Analysis rate of growth, employment, population and GDP of China before and after open market door policy to the world

Launched over three decades ago by Deng Xiaoping, China’s open market door policy aimed at opening the country’s doors to foreign investors. In 1980, Shenzhen, a Special Economic Zones (SEZ) was formed to increase China’s attractiveness to foreign direct investment, hence boosting the economy as well as modernising the country’s industry. After 1978, China moved swiftly to set up economic policies that encourage and support foreign investments and trade (Wei 1995).

Even though modern China believes in the 1978 policy, the initiation of the policy is traceable to 1899 and 1900 when the US developed interests of trading with the East nation. China was a source of cheap textiles for the US factories. The then US Secretary of State John Hay issued a circular to Russia, Japan, and key European nations to support in protecting China’s administrative and territorial integrity.

Wei (1995) posits that the American policy aimed at allowing all countries to have equal access to China; the open door policy strived to eliminate trade monopolization in the region. From the mid of the 19th century, nations began to violate the open door policy by dividing China into segments and colonies. Finally, the defeat of Japan in the Second World War, 1945, rendered the policy meaningless. Between 1945 and 1978, China adopted a strict market policy – a centralised or socialist economic system; there was no trade liberalization. Therefore, in opening up to the outside world from 1978, China decided to get ready markets for its surplus products as well as for other manufactured products in the international market.

After adopting the open market door policy, China recorded higher growth in its GDP, population, and employment rate than before. China had 806.7 million people by 1969; the number moved to 962.6 million people by 1978. This represented an increase of 156.9 million people in a span of ten years before the adoption of the open market door policy. However, in 1987, the country had a population of 1,104.2 million people; this represents an increase of 141.6 million people.

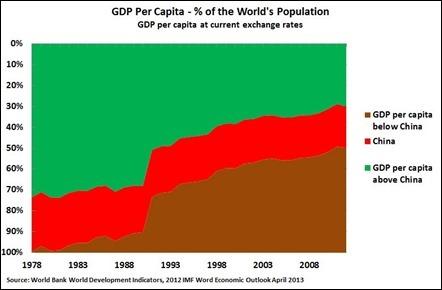

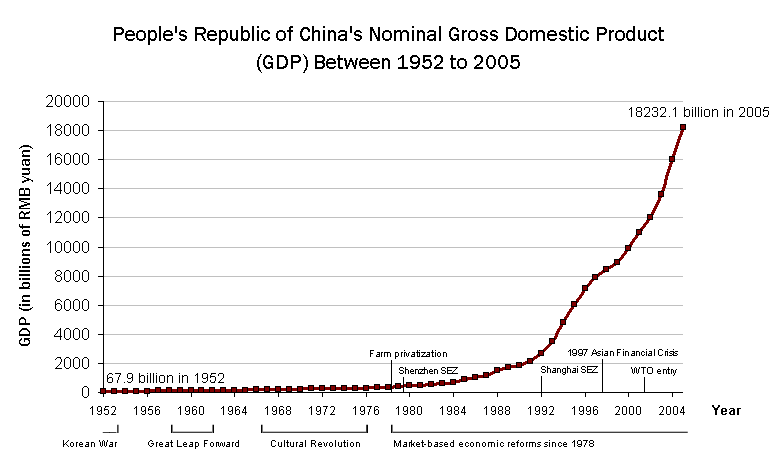

The growth rate has also been on the decrease since the country adopted the policy. The value has dropped from 16.61 in 1987 to 5.05 in 2009 per 1,000 per annum. China has been encouraging its citizens to use birth control methods after it adopted the policy. The once poorest nation in the world has moved to attain a greater GDP per capita than nations having the bulk of the world’s populace. Presently, China is a home of 19.6% of the world population. Before 1978, the country reported negative rates of growth in certain years. For example, 1967, 1968, and 1976 had annual growth rates of -5.7%, -4.1%, and -1.6% respectively. Since the introduction of the policy, China has never registered a negative real annual growth rate; it also recorded an increase in the GPD from Rmb362.4 billion in 1978 to Tmb30 trillion in 2008 (China’s gross domestic product (GDP) growth 2011).

The chart above illustrates how China’s has recorded increased in GDP per capita since 1978 when it adopted the open market door policy. Before instituting reforms, a whopping 73.5% of the global population lived in countries that had higher GDP per capita than China. However, this has changed with only 30% of living in nations with higher GDP than China. The country has witnessed an 8.3% growth rate of GDP per capita between 1988 and 2003. From the analysis of the per capita GDP, China has overtaken many countries in economic growth rates since it started to open up to the global market. In 2012 the IMF ranked China 94th out of 188 countries. The changes in the country’s GDP are deeply elaborated in the graph below.

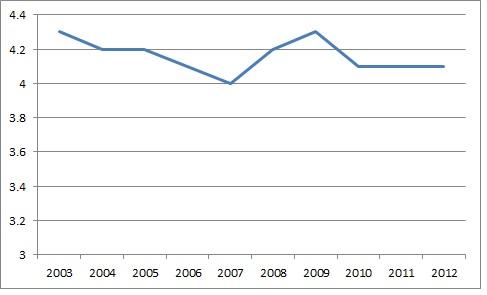

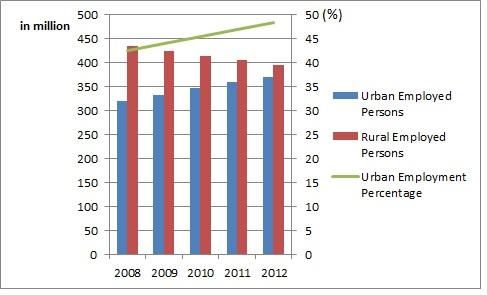

On the other hand, employment rate grew at an average level of 1% between 1990 and 2002. Notably, the introduction of reforms in 1980s resulted in lay-offs for many workers, as there were skill-based technological changes in the country. There has been irregular employment as well as increasing tendency in unemployment.

Recent Data

The change and comparison of China economic after the open market door policy to the world

There are numerous changes that have occurred to the Chinese economy after the introduction of the open market door policy to the world. The pursuit for economic reform to change from a rigid central planning economic system to a world economic system has seen China move from the thirty-second ranking in position it had in 1978 in terms of export volume to world’s largest exporter in 2013; it surpassed the US. The 1980s were the turning points for China; it annual trade expansion between 1978 and 1990 rose above 16%. This was three times more superior to the world’s trade expansion rate.

According to Wei (1995, p. 74), the over 15% increase in trade expansion rate in a span of 12 years is actually remarkable considering China’s ardent dislike to foreign investment before the adoption of the open market door policy in 1978. Back in 1955, officials held negative opinions on imports; they cited that the country can only import in order to gain industrial independence so that in future they will not depend on imports (Wei 1995, p.74). Before the introduction of the policy, the state monopolised trade by being the sole decision-maker in imports and exports to local governments as well as foreign nations.

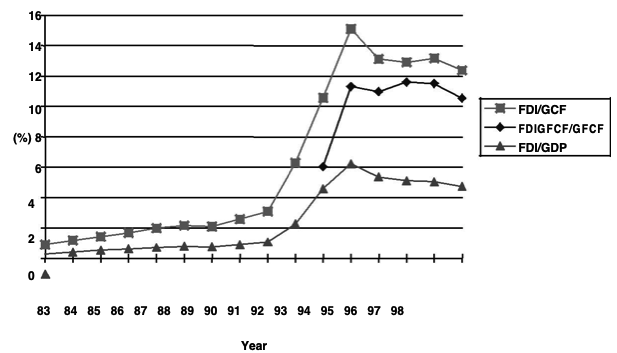

1998 Chinese Economic Indicator. (Main determinants and impacts of foreign direct investment on china’s economy 2000)

China has also been witnessing increase in flow of foreign investments since 1979. Between 1979 and 1990 an accumulated FDI touched $34.5 billion; foreign direct investment had been non-existent during the rigid centralised economic system. Hong Kong has remained the dominant supplier in terms of its share of FDI between 1983 and 1990; it share had been over 50% annually for the period of study. This was far much ahead of Japan’s share in FDI, which was ranked second and for the US, which was at the third place. At the same time, equity joint ventures made up 50% of all 1990 FDI; the tool had been inconsequential part of FDI before the implementation of the open market door policy in 1978.

Joint explorations, wholly foreign-owned ventures, and contractual joint ventures had FDI shares of 7%, 18%, and 18% respectively in 1990. Comparatively, it is evident that the policy has brought economic changes to the People Republic of China (PRC). Even though the policy targeted economic development, China has also witnessed massive changes in social, legal, and political systems. The listed factors are part of a country’s political economy; therefore, their status affects the nature of a country’s economic environment to attract foreign investors (Xue 2005).

FDI inflows into China Based on Current Prices.

It is in 1980 when the PRC applied to be a member of the UN Committee on Outer Space, and went to follow the operations of international arbitral tribunals in order to understand the arbitration for economic and trade matters. Additionally, the country made tremendous steps to review all the treaties, and went on to ratify a sizeable number of international agreements in different economic fields. Before 1979, out of the 273 multilateral international treaties, China had only joined 34 treaties. Evidently, the open market door policy has created positive economic engagement for the country given that it committed itself to 92% of the treaties after 1978.

China moved to adapt the international legal system by signing other international laws like the Convention against Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment, Administrative Procedure Law of 1989, Administrative Licensing Law of 2004, and the International Covenant on Economic, Social and Cultural Rights in order to appeal to appeal to all economic giants to invest in the country. The openness policy also facilitated China’s entry into the WTO in 2001, hence enabling the country to adopt numerous domestic regulations and laws. The agricultural sector is not left behind either; it was decollectivized.

The advantageous and disadvantageous of the open market door policy to the world

Open market door policy helps in liberalizing trade and investments across nations in the world. In keeping markets open to global links in terms of investments and trade, countries are able to benefit from reduced levies from common organizations and regional blocks like WTO, OECD, COMESA, and Asian-Pacific Alliance, hence acquiring a long-term advancement in living standards. Moreover, the world has realised greater volumes of merchandise trade and increase in Real GDP. Market integration has also resulted in increased growth of FDI outflows yearly. The open market door policy also makes countries to exploit their comparative advantages by devoting their financial and human resources in their areas of specialisation (Bose 2012, p. 167). Countries that have implemented the policy enjoy high rates of private investments; this increases employees’ wage levels and average labour productivity.

The policy encourages FDI’s, which in turn increases the value of exports and trade surplus for countries. The ease in movement of labour increases prosperity in developing nations, as they can easily tap effective managerial and technological skills from developed nations. The move has led to rise in prosperity in developing nations such as Uruguay, and even augmentation in demand for higher-valued commodities from OECD members.

Countries lacking certain human resources benefit hugely from open and flexible immigration policies that accompany a global market economy. Alternatively, a country with excess human capital can release the workforce to countries in need of such skills. This increases employment opportunities across the world, as the scenario results in effective use of available skills. Just like in China, other world nations are experiencing increased annual growth in economy after moving from a socialist economic system. Cuba is an example of such nation that has greatly benefited from the open market door policy. With its proximity to the US, Cuba has instituted and implemented economic reform policies to help in opening to the outside world.

Even though the policy has numerous positives, it does not fail to have some disadvantages to the globe. Inflation is a major drawback that accompanies open market door policy; world trade gives room for stiff competition, thus raising the prices of common products and services in the free market (Xue 2005). Notably, drastic inflation impoverishes citizens of affected countries. For example, the IMF holds that the dramatic price increments in the Soviet Union made Russia undergo over 1,000% inflation. This occurred immediately after the country moved from a socialistic economic system to a world trade economy.

The Asian financial crisis of 1997/1998 is also an example of an adverse effect of free flow of financial capital in a free economy. Even though the world is moving towards a liberal economy, strict measures and policies ought to be in place to prevent such situations from occurring. For example, strict regulations and penalties should be in place to monitor and control businesses that engage in different malpractices that can cause inflation. The policy can also destabilise most governments that are undergoing economic transitions since such government officials were accustomed to controlling trade operations and resource allocations. The new economic framework alters the functions of government officials of controlling business rules to leaving businesses control themselves.

Conclusion

Moving from a rigid socialist economy to a fast-developing economy, the PRC has gone a long way in its pursuit for economic superiority. The open policy has brought numerous changes in China’s business engagement with foreign investors as well as with other nations. For example, a positive bilateral relation between China and Netherland has promoted its economic development. It opened up China to foreign investments by lifting numerous regulations, protectionist rules, and price controls on products and services. Improvements in the legal system as well as the political system help in attracting foreign investors into a country.

Even though there are great changes in China’s economic strength since the introduction of the open market door policy, reforms in the banking industry have been slow. Government officials have maintained the conservative culture, and have been slow in permitting foreign financial institutions into the market. With more bureaucrats operating key financial institutions in the country, corruption has risen to be a major impediment to economic reforms in the PRC.

Imperfect contract and property laws have been barring foreign investors from identifying with the country. A weak legal framework is another serious obstacle that makes it difficult for China to attract foreign investment even with the adoption of the open market door policy. Enforcing such imperfect laws and increasing transparency in the legal system is vital for the country to enable its open door policy succeed. Undoubtedly, the policy has exposed Chinese firms and workers to universal ideals and technical knowhow, thus increasing their efficiency in maintaining a spirited competition globally. Currently, the country remains the second biggest economy in the globe after the US.

References

Bose, T. K 2012, ‘Advantages and Disadvantages of FDI in China and India’, International Business Research, vol. 5, no. 5, pp. 1-11. Web.

China’s gross domestic product (GDP) growth 2011. Web.

Main determinants and impacts of foreign direct investment on china’s economy 2000. Web.

Wei, S 1995, The Open Door Policy, and China’s Rapid Growth: Evidence from City-Level Data. Web.

Xue, H 2005, ‘China’s Open Policy and International Law’, Chinese Journal of International Law, vol. 4, no. 1, pp. 133-139. Web.