government. Therefore, it is actively involved in regulating national debt and passing legislation that promotes economic growth.

According to Keen (2016), Norway may suffer a major private debt crisis in the next one to three years. For many years, information about private debt was simply unavailable for many nations except the US and Australia. However, the bank of International Settlement has recently commenced a system of ranking some 40 countries according to the size of private debt (Keen 2016). Private expenditure is determined by adding GDP to the change in credit.

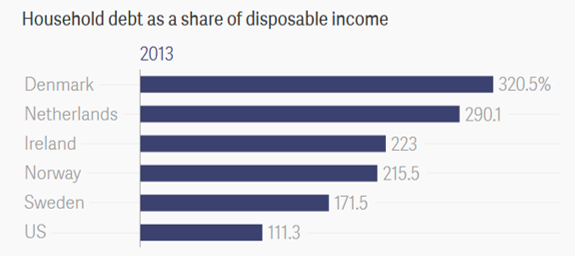

A crisis occurs where the private debt-to-ratio is large or where the change in credit is growing faster relative to the GDP. Phillips (2016) takes a similar opinion, pointing that Norwegian families are shouldering more household debt compared to the “spendthrift” Americans. Figure 1 below is an illustration of the household debt for Nordic households compared to that of the US.

The US has sustained a huge national debt since the Revolutionary War. Today, the national debt stands at $11.4 trillion. It grows by about $1 trillion each year (Amadeo 2016a). Two-thirds of the US national debt is public. Such a huge debt can easily degenerate into an economic crisis for the nation, or in the least, inhibit financial stability and economic growth.

Norway’s fiscal policy is shaped to gradually increase the spending of oil wealth, as well as cushioning the economy against Dutch disease. Norway’s fiscal rule restricts the structural non-oil deficit to within the anticipated trend income from the sovereign wealth fund, with the expected rate of return being 4% (Akram & Mumtaz 2016). Over time, the non-oil budget is expected to match the return on Government Pension Fund.

Norway’s fiscal rule is subject to modifications that are aimed at stabilizing fluctuations in the economy. On the other hand, the US’s fiscal policy is largely influenced by the response to the great recession and the current widening of government transfers (Hansen 2013). The fiscal measures adopted to counter the impact of the recession caused huge deficits that have subsisted to date. Deficits point to debt accumulation. Recent estimations by Congressional Budget Office (CBO) predict that the national debt will reach 75.4% by the end of 2016. While this figure is high, Martin (2016) points out that it is not particularly alarming when compared to the debt levels of other developed nations.

Inflation in Norway is below 2.5 percent, allowing the country to maintain its monetary policy at 1.5 percent. The Norwegian government has recently made proposals for a new tax regime, a cut on preferential tax treatment, and an increase in taxes from the oil sector. Regarding foreign exchange (fx), Norway’s fx reserves are categorized into four sub-portfolios. The first one, the immunization portfolio, is dedicated to matching foreign currency debt and countering interest risk associated with the debt.

Buffer portfolio for the Petroleum Fund allows the accumulation of foreign currency to be periodically transferred to the fund. Third, a liquidity portfolio is associated with the running of the monetary policy. On the other hand, the US foreign exchange is set by The Federal Reserve Bank collaborating with the Department of Treasury. The Treasury intervenes only when the need arises, and the interventions have reduced greatly over the last twenty years.

Consequences of Bretton Woods on Norway and the US

In 2006, the Norwegian government expressed its displeasure in policies used by institutions that are formed under Bretton Woods. The institutions included the World Bank and the IMF. The Bretton Woods institutions were accused of pursuing their interests by persuading the borrowing countries to implement trade liberalization and privatization (Bull, Jerve, & Sigvaldesen 2016). Loans advanced by the institutions had the privatization and trade liberalization conditions attached to them.

According to the Soria Moria Declaration on International Policy, the Norwegian government was not supposed to utilize its aid to further privatization or liberalization (Bull, Jerve, & Sigvaldesen 2016). The plan was seen to be a conflict of interest between the Bretton Woods Institutions and the Norwegian government.

During the 1960s, the US currency was valued against gold. The dollar was exchanging at a fixed exchange rate of $35 an ounce. Mason and Asher (2010) assert that the US had an obligation of maintaining the exchange rate in a bid to garner the world’s confidence in gold convertibility. Because of the balance of payments deficits by the US, the number of dollars held in foreign markets exceeded the gold stock in the US. Following the deficits, attempts were made to preserve the fixed exchange rate system.

The key in point is the Smithsonian Agreement, which was established in 1971. Despite the implementation of the accord, the number of deficits by the US continued decreasing, thus leading to an eventual collapse in 1973. The dissolution of Bretton Woods marked an end to the dollar being valued against gold, an announcement made by the then president of the US, President Nixon. Despite the dissolution of Bretton Woods, its institutions continued being operational (Mason & Asher 2010). Notably, the International Monetary Fund (IMF) continued providing liquidity to some countries.

Dealing with Debt Crisis

In addition to household debt, Norway is experiencing a public debt crisis because of the dropping oil prices. Norway relies on petroleum to support up to one-fifth of the economy (Esfahani, Mohaddes, & Pesaran 2014). With the increasing debt, the country plans to draw from its sovereign wealth fund, the largest of its kind in the world. Jensen (2016) proposes that the Norwegian government should initiate a “soft landing” by deflating the economy in a regulated manner. By allowing bankruptcy and forgiving the debt, the government may bring down housing prices. By lowering interest rates on housing, the government can tame runaway inflation while encouraging savings through consumer debt reduction.

Reinhart, Reinhart, and Rogoff (2015) have observed that the US, just like many other large economies, has developed a practice of capitalizing on a high growth rate to offset government debt. This option is adopted when the growth rate of the economy is higher than the interest accruing from government debt. Reinhart, Reinhart, and Rogoff (2015) warn that this practice can result in a sudden surge in the interest rate.

Evidence indicates that the growth of the real GDP when the debt is high would be lower relative to when the debt is lower (Reinhart, Reinhart, & Rogoff 2015). In this case, a high debt-to-GDP ratio reflects a slower economic growth rate. Perdue (2015) suggests that the way forward in curbing debt crisis in the US is by cutting government spending while growing the economy. Earlier this year, Congress enacted legislation aimed at curbing federal expenditure by $7 trillion for ten years. This move is important in turning around the debt situation, although much remains to be done such as eliminating redundant agencies within the government.

Role of Government in Achieving a Stable Financial Market

The economy of Norway is largely dependent on oil and gas. The sovereign wealth fund also plays a key role in anchoring the Nordic economy. Currently, the fund is worth $890 billion, the largest in the world. Norway also relies on markets to distribute the risk of the financial crisis. As a small country, Norway benefits largely from maintaining an open economy that welcomes different investors [foreign direct investment].

Similarly, Norway can invest its funds in other countries. Norwegian Minister of Finance, Siv Jensen, has explained how international capital markets assist the small country in separating the government as an investor from the capital requirements of Norwegian businesses (Jensen 2016). This way, local investors can pick their funding structure without the interference of the government’s financial involvement.

Campbell (2009) argues that the US government has a primary role in maintaining economic stability. To achieve this goal, policymakers should focus on developing the institutional role of governing. Areas where the government can focus on include currency stability, property rights, and fostering accountability. Additionally, Campbell (2009) identifies government spending as another area that can be tamed to achieve a stable financial market.

During economic tumults, government spending tends to rise because of the increasing demand for social safety. This spending can often result in somewhat economic stability because resources are used when the economy needs suddenly increased expenditure (Campbell 2009). In contrast, when the expenditure has to be sanctioned by Congress, the process is long, implying that the money may not have the intended effect of immediately rectifying the financial crisis.

The future stance of Norway and the US

Most people in Norway depend on the oil industry for jobs. At the start of 2016, it was predicted that investments in the petroleum industry would be in a sharp decline as investors opt for other sectors of the economy due to the decline in global oil prices. Consequently, the demand for petroleum products will continue decreasing coupled with a decline in imports. The decrease in imports will cushion the effects of low demand for its products.

The rate of inflation is expected to decline as the slack in the economy continues. Since the 2009 monetary predicament, 2015 registered the lowest increase in mainland GDP. The rates of unemployment have increased by 1.5% as the government’s spending continues on a sharp increase (Cecchetti, Mohanty, & Zampolli 2010). As a result, the growth in real wages will continue weakening more than it has ever done in the last 25 years. The Western and Southern parts of Norway will be the first to experience the impacts of high unemployment rates. However, the effects will spread gradually to other parts of the country.

Production in the US will shift to complex stuff such as chemicals, cars, and fuel. Such a shift has its roots in the financial crisis that hit the US in 2008. As a result, there will be a sharp decline in the number of full-time workers due to the ballooning wage bill. Thus, workers are expected to create alternative income sources to supplement the lack of jobs. The millennials are expected to rely on technology to create jobs for themselves since the ‘baby boomers’ are reluctant to vacate office. Due to the G7 establishment, more power was given to Russia, Brazil, India, and China (Cecchetti, Mohanty, & Zampolli 2010).

Their economies are improving, thus demanding more economic power relative to the US. The success of these economies is attributed to the decisions of their banks during the recession to avoid derivatives. For this reason, the standards of living in the US are projected to continue declining. The economic history of the US places it at a trend where the country experiences an economic crisis after every decade. To date, the US still bears scars from the 2008 financial crisis. The unstable global gas and oil prices subject the US economy to volatility. The result involves the rising food prices and housing costs among others. After the high oil prices in 2011, interest rates hit a sharp decrease. Global oil prices declined. As a result, it is predicted that the US could experience an economic crisis in 2020.

The best way forward for Norway and the US

Norway should utilize other naturally occurring resources such as forests, fjords, waterfalls, and other minerals. Traditional industries such as logging and fishing need allocation from the national budget to prevent over-reliance on the gas and oil industry. Exploiting natural resources will give rise to new occupations such as bio foraging. Consequently, the government has invested in entrepreneurship all over the country.

This strategy is made possible by institutions such as University Science Parks and Innovation Norway. Ideas by its locals are being funded by Northzone, which is a venture-capital firm. There have been reports of increased levels of volcanic ash in the atmosphere. For this reason, the Norwegian Institute of Air Research has invented a device that checks volcanic ash levels in the atmosphere. To reduce pollution, Clean Marine has invented a cleaning mechanism that is meant to clean the ships’ exhaust systems. A notable key figure in the culture industry is Karl Ove Knausgard who is a renowned literary icon.

In the US, the federal government has reduced interest rates to cure the effects of the 2008 financial crisis. Analysts opine that the government should also change its taxing systems and/or reduce the amount of public spending to trim down the amount of debt. The rich people should be subjected to higher taxation to cushion the effects of the recession. With the increase in living standards, the expenses made by the rich people do not influence their overall income.

On the other hand, those at the bottom feel every pinch of spending. Thus, it is reasonable to impose taxes on investment income and inheritances. The effect would be equal chances of wealth accumulation and a reduction of inequality levels. In 2009, banks were pressured by the federal government to find ways of raising the capital or have the government impose policies (Amadeo 2016b). The proposed policies contained restrictions such as bonus caps to senior executives. Efforts to recapitalize the banks should be informed by the Troubled Asset Relief Program of 2008.

Conclusion

Norway and the United States are among the most successful economies in the world based on the GDP and Human Development Index (HDI). However, recent revelations indicate that Norwegians are under heavy household debt, which may translate into a lower HDI. On the other hand, the US’ debt is largely public and that it is repaid by exploiting the differential between economic growth and interest rate accruing from the national debt. Norway may have to spend from the Sovereign Wealth Fund to counter the debt crisis caused by the drop in oil prices.

References

Akram, Q & Mumtaz, H. 2016. The role of oil prices and monetary policy in the Norwegian economy since the 1980s. Web.

Amadeo, K 2016a. The U.S. debt and how it got so big. Web.

Amadeo, K 2016b. What Is the Future of the U.S. Economy? Web.

Bull, B, Jerve, A & Sigvaldesen, E. 2016. The World Bank’s and the IMF’s use of Conditionality to Encourage Privatization and Liberalization: Current Issues and Practices, Norwegian Ministry of Foreign Affairs, Oslo, Norway.

Campbell, K. 2009. The Economic Role of Government: Focus on Stability, Not Spending, Heritage Foundation, Washington, DC.

Cecchetti, S, Mohanty, M & Zampolli, F. 2010. The future of public debt: prospects and implications. Web.

Esfahani, H, Mohaddes, K & Pesaran, M. 2014. ‘An empirical growth model for major oil exporters’. Journal of Applied Econometrics, vol. 29, no. 1, pp. 1-21.

Fan, J, Titman, S & Twite, G. 2012. ‘An international comparison of capital structure and debt maturity choices’, Journal of Financial and quantitative Analysis, vol. 47, no. 1, pp. 23-56.

Hansen, A. 2013. Fiscal policy & business cycles, Routledge, London.

Jensen, S. 2016. Outlook for the Norwegian Economy: Finance Norway’s Capital Markets Day, Routledge, London.

Keen, S. 2016. The seven countries most vulnerable to a debt crisis. Web.

Martin, F. 2016. U.S. Fiscal Policy: Reality and Outlook. Web.

Mason, E & Asher, R. 2010. The World Bank since Bretton Woods: The Origins, Policies, Operations, and Impact of the International Bank for Reconstruction and Development and the Other Members of the World Bank Group: the International Finance Corporation, the International Development Association [and] the International Centre for Settlement of Investment Disputes, Brookings Institution Press, Washington, D.C.

Perdue, D. 2015. The first step to fix the US debt crisis. Web.

Phillips, M. 2015. Scandinavians are more indebted than Americans. Web.

Reinhart, C, Reinhart, V & Rogoff, K. 2015. ‘Dealing with debt’, Journal of International Economics, vol. 96, no. 1, pp. 43-55.